Happy National Championship Tuesday! My prediction of the Tigers winning the game came true, and I’m sure all you funny guys and girls out there also felt the same way about your own predictions (for those that aren’t aware, both teams’ mascots were the Tigers.) And for those of you who stayed up until well past midnight on the East Coast to finish the near-4-hour game, I’m sure you’ve been super productive today with your normal amount of sleep you got. As someone who was sitting there thinking, oh good, it’s past 10 PM ET and we haven’t even gotten to the Halftime Show. Surely you can live without seeing the rest of the game and can go to bed at a decent time. Unfortunately, my brain lost out to my heart and I stayed up until the very bitter end for Clemson.

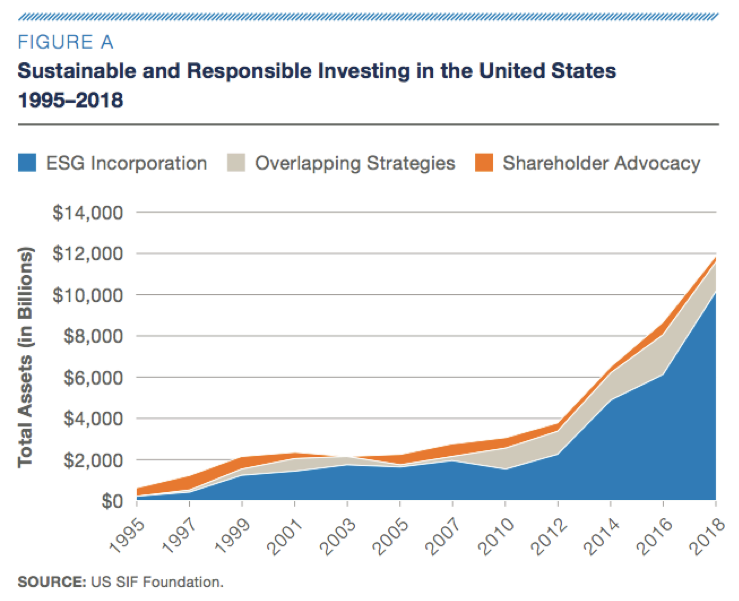

The heart is very convincing when it comes to many things. And most people probably feel like their heart is in the right place. Blackrock surely noticed this when they said they will focus more of its investment strategy towards sustainability. Blackrock seems to know what it’s doing when it comes to offering the funds they do and are offering this change in philosophy for a very good reason; they are simply following the money of investors, which have increasingly gone the sustainability route over the past few years. So, why?

When it comes to what people care about, I find you can really tell what’s important to people by what they are spending their dollars on. That can certainly be seen with tangible purchases like décor around the house or a man-cave, but these investors are showing the same level of care by contributing more to these sustainability funds than in the past. And what I find most of the time about something people care about, it’s often more about emotional decisions than cognitive ones.

Investing in these funds could be seen as putting your money towards investing in sustainability yourself, but it certainly isn’t a donation. For one, when you invest in a stock you aren’t giving money to the companies themselves (unless you’ve been lucky enough to participate in an IPO you have only ever bought stock through exchanges and not directly from the company.) As an investment vehicle there is a reasonable level of expectation that the value of said vehicle will create some level of financial growth or stability towards your future. Now, when I am investing in something, I don’t typically view the investments themselves as the things I’m putting my money towards, but instead what I will be able to achieve financially thanks to the financial growth of these investments. There are tons of different reasons why you’d invest, and I’m sure there are goals you are trying to reach with these investments (second home, paying for kids’ college, vacations, etc.) So, if your financial goals are being met with these investments, whichever investments you may choose, then mission accomplished. But, are you sacrificing your financial goals by also caring about what you’re investing in?

That’s my own personal opinion as to what investments should be used for; as a tool to get to where you want to go financially. I think there’s this connotation that there’s a level of selfishness that I’m turning a blind eye to how I’m reaching that financial goal, but I’m just using investments how they are intended to be used. The same goes for corporations. A corporation’s entire purpose of existence is to make money. As one of my favorite college professors said to me in my Accounting 101 course, “If you’re running a business and your goal isn’t to make money from it you don’t have a business. You have a hobby.” That may sound weird to hear because obviously a lot of people care about how you make money. Of course, as investors we are connected to these corporations; as they are making money, so are we. So, can a corporation or an investment account really be negative when they’re operating like they’re intended to be operated?

Now, there can certainly arguments to be made that you can grow your investment account and invest in companies that make us feel better. Businesses now are much more focused about the stakeholder instead of solely focusing on the stockholder. And part of that responsibility is on the stockholder by showing that it cares about the corporate stakeholders. Every corporation seems to have its own level of Corporate Social Responsibility to try and show that it too cares about the things the stockholders care about. Better working conditions for employees, fair wages, giving back to charities, and yes, helping the environment. There is an argument to be made that if a corporation is “falling behind” when it comes to various social issues it is bound to be in the middle of negative Twitter firestorms and other negative press that can certainly show its way back to the income statement.

I’m sure everyone has their own list of companies they are boycotting or refuse to do business with for whatever standard those businesses failed at, from a business operations standpoint or something completely separate from the product they were offering (such as my grandfather who refused to eat at Pizza Hut for over a decade because of slow service even though it was the only pizza place in their small town). Does that effect on the income statement equate to a net-positive compared to the expenses spent on whatever wings of CSR (Corporate Social Responsibility) the company is running? I don’t know, and I can’t speculate either way. But when it comes to investors picking which stocks to purchase, being in the good graces of the public can’t be a bad thing.

Of course, all of this is simply looking at the dollars at stake. I’m sure there are people who would happily invest dollars today in the non-dollar return of sustaining the planet because as I’ve heard “what good is saving money for the next 50-60 years if none of us will be alive in 30?” Which is to say if the returns you are seeking are in fact bigger than the dollars and you know what you are investing in, then why shouldn’t you choose that?

One of the greatest things about America is there are so many ways for people to express themselves. There is the expression through speech, which I’m sure everyone has been both thrilled and annoyed at various times that people have that freedom of expression. But you also can show expression through consumption. If you really want to boycott a business, for whatever reason, you can. You can spend your money however you want to. You can support whatever business or causes you want to. And I think America has set everyone up to be able to succeed at that as well.

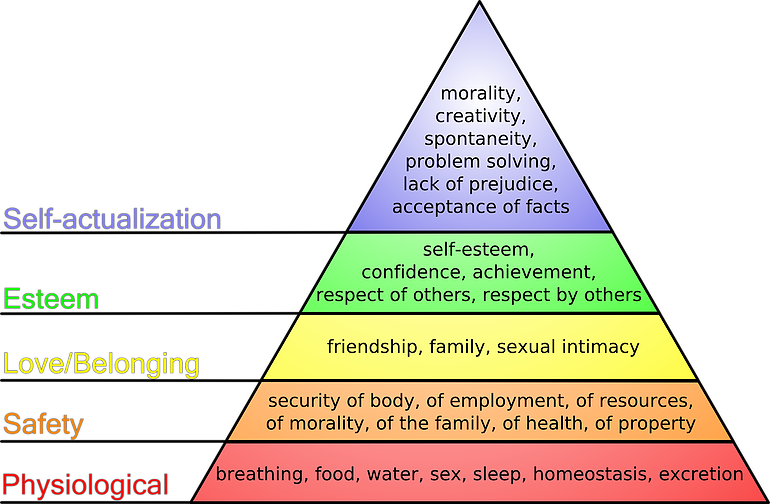

When studying my social sciences courses in college, we discussed the Maslow’s hierarchy in great detail, and that theory can be seen in America. In America, with the basic necessities of survival pretty much met by every person living here, you’re afforded the ability to move up the pyramid to other needs. That very top of the pyramid is focused on self-actualization, however you interpret that. When it comes to investing, there is some function of survival included in that. It wouldn’t make sense to emphasize virtues about who you are as a person over making sure you’re covering the basic things you need to live at all.

Once you’re past the “having enough money to survive in retirement” aspect of investing, the rest of the investments are going towards things that you choose to spend money on, and trust me, there’s a lot of options to spend your money on. But you just must remember the entire reason you are investing. If you are able to reach your goals, of both survival and lifestyle, then you can focus on that “top part of the pyramid” and focus on things you find important. So, how do you figure out if your goals are being met and which investments to pursue? Well, that’s where we come in!

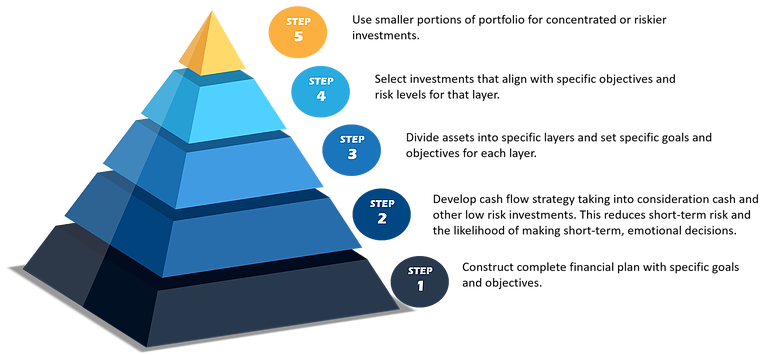

At SEM we advocate a “Behavioral Portfolio” approach. The base of the portfolio is a complete financial plan, followed by a cash flow strategy. After those two are developed we work with financial advisors to create a customized investment portfolio designed to work with both as well as the investment personality of the client. SEM is then responsible for on-going monitoring and adjustments of the portfolio as well as reporting back to the financial advisor any possible improvements that could be made to the allocations. The “top of the pyramid” is where we have flexibility to add investments to fulfill some of your personal desires without disrupting your overall financial plan and cash flow strategy.

Up until this year, this was really the only way when investing with SEM to “invest with your heart”. We had reviewed numerous studies which showed a significant performance difference between “responsible” investing funds and the broader index funds. However last fall, Jeff and I began studying ways SEM could add value to a “responsible” portfolio which would allow our clients to invest with their heart with more of their portfolios without taking on too much risk.

On January 2 we launched the SEM Cornerstone Models, which invest solely in Biblically Responsible Investment (BRI) funds. We will have the details in the coming weeks, but essentially these models utilize SEM’s AmeriGuard systems within the BRI universe. We were pleased the results of applying active management did not degrade the overall performance of the portfolios, which now allows us to include them in the main part of our investment recommendations. If you would like more information on the Cornerstone portfolios, let Jeff know.

Given the surprising results of our Cornerstone Models we will also begin working on “Socially Responsible” investments in the coming months. Stay tuned.