Expectations for volatility are at a record low. Despite a steady stream of events that could have sparked a wide-spread sell-off, the market was surprisingly resilient. The S&P 500 (including dividends) has been up every month since the election. This ties the longest streak on record (December 1994-September 1995). The longer the market rises, the more emboldened market participants become. They throw risk management to the side. Their minds play tricks on them as they start to believe a.) major losses will not be coming, b.) if they do come the market will snap right back, and c.) they will personally be able to handle the losses.

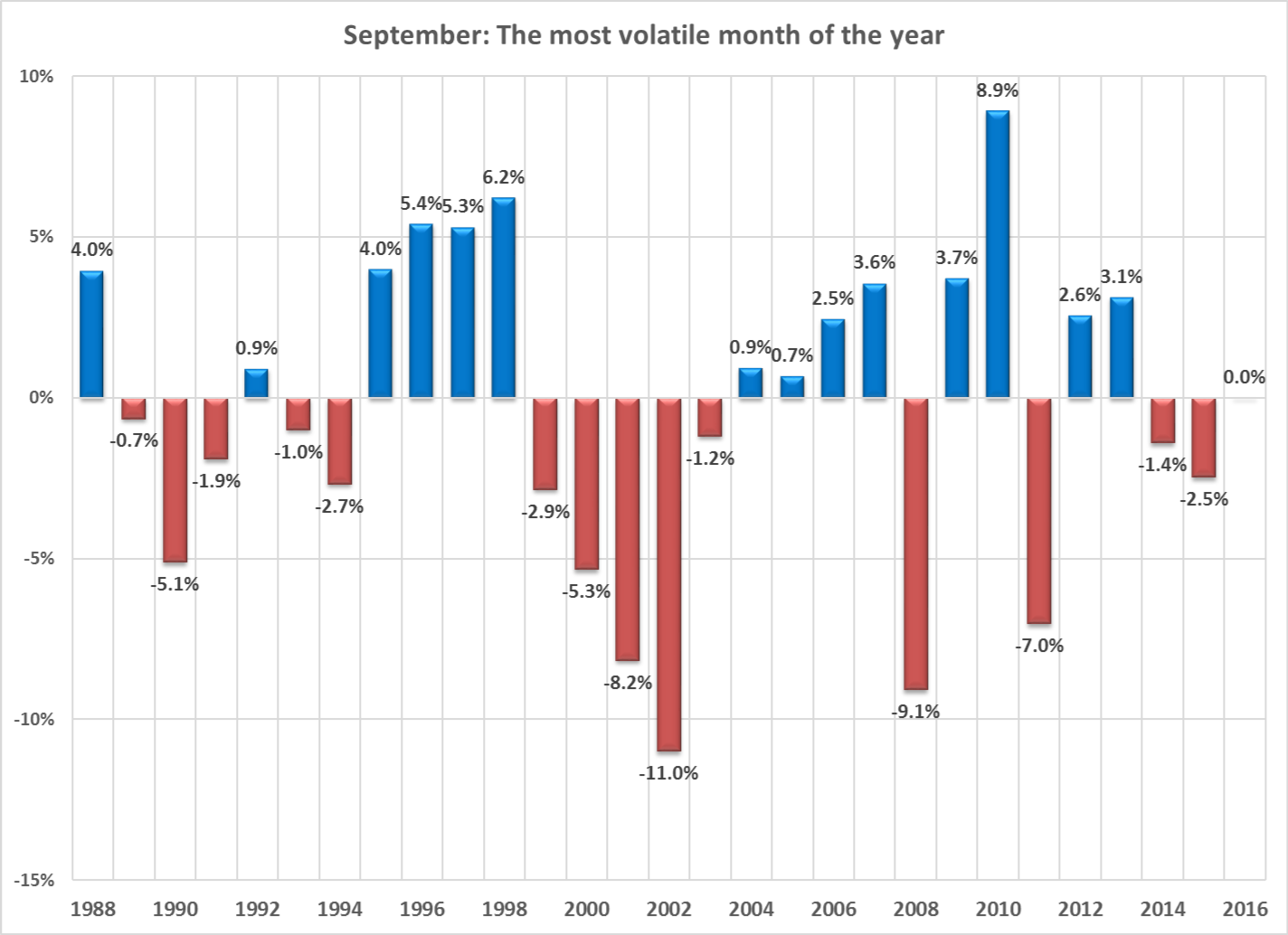

My study of history and 20 years of experience dealing with advisors and their clients tells me all 3 positions are quite dangerous to those that have an average or below average ABILITY to take risk (which is the case for the majority of people that are relying on their investments for retirement income or are approaching retirement in the next 5 years.) September could very well be a record setting month. While the average performance in September puts it as one of three months (June & August are the others) with a losing record, September is by far the most VOLATILE month.

Investing based on the calendar and the historical results for that time period is usually a losing proposition. However, knowing what the calendar says about the markets can help us prepare for what may be ahead. If September is as volatile as it has been in the past and the volatility is to the downside, market participants could panic following the steady stream of gains we’ve all enjoyed since the election.