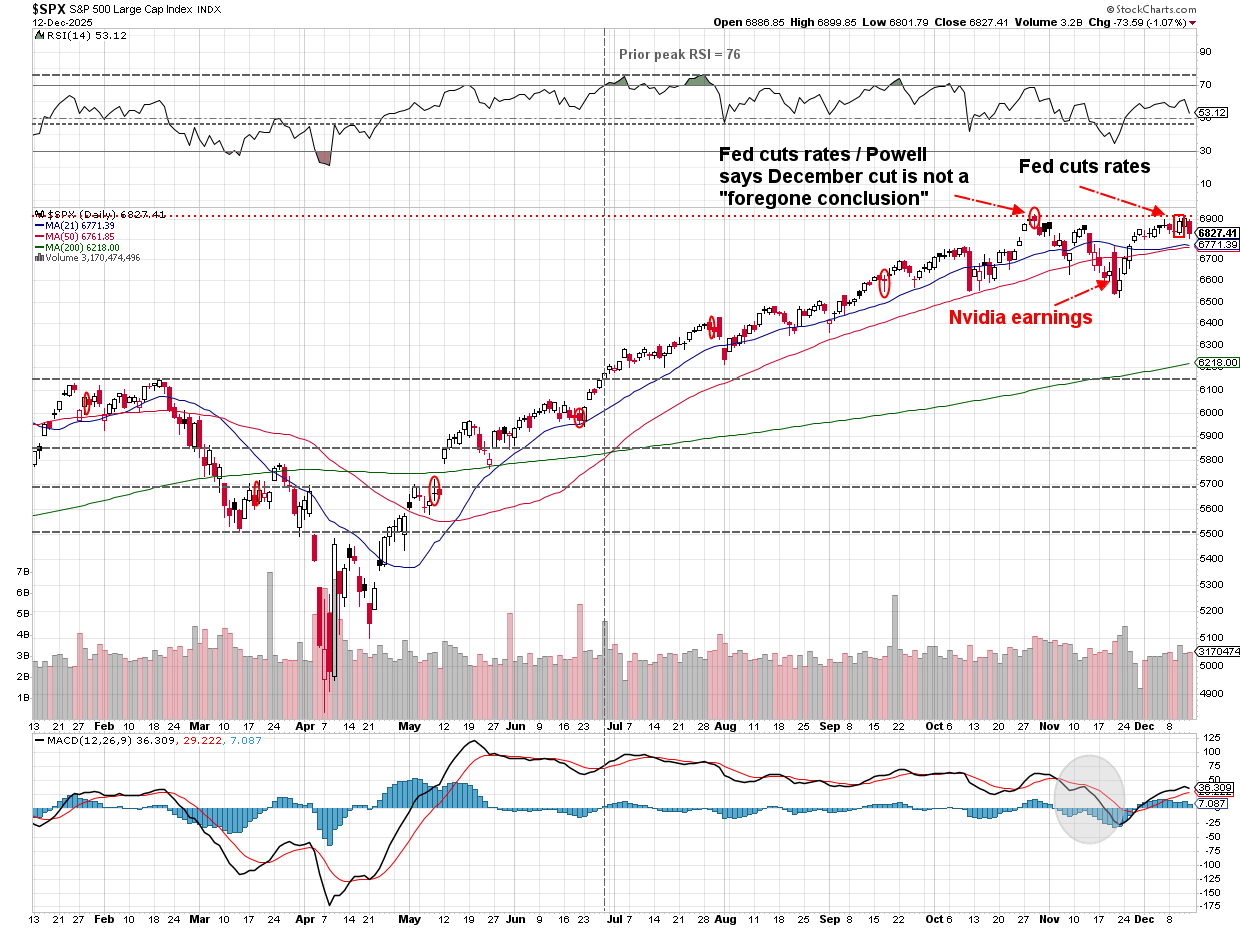

Last week the stock market got what it wanted. A month ago, it looked like it wasn't going to get its wish. Then a surprising twist happened and suddenly the market appeared to get everything it was asking for. Just the thought of receiving this Christmas wish was enough to spark a 2-week, 6% rally and return the market nearly to all-time highs. Santa Powell even threw out a surprising bonus, hoping to bring Christmas cheer to all.

But there is a twist, the market did not celebrate the way everyone thought they would. Oh for sure, some areas of the market cheered – we saw a 3-day rally in value stocks and segments of the market that had been struggling this year (especially small stocks). The thought is the Fed is focused on "main street" – letting inflation run hot to help boost employment). The issue of course is you can't just "wish" for something to happen and ignore the rally. The bond market being ever the realist actually INCREASED interest rates as the Fed stance appears to be one that could allow inflation to run TOO hot.

Higher interest rates (as we learned in 2022) hurts growth stocks the most. Combine that with the concerns I (and many others) have been raising regarding the financing of the AI Data Center buildout. Higher long-term rates is obviously a problem for these massive projects when investors are questioning the ultimate cash flows/operating profits they will generate.

[For a full breakdown of the market reaction last week, make sure you check out the Market Charts section].

All of this reminds me of a "classic" Christmas movie (at least in a family where we've had young children for over 25 years (and counting)). The movie – Elmo Saves Christmas. We watched this movie last week with our grandson. Spoiler Alert for those of you who haven't seen this 29-year old movie..................Elmo is gifted a magic snowglobe which gives him 3 wishes. As any 4 year-old would do – he wishes it could be Christmas everyday.

The next 40+ minutes are full of a reminder of why something "good" shouldn't happen "every day". Everyone WANTS the Fed to stimulate. Everyone WANTS the Fed to cut rates. Everyone WANTS the Fed to have maximum employment and stable prices. The problem is that's not possible. It "can't be Christmas everyday."

It's an economic fact that an economy cannot run without occasional recessions. The longer the expansion goes, the more inefficient the economy becomes. Bad ideas get funded, sucking up innovative new ideas that are necessary. A recession wipes out the bad ideas and allows the reallocation of capital to the good ideas. When money is easy, lots of bad ideas get funded.

We've seen this happening more and more the past 3 years. It's not a "new era" simply the same cycle playing out where in the late stages too many bad ideas are getting funded. Short of a recession, I will go on record saying we will see 4% inflation before we see it back to 2%. Can the economy handle this? I guess time will tell.

Can tech continue to deliver?

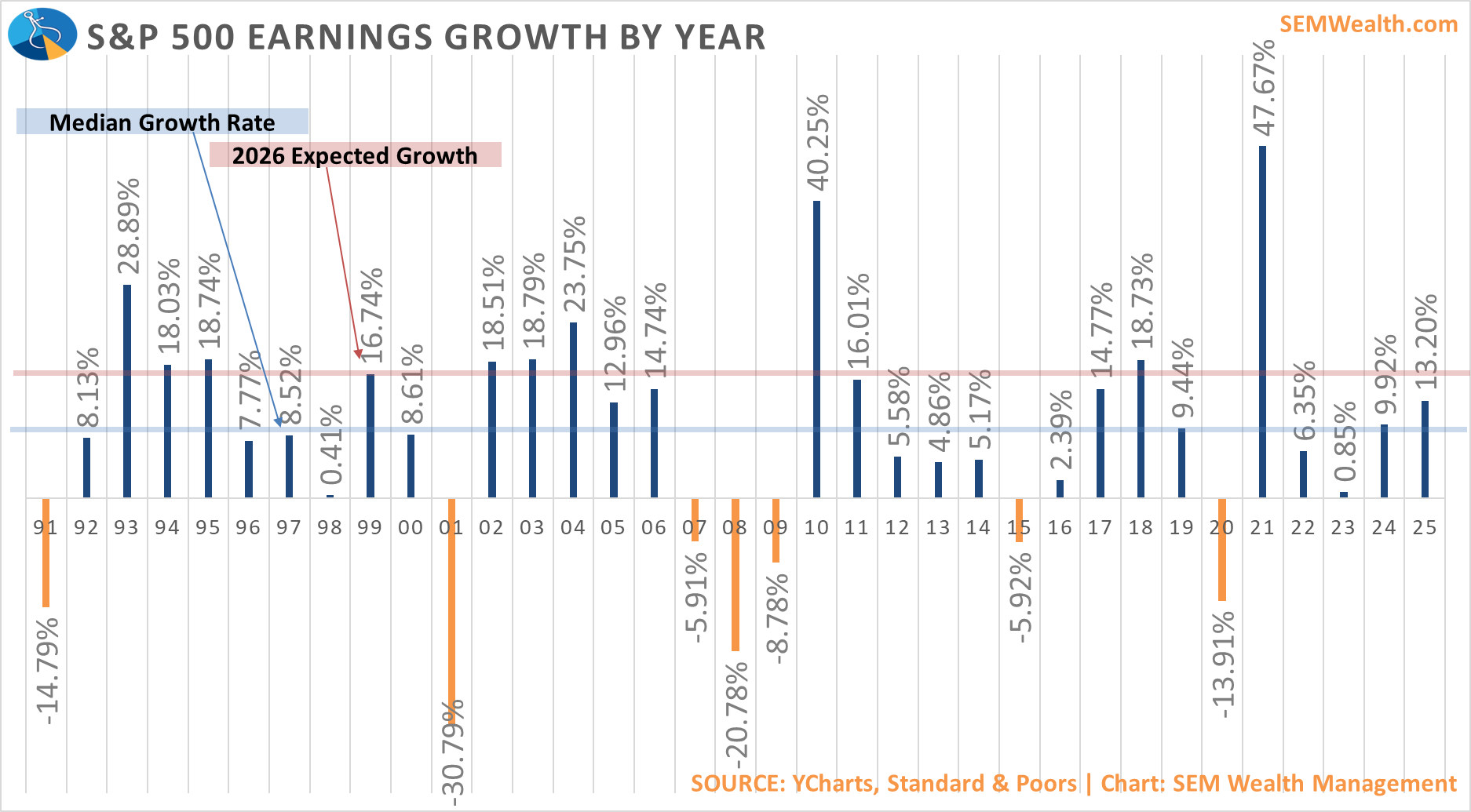

During our year-end update and outlook webinar, I included this chart which shows the calendar year earnings growth for the S&P 500. My point was to show how unprecedented the current 17% earnings growth would be by itself, but also to highlight the few other times we've seen this type of consecutively strong years (93-95, 02-06, & 17-18). It doesn't mean it cannot happen, but it is a high bar.

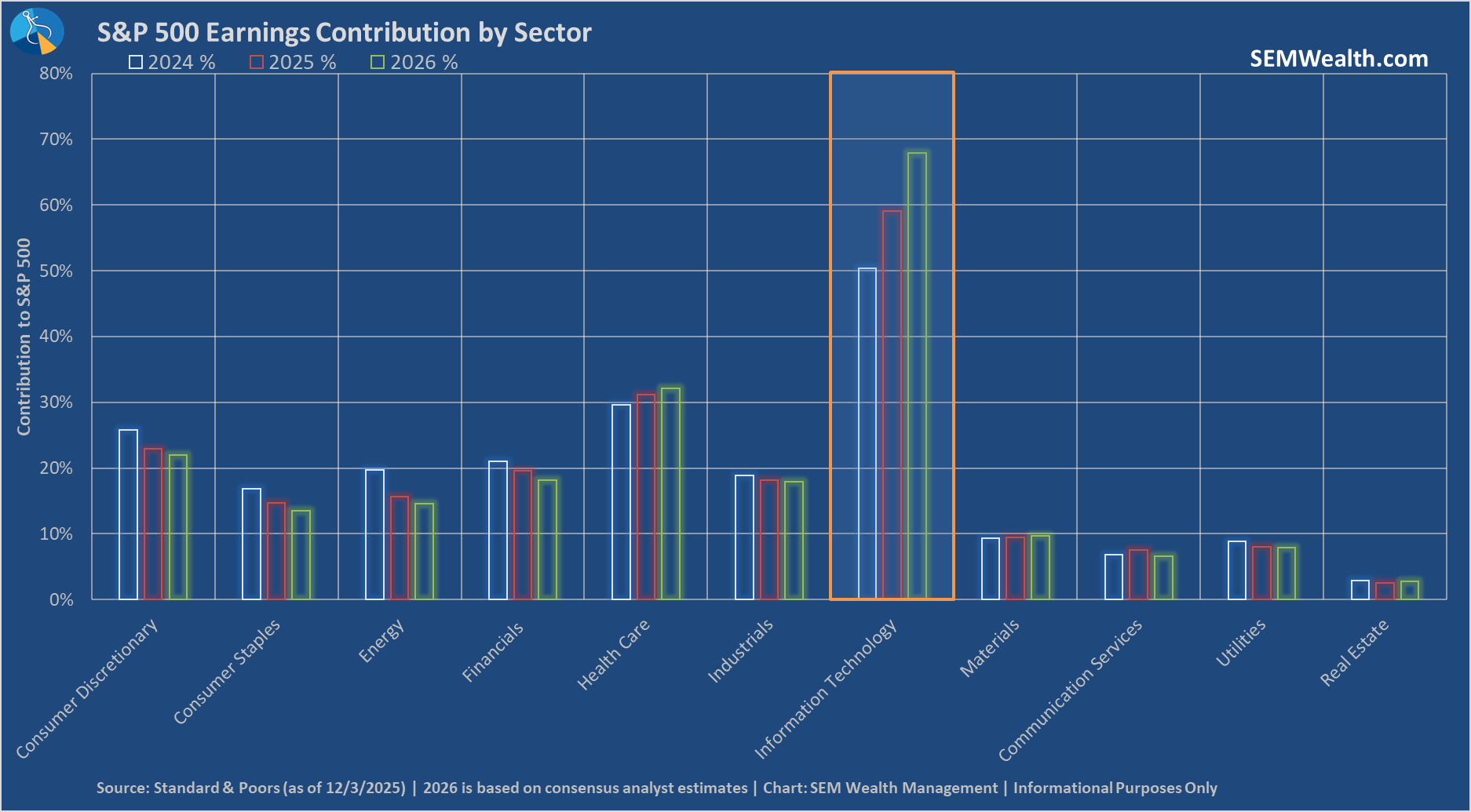

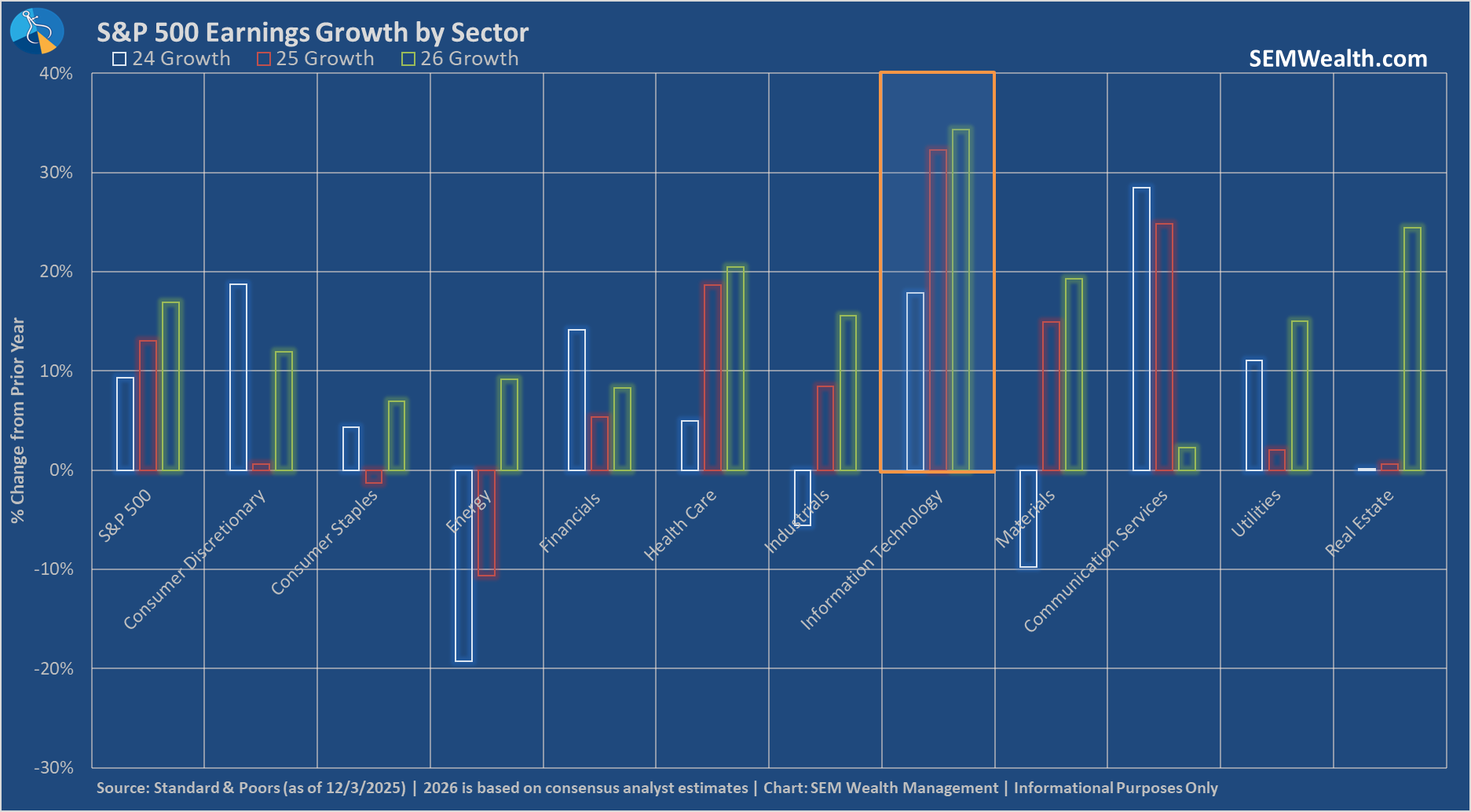

I've been hearing a lot of talk from analysts defending the 17% earnings growth targets by saying, "the S&P will broaden out in 2026." That got me thinking, what does Wall Street expect the rest of the S&P sectors to do to support this growth? So I downloaded the most recent earnings spreadsheet from Standard & Poors (linked on the Nerd Links tab of this blog along with my most often used data/news resources.)

Here's what we learned:

Technology is expected to contribute 68% of ALL EARNINGS (not growth......all earnings) in 2026, up from 59% in 2025 and 50% in 2024. Ten years ago technology was just 35% of TOTAL S&P 500 earnings growth.)

Not only are analysts not expecting a "broadening" in earnings, they are expecting earnings growth for technology companies to be even stronger in 2026, increasing by 34% (up from 32% in 2025 & 18% in 2024).

Can this happen? Sure. Remember what I've been saying, we could be in the "middle innings" of the latest technology revolution (similar to 1995-1997). We could have a year or two "blowout" like what we saw in 1998-1999. Stocks were "overvalued" from 1996-2000. The market was "narrow" being driven by technology related companies from 1996-2000. Warnings were happening from 1996-2000. I won't pretend to be able to pinpoint the exact "top".

We follow the data. The data says the economy is weak. By most accounts, if it weren't for the Data Center investments happening, GDP would be about half of the current 12-month rate, down to around 1%. Our sector rotation models are pointing to "toppish" behavior (more volatility in sectors and quicker rotations in and out of the 'top' sectors). However, the trend is still up.

What I have been reminding everyone of — we are all 5 years older than we were when the market bottomed in 2020. That means our time horizon is now 5 years shorter. For most people that means they should have LOWER risk in their portfolios (less equity exposure). I continue to see portfolios from new/prospective clients which have not been rebalanced since the lows of 2020. Bonds are NEGATIVE over the last 5 years, which means investors are 12-18% (or higher) over-exposed to stocks.

A rebalance is prudent. SEM rebalances our portfolios across all clients at least once a year (we strive for 12-months + 1 day or more to capture long-term gains). It's not a wholesale change, but it is a chance to take the winners off the table and redeploy to those assets which have underperformed.

If the market keeps going up for another year or two, yes you'll miss out on some gains, but if we are close to the top, deciding to de-risk after the market is falling is not so easy to do.

Time "Person of the Year"

There was a lot of discussion this week on Time Magazine's decision to name "The Architects of AI" as their "person of the year". These architects are: Mark Zuckerberg, Lisa Su, Elon Musk, Jensen Huang, Sam Altman, Demis Hassabis, Dario Amodei, and Fei-Fei Li. All but one (Fei-Fei Li) are CEOs of major companies. The discussion of course is whether or not this marks a "top" in the AI bubble.

Most are pointing out that by the time a major stock market mover makes the cover of Time Magazine "everybody" knows about it. This means there is not enough "new money" and enthusiasm to continue propping it up. The most used example is Amazon.com CEO Jeff Bezos being the Person of the Year in 1999. Amazon obviously survived and has become a dominant player, but Amazon stock lost 95% from its peak in December 1999 to its ultimate "bottom" in September 2001. (Side note: Amazon.com, the retail 'book seller' and eventual 'seller of everything' only started making money because of Amazon Web Services – repurposing all of the computer infrastructure and expertise into a "cloud" behemoth. )

I think the more interesting comparison (given my "we could be in the middle or end stages of the AI bubble" stance) is 1997's Person of the Year – Intel CEO Andy Gove. We've discussed the rise and fall of Intel in the past – most recently after Nvidia was named to the Dow to replace Intel, who was added right at the peak of the tech bubble.

Following the 1997 Person of the Year nod, Intel went on a furious rally – climbing 315% from December 1997 until the peak in August 2000. Following that the stock lost 82% until the "bottom" in 2002. If you'd bought Intel based on the December 1997 Time Cover, you lost 30% of your money from 1998 - 2002. Not the 95% that Amazon lost, but an astounding amount considering the spectacular gains you would have had in 1998 & 1999.

You could even go all the way back to 1927's Person of the Year, Charles Lindberg, who had just completed the first solo transatlantic flight. Aviation stocks surged following this before peaking in October 1929. The total losses for the aviation sector from the crash until the "bottom" in 1932 was 96%.

1928's Person of the Year was Walter Chrysler. The stock had already gained 50% in 1928 and was up 17% in the first 9 months of 1929. It lost 50% of its value in October-November 1929 and ultimately fell 96% (from a peak of $135 to $5 by 1932).

So is the Time cover the end of the bubble? It's too early to tell. Again, are we entering the 1998-99 phase of the cycle or are we close to the 2000-2002 stages?

Toby's Take

A weekly summary of top WSJ stories from our intern Toby.

12/8/2025 - Trump Says Deal for Netflix to Acquire Warner Bros. ‘Could Be a Problem’ - WSJ

Netflix had the winning bid to buy Warner Bros. Netflix already had a big market share, but having control of Warner Bros gives them possibly too much market share according to the White House. President Trump has praised the Co-Chief Executive of Netflix before, but he did say that it is a big market share and could be a problem. The Justice Department is investigating this now and there are talks about potentially steering Warner Bros to Paramount instead. This is obviously a huge win for Netflix right now, but could really hurt them if the Government decides to step in to control this deal.

We actually used this as one of our "Money Talks with Dad" videos on TikTok this week. Check it out here:

@moneytalkswithdad0 Well I guess we’ll just have to wait and see these next steps… #MoneyTalksWithDad #fyp #Netflix #streaming #gov ♬ original sound - MoneyTalksWithDad

12/9/2025 - Ford and Renault Team Up in Europe to Compete Against Low-Price Chinese Cars - WSJ

Ford is reaching out now to expand into different competition in Europe. Ford is partnering with Renault to make smaller cars that can compete with the low-price Chinese cars. This will affect both Ford and Renault, and if it does well we could see a big jump in stock price after Ford having a difficult year. Results of this won't show for a couple of years with the cars reaching European dealerships in 2028. However, even the hype of this business opportunity can raise the value.

12/10/2025 - The Silicon Valley Campaign to Win Trump Over on AI Regulation - WSJ

Nvidia, the current leader of the AI race, has said in a message to President Trump that there are a lot of state laws that are going to prevent the U.S. from staying ahead of this AI race. President Trump is a business man who also likes to win, so he is obviously going to everything he can to prevent these laws from preventing Nvidia from growing. He is likely to sign an executive order getting rid of state level AI restrictions. For Nvidia these laws are a scare for them that can impact growth and revenue causing consumers to potentially want to pull out of their stock. However, if state level AI restrictions are no more, then there is a chance that their stock value goes up even more.

12/11/2025 - Fed’s Fractured Vote Signals Trouble Ahead for Future Interest-Rate Cuts - WSJ

There was another Federal Reserve rate cut, but this time it went through with a fractured vote. Jerome Powell made a point to President Trump and his successor saying that cutting rates is harder than it looks. As we saw it is harder to get everybody to agree making potential future votes harder to predict. Having an unpredictable Fed can be stressful for investors and can cause emotional responses. We need to watch closely at how the Fed is leaning to understand how the market will respond.

12/12/2025 - Behind the Deal That Took Disney From AI Skeptic to OpenAI Investor - WSJ

Disney has made a move into AI which is a little surprising because they were skeptical at the start. They invested $1 billion into OpenAI to allow users to generate videos on ChatGPT using their characters. Obviously they will gain money because users will be able to enjoy the new feature for fun things like making videos of their kids favorite characters singing them "Happy Birthday." But, can we expect to see the trend of what other companies experienced when investing in OpenAI? We will see!

(Note: This ironically came a week after I had attempted to make a "Happy Birthday" video for one of our grandsons on ChatGPT using his latest favorite characters – Storm Troopers (a Disney-owned property). ChatGPT constantly tried to get around its 'copyright' settings, but couldn't. I switched to Gemini (owned by Google), which had no problem creating several versions. It had a harder time using the actual melody of "Happy Birthday" than using the Disney owned Storm Troopers. The same day as Disney announced the deal with OpenAI, Disney issued a "cease and desist" claim against Google.)

(SideNote2: Notice Disney is not receiving CASH for use of its characters — OpenAI is giving them stock.)

Market Charts

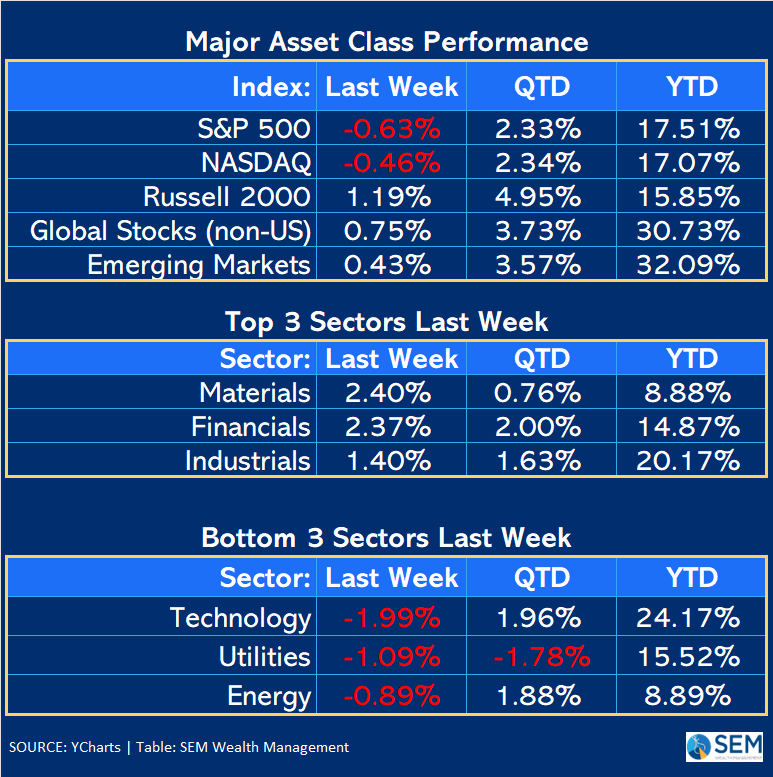

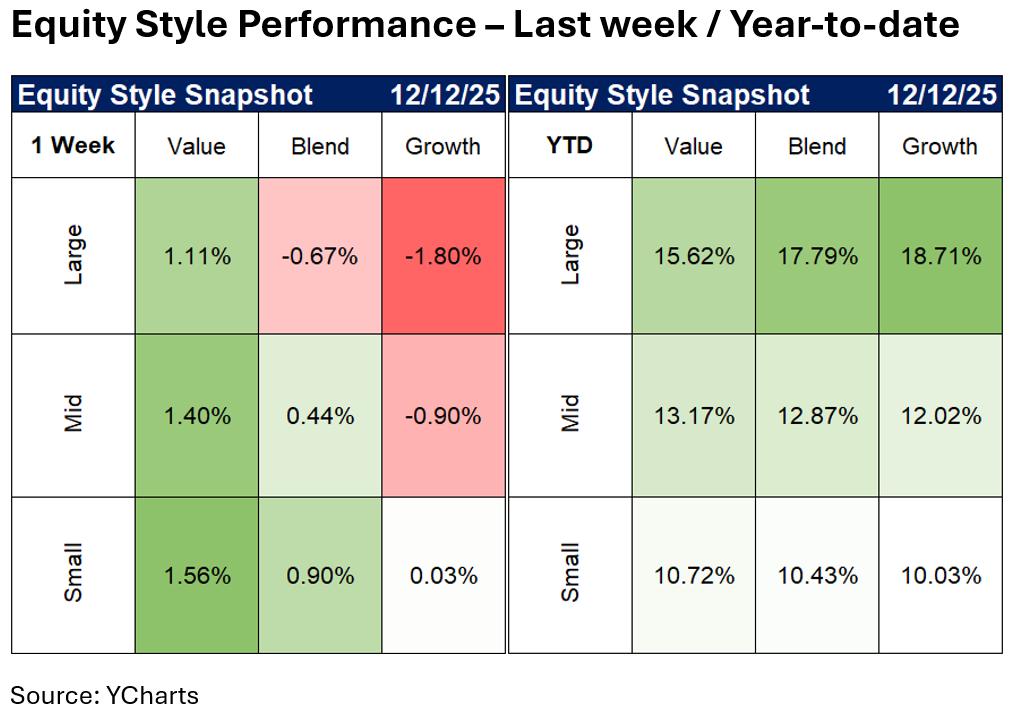

I'm including an additional table this week to illustrate the rotation from growth to value we saw last week:

One week does not make a trend, but it is worth watching.

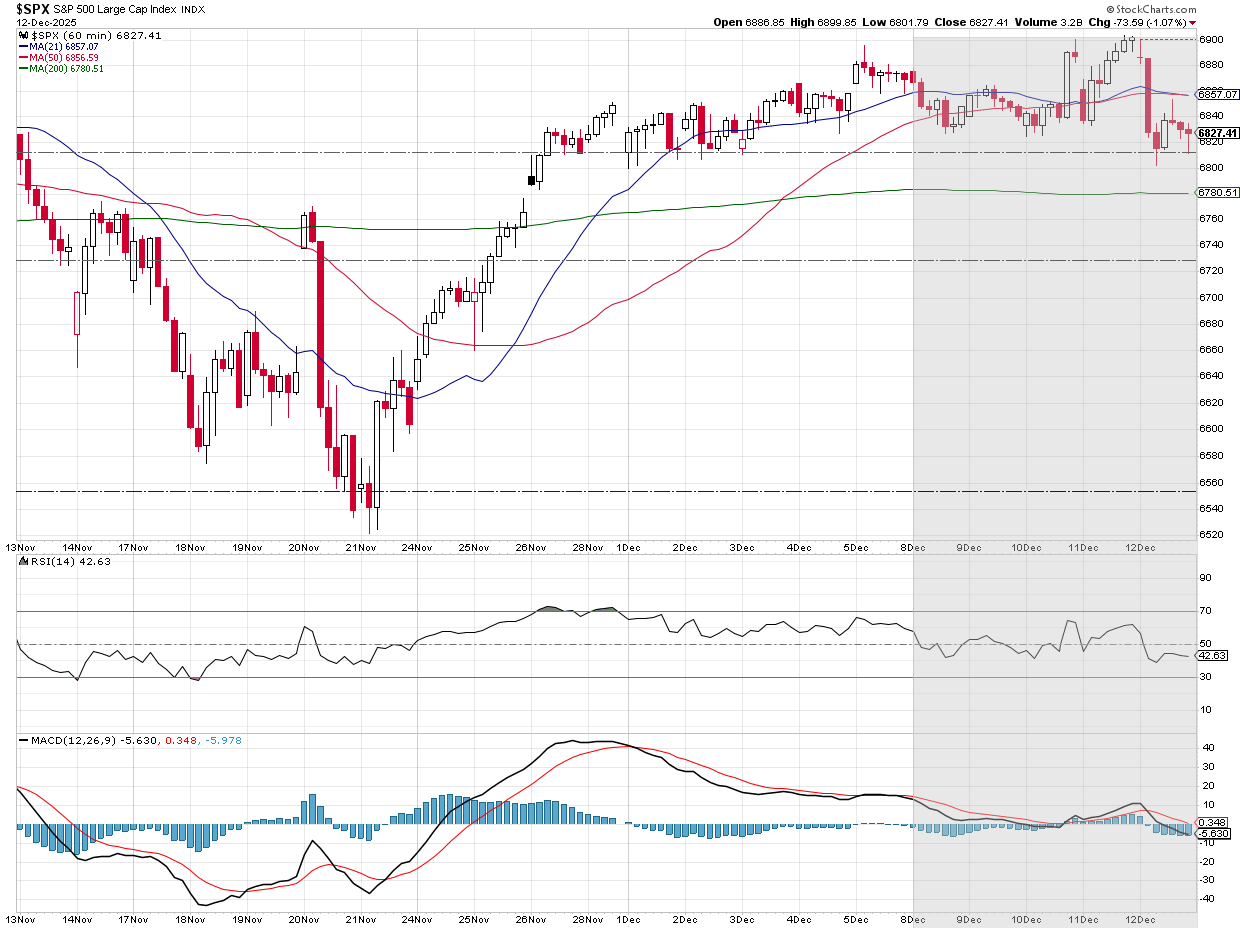

It was a relatively quiet week with really only two quick moves – the rally on Wednesday during the Fed's press conference and then the sell-off at the open on Friday following Oracle's "disappointing" earnings report.

Ironically (or not) the S&P 500 got within a few points of the same level it was at the day of the last Fed meeting – the one when Chair Powell said a December cut was not a "foregone" conclusion.

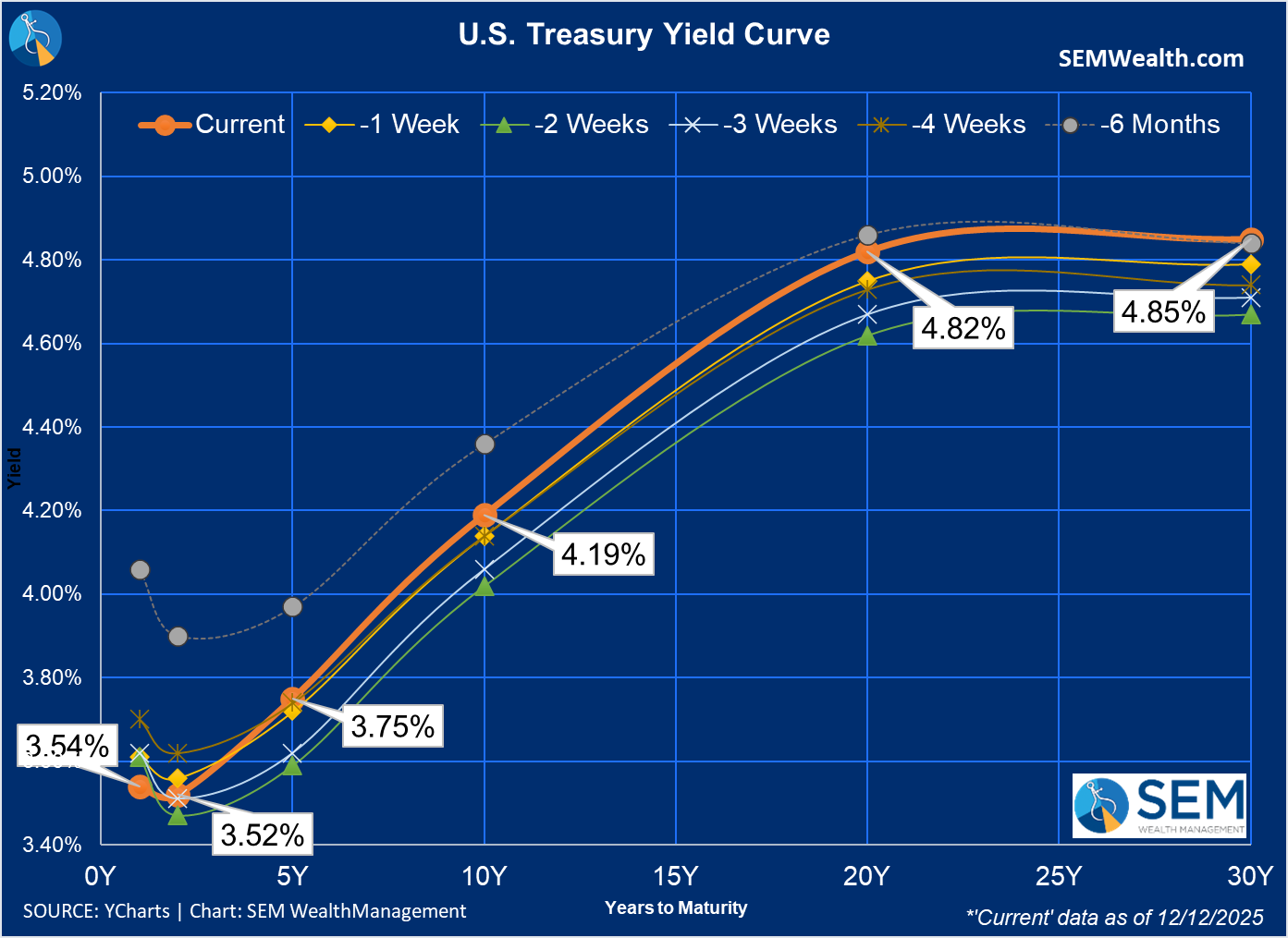

The bigger issue (again) remains the bond market. While short-term rates did drop with the Fed's latest rate cut, long-term rates increased (again) with 20 & 30 year yields hitting their highest levels in 6 months.

10-year yields broke out of the downtrend channel we illustrated last week. Wall Street borrows at short-term rates and lends to Main Street at long-term rates. If the Fed's true goal was to help Main Street the market has other ideas. The bond market sees inflation as the more important problem which is why rates went up.

The Fed announced a new facility to purchase Treasury Bills. We will be discussing this more as it is close to being implemented.

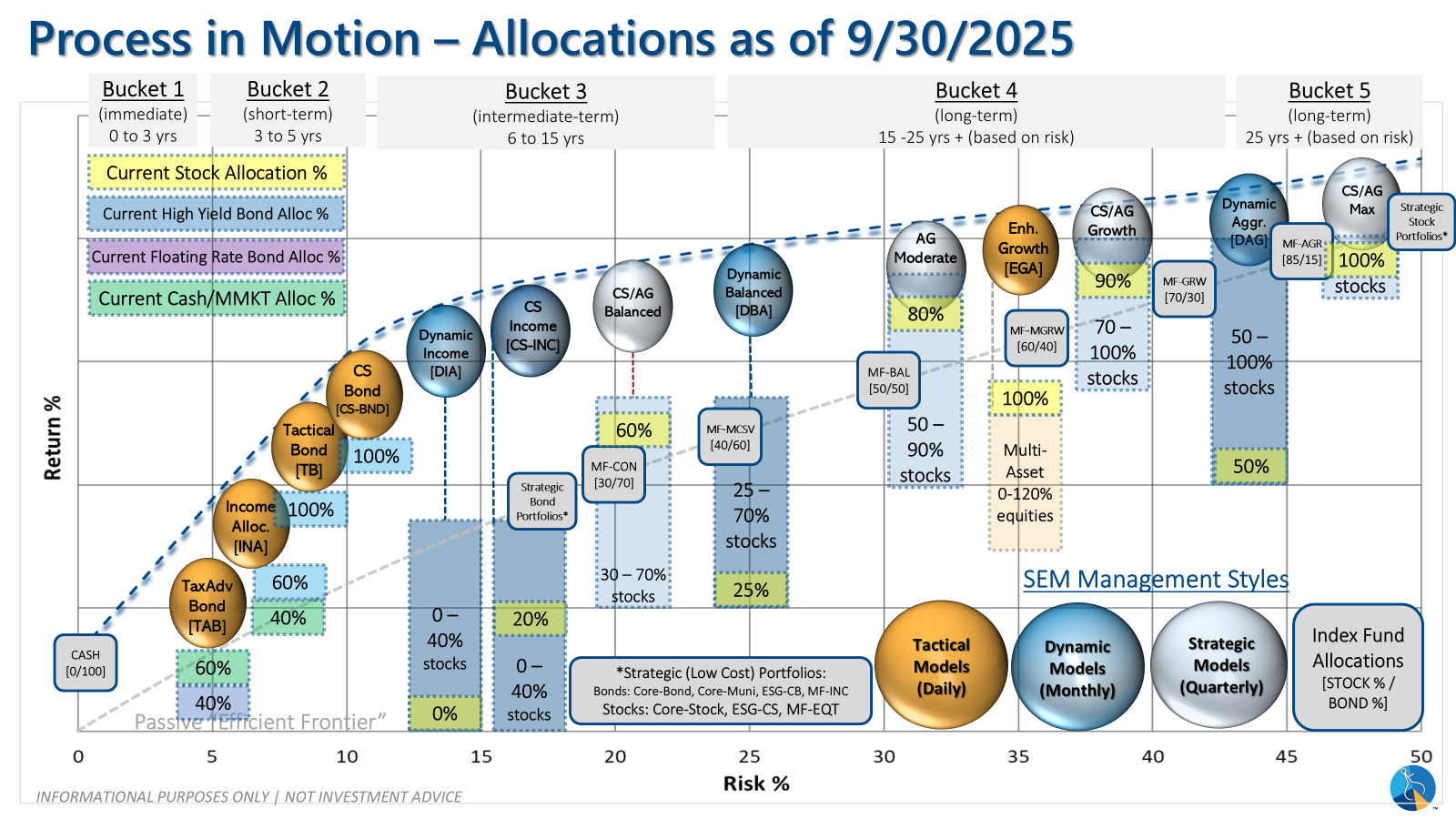

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

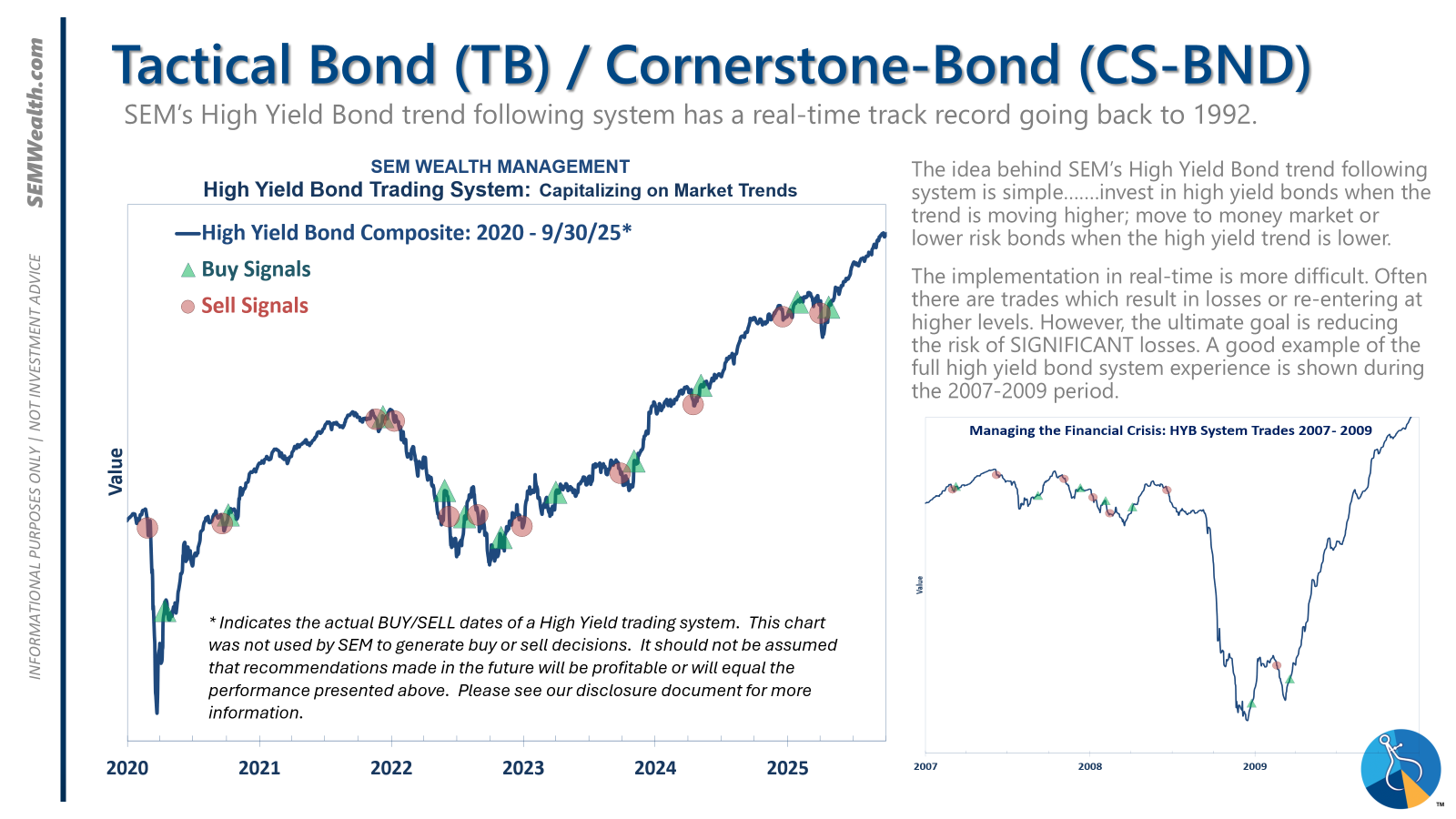

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

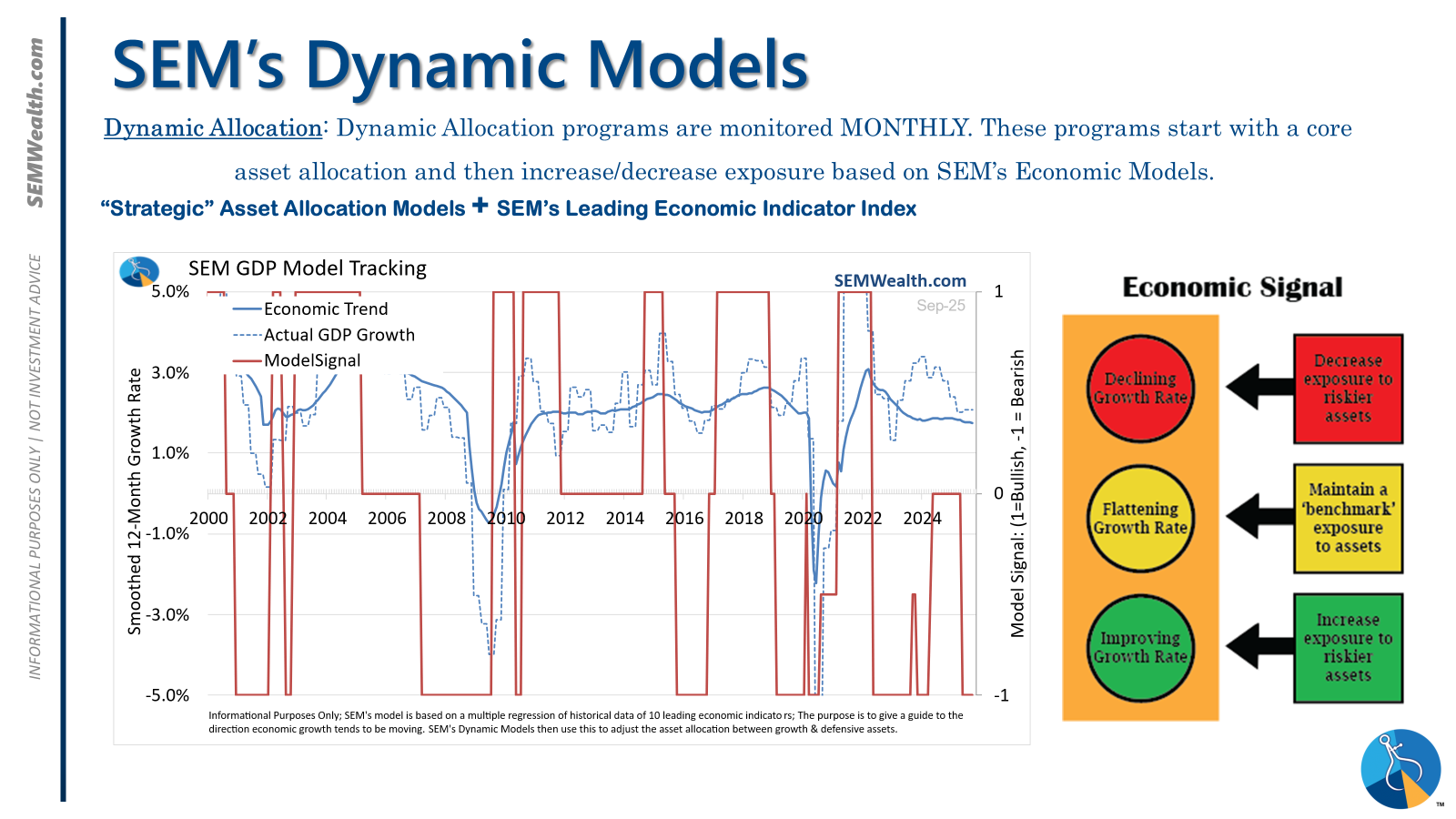

| Dynamic | Bearish | Economic model turned red – leaning defensive |

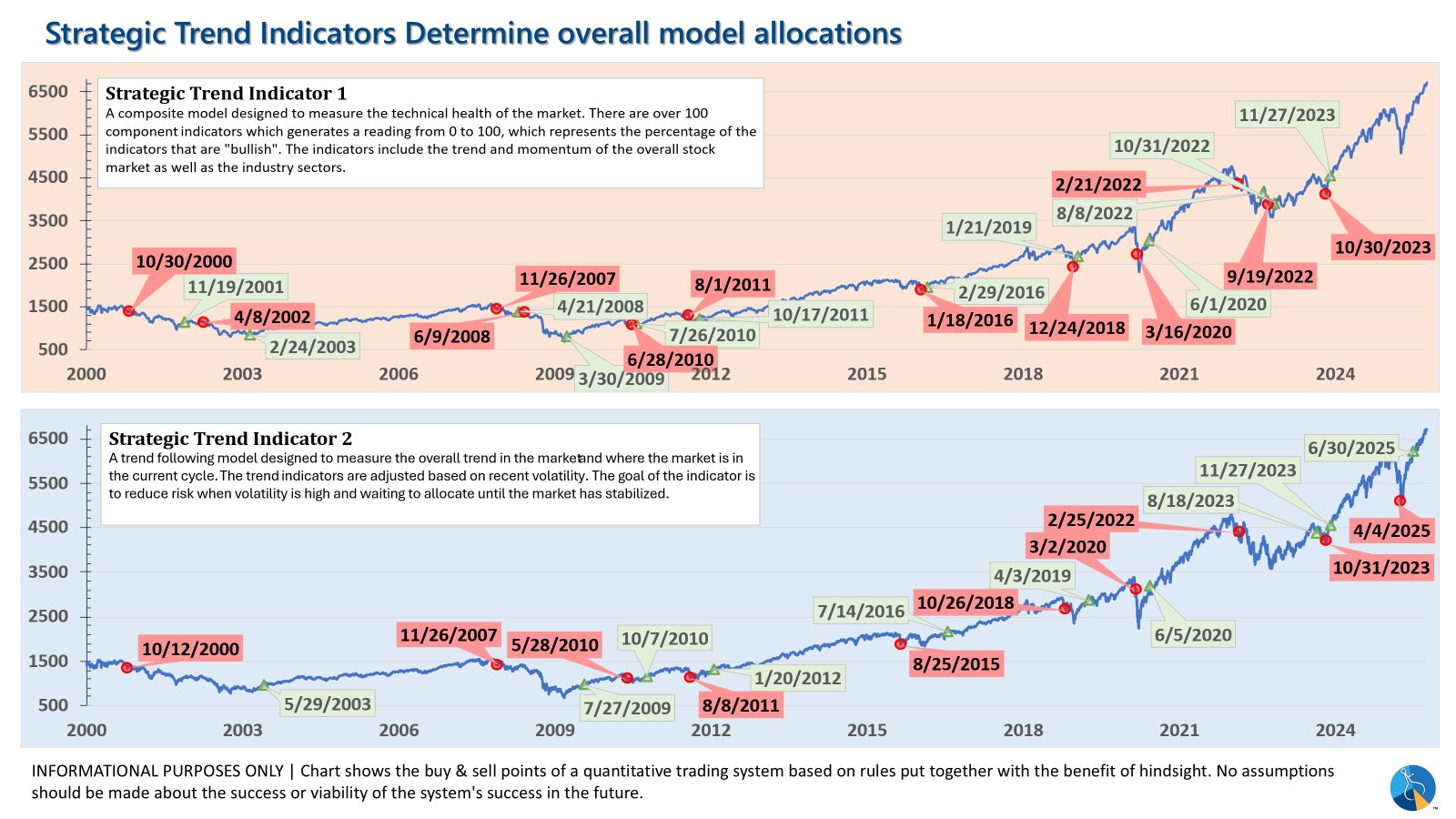

| Strategic | Slight under-weight | Trend overlay shaved 10 % equity in April -- added 5% back early July |

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire