As Joe Biden's poll numbers continue to increase, the chatter on Wall Street seems to be this is a good thing for the economy and the markets. I don't know if they are trying to do what they always do – providing justification to own stocks regardless of what is happening in the real world or if they honestly believe a Biden presidency will be a good thing. Regardless of their motivation, since the topic has come up in every call the past four weeks and it is all over my social media feeds, I thought we should address the specific proposals in Joe Biden's tax plan.

Before we get started, please understand, I'm not a "socialist". <rant> I'm actually an Independent and have been since 2008 when in my opinion the Republicans abandoned capitalism by choosing to bail out the biggest Wall Street banks, which disadvantaged the smaller banks while completely ignoring the citizens who suffered the most. Wall street recorded record profits throughout the housing bubble, by lending to anybody with a pulse. My libertarian heart says both the Wall Street banks should have failed along with the people who borrowed more than they should have. It worked with the S&L crisis in the late 80s and would have worked again. </rant>

Let me be clear -- in general I DO NOT like raising taxes. I've often shared this clip when it comes to taxes as it summarizes how I feel about taxes.

Side note, we will be doing a deeper dive into the election and what it means for the markets and your portfolios. I personally do not think a Biden victory is in the bank. We'll discuss what the DATA says on the special SEM University. You can sign-up here and watch the replay from last month's SEM U here:

Simple math says taxes must go up

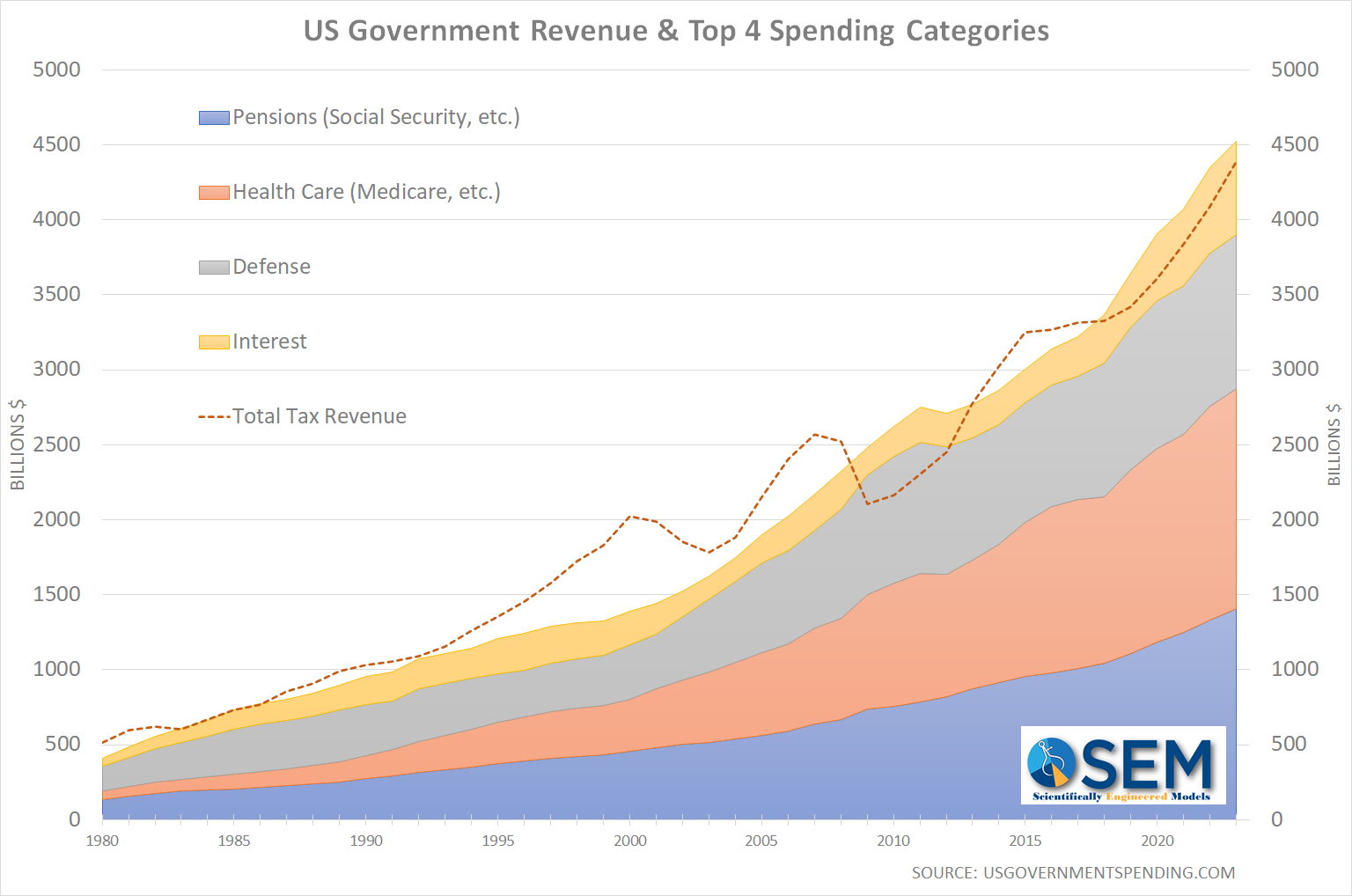

In addition, our country has run huge deficits since Reagan (minus a couple of years under Clinton), so we have to logically find places to raise taxes to pay for all of our spending. Republicans like to argue that we need to cut spending, but we could literally cut EVERYTHING down to ZERO except Social Security, Medicare, and Defense and still run a deficit. Nobody dares to mention cuts in any of those programs, so you MUST raise taxes somewhere.

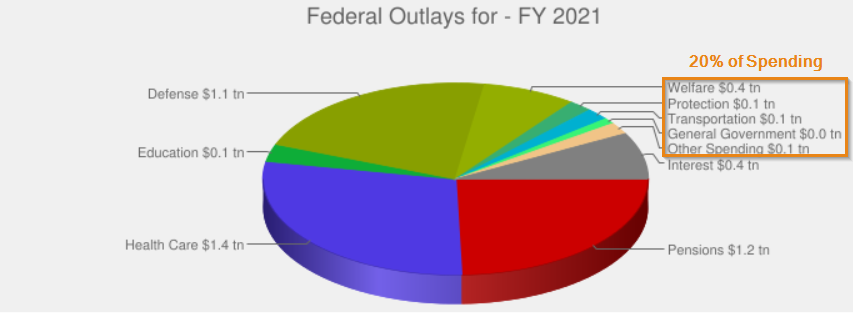

This chart with the budget numbers (BEFORE COVID19) shows the problem. The top 4 spending categories absorb more than the projected tax revenue combined.

Here's the chart that needs embedded in our minds when we hear somebody say, "all we need to do is cut down wasteful spending". If we eliminated every single department in the government except the military we still would run a deficit. The shortfall in Social Security and Medicare is going to start increasing even faster in the next five years. Lower paying jobs, more retirees, and a longer life expectancy are all working against lower tax rates.

Granted, there is waste in the military, social security programs, and especially in Medicare that needs to be addressed, but these government programs have become so convoluted and bloated over the years by the bureaucrats who have given in to every lobbying group out there, that cutting anything in these massive programs by itself is a difficult task.

The Biden Tax Plan

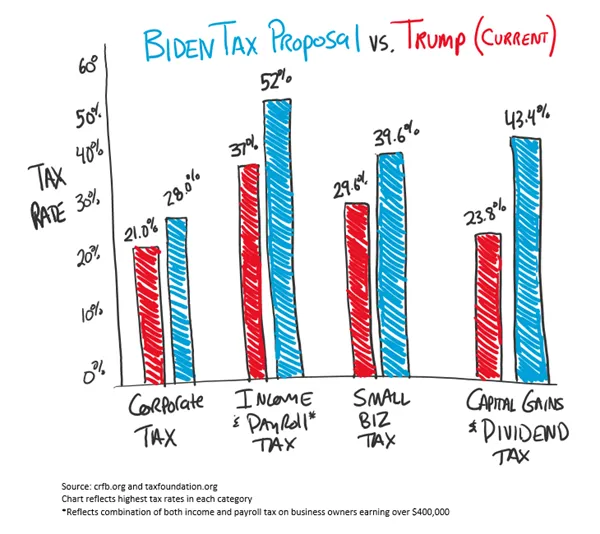

Let's dig deeper into what we know so far about the Biden Tax Plan. Memes similar to this have been going around social media since this summer.

The chart above is highly misleading. Here's a look at each category:

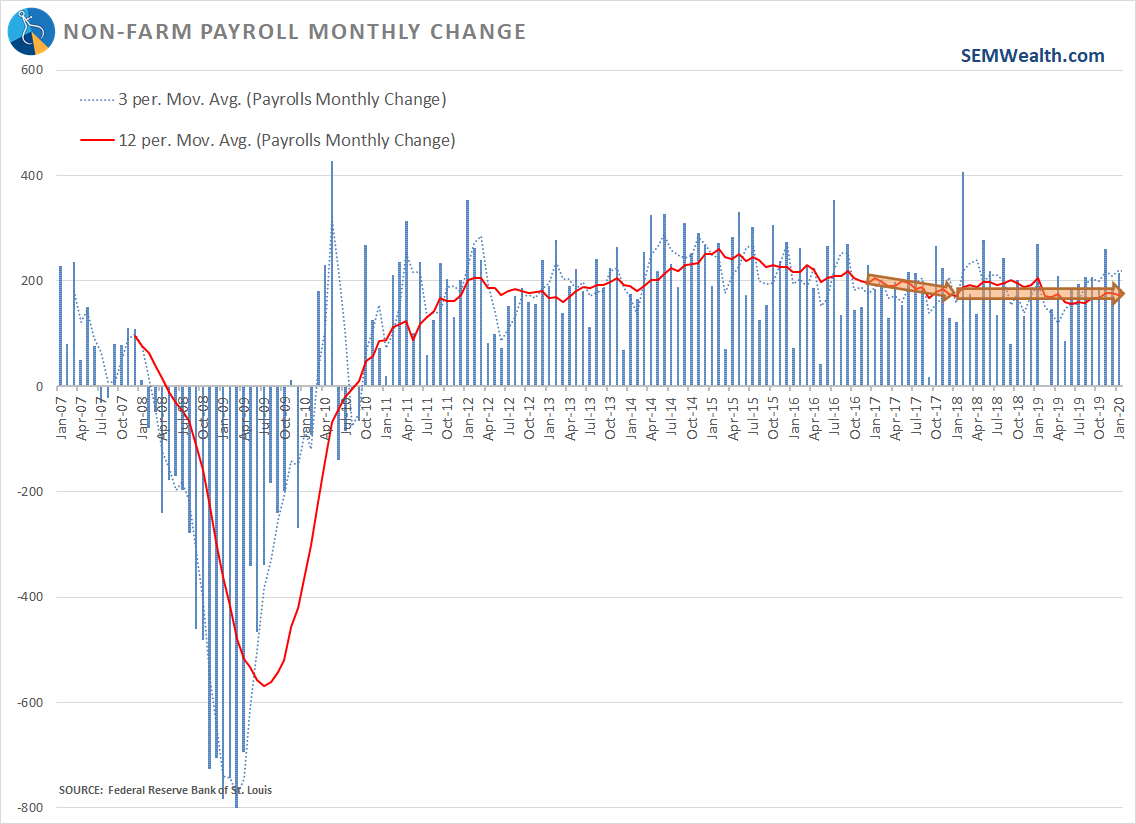

Corporate Tax Increase

In 2017 the corporate tax rate was 35%. Trump cut it to 21% starting in 2018. A study by Stanford has found it led to little to no job creation and instead higher dividends and investment in equipment designed to make the business more efficient, which led to the need for fewer employees. The 12 month rate of change in jobs in January 2020 was the same as it was in January 2018 when the tax cuts took effect. In fact, job creation pre-COVID was LOWER than the 12 month rate when President Trump took office.

Stocks are at record highs. Earnings are expected to be back above their highs by 2021. Raising corporate taxes when corporations are booming seems like a logical place to raise taxes without hurting the average American.

Income Taxes

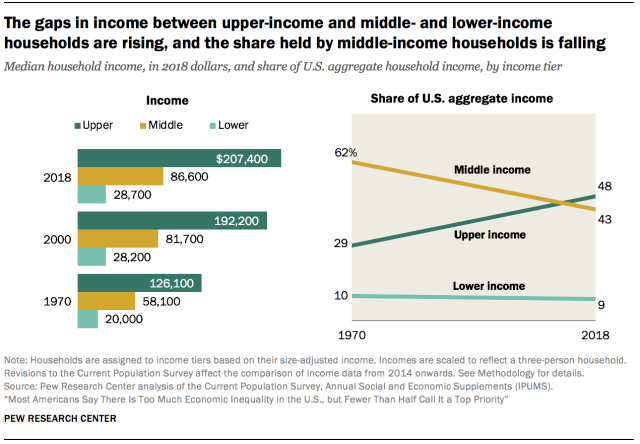

The only people who will see income taxes go up are those making above $400K. Those below may see lower taxes due to increases in the Earned Income Credit, Child Care Tax Credit, the Child Tax Credit, and adding back the first-time homebuyer tax credit Trump's tax cuts did not renew. There are also proposals included to increase the deduction for employer plan contributions for lower income workers and expanding the Obama Care tax credit. The top bracket goes back to the one we had from the mid-1990s until 2017. Itemized deductions will also be limited for those in the top tax bracket. The wealth gap since 2000 has continued to widen, so this seems like a logical place to raise taxes.

Payroll Taxes

I'm not sure how many people are aware, but you currently do not pay any social security taxes on income above $137K/year. The Biden plan adds back social security taxes on incomes over $400K. This means you pay Social Security tax from $0-$137K in earnings, do not pay on earnings between $138K and $399K and then again on earnings above $400K. Removing any income caps on social security taxes is one of the bipartisan proposals in the Simpson-Bowles plan agreed to back in 2011 to help control the deficit. As mentioned above, Social Security is one of the major contributors to the deficit. Without changes, Social Security will be insolvent by 2037. This is a small step towards that.

For some facts and myths on Social Security, check out this post:

The 52% Income & Payroll Tax % in the comparison table is the result of a move to the 39.6% top income tax rate + 6.2% employee social security tax + 6.2% employer social security tax.

Small Business Taxes

There was a portion of the Trump tax cuts that allowed QUALIFIED small businesses some tax credits on income less than $415,000 (joint) or $207,500 (single). Doctors, lawyers, accountants, financial advisors, and other professional businesses which require additional education and training were not included in those cuts. Biden's plan keeps the deduction. A very small fraction of qualified small business owners with joint income between $400K to $415K would lose their deduction. According to Bloomberg, in 2018 there was $150B in small business deductions claimed, but 35% of that amount went to taxpayers who reported over $1 million in income. Again, given the wealth gap which has widened the last decade, this seems like a logical place to add revenue without hurting small businesses.

Capital Gains and Dividend Taxes

The Biden proposal is to increase these taxes for tax payers who make more than $1 million in income. Short-term you may see a lot of high net worth people selling their long-term investments, but they'll still have to pay the tax on them. This will specifically close the carried interest loophole so many hedge funds and Wall Street firms use. President Trump campaigned on closing this loophole, but then was afraid to touch it once in office. Overall, not enough people fall into the $1 million+ in income for this to be a concern. According to CNBC, the top 1% earned $1.32 million or above in 2018.

Overall Plan Assessment

Some of our clients will be hurt by the Biden tax plan, but others will benefit – especially if we get a more balanced economy. If you look at the details of the plan, it is a logical way to close some of the gaps without impacting the overall economy. Simply sharing graphics showing the TOP LEVEL tax changes is misleading. I've seen studies which looked at an estimated economic drag of about 1.5% due to Biden's tax increases (even though both Clinton and Obama raised taxes on the upper end without impacting economic growth). These show a slight tax increase for ALL Americans as it assumes workers will bear the brunt of the corporate tax cut increase. I've also seen studies that show the average middle class household ($50K to $80K per year) would enjoy a $620 tax cut. Families making $89K to $160K per year would enjoy a $420 tax cut.

We need to remember one thing – this is a campaign IDEA. Nobody knows for sure what this will look like. The composition of Congress will play a major role in what, if any tax changes go into effect. How the extra income is spent will be far more important when evaluating the tax increases.

IF the additional spending from Biden goes into INVESTING in our future (infrastructure projects, education, health care, etc) it could be a net benefit for our economy longer-term. President Trump ran in 2016 promoting similar productivity improving measures. For whatever reason those proposals never made it to Congress over the last four years.

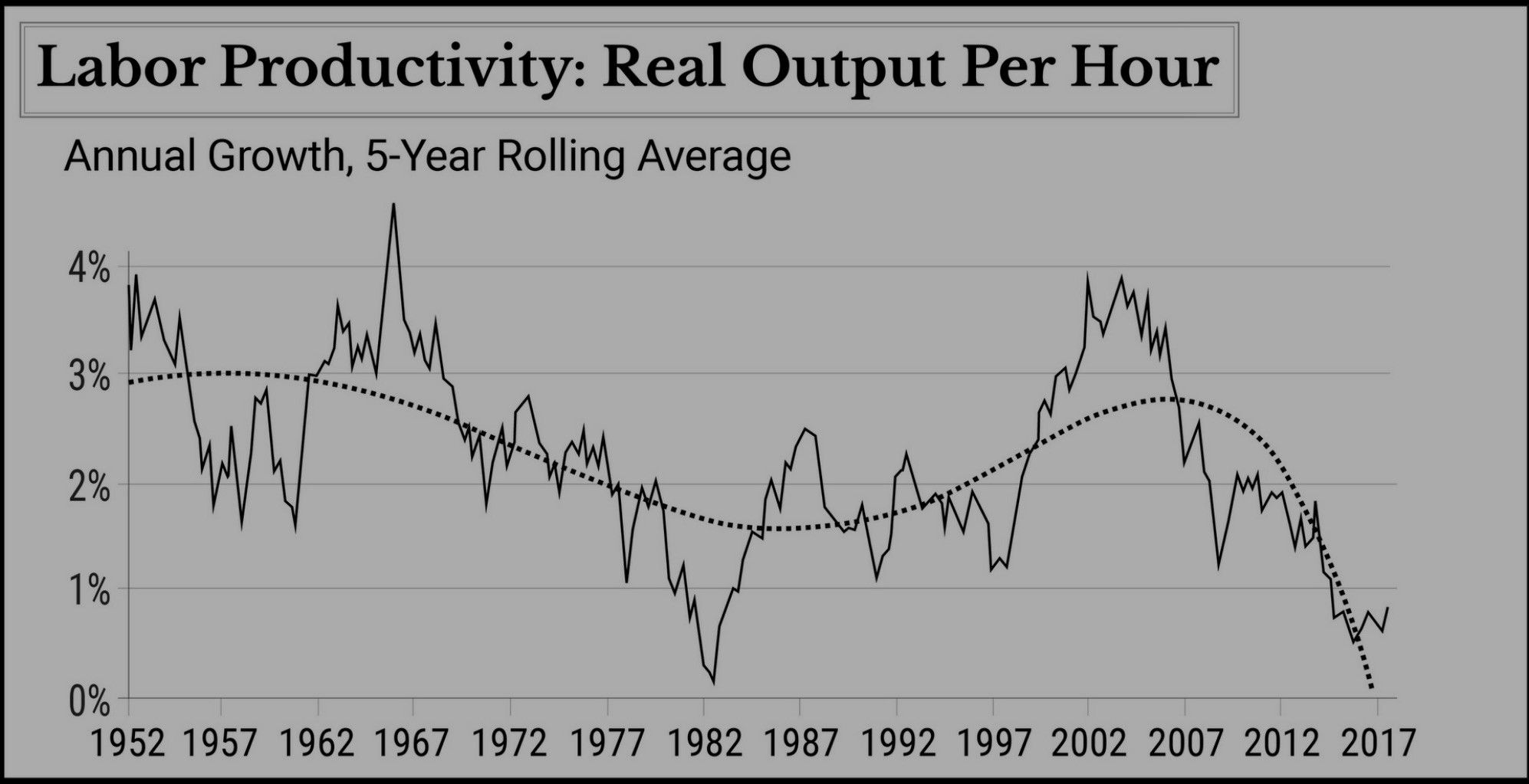

Long-term GDP Growth is a function of Growth in Productivity + Growth in the Labor Force. The current labor force is shrinking as the Boomers retire, but we have a bulge of Millennials in their mid-to-late 20s who could replace them. The problem is we don't have the high paying jobs the Boomers enjoyed. At the same time, productivity growth has plummeted.

INVESTING in programs designed to increase American jobs, making American workers more productive, teaching American workers skills to perform the higher paying jobs, making college affordable to ALL Americans (without burdening them with massive debt), and finding ways to LEGALLY allow high skilled workers to become American citizens are all things which could more than cover the higher tax rates on the upper end. How much of that actually happens is anybody's guess.

The End of an Era

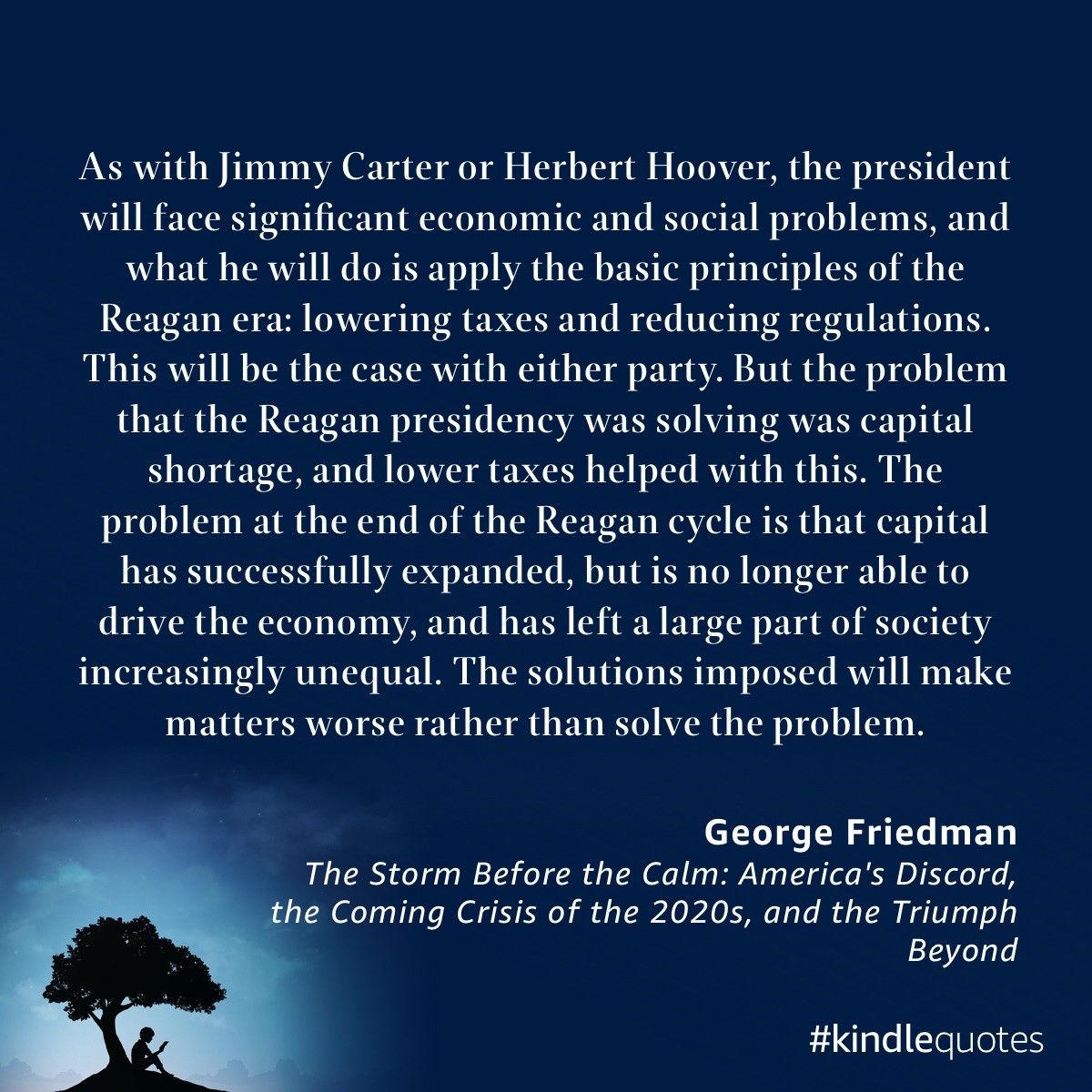

Many of you know for the past nearly two decades I've discussed the Social/Demographic cycle that is coming to an end and has been the source of much unrest throughout our history. This summer I started reading, "The Storm Before the Calm" by George Friedman. It looks at the coming collision of the 80 year industrial cycle and the 50 year Socioeconomic cycle. I picked it up again this weekend looking for something specific I had remembered reading regarding taxes. I'll have much more on the book in future posts. If you like studying history from a different perspective, it's a fascinating read.

Here was the quote I was looking for:

Each Socioeconomic cycle ends with a president attempting to do what has "always" worked. Using the solutions that helped start the cycle actually makes things worse. Interest rates have been pushed to zero (again) yet economic growth is lackluster. President Trump has cited (as have I) how the Obama expansion was the worst on record (in terms of average GDP growth). The second worst on record was the Bush II expansion. This is not a function of the president or his party, but rather the fact that the excess capital created by lowering interest rates, cutting taxes, and/or boosting "stimulus" does not have anywhere productive to INVEST. All it serves to do is widen the gap between the already wealthy and the working class.

President Trump was elected by the same groups who elected Ronald Reagan – business owners and the working class. President Reagan's tax cuts and reduced regulations created a 20 year boom (which was boosted by the tremendous gains following the invention of the microchip). Unfortunately for President Trump and those in the working class, the productivity boosts of the microchip have waned leaving little chance for those same policies to work. Businesses have outsourced the high paying jobs in order to squeeze whatever profits they can out of their products. While he challenged the technocrats who have been leading our country the past 40 years with his unorthodox methods, his Reagan era solutions simply cannot work in our current environment.

Ironically, the chaos President Trump has created in Washington has led many voters craving a more calming government. Professor Friedman predicted the Democrats would select a "normal" politician who will use the government to solve all the problems. The issue is during the past 70 years of the industrial cycle, the government has become so large with so many different departments and each law turning into tens of thousands of pages of regulations it is literally impossible for the government in its current structure to be the solution. Each "solution" will bring more laws, more departments, and more regulations, increasing the structural problems. The Demographic/Social Cycle, Socioeconomic Cycle, and Industrial Cycle all predict the Democrats would be viewed as the party to "solve the problems" when in reality their "tried and true" solutions will be the final chapter which ushers in a brand new era.

Raising taxes on those who are going through an economic boom in order to provide "stimulus" to those who are struggling may help briefly. But the problem is we've used short-term solutions for the last twenty years and continue to elect leaders who are unwilling to address the longer-term problems. Yes President Trump was not a normal leader, but he has been saddled with the same old Republicans and Democrats in Congress who continue to want to use their establishment ideologies to lead.

Like the Demographic/Social Cycle the Industrial and Socioeconomic cycles all ending this decade will create chaos, uncertainty, losses, and great unrest. Like all past cycles the other side will lead to generational opportunities for most Americans to prosper. This will be an emotional time for most Americans. We don't like change and we don't like the unknown.

From a financial standpoint, our Behavioral Approach is more important than ever to help navigate this next period. Financial plans will need adjusted, cash flow strategies tweaked, and investment portfolios will have to be able to adapt to both the coming large losses in some sectors and potential huge gains on the other side.

As we've done all along, we stand ready to be your resource and your partner through whatever the next phase of the cycle looks like.