The markets appear to be stabilizing. The thought is the Fed, FDIC, and Treasury Department have successfully eliminated the risk of another financial contagion. I said last week, "We shouldn't take a move up in prices as a sign the crisis is over. There will be more companies who run into problems over the months ahead." I also reminded everyone "a (fill in the blank [bear market], [crisis], [recession]) is a process not an event, meaning it's not straight down and then straight back up while it's over.

Academics try to convince us the market is "efficient" meaning all known data is already priced in. Anybody with any real-world experience knows that isn't true. Let the market adjust to the 'unknowns'. Do not chase stocks higher as they move up and do not panic as they go lower.

With things a bit more stable, I'll try to keep the 'musings' a bit shorter than the 2000-3000 words we had the last few weeks. Here we go:

Are lower rates a good thing? The market continues to have this backward thinking that all bad economic news or anything which would cause the Fed to lower rates is a positive for stocks. Everyone seems to forget the Fed dropped rates aggressively at the start of the last two recessionary bear markets (I don't classify 2020 as a recessionary bear market because the market only dropped 6 weeks before it bottomed and the recession was not 'naturally' caused.)

In both 2000 and 2008 the Fed slashed rates and resorted to other measures, yet they didn't prevent a major economic and market reset. Bad economic news means lower earnings and potentially layoffs, slowing consumer spending, and overall negative sentiment. That is not good news for stocks.

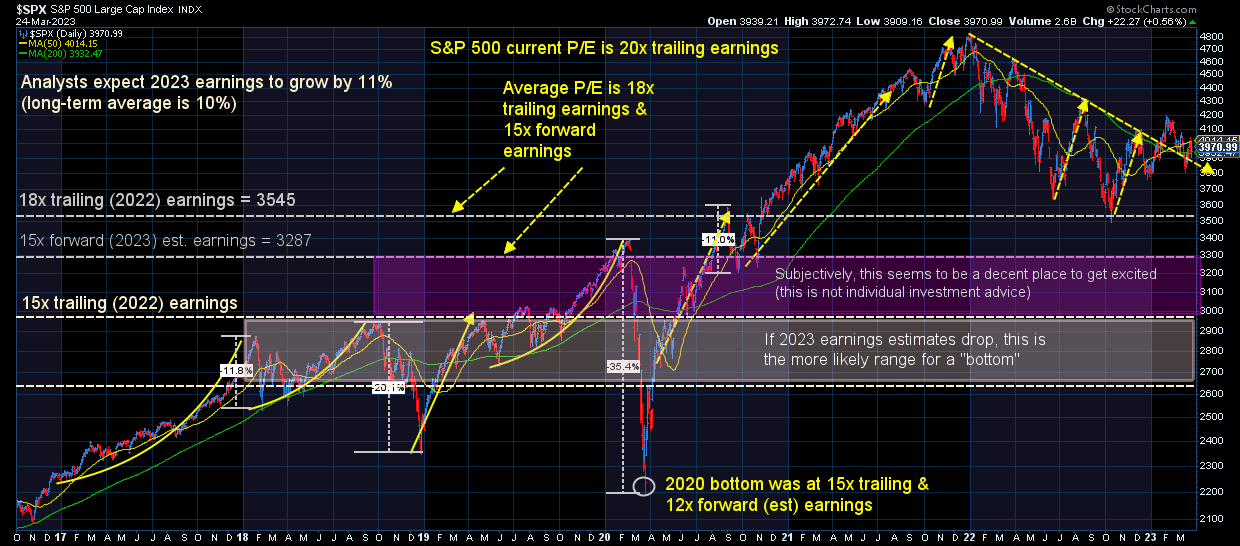

Stocks are massively overvalued: For at least 10 years I've heard academics and Wall Street cheerleaders argue the "average" P/E is "too low" because when interest rates are "low", funding costs as significantly reduced which stimulates higher growth rates. They also argued the lower "risk free" rates (government bond yields) meant a higher "present value" of earnings. This is all true.

The problem now is the 40-year downtrend in interest rates appears to be over. Rates have skyrocketed yet they still argue stocks at a P/E of 20 are "undervalued". I have no idea what they are seeing. Since 2000 the average P/E based on trailing earnings (the last 12 months) has been 18. The average P/E based on EXPECTED earnings (guesstimates) has been 15.

We are currently trading 20x trailing earnings and 18x EXPECTED (guesstimated) earnings. When we started 2022 we were trading 21x trailing earnings and 18x EXPECTED (guestimated). Stocks dropped because at the start of 2022, analysts expected 10% earnings growth. Instead earnings dropped by 2%.

Right now, analysts are still expecting 11% earnings growth, which is down from the 13% they expected at the start of the year. For reference, the long-term average growth of corporate earnings is 10%, so in this environment, Wall Street analysts expect corporations to have slightly above average growth.

I know cannabis has been legalized in most of the northeastern states, including New York. Maybe it's having the added benefit of Wall Street's "experts" knowing something the rest of us don't know. I cannot fathom how corporations could grow this much in this environment. Based on my experience, we will see earning estimates do what they did in 2022 — drop as reality sets in. When that happens, we are likely to see P/E ratios finally move back towards the long-term average.

I continue to use this chart as a guide on whether or not stocks are "attractive". They clearly are not.

This isn't 2008: I said this last week and in one of our "why banks fail" videos — we cannot use the 2008 playbook to guess what happens next. In 2008 a large chunk of the "assets" on bank balance sheets were WORTHLESS. Right now, they are simply WORTH LESS. This means the FDIC/Treasury/Fed have more wiggle room to buy assets from banks because they know eventually they will get their money back (probably at a profit).

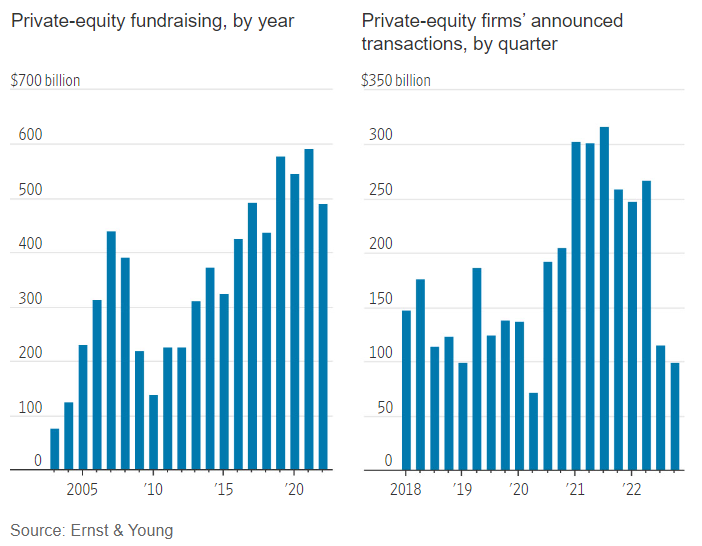

"Shadow" Banking is a problem: I read several articles over the weekend about the "shadow" banking industry. This is a broad term, but essentially it can be thought of as non-banks who provide funding for the economy. Private equity firms, pension funds, hedge funds, and insurance companies all have leapt in with both feet to fill a gap in lending due to the combination of low interest rates and freely flowing capital. Essentially these "shadow banks" borrow money from a regulated bank and then turn around and "invest" in non-traditional loans or other higher risk equity stakes. When rates stay low and the economy grows, these things look attractive and "low risk". When that trend reverses, we run into problems.

I've been shocked at the premiums smaller businesses have received from private equity firms both financial services companies and inside other industries. This consolidation was thought of as a "no-brainer" a couple of years ago. It's very likely the deals made in 2022 are already underwater, which could create some cash flow strains as investors in these funds cash out as returns drop. This will leave the banks who lent the funds money in a deeper hole.

If you want to read more, check out this article from the Wall Street Journal.

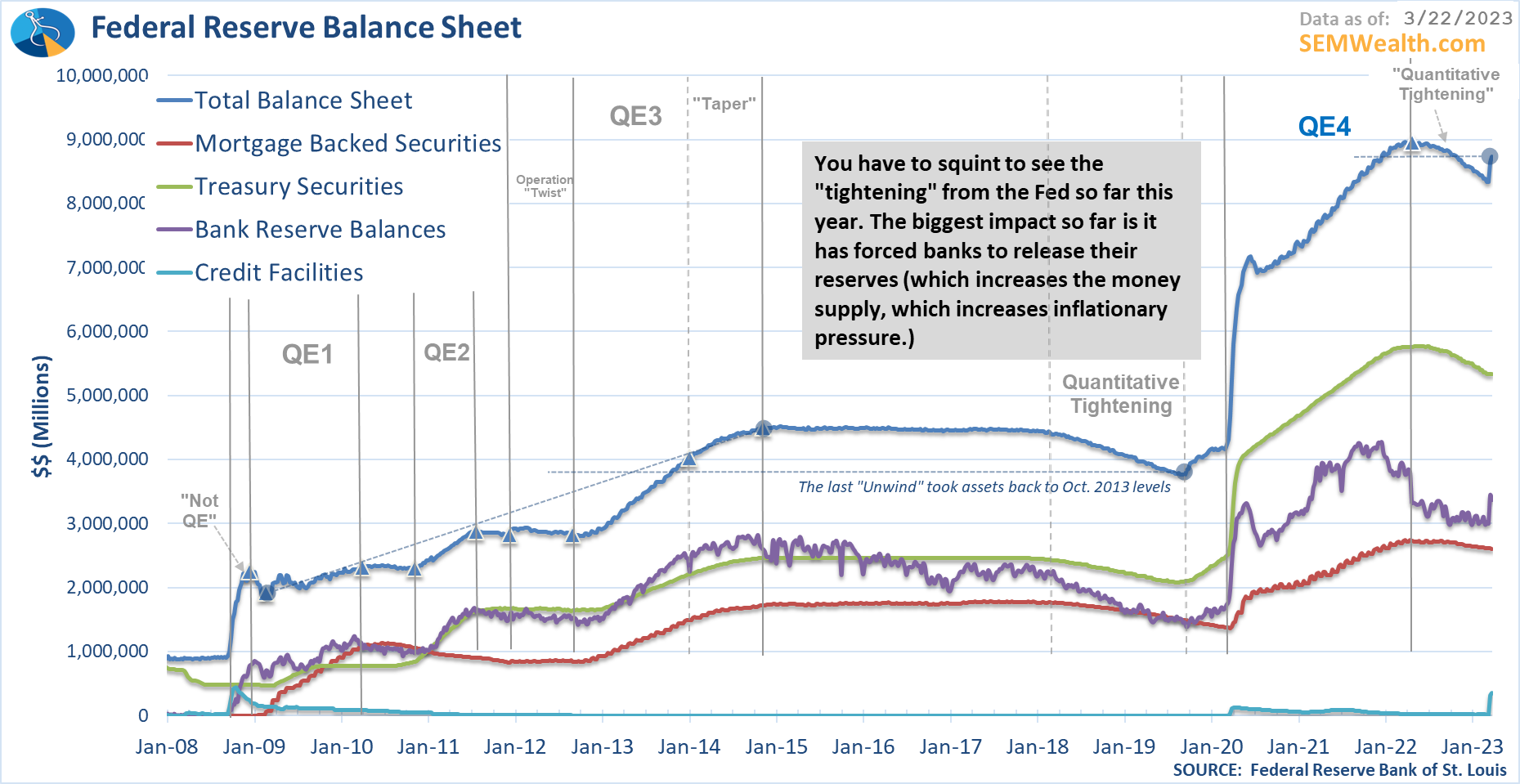

So much for Quantitative Tightening: In March 2020, the Fed acted with overwhelming force to buy essentially any bond with a "cusip" from banks. This extended to bond ETFs. The market essentially bottomed two weeks later and it was off the races. The Fed continued providing essentially free money throughout 2020 and 2021 and the first half of 2022. Nine months ago they started "unwinding" their purchases in a program called "Quantitative Tightening". This is temporarily over (for now) as you can see from their balance sheet:

Notice the big surge on the righthand side of the chart? They have essentially reversed 9 months of "tightening" in a couple of weeks.

Do you really trust the Fed? On March 7 & 8 Fed Chair Jerome Powell said he did not see any systematic issues due to their rate hikes. On March 10 the FDIC shutdown Silicon Valley Bank. On March 12 the Fed, FDIC, and Treasury had to launch emergency lending facilities (the aqua colored line on the bottom of the chart above). This was done to prevent systematic problems in the banking system.

We've outlined how clueless the Fed has been in their fight against inflation, including ignoring all the data and logic throughout 2021 and early 2022 that said inflation was a serious problem. Their ignorance created this mess and somehow the "market" trusts them to get us out of the mess.

Stability breeds instability: We first wrote about "Minsky" theory back in 2006. This turned into by far our most favorite article I ever wrote – The Pending Forest Fire. Tying the "forest fire" metaphor and Minsky's theory we essentially have a system where the "experts" tried to squash every single issue. This led to companies who probably should have gone out of business allowed to continue. This spread to confidence in the system. The belief the Fed would always be there to save us from financial calamities led to more risk taking. This risk taking led to more stability.

The Washington Post had an article yesterday discussing this in greater detail. I'd encourage you to check it out.

Volatility is the rule: Here's a quick look at the charts I look at each day. Not much to read into this other than we should expect continued ups and downs.

Bonds temporarily broke the 3.4% barrier, but are once again back above it. I don't know why this is the point where yields reverse higher (and prices drop), but bonds cannot yet be considered a "safe haven".

All of our models remain cautiously invested, with money markets or short duration bonds used as safe havens currently.

Congress is clueless: I've often become quite agitated whenever I watch a hearing in front of the House or Senate Financial Services or Banking committees (including the aforementioned testimony of Jerome Powell just before the banking crisis started). It is obvious the people on the committees are not there because of their expertise, but because they knew how to play politics. In fact we've seen with the mess in the bargaining for Speaker of the House in January committee placements being used to sway votes. We've also recently seen committee assignments pulled as "punishment" for various perceived violations of their party.

The people who write the laws on banking and financial services obviously have no idea how the banking industry works. Last week, the rest of America got to see what I've always known. This time the people who will write the laws on the internet and technology proved they have no idea how the things they are regulating actually work.

I included a clip from the hearing for those of you who haven't seen their ineptitude. I followed that with 3 things Congress could actually do if they were TRULY concerned about China (not grandstanding to try to win votes):

@finance_nerd How is this situation with #TikTok related to finance? #congress #internetfail #congressfail #howtheinternetworks #TikTokban #madeinchina #americaninnovation #madeinamerica #fundamericanpeople #vote #congressleaders ♬ original sound - Finance Nerd

Follow us on social media: While I still prefer to read my news, not everyone does. In order to get more people to see what we view is valuable, common-sense content, we've been posting more short-form videos on social media.

We are still learning the best ways to create and post videos, but we have found an easy way to post the same videos on all of our social channels. You can check them out here: