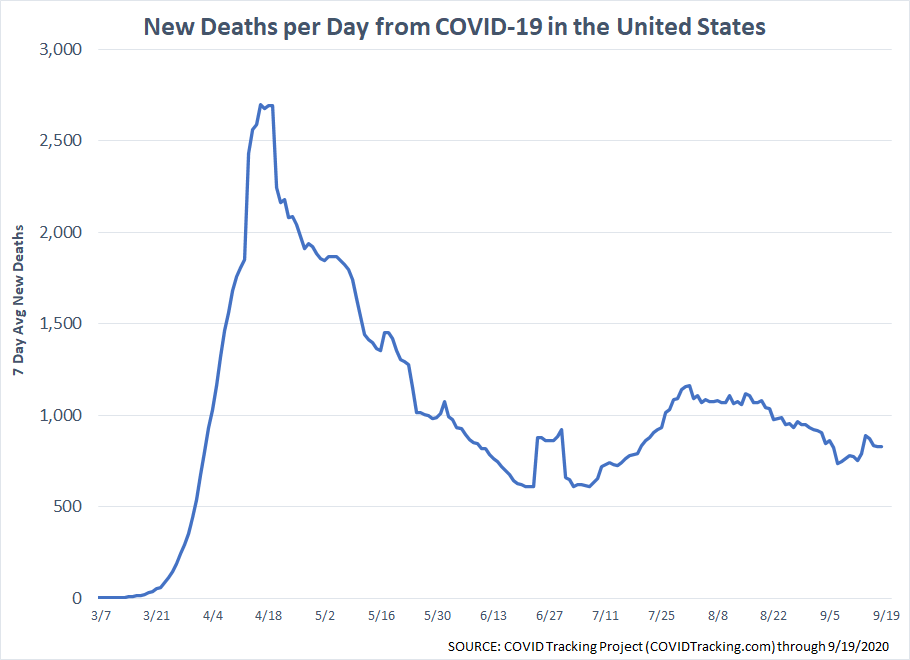

Last week as we crossed the 200,000 death total in the US we crossed the 6 month anniversary of "15 days to slow the spread" of the Coronavirus. From the outset I have cautioned us from using Hindsight Bias to question decisions made at the time. We've certainly learned a lot since the panic started 28 weeks ago. With the benefit of hindsight, my opinion is things could have turned out much worse. There were a lot of mistakes made along the way, but we are sitting in a solid position, but one where the wrong combination of decisions could set us up for a difficult 2021.

As those decisions are made we should expect more volatility. We won't know the ramifications of the upcoming decisions until months (or years) down the road. Let's take a quick look at the current landscape:

Election Uncertainty

Let me start off by issuing my #1 rule of election year investing:

Do not let your political opinions influence your investment decisions.

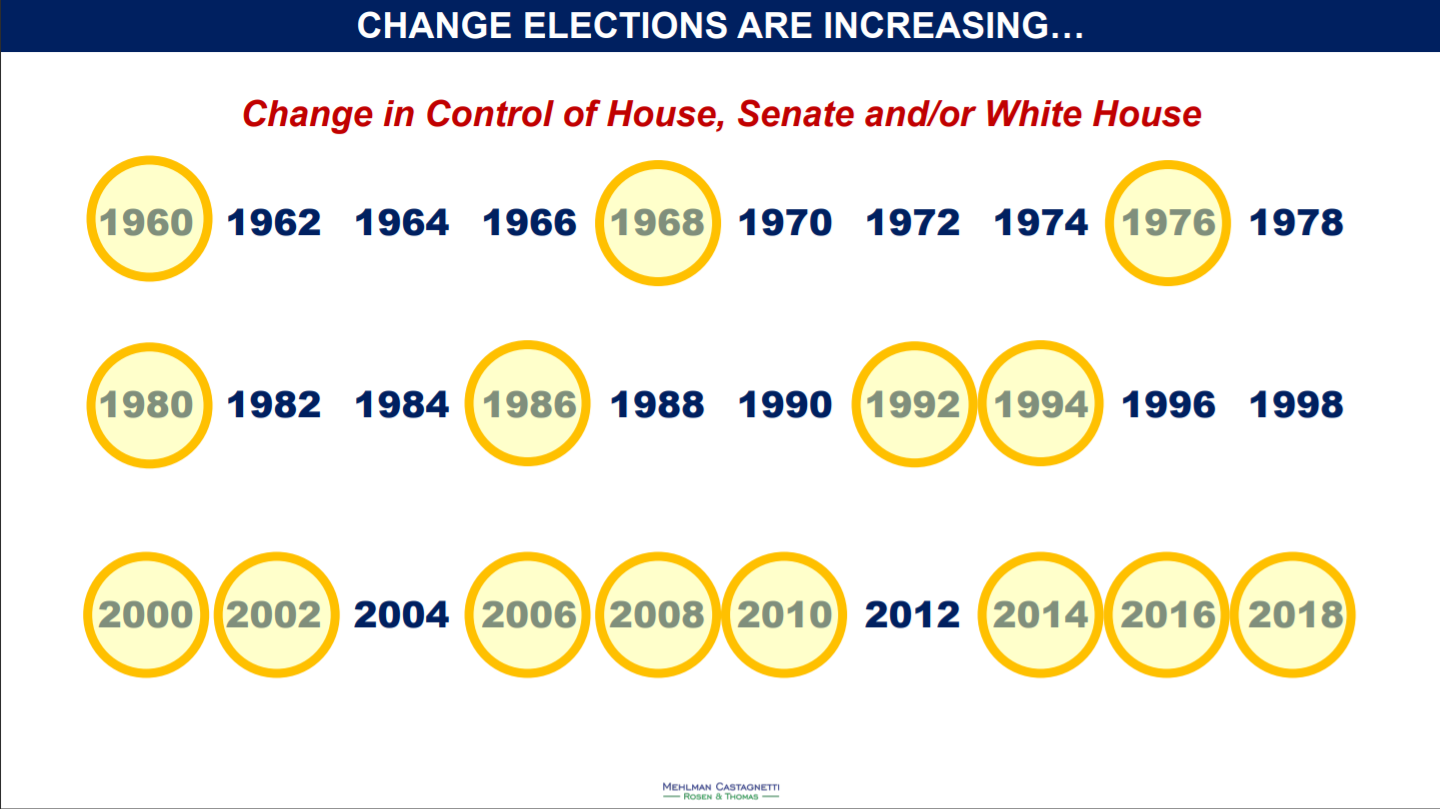

While I've heard from quite a few clients and advisors worried about the outcome and asking if SEM could go to cash if (fill in opposite party) wins, I don't think it is too much different than what I saw in 2016 and 2008. This century we've seen nearly every election being a "change" election. In 10 Congressional elections, we've seen the party in charge of the White House, Senate, and/or House change hands in 8 of them. From 1960 to 1978 we saw just 3 of the 20 being "change" elections. From 1980 to 1998 just 4 of the 20 involved a change in control (source).

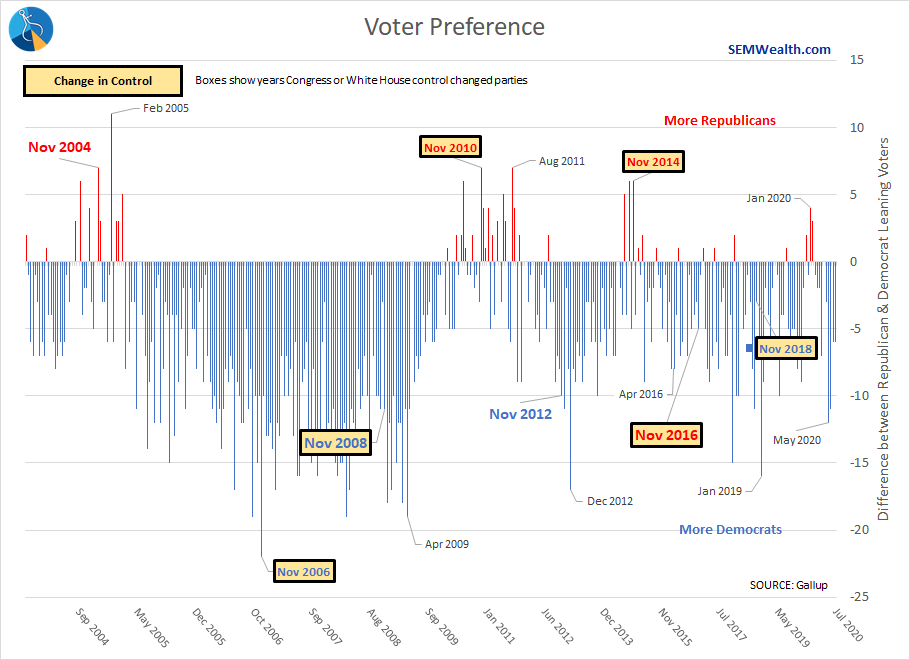

Gallup has gathered voter preference on a bi-weekly basis since 2004. I put together this chart showing the difference between Republican and Democratic preferences among likely voters. I then added the election years along with some other inflection points.

Both parties have had cracks at our growing list of problems and both have failed in the eyes of voters. Thinking one party is the be-all-end-all solution to our problems is misguided. According to Gallup approximately 40% of likely voters are Independents, so the way they lean will determine the outcome of the elections. The current gap has shrunk significantly from May of this year, but it is still larger than November 2018 when we saw voters give control of the House back to the Democrats.

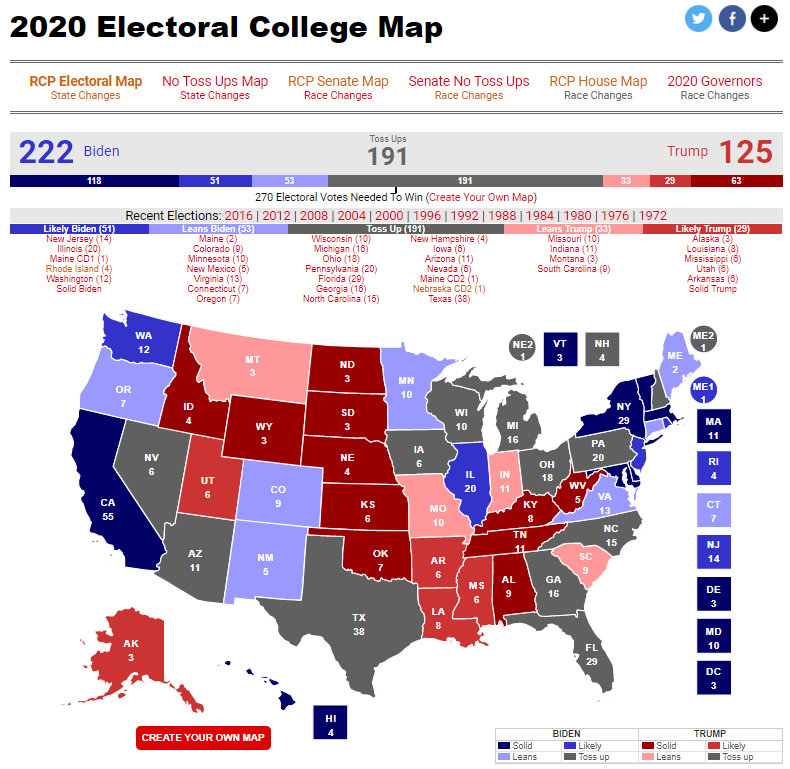

The election is not as clear-cut as many people believe. I've found RealClearPolitics to be one of the best sources for polling data. They show a whole lot of electoral votes up for grabs.

There is a WHOLE LOT more to cover in terms of the election. I'll be hosting a special edition of SEM University on September 29 at Noon ET. Make sure you sign-up here for a much deeper dive into what the data is saying about the election and how SEM is planning to adapt.

Social Cycle Getting Uglier

I've discussed the Social Cycle for years. What happens from a social perspective has a serious impact on our economy, taxes, and of course investments. In my discussions I always warned the prior 80-90 year cycles had some sort of armed conflict during the "crisis" stage (Revolutionary War, Civil War, and World War II). We don't necessarily have to have that this time, but we are seeing anger at the large disconnects in our society becoming increasingly violent. I'm not condoning the violence. I had hoped we would learn from history, but human nature doesn't change, which is why we go through these cycles.

I most recently wrote about it here:

President Trump is not the problem, but merely a symptom of it. We've become increasingly polarized and the President was actually the anti-establishment candidate. Remember, the Republican party did everything possible to push through their preferred candidates during the primaries. He won because voters were disenfranchised with the establishment. Now the establishment has reluctantly embraced Donald Trump at the same time on the Democratic side the most establishment candidate in the primaries somehow ended up on the ticket.

As an independent I'm not endorsing either candidate. I've said for a few decades the two party system is part of the problem, not the solution. We have some deep-rooted problems that will take a willingness to work together rather than placing all the blame on the opposite party. Those candidates currently are not winning their primaries, so we will continue to see this kind of social unrest. Sadly it looks like it will be the 2024 election before we actually get some truly new ideas not just a rehash of the 40 year ideological agendas the left and right continue to cling to. Our country didn't get into the mess we're in now during the Trump presidency. It was a long-time coming and will take hard work, sacrifice, and compromises to re-build.

Here's what's important – if you disagree with me, I'm not attacking you as a person. I want to have a conversation with you to understand why you feel the way you do. The data tells me there are good ideas from both sides and some really bad ideas from both sides. If we can work together to focus on the good ideas we will be that much closer to getting to the fun stage of the Social Cycle – the rebuilding (think 1950s).

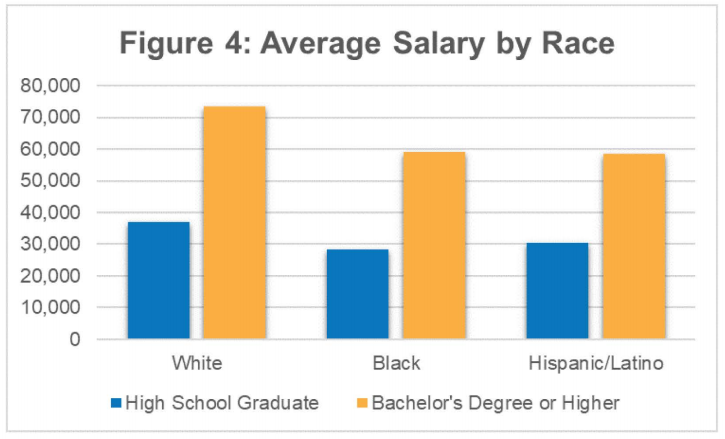

SEM wants to be part of the solution and have started an outreach program called 'Rooted'. We cannot mandate equal outcomes, but we can certainly work to improve areas where there are clearly not equal opportunities. Part of everything we do starts with research. We've created a diversity page of our website. I'd encourage you to check it out including our first research paper, which included this chart.

Stimulus Needed

I really cannot believe I'm typing those words. Although I've long said Keynes had it right – the government needs to be there to help smooth the economy during a recession, so long as we pay it back during the expansion. The problem is for 40 years both political parties have not bothered to pay any of the money back (minus a brief stint in the 1990s when a Democratic President and Republican Congress ran a surplus.)

It's estimated we still have 2.3 people unemployed for every 1 job opening. In February we had 0.9 people unemployed for every job opening (source). This means we have a large group of people who lost their job through no fault of their own.

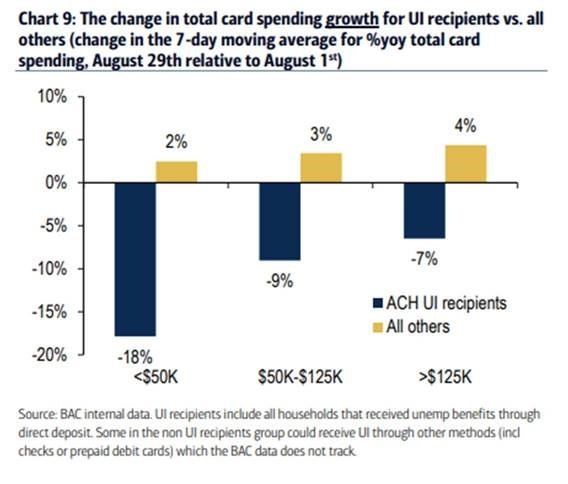

The massive influx of stimulus has helped keep us out of a depression (for now), but the expiration of the extended unemployment benefits is already making an impact on consumer spending. This will lead to even more layoffs, business closures, loan defaults, and bankruptcies. Bank of America was able to study the impact on spending from their customers from the beginning of August (when the extended benefits expired) to the end of August (since unemployment benefits (UI) are deposited electronically (source).

Until we can get the economy fully reopened (which will require also getting money to schools and local governments to pay for all the new safety requirements), we risk a major hit to the economy that could be difficult to repair.

Again, I absolutely hate saying this and hope at some point the "conservative" party finds some fiscal discipline regardless of who controls the White House. We absolutely must have the resolve to make sacrifices in the years ahead in order to get our federal (and state/local) balance sheet back under control or we risk permanently resetting our sustainable growth rate at a much lower level.

There is only so much the Fed can do. Many people believe the Fed will be able to keep the markets afloat forever. So long as inflation isn't an issue they may, but we are starting to see signs inflation could be a problem (have you tried to buy a 2x4 lately or even checked the price of paper towels?) When inflation is an issue bond investors will become especially vigilant. Inflation erodes the value of your interest payments and makes investors less willing to lend money. If inflation is a problem the Fed CANNOT keep inflating the economy. We haven't really had to deal with this problem since the mid-1990s and before that the 1970s.

I remember what the mid-1990s were like (pre-tech bubble) and it was not fun being a passive investment manager. At SEM we've been pouring most of our resources into testing, refining, and developing more inflation-adaptive strategies to handle what is likely to be a difficult 10 years. We also are actively seeking other outside managers to add to our platform who have capabilities and strengths we simply cannot develop in-house at SEM.

If you don't have those capabilities I would highly suggest we talk about deploying SEM as your Outsourced Chief Investment Officer (OCIO). Your job as a financial planner (or individual investor) is going to be hard enough with some likely tax law changes, sizeable changes to pensions, lower payouts from guaranteed products, and a shift in wealth from the Boomer generation to Gen X & the Millennials. We've been assisting several advisors in making this shift. We will purposely cap the number of advisors on the platform so we do not dilute our offerings and service level. I'd encourage you to look closely at how you spend your time. We'd love to help you out.

Market Still Disconnected

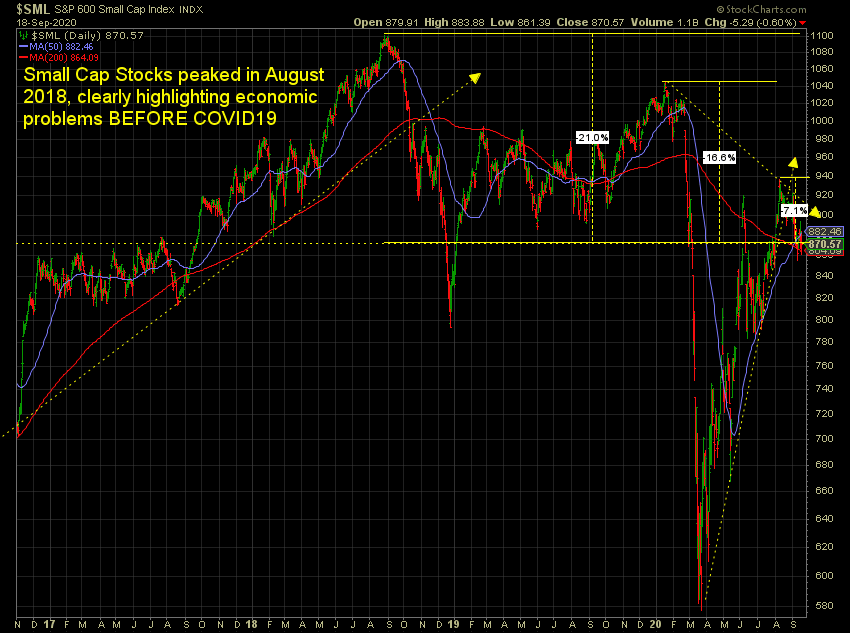

One popular fund company advised by some Nobel Prize winners has advocated "small over large, value over growth" based on their research. The fundamental reasons behind this are solid, but for the past 15 years having any small cap or value stocks in your portfolio has caused managers to underperform the "market" for the entire market cycle. I'm not one to declare the "death of value" or trumpet the "return of value".

At SEM we follow the trends and will overweight and underweight different sectors as those trends dictate. Our October SEM University will look at how SEM uses these "factors" in our portfolios. For now we remain overweight large cap with a heavy slant towards growth and currently no small cap exposure. We are reluctantly riding this trend as such a narrow market is not only not healthy (we need small caps to thrive to support the underlying economy), but especially dangerous.

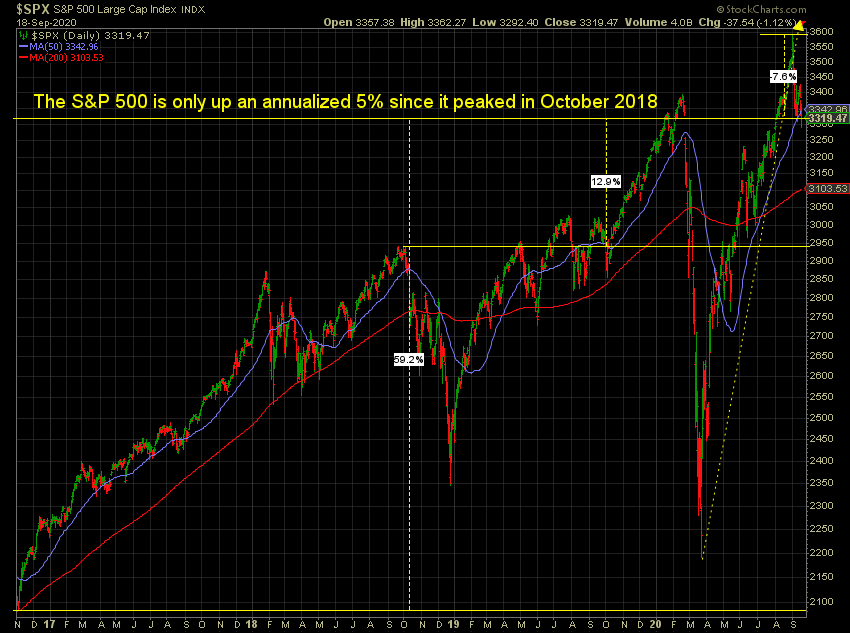

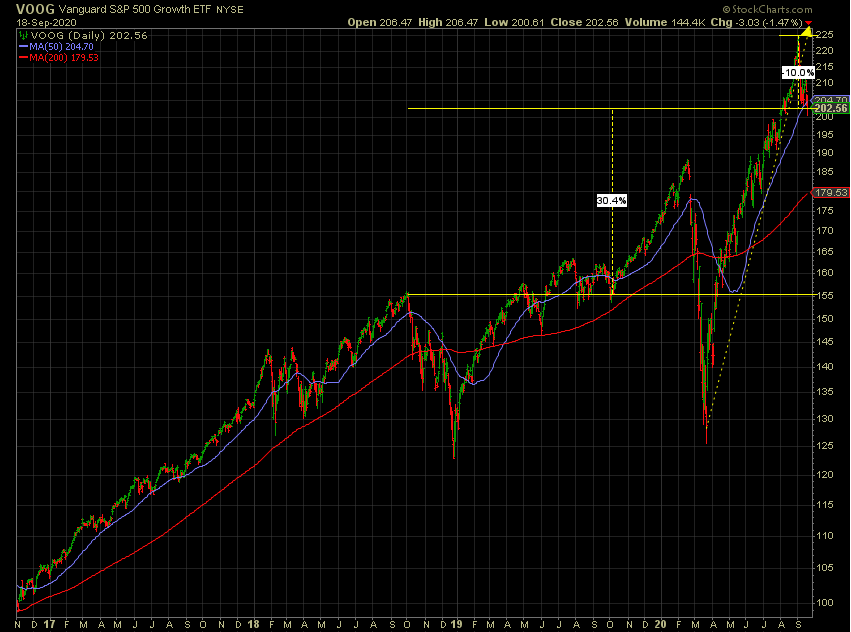

The last few weeks we've seen the high-flying large cap growth stocks take a hit. The NASDAQ lost 10% in 3 days, breaking the prior record of a 10% 6 day loss from February of this year. Small caps showed some momentum, but appear to have hit an inflection point. They are down 7% in just the past week and remain 17% off their February highs.

Since the peak in 2018, the S&P 500 has climbed 13%, which on an annualized rate is just 5%. That's still better than the nearly 10% annualized loss in small caps, but not as fantastic as so many people have believed. Both large and small caps received a huge boost from the Trump tax cuts, but that benefit quickly wore off.

Value stocks have struggled since early 2018 and are still 11% from their 2020 all-time highs.

Growth stocks, on the other hand have been the stars and are responsible for nearly all of the growth in the S&P 500 even after the 10% correction over the past week.

Even with the sell-off the trends remain in favor of growth. For years the small/value advocates have argued for the "great rotation". We saw the Blackrock's, SEIs, and other asset allocators make that call to start the quarter. They've done this many times over the past 5 years. There is no reason to guess. We'll let the data tells us when it's time to make that jump.

Virus Still An Issue

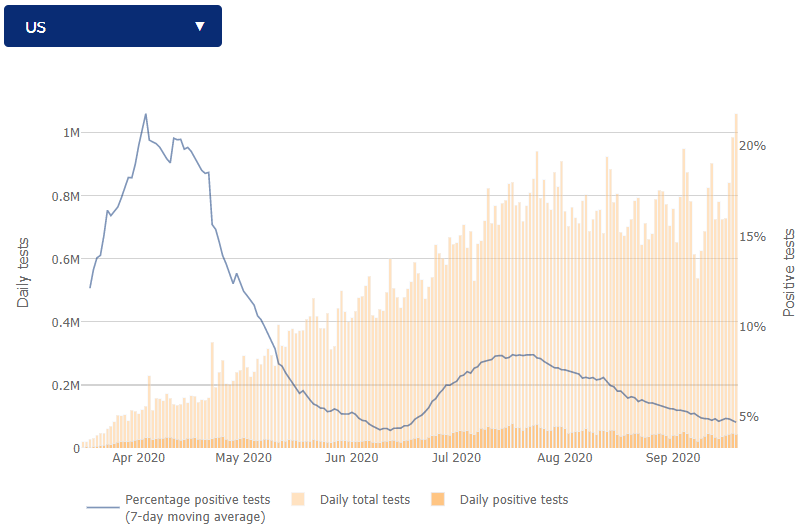

Last week I highlighted what I believe is the "best" case scenario for the virus.

My opinion-the best case scenario is we endure the coming wave of cases from college and other school re-openings for another month. With the much better treatment plans in place we have far fewer deaths. By November, pretty much everybody who was going to have it has had it. This could coincide with one or more vaccines that will be ready for production and distribution (although much slower than the White House is promising). I couldn't possibly assign odds to this, but I do believe it is not just a long shot.

I then discussed my "most likely" case.

The more likely case and one my doctor said she thinks is likely going to happen is similar to Dr. Fauci. Cases will not peak until late November, meaning hospitalizations and deaths will be high going into December. Many people were not yet exposed to the virus and will be vulnerable as we all let our guards down. This of course could have a psychological impact on consumers and could lead to another round of layoffs and business closures. Again, I cannot assign odds, but I do think it is something we all need to be prepared for.

We have another week or so to go before we will have a more clear picture, but so far things are looking good nationally and have us leaning towards the "best case". I hope that continues.

The Mauldin Strategic Investment Conference gave an update last week on some of their presentations from May. One of them, Dr. Rozien from the Cleveland Clinic echoed some of the positives I've been relaying the past few months (better treatments, fewer deaths, slower spread), but also cautioned about the vaccine. He mentioned how the Russian, Chinese, and Oxford vaccines are "dangerous" as they use outdated methods that actually have the potential to make the virus mutations even stronger. The other candidates use technology developed recently to help make the flu vaccines more efficient with fewer side effects. He warned that because it is new it may be a year or more before we should be fully confident in a vaccine.

Dr. Rozien then reminded us that you have a significantly higher chance of dying from the virus if you have underlying health conditions. The average person in the US dying from COVID had 2.5 comorbidities (underlying conditions). Most of those conditions are tied to things we can control (diet, exercise, and lifestyle). Changing those things also have the benefit of increasing your life expectancy and quality of life. The reason this virus has done so much more damage to America than others is partially related to the fact over 70% of Americans are considered obese (BMI over 30).

My physical last week was sobering, but not unexpected. As we get up there in age we all fear cancer. Those screens came back showing little risk in the major categories. However, for most of us it's not cancer that will get us.

It's tough seeing what you already know go into your medical records:

Patient is mildly obese (BMI of 31), has slightly high cholesterol, and too much sodium. Recommend changes in diet and increased exercise.

My weight jumped 20 pounds since the Super Bowl. I'm down about 8 since the peak, but still know I need to do better. I'll keep trying.

Have a fantastic week!