It's been a noisy, volatile year so far. It seems every week I have another 5 page essay to write just updating everything that happened during the prior week. Last week, I experienced a refreshingly different kind of noise – I spent the week at a conference and then took a weekend cruise to celebrate our 25 year anniversary. During the conference I focused on talking to every portfolio manager I could to get their outlook as well as talking to other advisors to understand their outlook and what their clients are most concerned about.

While I was able to keep up with the news of the day, I didn't have the time I usually do to go any deeper. During the cruise Saturday-Monday I purposely stayed "unplugged" to let my brain refresh. Of course the nerd in me enjoyed the time at the pool, on the beach, and on our balcony to finally finish reading 1929 from Andrew Ross Sorkin. I'll have more on that in later weeks/months.

Returning to our home in Virginia last night, I thought it was an interesting metaphor for the economy and the market right now. When we left it was cold (3 weeks straight below freezing), our yard and parts of our driveway were still covered with ice/snow, and it seemed like we'd never get out of the misery of the worst winter we've ever experienced here. When we returned it was above freezing (albeit just 42), the ice and snow was gone, and my attitude was markedly improved. Our yard looks like a soggy mess and there is probably some damaged trees that will need to be dealt with later in the spring. Ignoring them could lead to more damage down the road if the winds blow the wrong way.

That is what came to me the most last week as my mind thawed. It has been a very long 12 months with all of the news coming out of Washington, the Federal Reserve, and the technology sector. At times things looked very bleak, but as things warm up we will see things normalize, while knowing there was some severe damage done that cannot be ignored for long. This will be the theme in the coming weeks/months.

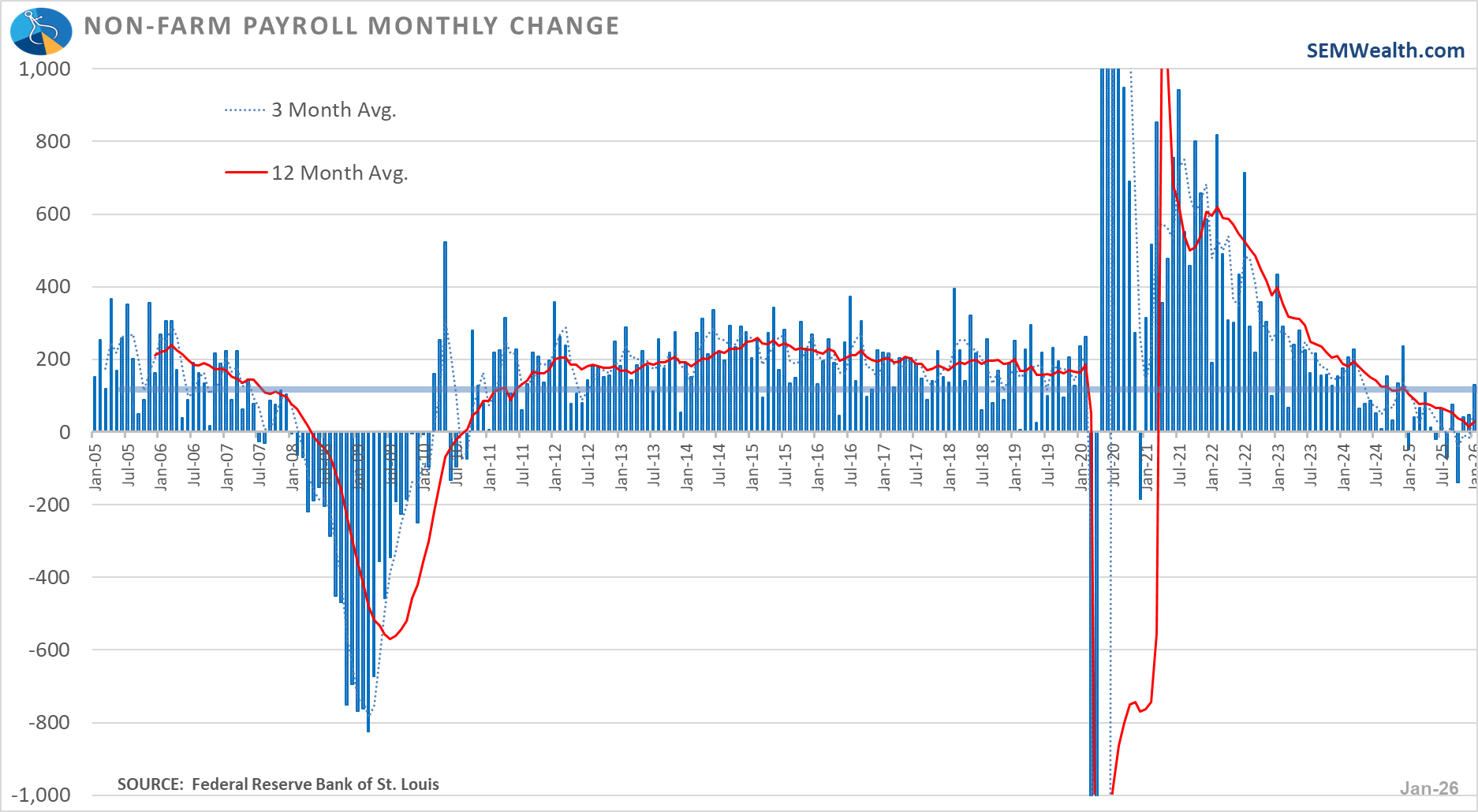

With a week's worth of noise to catch-up on, I used the weekend recaps from Bloomberg, MarketWatch, CNBC, among others to get a sense of what I missed. It seems like I didn't miss too much on the earnings front. The "SaaSpocalypse" I discussed last week is certainly still a concern (this was brought up by every portfolio manager I spoke to.) The biggest news (other than the Dow hitting 50,000 for the first time) came with the delayed jobs report and the CPI data.

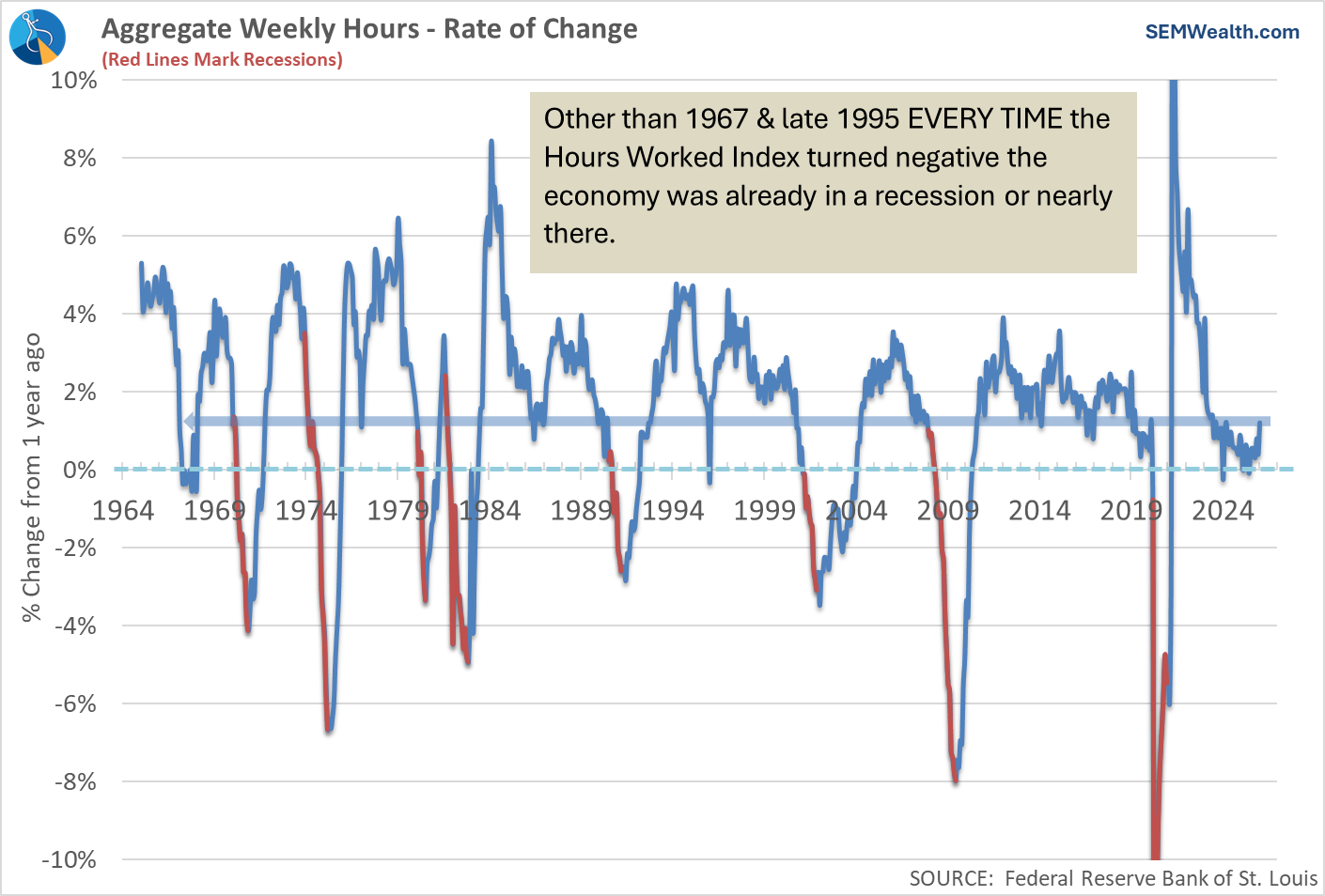

More importantly, the Hours Worked index hooked higher. At the conference I heard every portfolio manager I talked to describe this as a "no hire, no fire" economy. The stark move hire in the hours worked index is an encouraging sign as employers will first increase the hours their employees are working before they finally decide to hire more people.

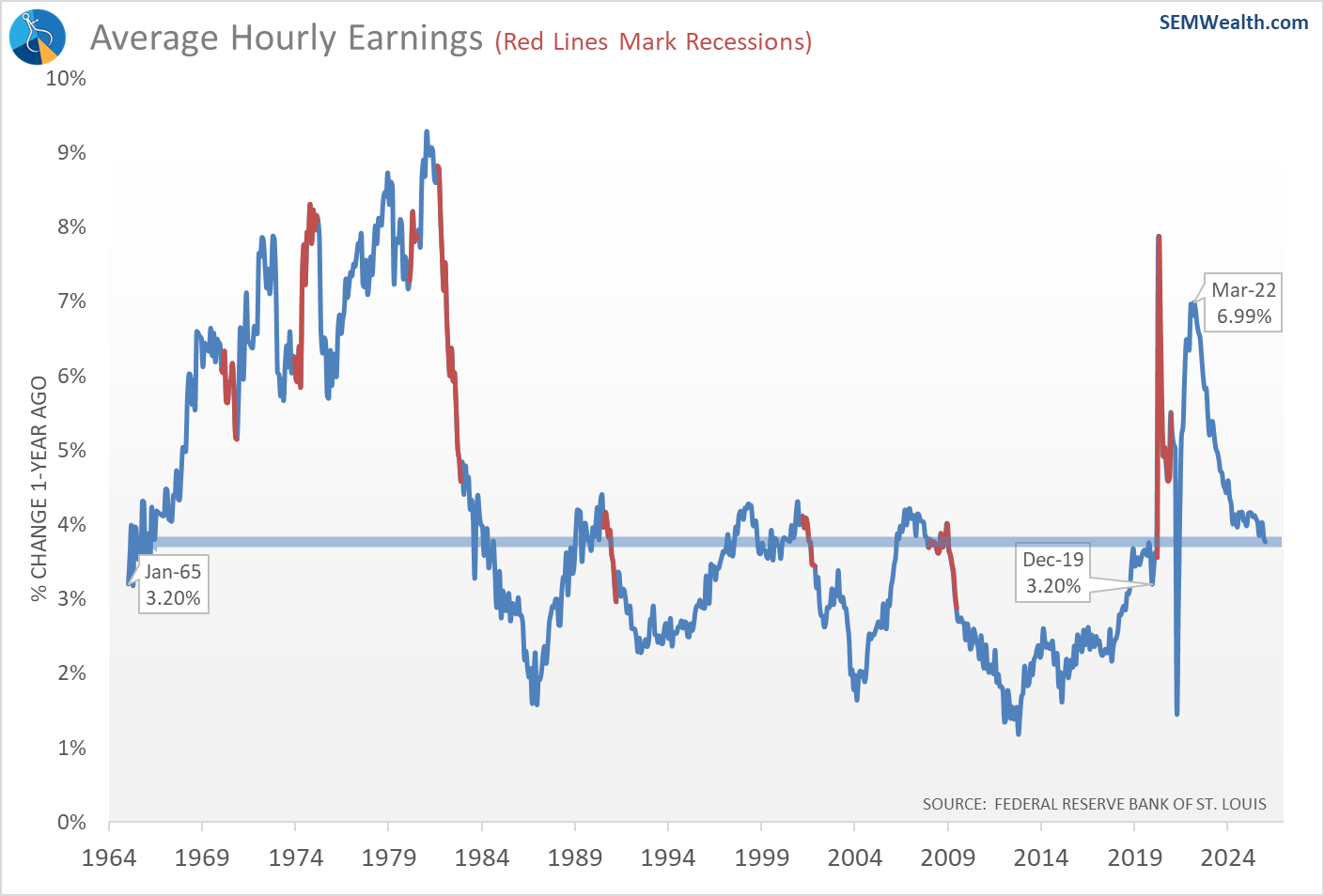

While Hours Worked increased, the growth in Average Hourly Earnings slowed.

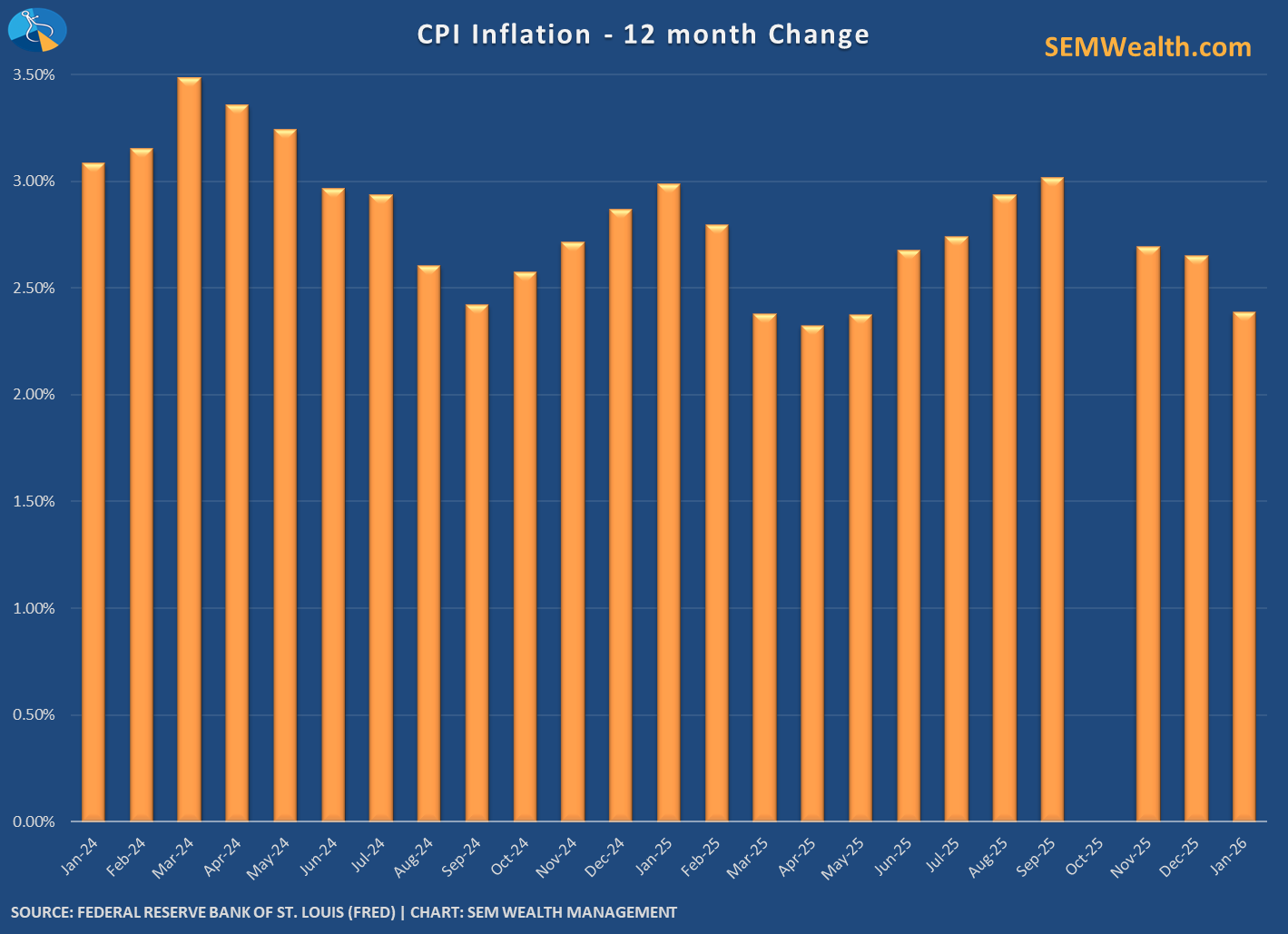

Following the jobs report stocks fell as the strong employment data led to the market pricing in little chance of a rate cut this year (after expecting 2-3 for a total of 75-100 basis points to start the year). That quickly changed on Friday when the CPI data was released, showing the rate of inflation decelerating once again in January.

The market is now pricing in 25 basis point rate cuts again in June (67% probability) or September (100% probability), with another 25 basis point cut in December (68% probability). Source: RateProbability.com

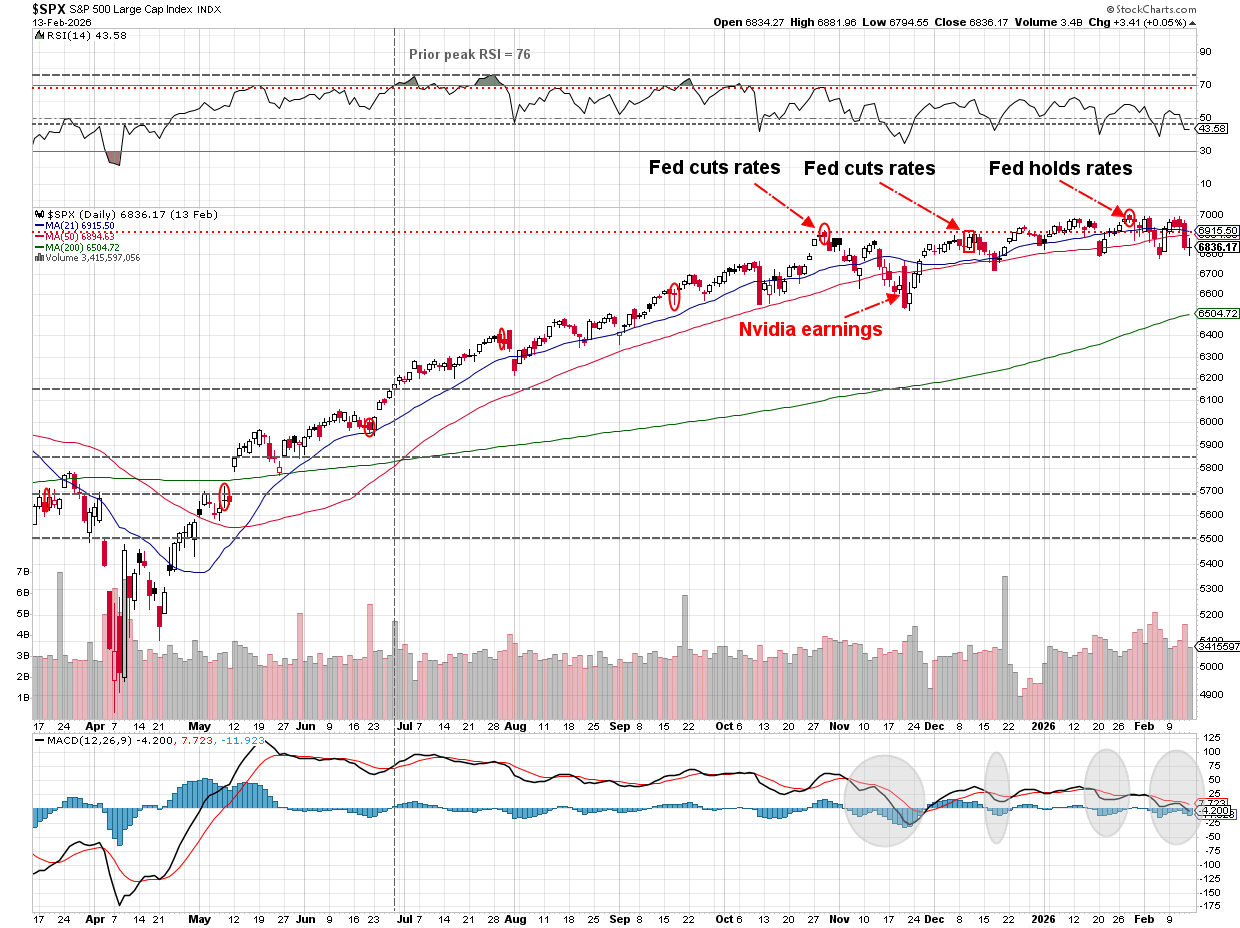

This week we will see the Fed minutes, a series of speeches from the Fed, GDP Data and the Fed's preferred inflation number - the PCE Price index (the latter two on Friday). We also have some consumer stocks which may give us an idea on how inflation and a slowdown in consumer spending is hitting the economy with earnings from McDonald's and Coca-Cola. NEXT week could be even more interesting as Nvidia releases their earnings, so we will also be interested to see how both Nvidia and the overall tech sector holds up.

It could be a bumpy ride, but as always our quantitative models are here to do what they do best – remove all the noise and focus on the data. Whatever comes next is any body's guess. Our models are designed to cut through the noise and use market history and the knowledge that human nature does not change, which leads to periods of overreactions to both the up and down sides.

Toby's Take

A look at our intern's top WSJ articles from last week

2/9/2026 - Immigration Raids in South Texas Are Starting to Hit the Economy - WSJ

Immigration raids have been a big topic recently with President Trump focusing on stopping illegal immigration. However, there are lots of stories where there have been ICE raids to pick up dozens of people even with legal documentation. Because of this contractors are facing difficulties finishing projects because they can't find workers who aren't afraid to go to work. President Trump has two big goals with his time in office. He wants to end illegal immigration and he wants to strengthen the economy. The issue with these two things is that one is affecting the other. While there are lots of criminals who are being deported there are lots of legal immigrants that get grabbed as well making other legal immigrants scared to go to work. We need to watch closely how this continues to affect the economy.

2/11/2026 - Activist Investor Pushes Warner to Walk Away From Netflix Deal - WSJ

More news on the bid for Warner Bros. Ancora holds $200 million in shares of Warner and is lobbying to make the deal with Paramount instead of Netflix because they believe it is better for the shareholders. Warner is worth $69 billion making their stake less than 1%, but they are using their voice to lobby other shareholders. There will be a shareholder vote expected next month. Ancora also believes that the reason Warner CEO favored the Netflix deal is to get an executive role at Netflix after the transaction closes. Paramount had offered the Warner CEO a role as co-CEO and co-chairman in their deal. All of this new information makes the already uncertain deal that much more uncertain.

2/12/2026 - Musk Announces xAI Reorganization, Staff Departures - WSJ

There is lots going on with Elon Musk all the time. After announcing the merger of xAI and SpaceX he said it was necessary to have some "reorganization" at xAI. He said that part of the reorganization would be letting some employees go because they were "better suited to the early stages." People could react to this is two different ways. They see his new reorganization plan as an opportunity to grow even more or they can see it as cost cutting due to slower sales, possibly causing loss in value.

2/13/2026 - U.S. Is Sending Its Largest Warship USS Gerald R. Ford to the Middle East - WSJ

The Pentagon is sending the U.S. Navy's largest and most advanced aircraft carrier to the Middle East. This is part of the plans for a potential attack on Iran. This is all a part of Trump's pressure he is putting on Iran to make concessions over its nuclear program. Trump said after the first round of talks last week that he is open to making a deal with Tehran to push off military action. All of this attention surrounding military weapons could be beneficial to our Patriot Portfolio.

Market Charts

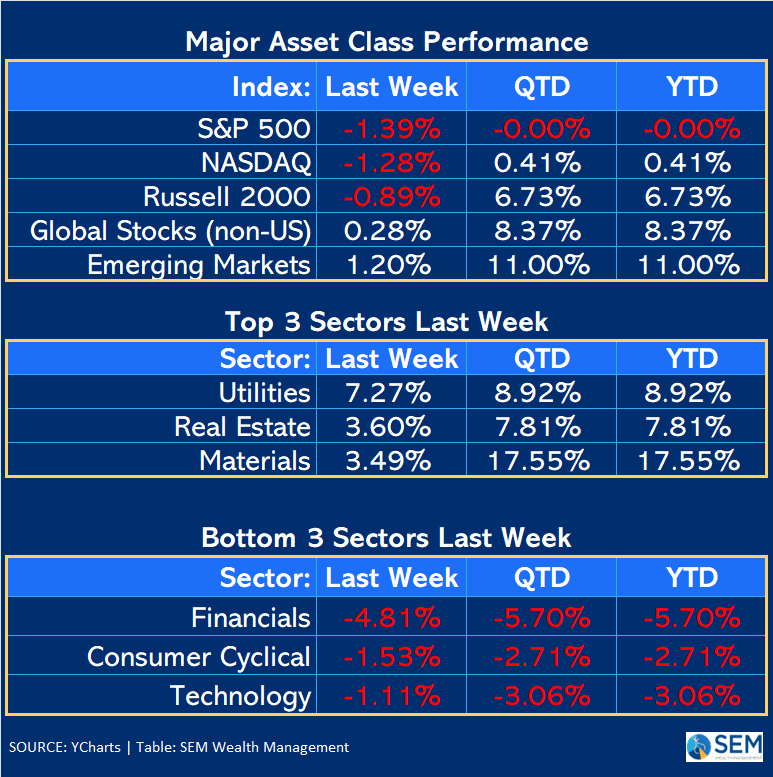

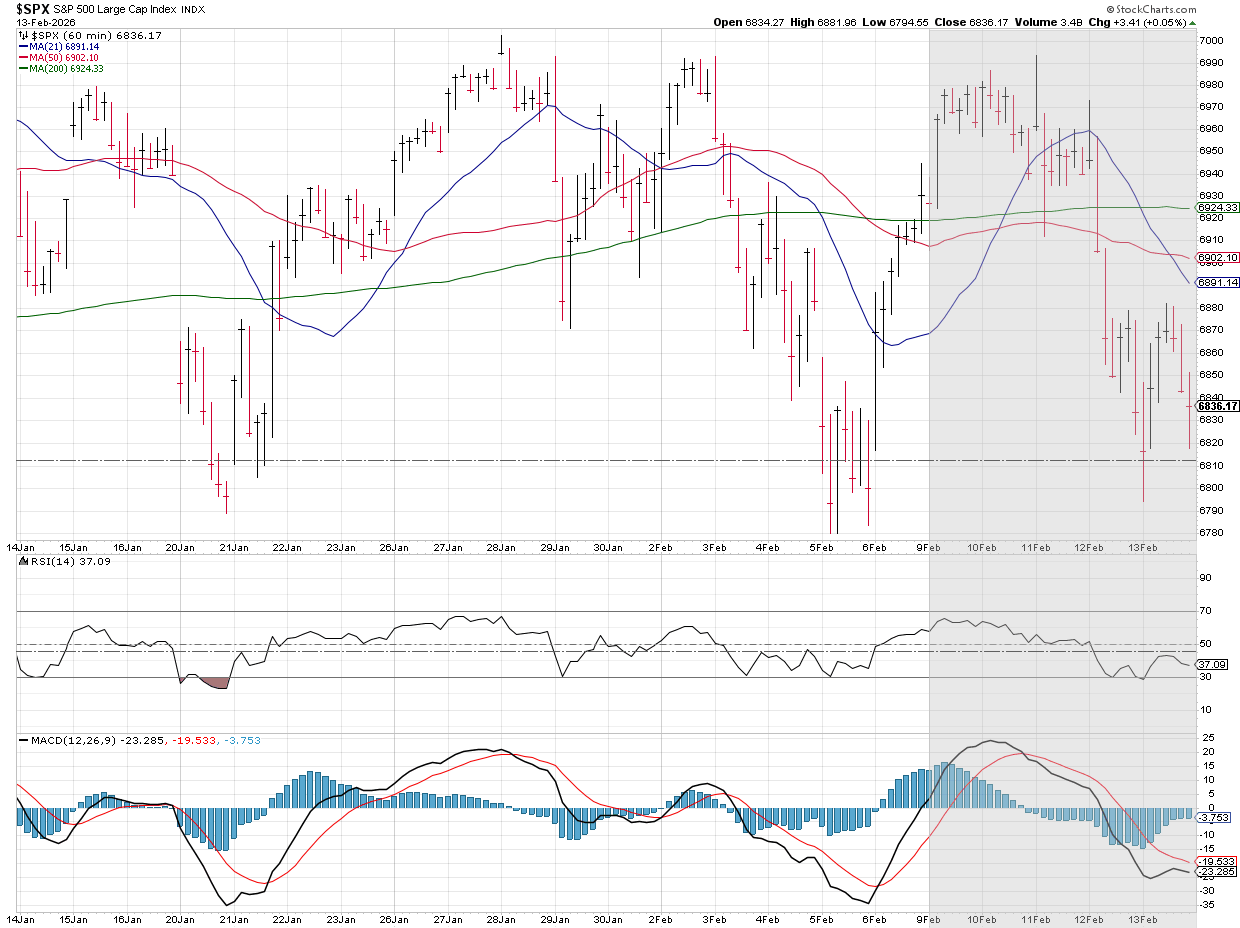

The strong jobs report on Wednesday was not a positive for the market. It tried to rally on the slowdown in CPI, but that rally faded late in the day on Friday.

Zooming out a bit we can see the slightly upward trending trading range the S&P 500 has been in since the Fed's October rate cut.

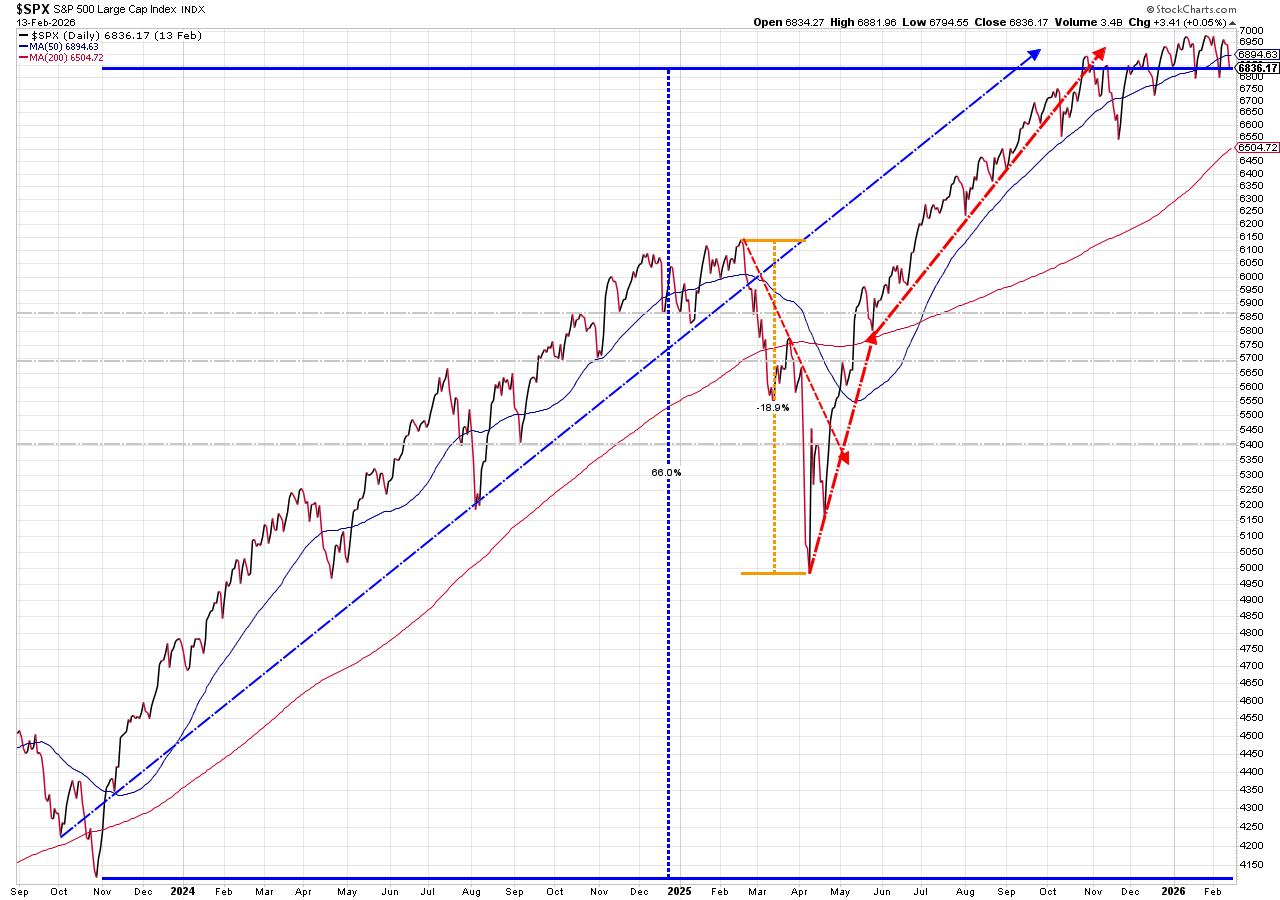

We're still up 66% since the Fed announced the end of their rate hikes back in late 2023. The consolidation does look like we could be topping out, but for now we are (barely) seeing higher highs and higher lows. We are well overdue for a correction, but we will leave the prediction of when that comes to everyone else.

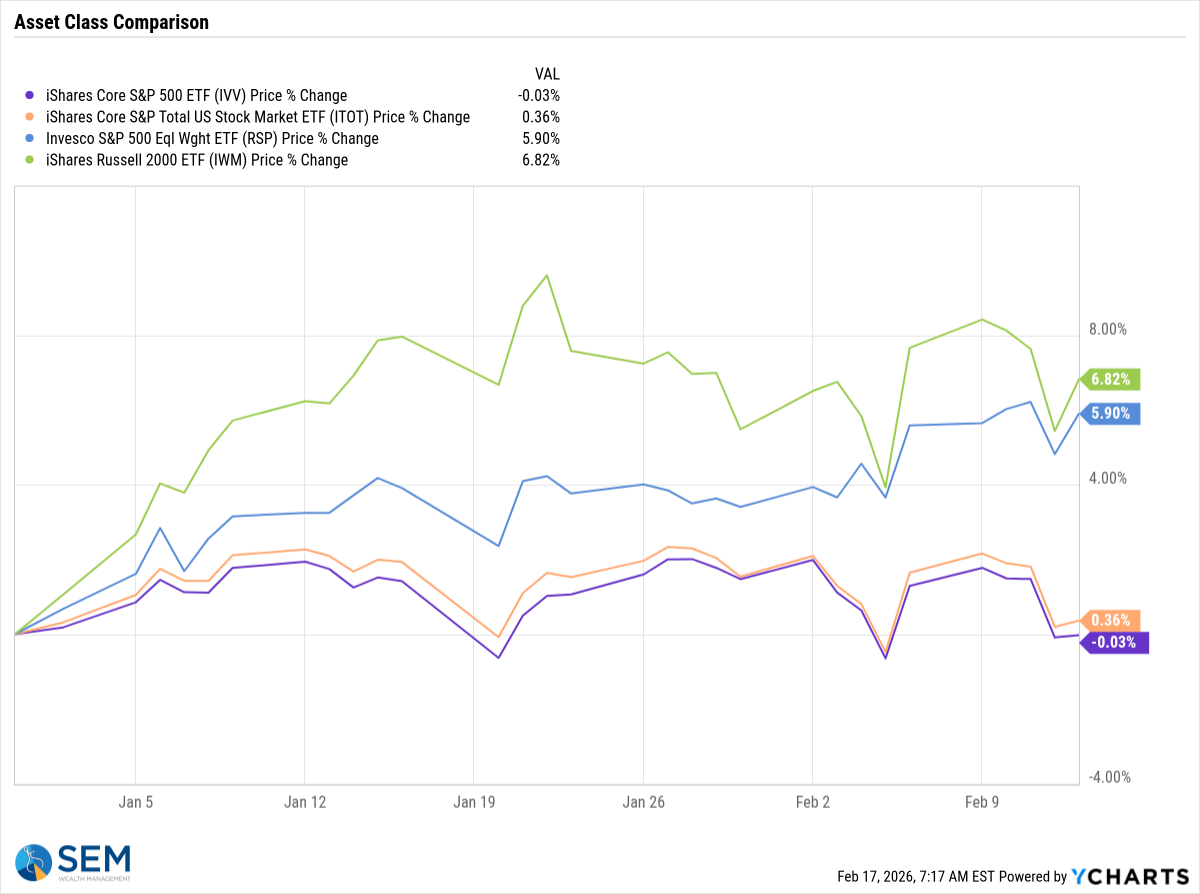

Small caps and the "equal weight" index continue to benefit from the "broadening". The last 2 years the companies SPENDING the money on AI were skyrocketing, leaving behind the companies actually RECEIVING the money from the spending. It is refreshing to see these companies catching-up. Our "growth" models continue to benefit from this broadening as well, especially our Cornerstone models, which due to the screens we apply are inherently underweight the largest companies.

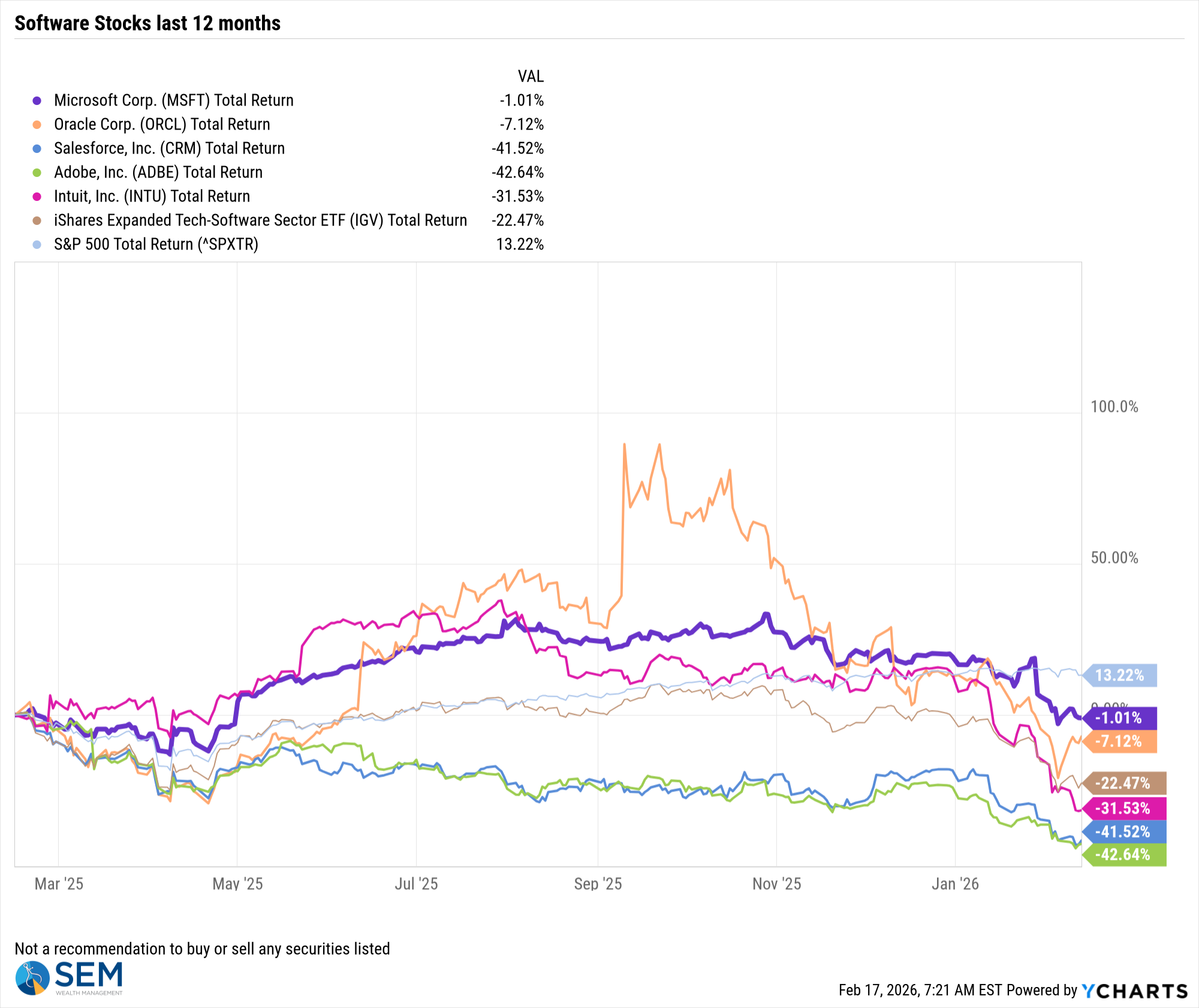

Software Stocks (SaaS) continue to struggle.

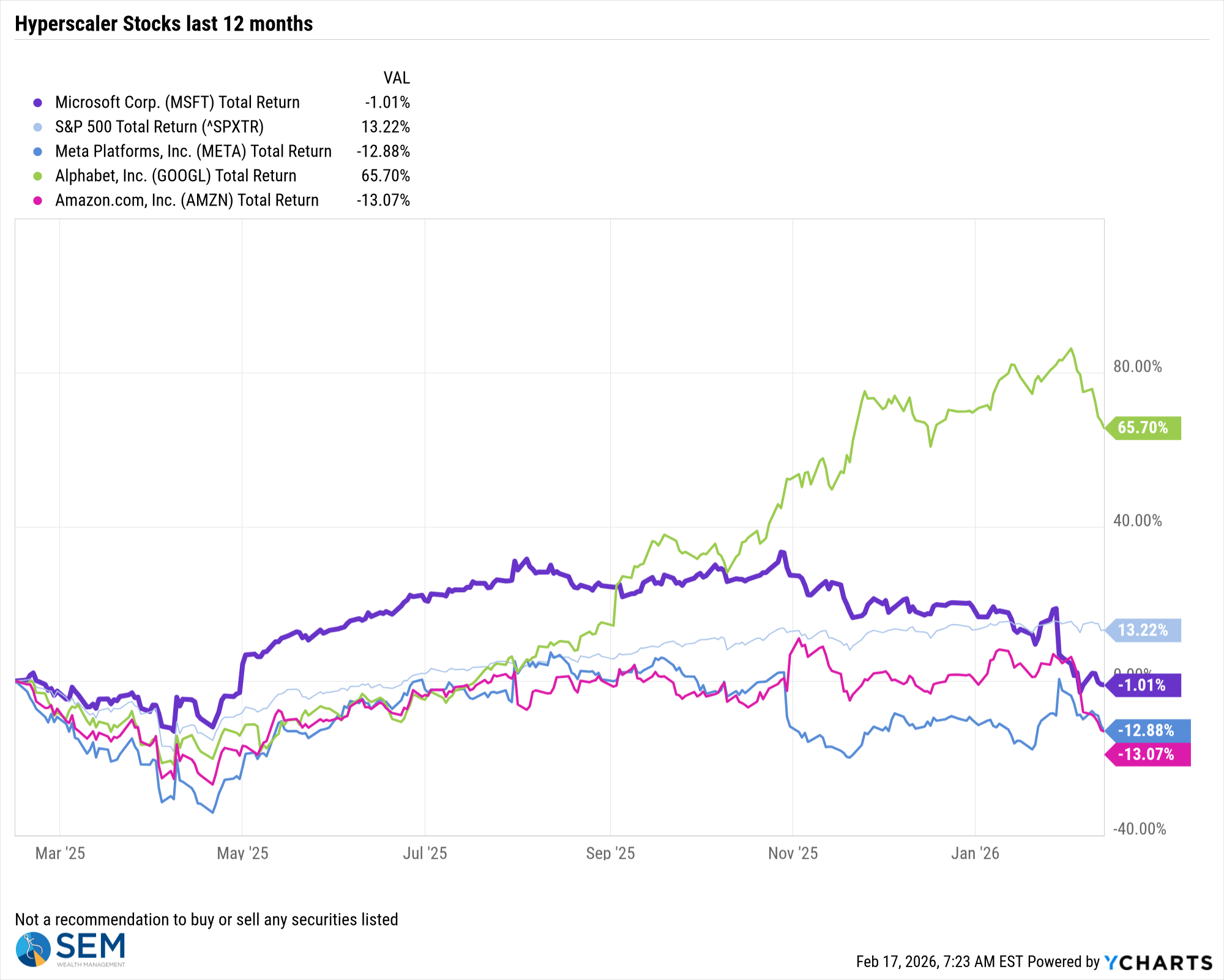

And other than Alphabet (Google), the "hyperscalers" spending all that money on "AI" Data Centers have dramatically underperformed the S&P 500.

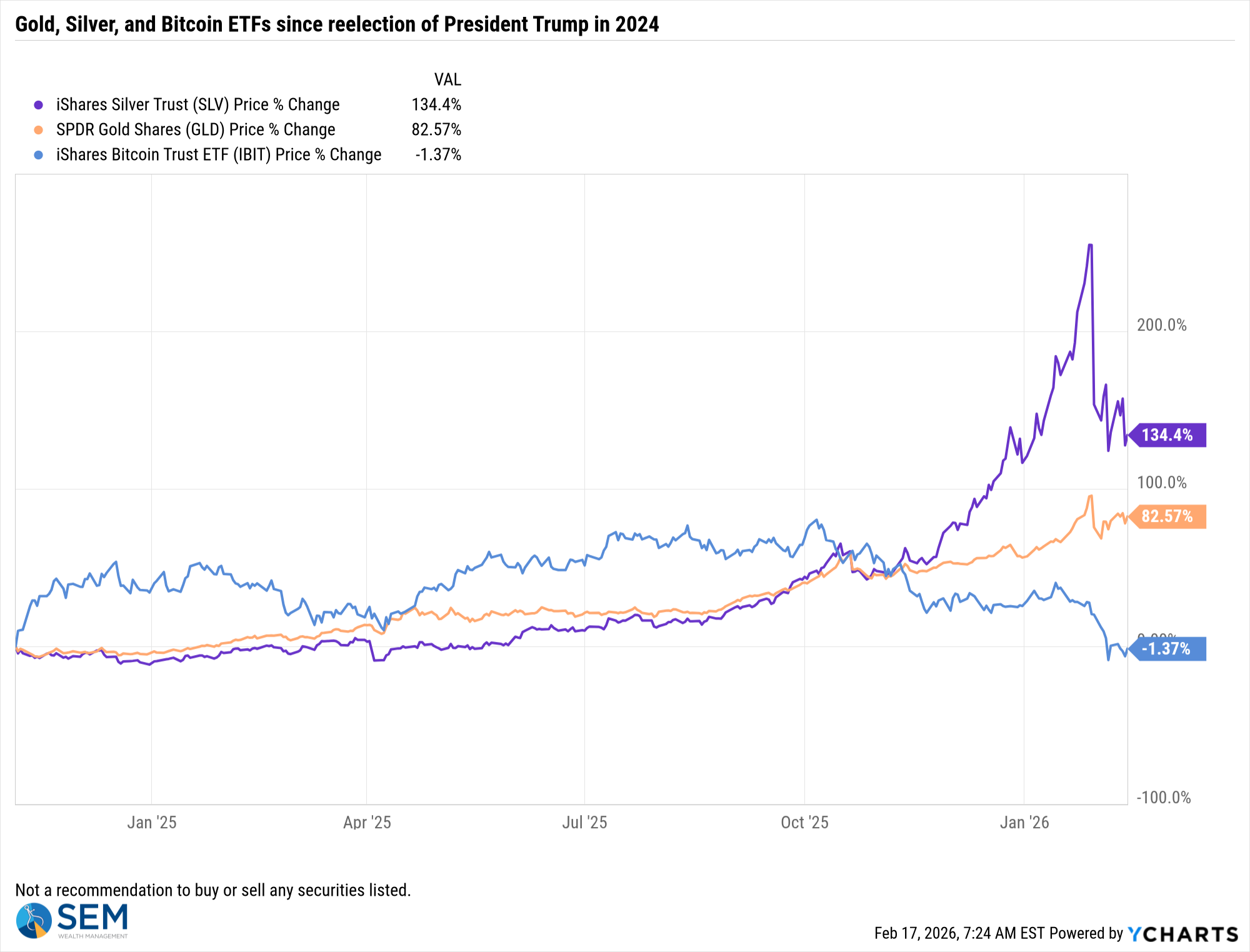

It was another tough week for Silver and Bitcoin, but Gold seemed to stabilize a bit.

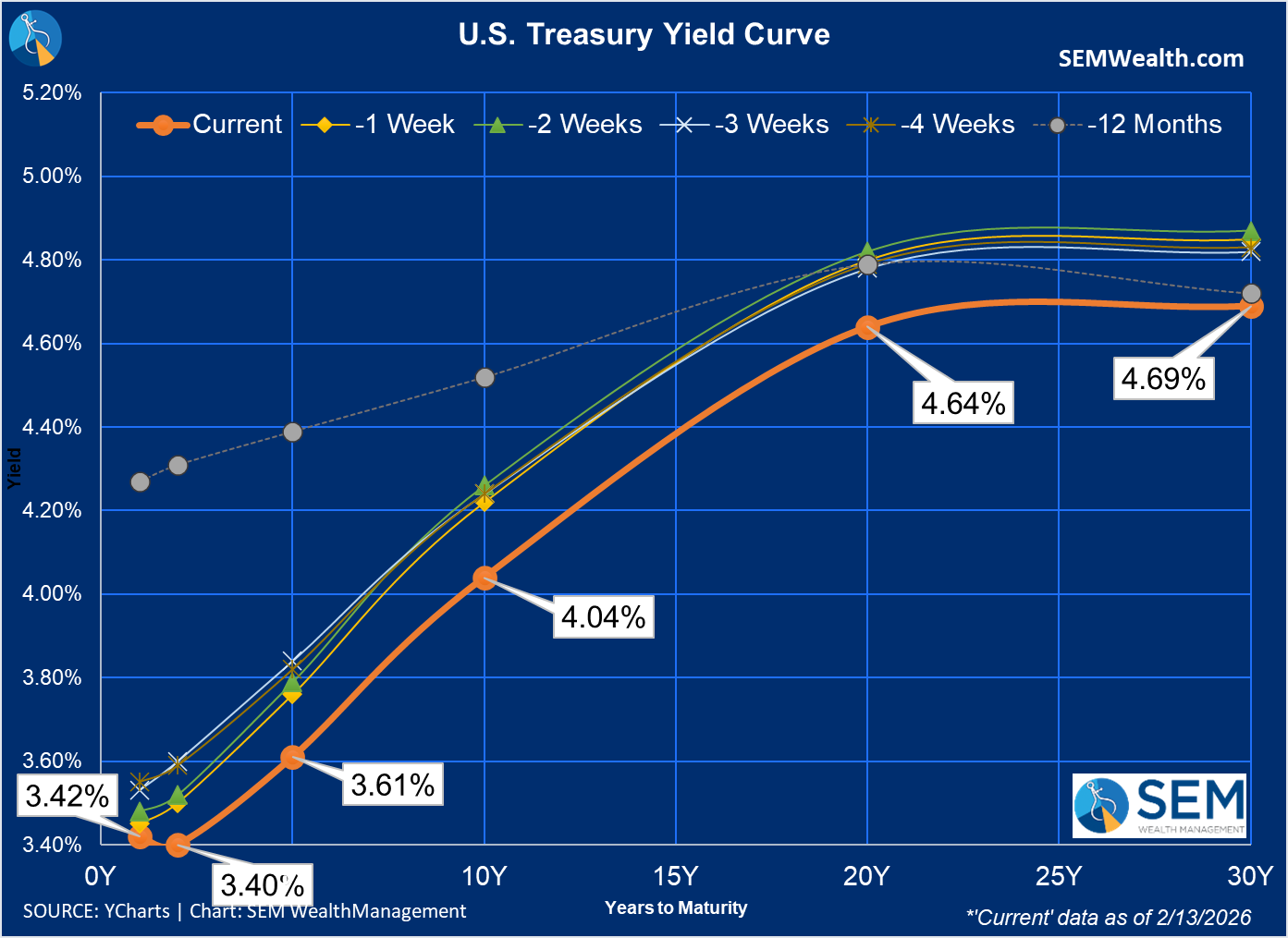

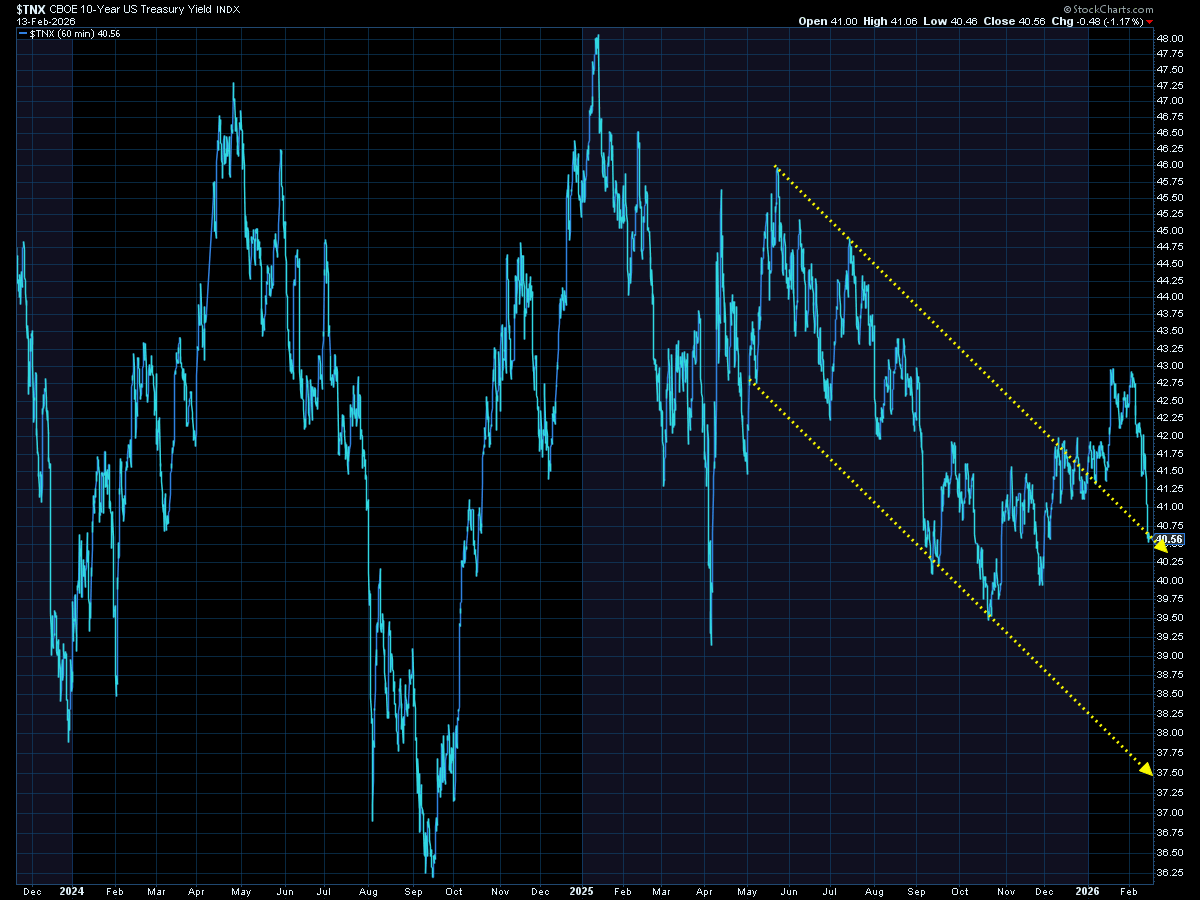

Probably the biggest market mover last week was the 10-year Treasury bond. Following the CPI data on Friday we saw a sharp move lower in bond yields. While the prospect of rate cuts are still pushed out to June (after Chair Powell's term ends), the market is clearly encouraged by the deceleration of the CPI data.

The move on Friday brought yields all the way back down to the downtrend channel we'd been focusing on.

SEM Market Positioning

| Model Style | Current Stance | Notes |

|---|---|---|

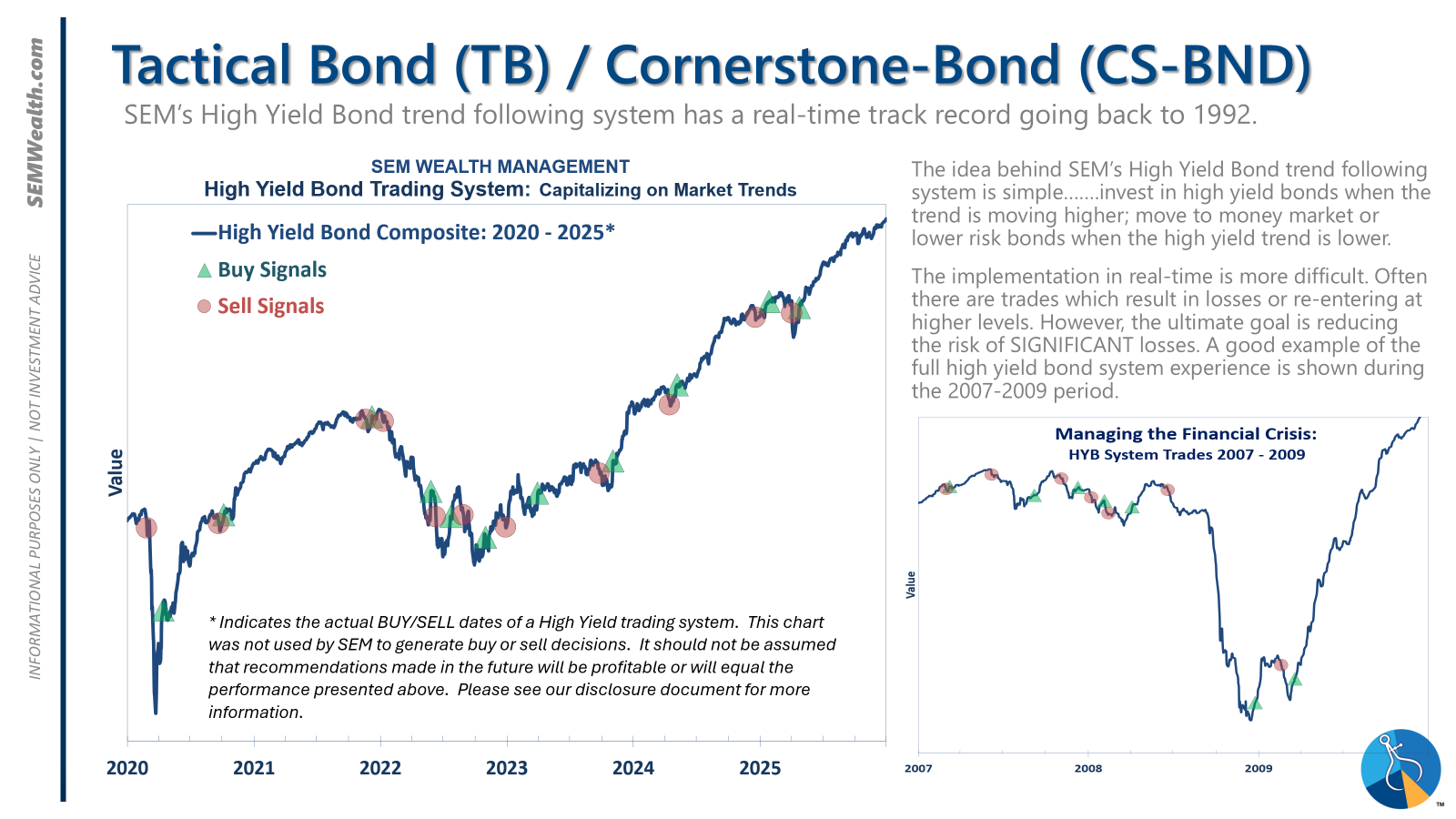

| Tactical | 100% high yield | High-yield spreads holding, but trend is slowing-watching closely |

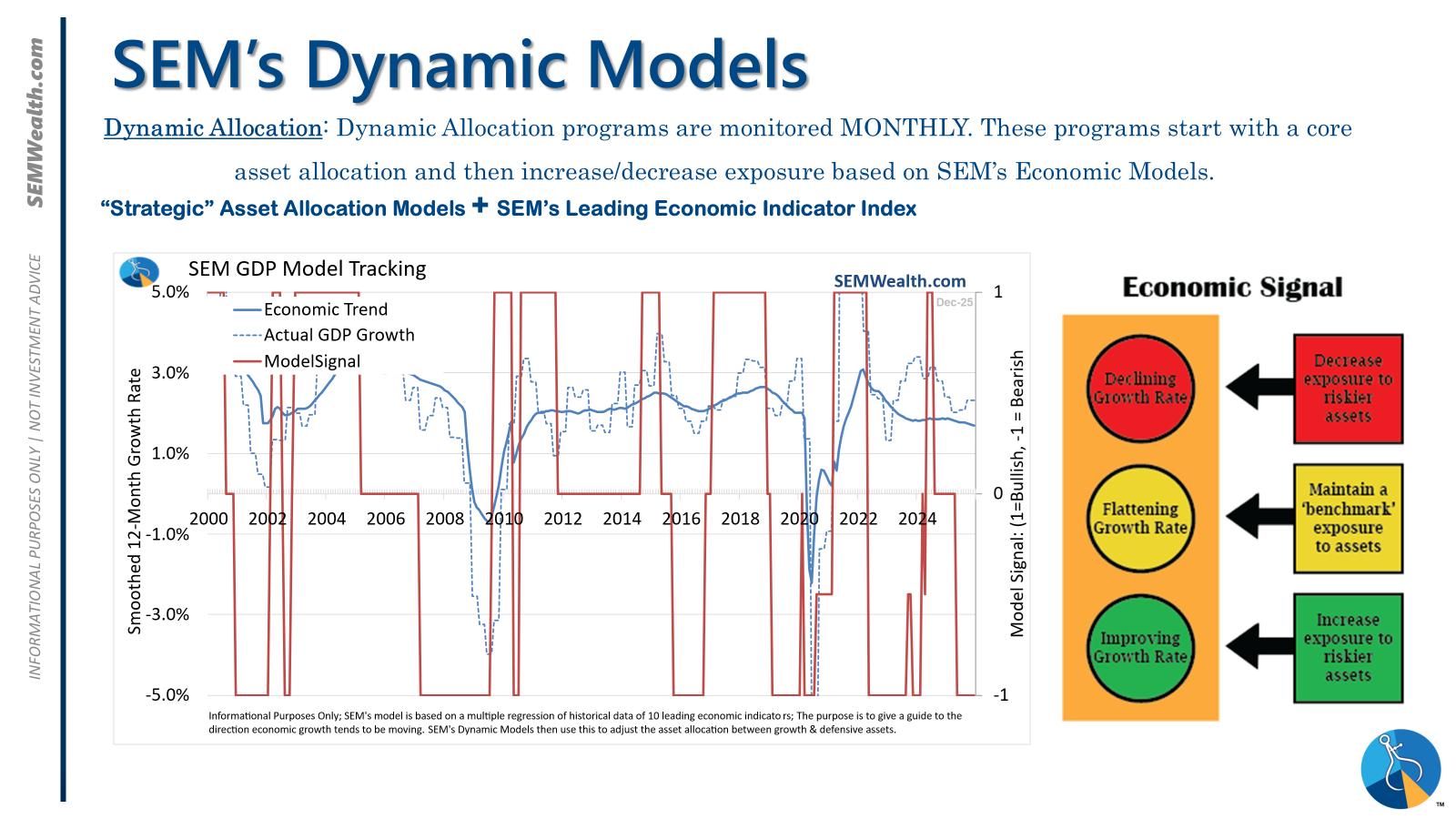

| Dynamic | Bearish | Economic model turned red June 30 '25' – leaning defensive |

| Strategic | Fully invested | Trend overlay shaved 10 % equity in April -- added back early July |

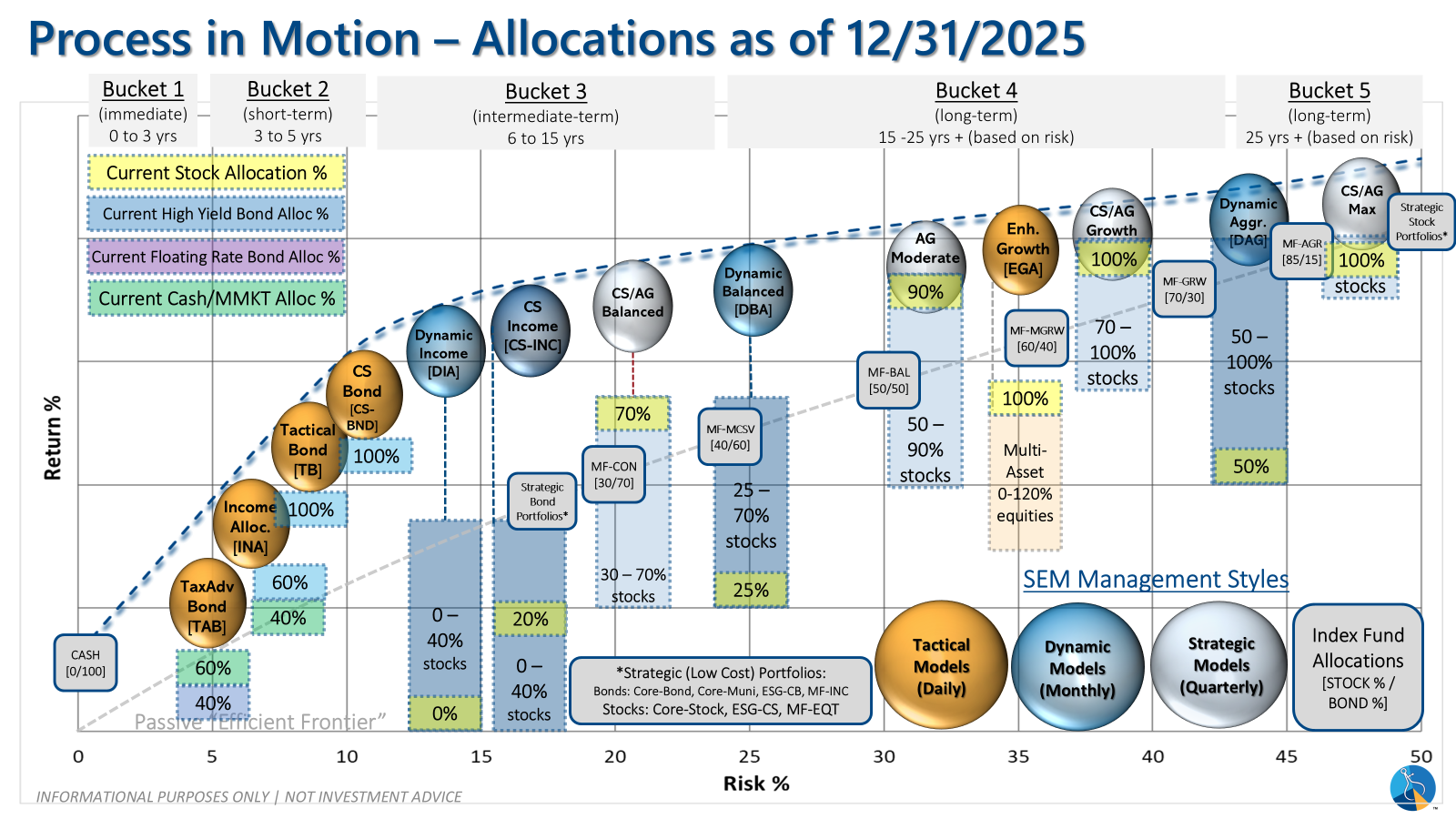

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The high yield system has been invested since 4/23/25 after a short time out of the market following the sell signal on 4/3/25.

Dynamic (monthly): The economic model went 'bearish' in June 2025 after being 'neutral' for 11 months. This means eliminating risky assets – sell the 20% dividend stocks in Dynamic Income and the 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is 'bullish' meaning higher duration (Treasury Bond) investments for the bulk of the bonds.

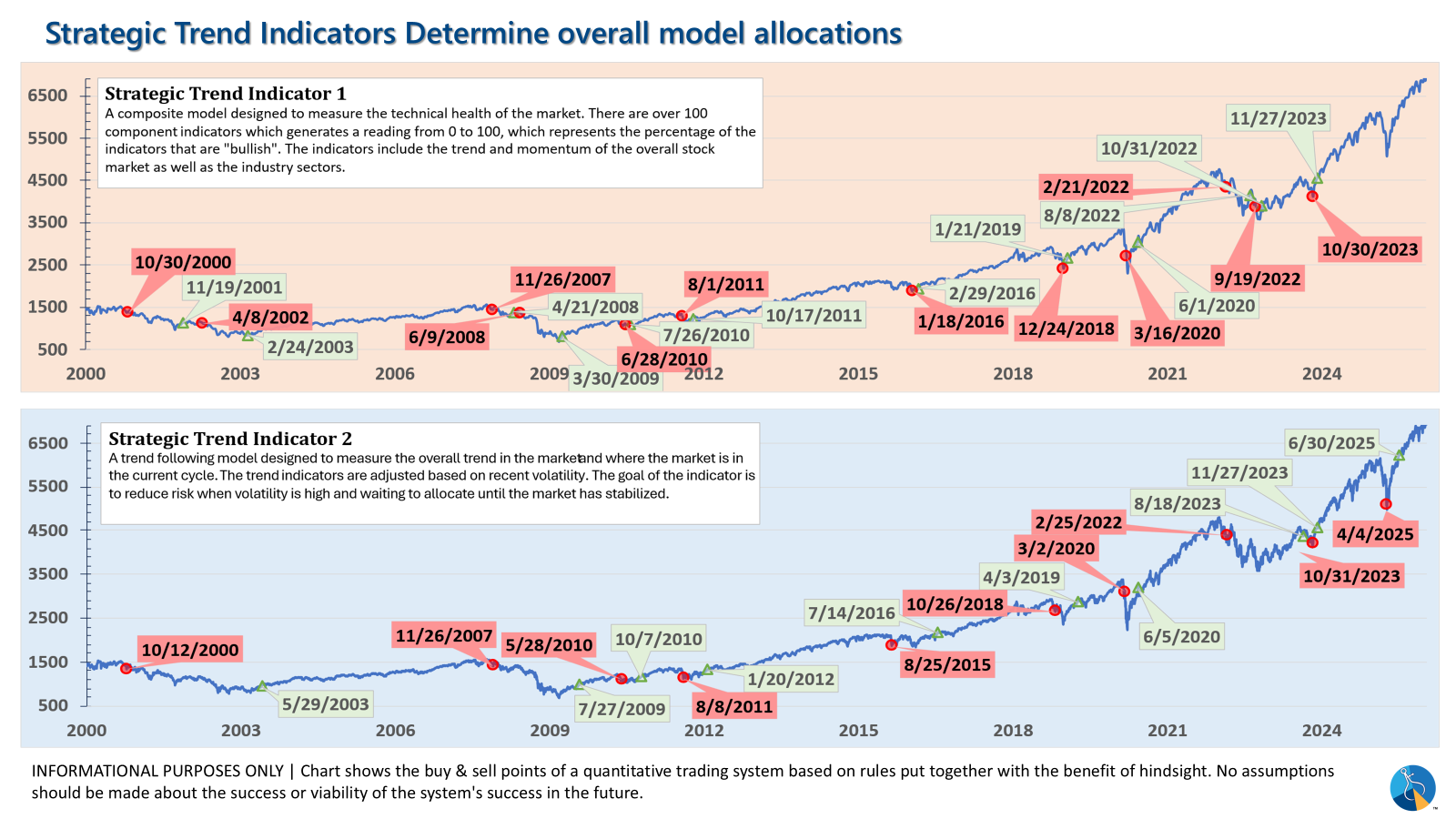

Strategic (quarterly)*: One Trend System sold on 4/4/2025; Re-entered on 6/30/2025

The core rotation is adjusted quarterly. This quarter we saw half of our international positions reduced (we sold developed markets and kept our emerging markets exposure). We also saw the remaining share of mid-cap reduced in favor of more small cap exposure. We remain with a "barbell" core portfolio – about half in large cap and half in small cap as the models expect the market to "broaden".

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire