For the first time since the election I decided to take a weekend to NOT read about anything related to the stock market, economy, or politics. Unfortunately because of the latter playing a key role in the markets my attempt to completely ignore everything market related was thwarted. Since we're already dealing with a short week and I've written some fairly deep posts the last several weeks, here's some quick hits on the items that the market is focusing on as we start the week:

1️⃣ EU Tariff Whipsaw

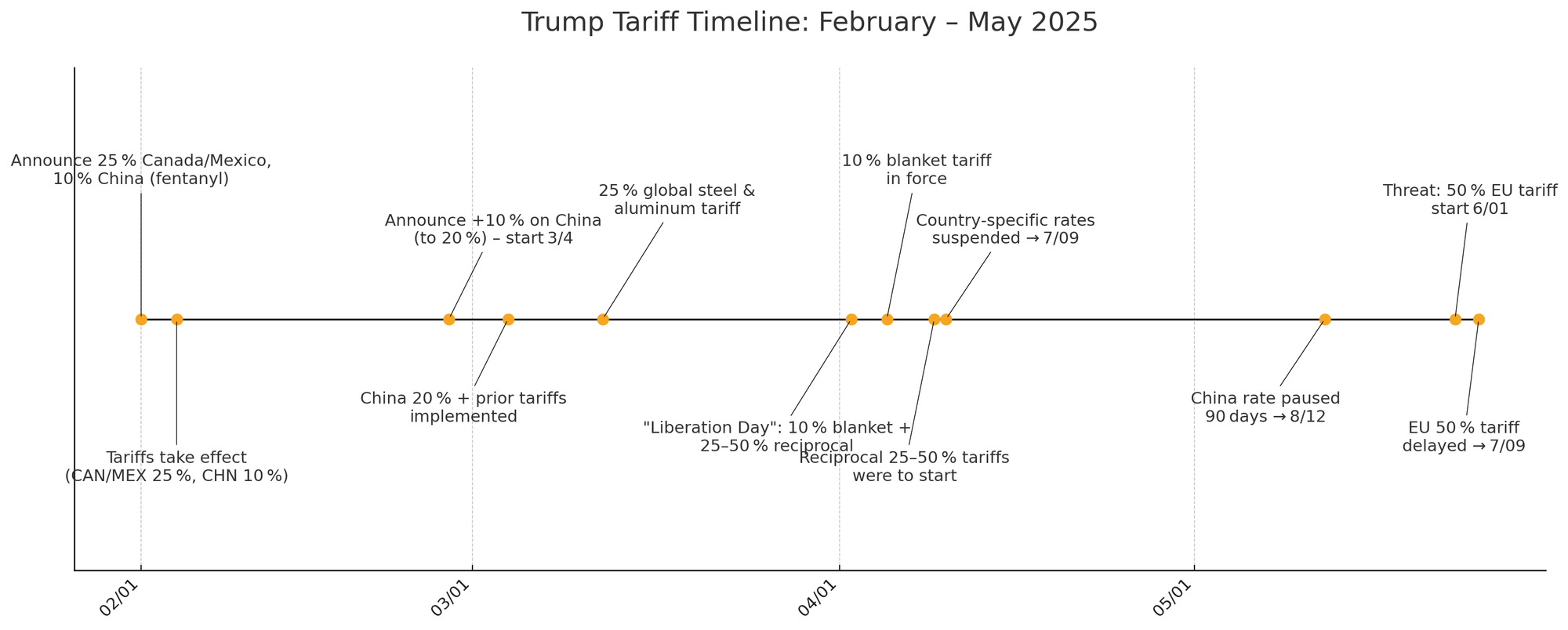

- Friday shock: Markets opened Friday to President Trump floating a straight 50 % tariff on all EU goods, knocking the European markets down -1.5 % and pushing the US markets even further into the red for the week (the S&P 500 gave up nearly 3% for the week). Note the President also threatened a tariff of 25% on smart phones made outside the US.

- Sunday U-turn: Late on Sunday the White House postponed implementation to July 9, giving negotiators “more runway.” U.S. futures popped more than 1 % pre-market on Monday night's open and are looking to start the week on a strong note.

- Takeaway: This could again be a "negotiating tactic" like we saw with the bulk of the "liberation day" tariffs". While not a full timeline, this shows the whipsaws we've already seen from the Trump Administration on tariffs.

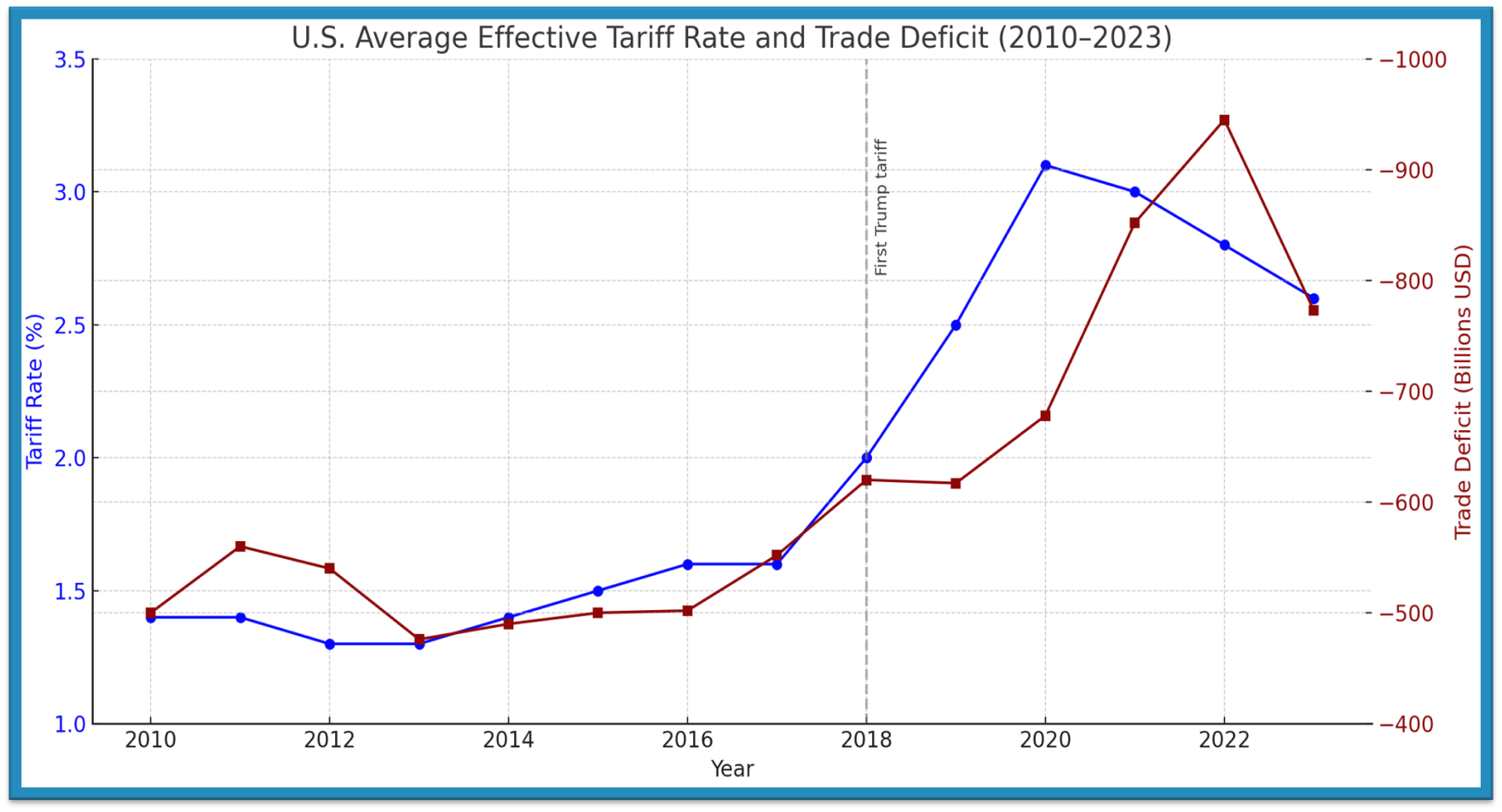

Will this work? What will be the final outcome? Will we actually flip the trade deficit to a surplus? Nobody knows. What we do know is the average tariff rate will be significantly HIGHER going forward AND the 2018-2020 tariffs implemented by Trump the first time around somehow seemed to INCREASE our trade deficit.

2️⃣ “Big Beautiful Bill” (BBB) Clears the House

- The tax-and-spend package squeaked through the House on Thursday by a single vote. Headline sweeteners (bigger child tax credit, no taxes on tips) mask permanent high-income cuts and new immigration funding; The Congressional Budget Office (CBO) pegs the debt impact at ≈ $3 T over 10 years.

- Market read-through: The 10-year Treasury yield pushed through 4.58% last week — a 19-month high — before moving lower as stocks sold off.

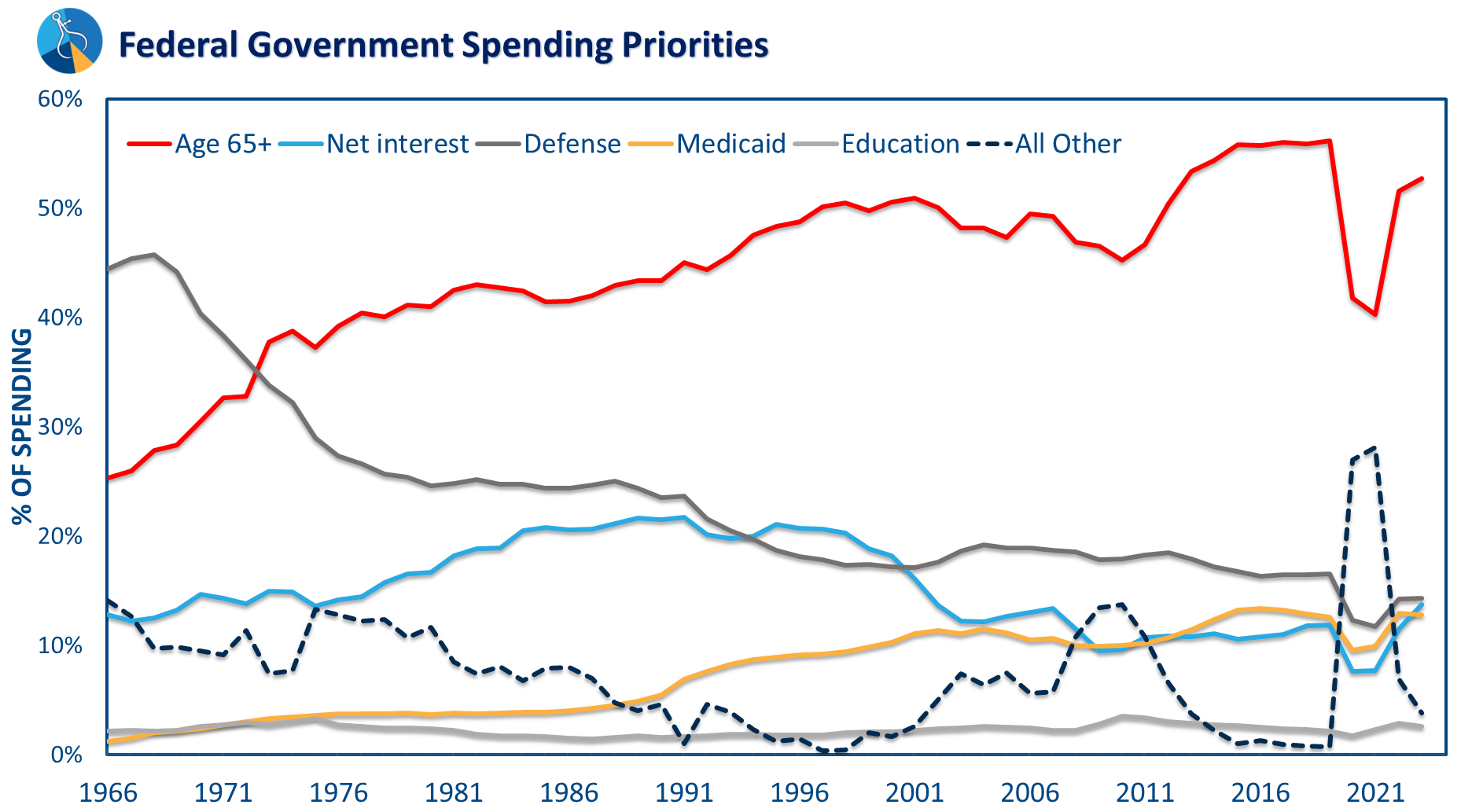

- Takeaway: The House has a slim majority to work with and did everything possible to "buy" votes to get this passed. Next up is the Senate. From a bigger picture perspective, Republicans seem to be banking on tax cuts "paying" for the spending, but we learned last time that never happened. Worse, the "conservatives" are focusing on making cuts to areas of the budget that in the whole scheme of things simply do not matter. 53% of federal spending is dedicated to retired people (Social Security, Medicare, and Federal Government Pensions.) Medicaid is 13% of spending and the Department of Education is 3%. Interest expense is about to surpass Defense spending.

From an economic perspective our country can only grow if we increase the workforce or make them more productive. When you dedicate more than half of your spending to retirees, it's difficult to grow your economy.

3️⃣ All Eyes on Nvidia (Earnings Wednesday)

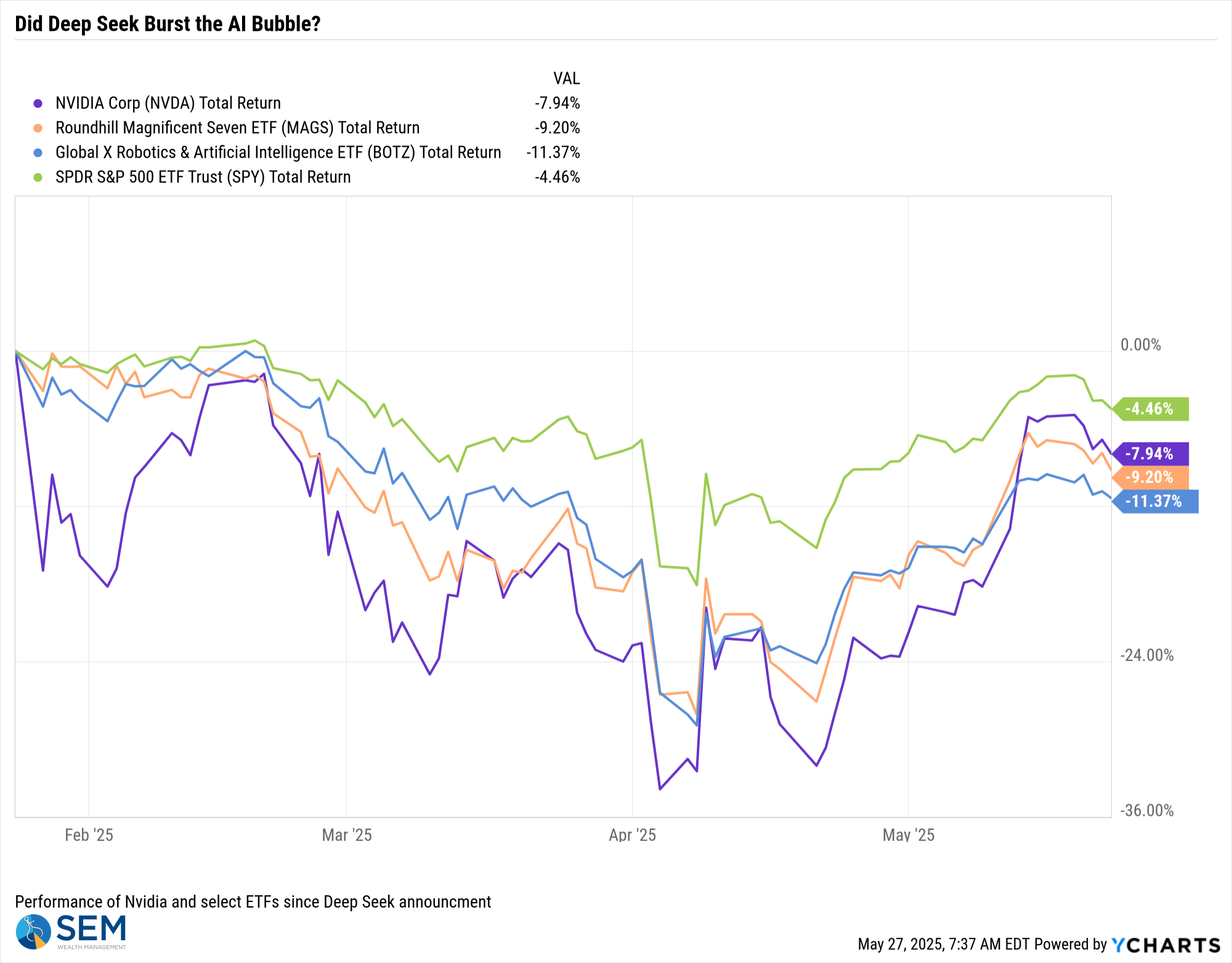

- After last week’s pull-back (both the S&P and NASDAQ were down nearly 3%). NVDA’s Q1 earnings release is the next litmus test for the AI trade.

- Set-up: Wall Street is looking for +45 % year-over-year revenue growth; anything soft could extend the rotation into value/defensives that started when Treasury yields spiked.

- Takeaway: AI remains the market’s security blanket – strong revenue and earnings growth CAN justify the high valuations, but they have to continue to perform at a high level. The AI stocks have nearly recovered their losses since the "Deep Seek" announcement in January. Nvidia's earnings could determine whether the rally continues.

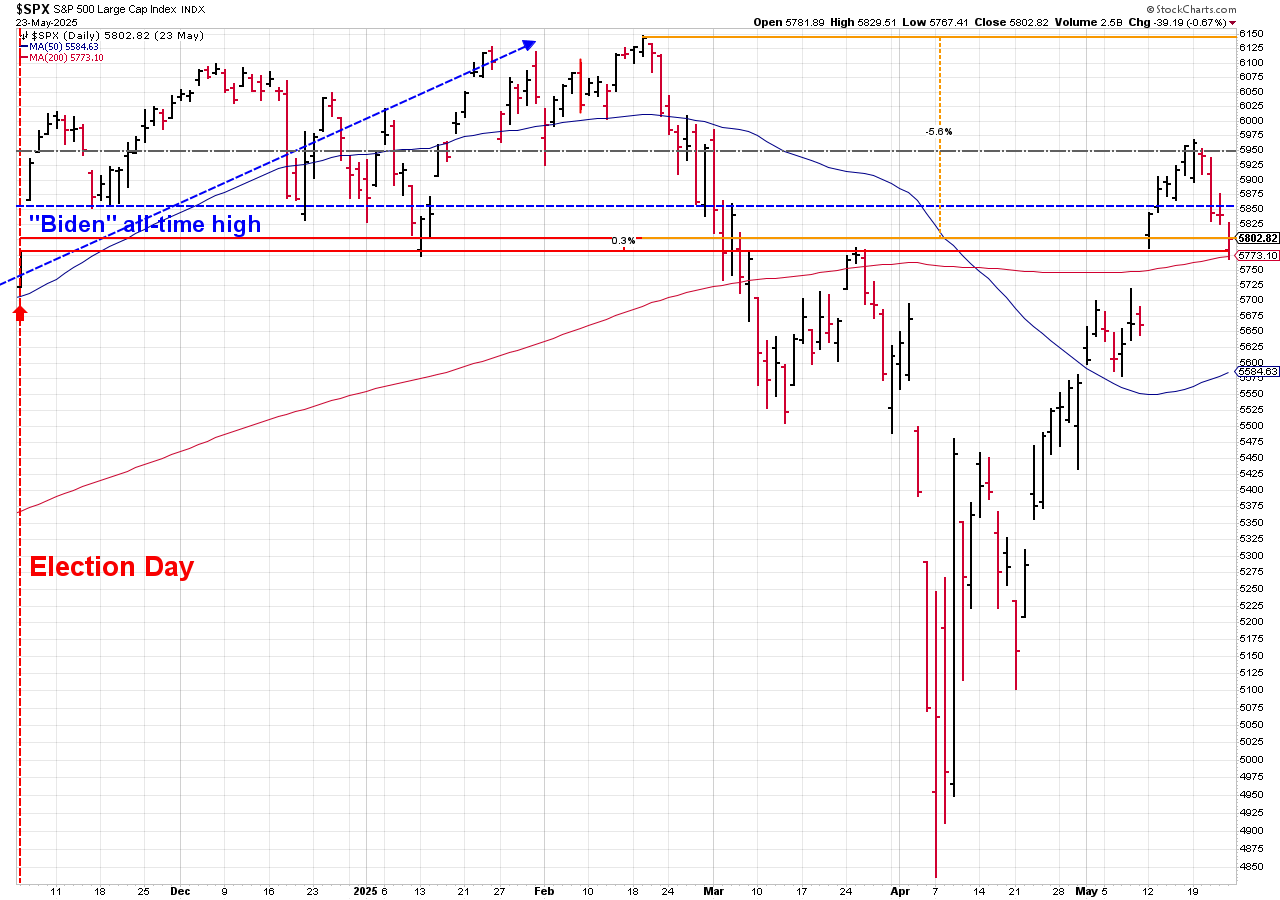

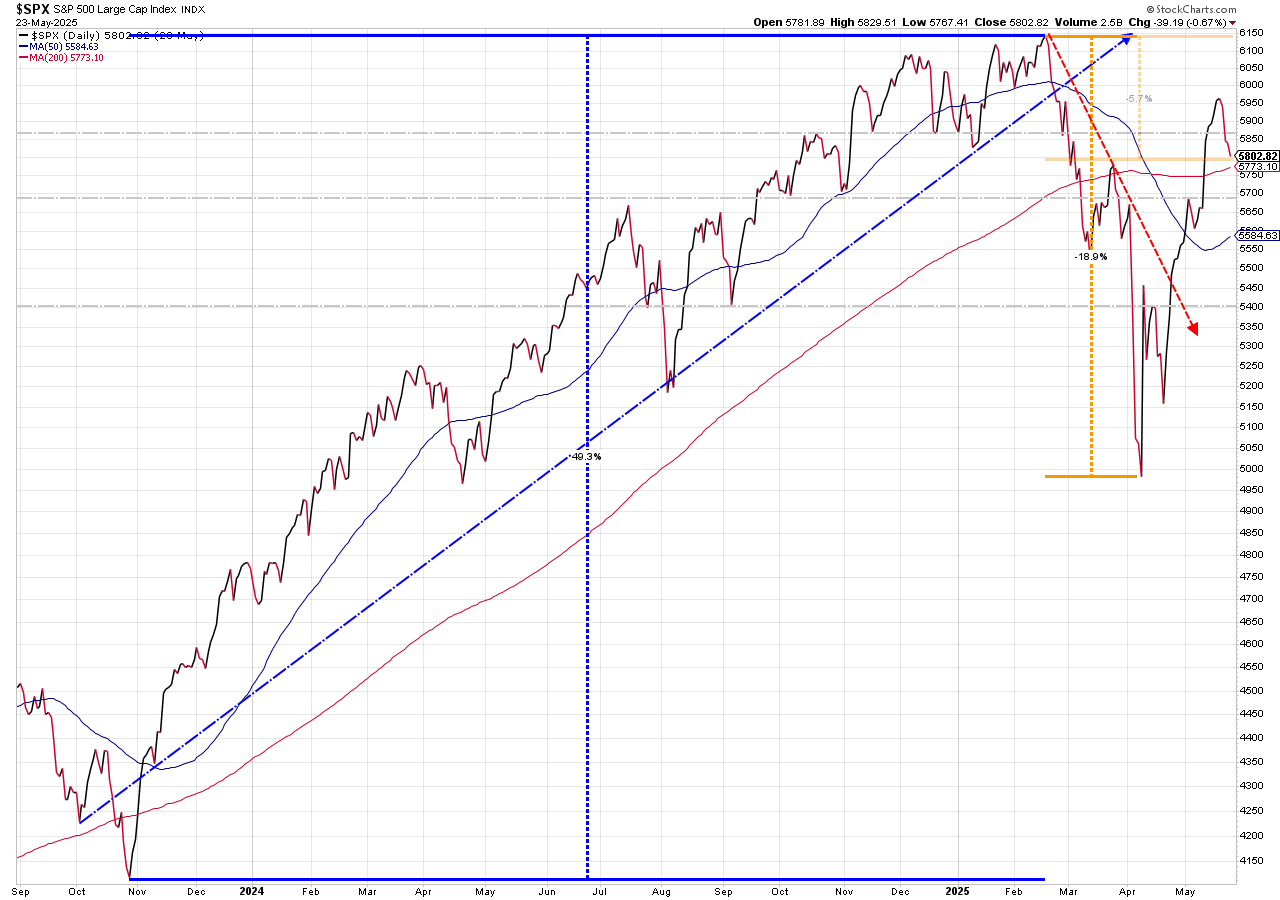

Market Charts

Probably fittingly so, the market continues to gravitate back to the election day levels on the S&P (5780). Given nobody knows what "news" will hit next, not making big bets either way seems like the wise choice.

Zooming out a bit, the 200-day moving average held last week so that could be a good staging ground at a rally to recover last week's losses.

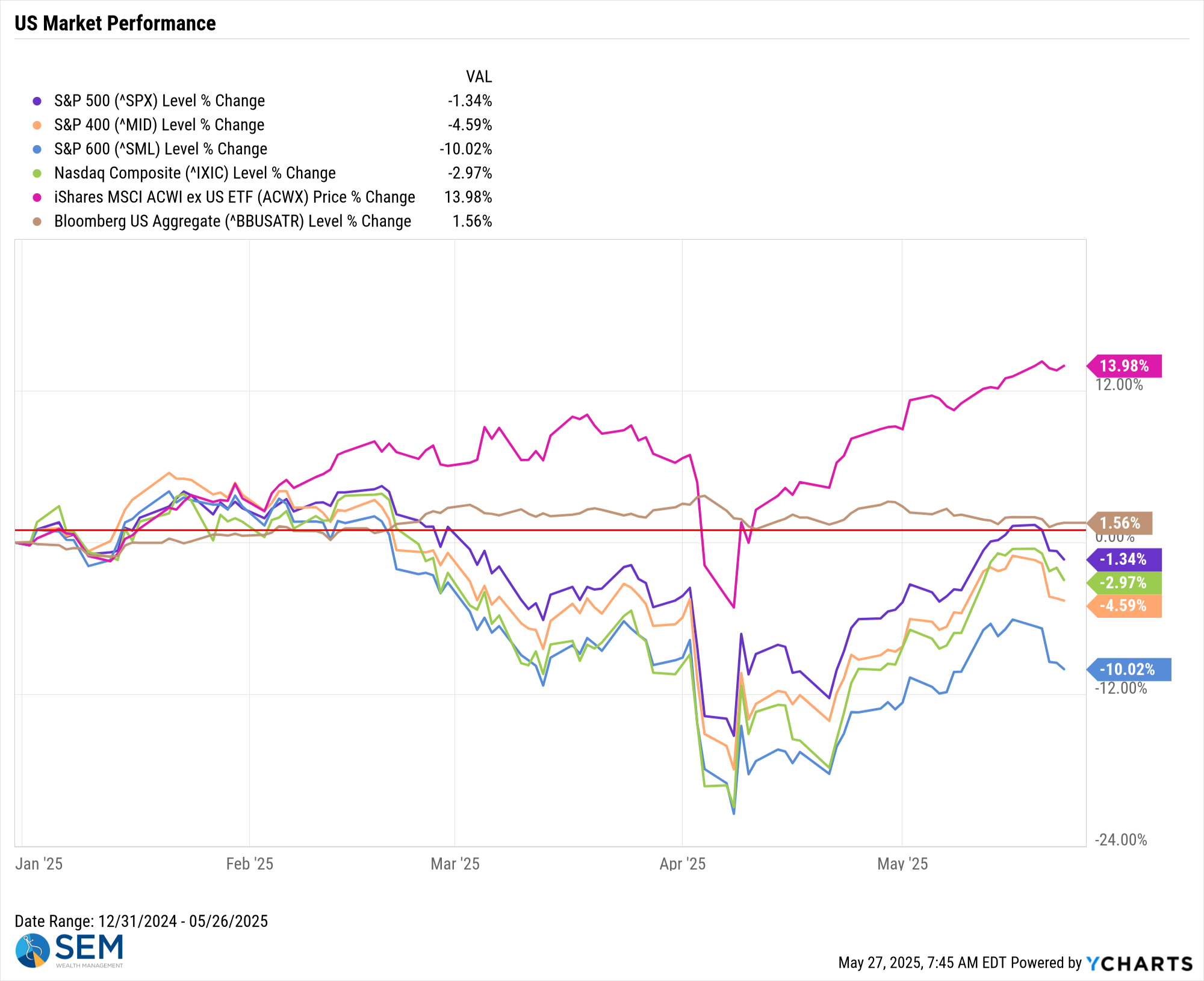

The S&P 500 remains in the lead for the major stock categories, with small caps again getting hit more than large caps. Given the downgrade of the US credit rating two weeks ago I've added the "non-US" global market ETF to our weekly charts. It has expanded its lead over the last month versus the US and is something worth watching.

The bond market will continue to be something we need to watch.

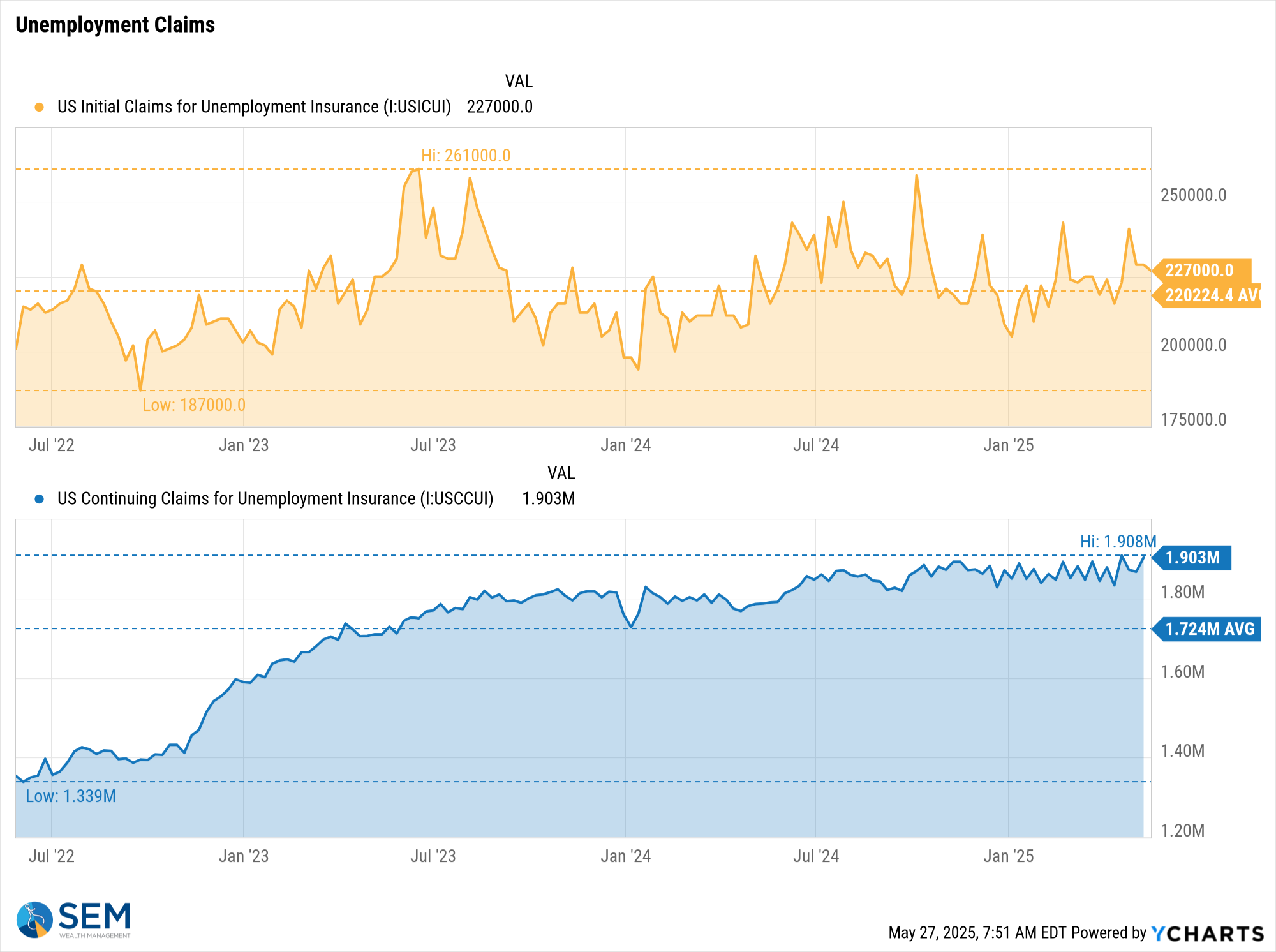

In the whole scheme of things, probably the most important chart for both stocks and bonds is unemployment claims. For now we aren't seeing an increase in people losing their jobs, but for those who lost their job it does appear they are having a hard time finding a new one.

SEM Model Positioning

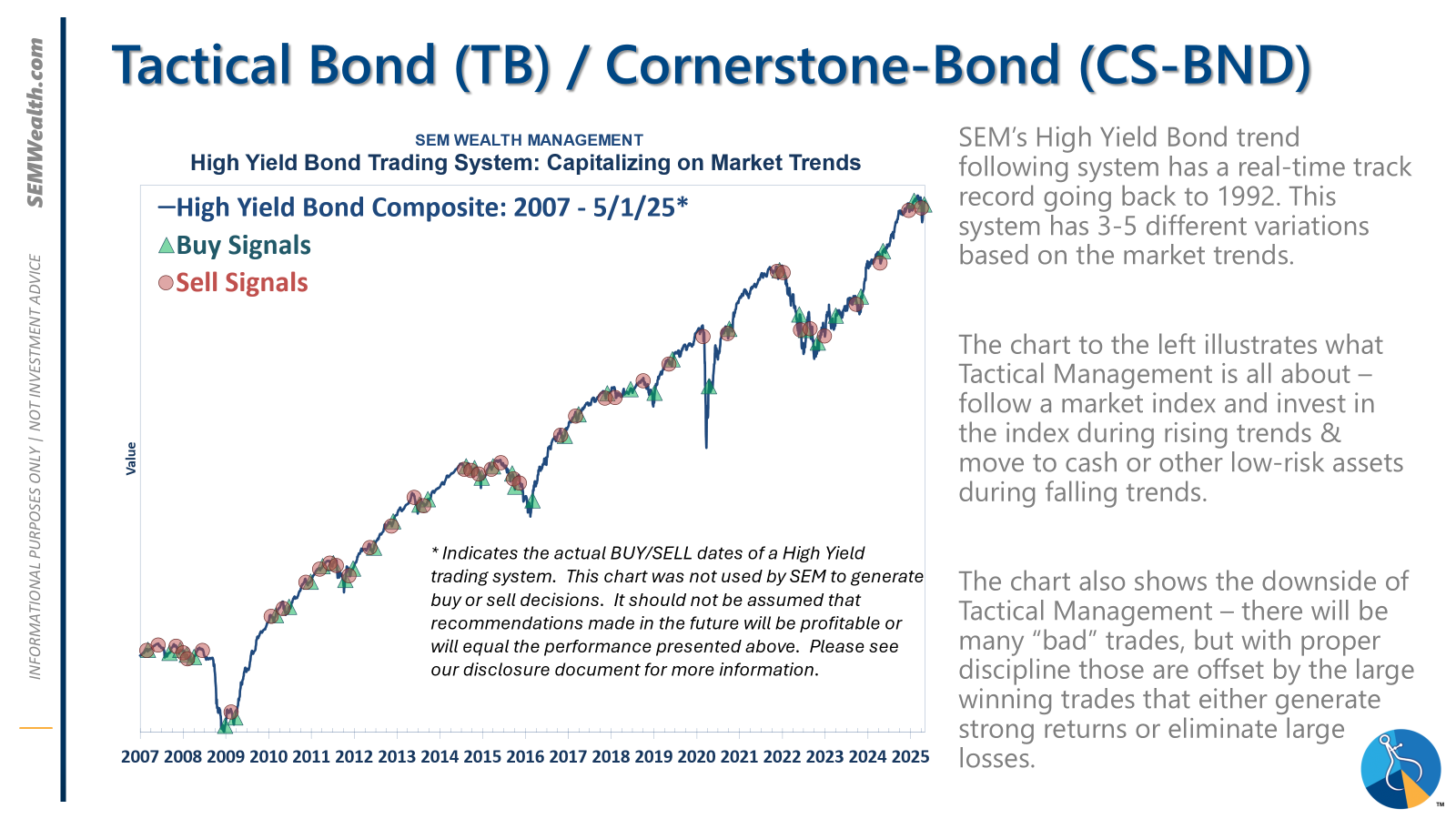

-Tactical High Yield sold high yield bonds on 4/3/25 after 9 weeks in these funds. These models bought back in on 4/24. All proceeds were moved to money market or short-term bonds, with a yield around 4.1% in money markets.

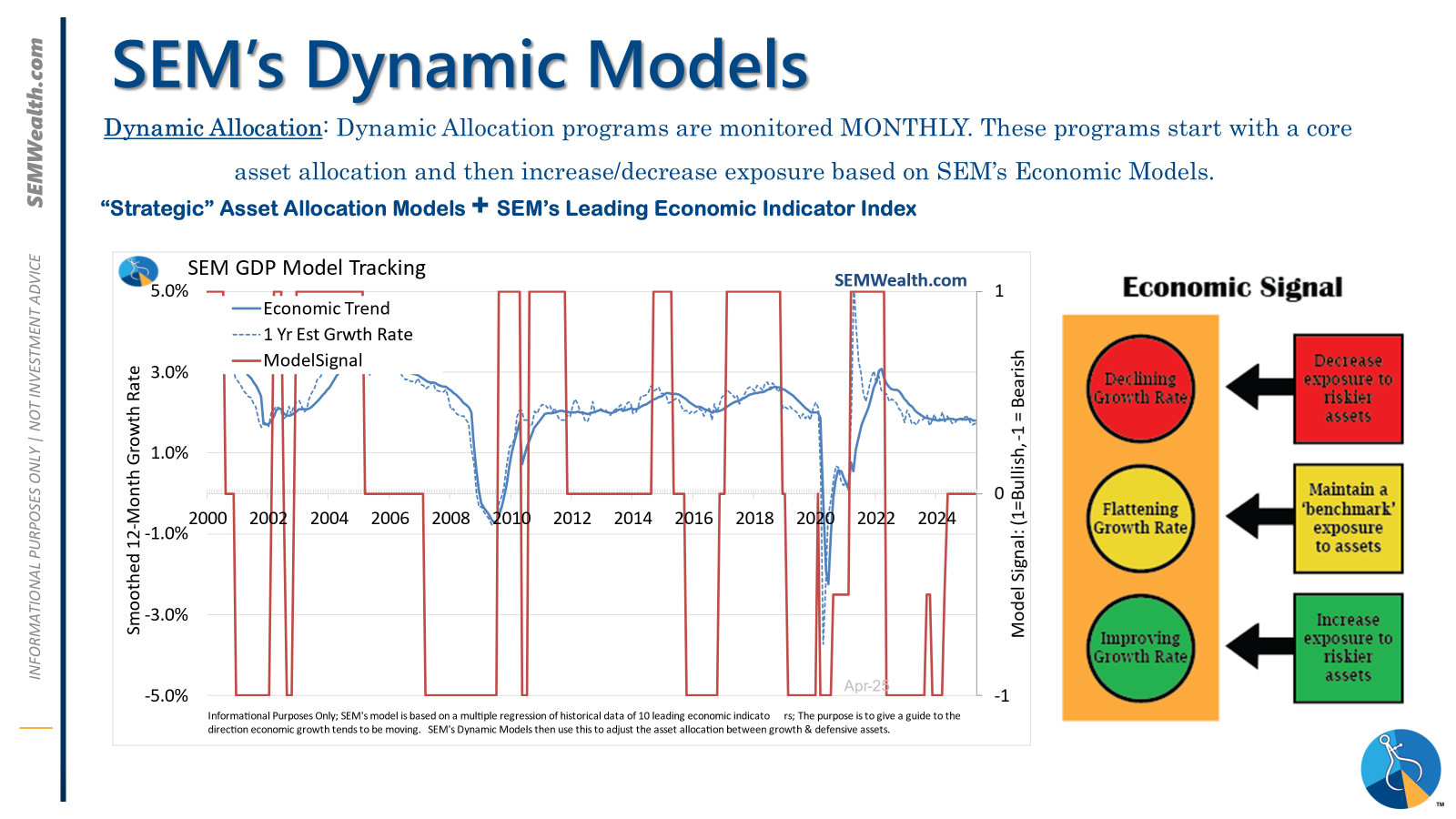

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. The interest rate model remains partially 'bullish' (long Treasuries).

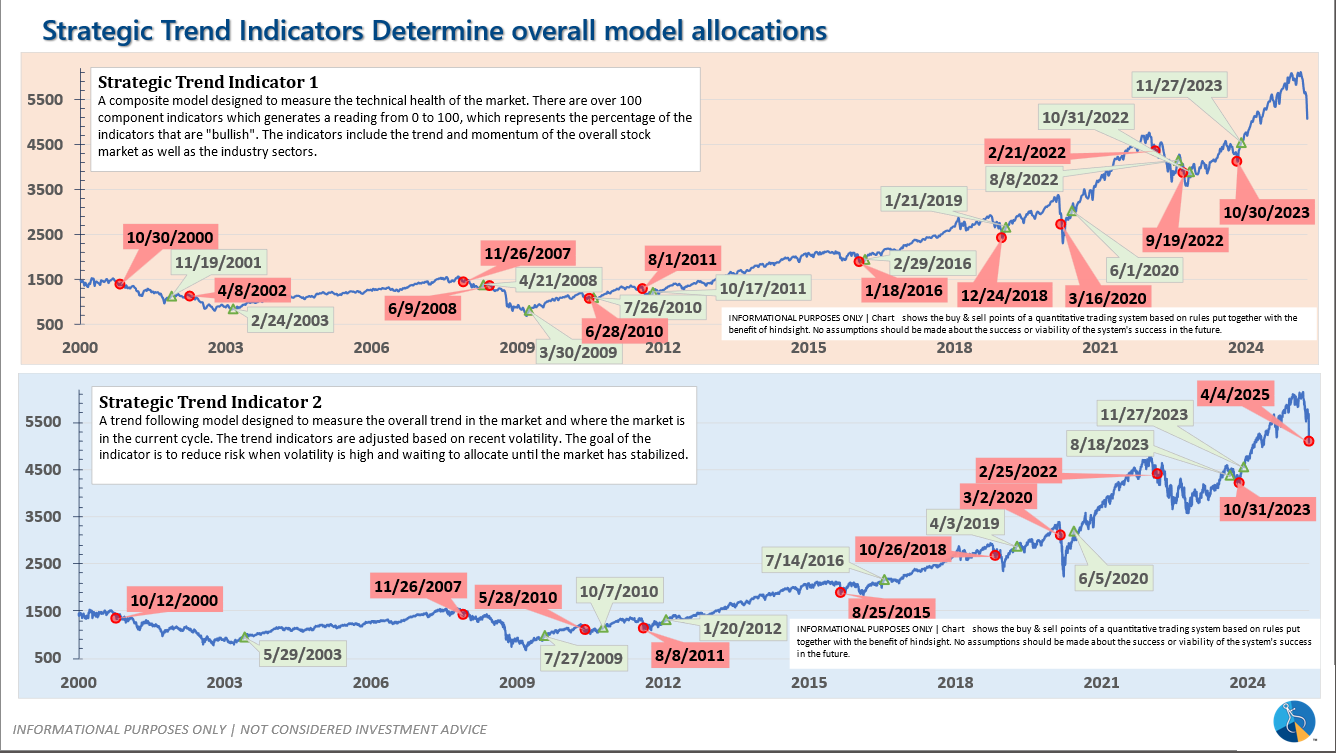

-Strategic Trend Models received 1/2 of the trend sell signal on 4/5/25

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 4/3/2025 our tactical high yield model sold out of high yield bond into money market.

Dynamic (monthly): The economic model was 'neutral' since February. In early May 2023 the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*: One Trend System sold on 4/4/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire