Relatively speaking, last week was fairly quiet. We did have some Trade War 2.0 whiplash on Monday and early Tuesday and again on Friday, but based on the past month it was nice to focus less on the latest Truth Social post from the President and more on the earnings and economic outlook.

Update 1: Apparently on Air Force One yesterday traveling back from the Super Bowl, the President said he would implement 25% tariffs on "all steel and aluminum imports" starting Monday. He also said he was preparing matching, retaliatory tariffs for Tuesday or Wednesday.

We had a big chunk of the S&P 500 report earnings. A couple of things stood out as they relate to what is/was driving the market. Both Google and AMD had disappointing results and issued weaker guidance. Nearly every company talked about concerns over tariffs possibly causing higher prices, supply chain issues, and lower revenue. No company has specifically said they were lowering their guidance since nobody knows for sure what the ultimate trade policies will look like.

With that in mind, here's some of the things I'm thinking about as we start the week.

Controlling our Fear (and Enthusiasm)

As would be expected based on the political divide in our country, the first 6 weeks of the year have been a roller coaster. With over 3000 accounts spread across the country we have seen all sorts of predictions on what Trump 2.0 will mean for the economy, the markets, and life in general. I'm not saying it is wrong to have these types of emotional reactions, but it is important to try to take a step back and look at things as objectively as possible.

What I'm seeing right now is the opposite of the first few months of Biden's term. This time it is MSNBC, not Fox fueling fears of massive government overreach by the new administration. We've been fielding calls from concerned clients about Elon Musk and Trump taking over Social Security payments, cutting Medicaid payments to certain states, and even having access to their 401Ks. A quick watch of MSNBC last week shows constant discussion about the "power" the President has given Elon and how the president, "doesn't care about the constitution."

In 2021, Fox was doing the same thing regarding the Biden administration tapping into the wealthy's 401Ks and IRAs to pay for their "woke" agenda. There was also concern for quite a few months about the Fed taking over the banking system as well as making the dollar "worthless" to wipe out our debt.

Obviously any of the above would be a concern. If you enjoy watching the news, great, but please understand their primary goal is to keep you watching hour after hour, night after night. I have to watch the news – it's my job. I've been doing this for over 25 years. This has given me a good filter on finding out what to keep on my radar and what to throw out as sensationalized fear mongering.

Even more importantly, due to our size we receive daily research from the likes of Goldman Sachs, Morgan Stanley, JP Morgan, Blackrock, Pimco, Nuveen, Invesco, and many other Wall Street firms. It's not a conspiracy theory when I say this — if the current administration was planning on any of the things talked about on MSNBC (or F0x) and those things were likely to become a reality, Wall Street would know. When Wall Street knows something big is on the horizon, they start letting their largest clients know so they can protect themselves (or profit from it.) That's just the way the world works. No administration can implement their policies without the assistance of Wall Street.

Since I have to watch the news on behalf of our clients and advisors, you should focus on things which bring you enjoyment. My promise, as always has been this:

- If there is a MAJOR policy change that impacts the markets (or our clients), I will post a blog as soon as possible AND we will send it out via email to our clients and advisors (think back to 2022 or 2020 or for those of you around long enough with SEM, 2011 & 2008).

- If there is IMPORTANT changes being discussed we need to continue watching, it will be discussed in the blog each Monday. I keep notes throughout the week from all the research I've received, what's moved the market each day, and other things that have crossed my screens.

- If there is something that is NOT LIKELY TO HAPPEN I won't discuss it. I'm happy to address it privately (use the comment section at the bottom of the blog or the contact page if you have a question).

Trade War 2.0 Impacting Stocks

We started the week last week with a big sell off in stocks after President Trump followed through with his threat of tariffs on Canada, Mexico, and China over fentanyl, illegal immigration, and trade deficits. Whether these were simply bargaining chips to force Canada & Mexico's hand or not, Trump quickly issued a 30-day moratorium after both countries committed more troops to the border. I'll leave the commentary there as I don't believe anybody can successfully predict what the President will or will not do over the coming months and what his definition will be in determining whether either country is doing "enough".

[Removing your political leanings, we will not know until well after the fact whether President Trump's unprecedented actions are 'good' or 'bad' for the country. My guess is they will be a little of both because he is addressing things our country needs to fix, but also using tools that may do short or even longer-term damage to the structure of our country.]

The market rallied after the moratorium, but on Friday President Trump reminded everyone he is "not done" announcing tariffs and was preparing "retaliatory" actions "soon".

If you've read the blog at all the past month or two, you're probably tired of seeing this chart, but I keep posting it as a reminder. Trade War 1.0 was not fun if you were watching the markets every day (or week). The "process" of restructuring trade agreements was done in the public, often times over Twitter. The President would then wait for the reaction of the market and our trading partners and adjust his strategy.

The primary difference between the 1st and 2nd Trump Trade War is the President first focused on cutting taxes in 2017 before he started tackling trade in 2018. This time he has pushed the Trade War to the top of his agenda while Congress works on a plan to extend and expand tax cuts.

Consumers Not So Optimistic

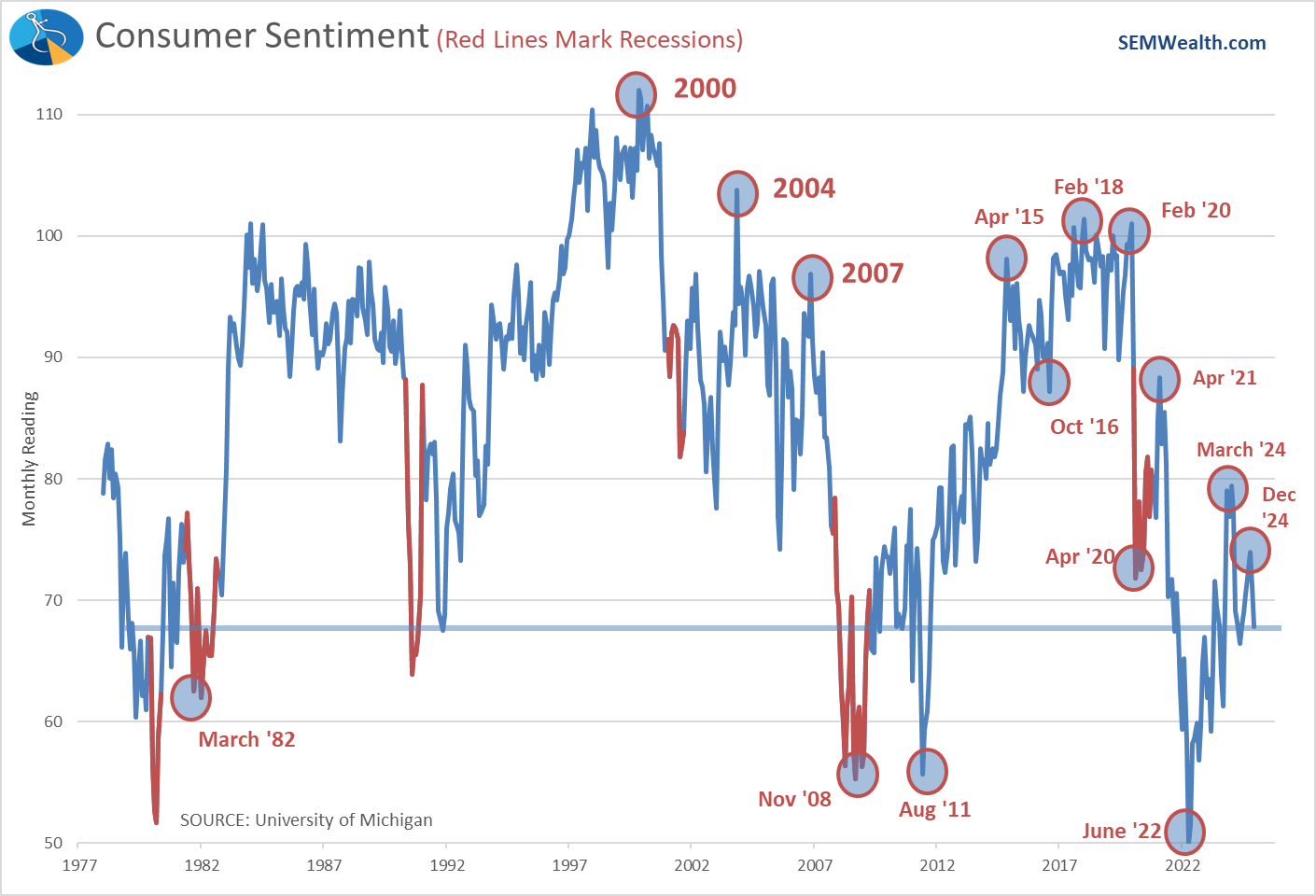

Unlike the reaction of the stock market to the re-election of Donald Trump, consumers have expressed angst. This could be due to many factors, but likely the primary one is the impact a trade war will have on consumer prices. Inflation expectations jumped for the 2nd month in a row, this time rising from 3.3% to 4.5%.

The market can (and has) overcome weak sentiment, but it could turn into a drag on spending and thus earnings. As you can see from the chart, this is a volatile number, but it is one we will need to watch closely each month now.

Labor Market Cools in January

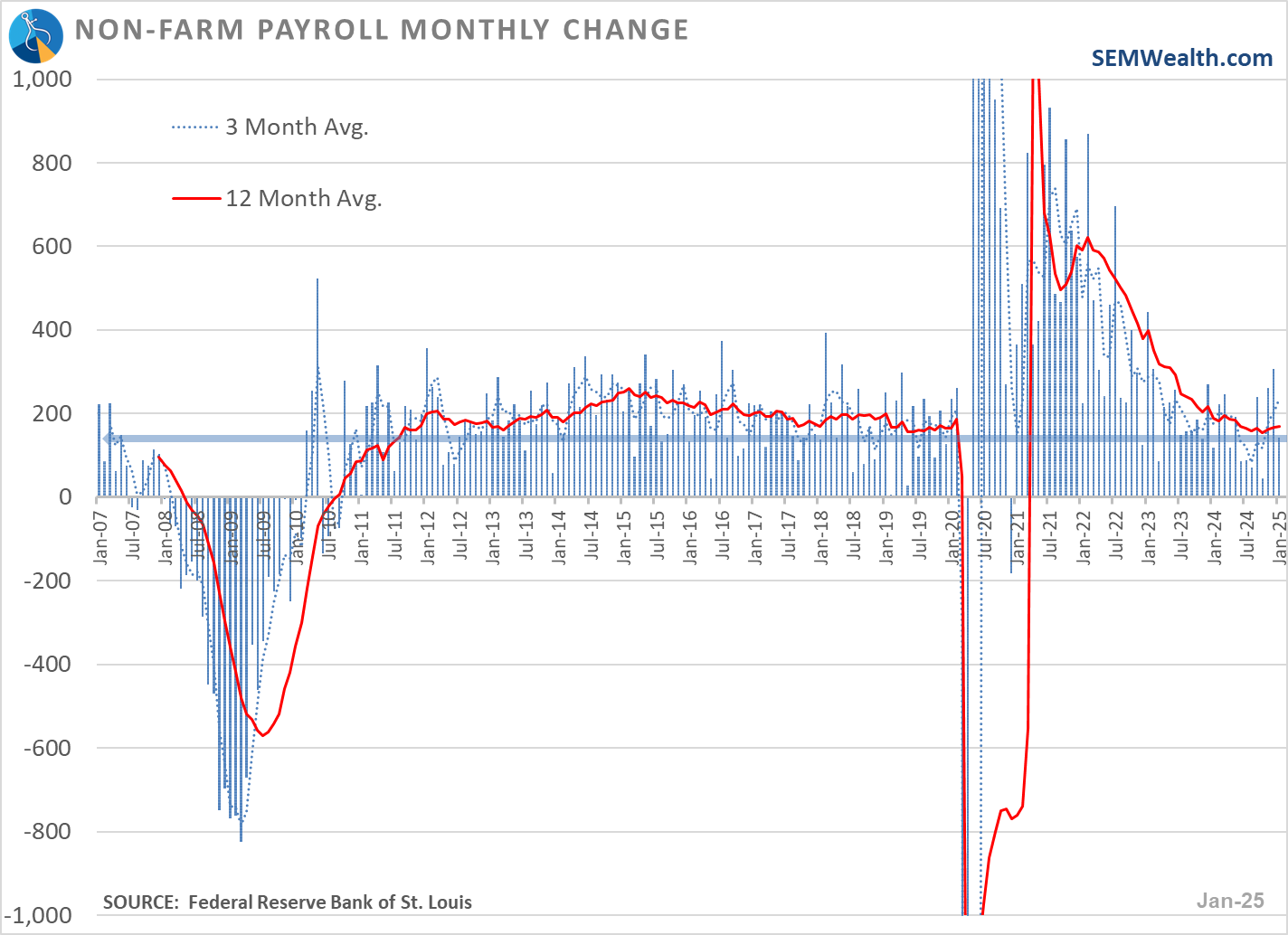

The January Payrolls report was what I would describe as 'decent'. Unlike the December report, it was not "too hot" which raised concerns the Fed may have to increase interest rates. The initial reaction was basically no reaction, with futures prices barely moving and a quiet open. The drop in prices was more of a reaction to consumer sentiment declining and more tariff threats (as discussed earlier).

The overall jobs picture looks like this. One month does not make a trend, but the number for January was below an already 'weak' 12-month average. It is generally thought a 'healthy' economy produces around 200-225K jobs per month. The 3-month average is still above that level at 250K, so everyone will be watching to see whether or not January was just a temporary blip.

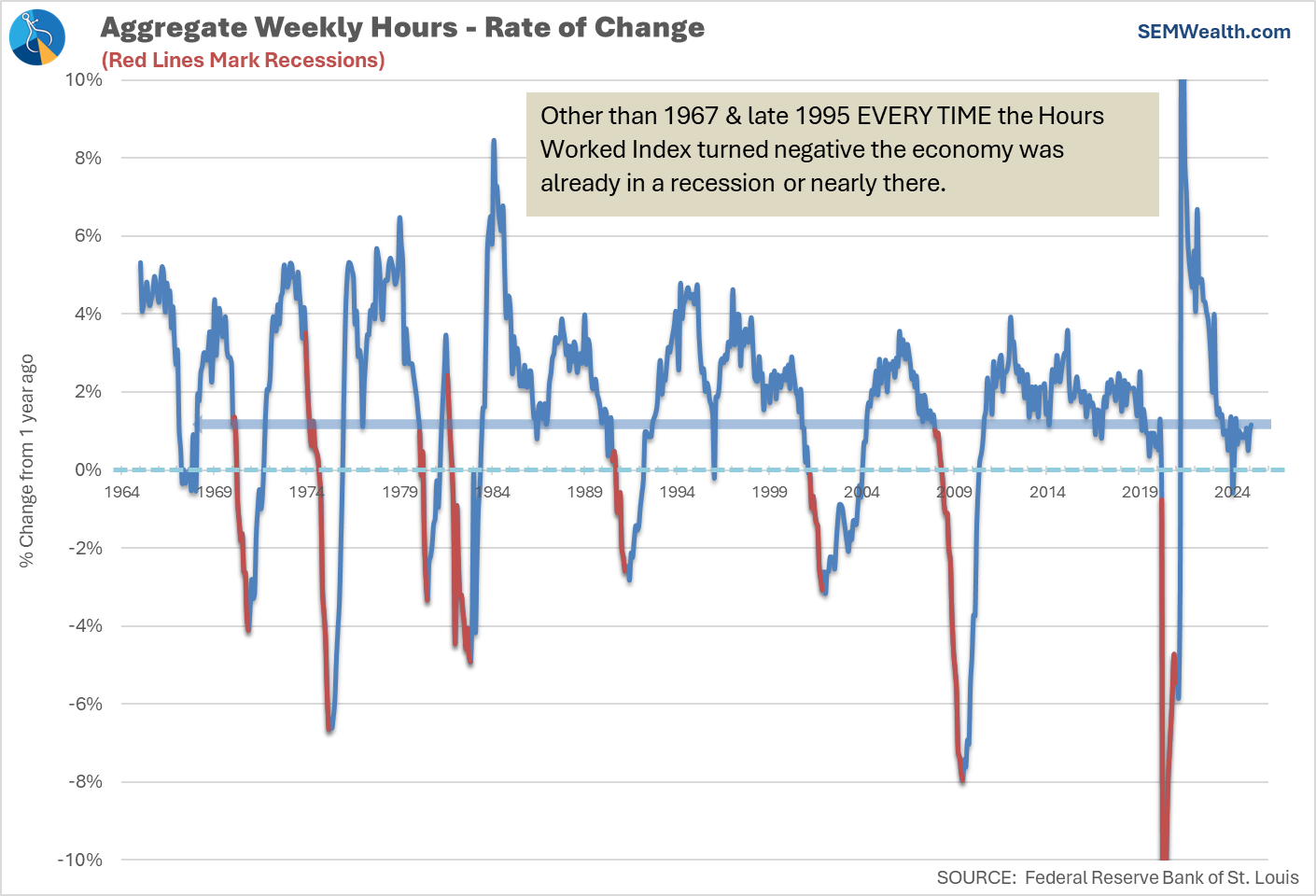

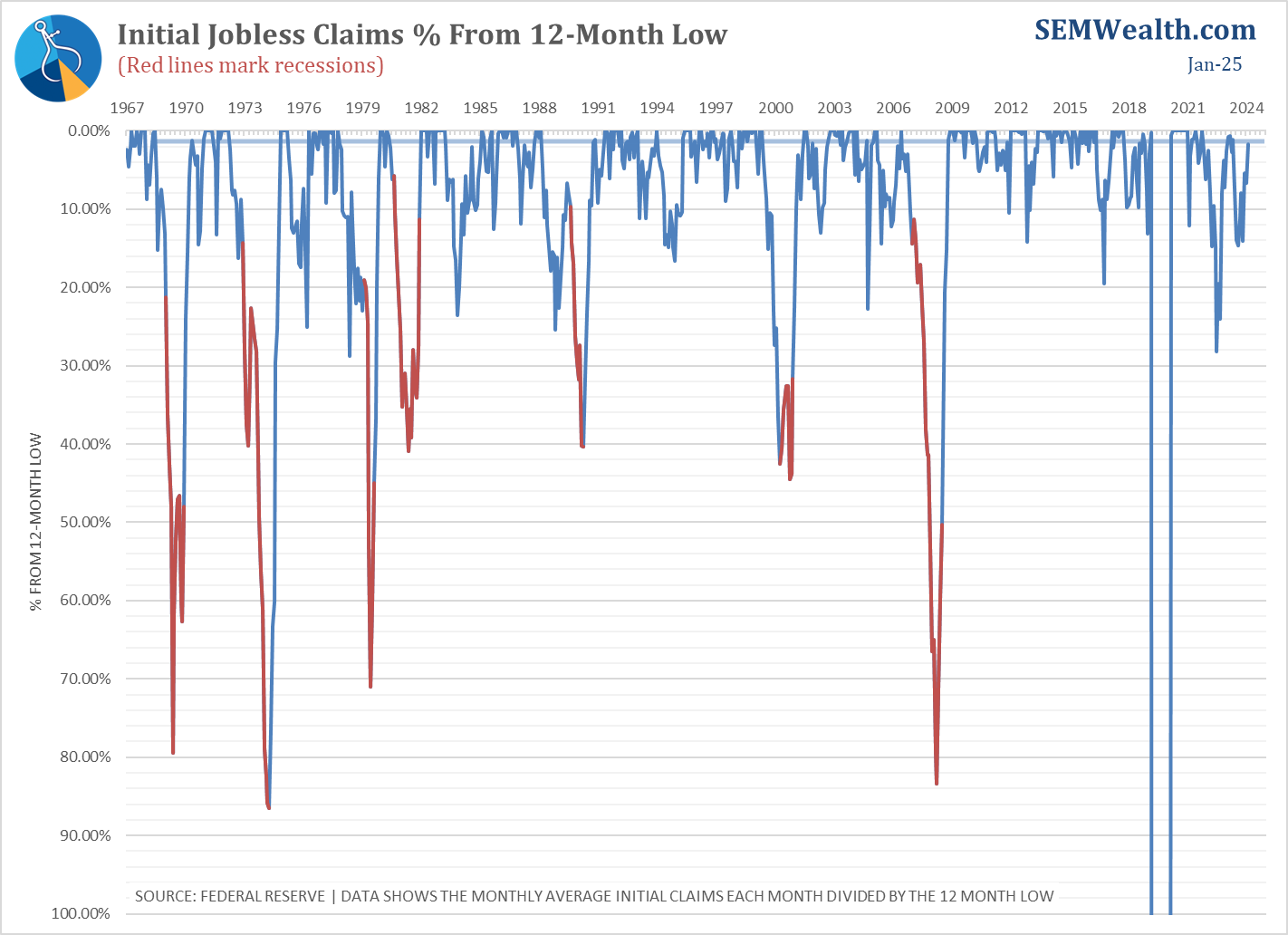

I like to watch both the Hours Worked chart & Initial Unemployment Claims. Both are not showing any signs of a labor market that is slowing.

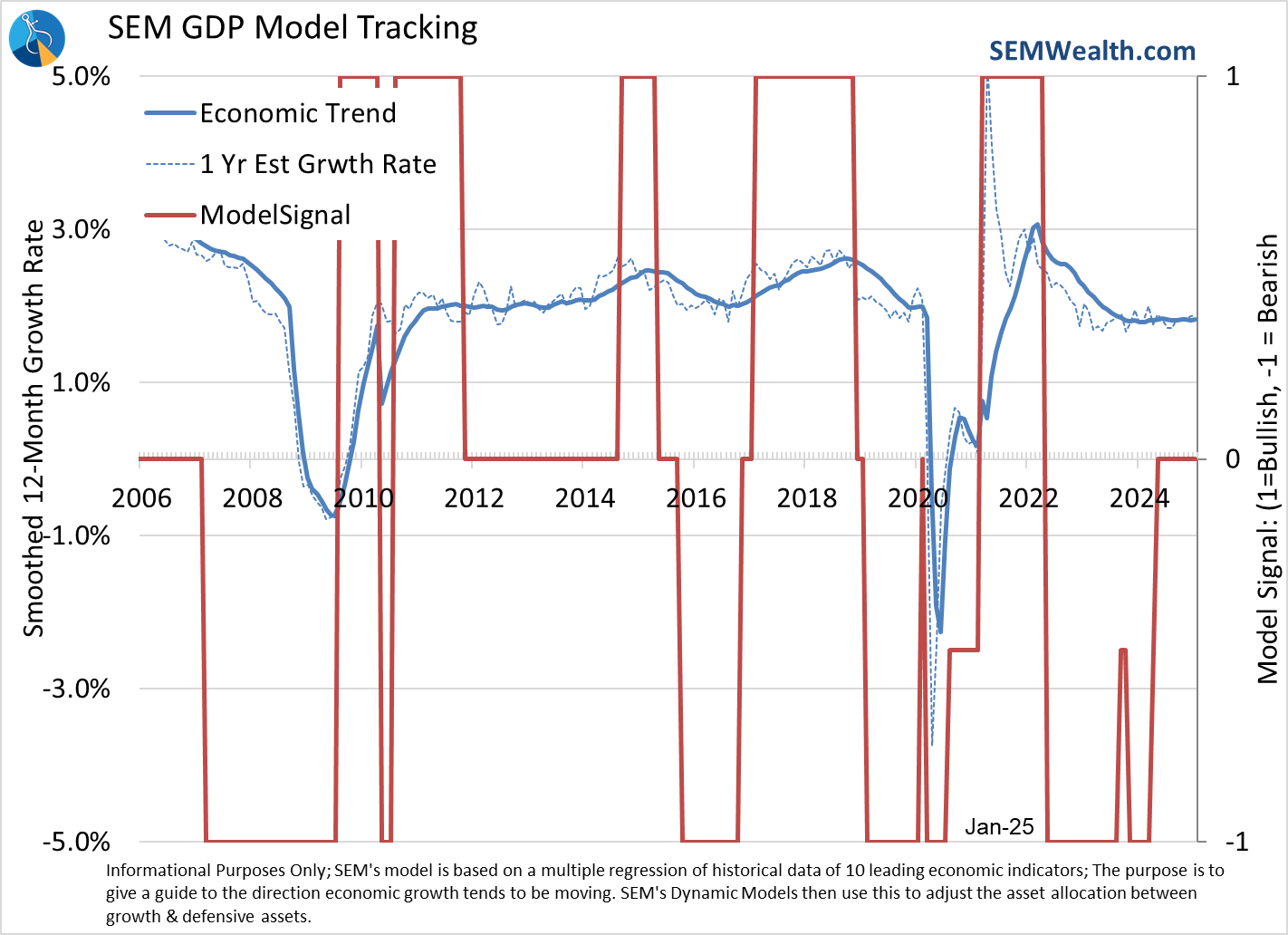

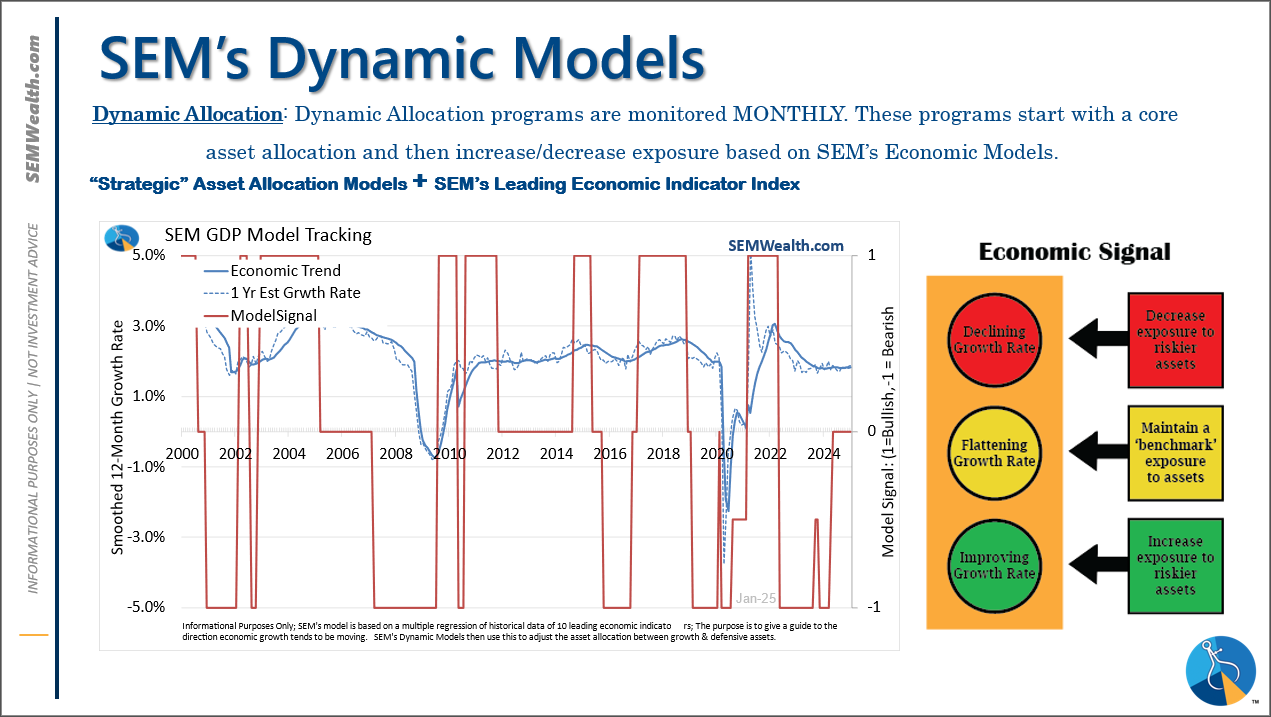

Economic Model Remains Neutral

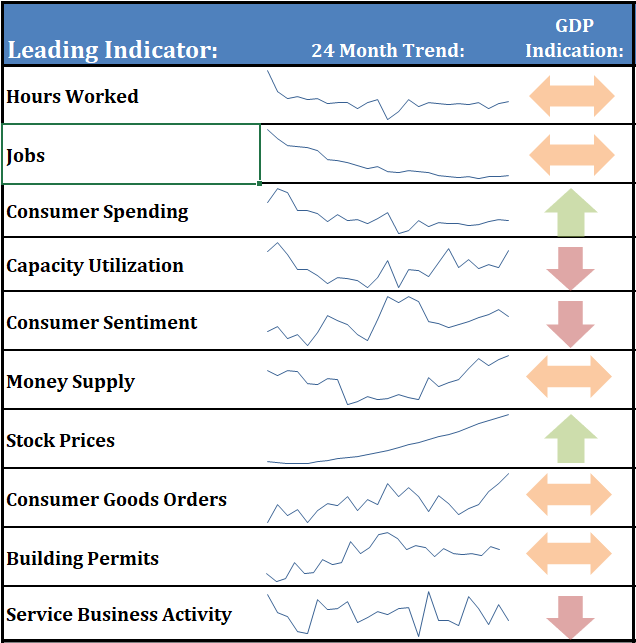

For the 9th consecutive month, our quantitative economic model remains "neutral". Various indicators have jumped around on our dashboard, but everything is still a mixed bag – not too hot and not too cold.

The thing that continues to surprise is Stock Prices. Stocks are a leading indicator because over the longer-term stock prices rise and fall based on the underlying economic performance of each company. If Wall Street believes earnings are going to slow, stocks will fall. For now, stocks and consumer spending are the only indicators pointing to "above average" growth. Which one is right? Will tariffs and weak consumer sentiment mark the end of the bull market or will we see resilience that eventually drags the rest of the economy higher?

No need to guess. SEM's models will be watching.

Market Charts

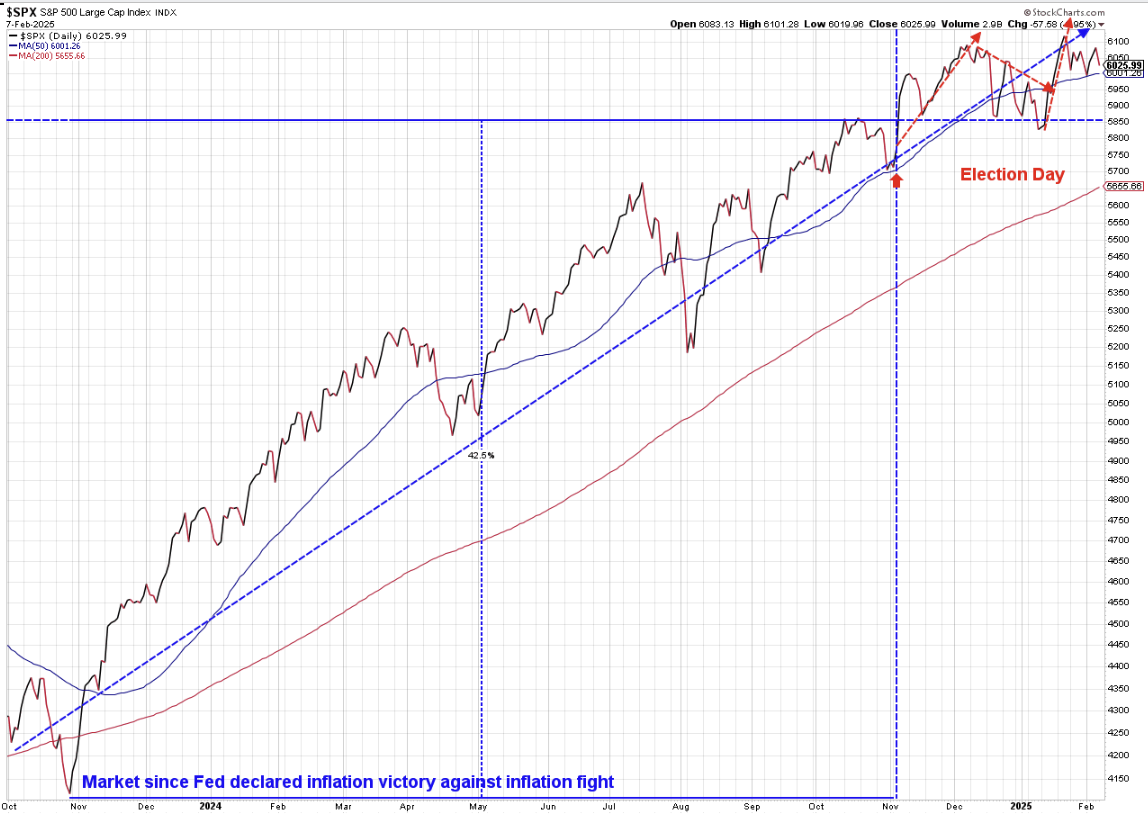

The Trump 2.0 Chart, which shows the S&P 500 daily fluctuations since the election shows how volatile the market has been so far. For the 2nd Friday in a row, rumblings from the President about additional tariff actions led to stocks closing Friday near the lows of the day.

The real chart to watch is the uptrend since the Fed shifted their inflation stance.

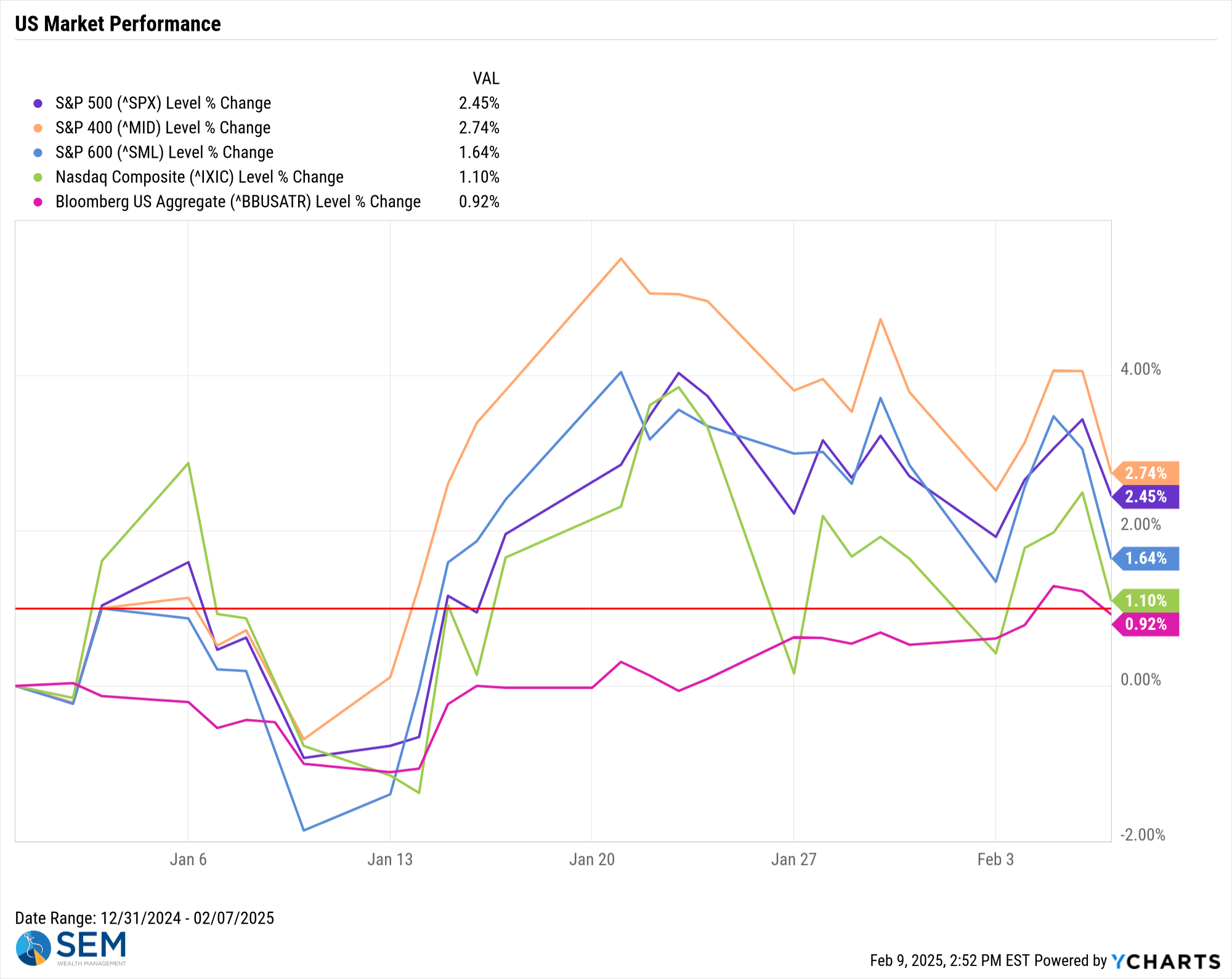

Looking at the market overall, Mid-caps continue to lead, but their lead has been lost. Small caps had a bad week as did tech stocks.

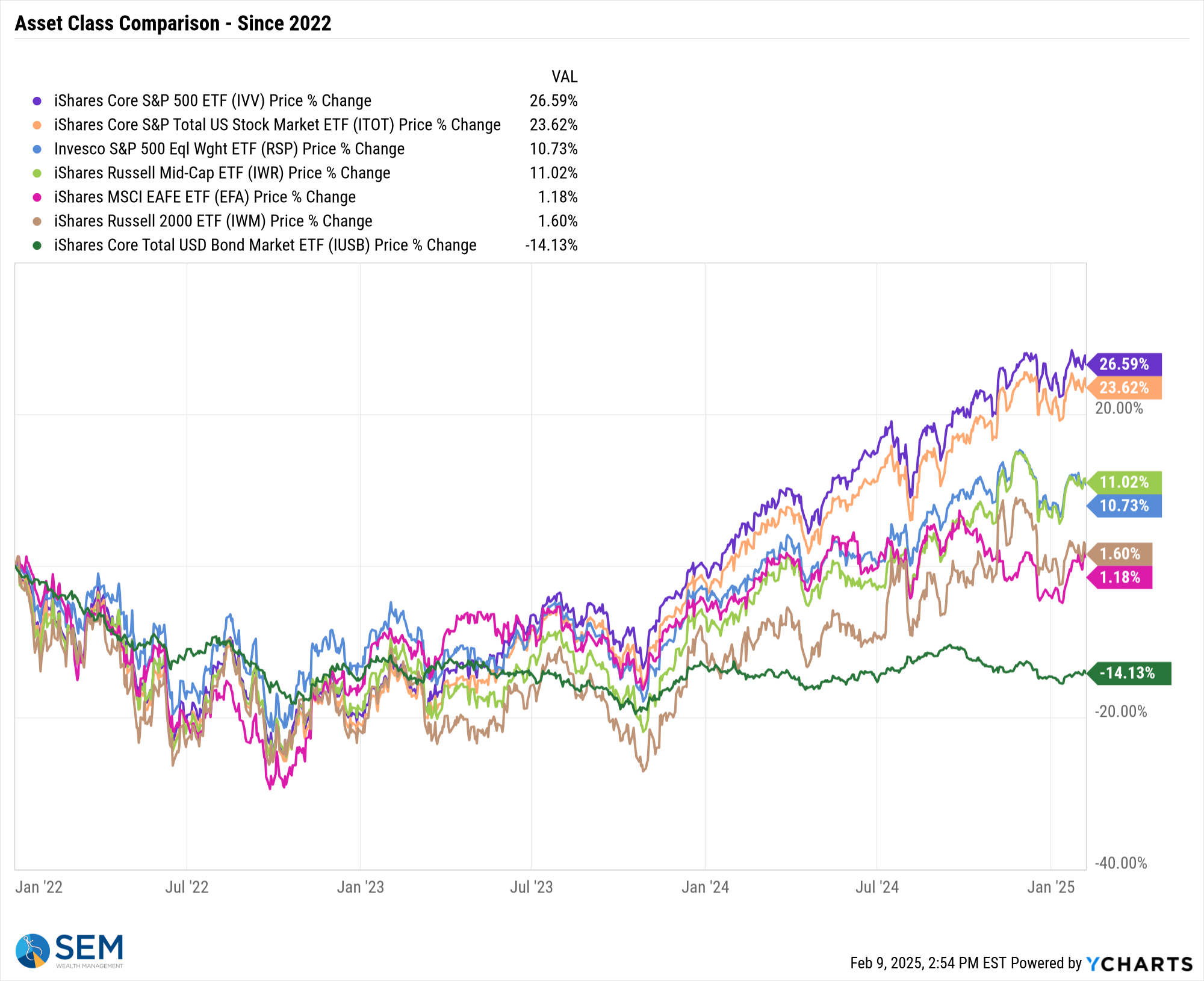

The stronger performance for mid-caps has been only recently. Going back to the peak in 2021, mid-cap stocks (and the equal weight S&P 500) have returned less than half of the S&P 500. Small cap stocks are barely above break-even and bonds remain down 14%.

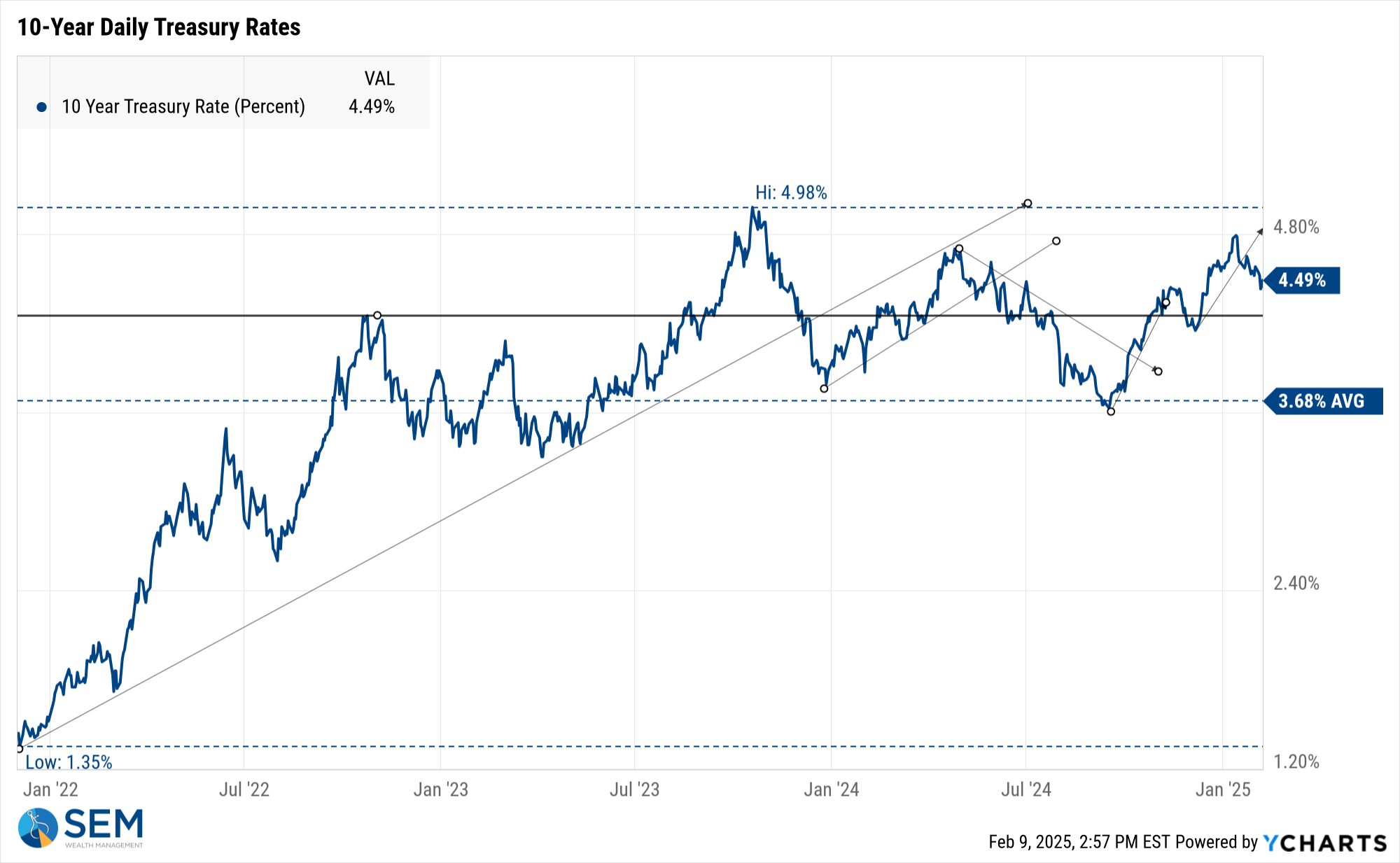

It was a somewhat better week for bonds, with 10-year yields dropping back below 4.5%. We've seen blips like this recently so it will be important for bond yields to continue moving down.

SEM Model Positioning

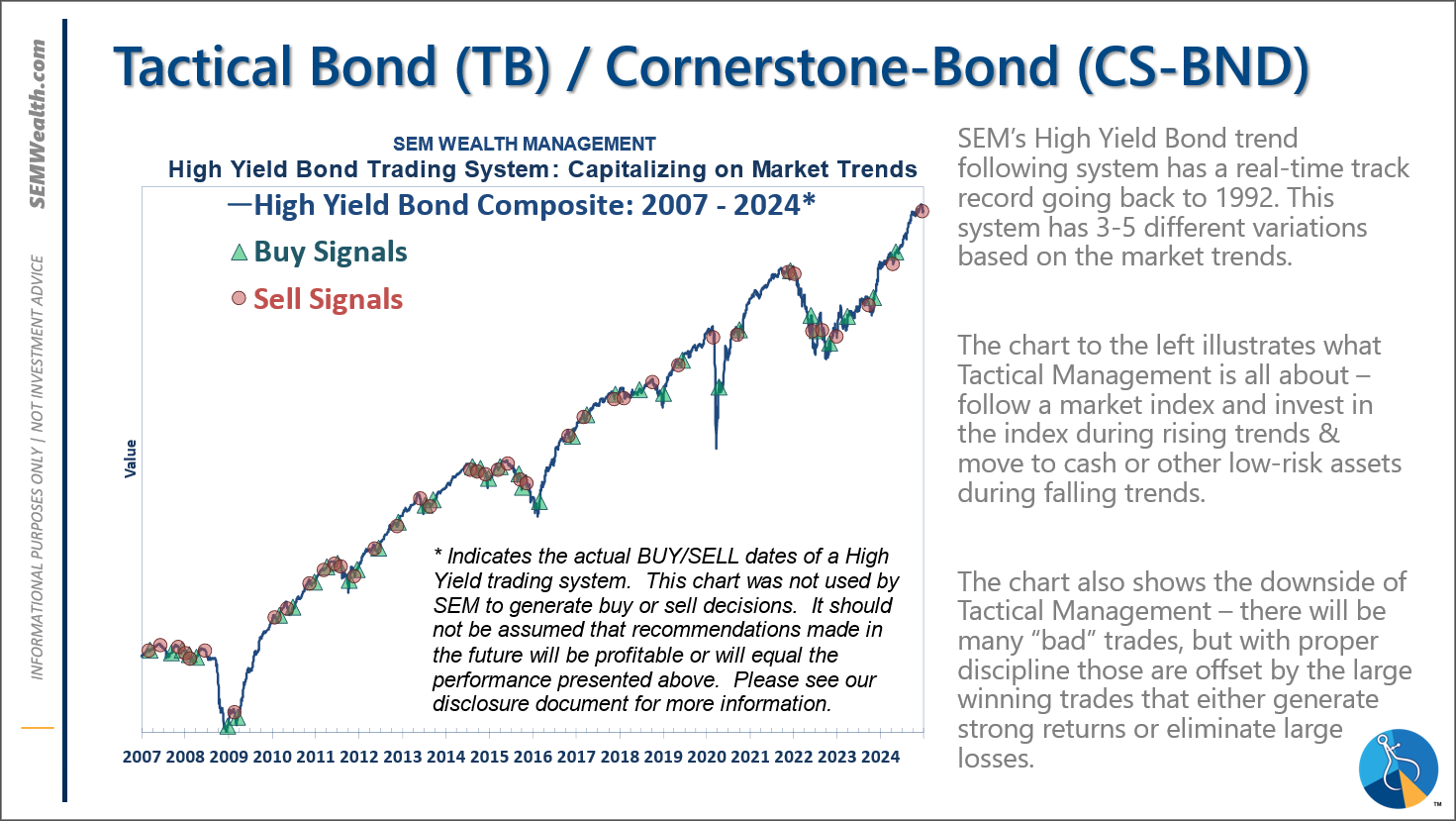

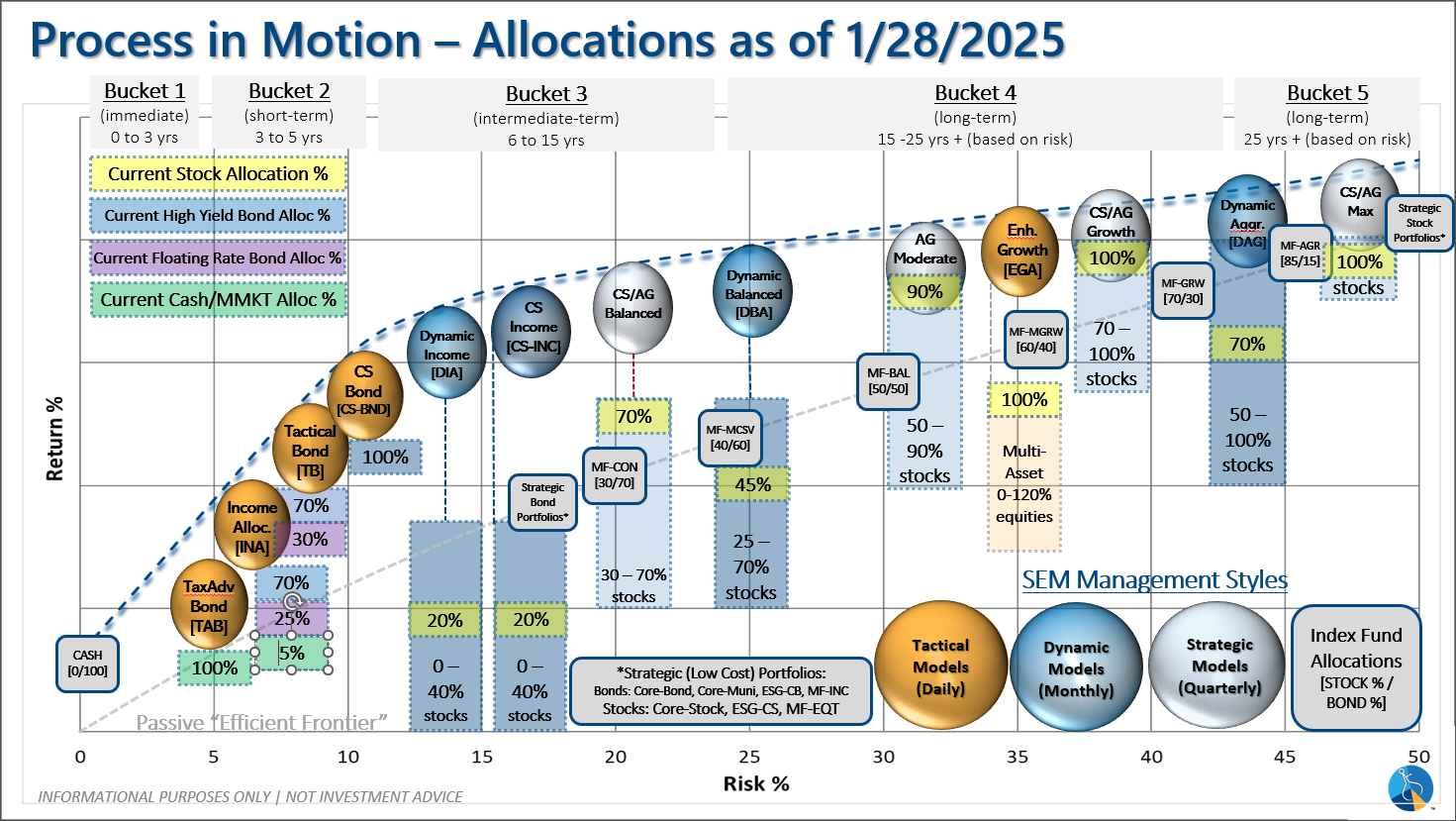

-Tactical High Yield reentered the high yield bond market on 1/27/25 after about 5 weeks on the sidelines. We had added a 30% position in floating rate bonds on 12/6/24, which currently have a 9% yield compared to a 6% yield in high yields and 4.6% in money markets.

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

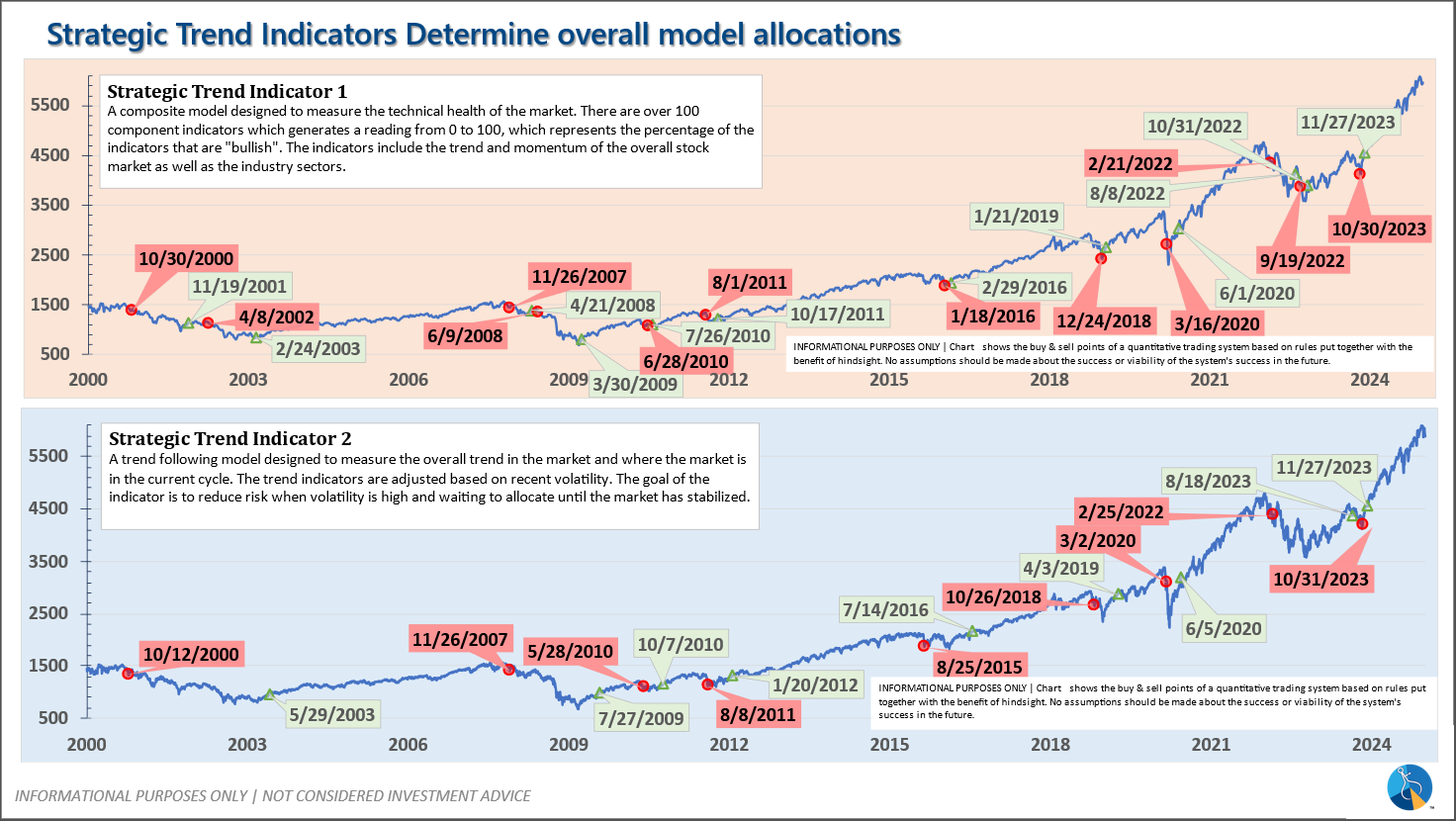

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 12/20/2024 our tactical high yield model sold out of high yield bond (about 70% of our holdings) into money market. The other 30% is invested in shorter duration, higher yielding floating rate bonds. These instruments are not as sensitive to credit risk and are typically allocated to in the early and late stages of a high yield bond move in our model.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*

: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire