If you’ve been trying to follow the government shutdown news and found yourself more confused than informed, you’re not alone. This isn’t just about missed paychecks or closed parks, or one side wanting to give "illegals" health insurance. It’s about how Congress funds the government (or doesn’t), how big bills like the “BBB” can become law without actually paying for anything, and why healthcare — specifically ACA subsidies — is at the center of the current fight. Today I'll walk you through how shutdowns happen, what’s different this time, and why the timing of open enrollment could make this one more disruptive than usual. As you'd expect, I'll also talk about the deficit, spending caps, and why both parties deserve blame for where we are today.

Is the Government Shutdown a Big Deal?

I don't want to make light of this situation, especially because I know we have clients who are federal employees who may not receive their next paycheck. If you're in that situation, I have empathy and truly hope this resolves as quickly as possible to avoid (more) disruption in your life.

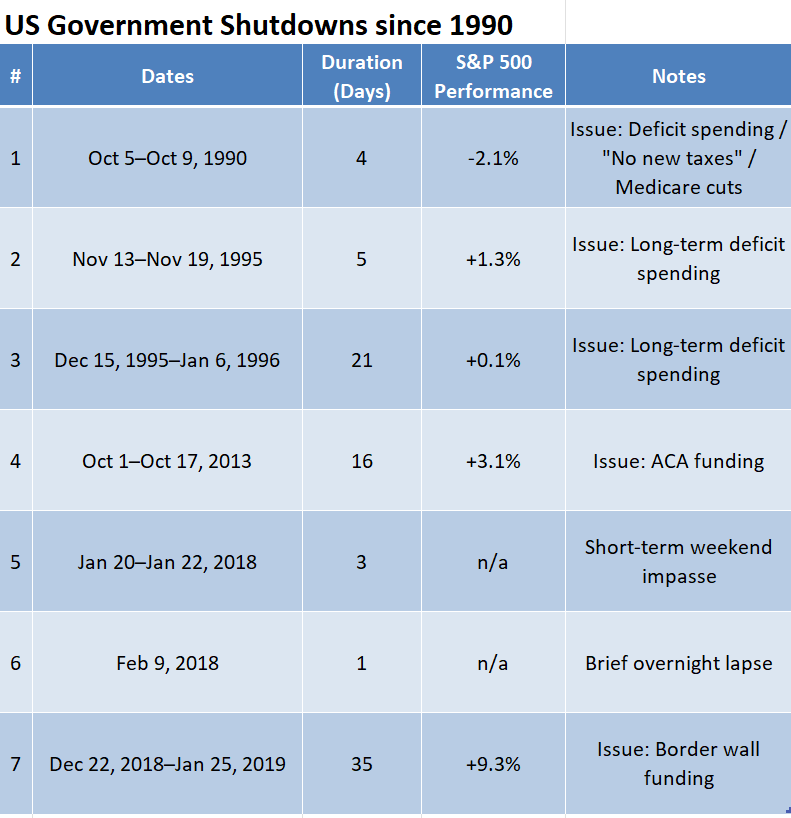

For everyone else, this may be an annoyance, but it isn't really a big deal in terms of stock market or economic impact. This is just the 7th time since 1990 the government has shut down. The last time was in late 2018/early 2019.

How this one ends up is anyone's guess. We'll leave the speculation to the pundits flooding wherever we like to get our news. I'm stuck watching the news (and addressing any of the concerns raised by our clients) so you don't have to.

Why Does the Government Shut Down?

I have heard few people actually explain why it is we have a shutdown when a.) Republicans control Congress an b.) Congress already passed the spending bills that are now the "law of the land".

Let me try to make this simple......every year, Congress is SUPPOSED to pass 12 separate spending bills to fund the different parts of the government. Think of it like setting a budget for each spending category in your household budget, but instead of "groceries" and "pets", you have defense, education, transportation, health care, and so on. If they don’t get those bills passed before the new fiscal year starts (October 1), the government does not have the funding to continue operations.

To avoid a shutdown, Congress can pass something called a continuing resolution (CR). It’s basically a temporary funding patch that says, “Let’s keep things running while we figure this out.” They’ve used CRs is some fashion in almost every year since the 1990s. (Probably because Congress seems to function best when the deadline has already passed.)

Interestingly enough, the only time Congress didn't need at least 1 CR since 1990 was for the 1997 fiscal year, which followed what at the time was the longest shutdown in the history of our country in 1995/96. This was when Newt Gingrich worked with President Clinton to implement as many portions of the "Contract with America" as possible. It also ushered in the last time the US ran a balanced budget.

The government has run ONLY on CRs in 2007, 2011, 2013, and 2025 (the fiscal year that just ended.)

Didn’t Congress Already Approve Spending?

They did. And this is where things get confusing.

Sometimes Congress passes major legislation — such as the “Big Beautiful Bill (BBB)” — using a special process called budget reconciliation. That process lets them skip the usual 60-vote requirement in the Senate (the filibuster rule) and pass the bill with just a simple majority.

But here’s the catch: reconciliation can only be used for laws that affect taxes, spending, or debt. It can’t be used to fund the day-to-day operations of the government.

So even if a bill (big or little) becomes law, Congress still has to pass separate appropriations bills to fund the programs inside it. If they can’t agree on how to do that — or if they run out of time — we end up with a shutdown.

What’s Happening Right Now?

In March, Congress passed a CR to fund the government under "current" spending levels through the end of the fiscal year (September 30). Democrats in the Senate agreed to allow a vote on it at the time waiting to see what the "BBB" eventually looked like. At the time, it looked like Republicans in the House and Senate had such a large divide they wouldn't be able to use the "reconciliation" process, giving Democrats leverage in the Senate to add their own items to the BBB. Ultimately, the GOP put aside their differences and the BBB became law.

Now, Congress is fighting over how to fund the government for Fiscal Year 2026 (when most provisions of the BBB take effect). They missed the October 1 deadline, and the government shut down. Both sides have proposed temporary funding bills (CRs), but they can’t agree on what should be included.

The Democrats want to extend the Affordable Care Act (ACA aka 'Obamacare') insurance subsidies that are set to expire at the end of the year. Republicans are saying, “Let’s keep it clean — no policy changes, just extend current funding until November 21, and we will work out everything by then.”

The fight is even messier because the Budget Control Act of 2011 expired at the end of the fiscal year (last week). This was designed to keep the annual increases inside each category in check (specific percentage increases allowed each year.) Obviously, these "caps" haven't done much to reign in the budget (mostly because of "emergency" spending in the name of the pandemic, inflation, and security over the past 9 years along with tax cuts which unfortunately did not pay for themselves by increasing tax revenue.)

Why are Dems so Dug in on Healthcare?

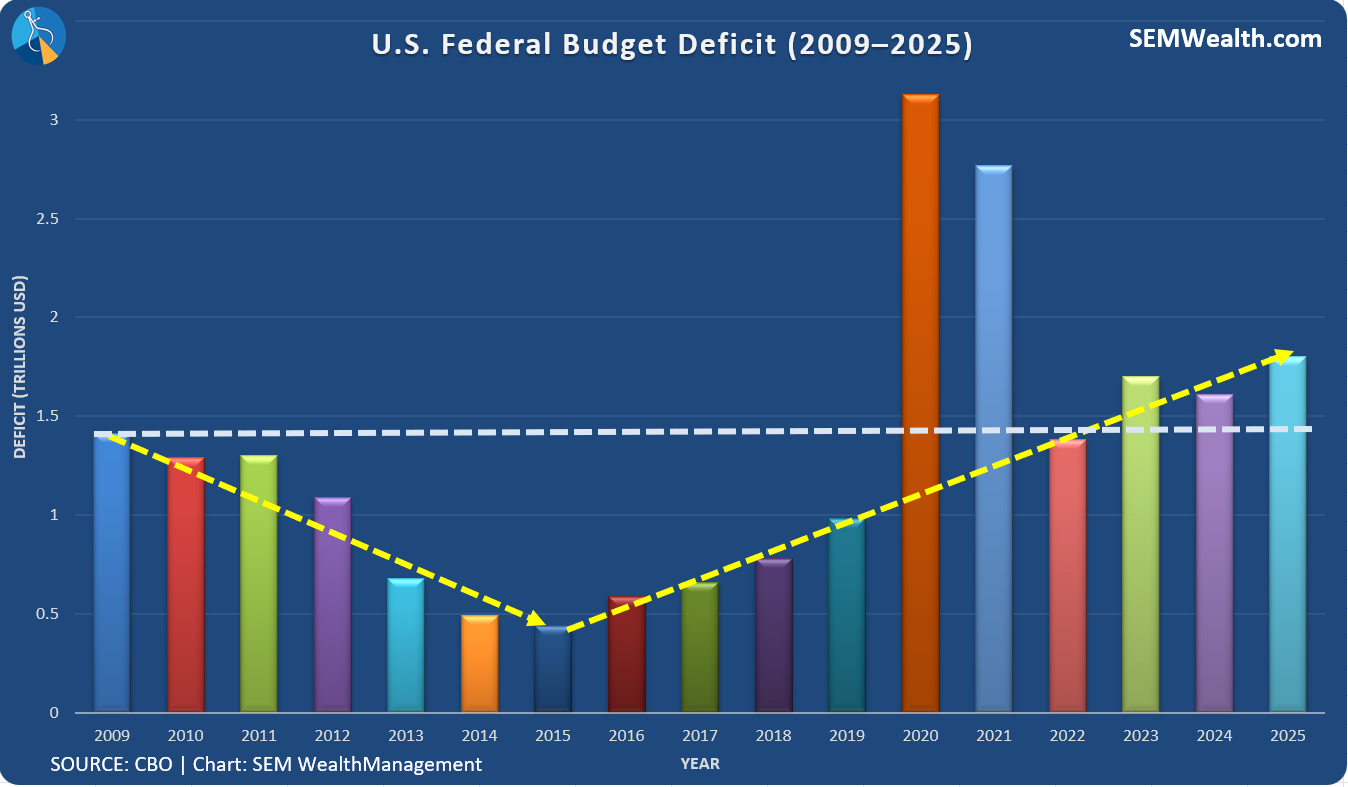

First off, despite what I see circulating, only Americans legally in the country are eligible for Medicare or coverage under the ACA. If anyone is not here legally, the only medical coverage they could receive is emergency care, which in 2024 represented less than 0.5% of Medicaid expenses (which is where hospitals file to be reimbursed for uncovered services.) The total was still $4B, but we are expected to run a $1.8 Trillion deficit in 2026. Put another way, we could wipe out the $4B and still be running the same deficit (because $4B out of $1800B is a rounding error.)

The real fight is over the ACA subsidies, which were expanded during COVID and extended under the "inflation reduction act" to 2025. Without any changes, we will revert back to the original ACA coverages, meaning about 4 million Americans will lose all access to the "exchanges". For everyone else on the exchange it is estimated out of pocket premiums will increase by 75-114%. An estimated 20 million Americans received the subsidies last year. Extending them permanently would cost about $35B per year (increasing our budget deficit by about 2% from the current levels.)

The timing is one of the main issues the Democrats have. If they agree to a CR to get us until November 21 and nothing happens on the ACA subsidies, the Open Enrollment period (which starts November 1) could be a mess. It would be an understatement to say that both sides have trust issues with the other, making it hard to get a deal done.

Look, I'm not advocating that we spend more and I'm not defending the ACA. As a (still youngish) business owner we've seen our health care costs increase close to 800% since the ACA became the law of the land. I won't go into a rant about all the things wrong with it, but there are certain Americans who have benefited greatly from this, including some of our younger clients who are just getting started in their adult lives. Buying a home or renting an apartment in most parts of the country is already a tough task unless you're making more than the median household income of $83K per year.

My issue is BOTH sides have ballooned our deficit since 2016. They've had control of the White House and full control of Congress (at times) and they BOTH have done NOTHING to control the runaway spending. Is the additional 2% spending on ACA subsidies the final straw where Republicans cannot take it? Where were they as the budget deficit went from a meager $400 Billion in 2015 to $1 Trillion in 2019 (can't blame COVID on that one)?

I'm not defending the Democrats either. It's sickening how BOTH sides don't seem to care about the FUTURE, but only in not upsetting their "base" out of fear of being "primaried" away by their party leadership (when the party decides to fund a challenger to their seat if they don't fall into the party lines). The last time we had fiscal leadership was when the Tea Party had a voice. What happened to them? They all faced heavily funded challengers supported by the GOP leadership.

This is a systematic issue. Don't let the latest talking points fool you. All I know is if we continue down this path, our future will have no chance of being as bright as the past. Ignore the rhetoric and start getting involved locally with your preferred political party. Demand actual FISCAL leadership and a vision of the LONG-TERM, not the next election.

Flying Blind (sort of)

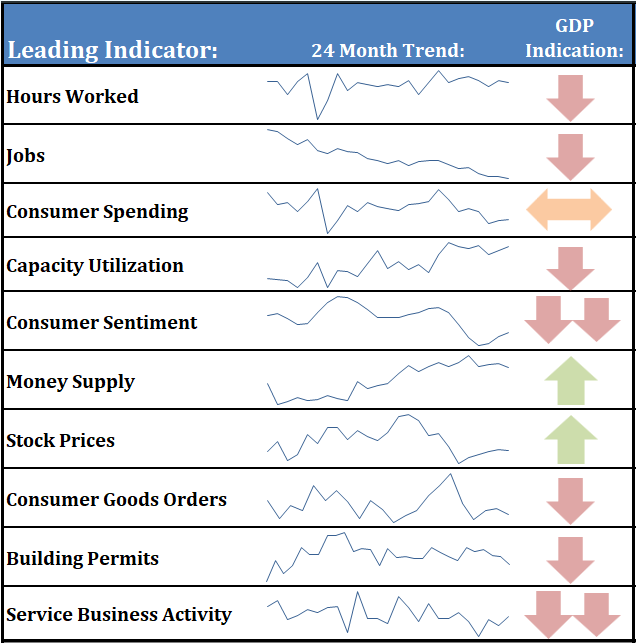

Friday was supposed to be the end of our economic data month with the release of the monthly jobs report. of course with the government shutdown any of their releases are postponed. This doesn't mean our model won't function (remember we dealt with this in 2018/2019.) One data point does not change our model. It focuses on the trends and we have enough privately provided data sources to still measure the TREND in the economy. It was decelerating going into the month and by all accounts decelerated even more in September (the ADP Private payrolls data confirmed this.) Here's how our dashboard looks currently. You will notice two positive arrows for the first time in three months — stock prices and Money Supply.

That by itself should tell you all that matters (for now). The Fed is back in "easing" mode and the stock market loves it. Like SEM's model, if the shutdown drags on they have enough other data to make decisions on the trend in the economy and based on this, we are likely to see another rate cut when they meet again this month.

As always, we will be here focusing on the DATA, not the noise to guide our decisions.

Market Charts

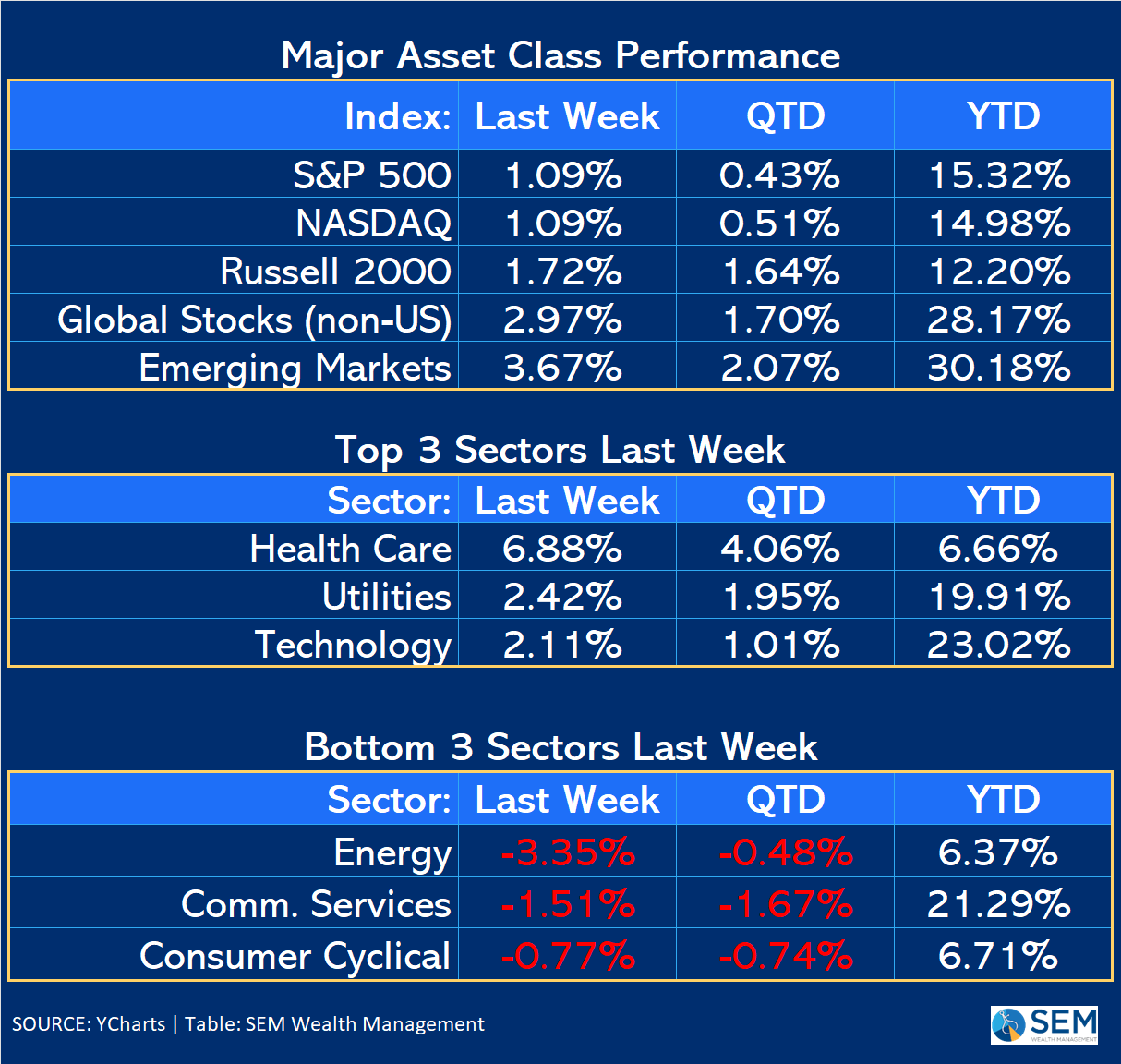

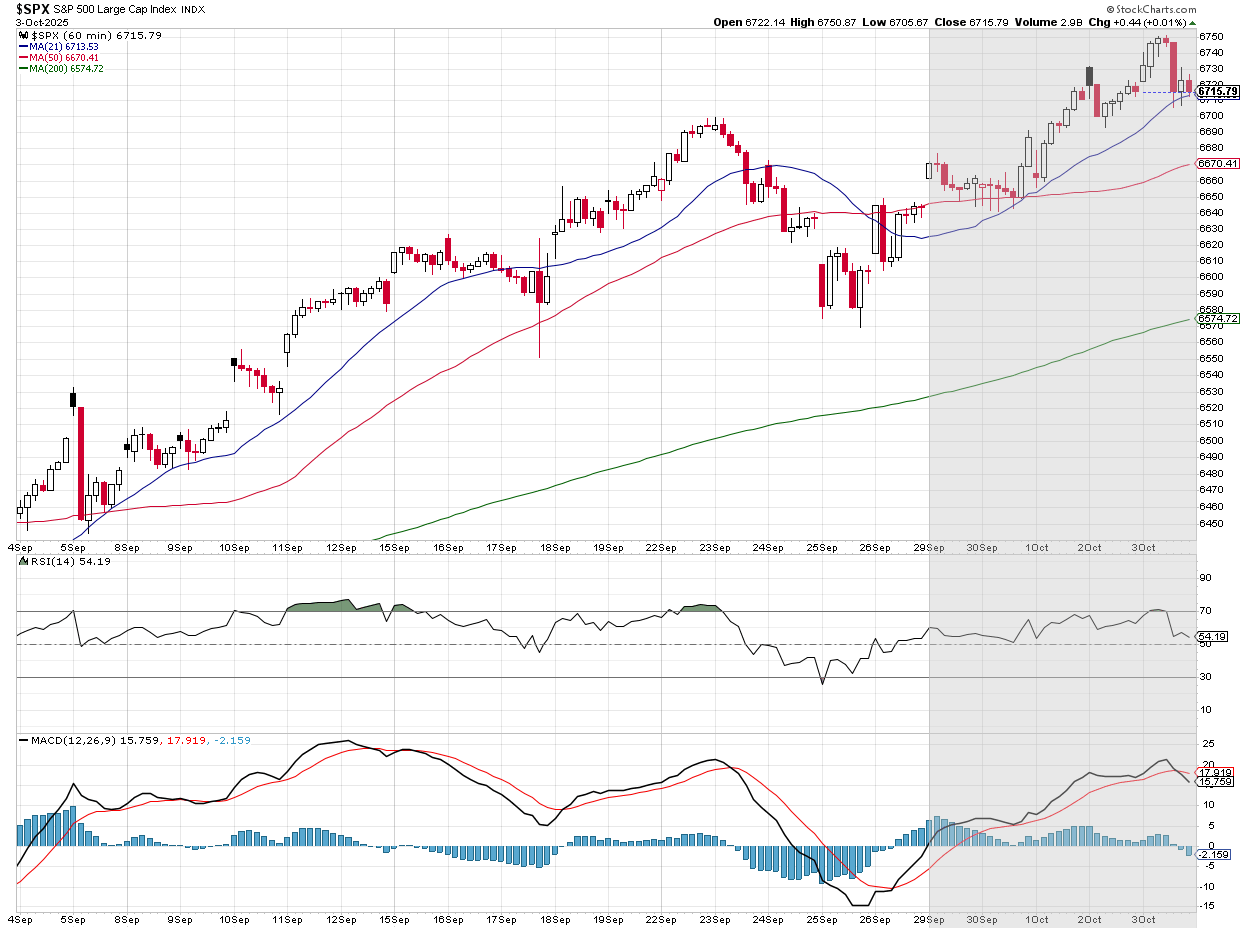

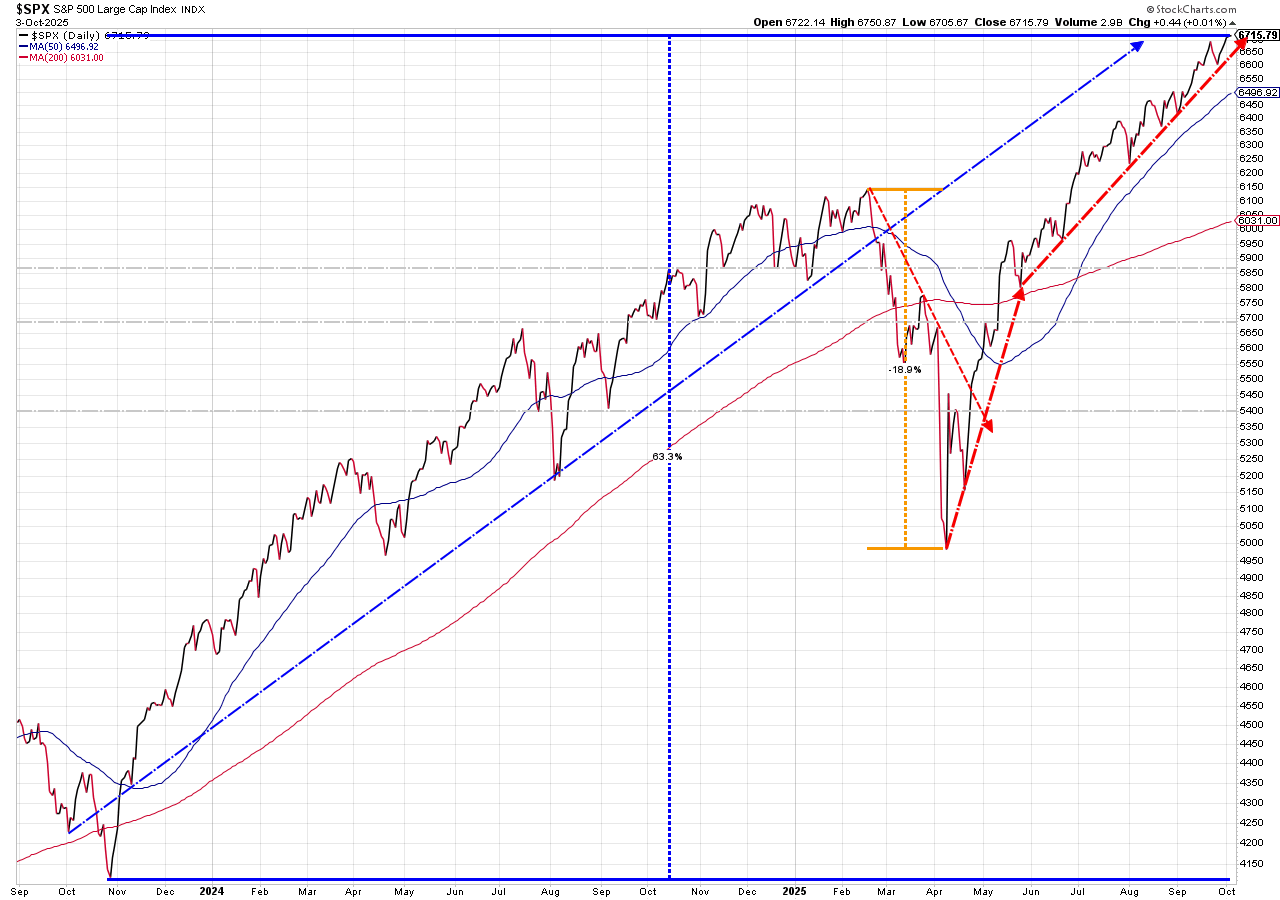

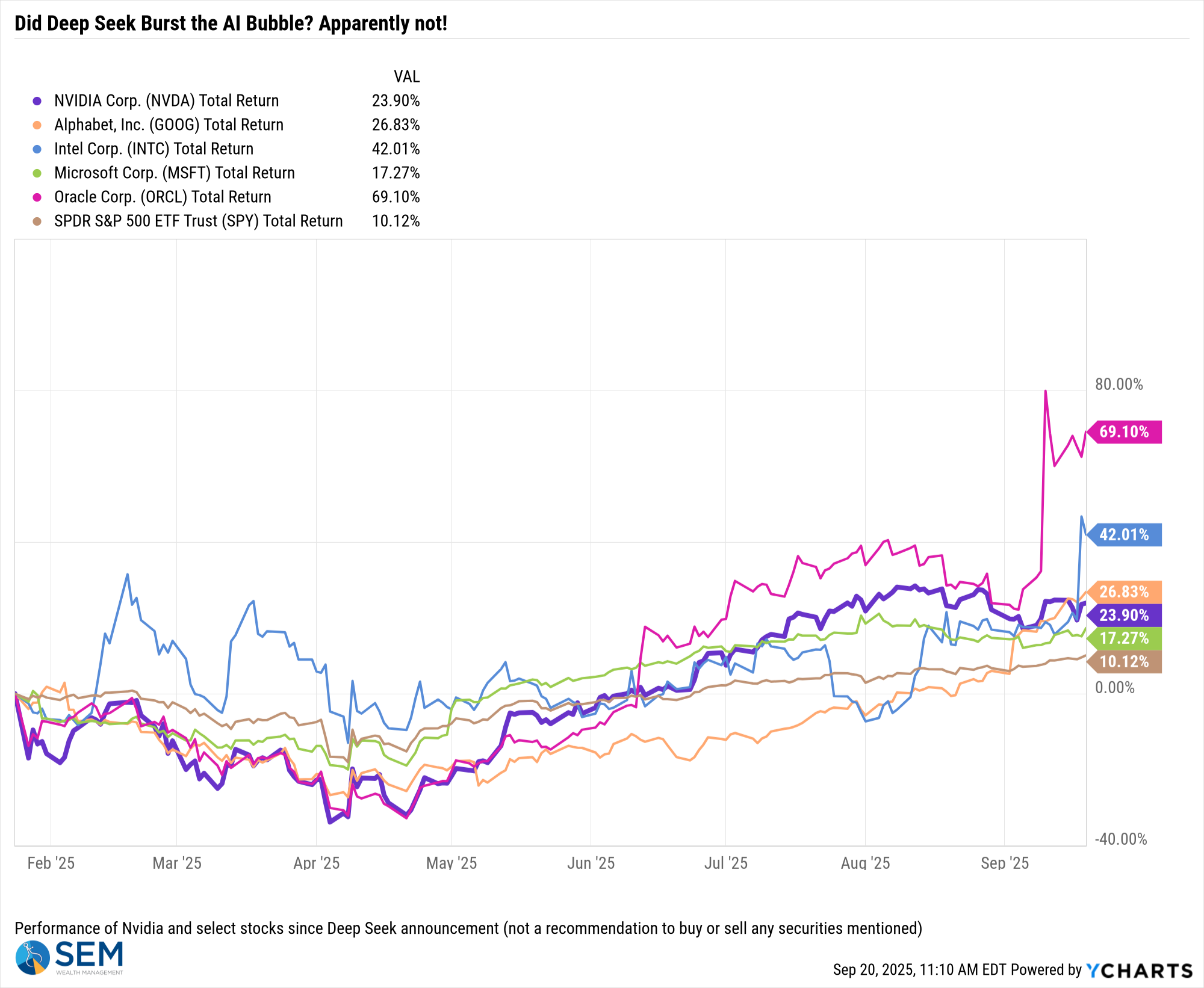

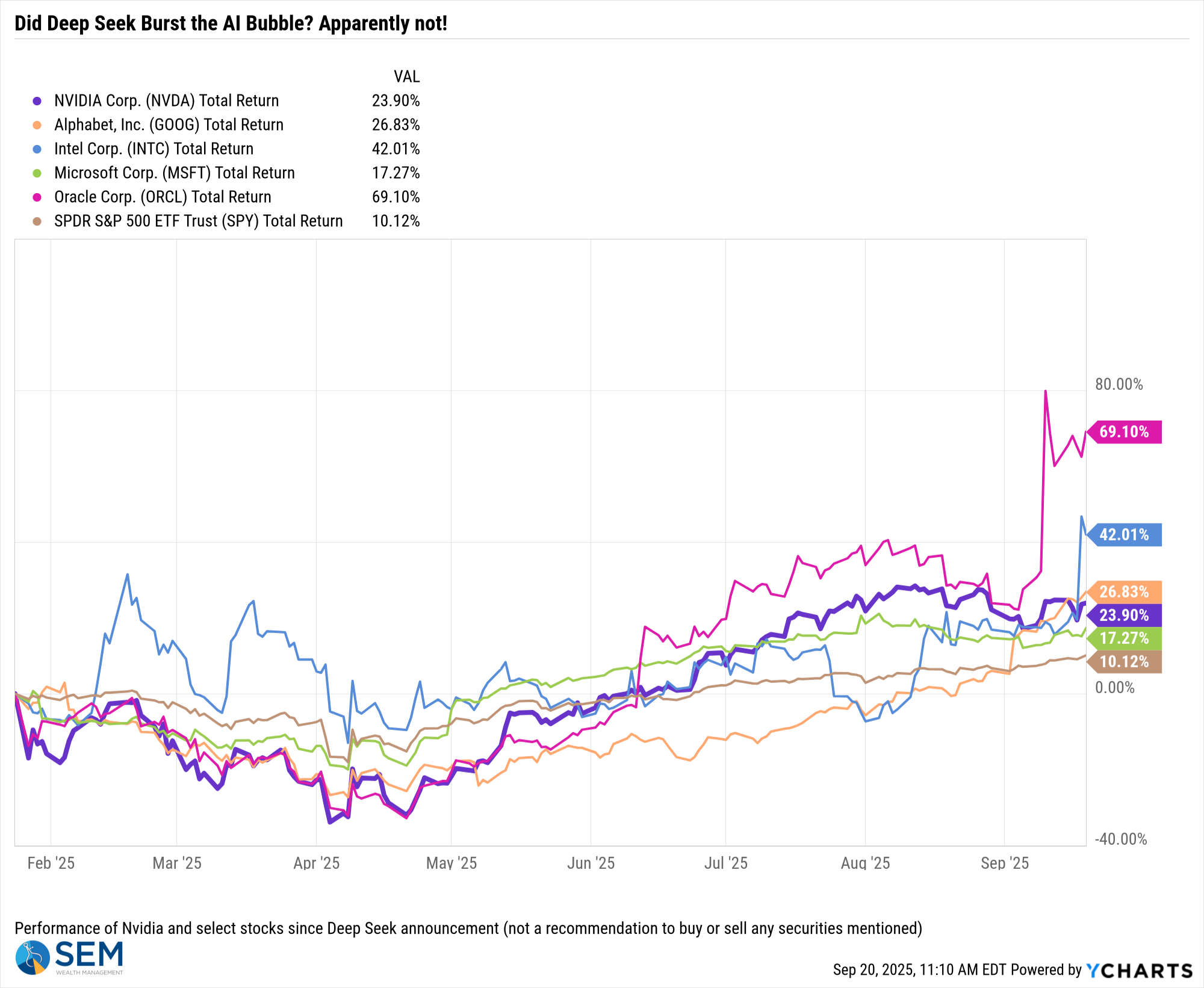

Shutdown, what shutdown? As noted at the top, the market generally does not care when the government shutsdown. The Fed is easing, AI spending is thought to be in the early days, and nothing can stop the market (or at least that's what you would be lured into believing by looking at the year so far.)

We're enjoying the ride, especially in our equity models. Our experience and study of history tells us that this will eventually end and when it does it could be a downright scary experience. But we also know, just because the uptrend is steep, valuations are high, and expectations are even higher doesn't mean it HAS to end immediately. Just make sure you aren't chasing stocks higher just because you want to make more money.

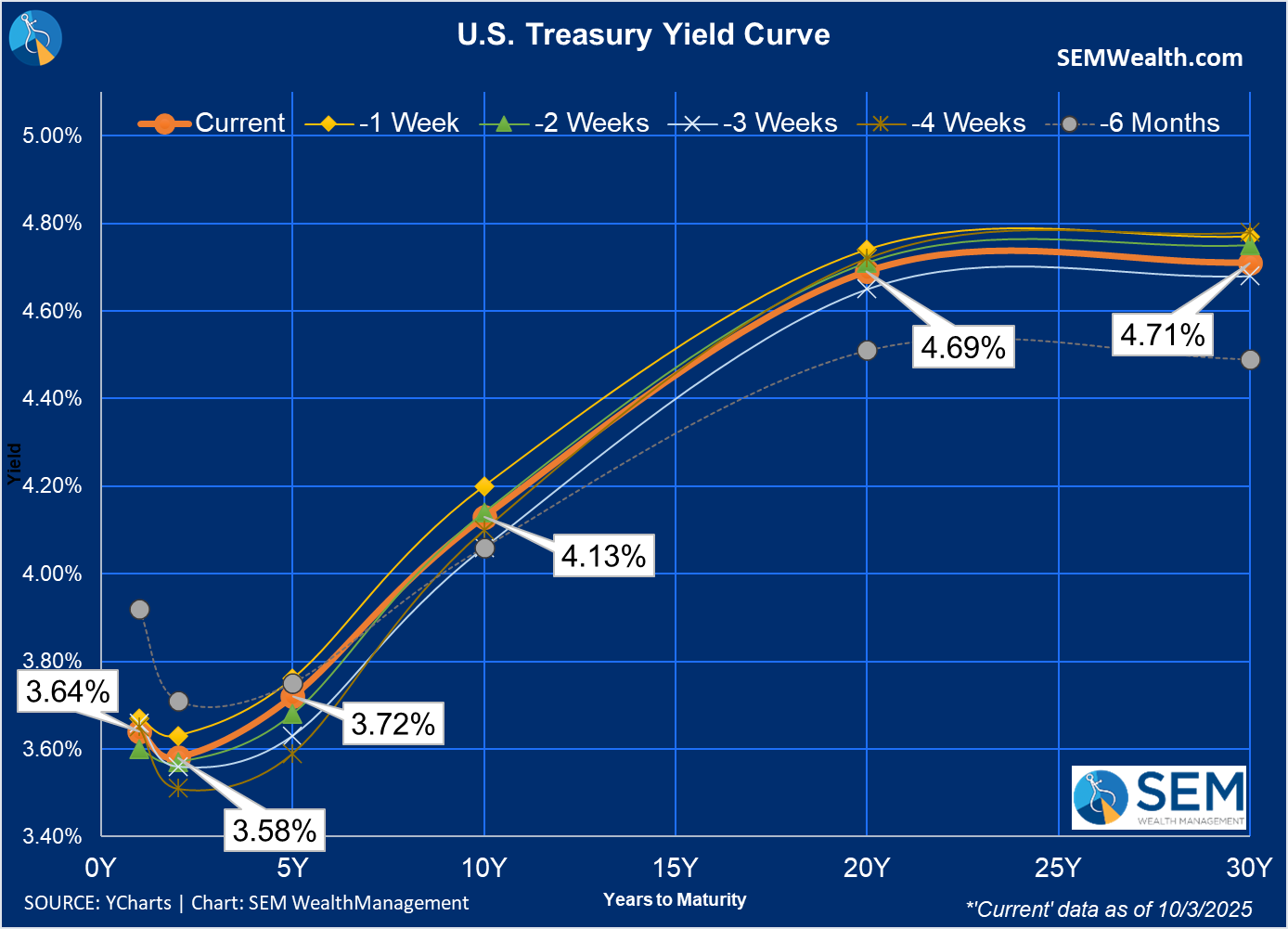

I still believe the cause of the NEXT big sell-off will start in the bond/financial markets. The yield curve is still a mess, inflation is still higher than it should be and we are starting to see signs in the credit card and auto loan segments of financial strain.

Rates did come down a bit last week, but we're still looking at rates higher than they were a month ago.

Ultimately the bond market could decide for Congress when the deficit is too high. For now, it doesn't seem to matter.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

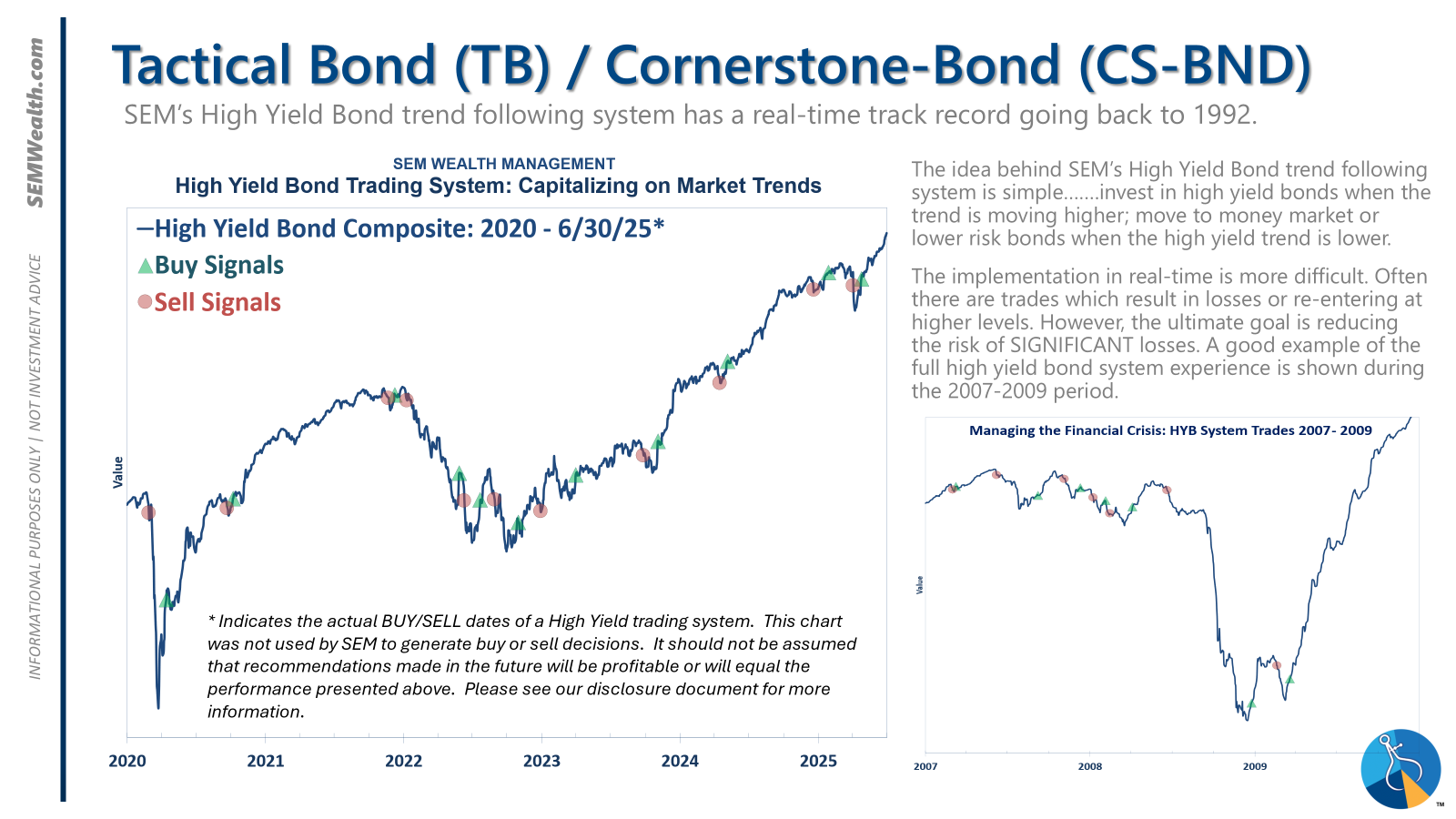

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

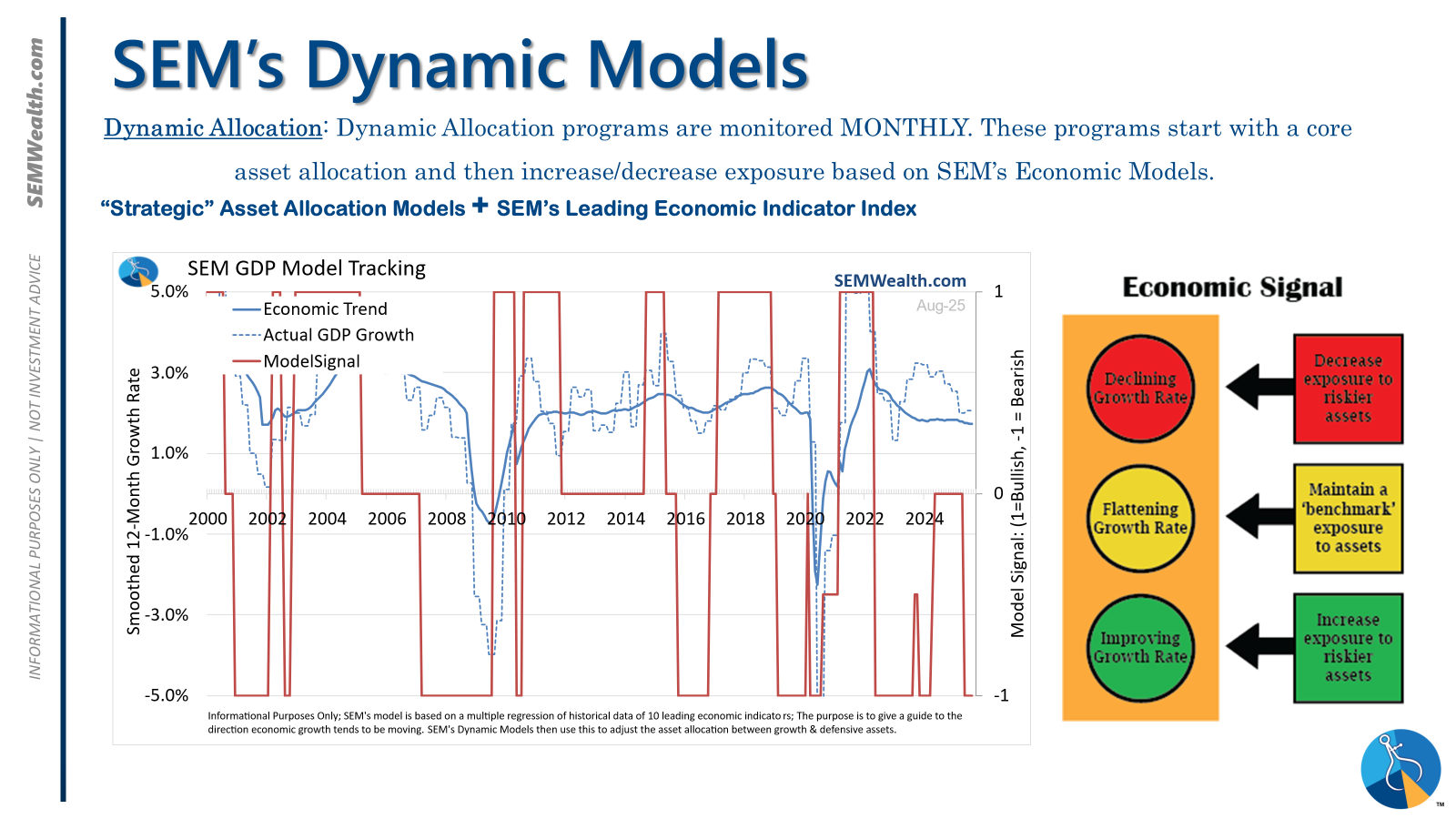

| Dynamic | Bearish | Economic model turned red – leaning defensive |

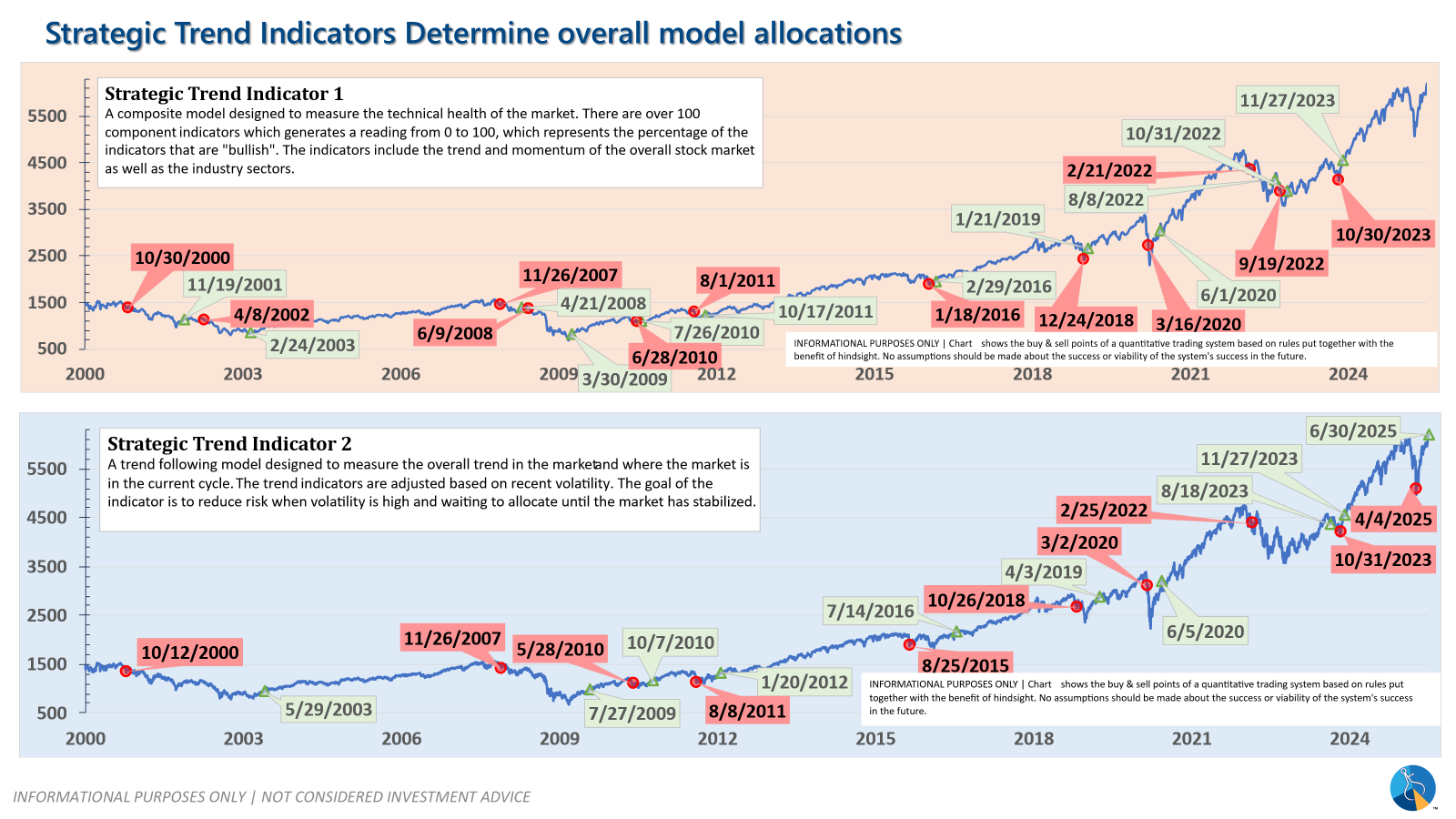

| Strategic | Slight under-weight | Trend overlay shaved 10 % equity in April -- added 5% back early July |

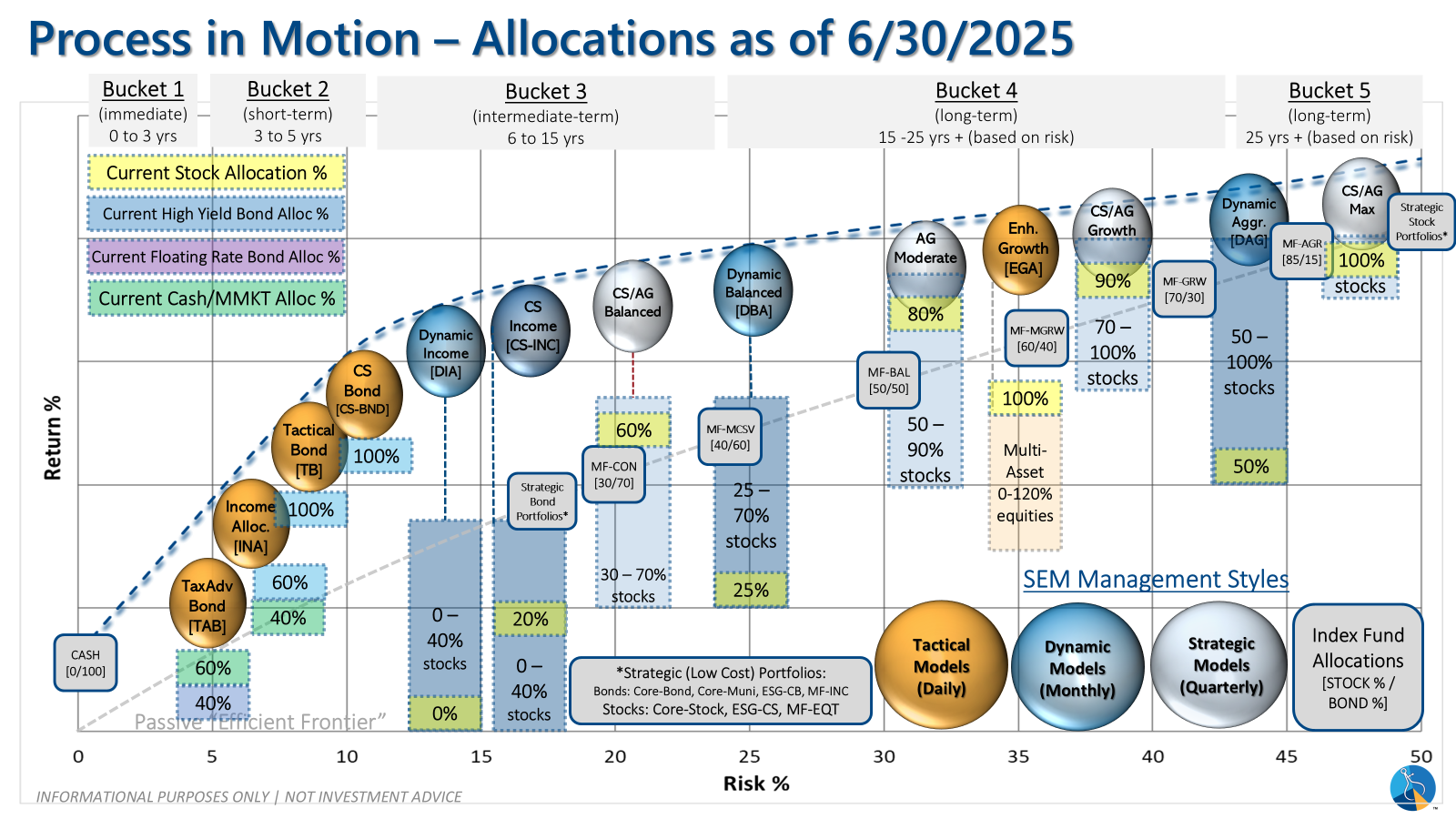

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire