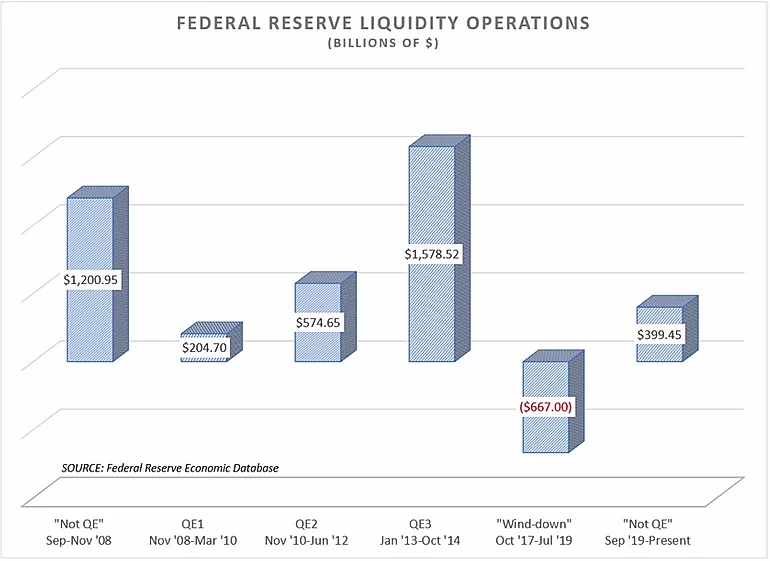

As we start a new decade it appears we will continue to have "unprecedented" measures by the Federal Reserve to keep the markets rising. While the Fed refuses to call the huge influx of cash into the banking system "Quantitative Easing (QE)," the fact the banking system still needs the Federal Reserve to provide liquidity 12 years after the financial crisis is a sign the banking system is broken.

I've argued since the first "not QE" operation back in 2008 that the Fed's actions would cause unintended consequences that will lead to a future crisis. By not allowing the banks who took on far too much risk to fail, they were encouraging the banks to continue taking extreme risks with our deposits, knowing the Fed would be there to bail them out. We've seen corporate debt grow at an exponential rate, far surpassing where it was at before the crisis. Household debt, which pre-crisis was led by mortgage debt has also surpassed where it was at in 2007. This time the jump was led by student loans and "consumer" debt (cars, credit cards, furniture, etc.) In other words, debt that cannot be paid off by selling what it was you used to accumulate it.

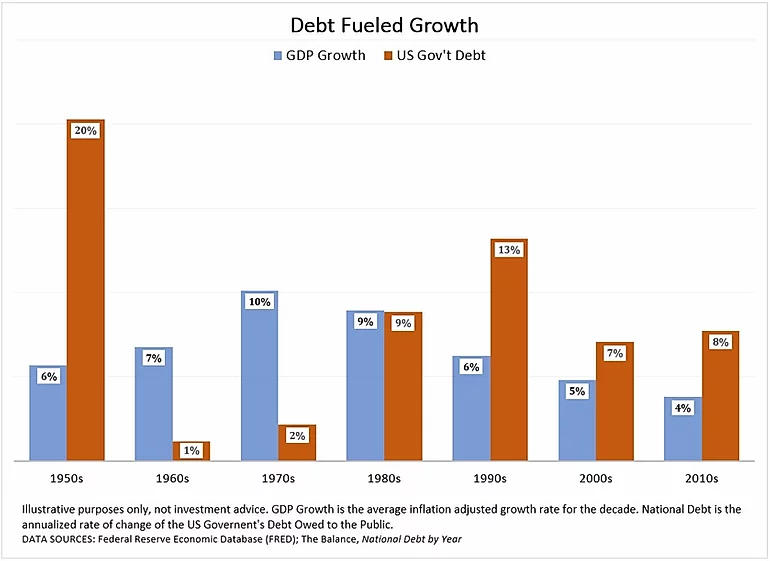

You would think all of this debt and stimulus provided by the Fed would lead to strong economic growth, but it hasn't. Instead we had the worst GDP growth of the modern era. Corporate earnings enjoyed strong growth, but personal income did not come anywhere near keeping up. All the Federal Reserve did was help fund the US Government's deficit and prop up the banks so they could post record profits. Sooner or later something has to give. When the free market takes over as it did in 2008, 2000, the 1970s, and the 1930s there will be nothing the Fed or the government can do to prevent it.

When that happens is anybody's guess, and far too complicated to address in this blog. Instead this week's Chart of the Week illustrates how weak our banking system really is.

The reason the banks need this injection is the US Government is borrowing far too much money for the free market to support. The Government sells bonds at auction to the primary dealers, who then hope to turn around and sell them in the free market. The auctions have been so large the banks simply do not have enough cash on hand to meet the demands on the cash and they haven't been able to find enough willing buyers to purchase the Treasury Bonds. So the Fed is stepping in and buying the bonds back from the banks to give them the cash liquidity they need.

For three decades now debt has grown significantly faster than the economy. Paying back the debt leads to even slower growth, which makes it harder for the free market to finance the debt. Whether it is due to higher taxes to finance the debt, reduced spending, or slower economic growth, at some point the working age voters will have enough and we will see a real Social & Economic crisis develop.

Whatever you call it, the Federal Reserve is literally financing the US Government deficit because the banks do not have enough money to do it and the free market has lost its appetite for this low yielding debt.