“My confidence has grown that inflation is on a sustainable path back to 2%"

“The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

"We do not seek or welcome further cooling in labor market conditions. We will do everything we can to support a strong labor market as we make further progress toward price stability."

“The limits of our knowledge — so clearly evident during the pandemic — demand humility and a questioning spirit focused on learning lessons from the past and applying them flexibly to our current challenges."

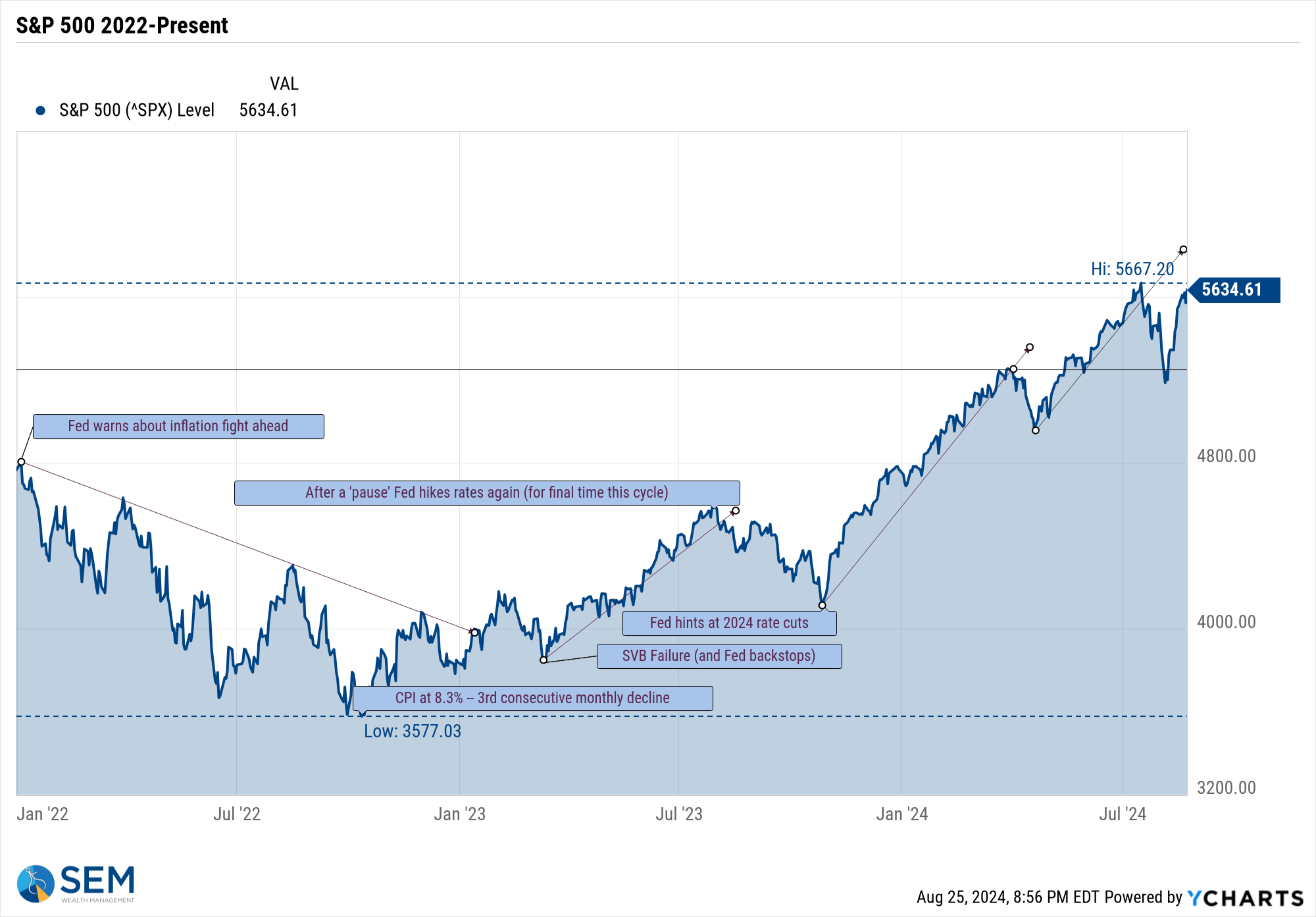

All of these things were said by Fed Chair Jerome Powell in his speech at the Jackson Hole Symposium last Friday. This ignited another strong rally for stocks and bonds to push the S&P 500 nearly back to its all-time closing high. Nothing seems to be in the way for the bulls. With Powell now worried about the labor market and believing inflation is under control, they will be able to slash interest rates aggressively, which will again save us from recession. There is nothing to risk, let's get all in!

That seems to be the prevailing thought for most people on Wall Street. We hope they are right. We love seeing our account balances go up so nicely most days. We especially love it for our fully invested AmeriGuard and Cornerstone models, but it's been nice for our 'under' invested Dynamic and Tactical Bond models because the 'low risk' assets in those portfolios are also rallying.

I HOPE we do not look back on Chair Powell's confident speech last week like we do at George Bush's when he declared victory over Iraq.

I truly hope Chair Powell and everybody celebrating is right. "Hope is not a strategy" I often remind both advisors and clients. I HOPE this is like the mid-80s and mid-90s where the Fed cut interest rates after hiking them aggressively. (I also HOPE that we do not endure a crash like we saw in 1987 and 2000-2002 when their aggressive rate cuts created a massive bubble that inevitably burst.) I HOPE this isn't like all the other times other than the mid-80s and 90s when the Fed was TOO LATE and their rate cuts did nothing to avoid a recession. I HOPE the Fed does not create a massive bubble in both stocks and housing by cutting interest rates, which will lead to more inflation. I HOPE the Fed doesn't further widen the gap between the 'haves' (upper half of our K-shaped economy) and the "have-nots".

In other words I HOPE this is another RARE event and not one which follows the normal economic fundamentals.

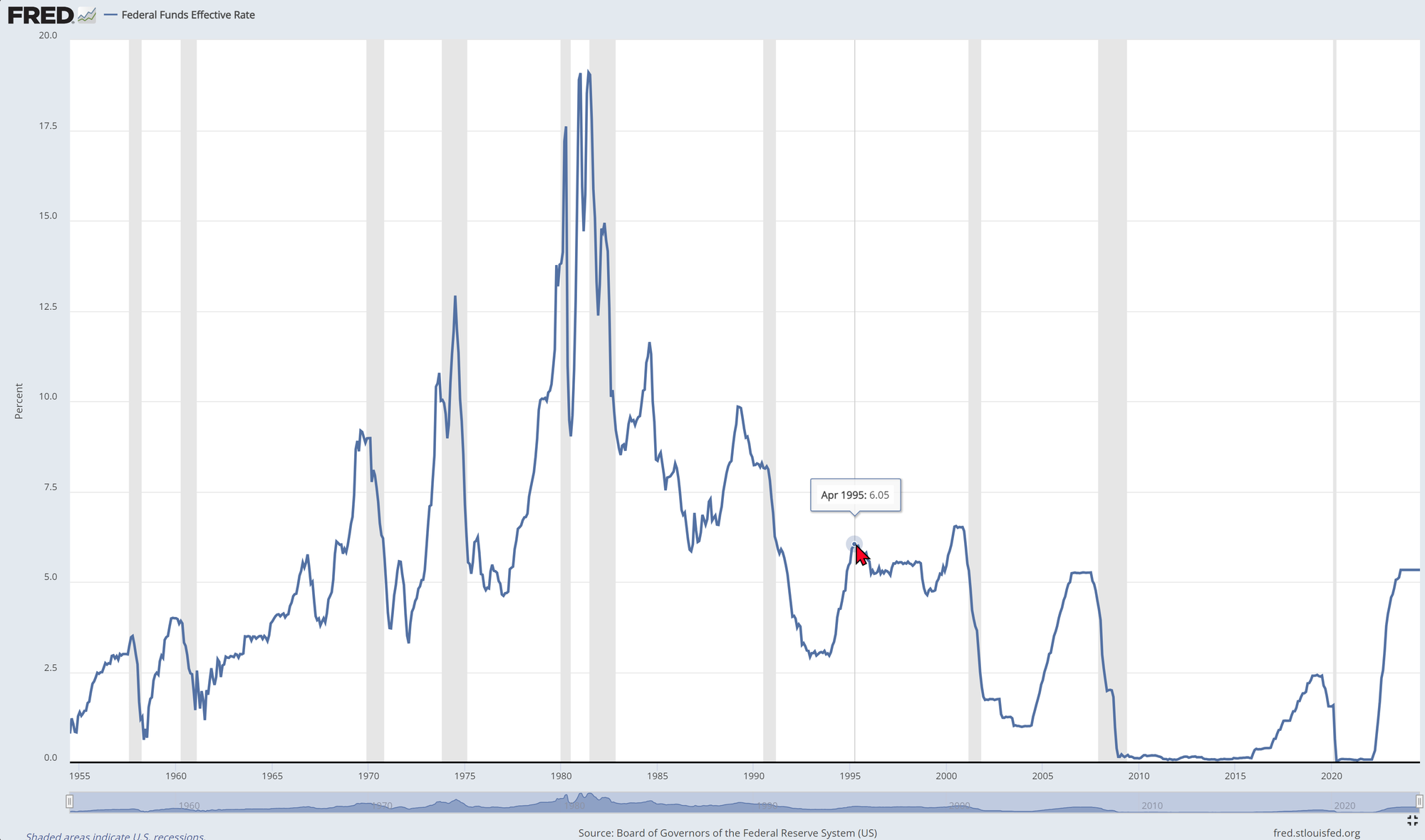

This chart shows the Fed Funds rate (the interest rate the Fed controls). The grey bars are recessions – not how many times rate cuts came just before our during a recession and how few times they were cutting rates when we didn't have a recession.

What nobody seems to be asking is.......

1.) What does the Fed see which created this sudden sense of urgency to cut rates?

2.) What happens if inflation does not come down much more and/or growth slows quickly?

It's your choice – you can HOPE or you can PLAN. At SEM we are following our pre-set plans – we are participating as much as possible with a close eye on what could go wrong. For more, see the next two sections.

Market Charts

Just like that the quick little scare in the S&P 500 is over. We are nearly back to all-time highs. Clearing the previous high could unlock even more people stampeding out of money markets and into stocks. Why wouldn't they? The Fed basically told us they are going to cut the payments we receive on money markets and savings accounts all to help out the economy.

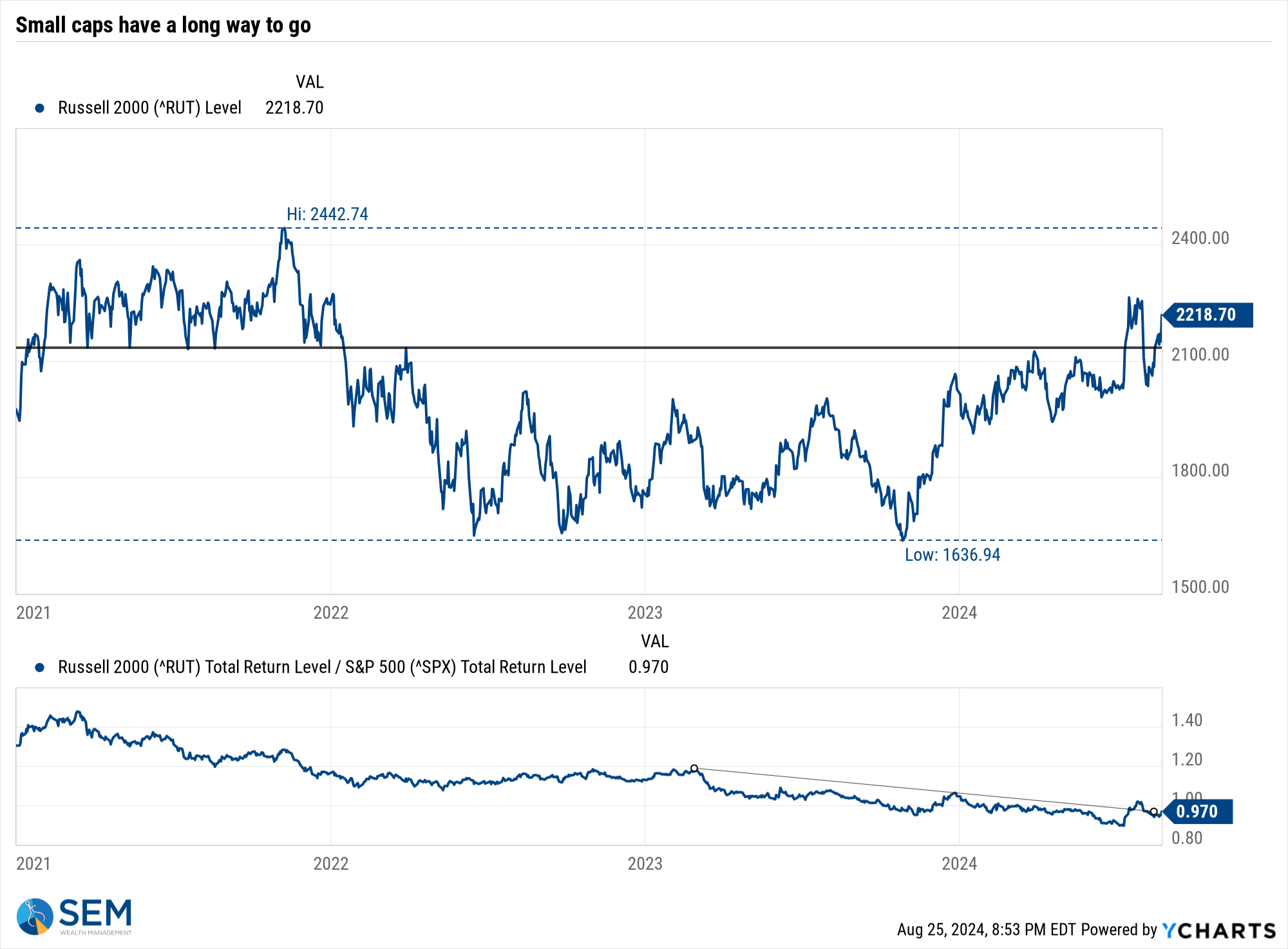

Small caps had a very strong day on Friday. If the Fed really is going to save us from a recession AND long-term rates also come down, that could be good news for small caps.

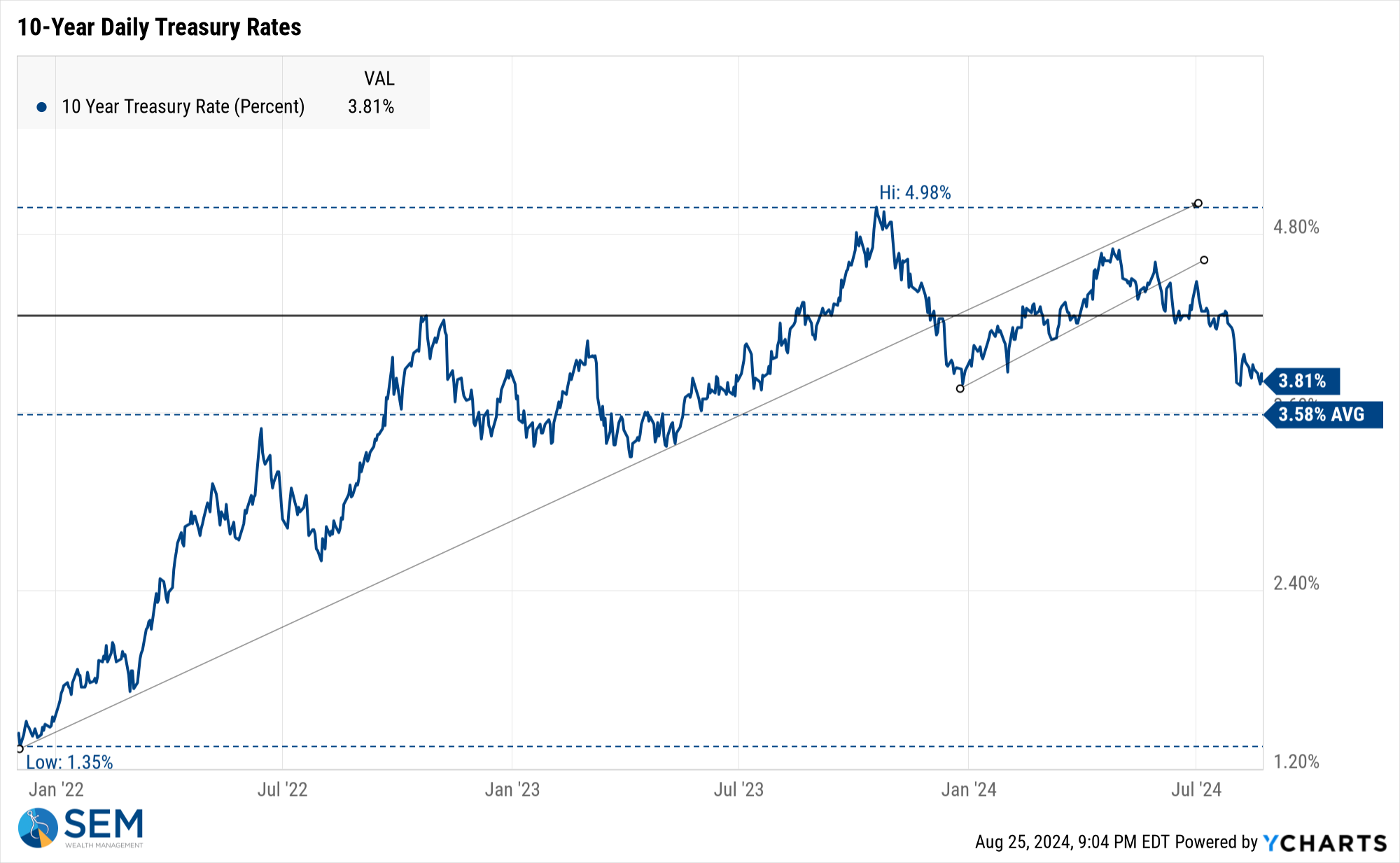

Bonds, both short and long-term duration are already moving ahead of the Fed.

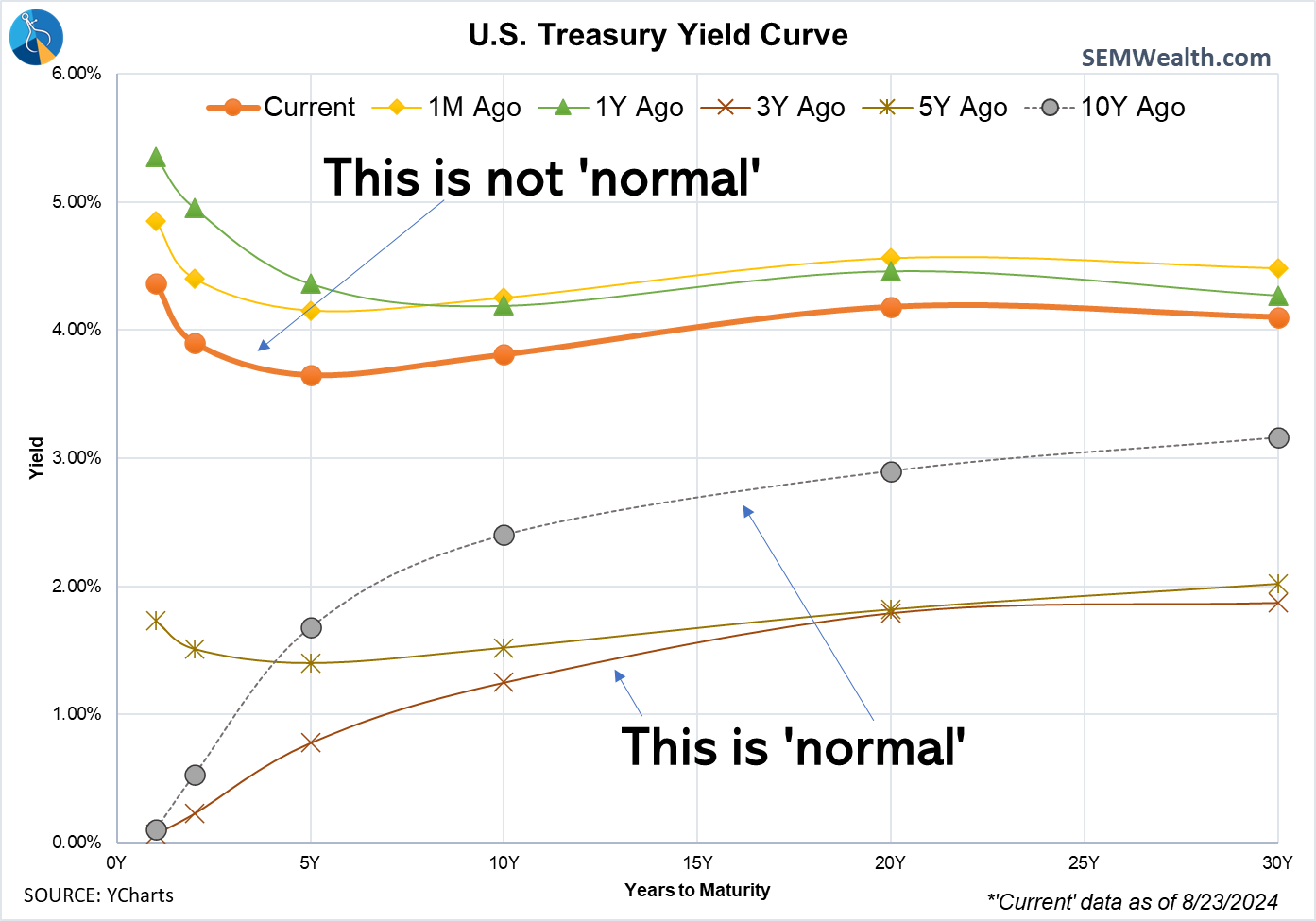

The yield curve is still out of whack. With long-term rates moving down so aggressively, you wonder how much the Fed would have to slash rates on the short side to 'normalize' the yield curve. If they have to do that what will the impact be on inflation?

As a reminder, when long-term rates are lower than short-term rates, it creates problems with banks and makes it harder for smaller and more risky companies to obtain capital to grow their businesses. Without a thriving small company economy, the economic boost we see over the short-term "mission accomplished" mania will be short-lived.

Thankfully, it's not our job to determine Fed policy or guess whether or not this is a good or bad thing. Our models are designed to focus on the data and have been handling the fluctuations quite nicely. For more, see below.

SEM Model Positioning

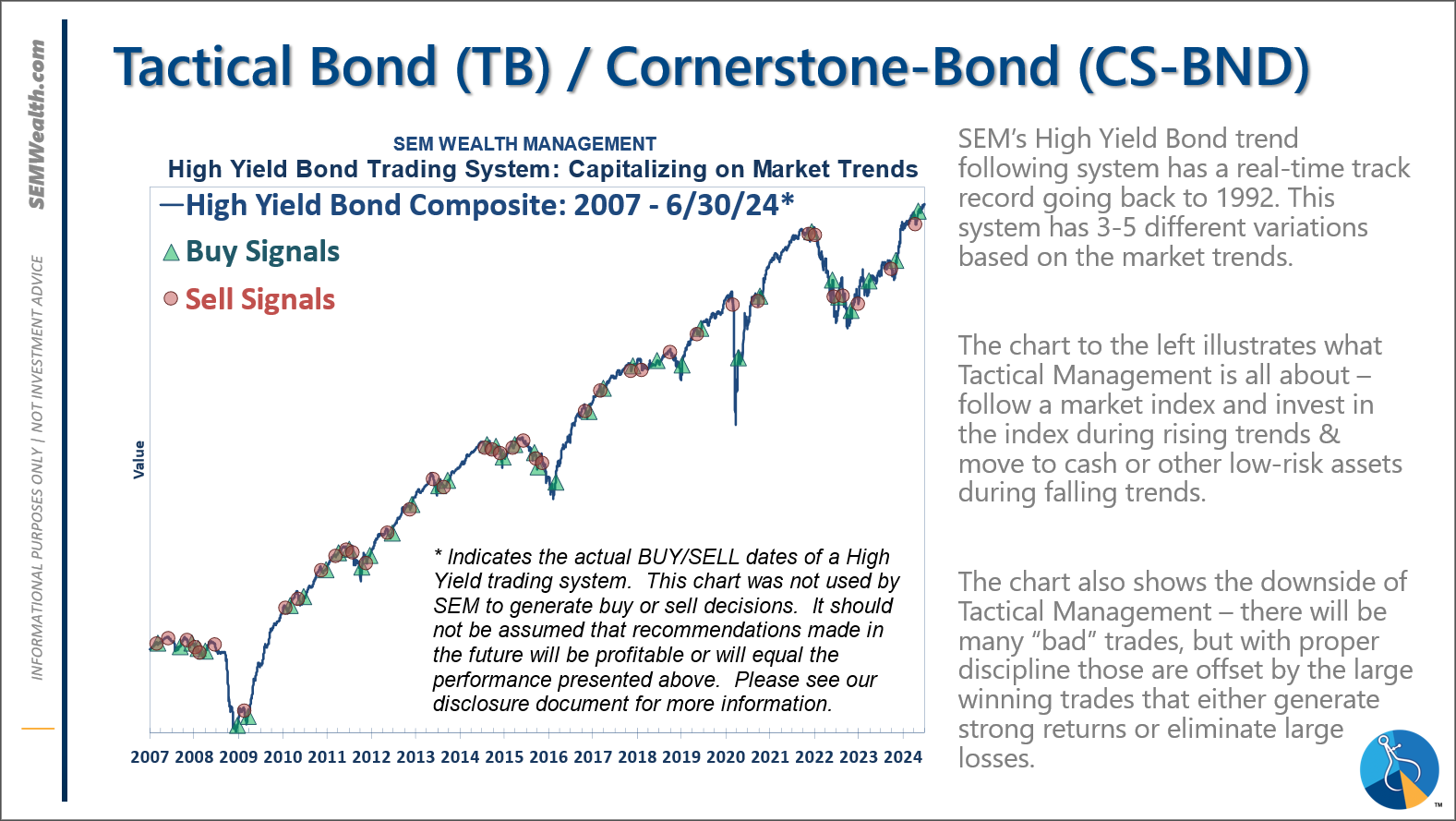

-Tactical High Yield had a partial buy signal on 5/6/24, reversing some of the sells on 4/16 & 17/2024 - the other portion of the signal remains on a sell as high yields continue to oscillate.

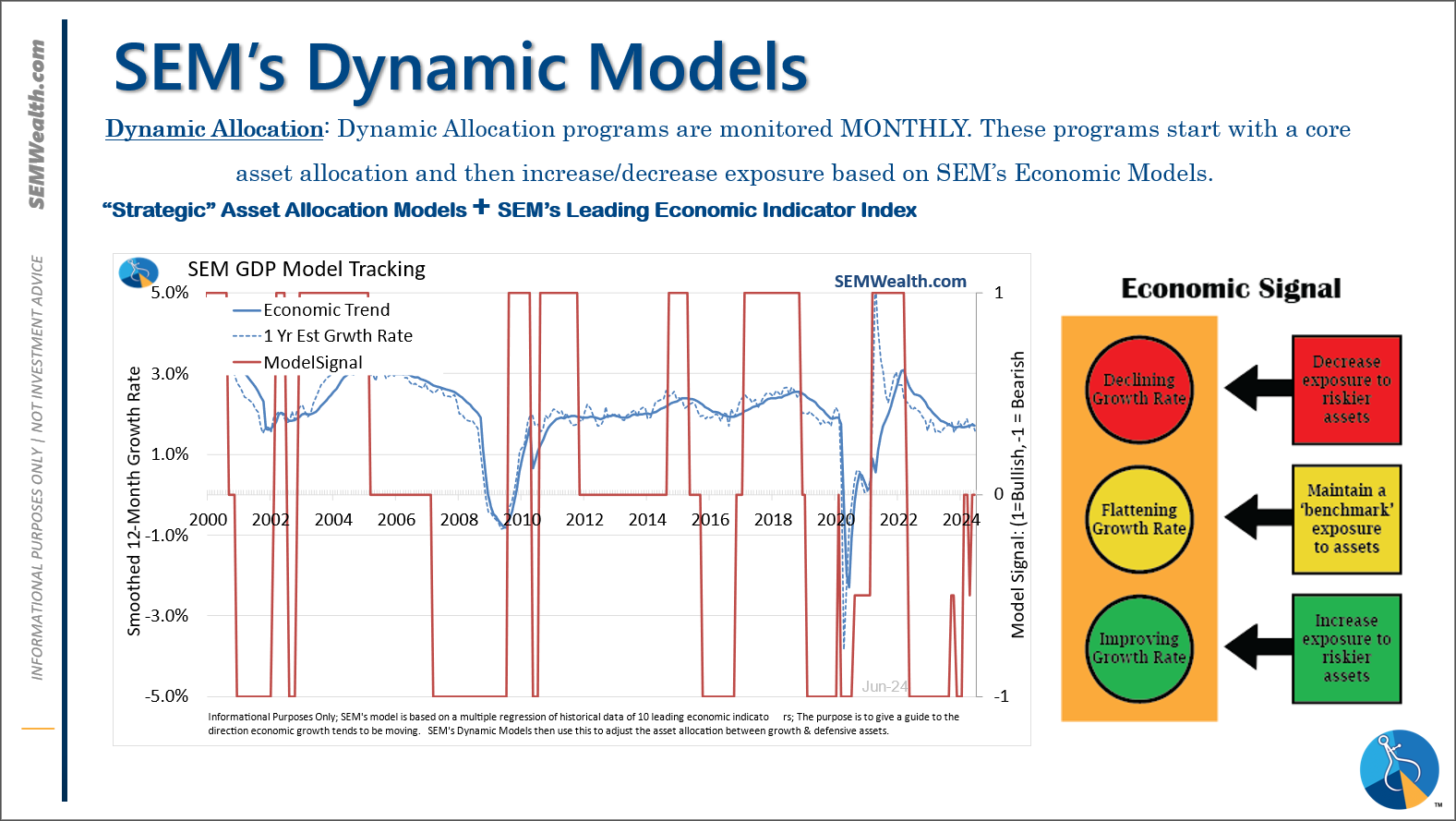

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. *NEW* 7/8/24 - interest rate model filled from partially bearish to partially bullish (lower long-term rates).

