We’ve had an internal debate in our offices about stock market sentiment. We are not necessarily seeing euphoria when we speak to clients about the market, but we are seeing overwhelming confidence is extremely unlikely. The ability of the Fed to mask the underlying weakness in the economy and drive investors into the market has led to a belief that stocks are the only place to invest. Over the long run I’m confident that is not a good thing, but over the short-run it may continue to lead to an underlying bid to the market.

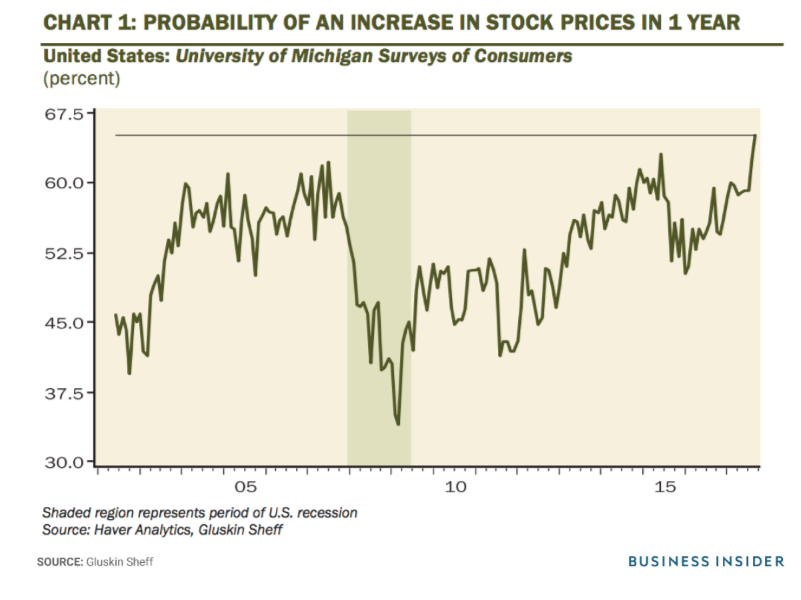

A recent University of Michigan study on consumer sentiment finds retail investors have never been this confident in rising prices. 65% of those surveyed believe stocks will be higher a year from now. This chart from Gluskin Shelf puts that number in perspective.

Sentiment surveys have a horrible track record in terms of guiding market direction. Investors can stay bullish far longer than most people can sustain a bearish position betting on a market decline. However, when sentiment does hit extremes such as this and most other investor sentiment surveys it serves as a warning there is not as much potential for gains going forward. Worse, those reluctant investors in the market will quickly turn into panicked sellers when the market reverse.

Going back at least to the time of Moses, human nature has not changed. We tend to focus heavily on the present and believe that’s how it will be for perpetuity. This is why our broad spectrum of active risk management portfolios continue to be the best way we know of to prevent falling into the trap far too many people already are in.