Fool: A person who acts unwisely or imprudently.

We see a lot of this going around. I get it, 2020 was a tough year. I sometimes look around and cannot believe how much our country changed in a year. Seeing people wearing masks, the social distancing measures, the social unrest, and many other things none of us thought would happen in our country have all happened.

When that happens, our brains naturally will struggle to find rationality. Without data or precedent to guide us, we all tend to be a bit more emotional in our decision making. There's nothing wrong with that. It's what makes us humans.

The trick is knowing your brain is not processing everything as it should and finding ways to not make decisions that end up costly down the road. That's easier said than done.

Throughout the pandemic and for the last 20+ years I've been trying to provide data to help our clients and advisors remove emotions and make wise decisions. Looking through my social media feed this weekend, even LinkedIn, it is clear emotions are extremely high. Anything the other side says is wrong, and their side has the only answers. I think most of us are rational enough to know that is not true, but the people with the loudest voices prevent compromise from happening.

This foolishness is going to threaten our economy and how soon we begin to rid our country of COVID19. Both sides are playing politics rather than looking out for the American people. No amount of data I provide will change the mind of anybody cemented on the far left or far right of the ideological divide, so today I won't bother.

For those interested in the data, I provided the slides and commentary from our 2021 outlook last week:

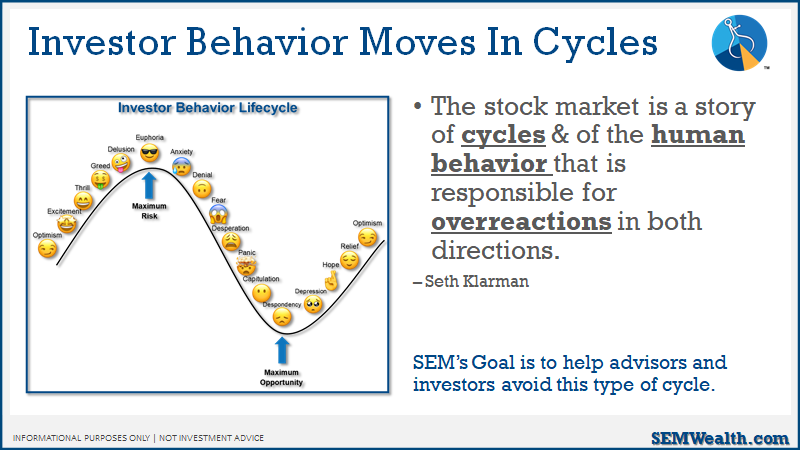

As for the market, in many aspects we are back to the euphoria stage.

The thought is the Fed and Congress will do whatever it takes to keep the economy and thus the market going. My experience and study of economic history tells me that is foolish. Besides the political game of chicken already being played by the new Congress, there is so much leverage and so much scarring already done returning to the pre-COVID levels will be difficult.

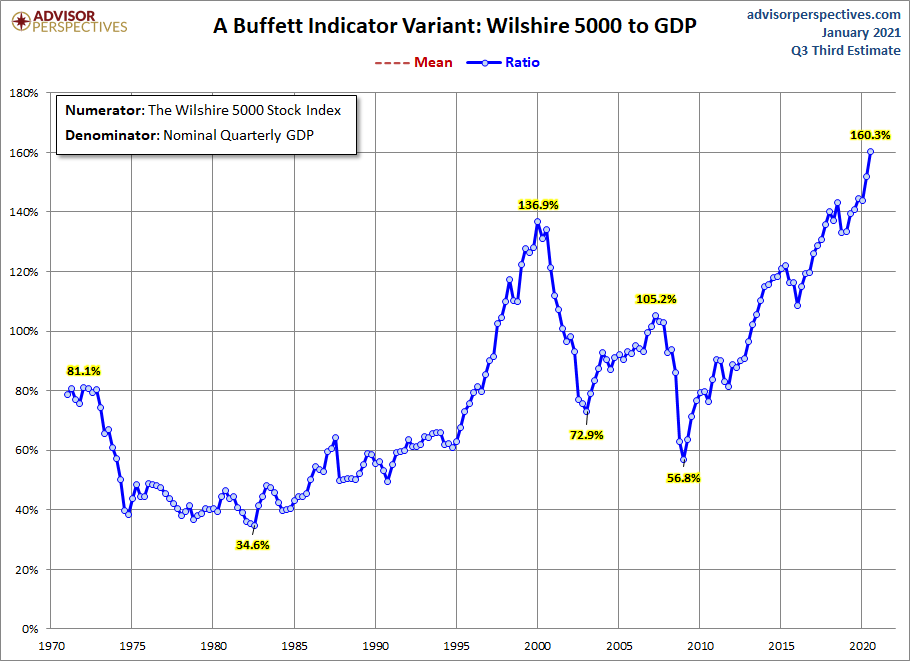

The real problem is how much stocks have rallied in anticipation of a return to normal. Market history is clear – the lower the starting valuation, the higher the long-term returns. The higher the starting valuation, the lower the long-term returns. Often times when you start at high valuations you end up losing money over the 7 to 10 year holding period. If you bought tech stocks in March 2000, you were underwater for 15 years. There are many stocks today that will be in the same category — if they even survive the next 15 years.

Let me be blunt — if you are retired or retiring in the next 10 years (or an advisor serving those clients), you are foolish if you trust a passive, low cost index strategy to make it through the next 10 years. Stocks are at historically high levels – levels which led to negative 7 to 10 year returns in the past. At the same time, bond yields are moving off of historically low levels and on the verge of breaking their downtrend. When yields go up, bond prices go down. For the past 40 years when stocks fell, bonds rallied. This made the traditional 60/40 stock/bond portfolio appear to be a steady solution for retirement.

Foolishness is running rampant

I apologize for the negativity today. For the third time in as many weeks last week we had a client who had an "income" objective and a 10% downside risk tolerance decide they wanted to liquidate their account to "buy individual stocks". The 8% return last year with only a 2% drop in February/March apparently was no longer good enough, nor the fact our AmeriGuard and Cornerstone Growth and Max models, designed for those with a higher risk tolerance were up over 20% in 2020. We've had others taking big chunks of their retirement accounts to buy a popular electric car maker (who is currently worth $1.9 million for every car they sold) or highly focused technology ETFs.

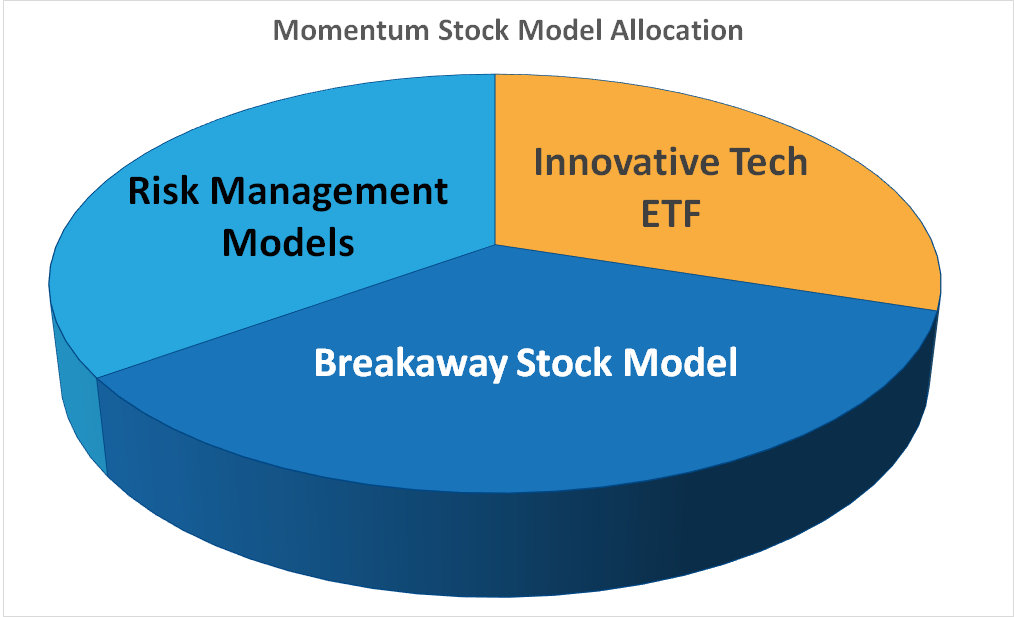

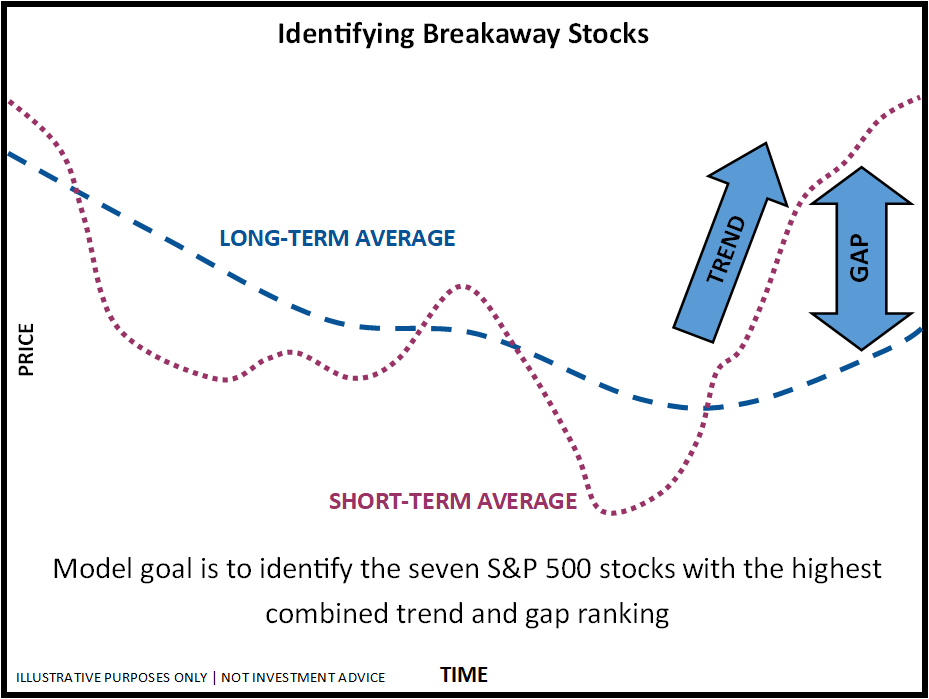

For those who do feel the need to get some of the euphoria of owning individual stocks, we launched our Momentum Stock Model (MSM) in the spring of 2020. We wanted a way to own individual stocks, but also something that had a trigger to take some of the risk off the table when momentum wanes.

You can learn more about this model here.

Data isn't on your side

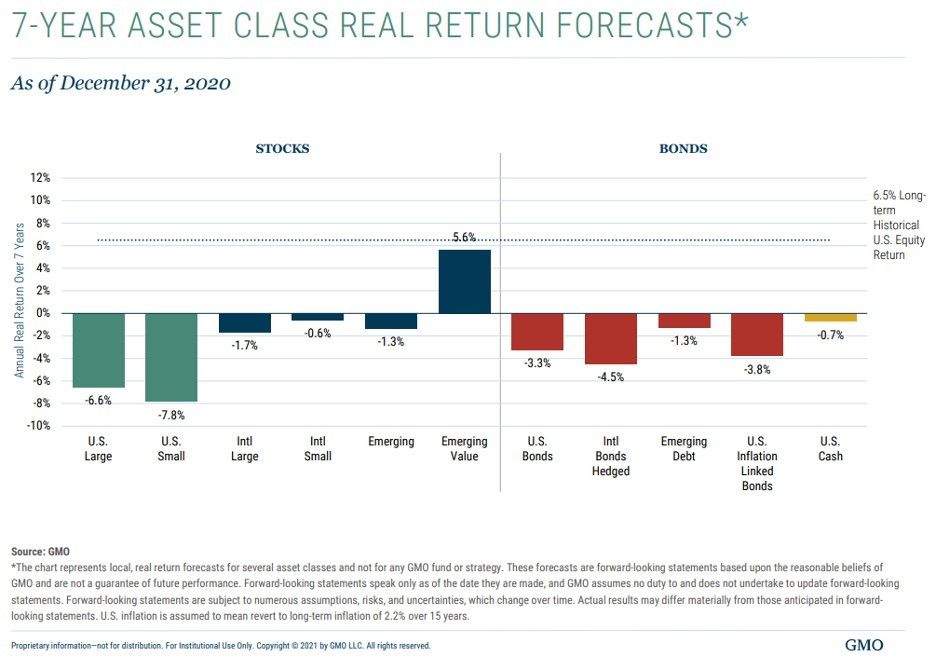

The people at GMO also agree. Each month they put out their data-driven forecast of 7-year returns. I haven't seen this since mid-summer. With the huge rally we've had in all stock markets, I haven't seen their projections this low since late 1999.

Remember, these are ANNUALIZED holding period returns. A negative 6% return over 7 years for US Large Cap Stocks would take a $100,000 investment down to $65,000 in just 7 years. There is little value left at all in the market. Keep in mind, the way you get to these negative returns is typically due to a very large drop at some point and then a climb back up. Stocks can easily go up another few months or even few years before the big drop, but history tells us the drop is coming and will be painful for those who will be relying on their investments over the next 7 years.

When it happens is not something we have the tools to predict. What we will do is what we've done for the past nearly 30 years – follow the trends. As long as they keep moving higher we will be along for the ride, but when they reverse the systems are in place to move money to the sidelines and wait for a much better entry point.