Dating back to my days in high school government class, the REAL most interesting branch of government I always thought was Congress. After all, the Congressional Article was the Article before the Executive Branch in the Constitution, so our founding fathers seem to agree with me. It’s typically just easier for us as a news-seeking populace to track one person and feel like we are in the loop. Although this current one person to track doesn’t seem to make his way into the mainstream as much as the previous person, but that’s beside the point. Congress is like a weird reality show with all of these differing personalities combing every square mile of this country to get the “best” of us to represent the rest of us (never mind that the most recent Economist Congressional Job Approval was at a paltry 21%, which was steady at this level of approval the entirety of the previous Administration as well). I do a lot of vote tracking and keeping tabs of the House and the Senate. Let me tell you, there’s a lot of…well, nothing. You guys aren’t really missing much, but occasionally, they do something. In this case, the something made its way into the mainstream, when headlines were made about a $1T “bipartisan” infrastructure bill. Is this progress? Is gridlock dead?

The Senate version of the bill passed with all Democrats favoring the package, which with Democrats holding the tiebreak in the Senate, that would be enough to pass it regardless of Republican support. However, 19 Republicans did come along to also vote to pass this package. All it took was adding in 19 amendments to the bill (interesting that the number of proposed amendments match exactly the number of voters from across the aisle). Side point, that is exactly how we get these bills to end up as thousands of pages, because each and every amendment bill to sweeten a "yes" vote adds an extra layer of complexity to it, which creates a complete mess of legislation that nobody without a law degree can follow. As you’d imagine, for a wide-scale infrastructure package there are a number of things that can be added on to help get a representative’s constituents to feel positively about this bill – and constituents like stuff. Who wouldn’t like roads and schools and drinking water improvements? So, is it really a positive development? The parties are the same in that regard.

The timeline is fascinating to look at. The Senate infrastructure bill passed Tuesday. If we fast forward the next day, bipartisanship certainly carried forward, right? Well, no. Because a vote to set the 2022 congressional budget was approved with 50 "yes" votes – all Democratic. Which I think is a very interesting thing about fiscal conservatism today within the Republican Party. The ENTIRE budget, with just a very big number attached to it spreading across ALL areas of our federal spending, Republicans will stay true to their fiscal conservatism. But when you start going into specifics, at a “smaller” $1T price tag, ears can be opened. We all have our point of compromise. [Jeff here: A few weeks back I wrote about a speech given by former Federal Reserve Governor Richard Fisher. When talking about the idea that Republicans were fiscally conservative he said, “Both Republicans and Democrats enjoy spending money. Democrats just seem to enjoy it a little bit more.”]

Just like everything involved in Congress, the issue of partisan lines and ideologies are far more complex than the simple “Democrats control the House and Senate they can pass whatever they want”, because not all Democrats are the same, just like not all Republicans are the same. The reason why this isn’t just a simple “here’s $1T for roads and other stuff” is because the House will not even take the Senate version of the bill to the floor. $1T is not enough, but the House can’t pass their everything plus the kitchen sink infrastructure bill because moderate Democrats Joe Manchin and Kirsten Sinema have said that their ceiling of support is somewhere around $3.5T. What this likely means is that we will not get a joint agreement between the two chambers, and until that happens, nothing gets sent to President Biden’s desk to sign. Messy, messy Congress.

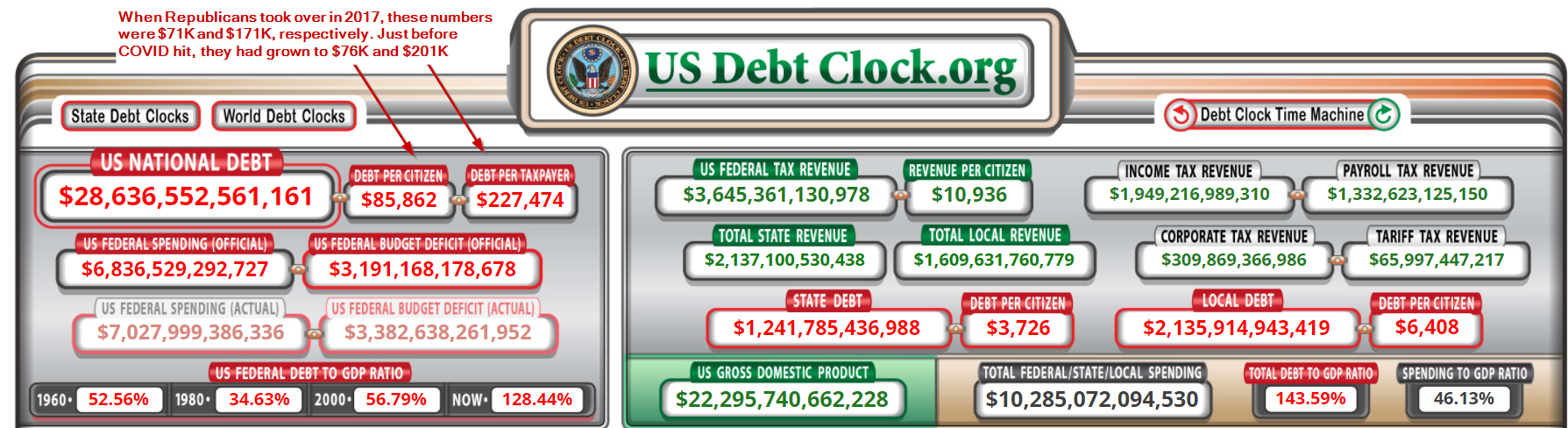

While this is mostly just politics as usual, there are some impacts to look out for that can affect the economy. Certainly an infrastructure package would add jobs and other potential long-term economic benefits, but it also could add to a debt ceiling that has continued to spiral upward exponentially with no real levy to stop it from going upward. There’s a lot of different ways to think about this new package, and a lot of different ways to think about the debt ceiling. [Jeff again: Let’s not forget the Republican Controlled Congress temporarily repealed the debt ceiling because the Trump Tax Cuts were going to add to the deficit. Also, the impact on the economy will be spread over years or even decades – we’re still seeing benefits from some of the infrastructure spending passed during President Obama’s first year, mostly because it took that long for the projects to get off the ground.]

That is the essence of what politics is; thoughts and ideas being debated to determine the correct way to do things with no clear right answer. The no right answer part tends to allude random people you might find on the Internet. But for the most part, people don’t like politics. They don’t like how messy it is. They don’t like Congress FAR more than they don’t like either of our last 3 presidents, and Congress is the final form of Politics. So while I find this stuff interesting, because I’m weird, SEM is not going to dabble in this level of thought and debate. Hopefully that will ensure that SEM doesn’t have the same approval rating issues that Congress has and we will continue to look at market data without human bias and provide sound investment management regardless of what other messes our political climate finds itself in.

Jeff's Random Musing

I find myself having more and more conversations with people about the prospects of the stock market never having another bear market. These are conversations have occurred with new investors, seasoned investors, young financial advisors, and experienced advisors. Maybe they are right, but I suspect there is a large dose of availability (recency) bias.

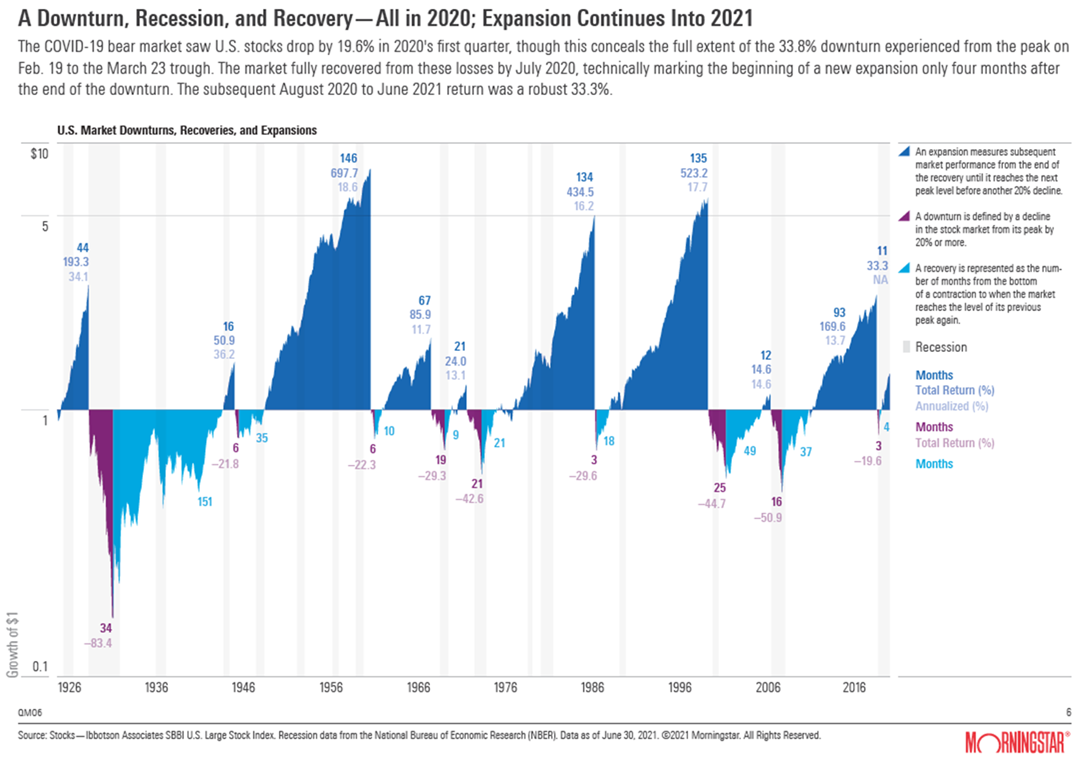

2020 gave us the shortest recession and the shortest bear market on record. The overwhelming force thrown at the economy and financial markets by Congress and the Federal Reserve was unprecedented. Based on my conversations this is now believed to be the norm. I think that is completely misguided. I would love to never have to see investors lose half their retirement savings again, but the fundamentals of the economy do not allow for every company to be a winner and every investor to always make money.

Over the long-run, the growth of the stock market is equal to economic (GDP) growth + inflation + dividends. When market growth exceeds this formula for too long, we see a sharp correction. Not every company can be a winner. Even if Congress and the Federal Reserve attempt to ensure this over the short-term, eventually their short-term solutions turn into unforeseen problems. They create disconnects in the economy that must be resolved.

I don’t believe we’ve seen a permanent shift. Recessions and bear markets will happen and we won’t see the amount of money and effort thrown at them to prevent some severe damage. I like to look at this chart from Morningstar to provide prospective. Most of the time the market goes up as you can see from the dark blue areas. However, there are times in between where the market can lose a lot of money and spend 1-5 years “underwater”. If you are young and working and not living off your investments, those are frustrating years, but nothing dire. If you are older, retired, or nearly retired or needing the investments for something in the next 5-10 years those periods in the lower half of the chart can be devastating.

The nice part about working with SEM is that we can create a customized solution based on your financial plan, cash flow strategy, and investment personality. For those who have time on their side, we have models that are fully participating in the market rally. For those with not so much time, we have models designed to squeeze as much low risk income as possible at the current stage and wait patiently for the next big buying opportunity.

The key value when working with SEM is this – you don’t have to believe recessions and bear markets will never happen again. You don’t have to trust Congress and the Federal Reserve to do the right thing at the right time to save your account. You don’t have to HOPE things work out.

If you are in the camp of “no more recessions/bear markets”, let’s start a conversation in the comments below. I’m open to admitting when I’m wrong and love to hear other points of view.