I had my annual medical check-up this morning. With that in mind, I thought I'd do a quick check-up on the market.

Stocks are VERY Overvalued

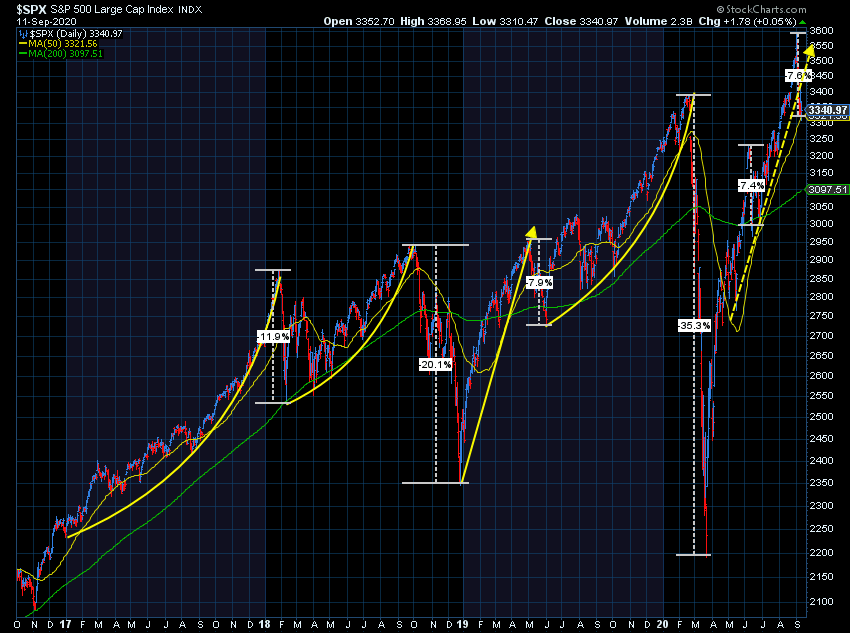

The S&P 500 has dropped nearly 8% since September 1. This isn't the first time it's dropped this much during the parabolic move off the bottom. There really wasn't any news that would cause this large of an adjustment. Sentiment was obviously extremely bullish going into the month. We had 4 clients in one week asking if we could buy Tesla stock for them. Let's just say it hasn't gone well for the one client we couldn't talk out of it. We've fielded increasing calls to buy Apple, Google, Amazon, and other high-flying stocks the past several weeks. The late 90s did see much more delusional greed towards individual stocks, but this is the first time since the tech bubble burst I saw this kind of desire to get in on a mania.

