Whenever an investment goes through a significant drop in value, you will always hear people say it is a "buying opportunity". You will also typically hear other people say the drop was a "reasonable correction". Over the past couple of weeks we've seen relatively minor news erase trillions of dollars of value in some of the biggest winners from the past two years. In all cases we heard both arguments.............so are these big drops buying opportunities or reasonable corrections?

The answer really comes down to whether or not you (or the market) believes the gains from the past two years were reasonable based on strong fundamentals or a mania driven by natural human greed. For each asset class/stock/precious metal/cryptocurrency the answer could be different. The past couple of weeks we've seen a blizzard of seemingly minor news stories lead to 10%+ drops in a wide range of investments. I tried to take notes of the ones that were most important as we went through the week.

Here are some of my thoughts:

The SAASpocalypse

I saw this term several times last week and thought it was clever. SAAS – Software as a Service, is a buzzword that led to the redemption of many companies who had to pivot from having their software installed via a disc/CD to selling subscription based services. IBM and Microsoft are the two biggest names who made this pivot over the last decade, literally changing the prospects of their companies around. Instead of selling physical software, they instead sell licenses via subscription – much lower overhead and a much more stable recurring revenue stream.

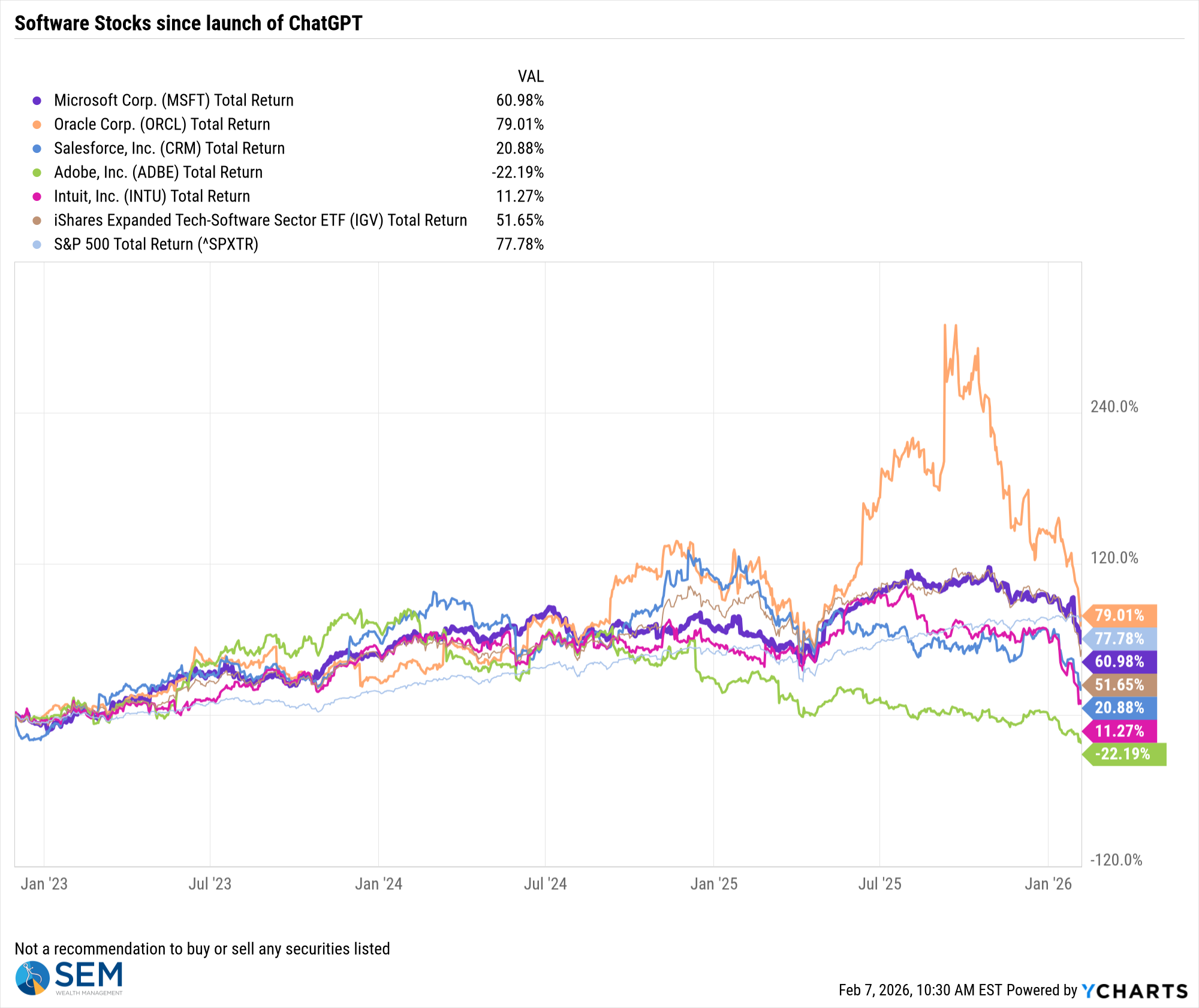

Along with Microsoft, companies such as Adobe, Oracle, Intuit, and Salesforce have enjoyed strong gains the past few years. All have announced big spending on AI initiatives and thus enjoyed huge gains in their stock prices. Last week that changed when Anthropic's Claude launched an AI Cowork tool that suddenly made investors consider whether or not some of the biggest names in technology were facing extinction as AI makes it easier for businesses to code their own software and apps.

I have MANY thoughts on this, but given all the other items on my list will save that for another time. We don't invest in individual stocks (other than our Momentum Stock Model and Patriot Portfolios) so thankfully I don't have to breakdown this threat for any of our holdings.

Is this sell-off a buying opportunity or a reasonable correction given the new news last week? That depends on whether or not you believe the rally in these stocks the last few years was based on solid fundamentals which are still in place, or if the stock was swept up in overly optimistic AI enthusiasm.

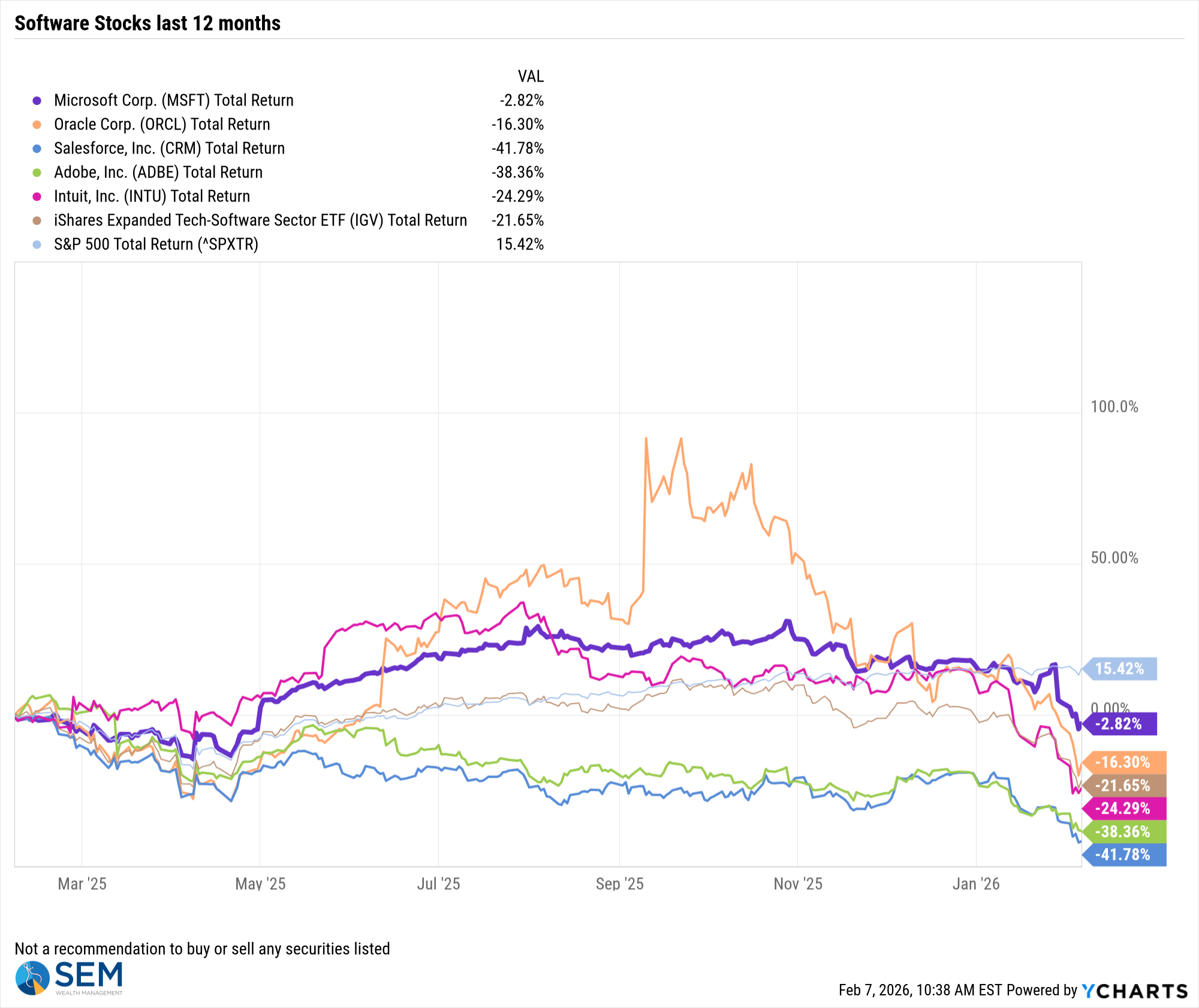

While last week's sell-off in SAAS stocks was alarming, the bulk of these stocks have actually been struggling for the past year.

One thing I've said in many meetings and several times in the blog — the key question is whether businesses and consumers will pay increased subscription fees for the "AI tools" all of these companies are offering and most importantly, will the increased sales offset all the money they've spent on AI. So far, it appears the market has decided they will not, which brings us to the next and more important point...........

Will the Data Center Spending Pay Off?

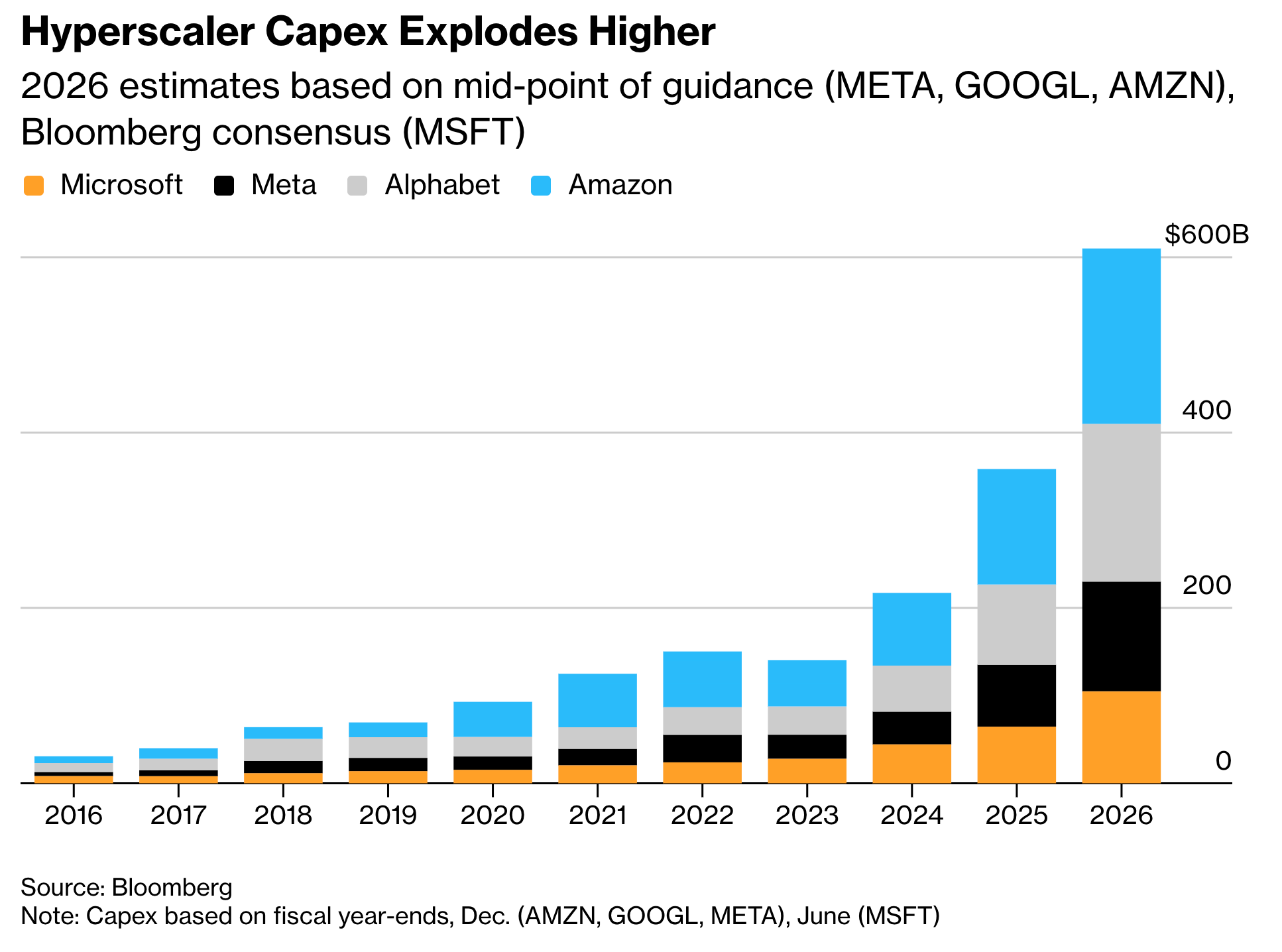

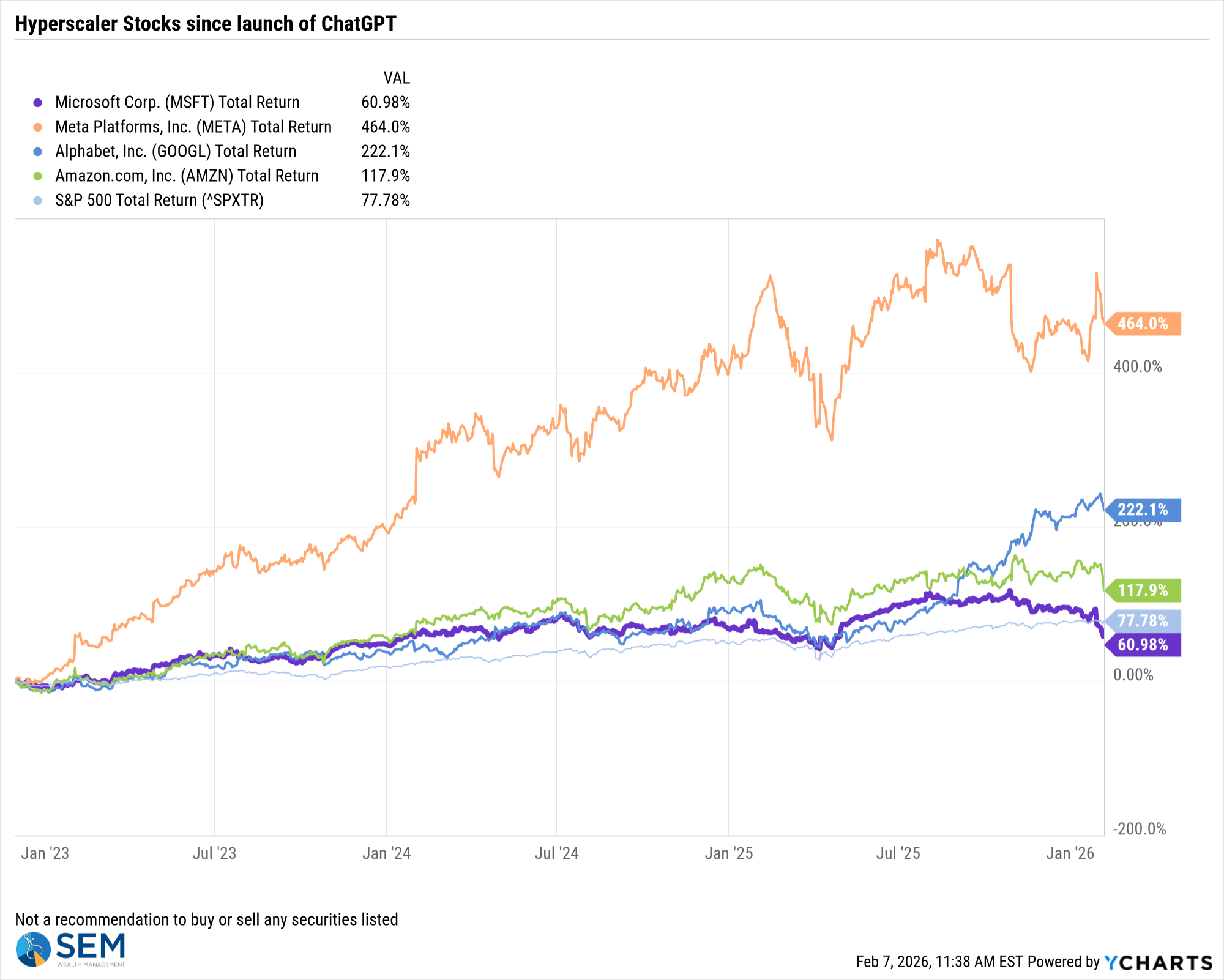

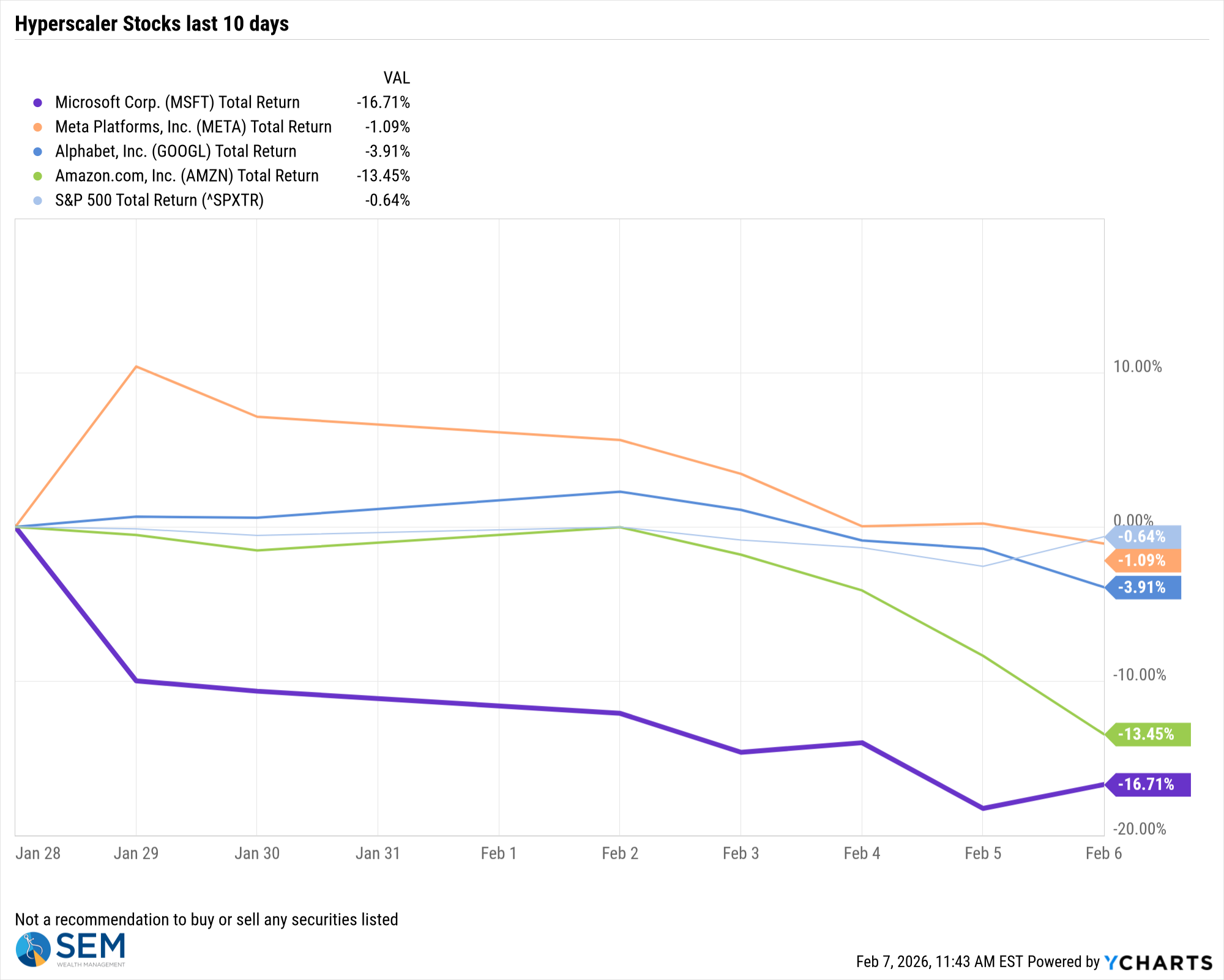

It wasn't just software stocks taking big losses the last few weeks. The s0-called "hyperscalers", the companies spending hundreds of billions of dollars each to build data centers were hit when they announced an increase in their planned spending for 2026.

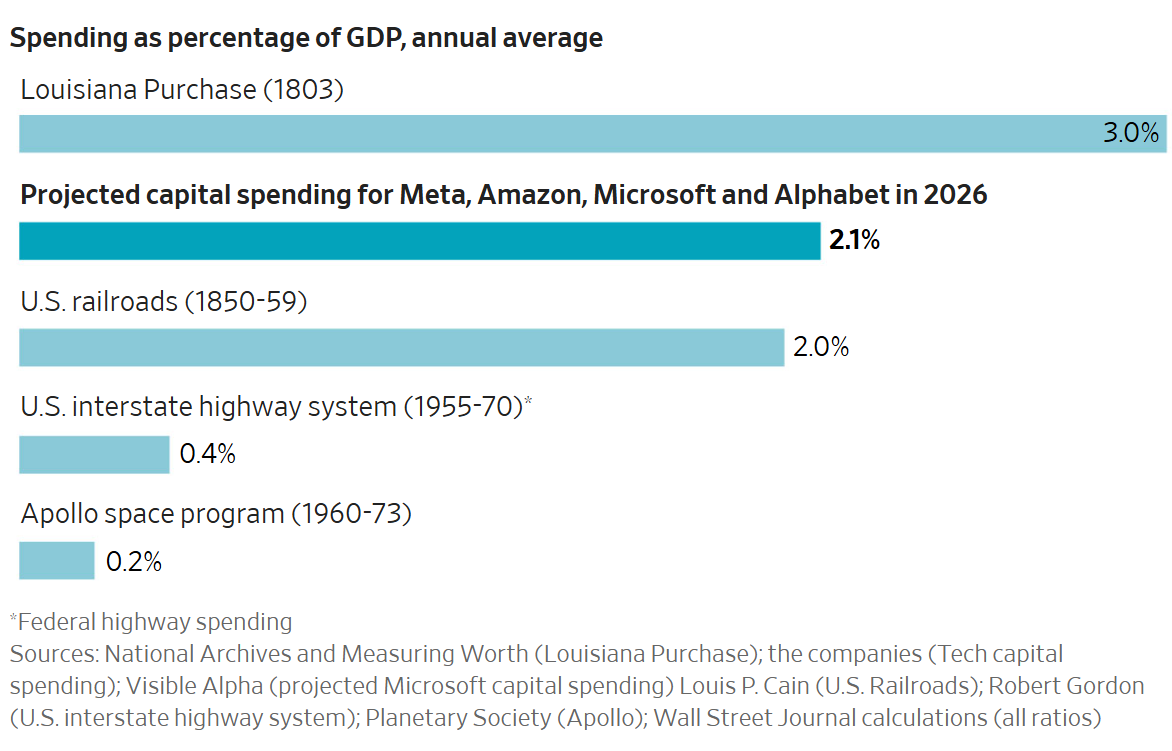

Over the weekend, the Wall Street Journal posted an article comparing the spending of the hyperscalers to other large build-outs in our country's history.

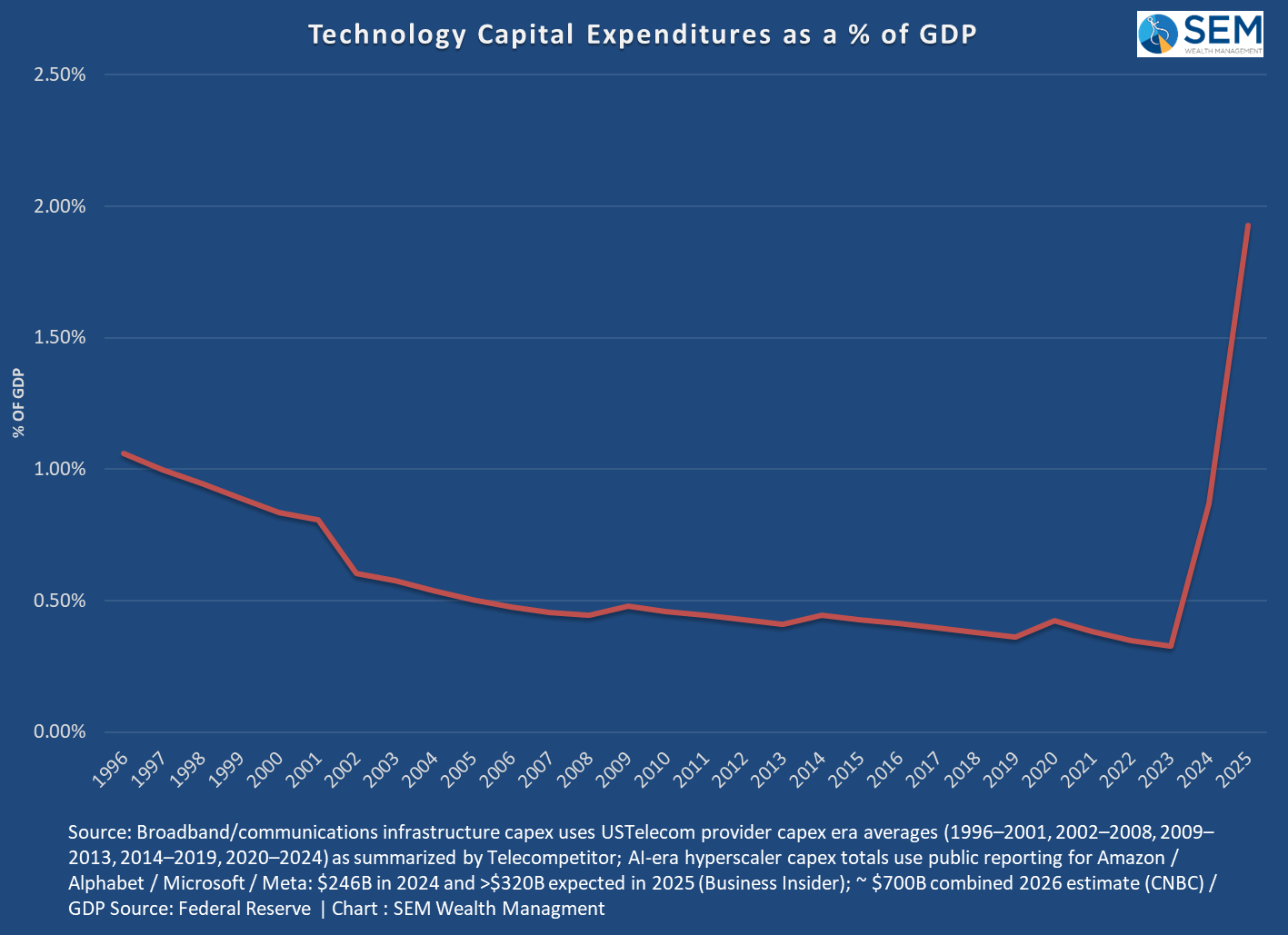

This led me on a side-quest because I was curious why they didn't include the capital expenditures for our country's broadband buildout. It took my quite a bit of time, but I was able to piece together the data from several different resources. The problem of course is the broadband buildout that was the driver of the tech bubble in the second half of the 90s is still going on today. Our house in Virginia finally was able to get fiber internet in 2024 with our office getting upgraded shortly after that. In other words, it is still going on today.

Since the broadband buildout has some overlap with the data center/AI buildout, I decided to split the data on technology capital expenditures using the rollout of Chat GPT at the end of 2022 as the dividing line.

Over the 5 year period from 1996-2001, the broadband capital expenditures averaged 0.8% of GDP – double the spending on our interstate highway system, but nowhere close to the spending on railroads or what we saw last year on data centers.

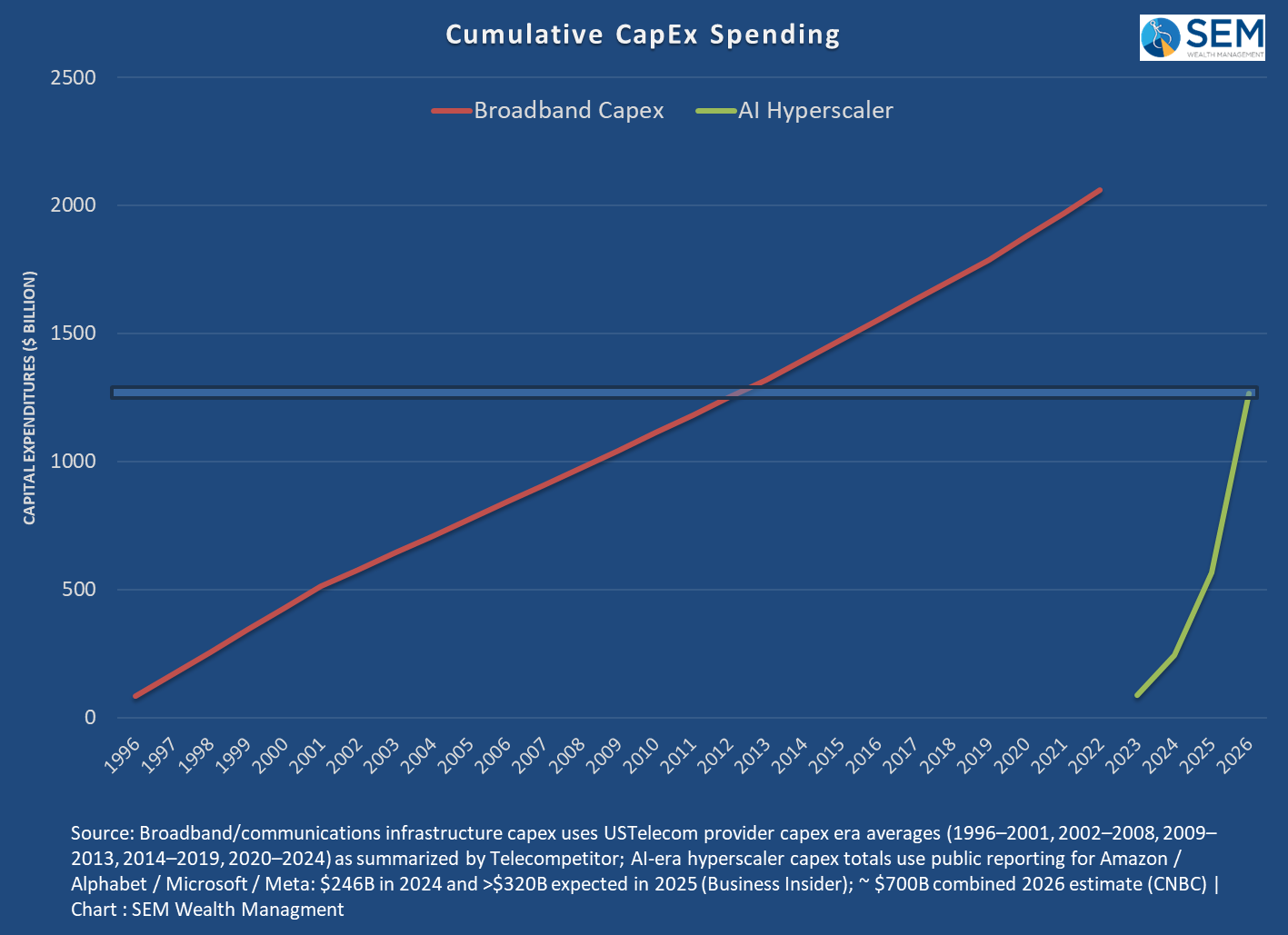

The amount of money being spent is staggering. In just 3 years, the hyperscalers have spent as much on data centers as was spent for the broadband buildout from 1996-2012!

Is this sell-off a buying opportunity or a reasonable correction given the new news last week? That depends on whether or not you believe the rally in these stocks the last few years was based on solid fundamentals which are still in place, or if the stock was swept up in overly optimistic AI enthusiasm. The cash spending was rewarded – any new announced spend led to large increases in their stock prices.

Microsoft and Amazon took the biggest hits following their earnings announcement. Even though both saw Azure and AWS growth (where they house their data center spending) strong. It was "disappointing". We are currently living in a world where a company can grow their top business segment by 39% and 24% respectively and see their stocks lose $200-$300 billion in market cap in a single day.

Microsoft had $38 billion in capital expenditures last quarter and Amazon had $38 billion. For context, Microsoft's Azure revenue was $33 billion and Amazon's AWS saw $36 billion in revenue.

Like with software companies, the key question is whether businesses and consumers will pay increased subscription fees for AI and most importantly, will the increased sales offset all the money they've spent on AI. How long will these companies be allowed to spend more on "investments" than they generate in revenue?

This brings me to the next topic..................

Is data center financing at risk?

Throughout the 4th quarter I discussed my biggest concern with the market rally – the circular and increasingly creative ways companies were financing the data center buildout.

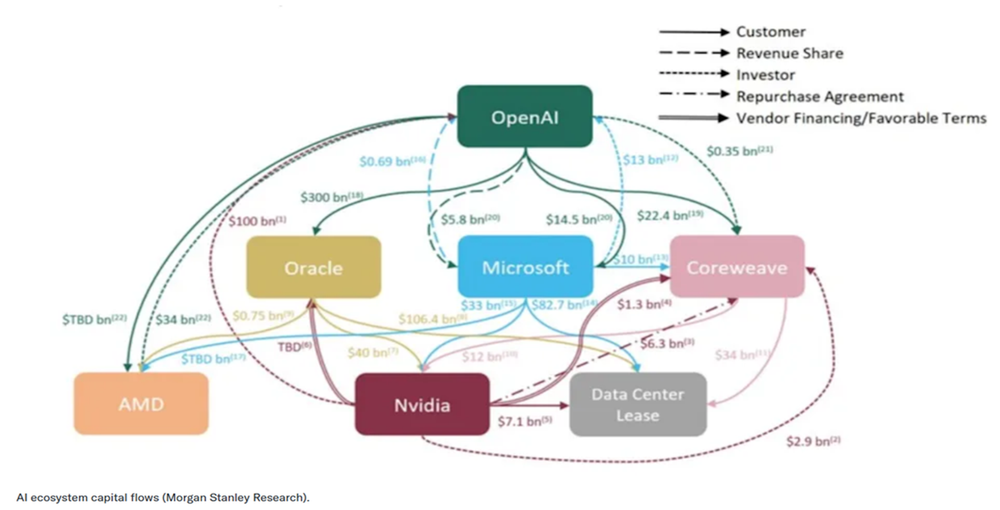

I've shown this chart often from Morgan Stanley highlighting the capital flow with Open AI.

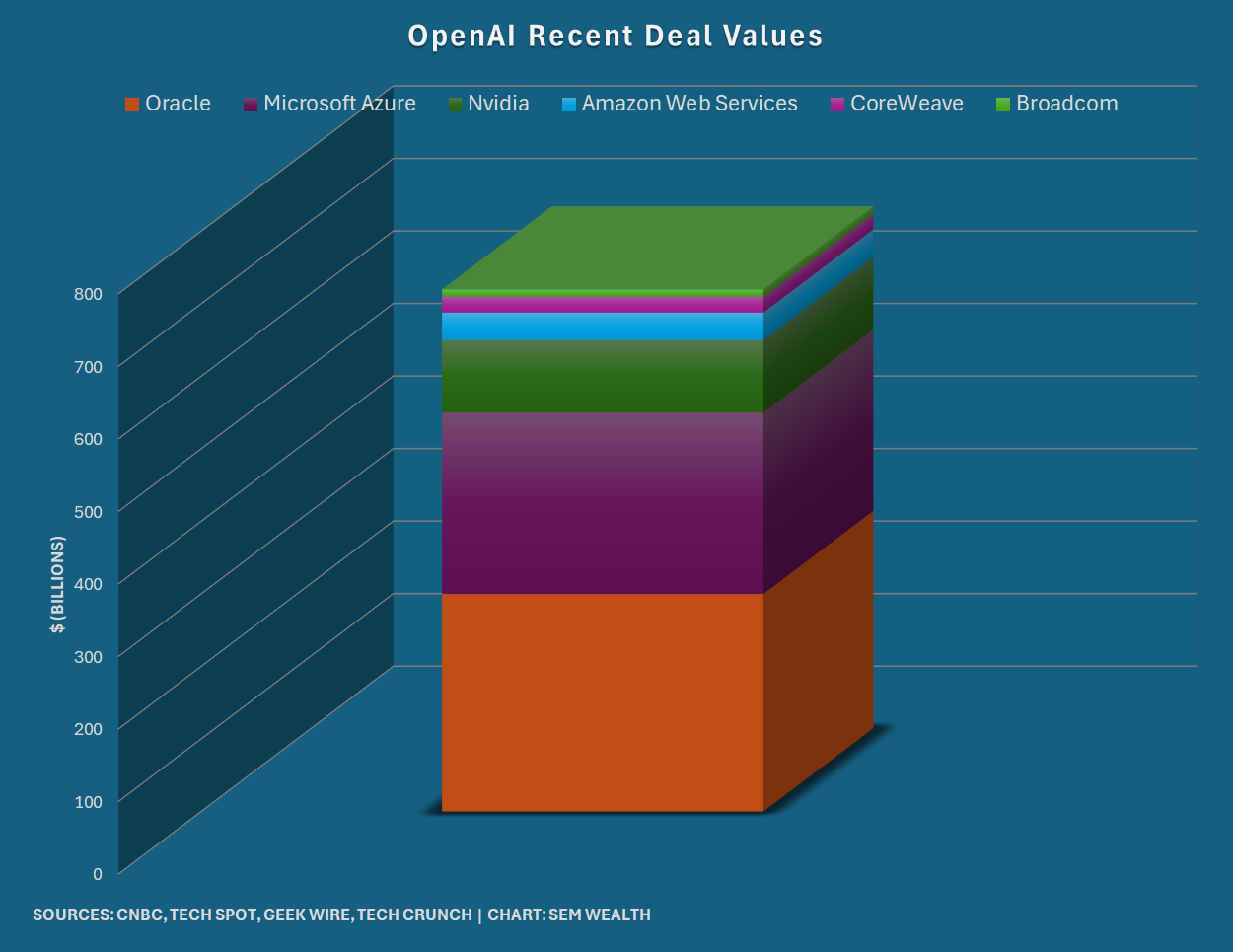

Toby also put together this chart of the commitment's OpenAI had made over the past year (which at the time led to huge increases in the stock prices of those companies.)

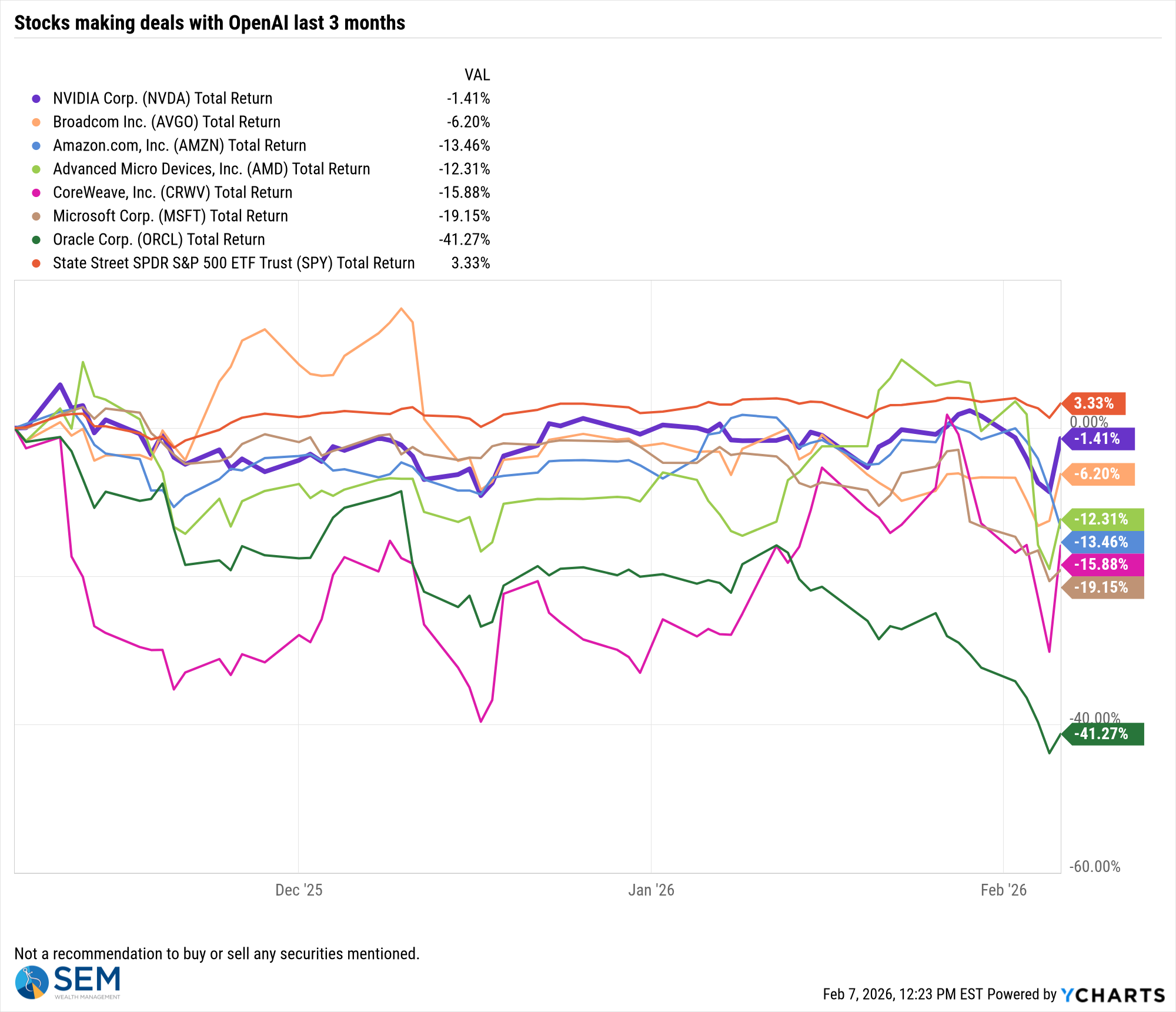

It has been a roller coaster ride for these companies since November (which is around the time Google's Gemini came out with an update that moved them ahead of ChatGPT's abilities — at least according to the industry experts.)

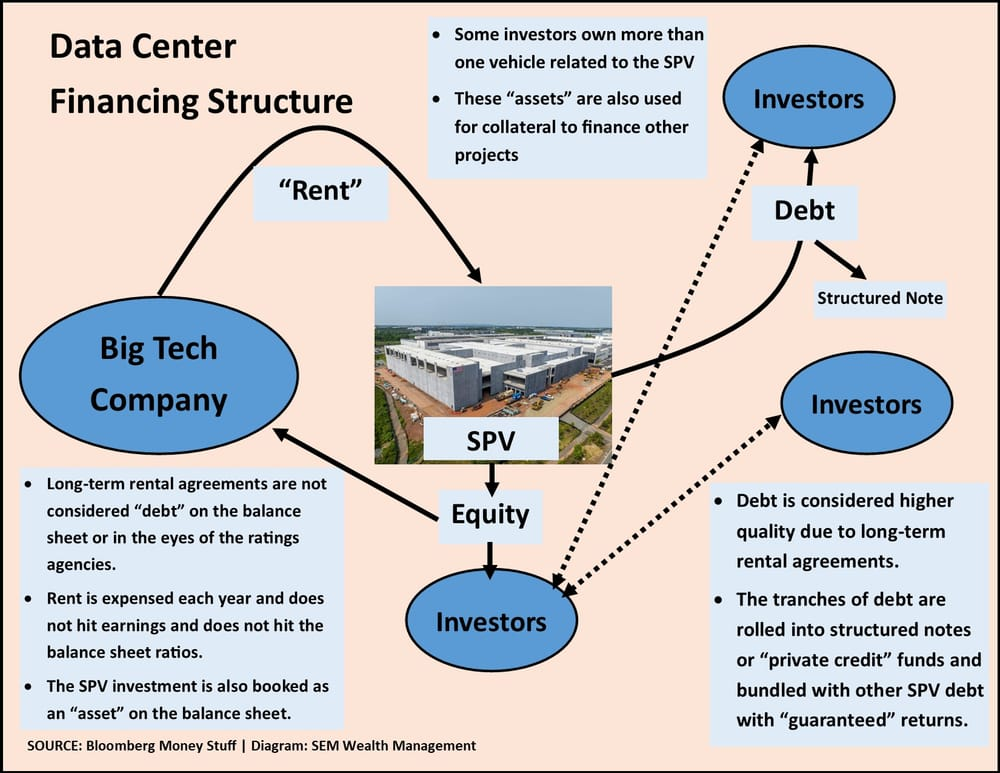

As these deals came out I also put together this diagram to describe the ways some of the newer data centers are being financed. The hyperscalers cannot keep spending their free cash flow on this buildout and they don't want to add debt to their pristine balance sheets, so their bankers have gotten creative.

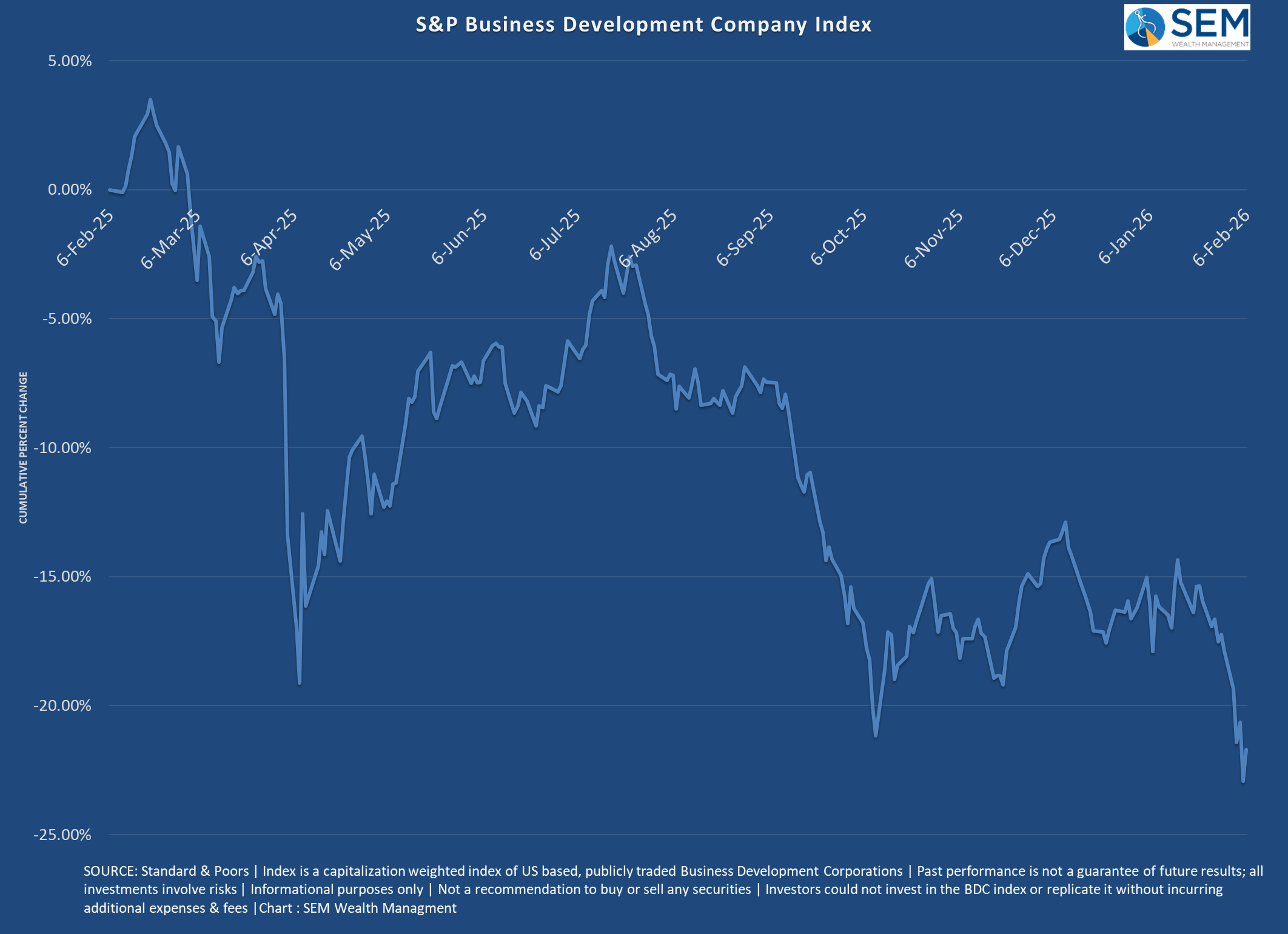

One of the indicators I've been watching for signs the blank checks may eventually dry up is in the Business Development Company index. Many of us have been bombarded by emails and wholesalers selling us on the benefits of "private credit" (the companies creating the "SPVs" in the graphic above.) This index is a way to see how public companies who offer private credit financing are performing. It is really the only thing we have to go on since by design private credit offerings do not offer much in the way of updated performance.

As the chart below shows, it has been a roller coaster ride the past 12 months for these companies. Over the past several weeks, there has been increasing concern that the defaults may start piling up on some of the newer loans if the cash flow streams dry up.

Speaking of alternatives, let's look at another set of investments that have gone on a wild ride the past few weeks............

When "safe havens" aren't so safe

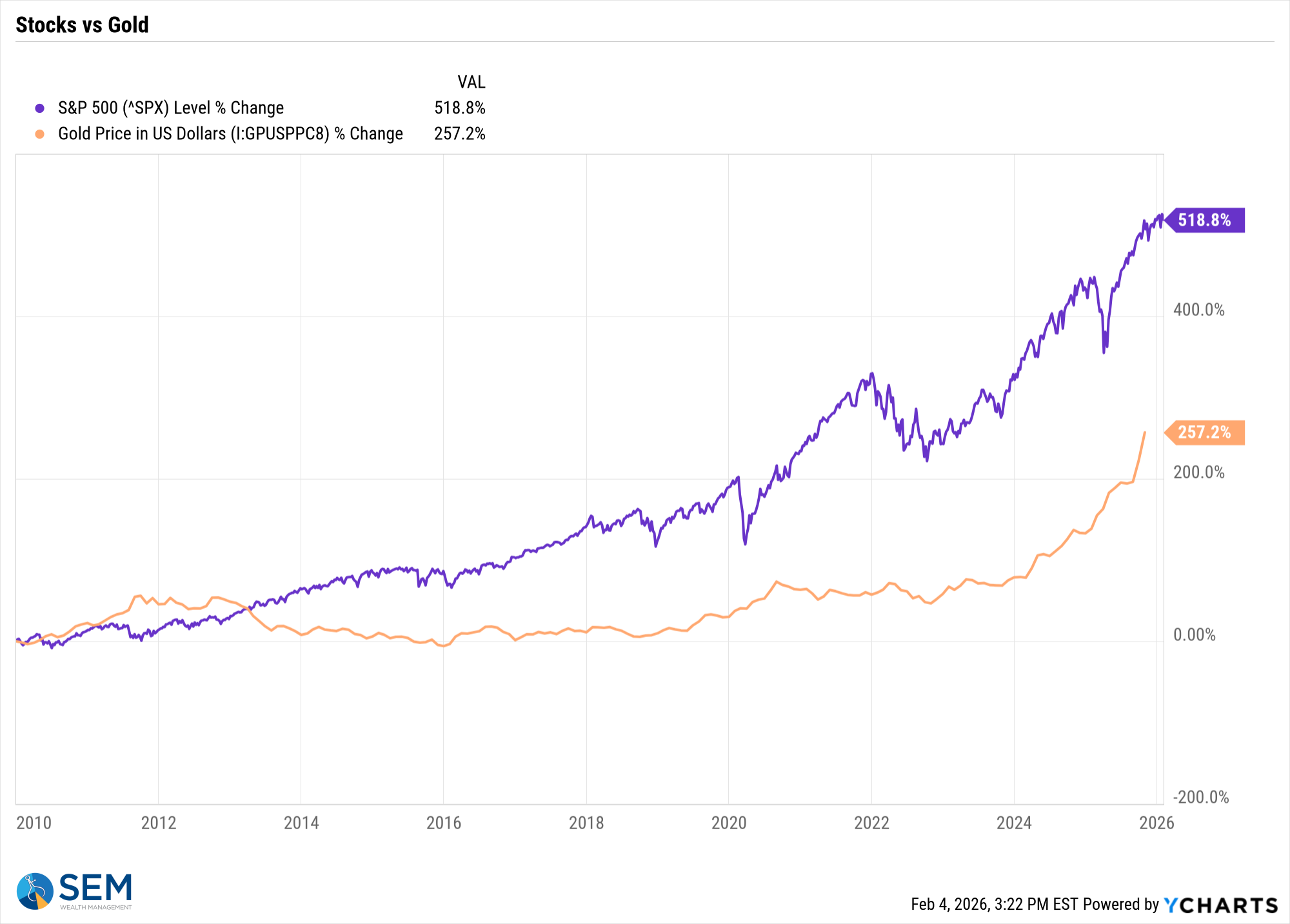

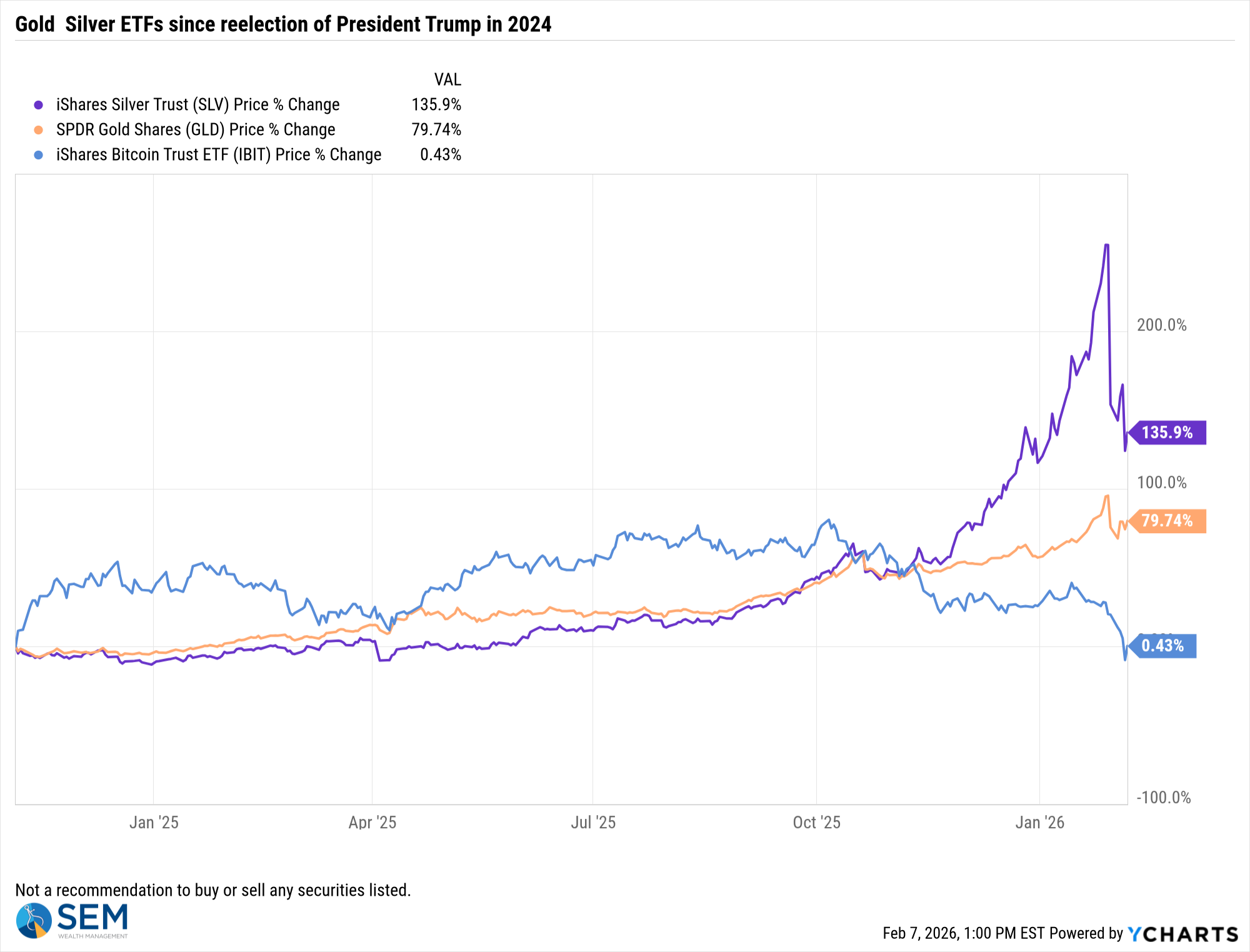

Gold and silver have had an impressive run going back to 2017 (following a 5 year bear market where gold lost 45% of its value and silver lost a whopping 77%!). With hindsight we identify a logical shift in the demand for gold coinciding with President Trump's first term. Trade wars, protectionist policies, massive government stimulus, and increased spending on the military are all fundamental drivers of inflation (or the fear of inflation), which increases the usefulness of gold in a portfolio. Gold bottomed in late 2016, but still lagged stock prices.

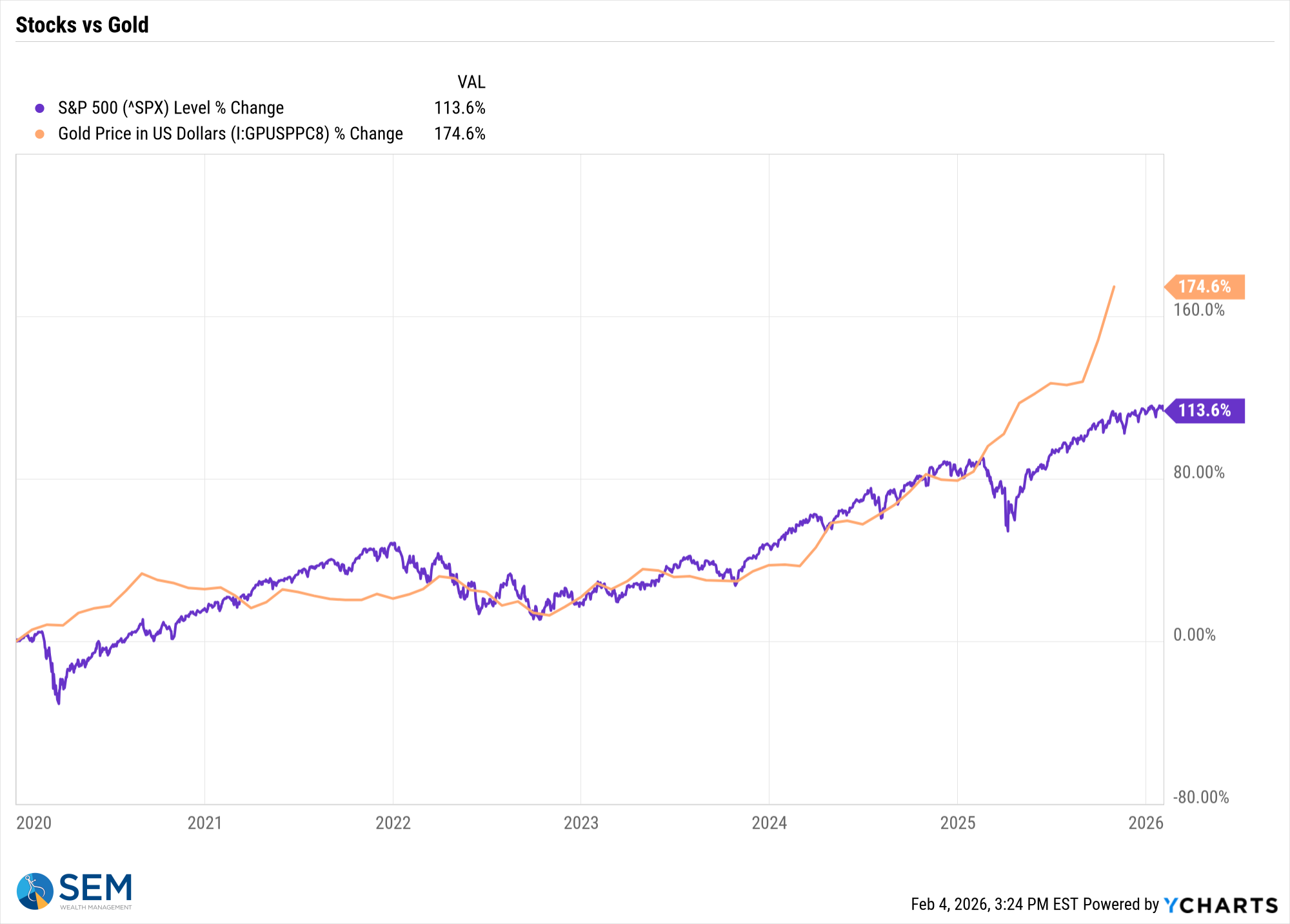

Since the pandemic hit, the performance of gold nearly matched the S&P 500, especially following the inflation driven sell-off in stocks in 2022. When President Trump's 2nd term started is when gold (and silver) started to go absolutely ballistic.

I often caution people from making clear "bets" on the environment and outcome. One of the reasons gold (and especially silver) had such a terrible bear market as the inflation everyone thought we would have due to QE2 & 3 never materialized. All those who were pushing gold and silver on us at the end of the financial crisis may have eventually been right, but the chart since 2010 shows the danger of making these types of bets.

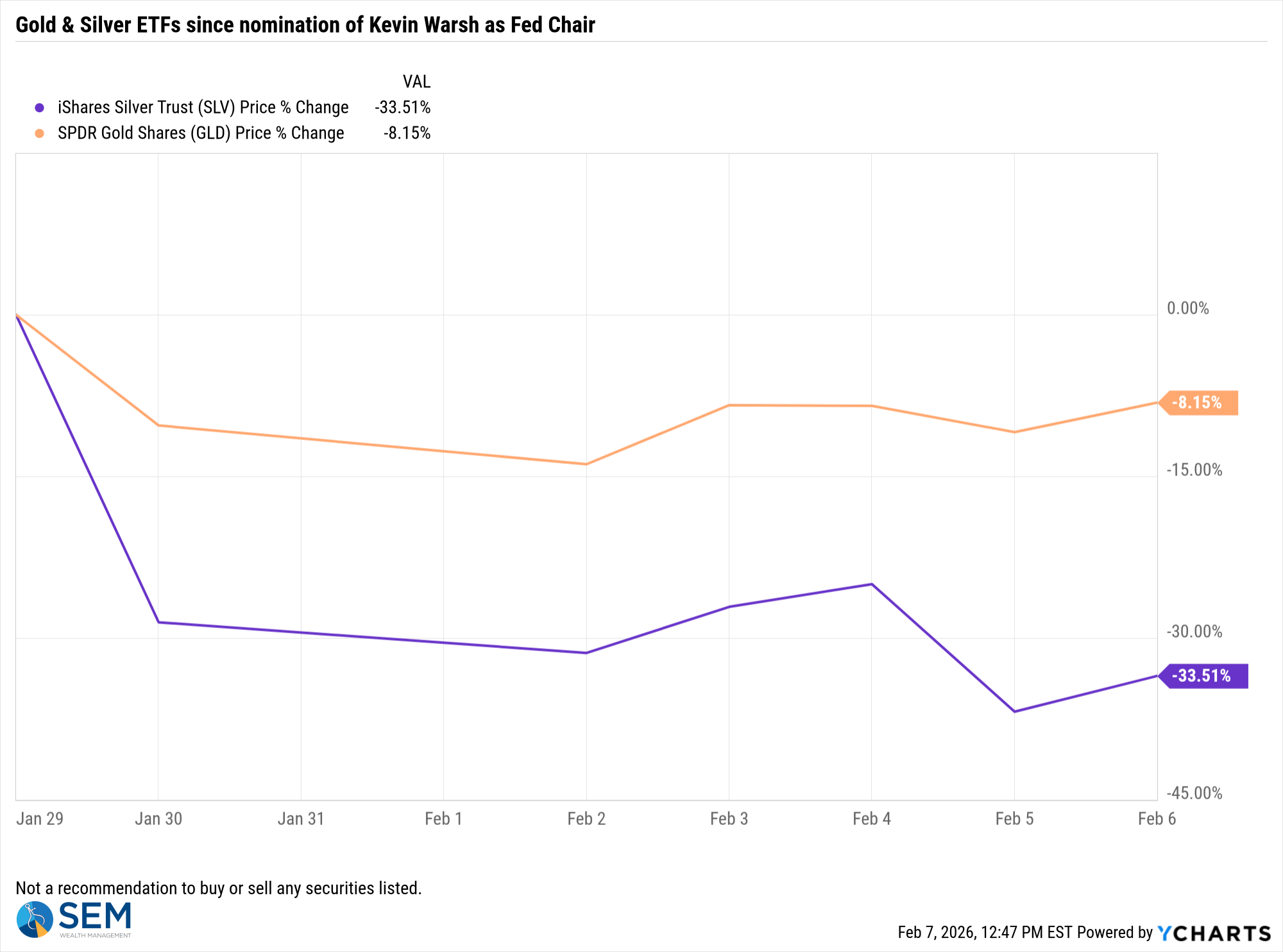

When President Trump nominated Kevin Warsh for Fed Chair on January 30, suddenly gold and silver lost their luster. Even though the President has insisted any Fed Chair would be open to his input on interest rates, the concern is related to other Fed policies. Mr. Warsh has indicated he believes interest rates should be at least 100 basis points (1% lower). However, comments and actions during the financial crisis when Mr. Warsh served alongside Ben Bernanke has led to the belief the Fed may not be as supportive to the financial markets as Chairs Powell, Yellen, and Bernanke were.

It all comes down to the Fed's Balance sheet and Mr. Warsh's belief the Fed should not be stimulating with these measures as much as they have. At times over the past decade, the Fed has purchased literally 100% of all Treasury bonds issued. This, in Mr. Warsh's opinion allows the government to overspend, which is bad for the economy long-term.

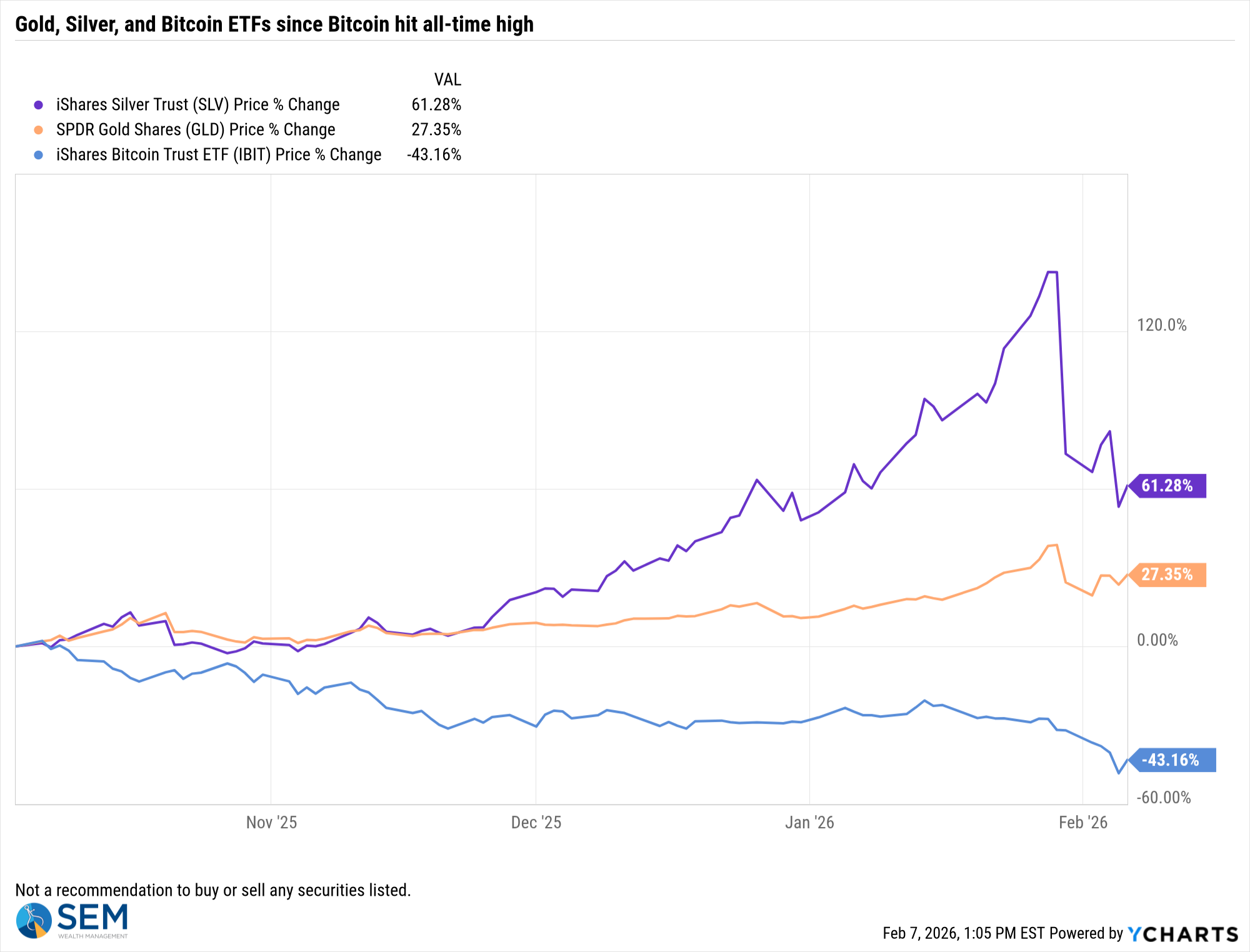

This calls into question whether the Fed under Mr. Warsh will allow the government to run unchecked budget deficits in the future. If spending is forced to come down that would take away one of the main reasons people have been buying gold. Check out the performance of the Gold and Silver ETFs since Mr. Warsh was announced as the President's choice:

I personally believe it is far too early to know how Mr. Warsh will direct Fed policies going forward. The question, like all the other questions the last few weeks is whether this drop in prices is a buying opportunity or a reasonable correction.

Is this the death of Bitcoin?

In a week of large losses, I'll finish with the drop in Bitcoin. At the lows last week, Bitcoin was down nearly 50% from its all-time high. Like with other times we've seen these 40% drops in Bitcoin, there are all kinds of "I told you so" articles out there.

I will caution anybody that all the other times I heard the "I told you so" following a "crash" in Bitcoin prices it did come roaring back for inexplicable reasons (not a recommendation to buy (or sell) this dip, just an observati0on.)

I am by no means at expert on Bitcoin. I continue to say that "I don't get it" in terms of being an actual usable currency. However, the TECHNOLOGY behind it and what it could mean for actual digital payments. President Trump was supposed to be the "crypto" president. That helped lead to a huge run-up in Bitcoin and other crytpo-related companies and securities. With this drop, many are asking what happened?

I think the biggest misunderstanding is the policies, orders, and directives issued so far from President Trump have mostly centered around stablecoins and other payment mechanisms. Unlike Bitcoin, a stablecoin does not fluctuate in value. I continue to lament that it makes zero sense that when somebody pays me electronically why my bank does not give me full access to that money immediately. Stablecoins and all of the various electronic payment methods being developed are designed to allow users to have access to their money immediately.

Banks of course do not want this or not all of them do. Some are developing their own digital coins to speed payment and access to your money. It is my firm belief that the MARKET will force banks to either give us access to our electronic money immediately or the banks will lose so much business we won't need them any more for transactions. The spending behind that is what I've always been excited about. Bitcoin simply serves as a proxy for the industry as the first and largest cryptocurrency.

While I can't tell you if the latest crash of Bitcoin prices is the end of Bitcoin, I can tell you at some point the damage done to the companies who will build out the digital payments infrastructure could be a buying opportunity. (When that is, I couldn't tell you.)

Toby's Take

A look at our intern's top WSJ stories from the week

2/2/2026 - These Rural Americans Are Trying to Hold Back the Tide of AI - WSJ

AI expansion has been a very fast growing part of our economy and it continues growing. However, there is starting to be a bit more push back. A planned 1000 acre data center in Michigan was voted against by the county potentially signaling a nationwide pushback. Yes, AI is a great business and helping America a lot, but its infrastructure is hard to ignore. There is already lots of backlash due to how much power AI data centers draw, but it's becoming more and more apparent how much land it uses.

2/3/2026 - SpaceX, xAI Tie Up, Forming $1.25 Trillion Company - WSJ

Elon Musk, the CEO of both SpaceX and xAI has decided to merge the two companies combining their worth to $1.25 trillion. We can't say for sure what this could lead to, but bringing AI to space travel could be a big step to the future! This is an exciting merger and has a chance to bring up their value a good bit. We will keep watching to see what else Elon Musk does.

2/4/2026 - Why India Will Struggle to Reduce Its Reliance on Russian Oil - WSJ

President Trump made a trade deal with India on Monday and said that India, one of Russia's biggest customers, agreed to stop buying from Russia and buy American/Venezuelan oil instead. If that were true it would put big economic pressure on Russia to negotiate an end to the Ukraine War. India had and still hasn't confirmed the oil part of the trade deal with President Trump. The Kremlin also told reporters on Tuesday that it hadn't heard anything from India about plans to stop purchasing Russian oil. If it comes out that what President Trump said is actually true, it could be a really good thing for our home oil producers.

2/5/2026 - The $100 Billion Bet on Venezuelan Oil Relies on a Broken State Company - WSJ

Venezuela is said to have one of the world's largest crude reserves at one point producing 3 million barrels a day. While under

Nicolás Maduro that dropped down to 300,000 a day. That means with proper leadership and resources, American oil companies could gain a lot from these reserves. However, there is a large company that has a history of being called corrupt known as PdVSA. Any business in Venezuela usually has to talk to PdVSA first. This could cause problems with American companies.

2/6/2026 - Cuba Says It Is Ready to Engage With Trump as Fuel Shortages Worsen - WSJ

According to President Trump, Cuba is an "unusual and extraordinary threat" because of their alliance to Russia, China, and Iran. With this, the Trump administration has decided to "choke off" Cuba's fuel lifeline. The Cuban President said that Cuba was no danger to the U.S. and said that the U.S. is the biggest threat to the world's security. He also said that they aren't in a state of war but are preparing in case they have to be. President Trump said that it "doesn't have to be a humanitarian crisis," and "I think they probably would come to us and want to make a deal." This could mean that the Patriot portfolio gets some attention and growth in preps for whatever this may be.

Market Charts

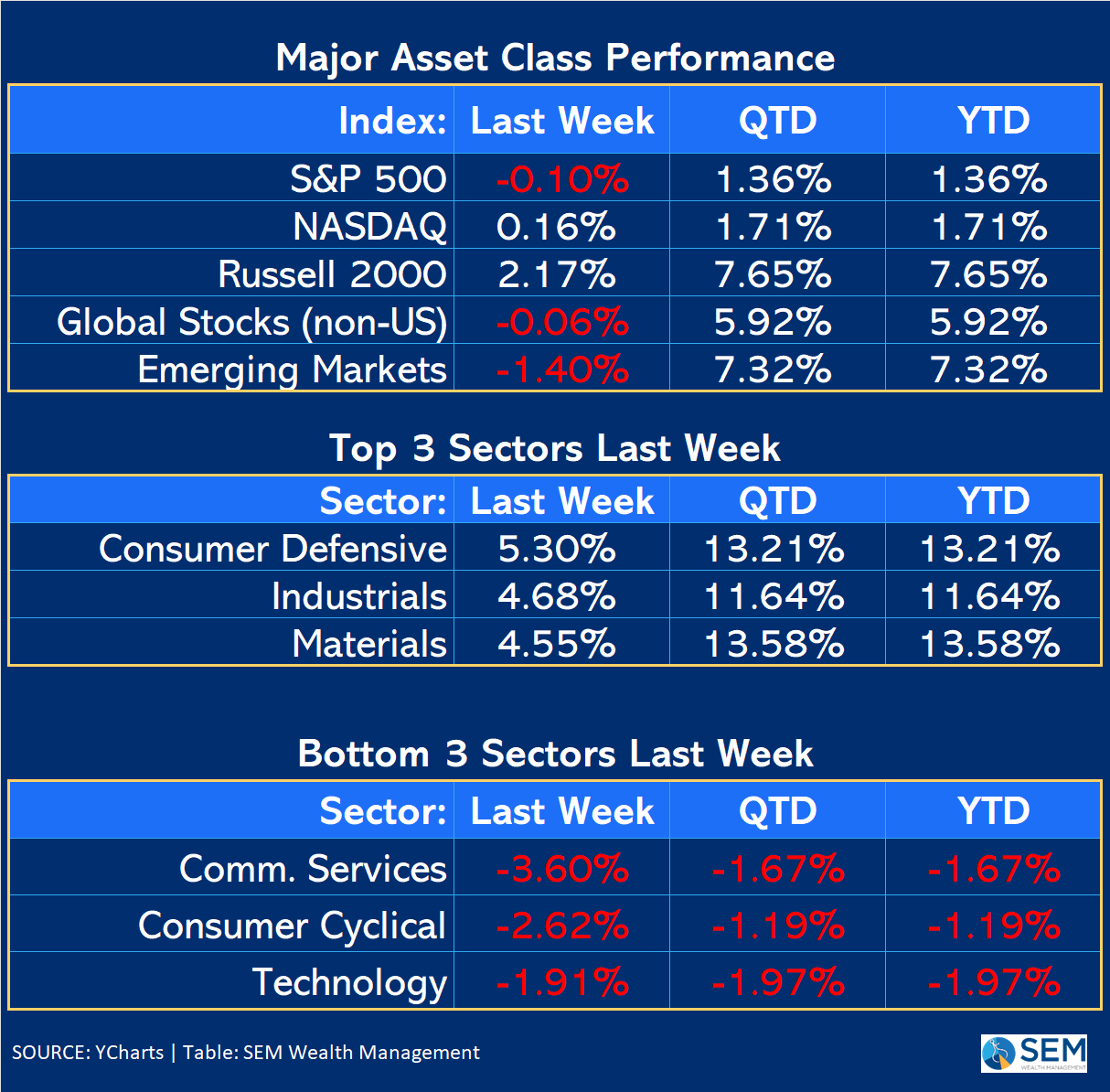

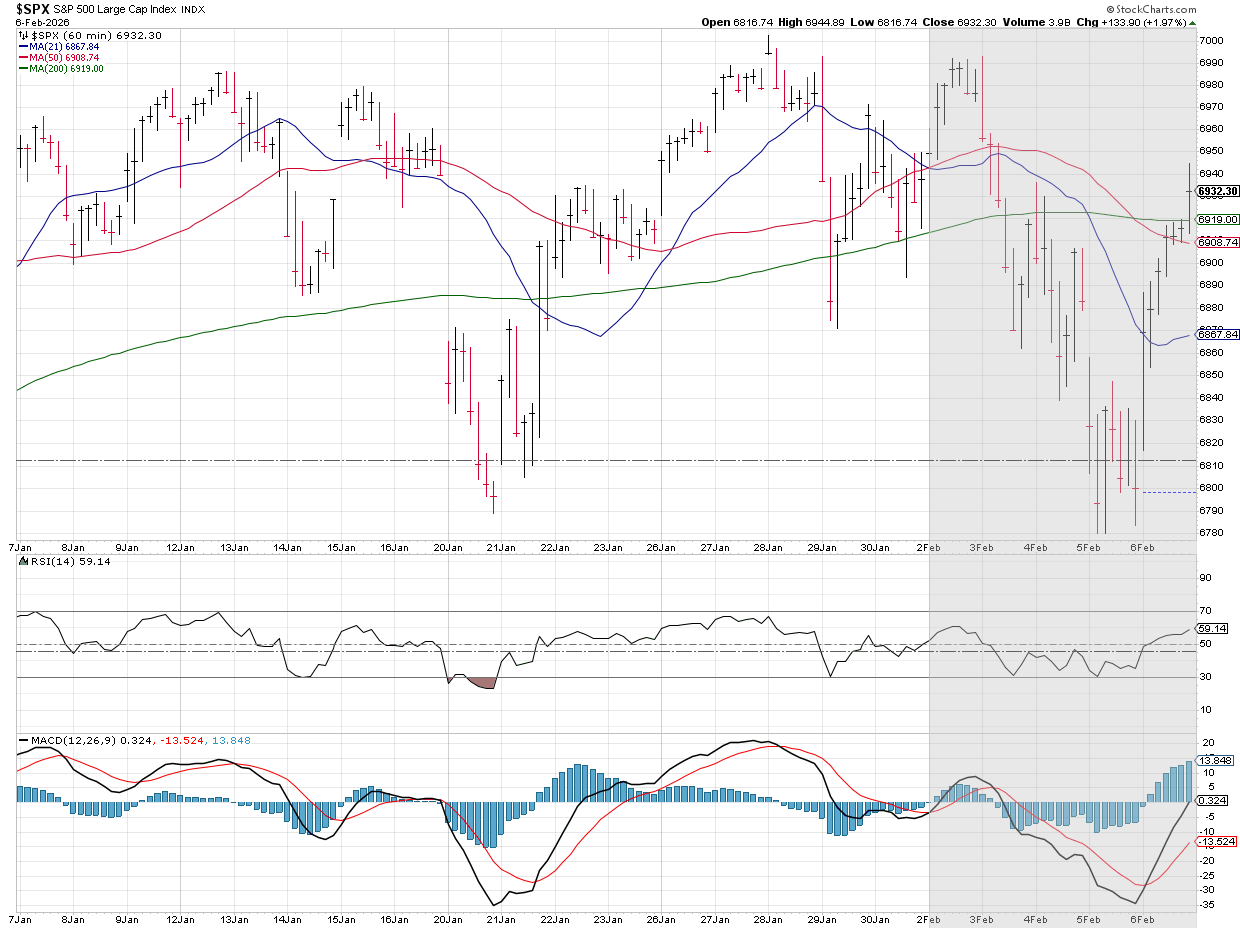

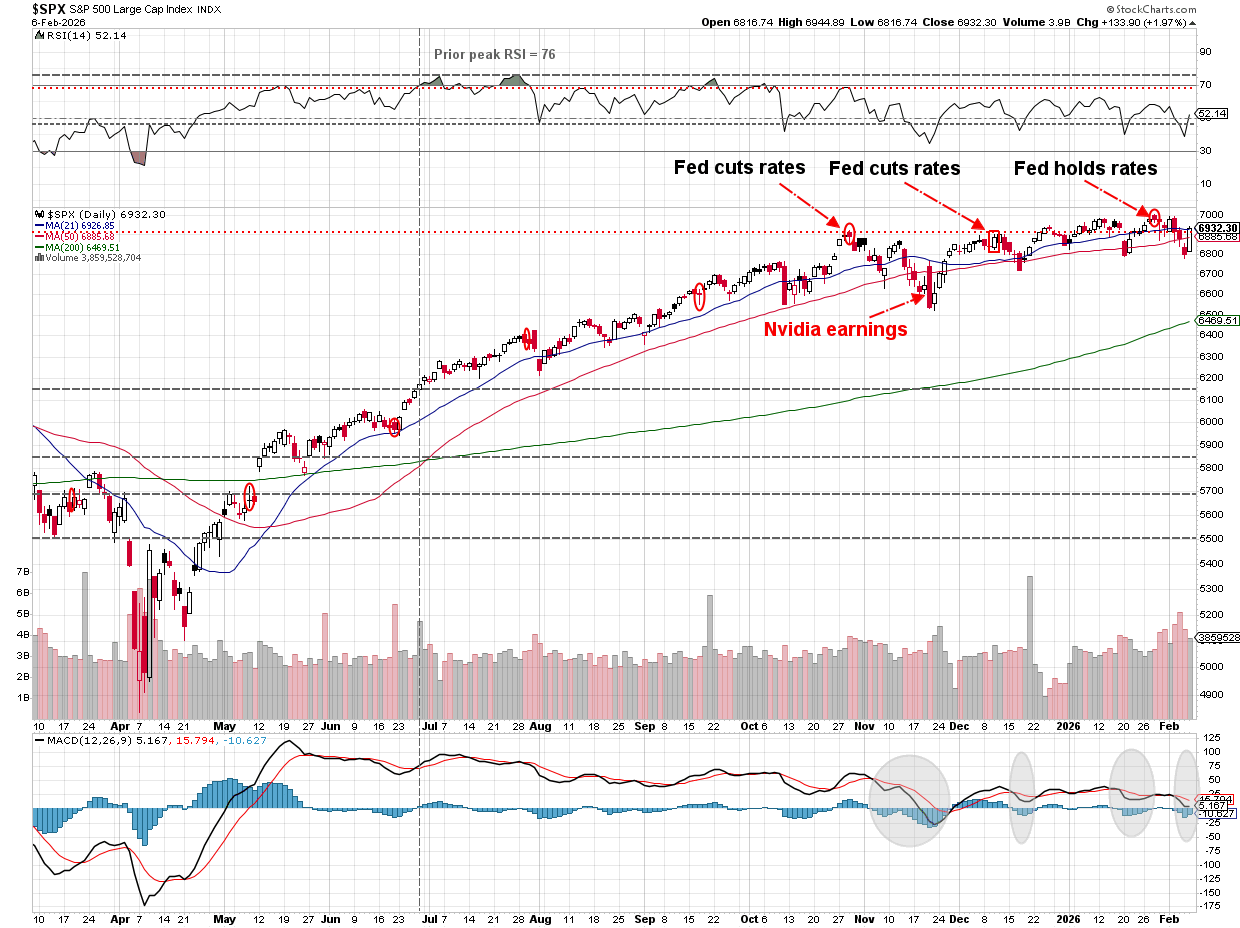

Friday's rally saved the week for the S&P 500.

Bigger picture, the S&P continues to be pinned around the level it was during the last 3 Fed meetings.

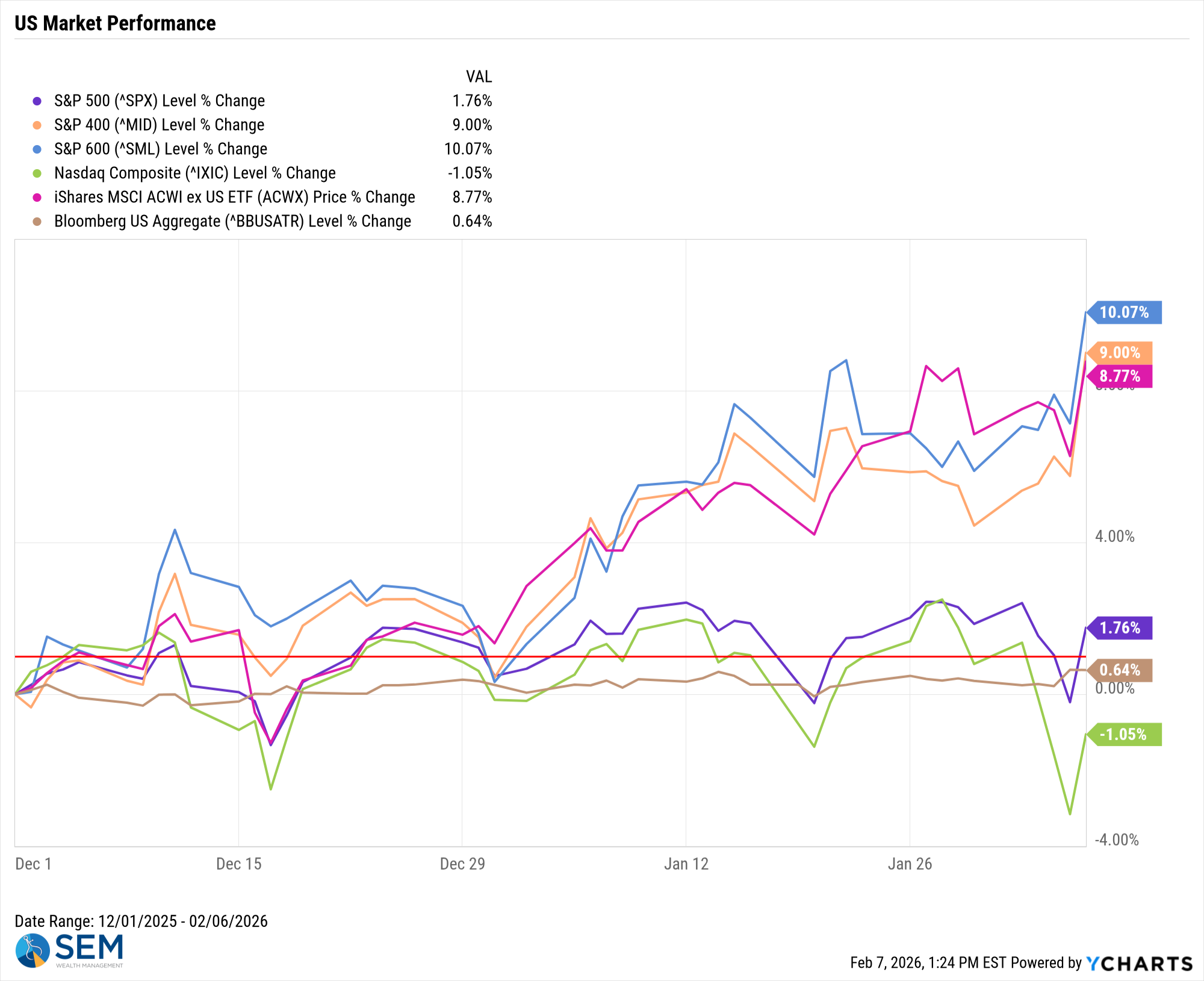

The bigger story is the broadening of the stock market we've been seeing since late last fall. Small caps have soundly outperformed the large cap stocks (finally). As fiduciary managers who cannot overly invest in an index where 10 stocks represent half the index, this broadening has been welcome to our growth portfolios.

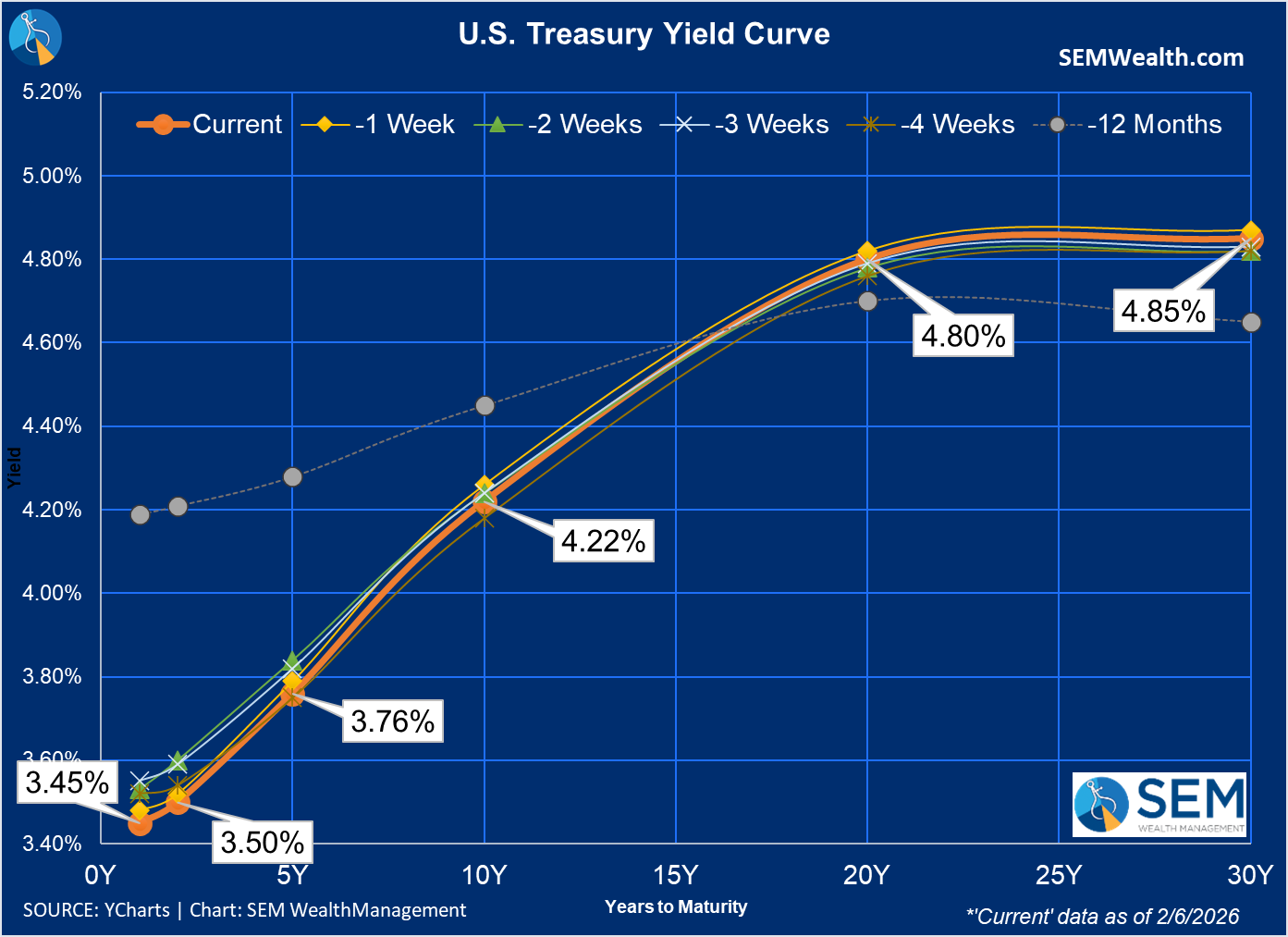

Last week we didn't see too much movement in bond yields.

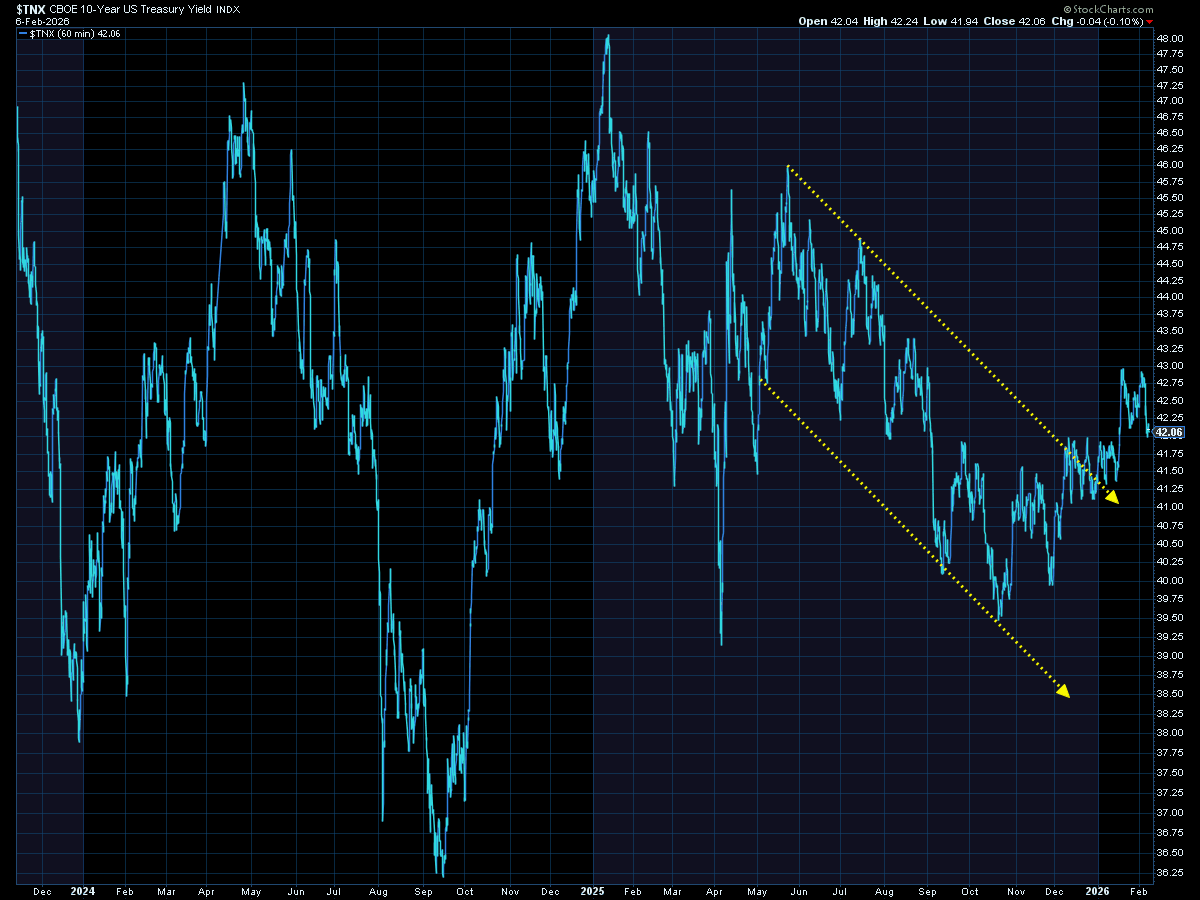

We saw rates spike higher earlier in the week and then fall, but still remaining above 4.2% on the 10-year.

SEM Market Positioning

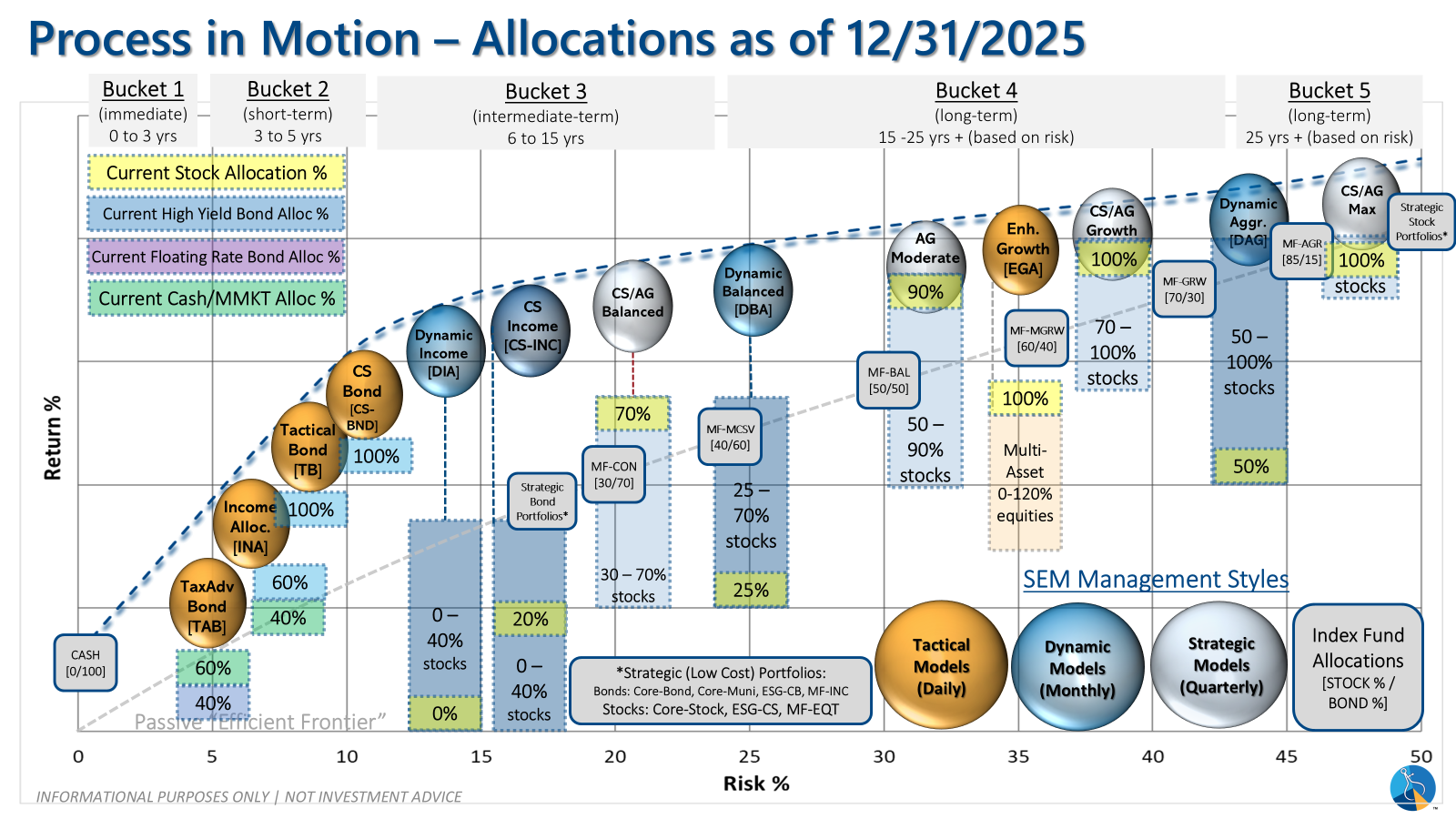

| Model Style | Current Stance | Notes |

|---|---|---|

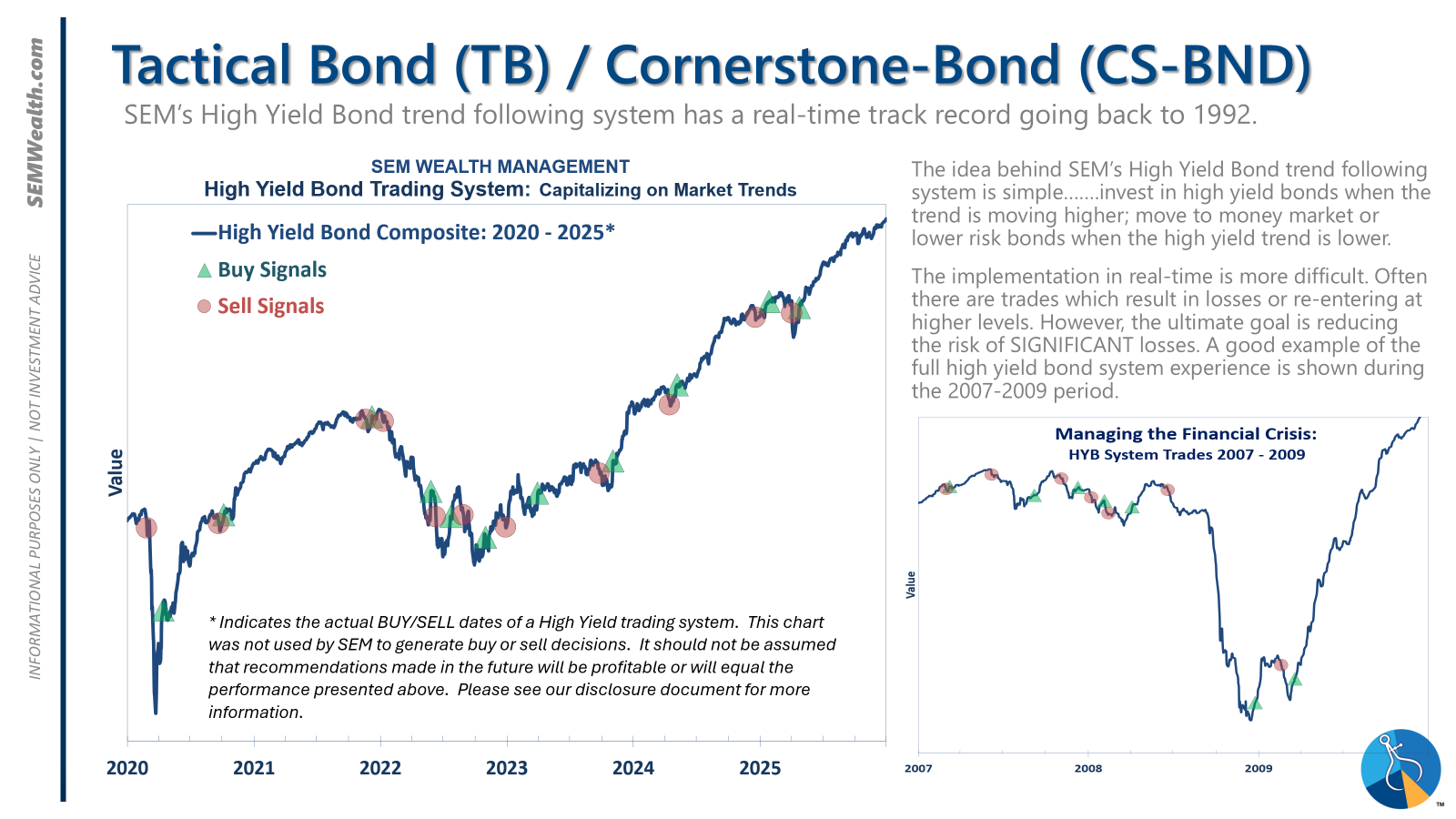

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

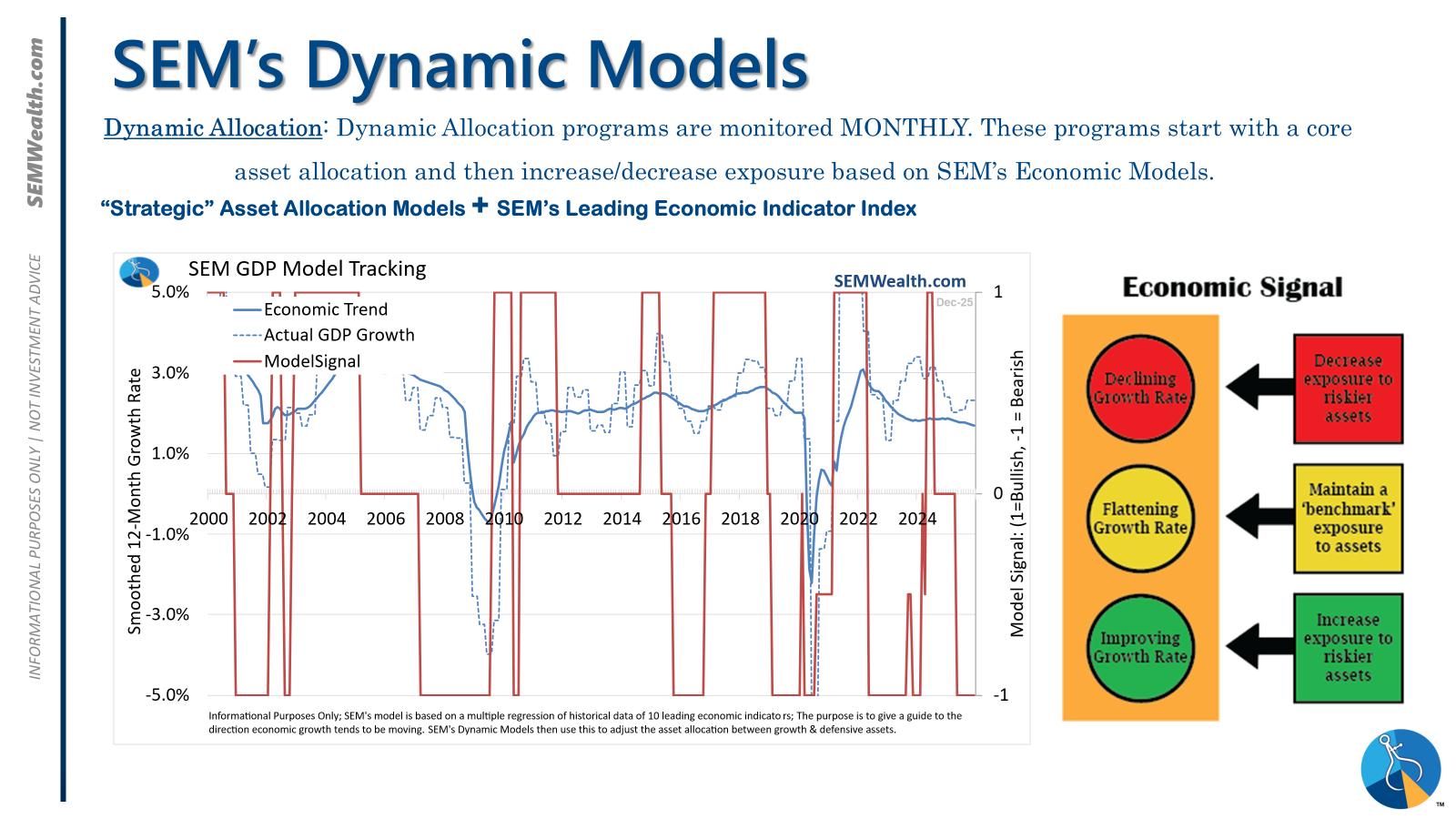

| Dynamic | Bearish | Economic model turned red June 30 '25' – leaning defensive |

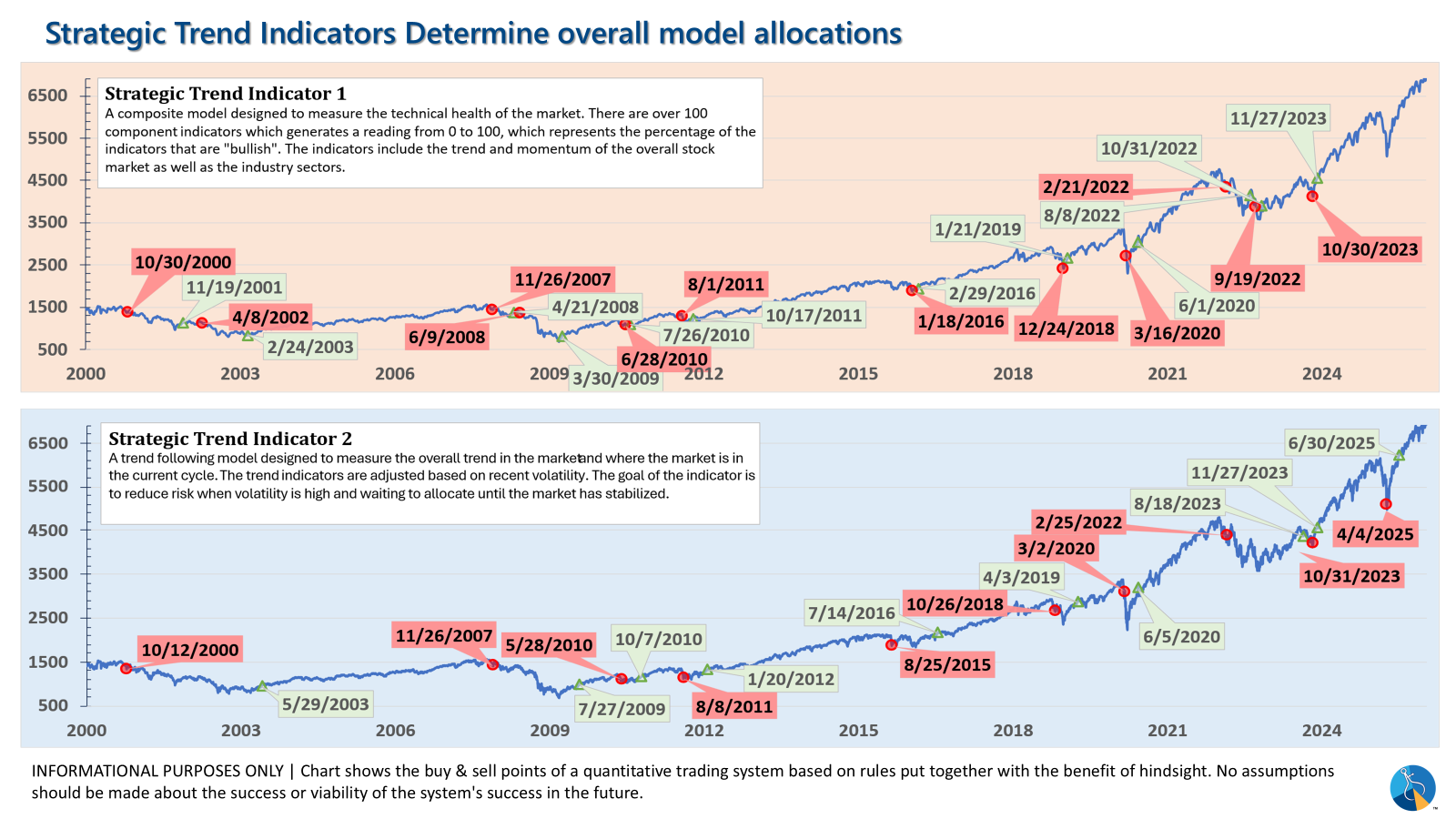

| Strategic | Fully invested | Trend overlay shaved 10 % equity in April -- added back early July |

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. This quarter we saw half of our international positions reduced (we sold developed markets and kept our emerging markets exposure). We also saw the remaining share of mid-cap reduced in favor of more small cap exposure. We remain with a "barbell" core portfolio – about half in large cap and half in small cap as the models expect the market to "broaden".

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire