Writing a weekly blog discussing the market is never easy. At times it is easy to see what is moving the market, other times it is difficult to pinpoint. Sometimes there is so much news causing wild swings in various asset classes it is nearly impossible to address everything. This is definitely one of those times. The other challenge is the purpose of this blog is to focus on the bigger picture and help cut through the day-to-day noise. This has been almost impossible the past month.

Since our quarterly newsletter at the end of September, I've included discussion about various layers of the AI industry and some of the ramifications and concerns I am seeing. While I was early in writing about it (the market staged a big rally to end October), lately we've finally seen big name firms and investors questioning the AI data center buildout. We saw this again on Wednesday and Thursday following Nvidia's quarterly earnings release. After another spectacular quarter that blew away even the most optimistic expectations, the stock rallied 5% in after-hours trading. It opened Thursday higher, but then reversed, pulling the entire market down with it.

The key question: Is the "demand" Nvidia and others are reporting supported by the actual NEED for all these data centers?

This leads to plenty of other questions:

- Will the data centers ever provide cash flows?

- Why is Nvidia investing in its customers if demand is so strong

- What happens if we end up with too much capacity?

- What would be the impact to the economy if the data center build-out falters?

I mentioned my stance last week that I firmly believe in the potential and economic impact of the AI build-out, but the euphoria is likely well ahead of reality. The recent skepticism is actually quite healthy. I've also mentioned several times that if we use the 90s broadband buildout as an example, we could be anywhere from the mid-1990s or the very late 1990s. In other words, we could have several more years of well above average returns or we could be approaching the "reset" necessary to finish the buildout.

With the staggering amount of money being thrown at these projects we could see huge losses ahead. If the amount gets into the hundreds of billions of dollars, the whole pyramid could collapse, to be built back up by those companies who were more conservative with their investments (or by those companies not even formed yet.)

In case you missed it, check out last week's blog:

I had originally planned on going deeper into the Private Credit concerns I have, which is related, but don't want that important topic to be lost in the other key concern I have for the market – its reliance on the Fed.

With so much going on, make sure you sign-up for our Economic & Market Outlook webinar happening next week.

Did the Fed Meeting Spark the Sell-off?

The S&P 500 peaked on October 29. This was the same day the Federal Reserve cut interest rates for the second consecutive meeting. Correlation is not causation, but knowing how much hope investors (speculators) have placed on the Fed saving the economy/market, I think it is no coincidence. At the press conference, one of the most emphasized phrases was "foregone conclusion" as Chair Jerome Powell discussed the idea of more rate cuts in December.

Powell's Prepared Statement:

"With today’s decision, we remain well positioned to respond in a timely way to potential economic developments. We will continue to determine the appropriate stance of monetary policy based on the incoming data, the evolving outlook, and the balance of risks. We continue to face two-sided risks. In the Committee’s discussions at this meeting, there were strongly differing views about how to proceed in December. A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it. Policy is not on a preset course."

Three reporters then asked follow-up questions.

Nick Timiraos, The Wall Street Journal: "Chair Powell, are you uncomfortable with how market pricing has assumed a rate cut is a foregone conclusion at your next meeting?"

Powell's Response:

Well, as I just mentioned, a further reduction to the policy rate at the December meeting is not a foregone conclusion, as I’ve just said. So I would say that that needs October 29, 2025 Chair Powell’s Press Conference FINAL Page 5 of 28 to be taken on board. We had—you know, I would just say this—19 participants on the Committee, everyone works very hard at this and takes their obligations to serve the American people very seriously. And at a time when we have tension between our two goals, we have strong views across the Committee. And, as I mentioned, they were strongly differing views today. And the “takeaway” from that is that we haven’t made a decision about December, and we’re going to be looking at the data that we have, how that affects the outlook and the balance of risks, and I’ll just say that."

Claire Jones, The Financial Times: "We’ve just heard from you that the discussion in December and the conclusion that the discussion is not a foregone conclusion. I’d like to just dig into that a little bit more, about what sort of arguments were brought up."

Powell's Response:

"Once again, I would just point out that we have the situation where the risks are to the upside for inflation and to the downside for employment. We have one tool. It can’t do both of those—you can’t address both of those at once. You’ve got a very different situation. So you have some people—people have different forecasts, right? So they’ll feel—they’ll forecast faster or slower progress on one or the other. And they also have different levels of risk aversion. And people—some will be more averse to inflation overruns, and some will be more averse to underruns of employment. And so you put that together, and as you can see from the SEP and from the public discussion that goes on between the meetings when participants go out and talk, they’re very disparate views. And they were reflected in strongly differing views in today’s meeting, as I pointed out in my remarks. And that’s what leads me to say that, that we haven’t made a decision about December. You know, I always say that it’s a fact that we don’t make decisions in advance. But this is—I’m saying something in addition here, that it’s not—it’s not to be seen as a foregone conclusion—in fact, far from it."

Edward Lawrence, Fox Business: "So Mr. Chairman, I want to take another crack at the further reduction in rates is not a foregone conclusion in December—you said “far from it.” So if a cut might not be on the table for December because of lack of data, what is the other concerns then stem from? So if it’s not lack of data as the reason December is not a foregone conclusion, what other things could be the concern then?

Powell's Response:

"Well, perspectives of people on the Committee that we’ve now moved 150 basis points and that we’re down into—you’re into that range between 3 and 4, where most estimates of—many estimates of the neutral rate live in that 3 to 4 percent area. You’re there now. You’re above the median number for the Committee. But I think there are people on the Committee who have higher estimates of the neutral rate, and that’s—you can argue these positions since it can’t be directly observed, the neutral rate. So I think for some part of the Committee, it’s time to maybe take a step back and see whether there really are downside risks to the labor market, or see whether, in fact, the growth—that the stronger growth that we’re seeing is real. So people just have—again, we’ve cut 50 more basis points in the last two meetings and there was a sense, from some, “let’s pause here” kind of thing, and a sense from others wanting to go ahead. But that’s why I say differing views—strongly differing views."

Chair Powell is known to be very cautious with his words. The fact he did not back down on pushing back on the expectations for a December rate cut was apparently enough for investors (speculators) to cash in on the spectacular gains we've been enjoying since April.

Can 2 Fed Members Shift the Vote?

On Friday, stocks staged a big turnaround following 2 speeches from some key Fed members:

- John Williams (NY Fed President)

Normally a centrist voice, Williams leaned decisively dovish. He described policy as “modestly restrictive” and hinted at “room for a further adjustment in the near term” to move closer to neutral. Translation: the Fed is ready to ease if labor market risks grow. Williams acknowledged inflation progress has stalled around 2.75%, but expects tariff effects to fade and inflation to return to 2% by 2027. He warned against “undue risks to maximum employment”. - Stephen Miran (Fed Governor (and former/future White House Economic Advisor)

While no surprise given his former and future boss when his temporary term expires next year, Miran went further, saying he would “absolutely vote for a 25 bps cut” in December. He criticized backward-looking inflation metrics and argued policy should reflect forward conditions—cooling labor markets and rising unemployment (now 4.4%). Keep in mind he was asking for a 100 basis point cut in September and 50 basis points in October.

The rally did fade a bit in the afternoon as Boston’s Susan Collins and Dallas’ Lorie Logan stuck more to Powell's post meeting message – restrictive policy remains “appropriate.” Their comments show the Fed isn’t unanimous and to quote the Fed Chair, "a cut in December isn't a foregone conclusion"

The market does beg to differ as the odds of a 25 basis point rate cut jumped from 25% on Thursday to the 70-75% range throughout the day on Friday.

Old Data

One of the issues with the government shutdown is the lack of economic data. For a Fed that says they are "data dependent" this is creating issues. We finally saw September's payroll report numbers last week. While not great it also did not raise concerns that the labor market was slowing rapidly.

The unemployment rate ticked up a bit, but that was partially because more people entered the labor force.

We should have received October's payroll data 3 weeks ago, but while the US Government has not gathered the state level unemployment claims data, private services who gathered the data independently reported no real uptick in unemployment claims the last 7 weeks. In other words, we have zero proof the employment situation is deteriorating enough to justify another rate cut.

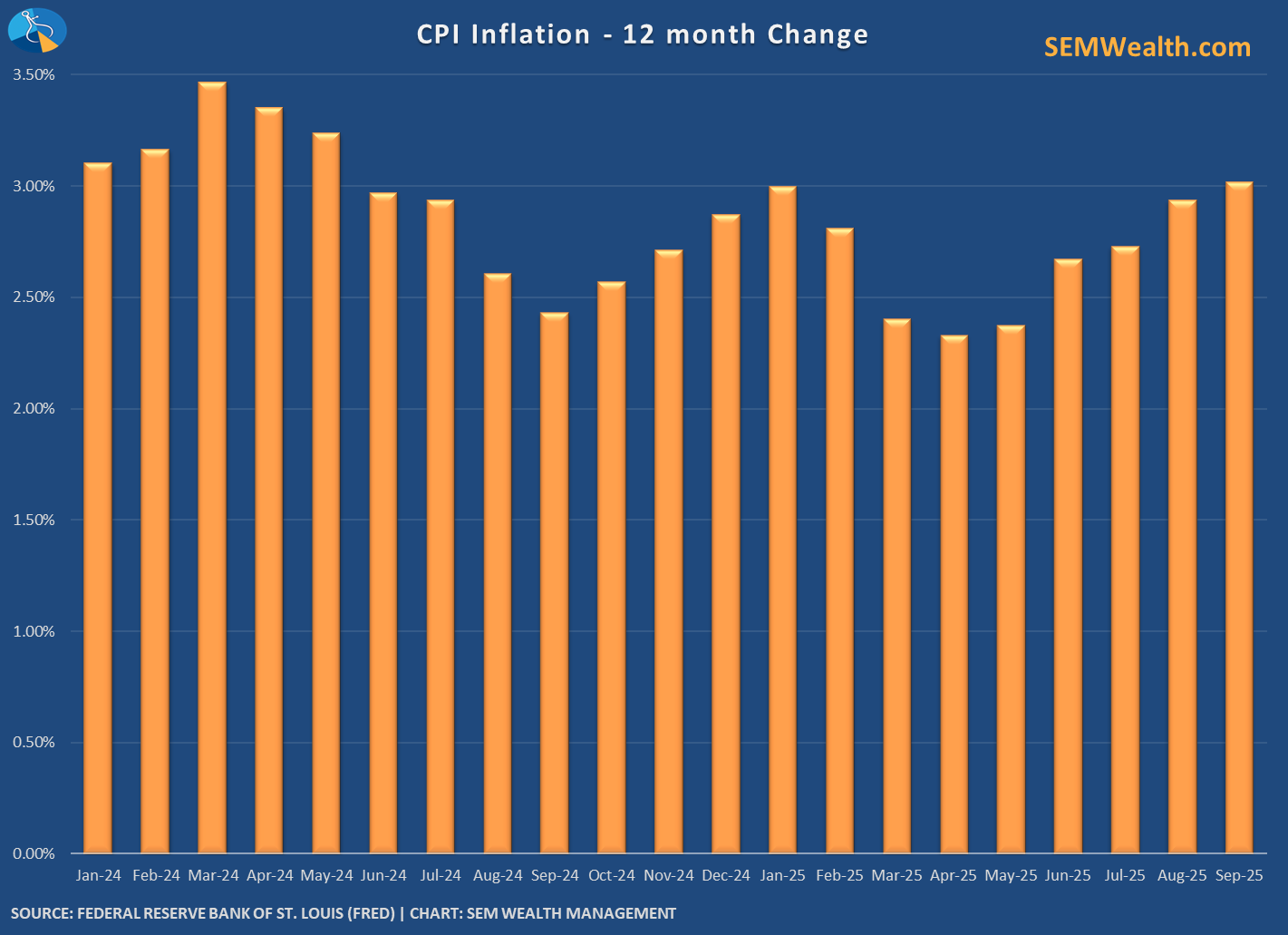

More importantly, there is ZERO indication inflation is going in the direction the Fed would like. The BLS came back to work during the shutdown to give us the September CPI report. That did little to calm the concern that inflation is no longer moving down.

Unfortunately, the BLS announced late Friday they would not even bother releasing the October CPI report, which was due last week. This leaves the Fed flying blind, but most regional reports show inflation is still an issue. Add to that continued mentions of the President sending $2,000 "dividend" checks and reduced tax withholdings to start the year as the "OBBB" is implemented and the Fed has a difficult fight ahead to keep inflation from continuing to move above 3%.

We have a few more weeks until the next Fed meeting with plenty more speeches to come. Stay tuned.

Toby's Take

11/17/2025 - FAA to Lift Government Shutdown-Related Flight Restrictions - WSJ

With the government shutdown coming to an end, travel can finally pick up again. After staffing issues, the FAA required traffic cuts of up to 10% at major airports. This caused a lot of delayed and or canceled flights. This obviously affect certain parts of the market. But, the good news is here that the FAA is lifting the restrictions after reviewing to see that staffing has picked back up! Things seem to be leveling out and hopefully the market will begin to reflect that as well.

11/18/2025 - Trump’s Grip on Republicans Shows First Signs of Slipping - WSJ

Since his election in 2016, President Trump has seemed to have a lot of sway over the Republican party. This pretty much allowed him to have control in the Legislative branch over the majority holding Republican party. This "power" of his seems to be slipping away with one of his loudest supporters, Rep. Lauren Boebert, is pushing for the release of the Epstein files. This was clearly defying what President Trump wanted and could be brushed off, but the whole party seems to be leaning that way. This could be the final push to release the files that have already mentioned the President several times. It is set to be voted on tomorrow. Depending on the release of them and exactly what is in them, we could see some big changes in our Government shaking up the market.

11/19/2025 - Congress Approves Bill to Release Epstein Files After Monthslong Fight - WSJ

The vote has happened. The House has passed the measure to release the files with a vote of 427-1. This is a perfect demonstration of the GOP not just following whatever the President says and actually vote for their people. Rep. Marjorie Taylor Greene, a Republican from Georgia, was labeled a traitor by President Trump because of her initial push to release the files. Now, almost the entire party has followed her lead. Depending on the results of the Senate vote, this could really shake up the market because of the uncertainty around officials and leaders.

11/20/2025 - Nvidia Profits Soar, Soothing Investor Jitters Over AI Boom - WSJ

With the AI bubble growing bigger and bigger investors are starting to get worried. This feeling is especially strong around the world's most-valuable publicly listed company, Nvidia. However, Nvidia just reported record sales that were much higher than expected. This helped smooth people's jitters. It does seem that AI is going every direction at full speed with how fast it grows. Worse, it isn't exactly an easy topic to understand. This can all make investors like me and you nervous. We need to be aware of this and be able to explain AI well to nervous investors.

11/21/2025 - Air-Traffic Controllers With Perfect Shutdown Attendance to Get $10,000 Bonuses - WSJ

The Transportation Department has said that they are going to pay $10,000 bonuses to air-traffic controllers who had perfect attendance during the shutdown. Out of roughly 11,000 fully certified air-traffic controllers, only 776 went in every shift. Because of these men and women showing such patriotism by working even when not being paid, they are being rewarded handsomely. This is a good thing to see because good people are being rewarded, but also it may cause other controllers to work harder and keep the sky's even safer. Overall, good attention in the air travel world could boost stocks in that side.

Market Charts

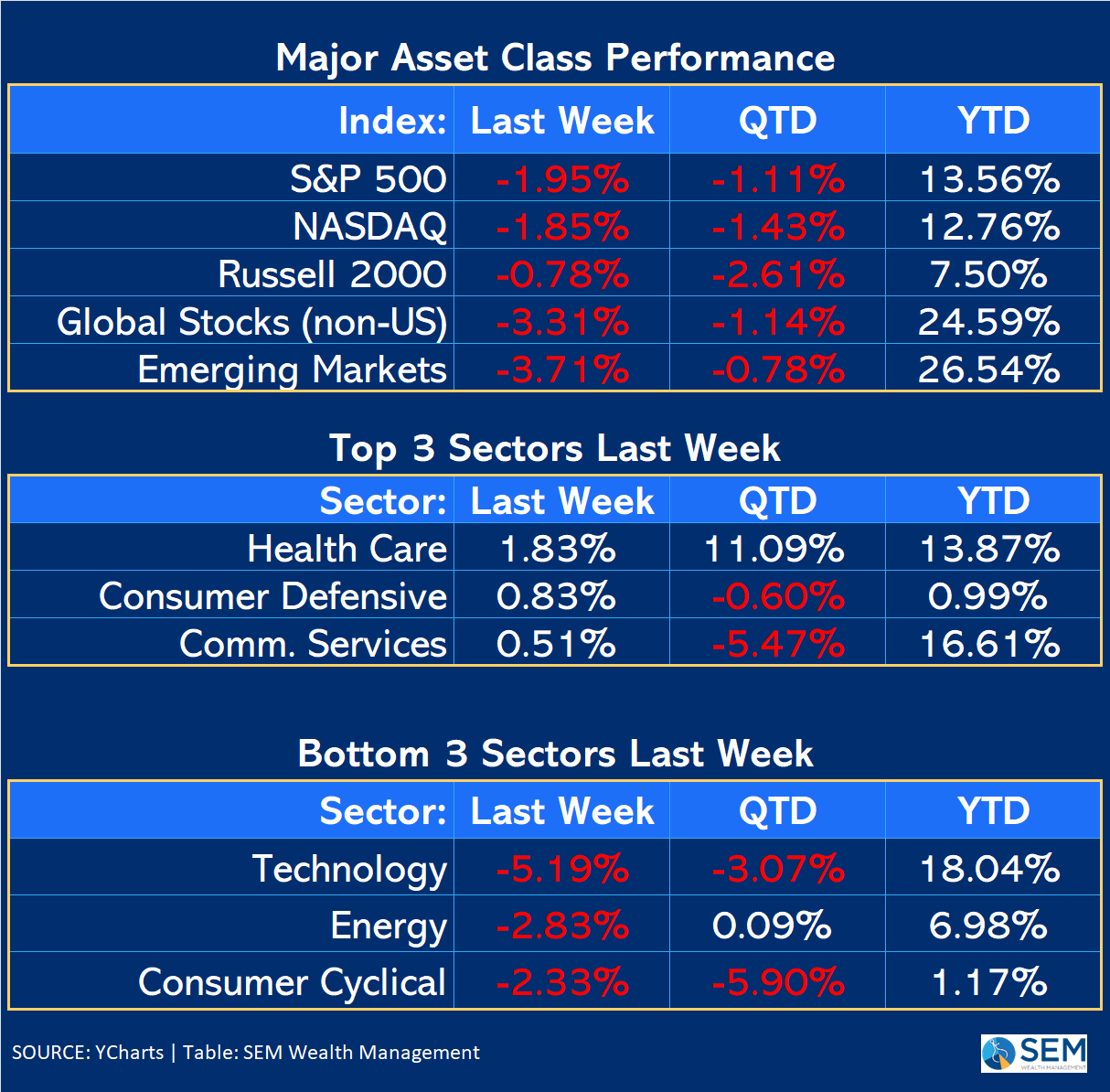

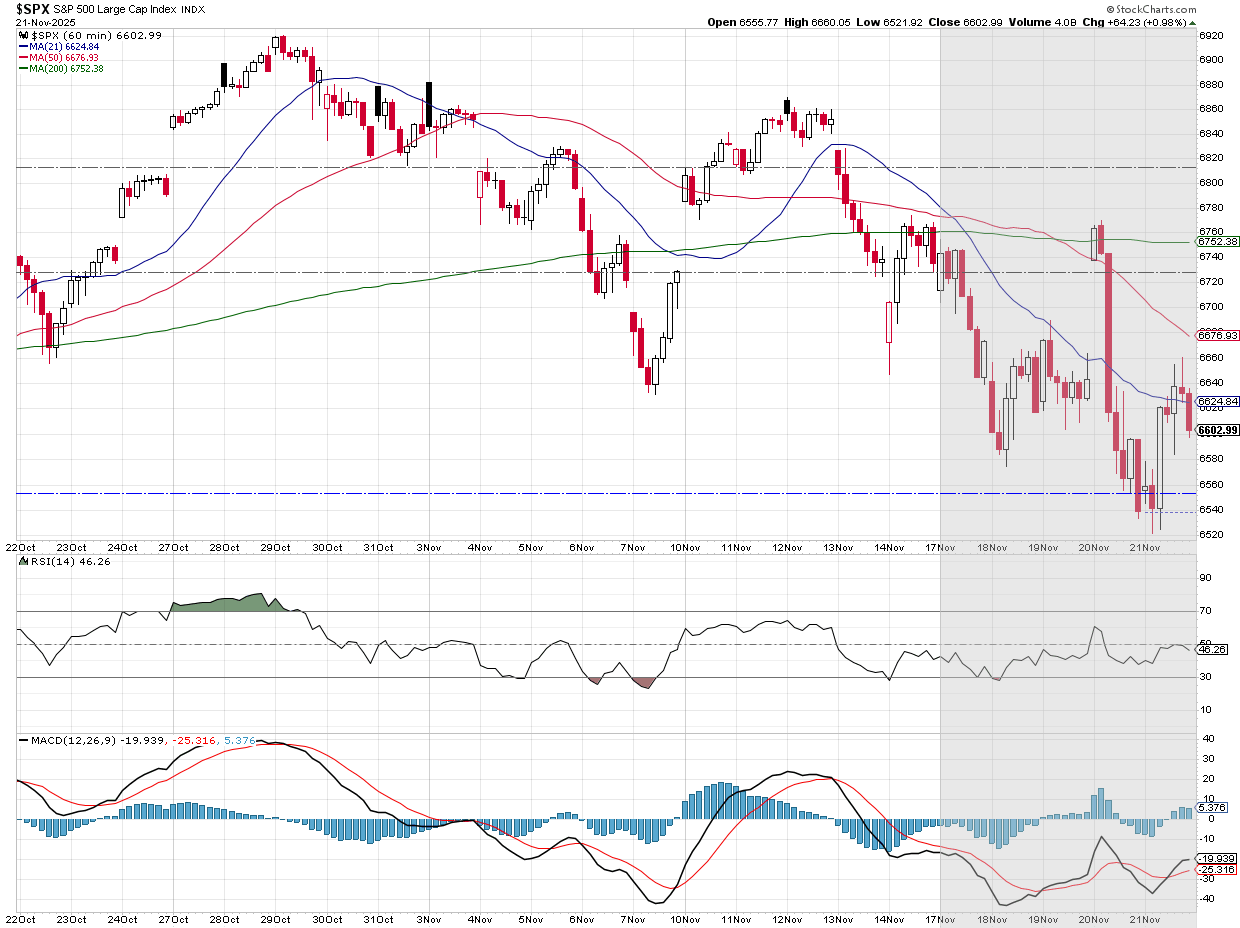

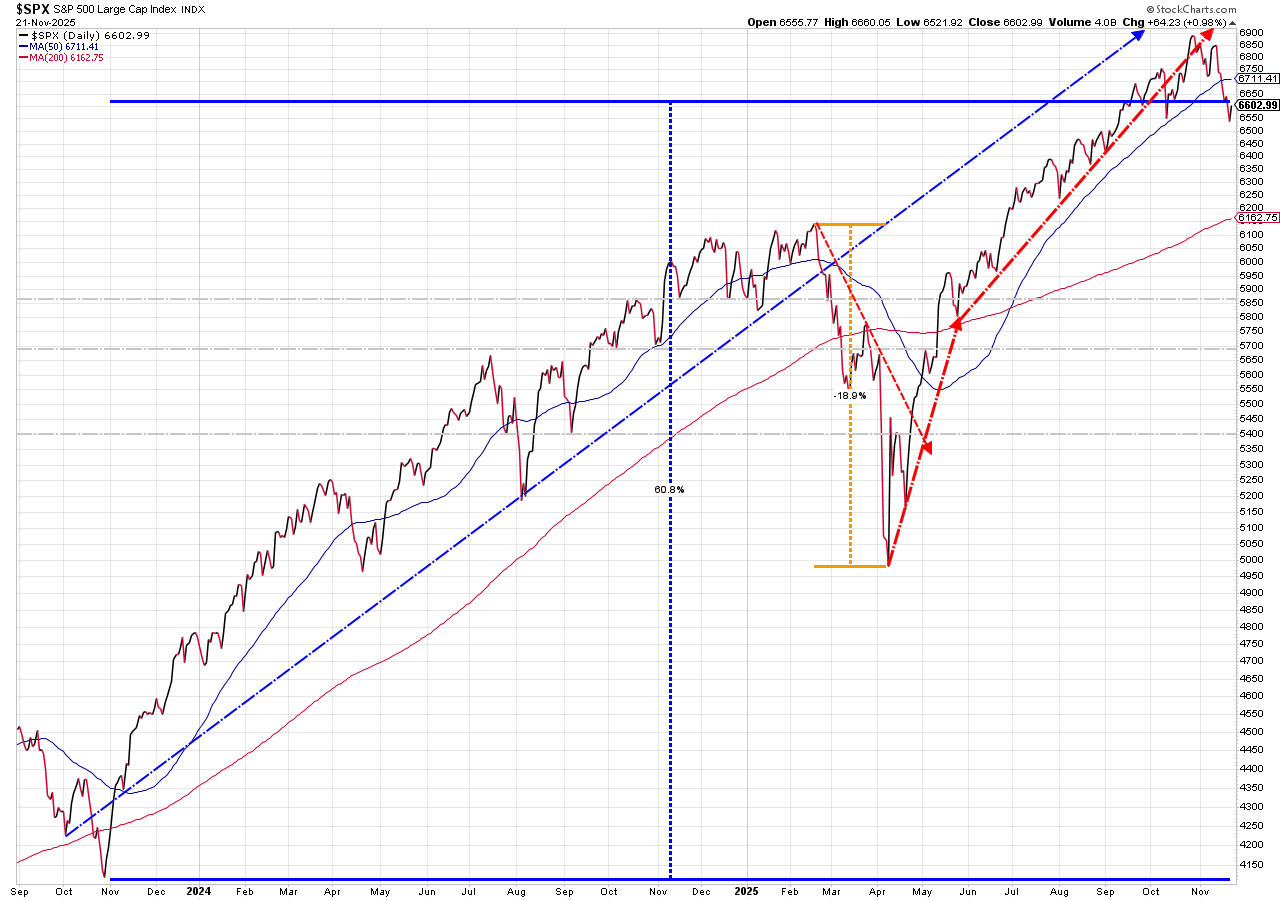

Even with Friday's rally it was a rough week for stocks.

The steep uptrend has been broken for the S&P 500, but that's been the case since early October. Stocks are still up 60% in the 2 years since the Fed ended their rate hike cycle.

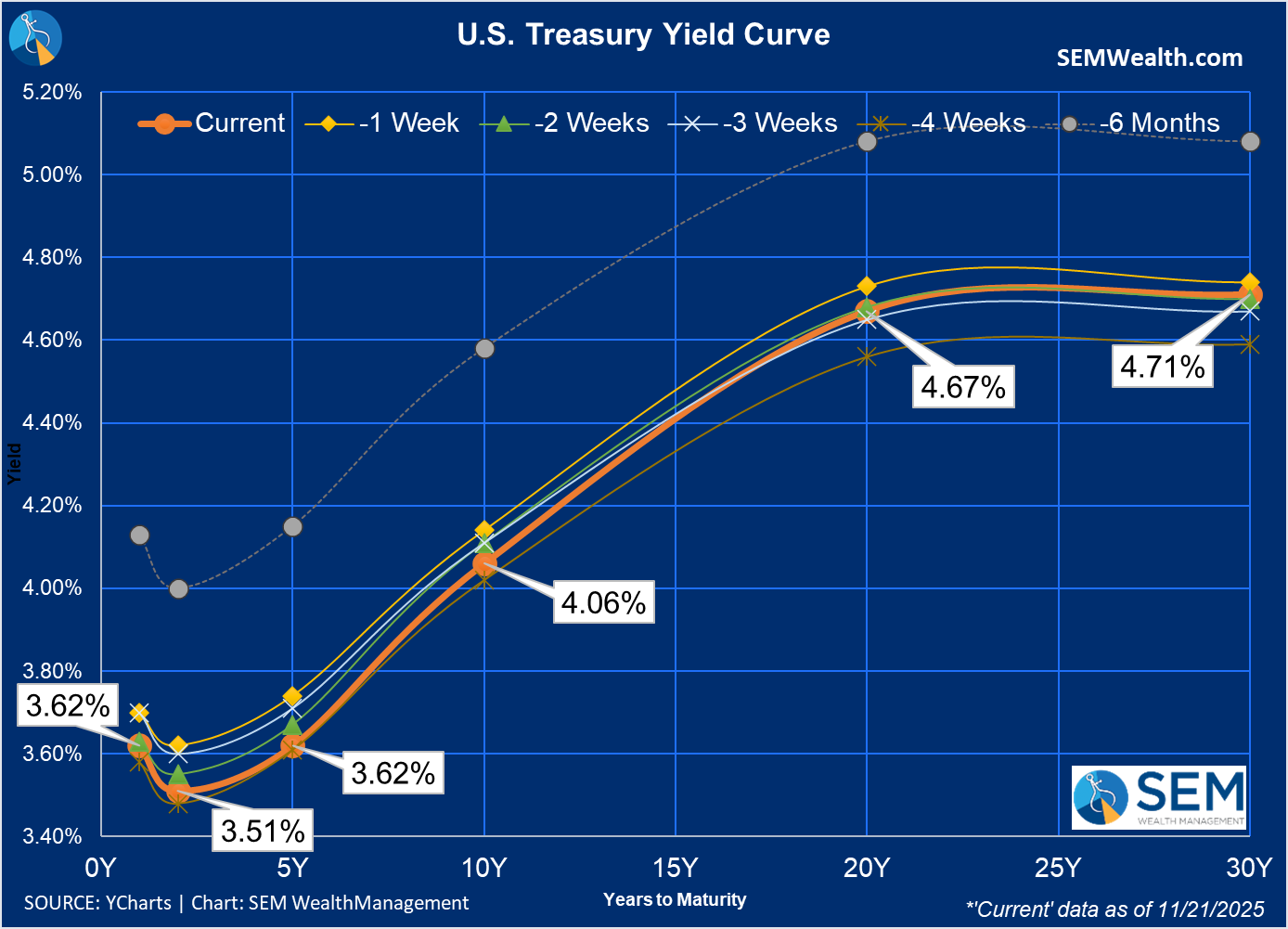

Turning to bonds, the yield curve shifted down on Friday following the 2 "dovish" Fed speakers. Short-term rates are nearly back to where they were just before the last Fed meeting. 10-year rates remain higher.

The 10-year yield is a much more important indicator as it is sensitive to the inflation outlook. Most borrowing rates are set based on the 10-year bond, not the short-term Fed Funds rate.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

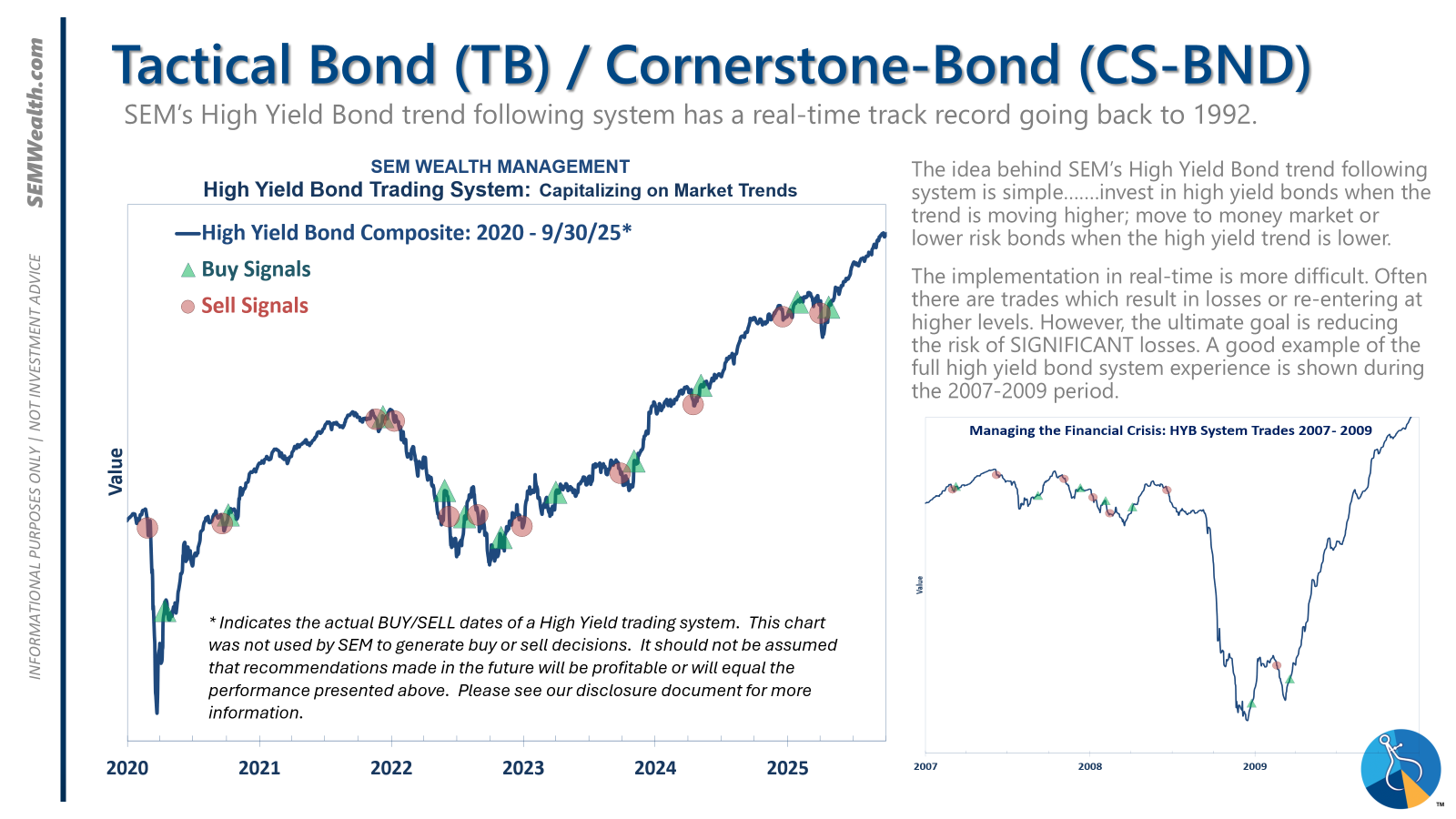

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

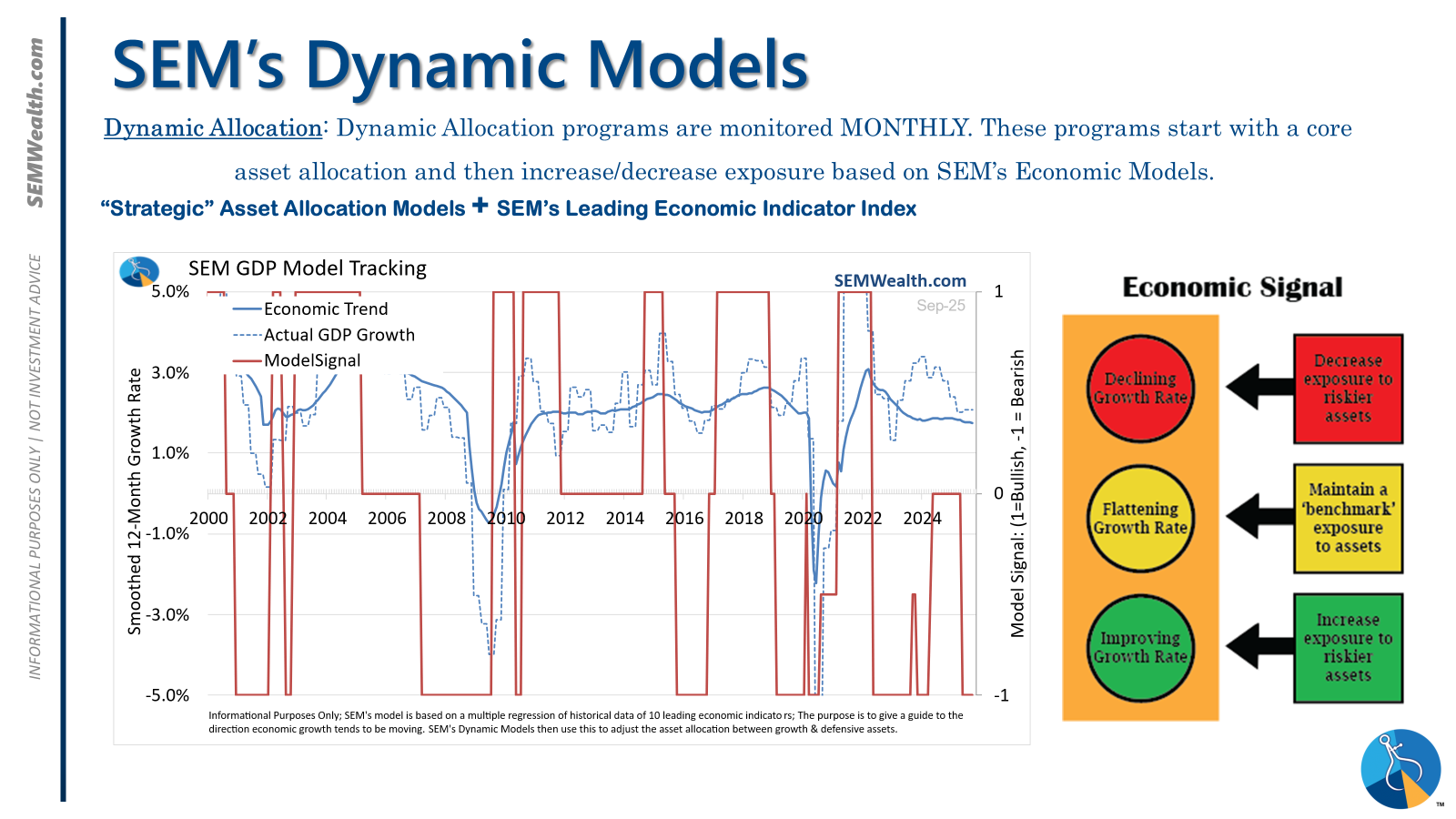

| Dynamic | Bearish | Economic model turned red – leaning defensive |

| Strategic | Slight under-weight | Trend overlay shaved 10 % equity in April -- added 5% back early July |

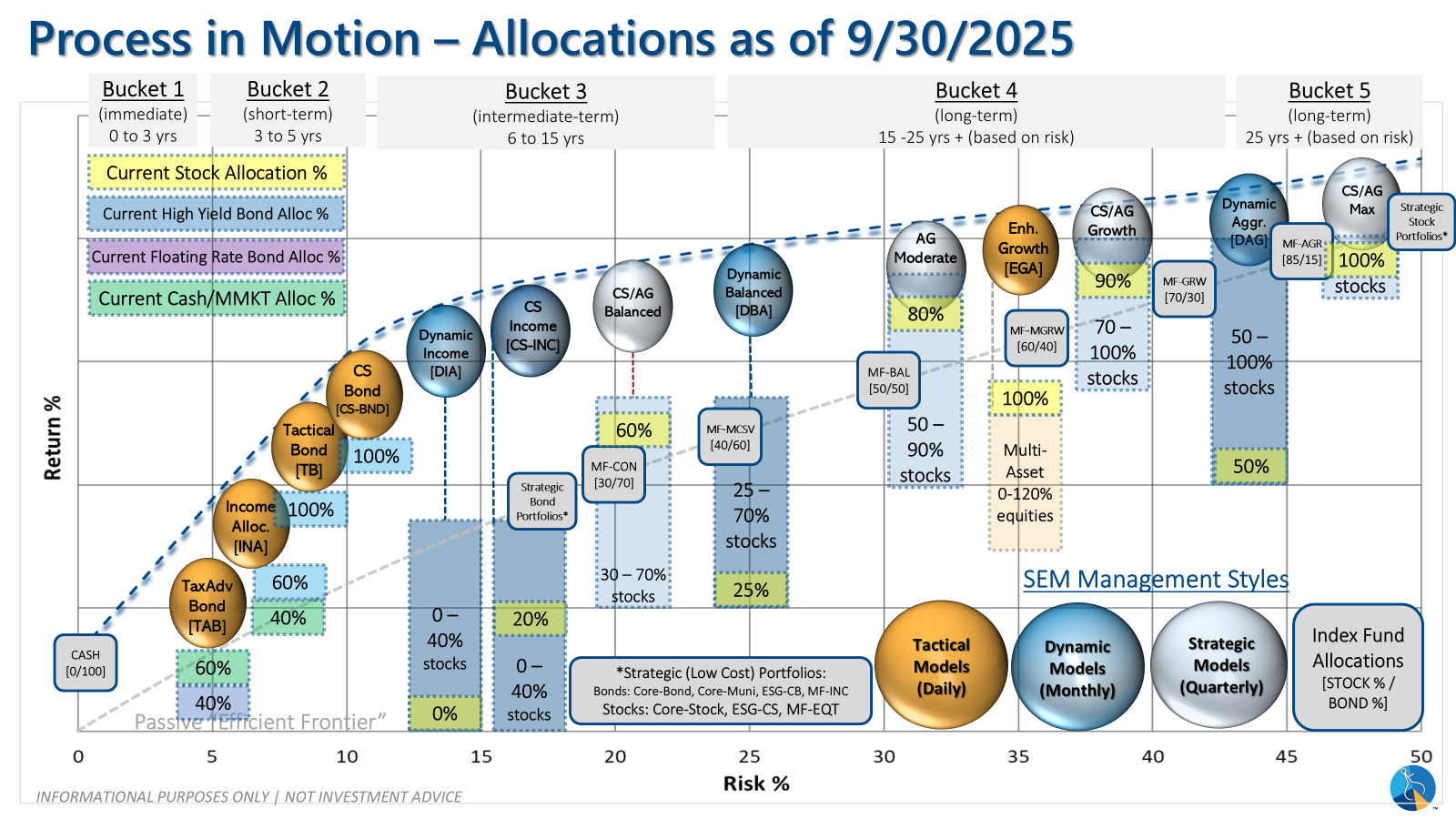

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

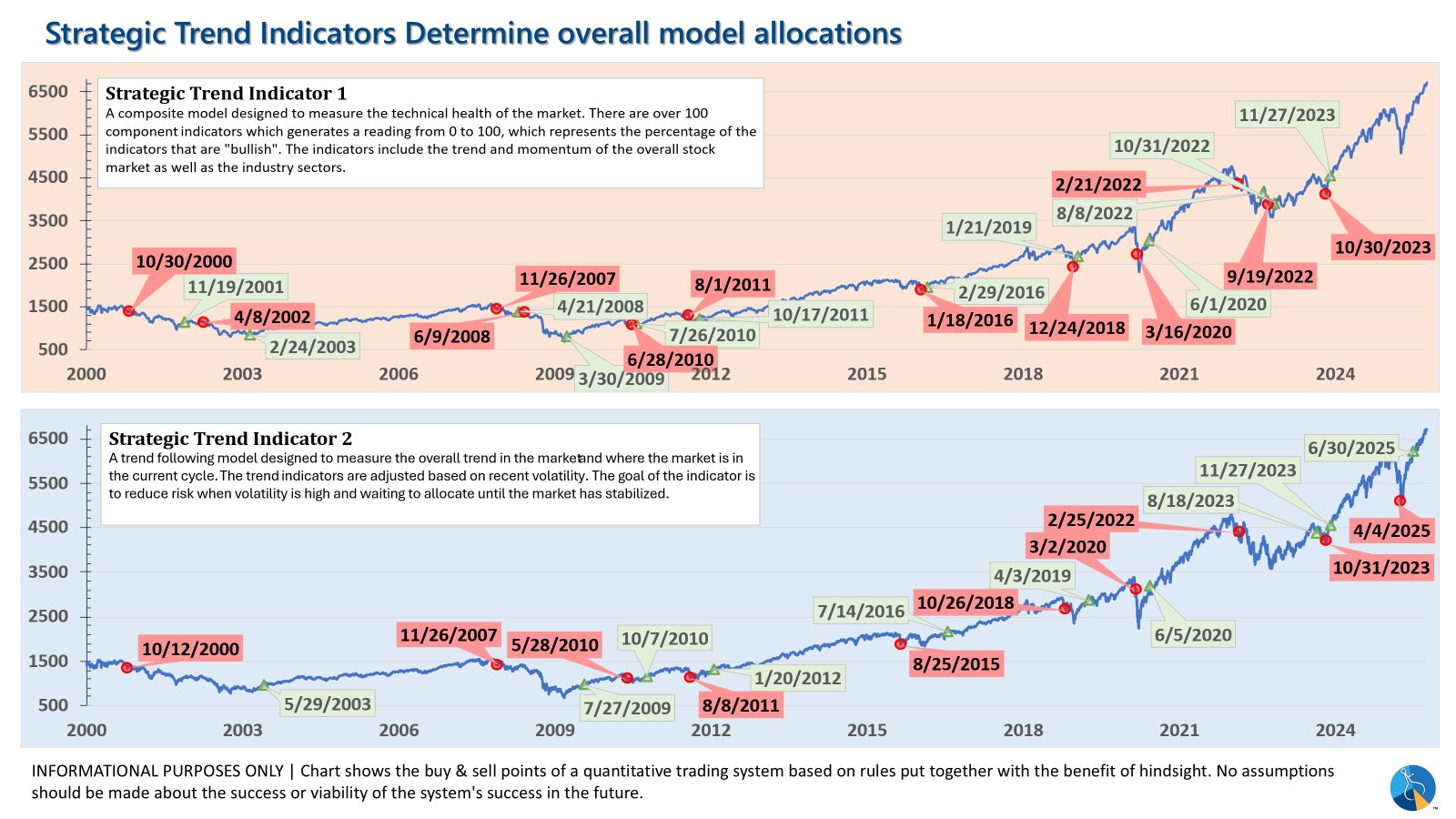

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire