Defense, AI, and Crypto are surging while tariffs, inflation, and politics remain threats to the rally

We wrapped up our 6 week cross-country circuit last week. What was supposed to be a relaxing week in Myrtle Beach was derailed by an extremely busy week for the markets.

Here's a wrap-up of what I thought were the 10 biggest headlines from last week.

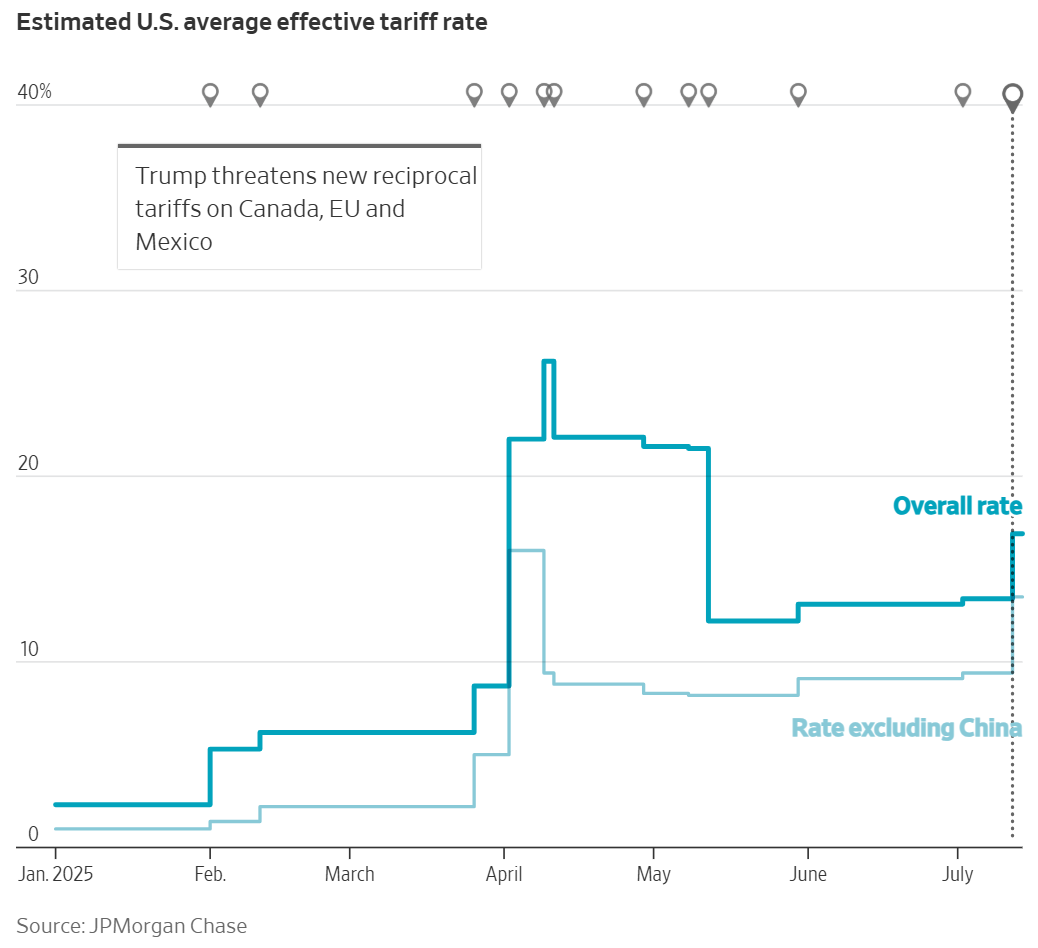

1. 🔥 Trump Threatens New 30 % Tariffs on EU & Mexico

Headline: On Monday, President Trump announced plans to impose 30 % tariffs on European and Mexican imports starting August 1, with threats of deeper measures if talks falter. Markets dipped slightly but largely shrugged, with futures slipping ~0.2% as traders awaited fresh data and earnings (Sources: Reuters, Investopedia).

Why it matters: This again increases uncertainty around trade policy, potentially boosting inflation and weighing on corporate profits and the economy.

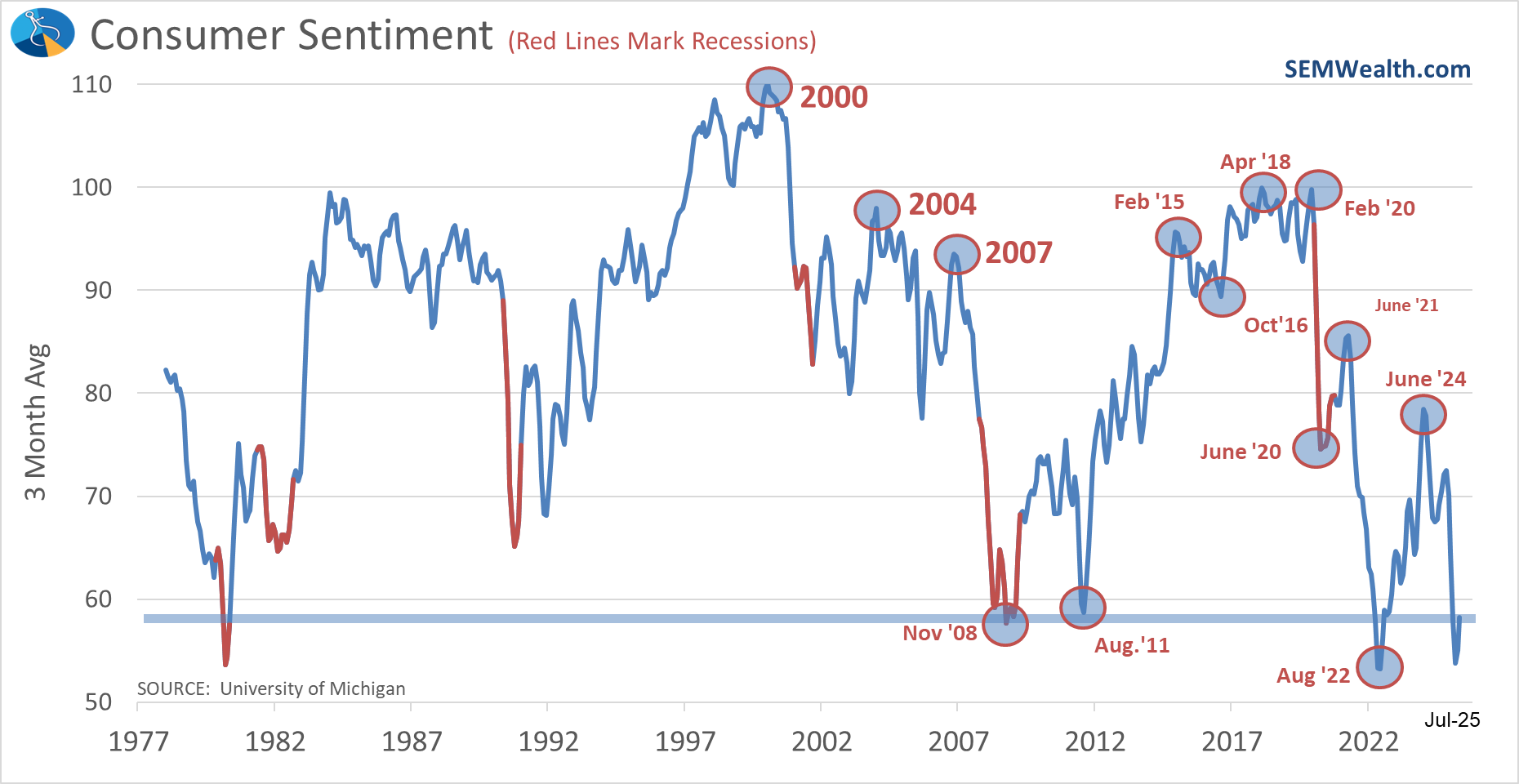

2. 🧮 University of Michigan Consumer Sentiment

Headline: Friday saw the preliminary July University of Michigan consumer sentiment released: it rose to 61.8 from 60.7, driven by lower inflation expectations (the 1‑year is a still high 4.4% and longer‑run is at 3.6%) (Sources: Reuters University of Michigan).

Why it matters: Sentiment is important because consumer spending drives most economic growth; this modest uptick could support a cautious consumer outlook, but the Fed does watch inflation expectations closely, which is still running well above the Fed's comfort level.

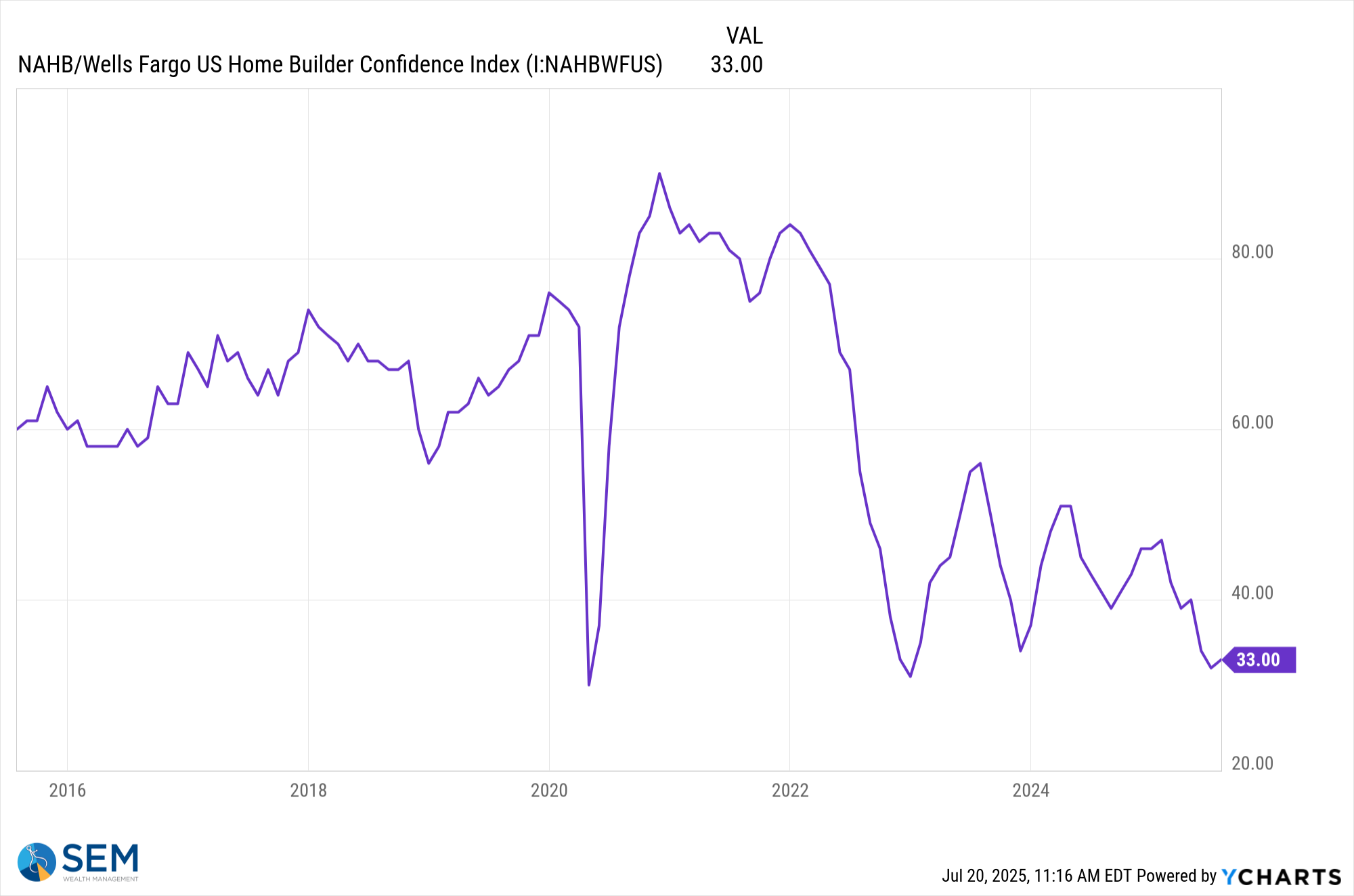

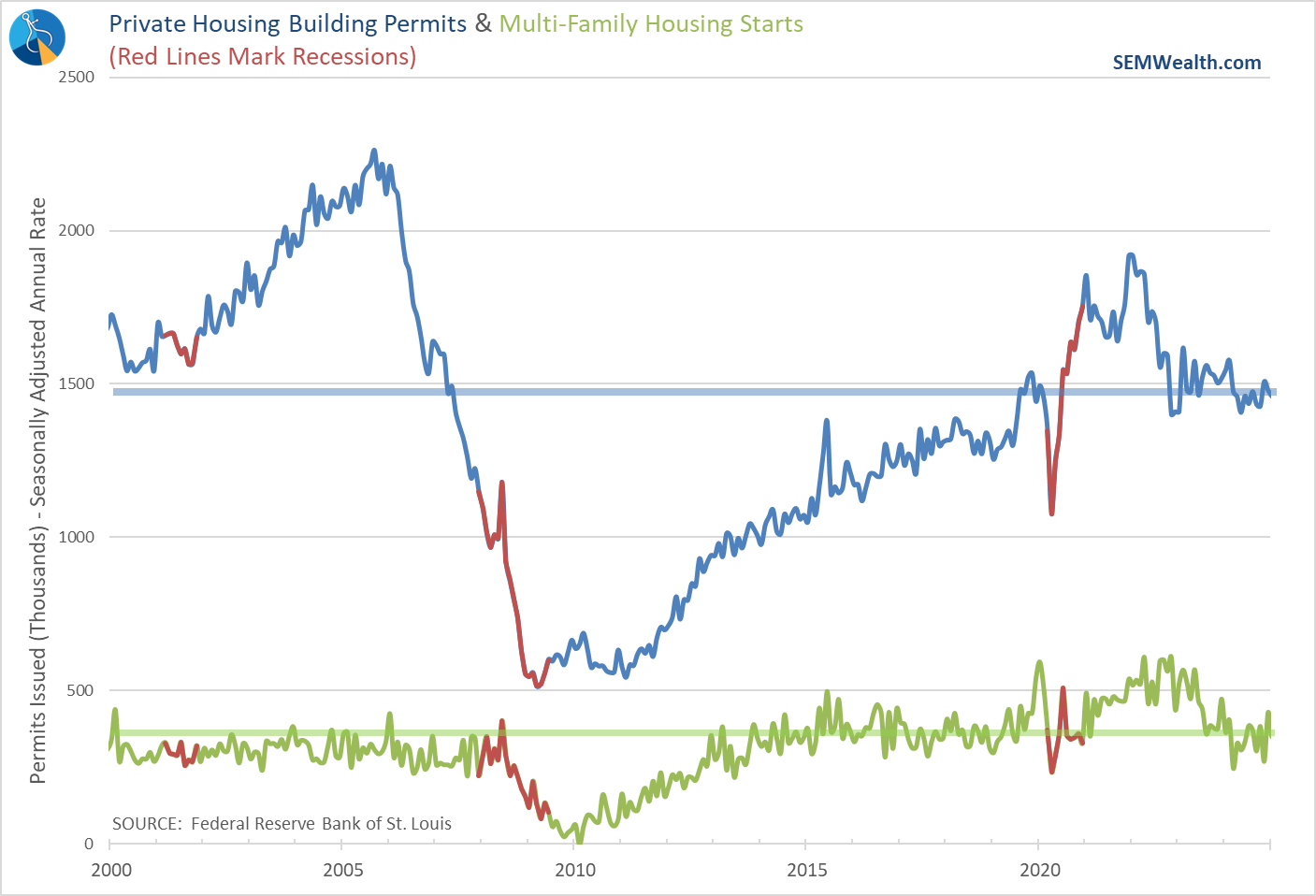

3. 🚗 Home Builder Confidence Remains Low

Headline: On Thursday, the NAHB reported HMI at 33, up one point from June, but still sitting near the lows of the pandemic and the summer of 2022. A more troubling sign - 38 % of builders cut prices and 62 % offered incentives (Sources: ABA Banking Journal, Advisor Perspectives, MarketWatch.

Why it matters: Builders’ increased use of incentives highlights soft housing demand and affordability pressures, which can influence regional economies.

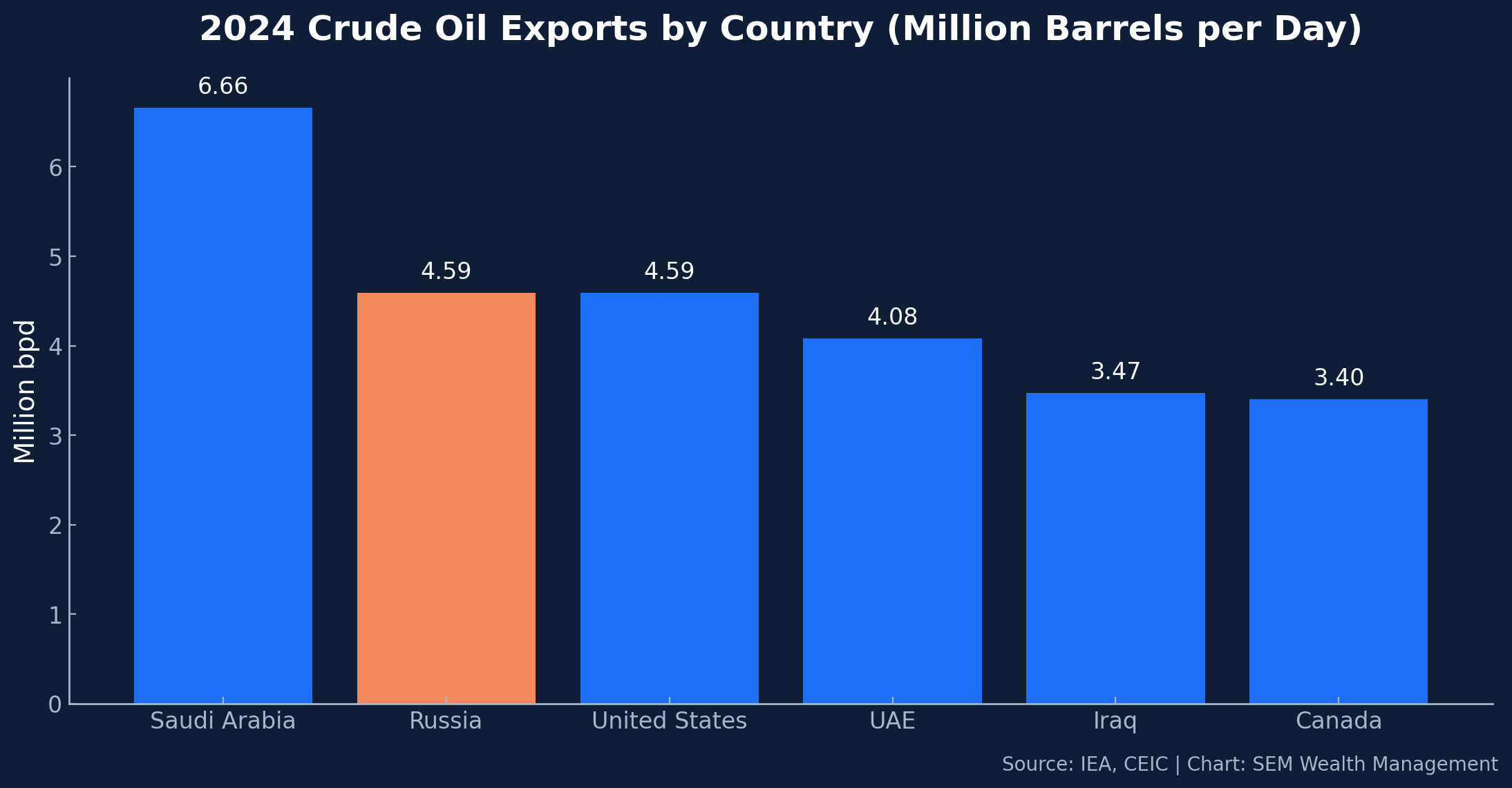

4. ⚖️ EU Imposes (more) Russian Sanctions / Congress & Trump may add their own

Headline: On Friday, the EU approved its 18th sanctions package, cutting crude oil price cap from $60 to $47.60, banning refined exports, shadow fleet vessels, and tightening financial restrictions. The bigger news is from Congress where an overwhelming majority of Congress from both parties and both chambers has pushed a major sanctions bill forward after President Trump said Russia had 50 days to "stop dragging his feet" on a ceasefire with Ukraine. (Sources: The Guardian, Reuters, Consilium, Radio Free Europe, NPR).

Why it matters: Despite sanctions and oil price caps, Russia remains a big player in global energy market, which underpins its ability to sustain revenues and geopolitical influence. With the United States joining the EU, tighter sanctions could pressure global energy supply, impacting oil prices and global inflation trends (and creating more uncertainty for our economy.)

5.🧭 Will He or Won’t He? Trump Continues Attacks on Powell

Headlines from the week: President Trump renewed his criticisms of Fed Chair Jerome Powell during. He suggested he may fire Powell over delays in rate cuts and a $2.5 billion renovation project at the Fed headquarters—even calling him “knucklehead”, “major loser”, and accusing the central bank of “choking out” the housing market (Sources: Fox Business, CBS News, Reuters 1, 2, 3, 4, 5).

Market response: On Wednesday, the day the attacks were most prominent, markets reacted: the dollar weakened and Treasury yields jumped when a report surfaced that Trump might fire Powell. But the move reversed after Trump closed the door, saying it was “highly unlikely” unless Powell committed fraud

Why it matters:

- Fed independence is on the line: Any attempt to replace the Fed chair for policy reasons could shake investor confidence and destabilize long-term inflation expectations

- Policy uncertainty returns: The saga may shift investor focus back to whether rate cuts will arrive, and when. A preemptive replacement—or shadow nomination—could further rattle markets.

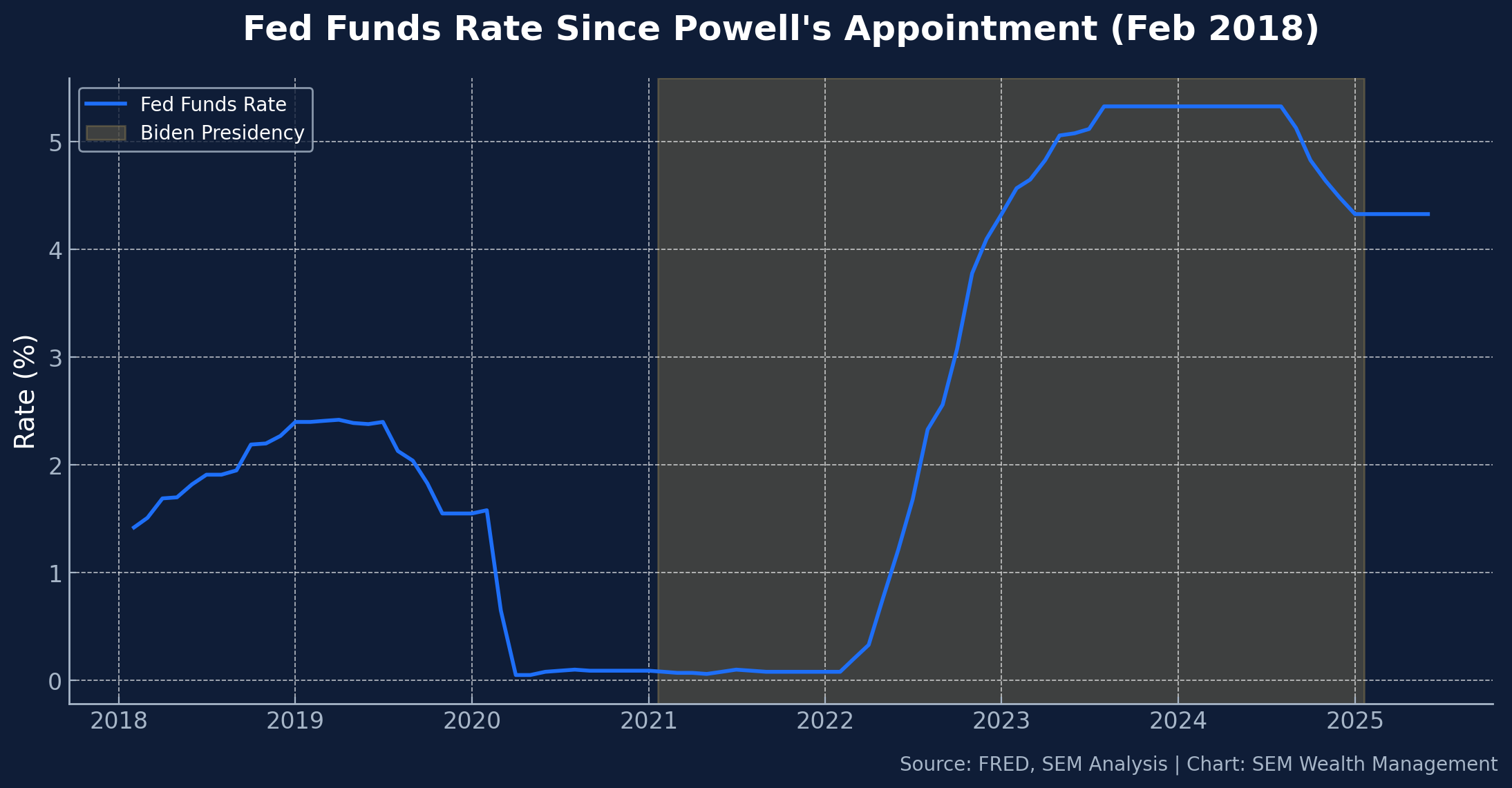

Rate were actually higher for most of Biden's presidency, especially compared to where they were during Trump's first term (even before COVID).

Side Note: Despite your political leanings, I hope you understand the importance of an independent Federal Reserve. Remember, their primary responsibility is to ensure the stability of the financial system. Secondarily, they are supposed to maintain the value of the dollar (control inflation), and to support an economy near "maximum" employment. If the Fed was not independent, the President or Congress would have free will to do what they think is best, which would create more volatility, a lower value of the dollar, and higher interest rates.

Side Note 2: During the 2016 Presidential campaign, President Trump was highly critical of Fed Chair Janet Yellen saying she kept rates too low for too long to "support Obama." In reality, the Fed had been raising rates to slow the economy. The President also seems to have forgotten that he himself appointed Chair Powell, a pick highly praised by Wall Street due to his experience and data-driven approach. The President quickly lost favor with Chair Powell when the Fed raised interest rates to combat the inflationary pressure of the 2017 Tax Cuts and Jobs Act and new tariffs being imposed. The Fed then started cutting rates in 2019.

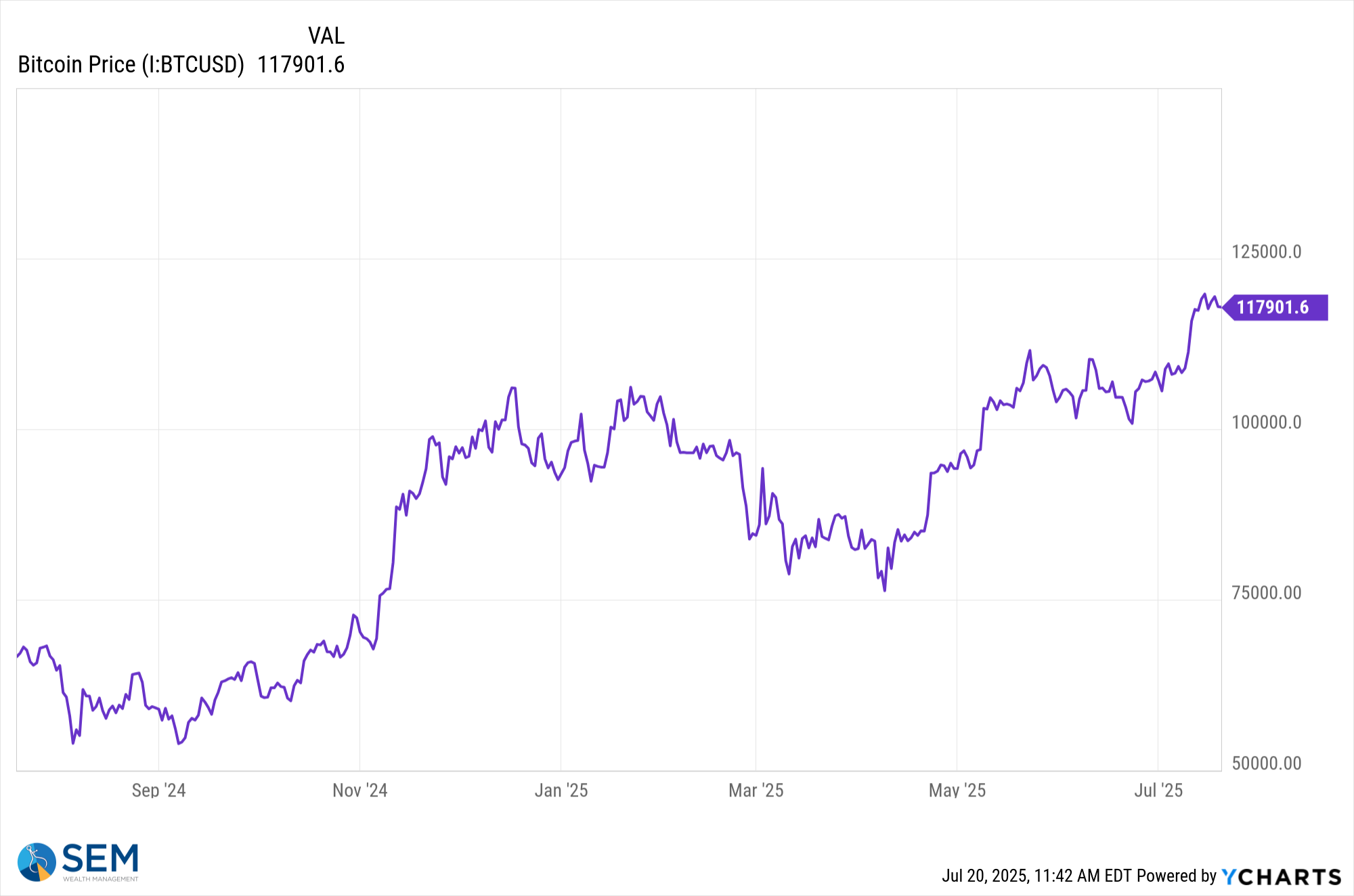

6. ₿ Bitcoin Tops Record ~$123K

Headline: All week, Bitcoin and other crypto-related assets hit new all-time highs amid anticipation of “Crypto Week” in Congress and regulatory clarity from the GENIUS Act (Sources: New York Post, Reuters, CoinDesk, MarketWatch).

Why it matters: Crypto’s rally signals increasing corporate interest and regulatory legitimacy, a growing consideration in diversified portfolios, but it also signals a high appetite for "risk", similar to what we saw in 2021.)

SEM Research Update: One of the major projects during my version of a summer "sabbatical" was working on an SEM "crypto" portfolio. I'm getting close to the final structure. The rally this week was both encouraging and disappointing. Encouraging, because there is merit in what we are putting together. Discouraging, because the move we saw last week still carries "bubble"-type price action, which brings in more risk. Probably the biggest obstacle is managing the downside. The rally since April hides the fact Bitcoin lost 20% in less than 2 months. Historically those losses have been even bigger, which means we have to be creative in creating something that has long-term viability for investors. Stay tuned!

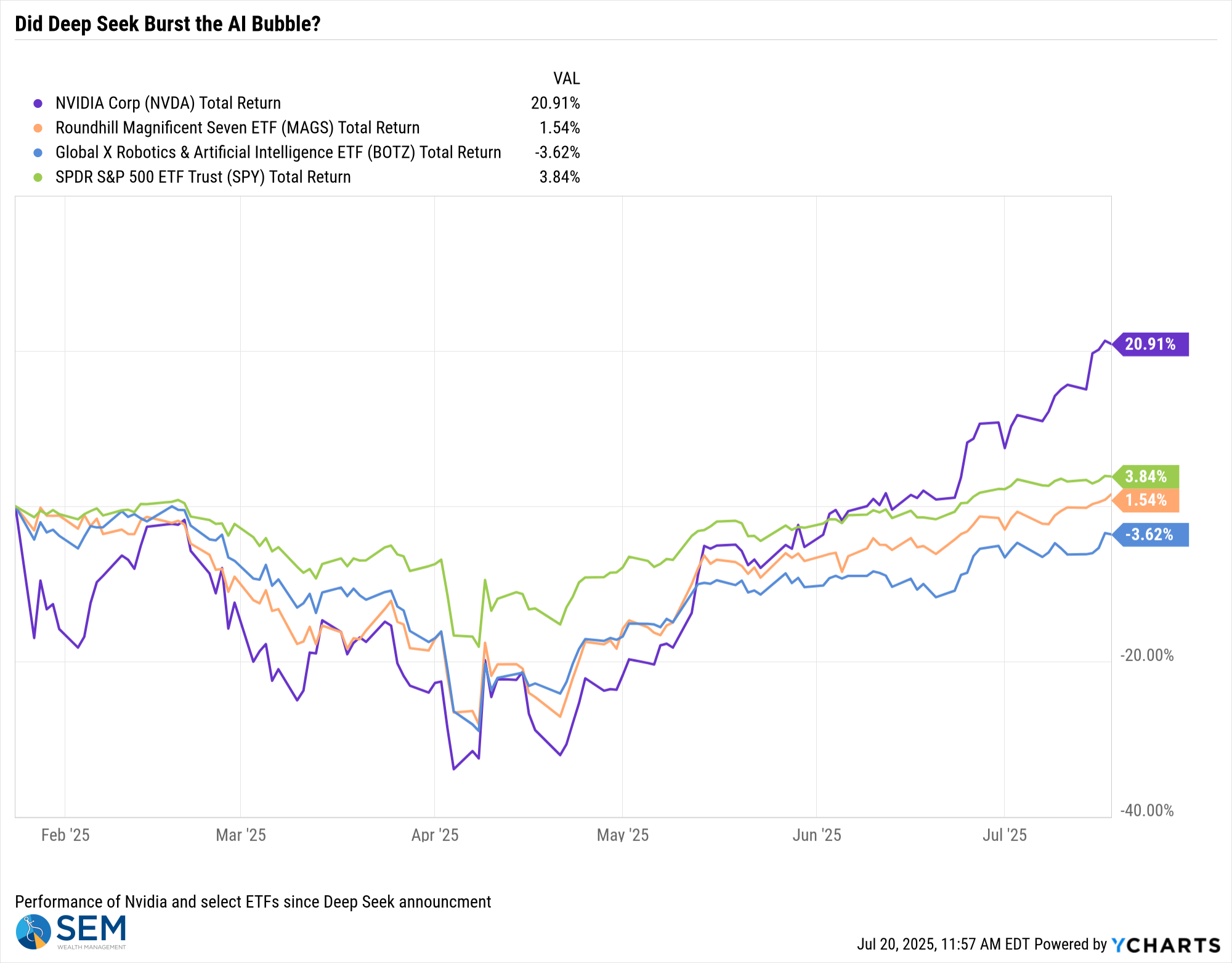

7. 🚀 AI Stocks Rally on Nvidia Chip Resumption

Headline: Shares of Nvidia surged 4% on Tuesday after Washington approved resuming sales of its H20 AI chips to China. The move lifted broader chip names like AMD (+6%), Arm, and Broadcom (+2%), while indexes tied to AI innovation continued hitting new highs. (Sources: USFunds, Wall Street Journal).

Why it matters: Continued momentum in AI-related equities supports thematic allocations and reinforces the strong technical setup across this sector.

Remember the big sell-off in January after the "Deep Seek announcement"? It seems that was (at least for now) a non-event and a buying opportunity.

8. 🏦 Intel Layoffs Across U.S. Campuses

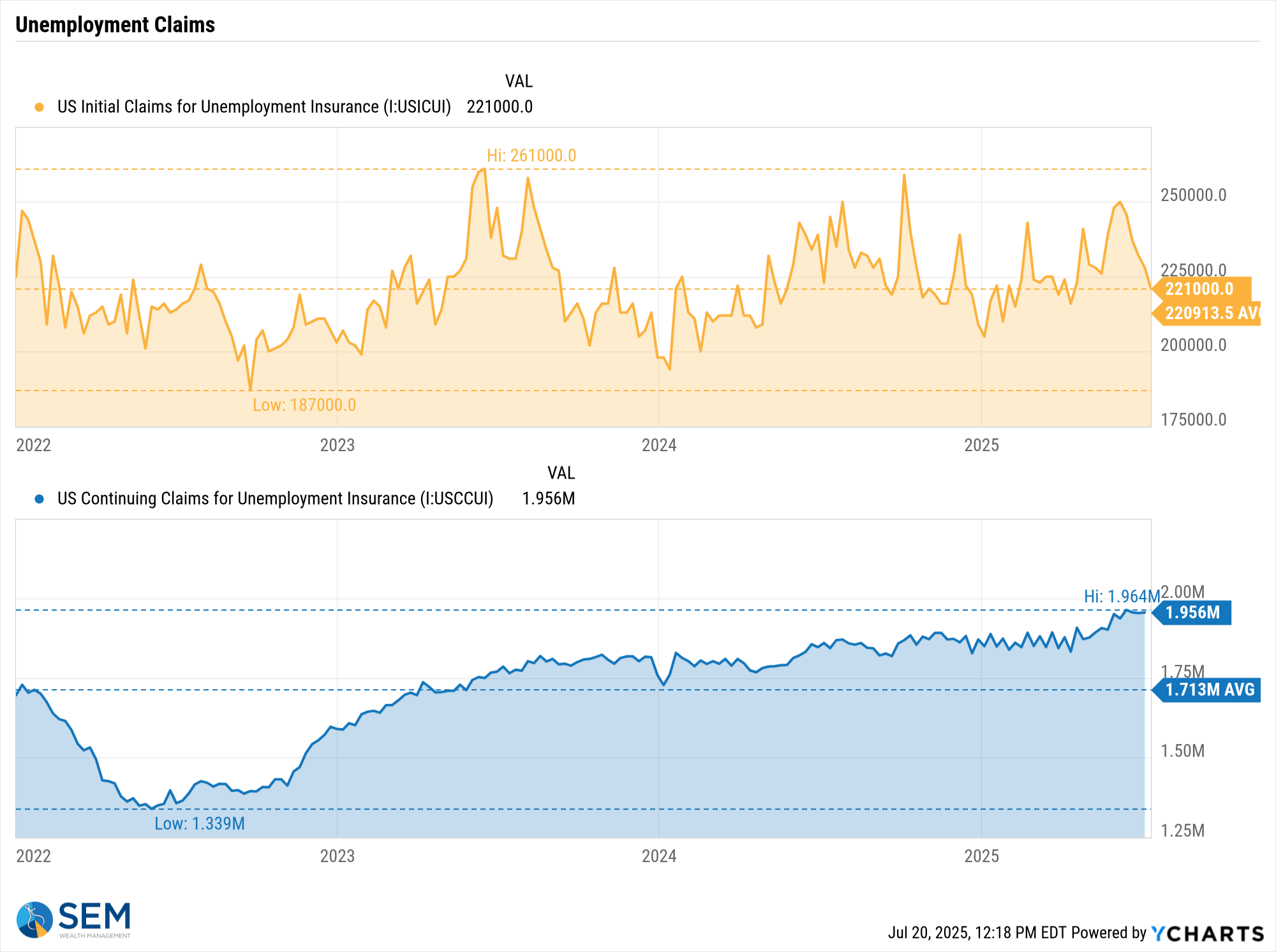

Headline: Monday news broke that Intel planned to lay off thousands—up to 2,400 people—in Washington County as part of its broader restructuring. This is just the latest in a series of tech layoffs. Microsoft recently announced 9,000 more job cuts, on top of the 6,000 they cut in May. (Sources: Valley Times, YahooFinance).

Why it matters: This highlights tech sector employment vulnerabilities and signals budgetary pressures at major semiconductor firms. More importantly, we are watching closely Jobless Claims data. Remember, these layoffs do not show up until after the severance packages end, which could be 2-6 months down the road. The theme right now is, "we aren't seeing a lot of job cuts, but if you lose your job, you're going to have a tough time finding a new one.)

9. 🧭 U.S. Construction Data Mixed

Headline: On Friday, we saw a mixed picture on housing construction. Building permits declined, while housing starts jumped. The starts data was skewed by a 30% increase in multi-family starts. Single family starts declined (again) (Source: Reuters).

Why it matters: These mixed signals suggest uneven activity in housing. We have a major housing affordability crisis that cannot be solved easily. We need a long-term solution. Shorter-term, the slowdown in single family starts is a negative for our economy.

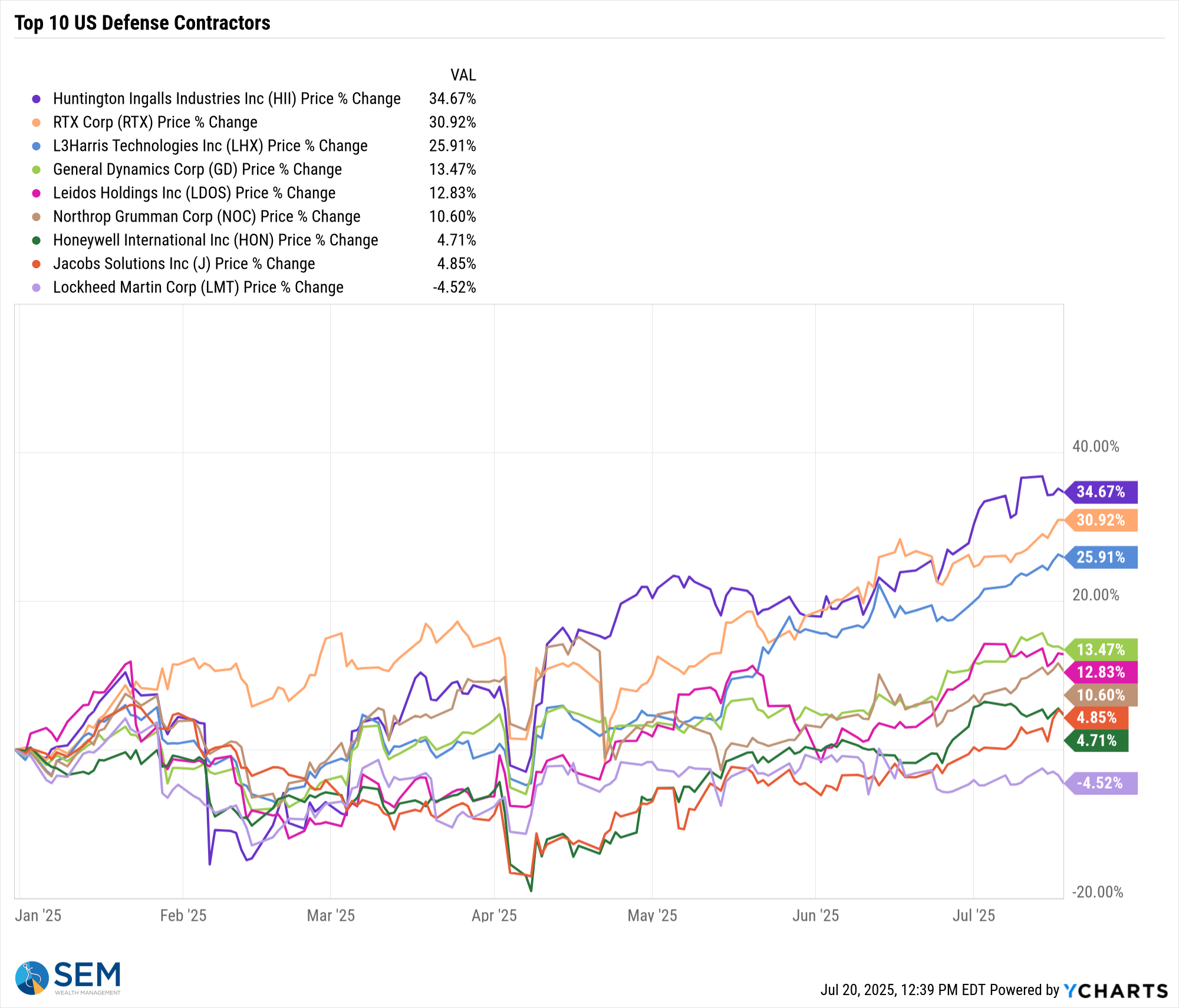

10. 🛡️ Defense Stocks Extend Rally

Headline: All week we saw U.S. defense contractors like Lockheed Martin, RTX, Northrop Grumman, and others in SEM’s Patriot Portfolio continue a multi-week rally. Reuters reported on Monday that President Trump announced plans to send Patriot air-defense missile systems to Ukraine, with costs to be reimbursed by the EU. This marks a significant shift toward providing heavier defensive aid amid Russia’s daily missile attacks. This followed the Pentagon announcing they were ending drone restrictions and the National Defense Authorization Act (NDAA) including $500M in Ukraine weapons aid. On Friday, the House passed the $826B Defense Appropriations bill, despite protests from some Republicans over the inclusion of foreign aid. (Sources: IBD, Investors.com, Reuters, Morningstar, New York Post).

Why it matters: This aligns directly with SEM’s Patriot Model strategy, showing market participants are paying up for defense exposure amid global instability—an important theme in portfolio positioning.

SEM Model Note: This portfolio is obviously not without risk, especially given the divide we are seeing develop over government spending. It can be a nice "satellite" diversifier for clients who want some non-correlation to the overall US Stock market as well as exposure to this industry.

All of this action did not lead to any changes in SEM's portfolios last week. For more details, check out the SEM Model Positioning below.

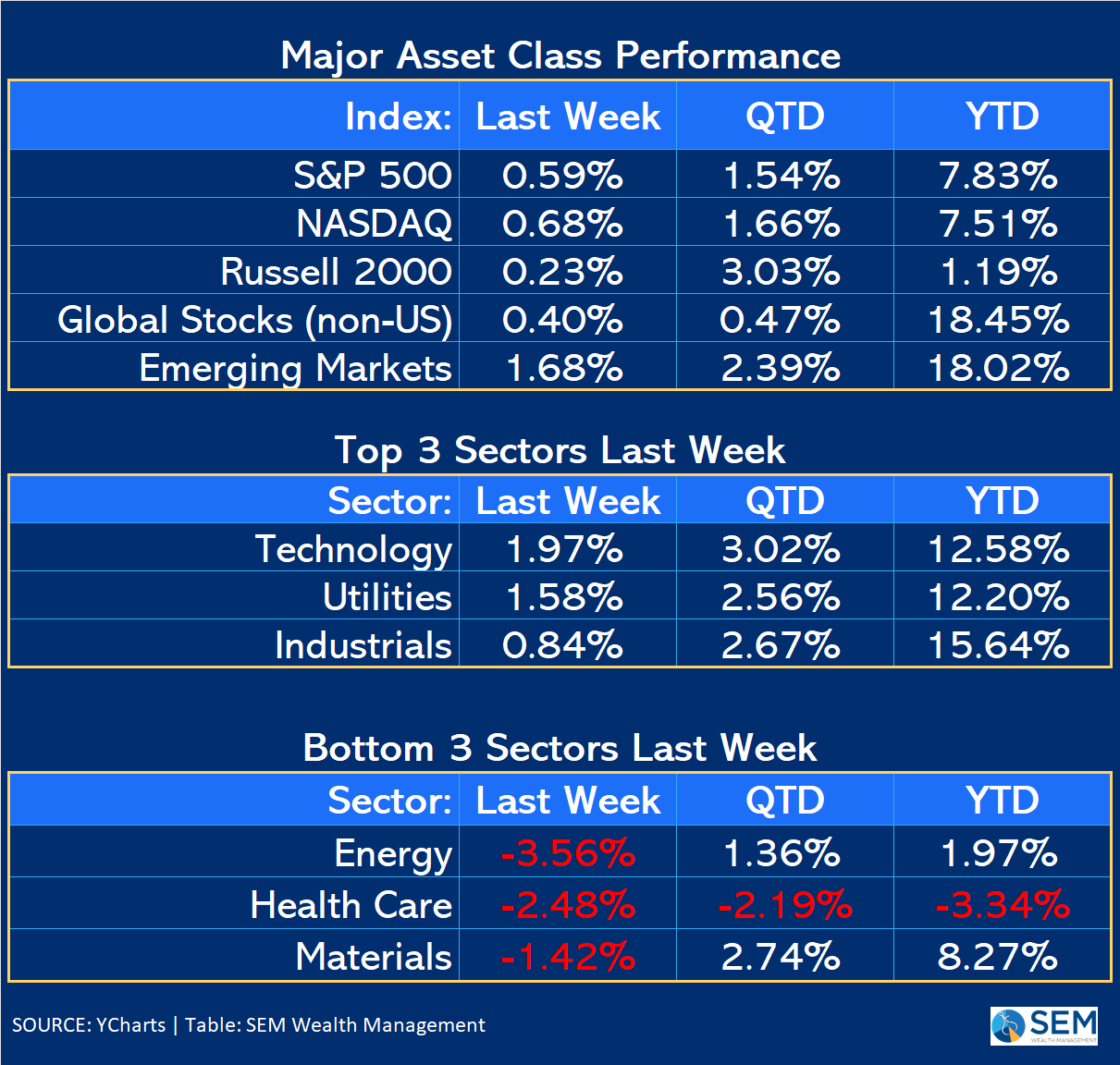

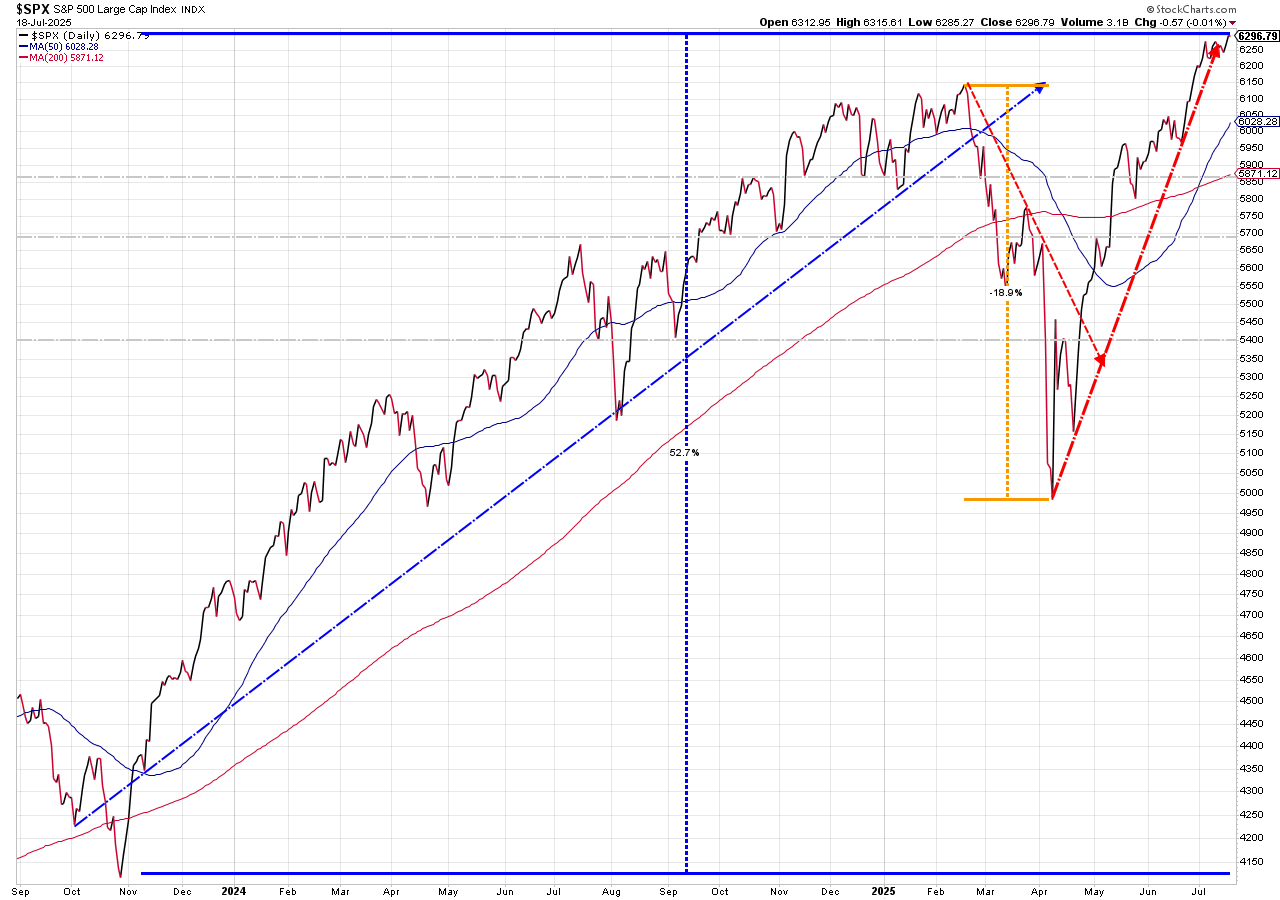

Market Charts

It was a relatively tame week for the broader market despite all the headlines, but we did manage to close at another all-time high for the S&P 500.

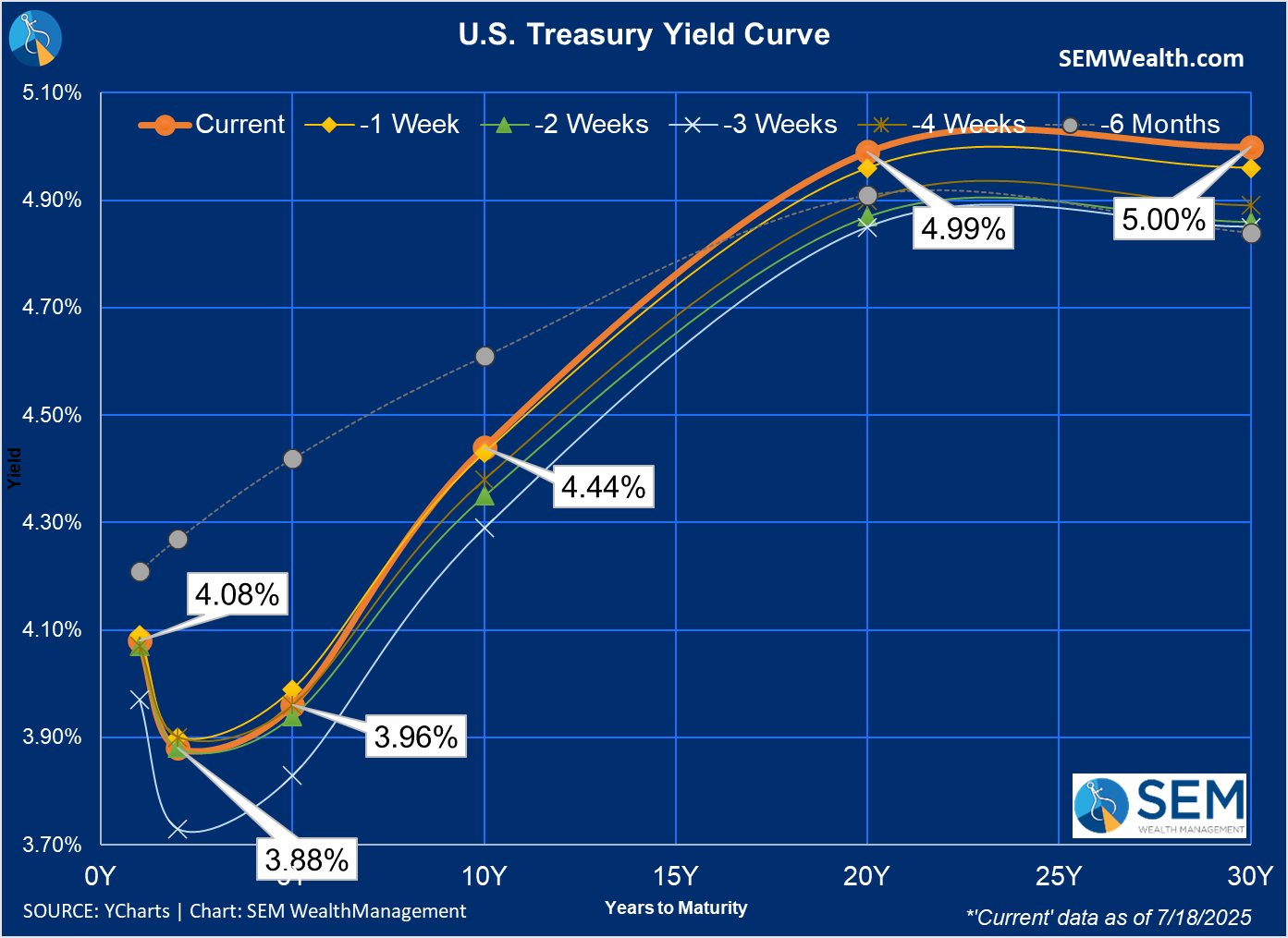

Turning to the bond market, short-term rates were mostly unchanged last week, but long-term rates did inch higher, with the 30 Year Treasury again hitting 5%.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

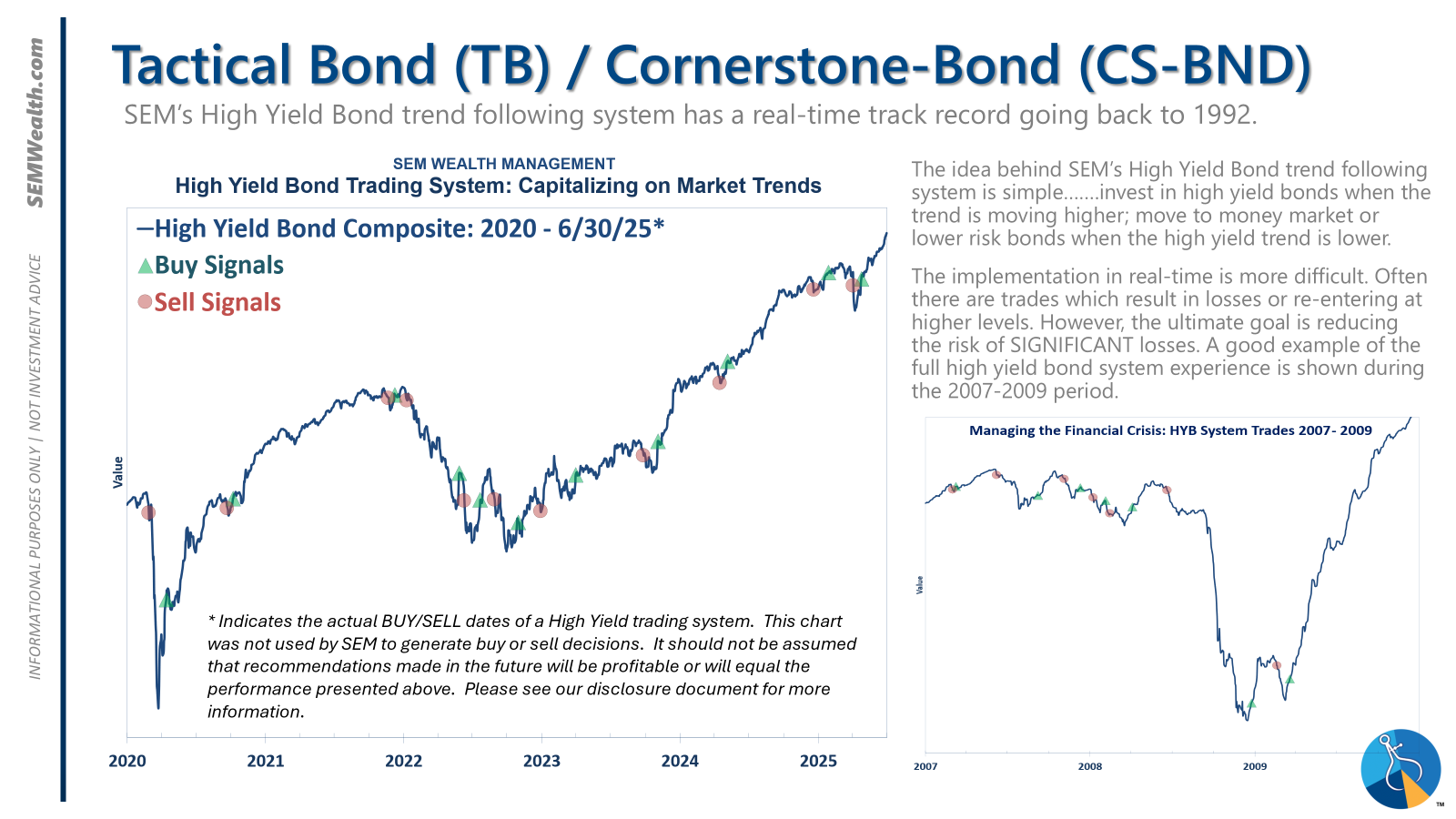

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

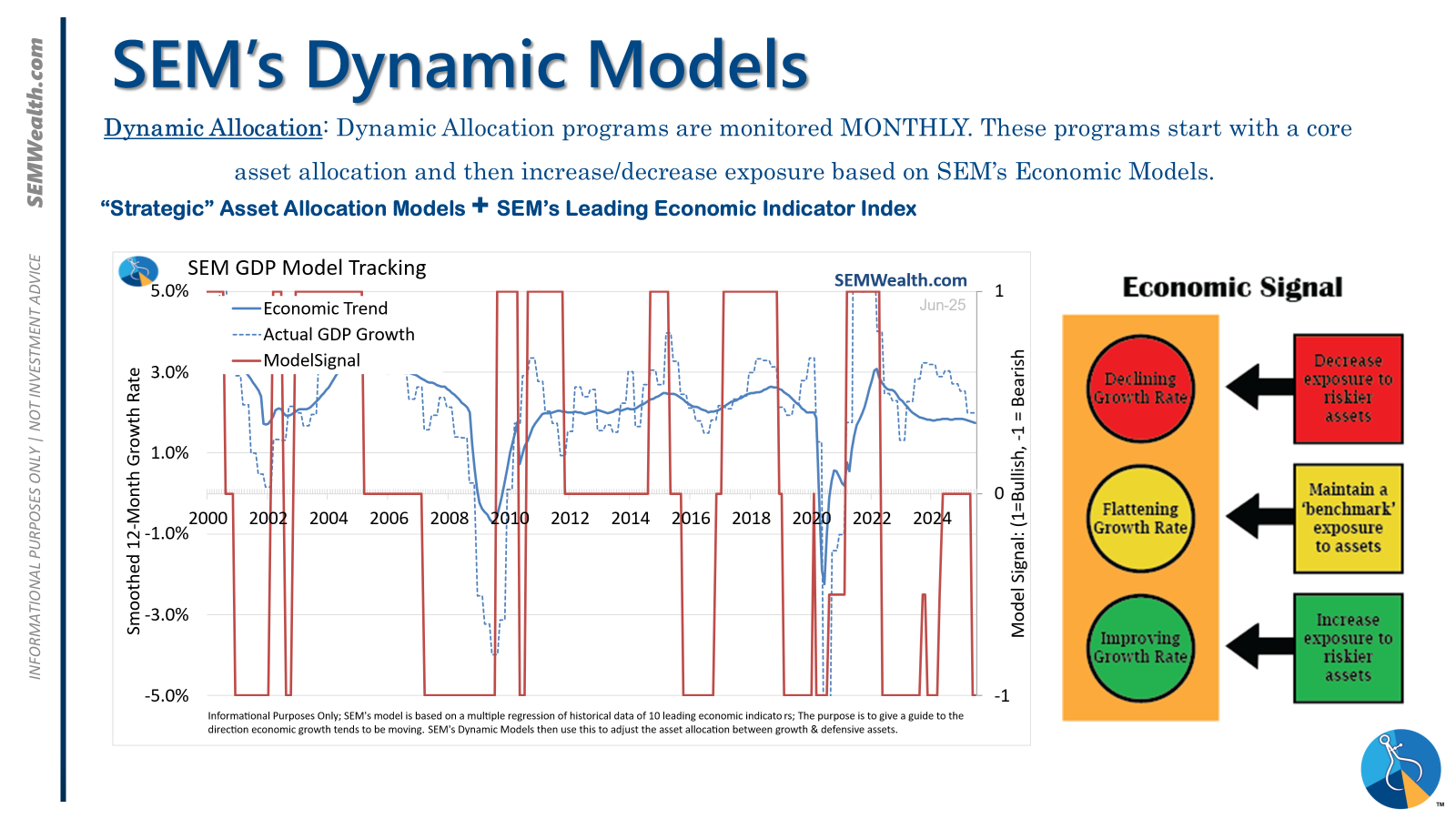

| Dynamic | Bearish | Economic model turned red – leaning defensive |

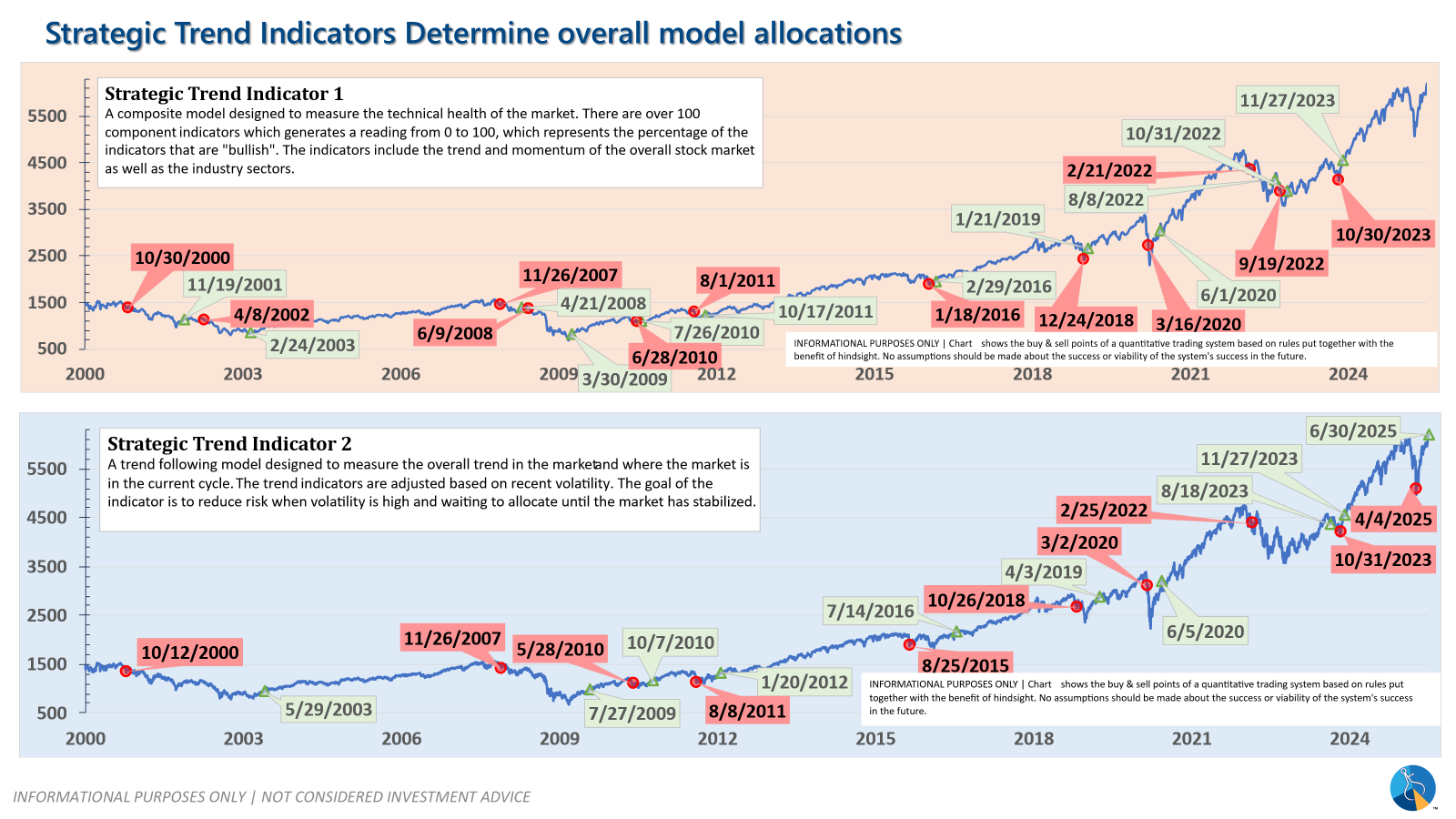

| Strategic | Slight under-weight | Trend overlay shaved 10 % equity in April -- added 5% back early July |

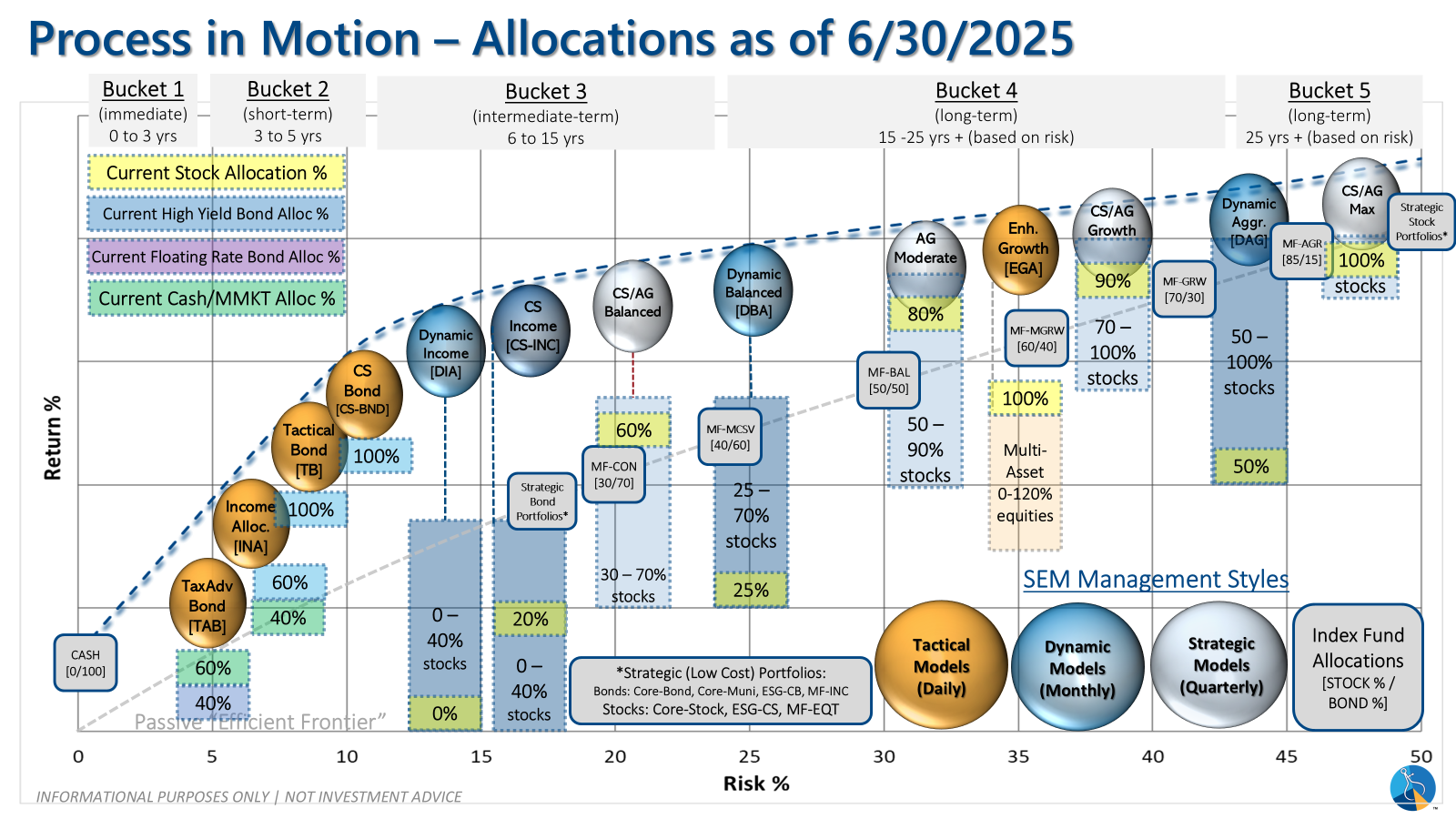

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'neutral' meaning low duration/money market investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire

We manage risk so advisors can focus on planning.

Questions or comments - drop us a note?

© 2025 SEM Wealth Management