As we wrap up September and head into the final quarter of the year, markets continue to be shaped by a mix of monetary policy shifts, economic resilience, and political uncertainty. Last week brought a rate cut from the Fed, fresh record highs in stocks, and renewed trade tensions—all while Washington tiptoes toward a possible government shutdown. Unfortunately this means the market will be focused on Washington DC once again. Before we do that, let's take a look at the five key themes that moved markets last week

1. Fed Cuts Rates, But Yields Climb

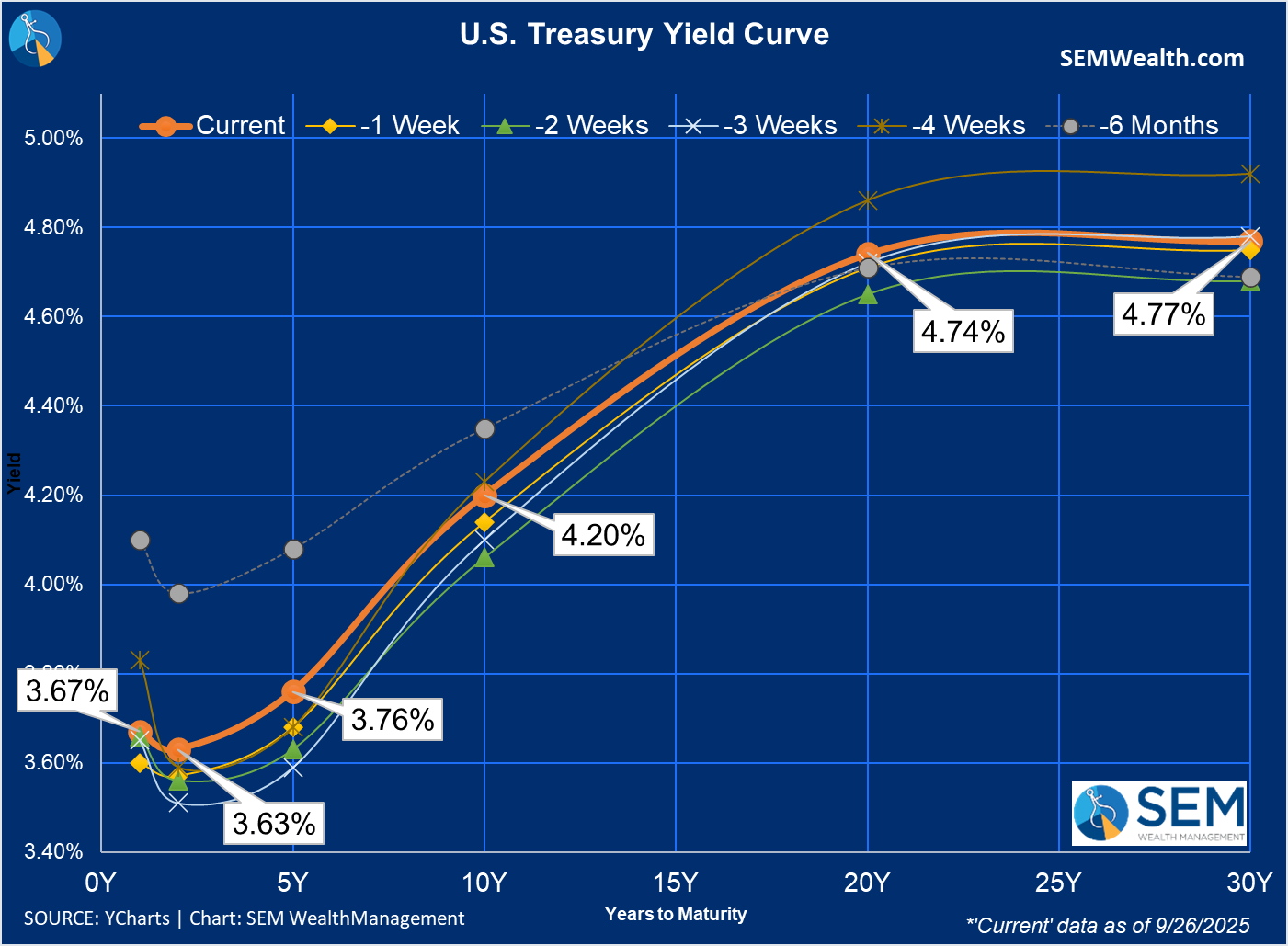

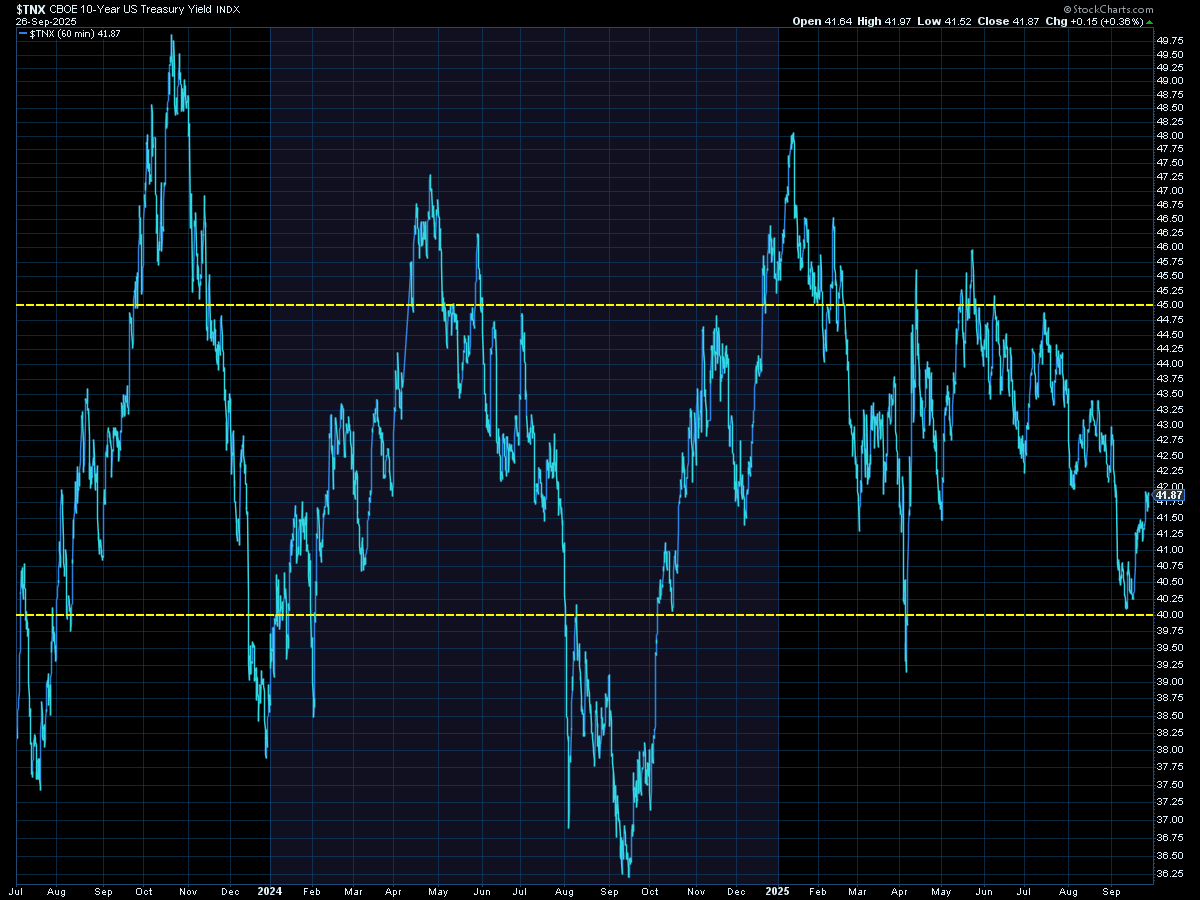

The Federal Reserve cut interest rates by 0.25% two weeks back – its first rate reduction of 2025 – bringing the benchmark rate down to a 4.00%–4.25% range. Notably, Fed officials signaled this might not be the last; projections suggest two more quarter-point cuts could be on the table before year-end. Despite the rate cut (which usually pushes bond yields lower), the opposite occurred with longer-term bonds: the 10-year Treasury yield ticked up to about 4.2% by Friday, roughly a two-week high. In other words, even as the Fed provided stimulus, bond investors seemed focused on persistent inflation and heavy Treasury debt supply, nudging yields higher.

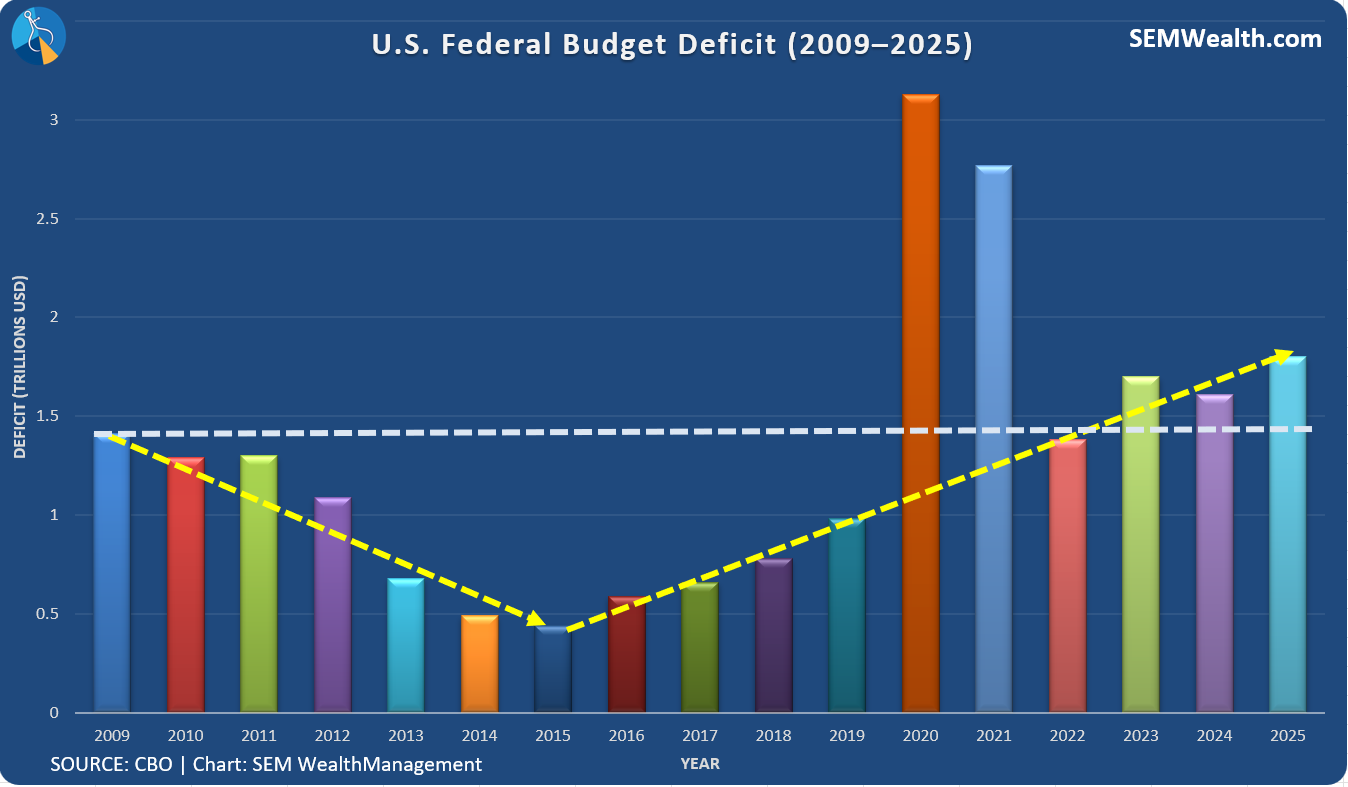

The Fed’s rate cut is meant to support the economy (good for stocks and borrowers), but rising long-term yields can raise borrowing costs for businesses and consumers (which can cool things down). The fact that yields rose suggests investors see economic growth holding up and are wary of inflation or large government financing needs. It's important to remember just because the Fed is "easing" the bond market’s reaction implies caution about future inflation. It could also be a warning from the bond market about the heavy budget deficits we continue to run.

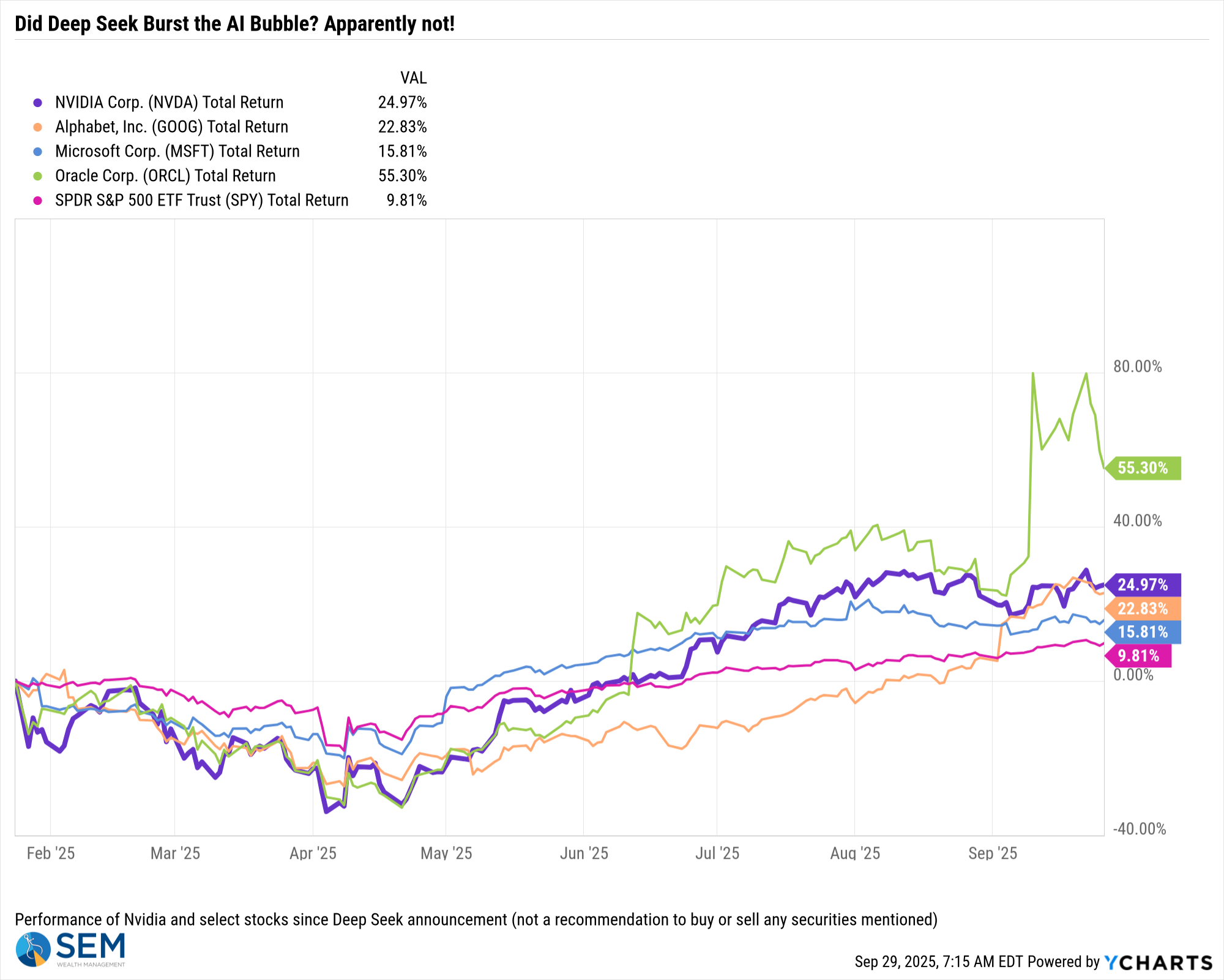

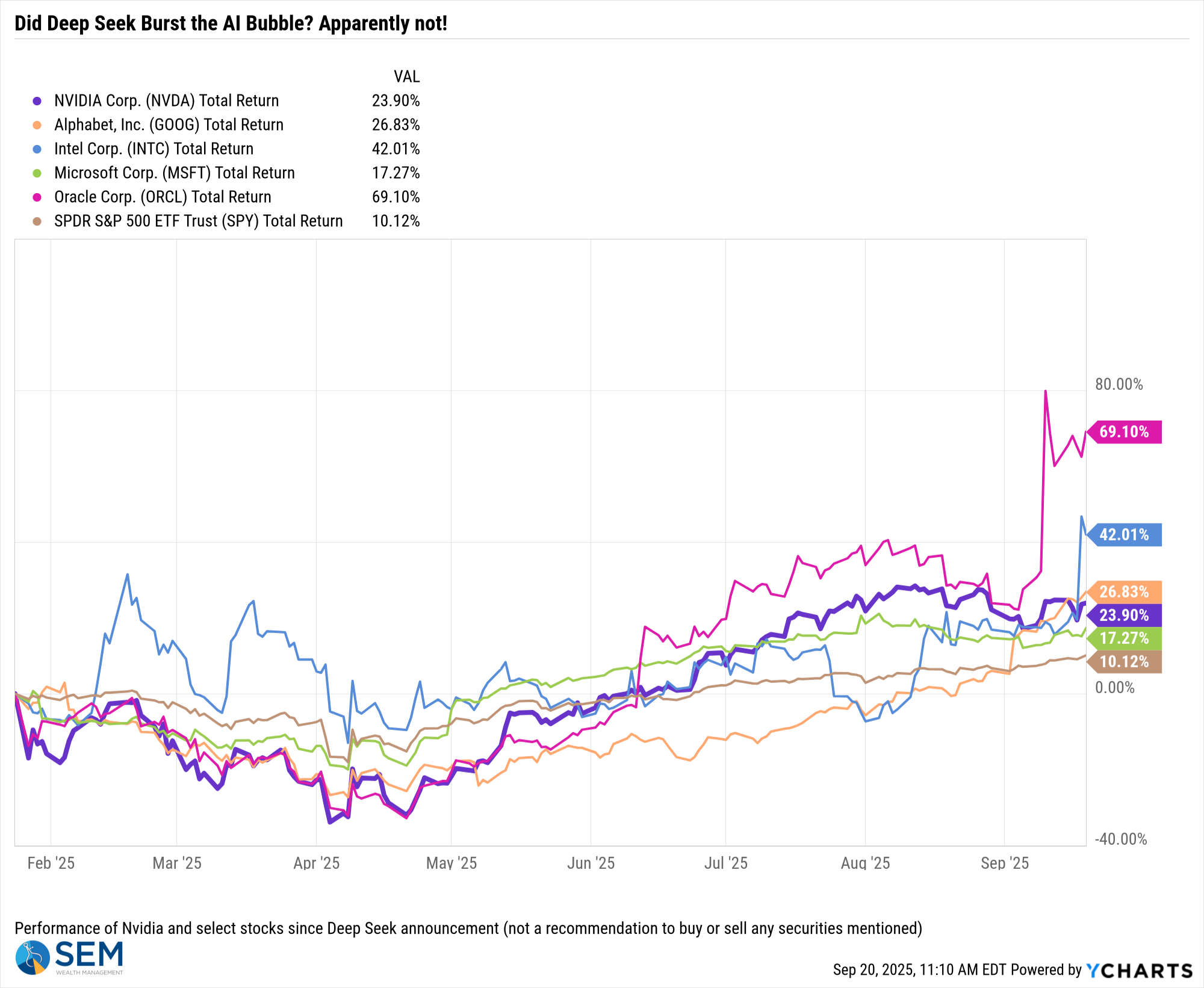

2. Nvidia’s Massive Investment in OpenAI Fuels (more) AI Frenzy

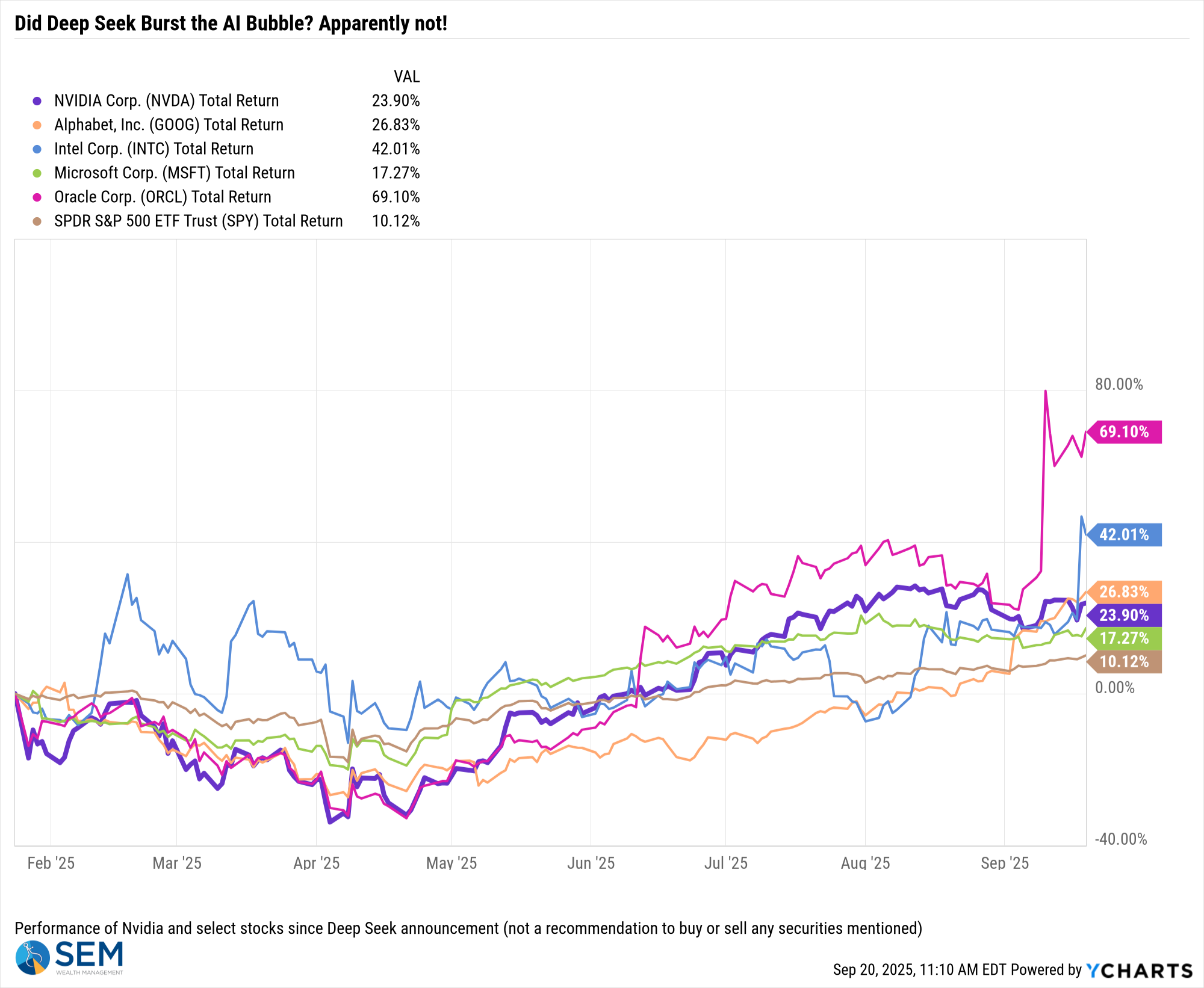

Remember a few weeks back when I questioned how OpenAI was going to come up with the $60 billion in annual orders Oracle announced (which caused their stock to spike by 35%)? Well we found a small portion of that last week when Nvidia announced plans to invest up to $100 billion in OpenAI, the company behind ChatGPT. This strategic partnership is designed to build out giant cloud computing facilities over the next few years, ensuring OpenAI has ample horsepower for its next-generation AI models. The twist is that Nvidia’s investment will largely come back to Nvidia itself in a way: OpenAI will use most of the funds to lease Nvidia’s GPU chips and hardware for those data centers, rather than buying the processors outright. Nvidia’s CEO Jensen Huang called the deal “monumental in size,” and for good reason – it locks in OpenAI as a major customer and bolsters Nvidia’s dominance in AI infrastructure.

I spent the last few days last week working on our client newsletter's bonus content. I took a very deep dive into AI, asking the question whether AI is a boom, bubble, or both. One of the areas I focused on was the circular nature of what we are seeing in the AI space – companies investing in their own customers. From an accounting perspective, Nvidia (and others) are using their balance sheets to boost their income statements. How long can that last? Will they actually see a strong enough return on their investment? What would happen if due to the short-term life of AI chips companies were required to write them off much sooner than they are (moving them off the balance sheet onto their income statement)? How much will the end customers actually pay for AI infused apps?

These are all questions that need answered. We obviously don't have them yet, but stay tuned for our newsletter post later this week.

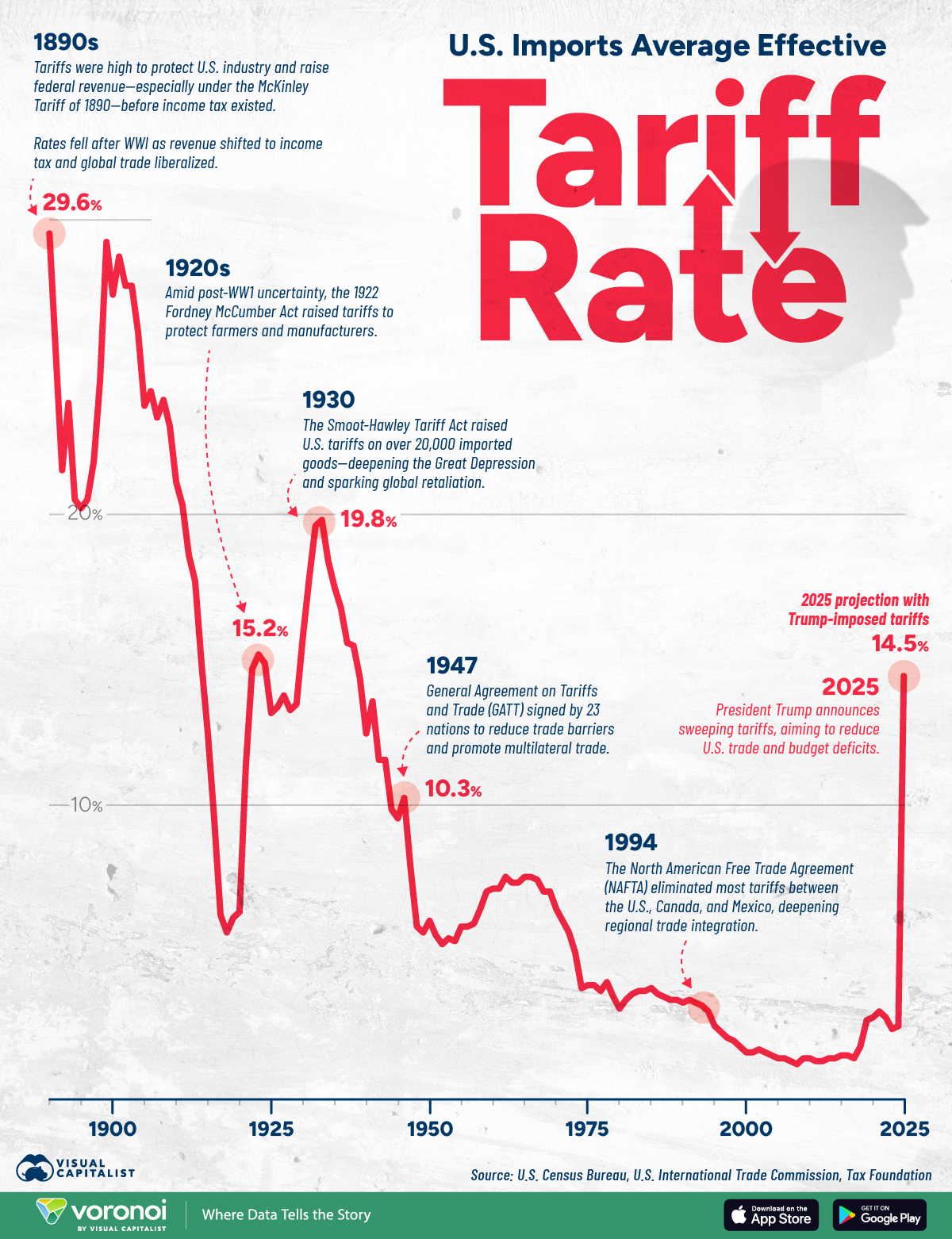

3. Trade Tensions Renewed with Tariff Surprise

Trade policy jumped back into the headlines late in the week. President Trump announced a new round of tariffs on several imported goods, catching many off guard. Specifically, the administration will impose a 100% tariff on branded pharmaceuticals, a 50% tariff on kitchen and bathroom cabinets, a 30% tariff on upholstered furniture, and a 25% tariff on imported heavy-duty trucks, all set to take effect October 1st. These hefty tariffs are part of a broader effort to pressure other countries (and U.S. importers) and encourage more domestic production. For example, the White House pointed to a “flood” of inexpensive cabinets and furniture from abroad and cited national security reasons for supporting U.S. truck manufacturing. The immediate market reaction was mixed: shares of domestic truck makers and furniture companies got a boost (on hopes of protection from foreign competition), while stocks reliant on imported goods felt a pinch. Overall, the news injected a bit of uncertainty into the market and reminded us the on-going trade war against the world is far from over.

This is a reminder that policy risks like tariffs haven’t disappeared. Trade tensions can influence inflation and corporate supply chains. For instance, a 100% levy on certain drugs could eventually mean higher prices if companies pass costs to consumers, potentially affecting healthcare inflation (at a time where Congress is threatening to take away a large chunk of Obamacare subsidies.) Similarly, steeper tariffs on furniture or trucks could impact housing and transportation industries. From a macro perspective, if these tariffs lead to higher prices on goods, it could nudge inflation expectations upward, which is obviously something the Federal Reserve would watch closely.

4. Solid Economic Data Signals Resilience

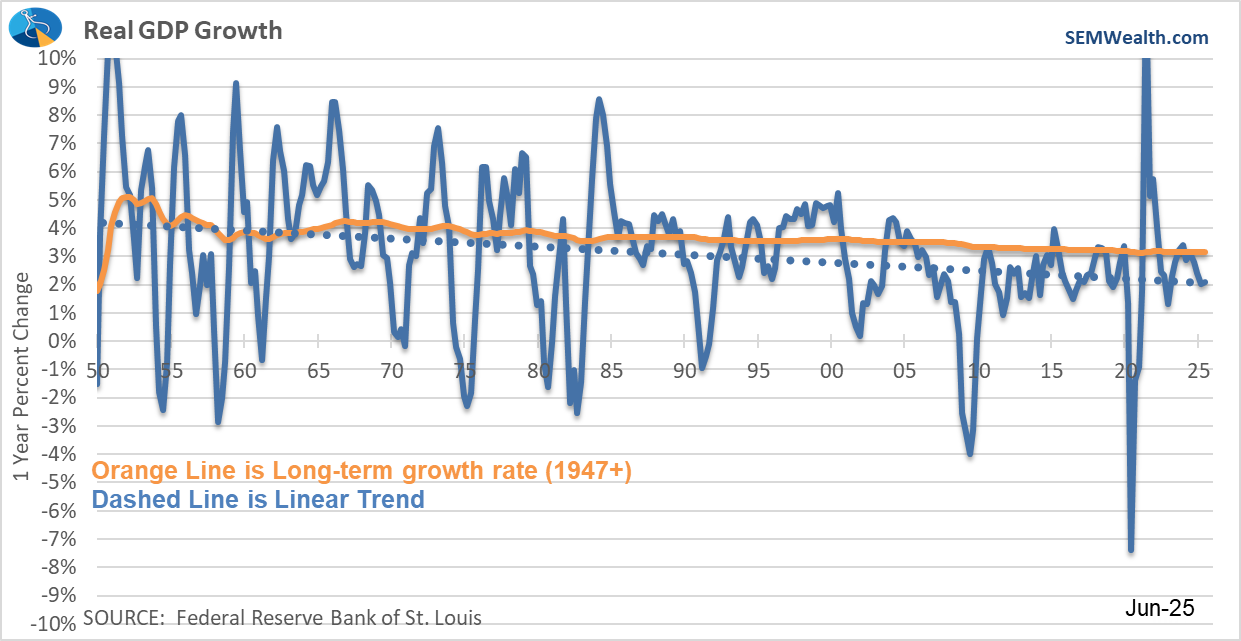

Last week delivered a batch of strong U.S. economic data that underscores a still-resilient economy. First, the Commerce Department’s final revision of Q2 GDP showed the economy grew faster than initially thought – 3.8% annualized vs. an earlier 3.3% estimate. (Side note: GDP data is the only data point where a short time frame (3 months) is then annualized. Most other data looks at a year-over-year comparison. This leads to wide fluctuations. Looking back at the last 12 months, the economy is up 2.08%, down significantly from where it was last year.)

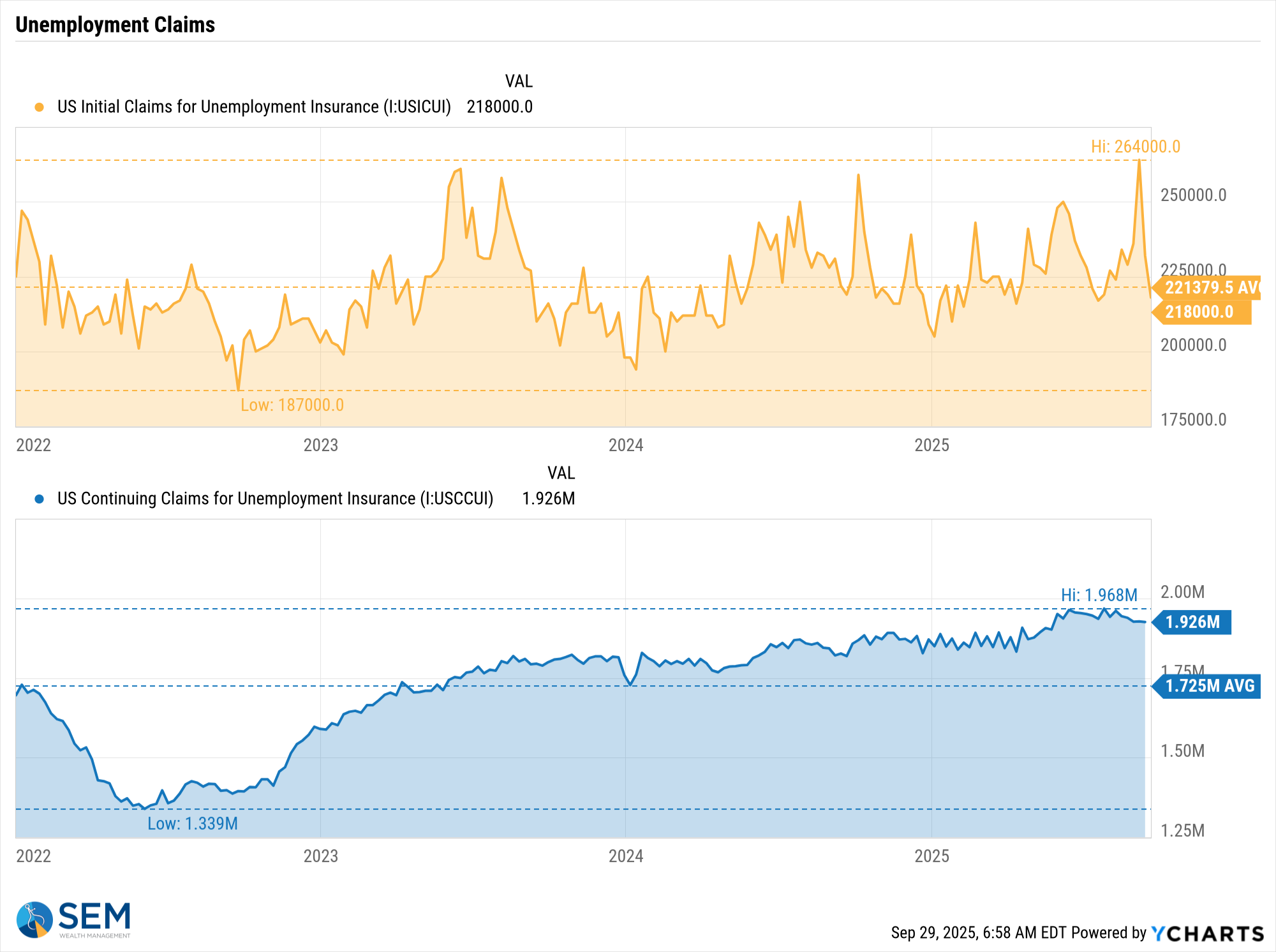

Consumers and businesses spent more in the spring than anticipated, painting a picture of solid momentum. We also saw a big surprise in durable goods orders (orders for long-lasting manufactured items like machinery and appliances): orders rebounded +2.9% in August after a dip in July, handily beating expectations of a small decline. This jump suggests that business investment is holding up. Additionally, weekly jobless claims fell to their lowest levels in months, indicating the labor market remains relatively tight.

Big picture, this mix of data is a double-edged sword for markets. Strong short-term growth and slight increases in demand are encouraging, but SEM's economic model says this could be a short-term blip. However, it could mean the Fed decides to not cut rates as quickly as the market is expecting.

5. Government Shutdown Jitters in Washington

Here we go again. In our last quarterly newsletter I flagged our debt/deficit as something that we need to pay attention to. I said I didn't know when, but it will continue to pop up. This week the U.S. government is inching toward a potential shutdown. The last temporary funding bill they passed expires at midnight on Tuesday (September 30). Congress seems to be at an impasse – particularly a dispute between House Republicans (where a faction are again claiming to be fiscally conservative despite voting for the "BBB" which is spiking our deficit) and the Senate. Democrats, who helped pass the last temporary measure in the House have also dug in, raising the odds that parts of the government could shut down starting October 1st.

Maybe this matters for a short-time, but I've gone through enough of these to know that it will create a lot of noise, but ultimately not be something that shifts the direction of the economy or the market. It most likely will be somewhat short, but it can create volatility and headlines that might make clients uneasy. Importantly, if a shutdown drags on, it could have modest economic effects (e.g. reduced consumer spending from furloughed workers, delayed data making the Fed “fly blind” in the short term).

I shared this image last week. Congress will try to blame the other side, but BOTH SIDES have had full control of the government at times over the past 15 years and BOTH PARTIES have done nothing but spend more than we have each year. Remember when Republicans blamed Obama for all of our fiscal woes in 2011? The Tea Party and some of the other measures put in place during the "debt ceiling circus" of 2011 were working.....until 2016 when Republicans forced most of the Tea Party members out of office by funding their primary opponents. Don't let their talking points fool you — the only thing Congress cares about is keeping their seat next election and they've learned the best way to do that is to spend money now and worry about paying for it later.

We’ll be watching how this week unfolds and will be back next Monday with fresh insights to guide your conversations and planning.

Toby's Take

A look at the top WSJ articles from last week according to our intern Toby.

9/22/2025 - TikTok Deal: The Investors, Algorithm Changes and User Data Explained - WSJ

The deal for TikTok to stay in the U.S. is getting closer. Whether that is a good or a bad thing nobody knows. The U.S. government, specifically the MAGA base, has been trying since President Trump's first term to ban TikTok for concern over the use of U.S. citizen's user data. Now they decided to just buy it and filter what content we can see. The final push for this started in 2023 when Congress noticed that pro-Palestinian hashtags were getting more views than pro-Israel hashtags. If the deal goes through ByteDance, the original owner of TikTok, would own less than 20% and only be allowed to appoint 1 of the 7 board members. That member would not be allowed on the security team. The rest of the shares will be controlled mostly by Silver Lake and Oracle and the remaining shares potentially going to existing investors like Susquehanna International. The algorithm would be copied from ByteDance and then supervised and filtered by Oracle and the U.S. government. The deal is not done, but once the final framework is done the President will sign it off with an executive order (this happened on 9/25). After all of this, the U.S. government will be getting a multibillion-dollar fee for facilitating the agreement. What we need to note on all of this is that TikTok users will not like that the Government will hold power over the algorithm and what users see. They could flee to another app. Any models that may have Oracle, TikTok, or other MAGA related companies may take a big hit after all of this is done due to a backlash over censorship.

9/23/2025 - How Nvidia Is Backstopping America’s AI Boom - WSJ

Nvidia is going to invest $100 billion in OpenAI. This means that AI in America isn't going to be slowing down anytime soon. OpenAI has been losing lots of money by having to rent data centers and buy expensive chips. With this investment OpenAI will have more money for renting data centers and a discount on Nvidia AI chips. This is big for both Nvidia and OpenAI because Nvidia will have higher sales after this and OpenAI is able to continue growing to hopefully turn to making profit and become publicly traded.

9/24/2025 - Trump Says Ukraine Can Take Back All Lost Territory From Russia - WSJ

President Trump said that Ukraine can take back all of their lost territory. He is also encouraging allies to shoot down Russian aircraft if they entered North Atlantic Treaty Organization airspace. President Trump said, "after getting to know and fully understand the Ukraine/Russia Military and Economic situation and, after seeing the economic trouble it is causing Russia, I think Ukraine, with the support of the European Union, is in a position to fight and win all of Ukraine back in its original form." Trump believes that Putin has been falsely claiming how powerful their military is because a "real military power" would take less than a week to win. Because of this change in support by President Trump, I believe that the United States may be providing more support in this war which could have a big impact on the Patriot Portfolio. President Zelensky is mostly asking that the United States puts more pressure on Putin through sales of energy and tariffs to get the people of Moscow to get Putin to stop the war. That obviously would affect our own energy production market causing us to buy more from them supply and demand shifts. We need to keep our eye on how the government handles that task before making assumptions.

9/25/2025 - RFK Jr.’s Team Wanted to Tout an Autism Therapy. He Went After Tylenol Instead. - WSJ

Health Secretary RFK Jr. just released news on Tylenol being a risk for pregnant women! According to him using Tylenol while pregnant can cause the child to develop autism or other neurodevelopmental diseases. Obviously after this announcement, more medical research teams will look into this and announce their findings, but for now, this is a really big hit on Tylenol and anything that has acetaminophen. We may want to watch any models that include medical stocks just because this can cause backlash on them as well.

Market Charts

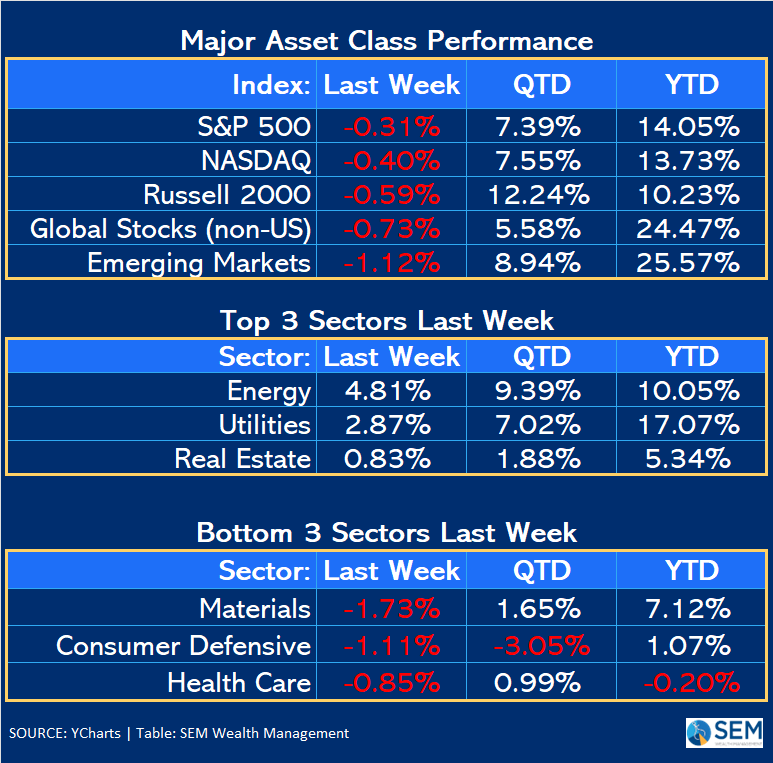

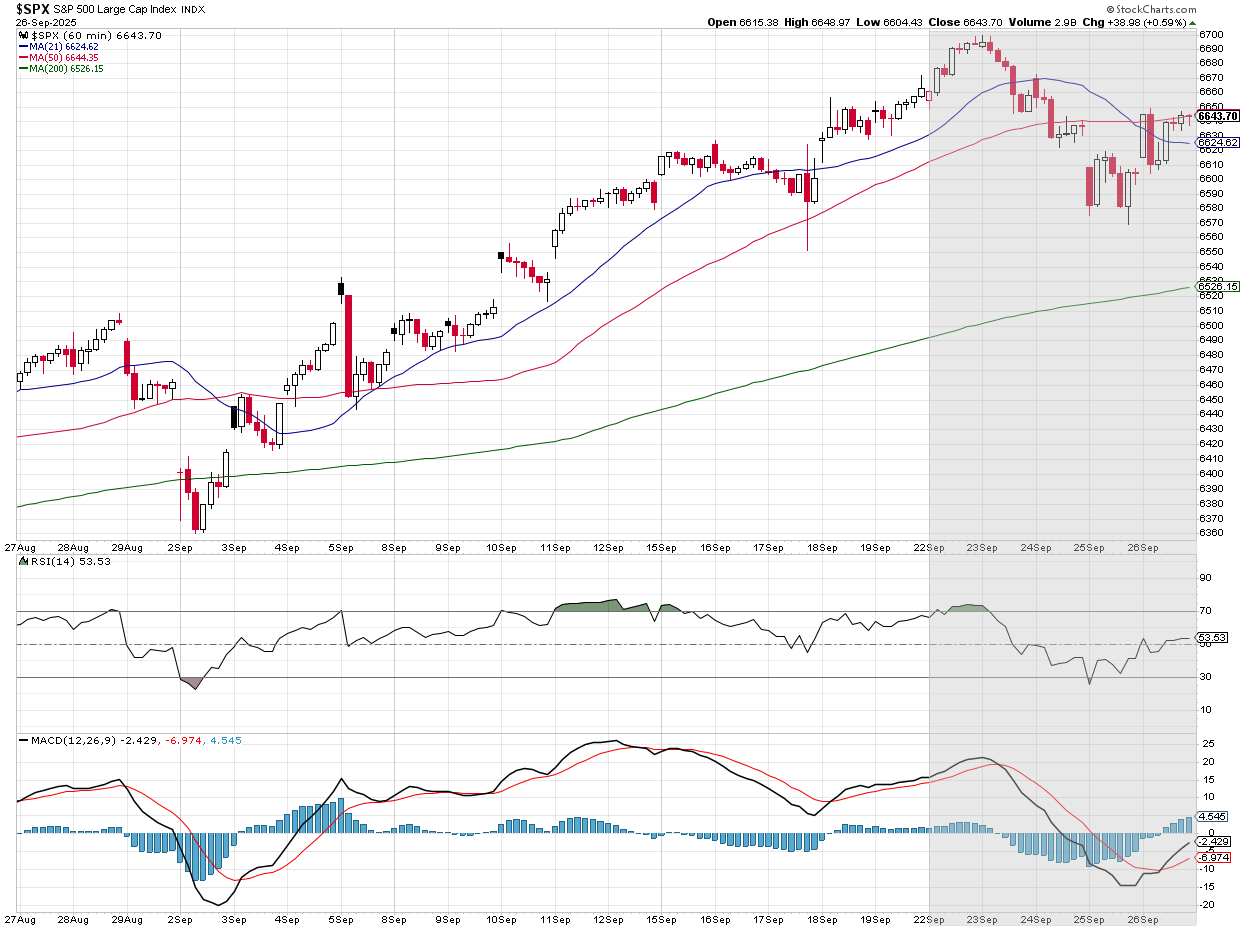

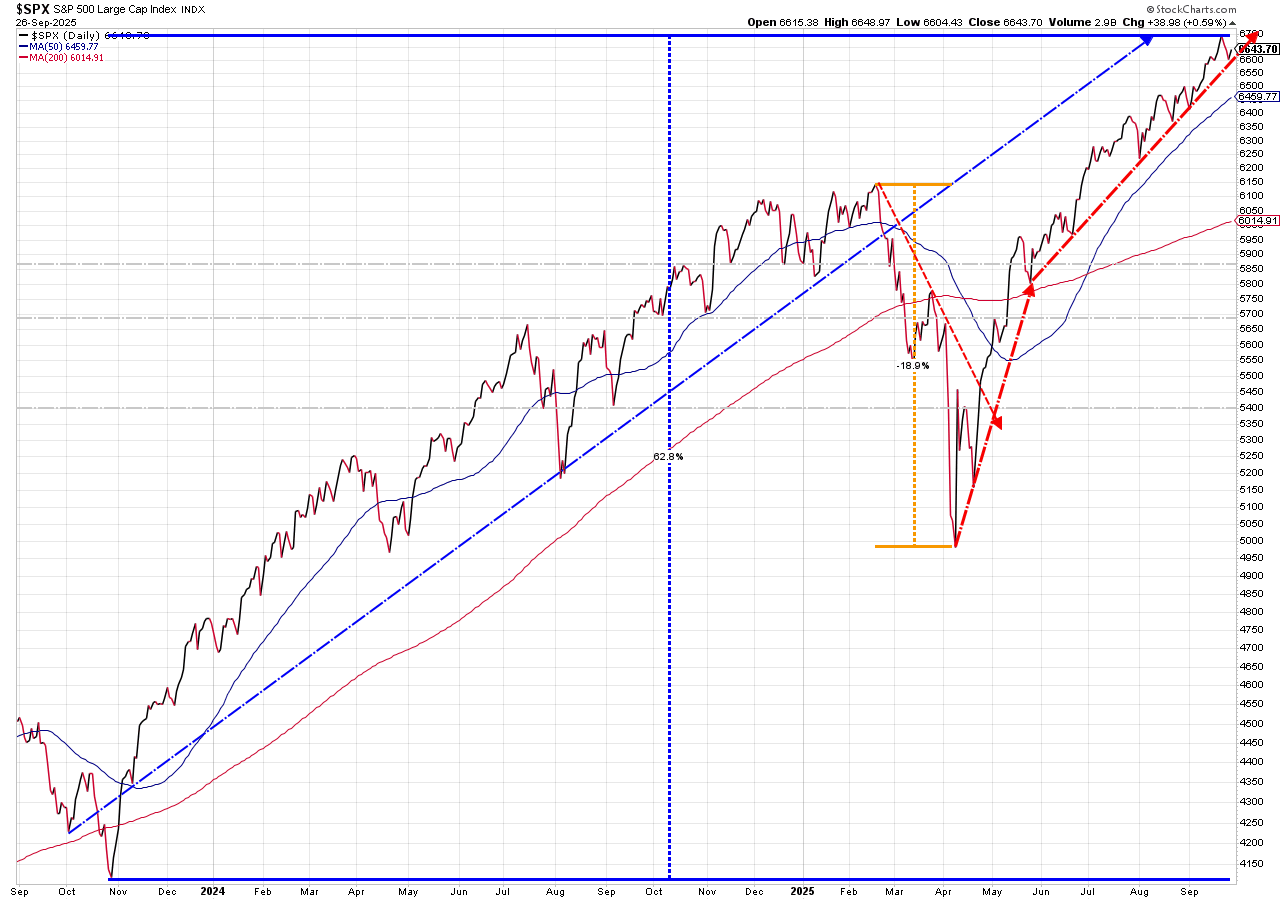

It was mostly a down week for stocks last week. Friday's rally made the loss for the week minimal.

Stocks are now up 63% since the Fed announced they were done hiking interest rates in November 2023. The uptrend is steep, but still in tact.

The catalyst for the week was the continued rise in longer-term interest rates, with the 10-year moving closer to 4.2%. It had hit 4.0% the day the Fed cut interest rates two weeks ago.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

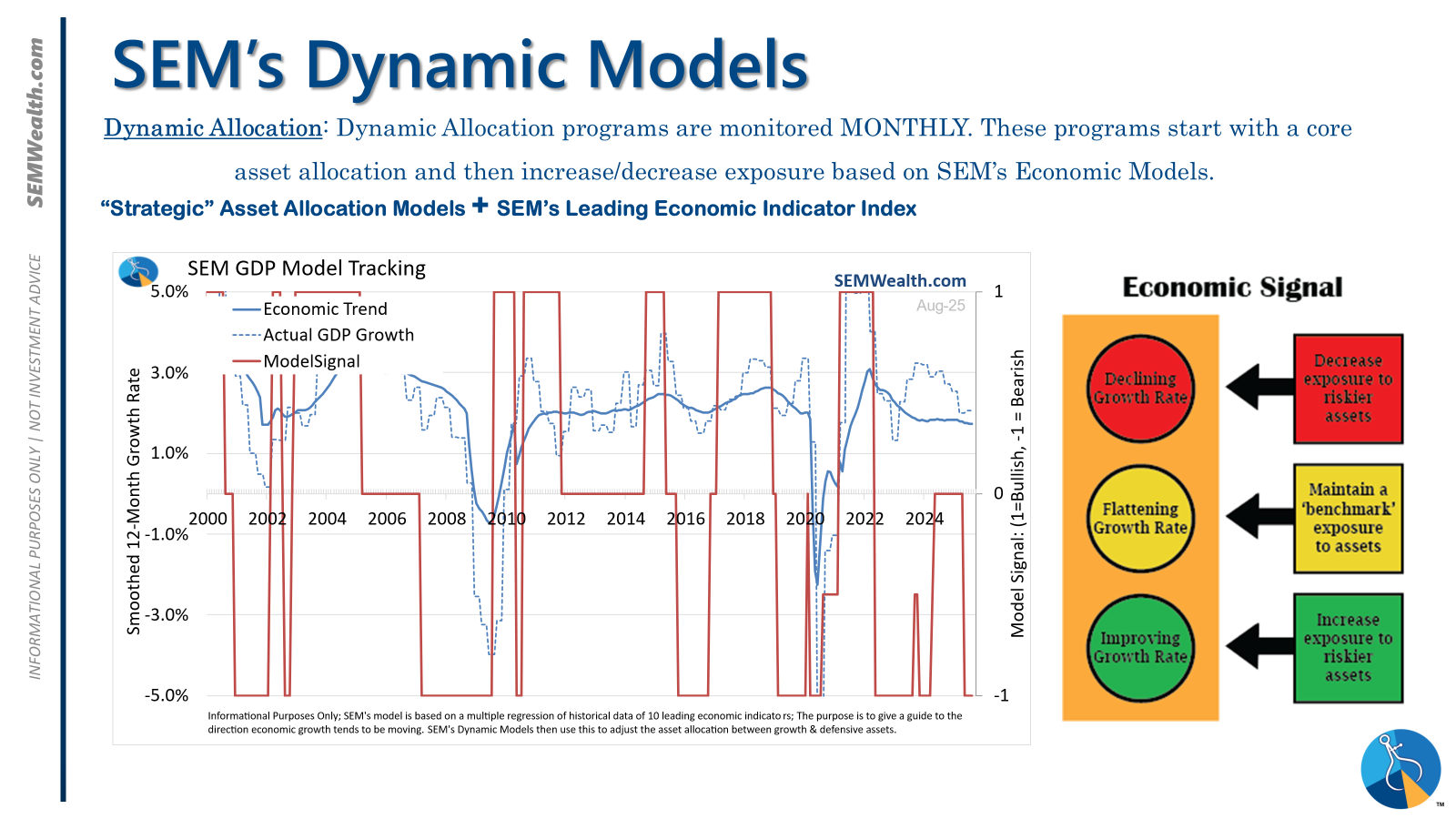

| Dynamic | Bearish | Economic model turned red – leaning defensive |

| Strategic | Slight under-weight | Trend overlay shaved 10 % equity in April -- added 5% back early July |

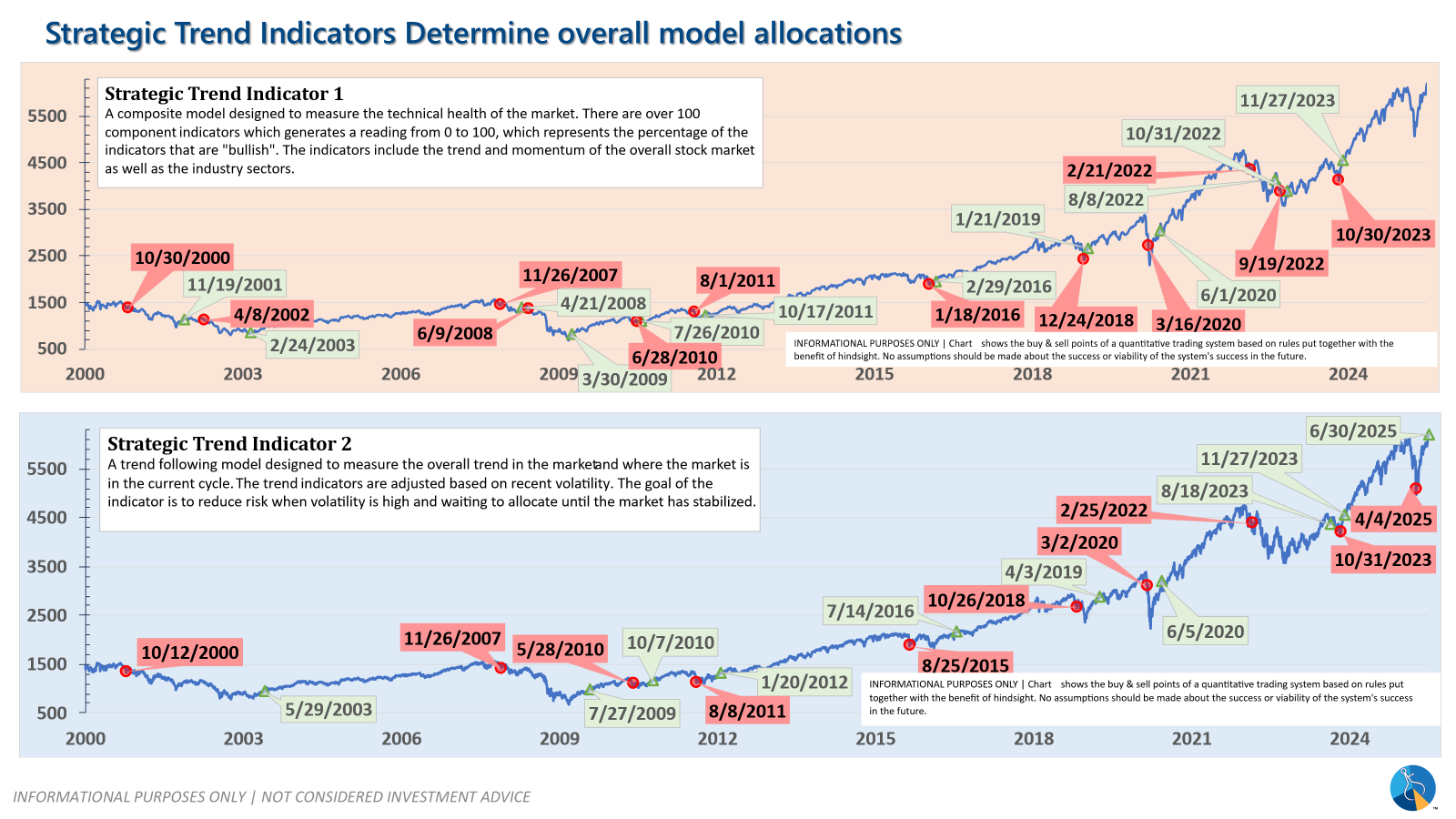

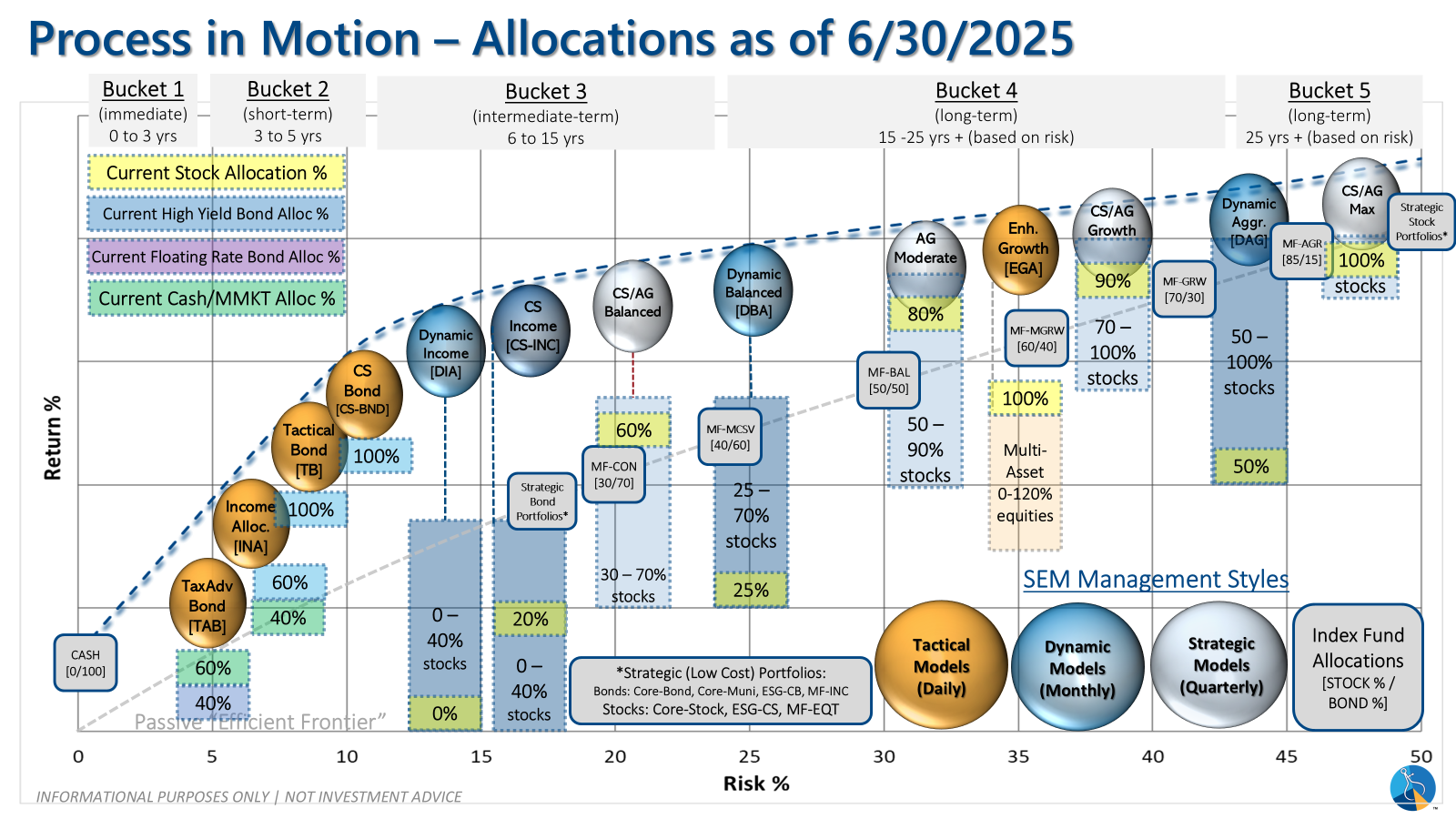

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

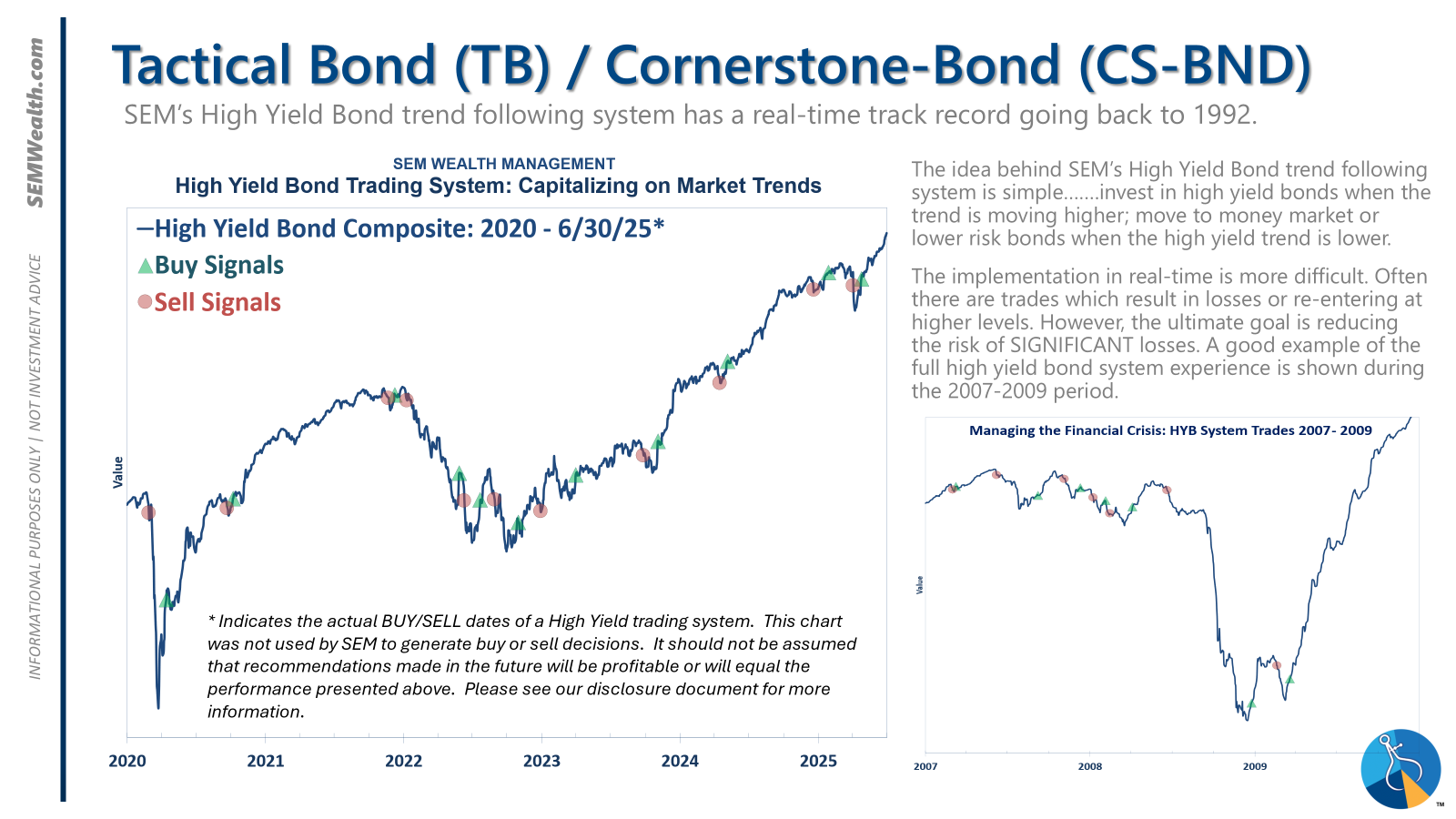

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire