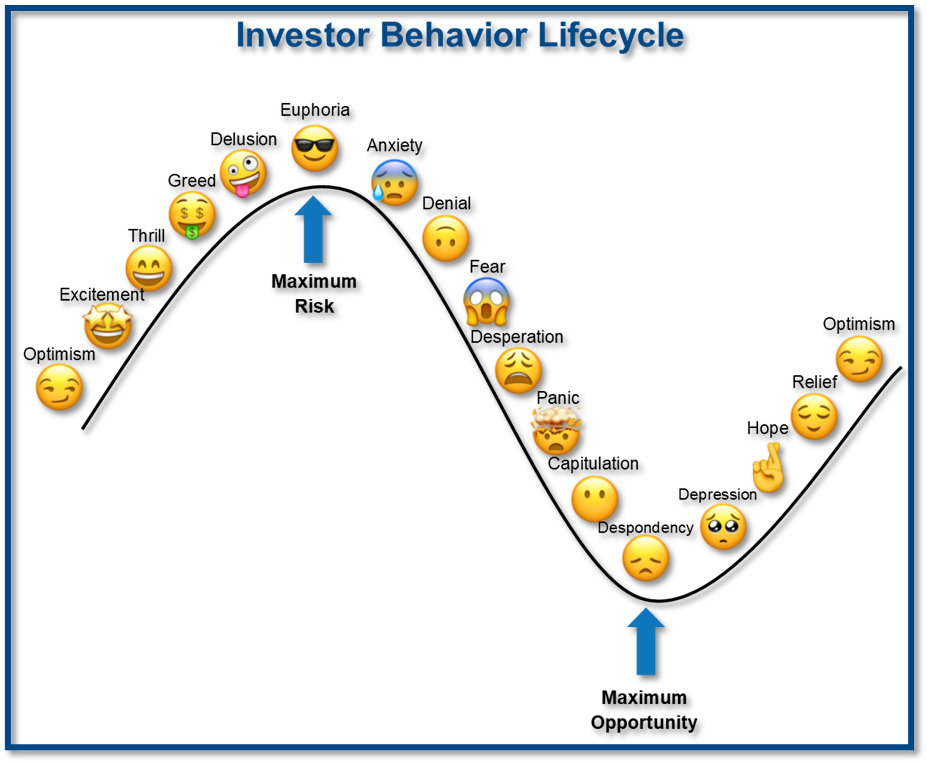

Our brains are programmed to remember more recent or very traumatic events more clearly, which makes us focus on those outcomes rather than other less memorable ones. This cycle actually drives bull and bear markets. Most investors individually follow the same emotional cycle. Since the markets are driven by humans, collectively the markets follow the same cycle.

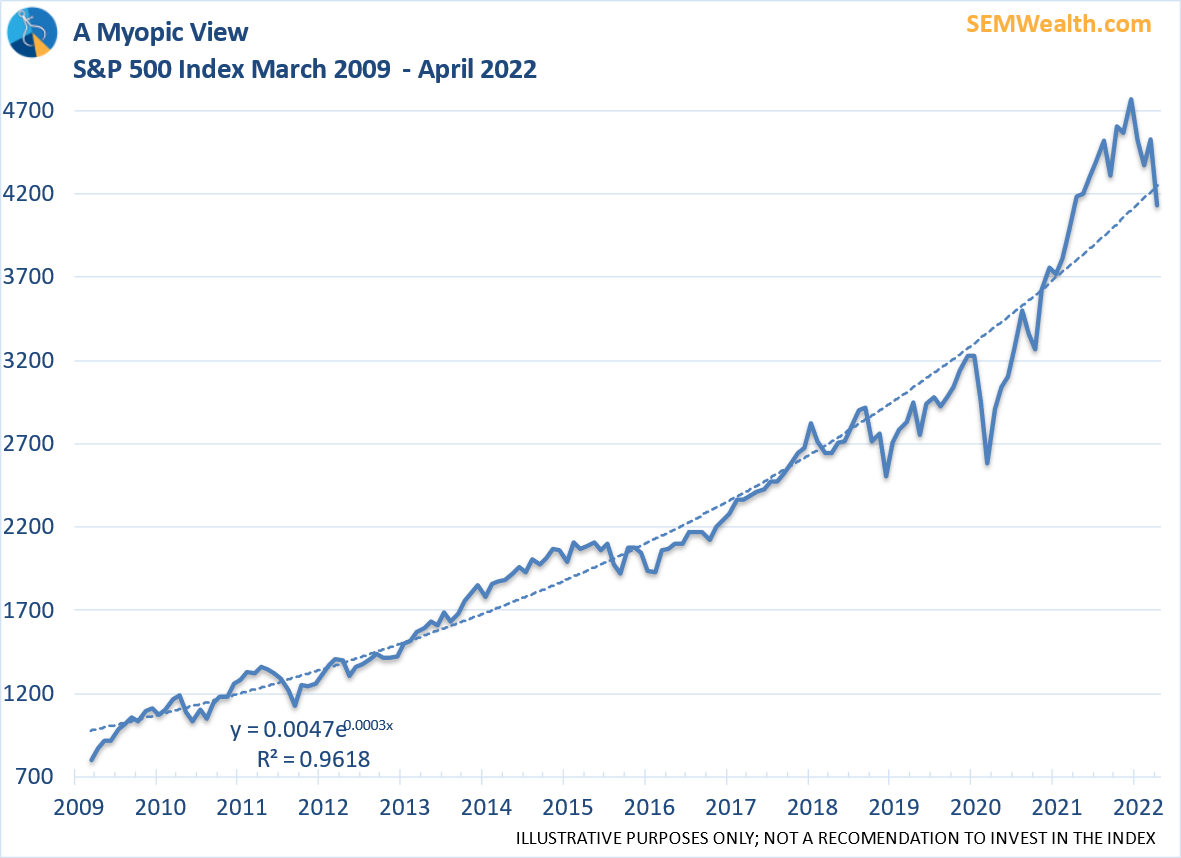

Typically, this leads to a mantra of "buy the dip" during bull markets. Because it naturally works when everything is in the market's favor, this reinforces the "buy the dip" mentality every time the market drops. If you look at the last 12 years, this has worked very well.

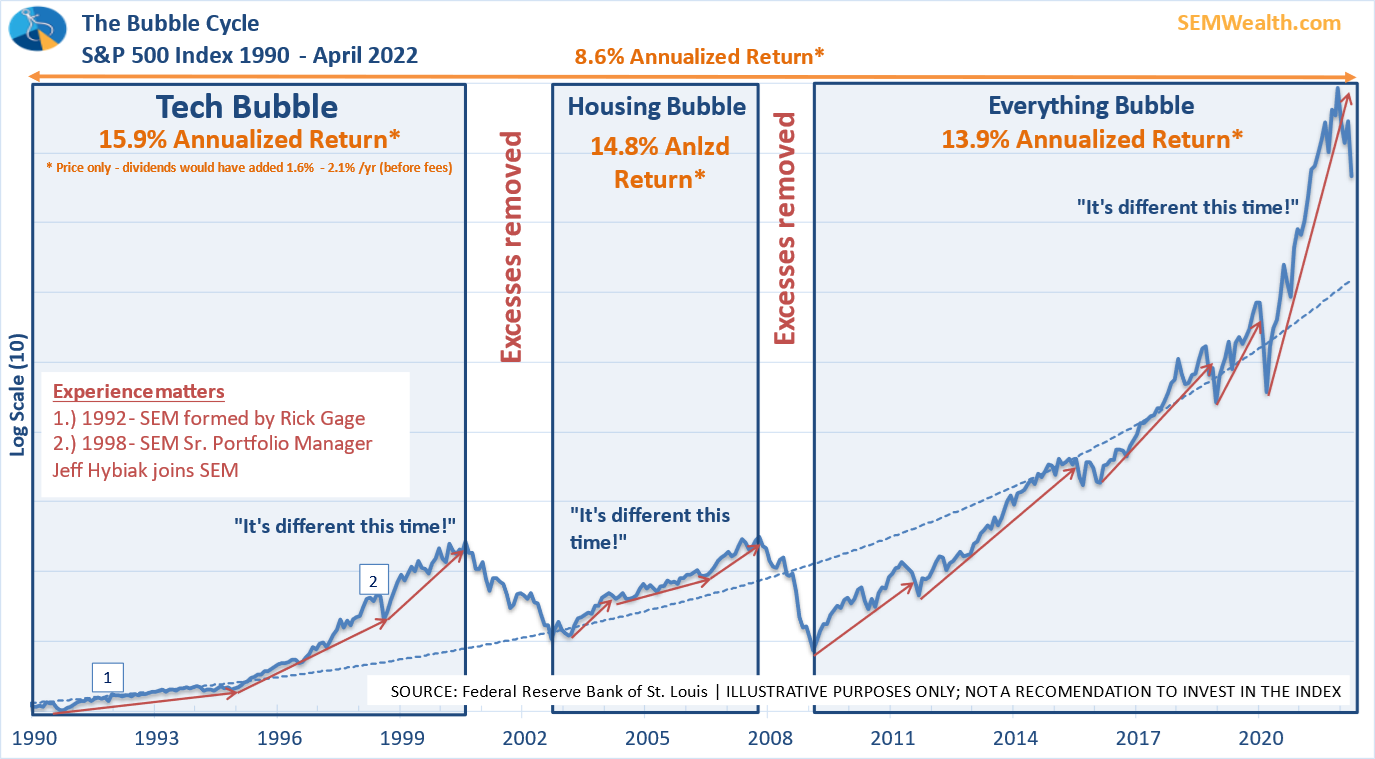

I often say, "buying the dip works until it doesn't." When we zoom out to look at the last 30 years, which has included some very strong economic developments, we can see anytime we had a prolonged period of time where returns were well above the long-term average (and where buying the dip seemed to be a flawless strategy), we see eventually the gains cannot keep up with the underlying fundamentals and prices reset.

We share this chart in most investor presentations as a reminder that we ALL are susceptible to these emotions.

Based on my 25+ years of experience, I would guess we are somewhere in the denial stage. Everything that supported stocks since the bottom in March 2020 (Congressional stimulus, Federal Reserve support, easing of COVID restrictions, and a strong economic recovery) are not only gone, but going in the opposite direction. Few people have priced that into their outlooks. The market is well overdue for a reset in expectations/prices.

My main subjective support of this opinion is how many people each day are on tv telling us the worst is over. In my experience, the worst isn't over until you mention owning stocks and people think you're crazy.

Last week we didn't really see any changes. The markets were volatile, and we could be going through a nice bounce. Just because stocks are going higher we shouldn't believe all of the fundamental problems that caused the sell-off have disappeared. I'm going to re-share last week's talking points as I believe they are important when asking if you should "buy the dip".......

Weekly Talking Points

It depends on your time horizon......

- 3-6 months: the next direction is a coin flip. We certainly could see a huge rally that recovers half of the losses so far this year. That is actually normal following a large drop in prices. Conversely, given where we were in terms of valuations and returns that were double the long-term average the past 3 years, we could continue to see prices drop. Either way, the short-term direction could be volatile.

- 6-18 months: economic fundamentals and valuations mean the market is likely going to struggle, especially when you weigh the impacts of inflation. With so much stimulus from Congress that is working its way out of the system and with unprecedented manipulation of the financial markets by the Fed, nobody knows for sure what "fair value" is for stocks and interest rates. Going into COVID our economic model was indicating a slowdown, so unless the economy got BETTER during the last two years, the best case is we will have a slowing economy, which is rarely good for stock prices.

- 18-36 months: There will be some nice rallies that will suck people into believing the worst is over. The only way this will be true is if we've gotten to the other side of the "unwind" of stimulus. A typical bear market last 18-24 months with the market dropping 35-50%. This means over the next 18-36 months we will see the "bottom". Most of the time, when we are at or near the bottom few people will WANT to buy stocks. In all past bear markets we've been met with skepticism and anger when advisors and clients see us jumping back into riskier assets. As I always say, when it feels good to buy you probably are near the top. When it feels awful, you're probably near the bottom.

- 3-7 years: This will all depend on how the STRUCTURAL issues are resolved. We entered COVID with too much debt and not enough investment. We had a massive trade imbalance. We had a demographic imbalance (too many looming retirements and not enough workers or QUALITY jobs to replace them.) During recessions we often see a restructuring of our economy. If we have leadership willing to make the difficult choices, we could see a generational low in the markets that leads to very strong economic (and market growth) for a long, long time. If we continue to use short-term solutions, we will continue to see fits and starts in both economic growth and the markets.

- 7-15 years: We could see 2-4 bull markets over this time frame. Based on market history, the market SHOULD be higher 7-15 years from now, so if your time horizon is this long the only thing you need to do with that portion of your portfolio is to make sure you are in a well-diversified portfolio that aligns with your objectives and overall risk tolerance. Remember, the industries/companies that led us into the last expansion are rarely the ones which lead during the next expansion.

- 15+ years: Based on 150 years of stock market history, stocks should be higher than they are now 15 or more years from now. Keep pouring as much money as possible into a well-diversified portfolio. Max out all available retirement plans. Avoid looking at your account values – you have a long time before you actually need the money. Stick to your plan.

I'd encourage you to read the full article for a deeper discussion.

I'd also encourage you to sign-up for our webinar on Wednesday (or if you are reading this after Wednesday afternoon, to check-out the replay.)

In music, I often say "less is more". With that in mind, I'm going to end with a walk through of a couple of charts to help us keep things in perspective. Focus on the talking points above – everything should depend on your time horizon, which should also be based on your overall financial plan and cash flow strategy.

Even with the big rally on Friday, stocks still had a terrible week. Typically, past "support" becomes "resistance". This means the "dip" that was bought around 4175 four different times is the "break-even" point for many people. Psychologically, those who bought the dip and then watched the losses pile up could decide to "cash out".

On a closing basis, the 4150 area is also important. From a bigger picture perspective, everyone who jumped into stocks over the past year is now underwater on those positions. This could mean multiple layers of sellers coming in as stocks head back to 4150.

"The trend is your friend" is an important axiom. The uptrend off the lows of 2020 is clearly broken and we are in a fairly well-defined downtrend now.

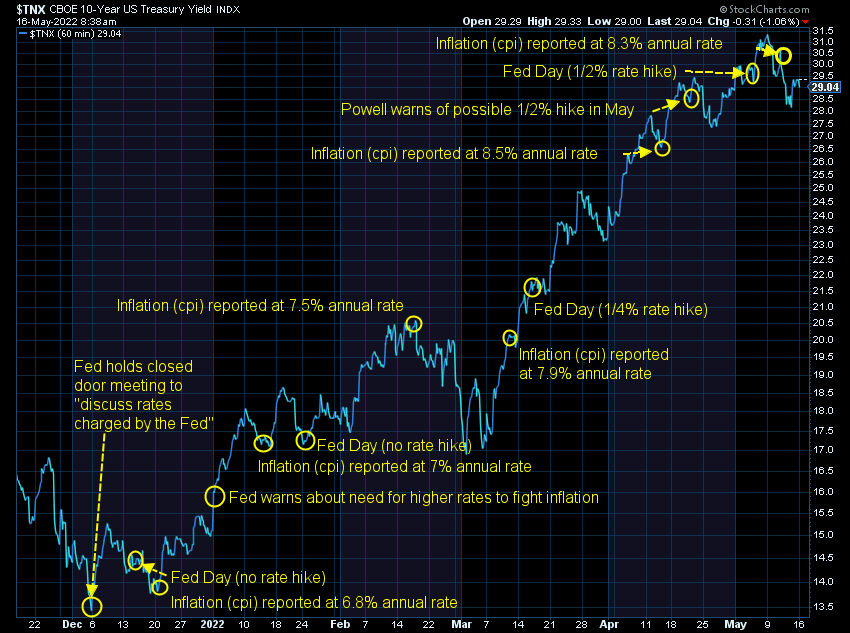

On the bond side, we may be seeing the beginning of some bonds being a "safe-haven" again. Stocks got hit hard following the release of the latest inflation report, but that led to investors/speculators buying long-term Treasury bonds, pushing yields lower.

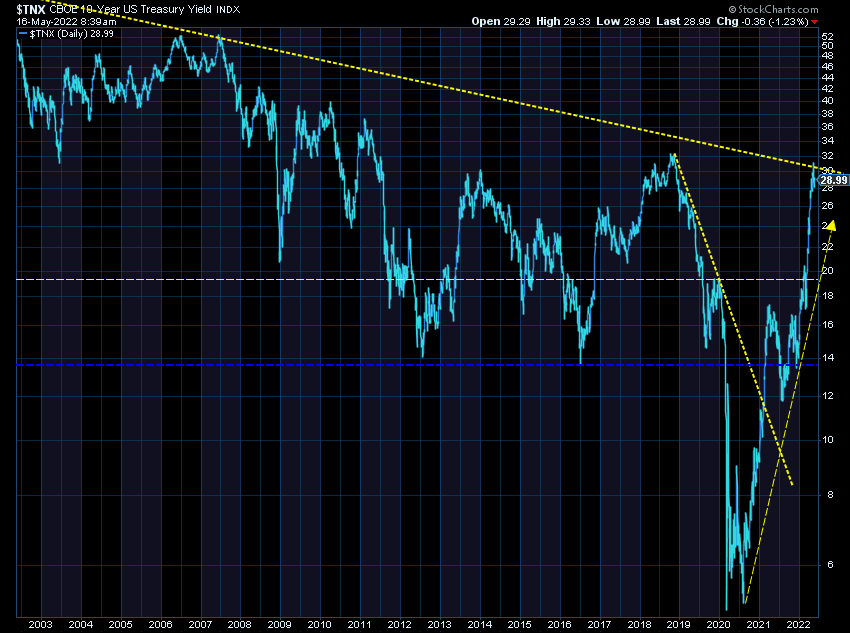

This even brought yields back below the long-term downtrend line.

Please don't take this as a sign your bond funds are safe. Treasury bonds are the ONLY category that is TRYING to find a bottom. All other categories remain in a steep downtrend and didn't show much sign of improvement even with the easing of Treasury yields last week. Most bond funds are invested in the "aggregate bond" index, which dropped nearly 13% from its highs.

Relying on opinions, feelings, memories, or anything else during this time can be particularly dangerous. At SEM we have dozens of different trading systems working independently to focus only on the data. This has us in our lowest risk allocations mandated in each model, allowing us to wait patiently for much more attractive and lower risk opportunities to enter the market.