“Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” –Sir John Templeton

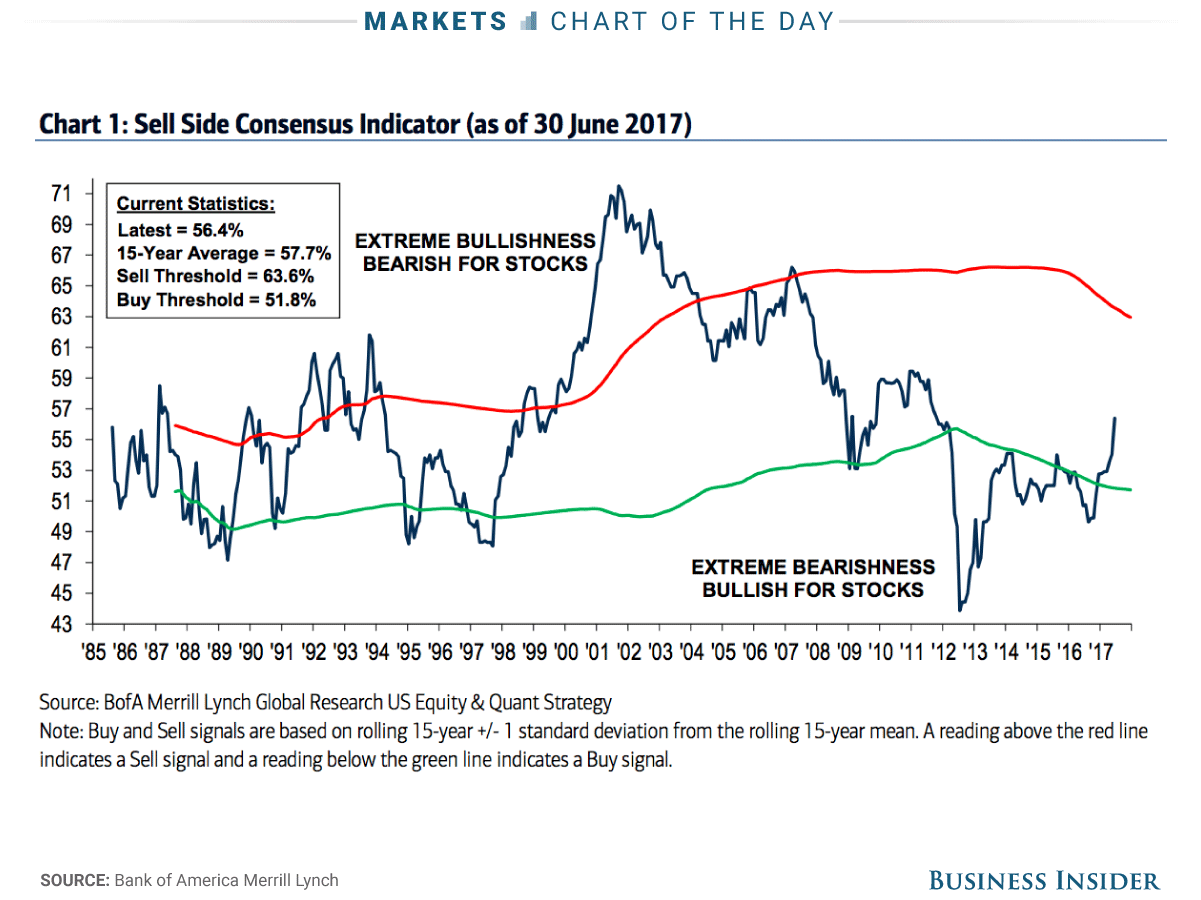

While we could have a long way to go in this bull market, Bank of America Merrill Lynch’s consensus indicator is at its highest level since 2011. You may recall that was the last time the stock market went through any sort of correction — with the S&P 500 losing nearly 20%.

Based on client reviews, conversations with advisors, the main stream financial media, and the outflow of assets from risk managed to unmanaged “low cost” accounts, it is hard to argue we are not in the “euphoric” area that Sir John Templeton warned about. Our scientifically engineered models are not as optimistic as everyone else it seems. All have taken money off the table recently, including our Dynamic Aggressive Growth program. It doesn’t mean the end is near, but it does mean the data is telling us the risks of a decline have increased significantly over the last few months.