It's that time of year again we all dread. I'm not talking about the dozens of Christmas parties we all seem to be invited to, or heading to the mall to pick out presents for our kids or grandkids that may or may not be played with, or even figuring out a way to say no to the myriad treats that will be offered to us over the next three weeks. What I'm talking about is tax harvesting season.

Oh wait, chances are most of you reading this pay little to no attention to this critical investment management task that takes up a large part of our portfolio management team's final month and a half of the year. I'm not saying it's a bad thing that you aren't thinking of this. You have a lot of other things you are probably juggling -- from making sure your clients have satisfied their Required Minimum Distributions, to dealing with last minute withdrawal requests, to answering the inevitable "what will next year look like" questions, to all the other things you as a financial advisor are tasked with handling.

Tax harvesting is complicated and cumbersome. Each year brings a different set of challenges and situations. I don't blame you for not dedicating the last six weeks of the year to making sure your clients don't receive some unwanted taxable income to close out their year. If you're bringing in new clients during the last quarter of the year, paying attention to tax harvesting is essential in avoiding the uncomfortable situation of having to explain to your new clients why they owe taxes for accounts you barely had a chance to manage.

At SEM there are a lot of different things we do throughout the year for our Platinum advisors to help offset as much taxable income as possible. There are also things we can do on a macro/model basis this time of year to either realize some losses or gains depending on where we are at in the current market environment. What becomes difficult is when a mutual fund or ETF pays a capital gain distribution to a new client. They've barely been invested with you and now they owe taxes on income they never received? Those are the rules of the game and require specialized treatment of your new (and possibly long-time) clients (depending on the year).

At SEM we take a very active approach to managing capital gains distributions. We have a lot of advisors who have significant amounts of client money invested with American Funds. I'm not picking on American Funds. We love American Funds. We literally created an investment model (AmeriGuard), which uses American Funds as the core building block. I'm using American Funds as an example because for the past 4 weeks I've been actively adjusting our client portfolios on a case by case basis specifically because of the planned taxable distributions from American Funds, some of which are going to be quite hefty.

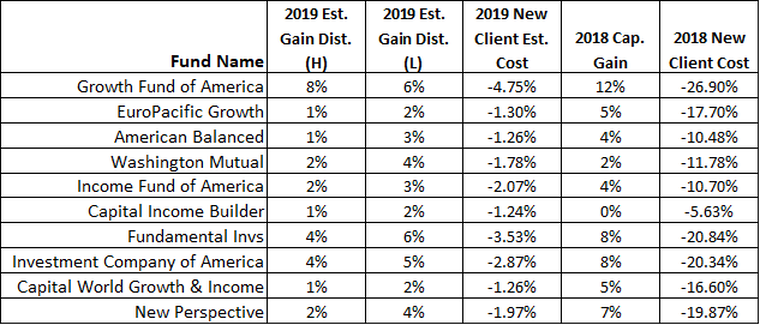

What we're about to see happening is American Funds will be paying out a Capital Gain Distribution (and 'special' one-time dividends) to all of their shareholders. The price of the fund will drop by the amount of the dividend and the shareholders will receive more shares of the fund. For instance, Growth Fund of America is expected to pay a capital gain of 6-8%. Shareholders will owe taxes on that 6-8% distribution and at the same time will now be carrying an UNREALIZED LOSS (meaning they cannot write it off). So now your new client statements will show the loss in those positions (even though they received more shares and the value of their account didn't change). Unless the fund has had significant gains since they joined, the new clients could have questions for you when they receive their December statements (and their 1099s!)

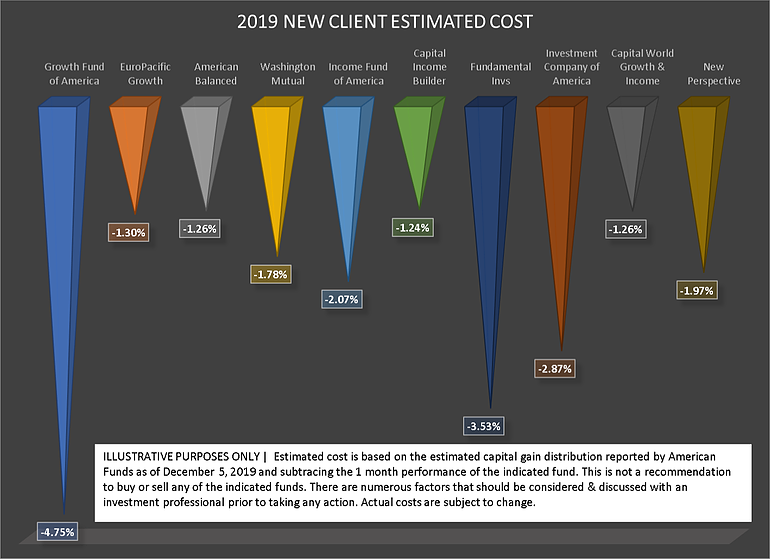

Here's what it's looking like for new clients in the top 10 American Funds offerings:

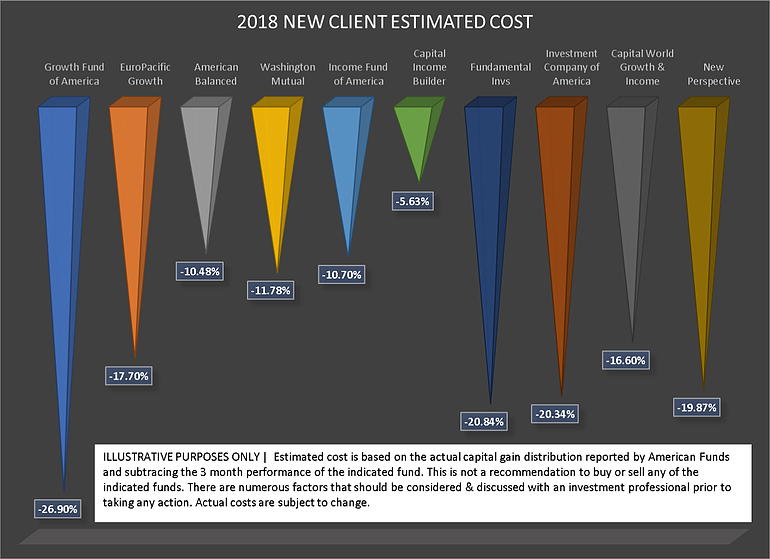

That's just this year when the market was up. Remember, each year is different. Last year saw a horrible situation for most taxable investors -- a losing year along with hefty capital gains distributions. New clients at American Funds not only had huge losses, they owed taxes for gains they never enjoyed!

Finally, here's a summary table of the 2019 estimates and 2018 distributions.

Again each year is different. You've gotten off relatively easily in 2019, so now is the time to make a change so whatever next year brings, you have somebody looking out for your clients.

At SEM we have a proprietary set of methods to deal with these situations. All involve individual, customized account management. This becomes very difficult (or impossible) for you to do if you have money invested on a "platform" or direct with a fund family or brokerage account. Besides, do you really want to be at your desk the week between Christmas and New Year's Day watching for a fund company to sneak in a distribution into your accounts before you have a chance to act? Hiring SEM as your Outsourced Chief Investment Officer (OCIO) means you get this valuable intangible benefit that helps both you and your clients.

While we do our best on a "macro/model" level to offset any of these painful distributions, the individualized tax management takes a lot more work. Obviously we cannot do this for every single advisor, so we have limited "Platinum" slots available. If you'd like more information on how you can become one of these select advisors, let me know.

For those of you in the trenches with me the rest of the year fighting the taxable distribution battle, I'd love to trade ideas and techniques with you. For everybody else, enjoy your Christmas and New Year!

ILLUSTRATIVE PURPOSES ONLY | Estimated cost is based on the estimated capital gain distribution reported by American Funds as of December 5, 2019 and subtracing the 1 month performance of the indicated fund. This is not a recommendation to buy or sell any of the indicated funds. There are numerous factors that should be considered & discussed with an investment professional prior to taking any action. Actual costs are subject to change.