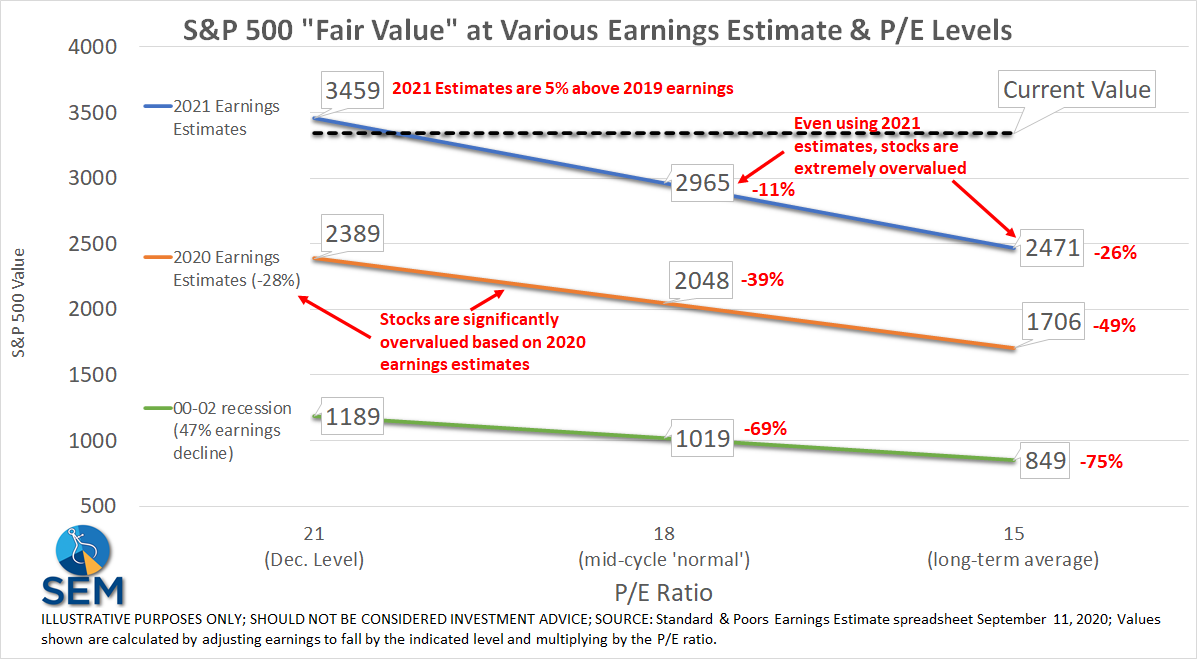

Let's look at the most popular valuation metric, the Price/Earnings ratio. The average P/E ratio is 15, but let's give the market the benefit of the doubt and use the "mid-cycle" average P/E, which is also the median P/E the past 20 years of 18. The P/E is normally calculated using the last 12 months of earnings. For obvious reasons, the "E" is low and heading lower for a bit longer, so most market experts are using an adjusted number when determining a "fair value" for stocks.

Here is the P/E ratio using various earnings numbers:

- Trailing 12 Months: 29

- 2019 Earnings: 20

- 2021 Earnings Estimates: 21

- 2022 Earnings Estimates: 18

The only time we've seen valuations this high on future estimates was in the final days of past market bubbles (2000 & 1929). Think of it this way. Even if stocks do hit the earnings estimates in 2021 and 2022, if you are buying stocks today (after the 8% drop in the market), you are paying significantly more than the long-term average. The only way for you to make money is to have higher than expected growth AND a willingness on the part of investors to continue paying very high multiples on earnings.

Just a small adjustment in risk appetite or earnings estimates can lead to huge losses. That said, the market can stay overvalued far longer than most of us will expect. The market is usually not rational. We remain invested heavily in stocks in our equity programs, but are warning clients we could certainly see a correction before our models are ready to adjust. That last part is the most important part – just as we did in February and March and as we've done for the past 29 years, we are ready to unemotionally reduce risk in our client's accounts as needed.

Bonds are Also VERY Overvalued

For 10 years now I've been having to talk clients out of moving out of our fixed income programs because they heard bonds were overvalued. I always brought up a few points:

- There are many types of bonds, each of which have different traits that react differently to different environments.

- There is a lot of opportunity to make money in fixed income when rates make big moves up or down.

- Bonds can play a key role in specific types of portfolios, especially for more conservative investors or those retired or nearly retired. You CANNOT compare bond yields to stock yields. With bonds you still have a fairly high likelihood of getting your money back. Just like in 2008, dividend stocks were CRUSHED in February/March this year and lost significantly more than junk bonds.

All those points still hold true, but the Fed has pushed us closer to the zero-bound limit on bond yields. Yes rates could technically go negative, but that could cause serious unintended consequences. The Fed is aware of this and has made it clear they do not plan on pushing policy rates into negative territory. (This does not mean other parts of the Treasury curve could not go negative since the bond market tends to control rates more than the Fed the further out you go in maturity.)

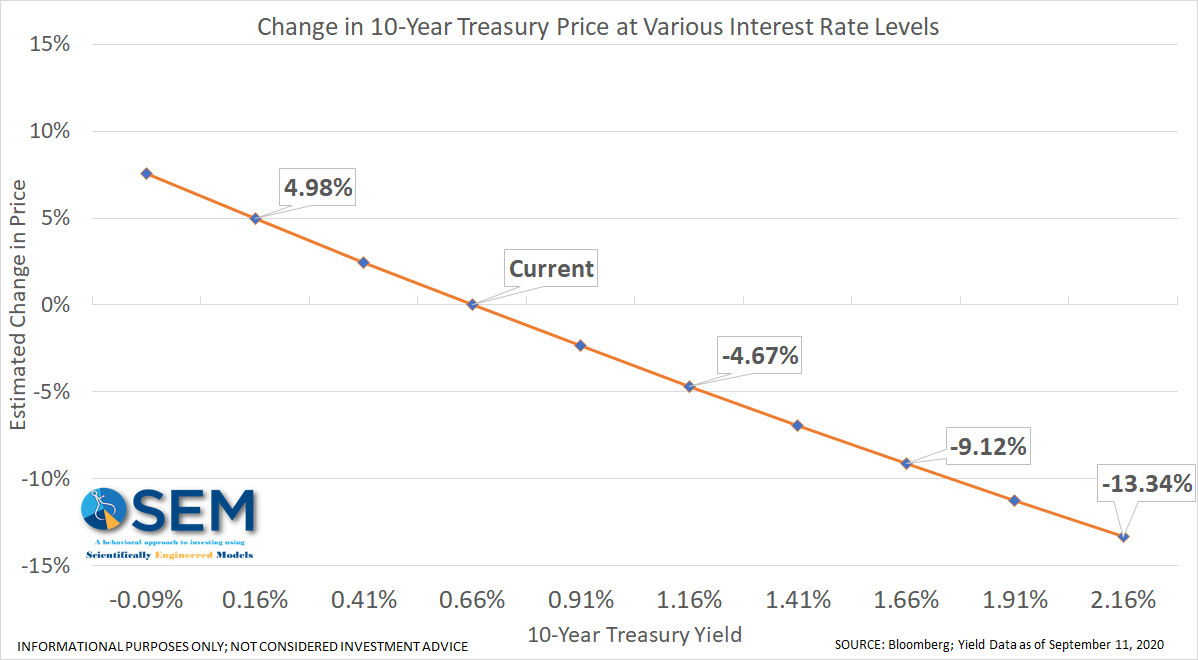

There is still room to make money if rates do go lower (in this scenario stocks would likely be hit hard because it would mean we had serious problems with the economic recovery). However, you could also lose a lot of money in Treasury bonds. This chart illustrates the price changes on 10-year Treasury Bonds as yields move in either direction. A 1% move higher in rates would lead to a 9% drop in the price.

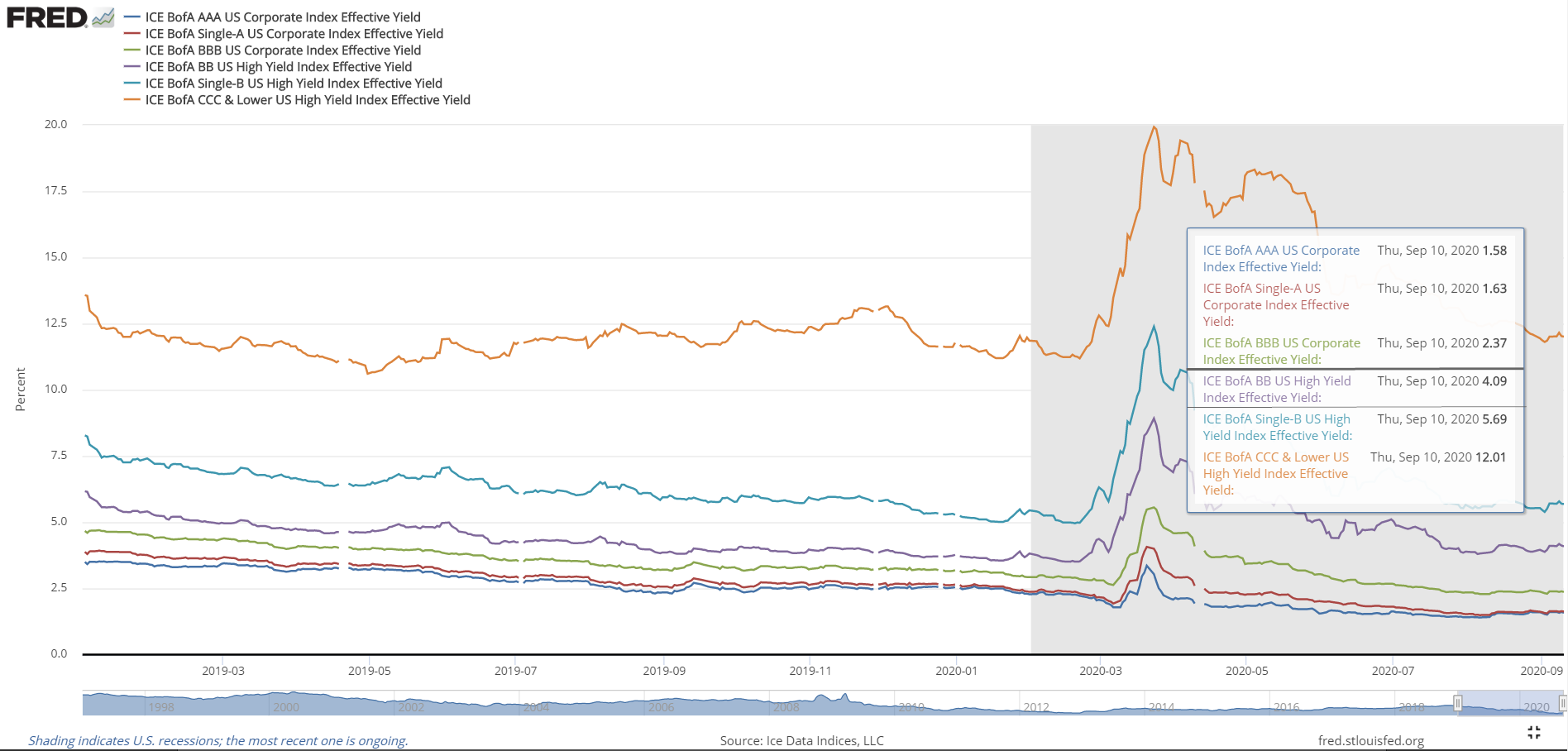

A bigger concern is the lack of yield available for corporate bonds. There are a few key areas of concern. BBB bonds are the lowest rated "investment grade" bond issues. The problem is leverage ratios for those issuers has doubled since 2007. Another way to think of it those bonds that are "investment grade" now, would have been rated "junk" in 2007.

The other issue is the yields you are receiving.

The aforementioned BBB bonds are only paying 2.37% right now despite the high levels of leverage from the issuers. The first level of "junk" (BB) gives you 4.09%. The Fed is authorized to buy those bonds (if they were above investment grade in pre-COVID). To put that yield in perspective, 10-year Treasury Bonds were yielding 4.9% in 2007. Maybe with the Fed as a backstop on BBB and BB bonds, it's worth it, but the Fed cannot buy EVERY bond.

The bigger issue is the B-rated bonds, which give you a 5.7% yield. This is the "average" rating in the high yield bond fund index and for most high yield mutual funds. The Fed CANNOT buy B-rated bonds. Is the extra 1.7% yield between BB and B-rated bonds worth it? Spreads between high yield bonds and Treasuries are once again below the long-term average and are back to where they were at pre-COVID.

The Fed and Congress did a good job preventing mass financial chaos. We were due for a recession and are still very likely to see the normal impacts we see during every recession – large amounts of business closures, widespread layoffs, and a spike in loan defaults. Your 4 or 5% yields will not cover the risk you are taking in the bond market. When that happens is anybody's guess. We could certainly see yields go even lower (and prices rising) for some time. We remain heavily invested in high yield bonds, but as we've done for the past 29 years (and as we did in late February) are ready to move out of high yields and into lower risk bonds.

Keep in mind, a spike in defaults and a sell-off in high yields is never good for stock prices (although it would be good for Treasury Bond prices.)

95% Economy is a Big Problem

Most people are expecting the economy to return to "normal". For reasons we've documented many times the past few months (and touched on above), getting back to 100% is not realistic. Instead, we seem to be heading to a 95% recovery. This "new normal" is not priced into stocks and could cause ripple effects throughout the economy.

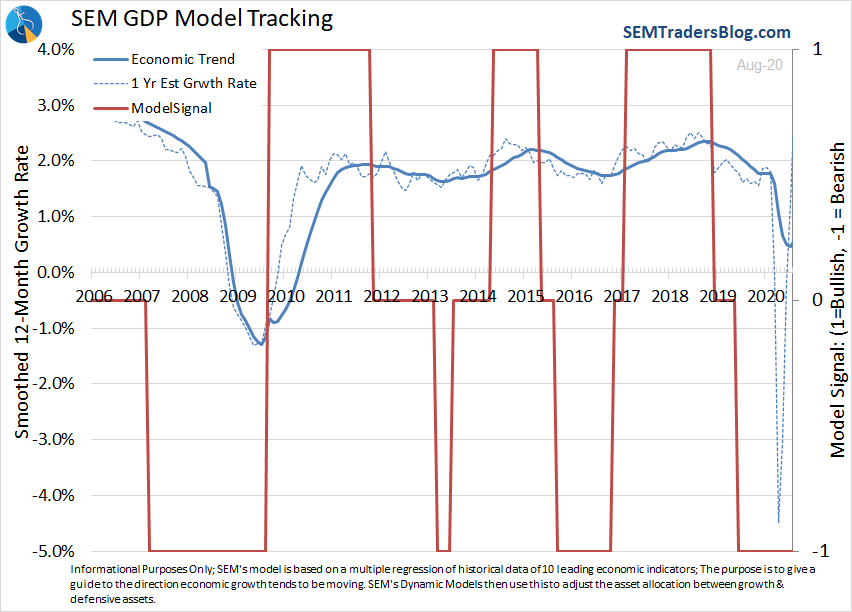

Here is our latest economic update:

Bracing for the Election

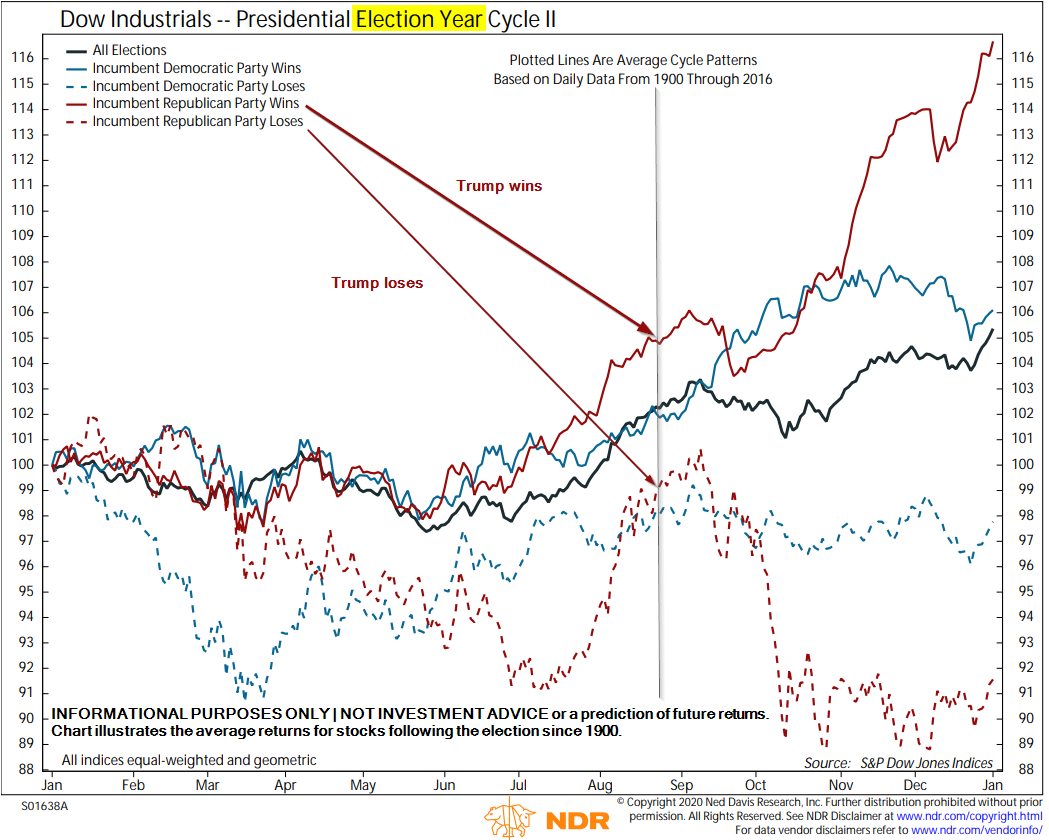

A few weeks back I highlighted what the data says we could expect the rest of the year. Essentially there will be opposite reactions based on the outcome (with some of those moves reversed the following year). September is usually when the volatility starts.

Of course the data was put together with the benefit of hindsight. Since we won't know who ended up winning until at least November we will have to let the market be a guide to what to expect. As always, our behavioral approach is designed to adjust to whatever direction the market decides to take going into and after the election. 2016 was a good year for us. Even though the market got it wrong, our clients were able to side-step a large chunk of the volatility and quickly adjust back into the market when the post-election rally began. This year is likely to be even more volatile than 2016.

This brings up my number one rule in investing during election years:

Do not let your political opinions influence your investment decisions. (If you're an advisor, this means not letting it influence your advice to clients.)

And We Still have COVID-19

From the outset, I've been attempting to use data and a mosaic approach to provide a general idea of what to expect. I read A LOT and sit in on A LOT of calls and virtual conferences. I've cautioned about any of us using hindsight bias in questioning our leaders (from either party). Decisions seem much more clear when we have all the data that wasn't known when the decision was made. The biggest issue with hindsight bias is it can harm our ability to make wise future decisions. If we think the decision should have been obvious in the past, then we will wait for the "obvious" path to emerge.

This presents a major problem as we move into the fall. Dr. Fauci is warning about some serious problems as we move indoors and run smack into flu season. Others are saying we've hit "herd immunity" and the fall won't be an issue. The problem is, we again will not know until it's too late what the best path forward the next few months will be.

My opinion-the best case scenario is we endure the coming wave of cases from college and other school re-openings for another month. With the much better treatment plans in place we have far fewer deaths. By November, pretty much everybody who was going to have it has had it. This could coincide with one or more vaccines that will be ready for production and distribution (although much slower than the White House is promising). I couldn't possibly assign odds to this, but I do believe it is not just a long shot.

The more likely case and one my doctor said she thinks is likely going to happen is similar to Dr. Fauci. Cases will not peak until late November, meaning hospitalizations and deaths will be high going into December. Many people were not yet exposed to the virus and will be vulnerable as we all let our guards down. This of course could have a psychological impact on consumers and could lead to another round of layoffs and business closures. Again, I cannot assign odds, but I do think it is something we all need to be prepared for.

When working with SEM, you don't have to worry about making those types of predictions. If the market signals indicate a need to take risk off the table we'll take risk off the table. If they see little risk, you'll see us add risk exposure. At the current time, the market is saying there is very little risk. The problem is if the more likely scenario on COVID develops at a time where stocks and bonds are overvalued the selling could be severe.

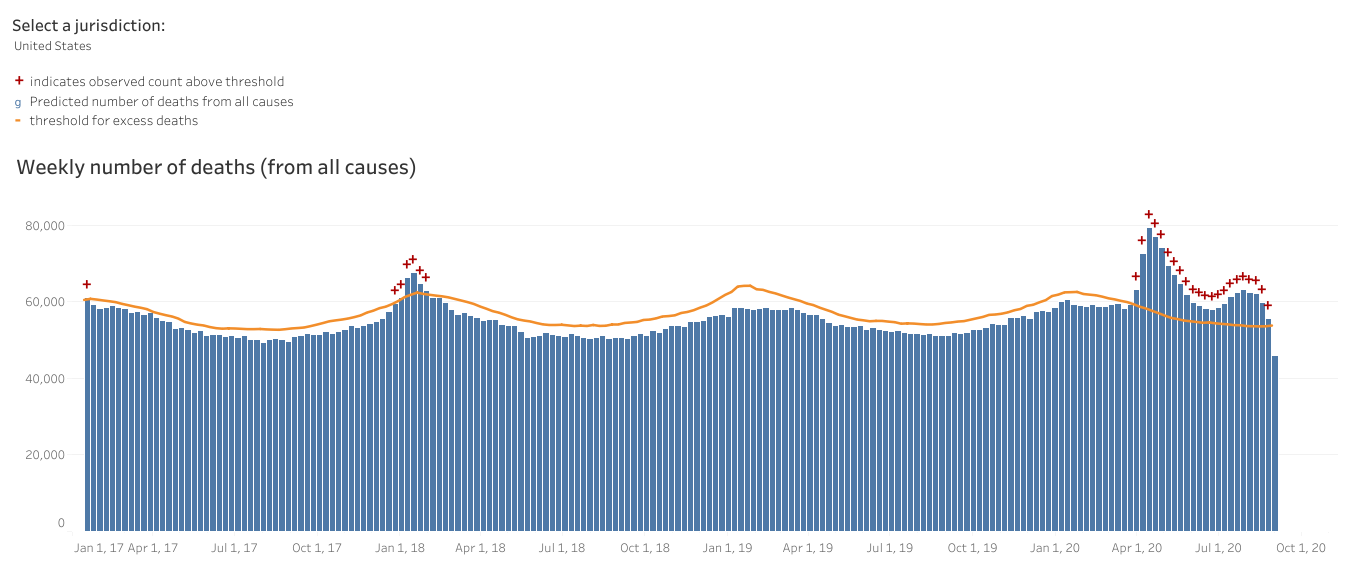

I didn't have time to update the COVID charts this morning. A quick glance at the data and the trends remain favorable both nationally and in Arizona and Virginia. We do have spikes in the midwest, but nothing yet to be alarmed about. One thing I wanted to address was the report circulating on social media about how less than 10,000 deaths are related to COVID alone. The argument, is COVID is not serious if it has not killed that many people by itself.

The issue is COVID attacks the weak. Nearly all of the deaths had a comorbidity, meaning there was some sort of underlying condition. In fact, the average person dying of COVID had 2.5 comorbidities. America is an obese nation. 70% of Americans are overweight or obese based on BMI data. A BMI over 30 is an "underlying health condition" or a comorbidity.

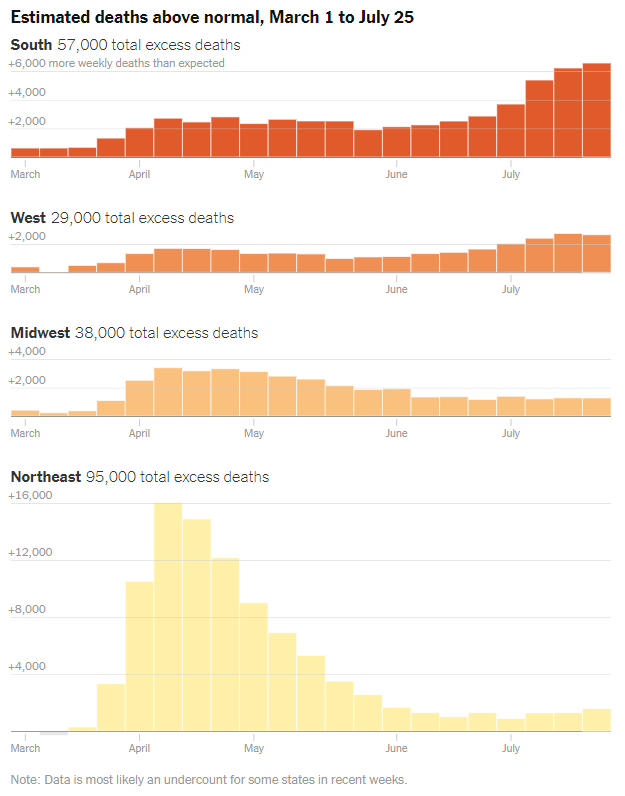

The fact is we've had 200,000 more people die this year than would have been expected in a "normal" year. The deaths have been clumped together in different regions. Whether or not there will be more in the months ahead is unknown.

We've probably passed the worst of it, but I've known a few people lately who let their guard down and caught it. It attacked the family members in different ways. The younger kids barely had symptoms. In both cases the dads were laid out for nearly 2 weeks and barely able to get any work done from home. It's not something I want to deal with or wish on anybody.