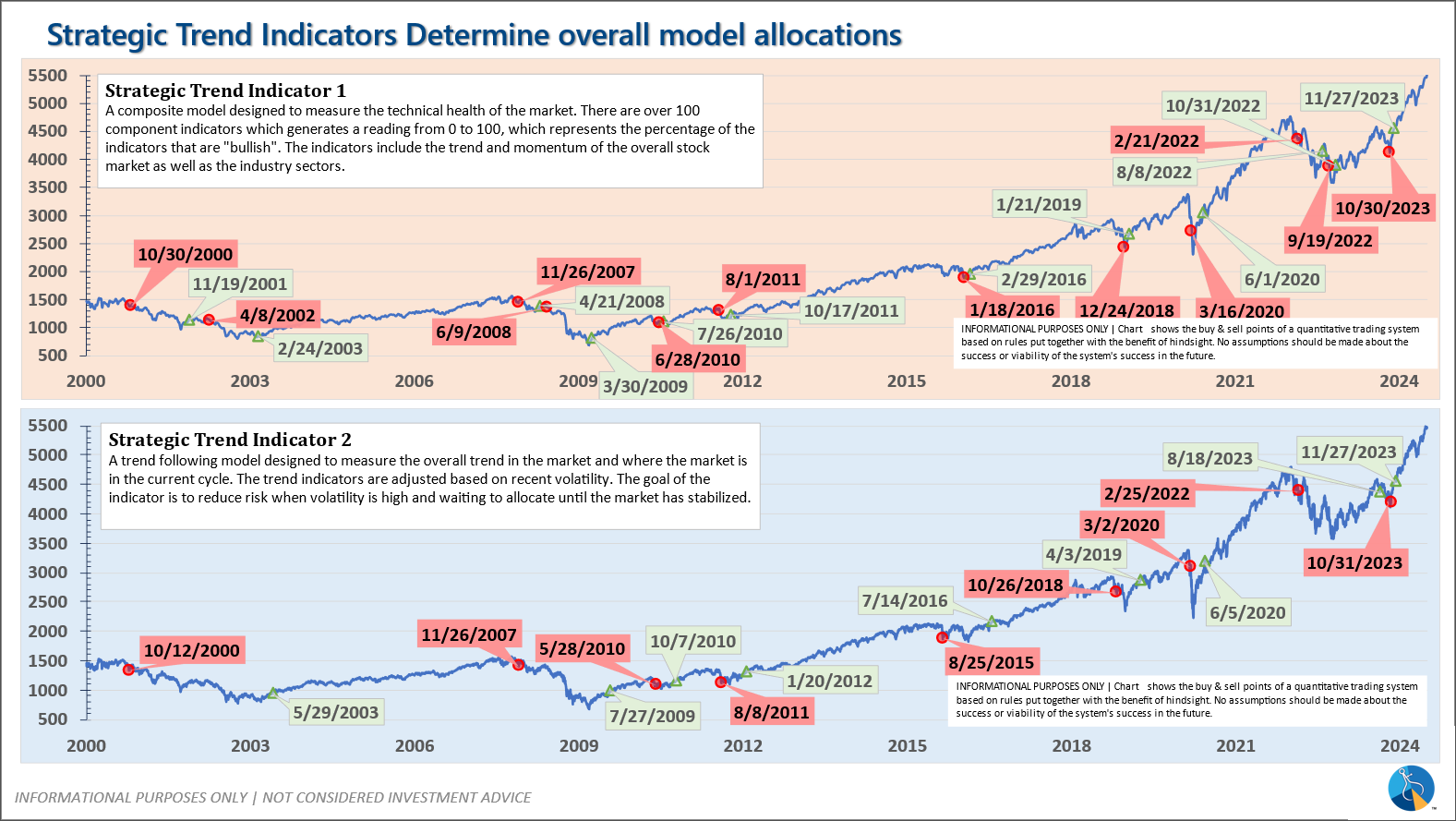

-Strategic Trend Models went on a buy 11/27/2023; *NEW* 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

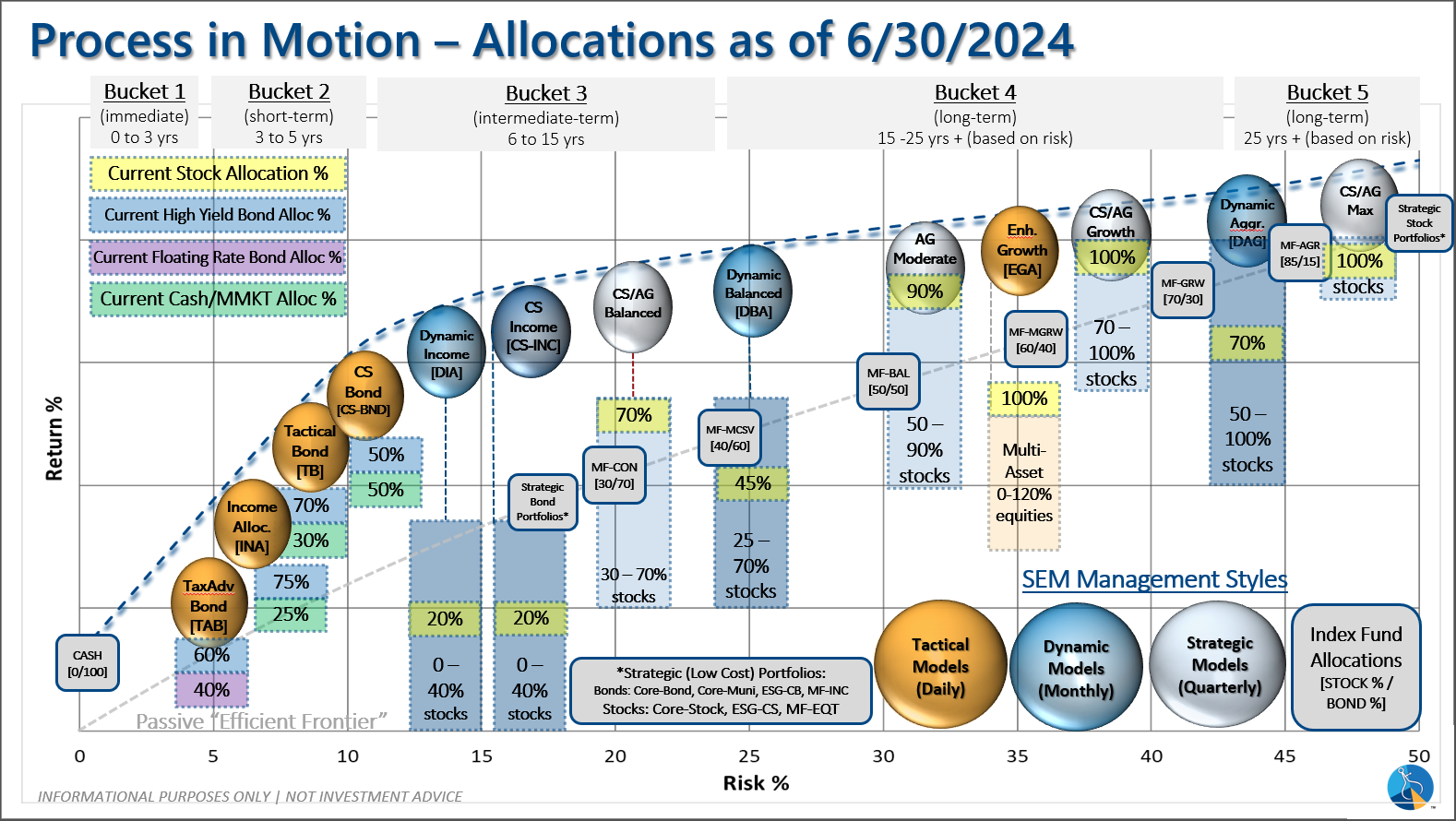

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 5/6/24 about half of the signals in our high yield models switched to a buy. The other half remains in money market funds. The money market funds we are currently invested in are yielding between 4.8-5.3% annually.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire