Election week is finally here. This has literally been the longest presidential election period with Donald Trump essentially running for re-election since 2021 and Joe Biden declaring his intention to run again shortly after taking office. I don't know about anybody else, but I'll be glad to have at least the political ads and campaign speeches over with, although I'm not optimistic about the election actually being over this week given how close the vote is likely to be.

While social issues seem to be getting more attention from voters and the candidates, the economy still matters. I know both candidates have convinced their supporters that they are the answer to all of their economic problems. At SEM we have always chosen to focus on the data. With the release of the October jobs report last Friday SEM's economic model closed out the month. This is actually good timing as it gives us a chance to focus on what the data says the economy is doing (not what people are telling us it is doing).

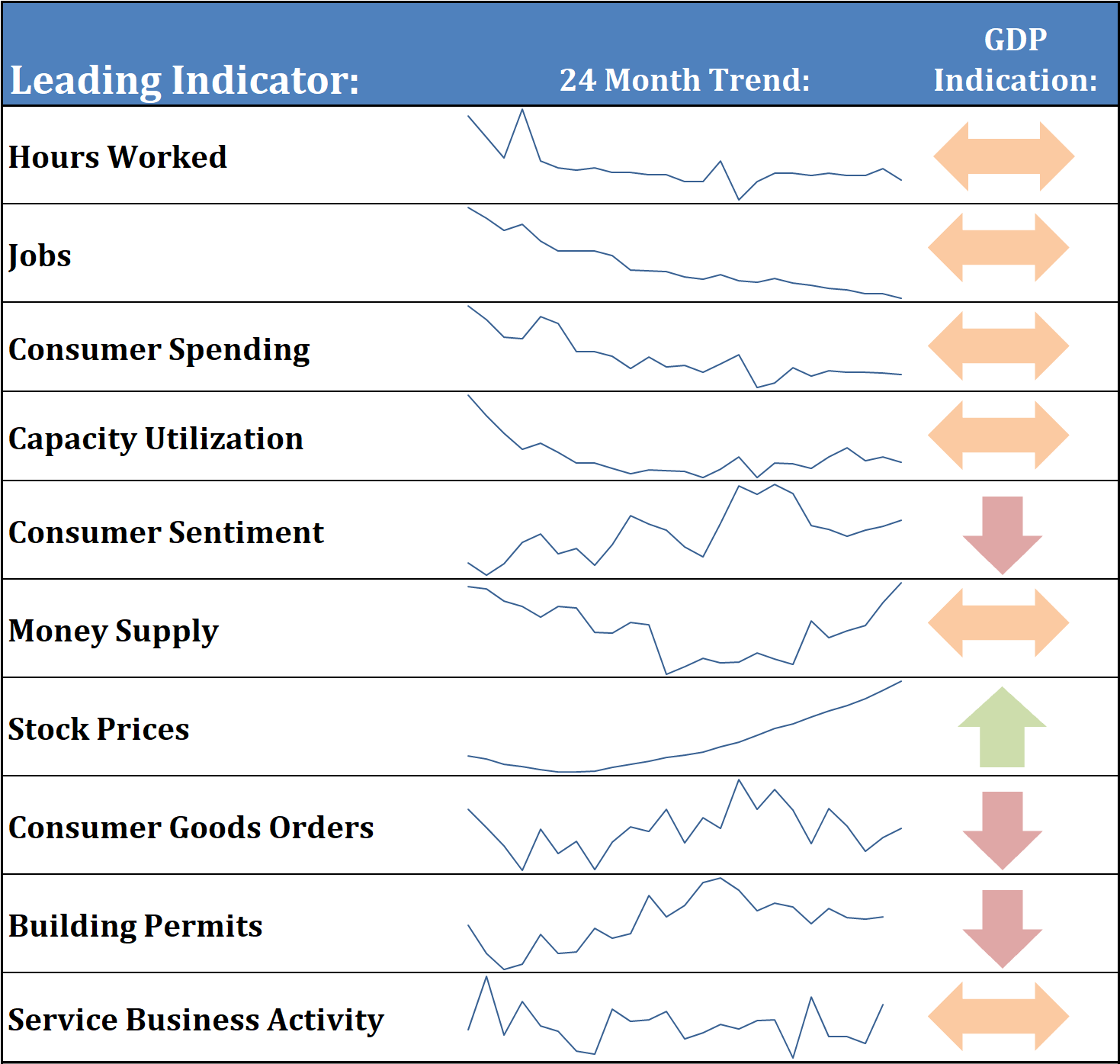

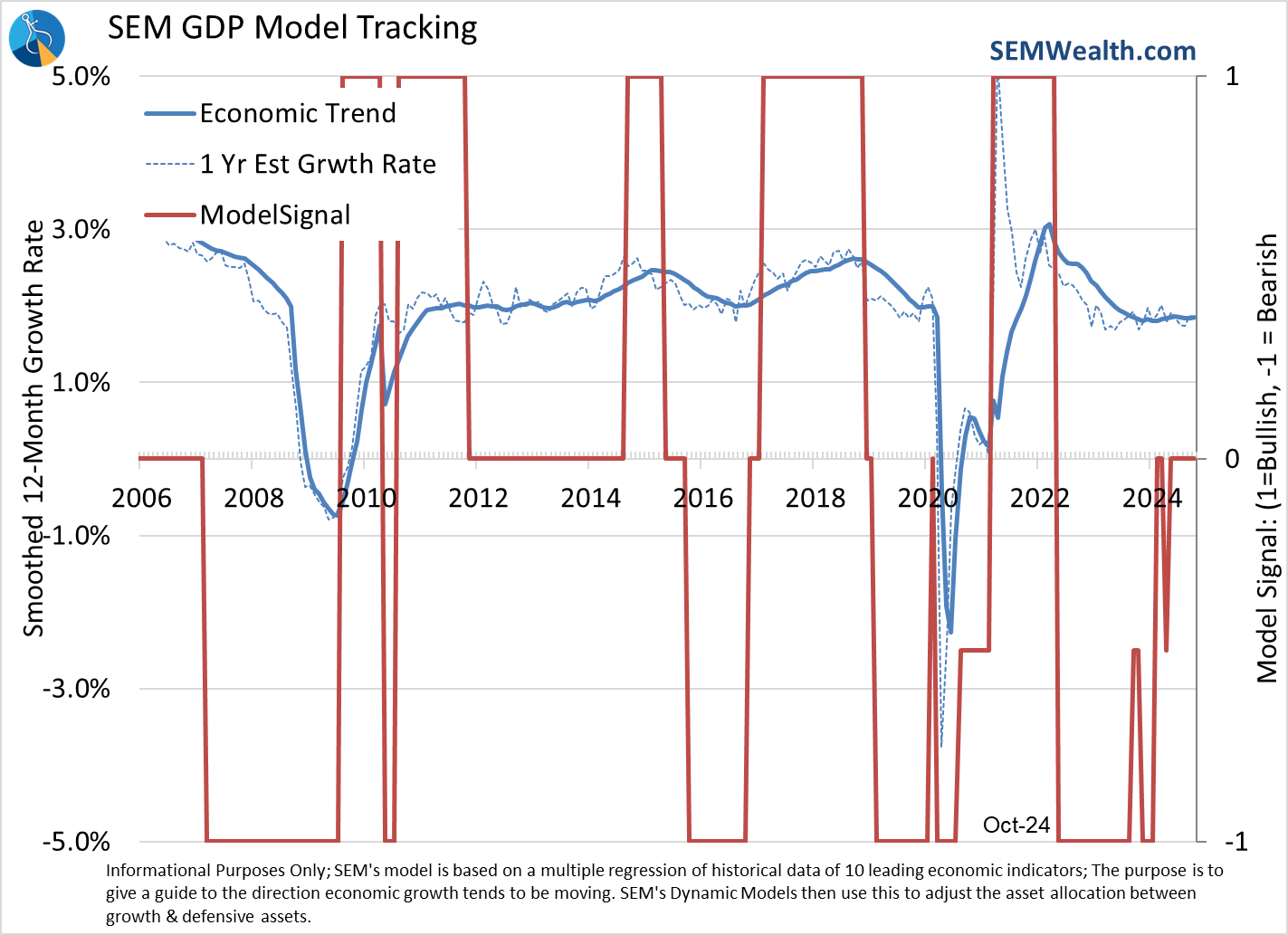

Similar to last month, most of the indicators are flat or down. Once again, the only indicator that is positive is stock prices. The question remains if stocks are 'right' in predicting a strong economy or if history is about to repeat itself and investors became overly optimistic about the ability for the economy to grow at a stronger than average rate.

With this being election week and very little changing in terms of our economic model, I thought I'd highlight a few charts from our SEM University on the impact of the election and the economy.

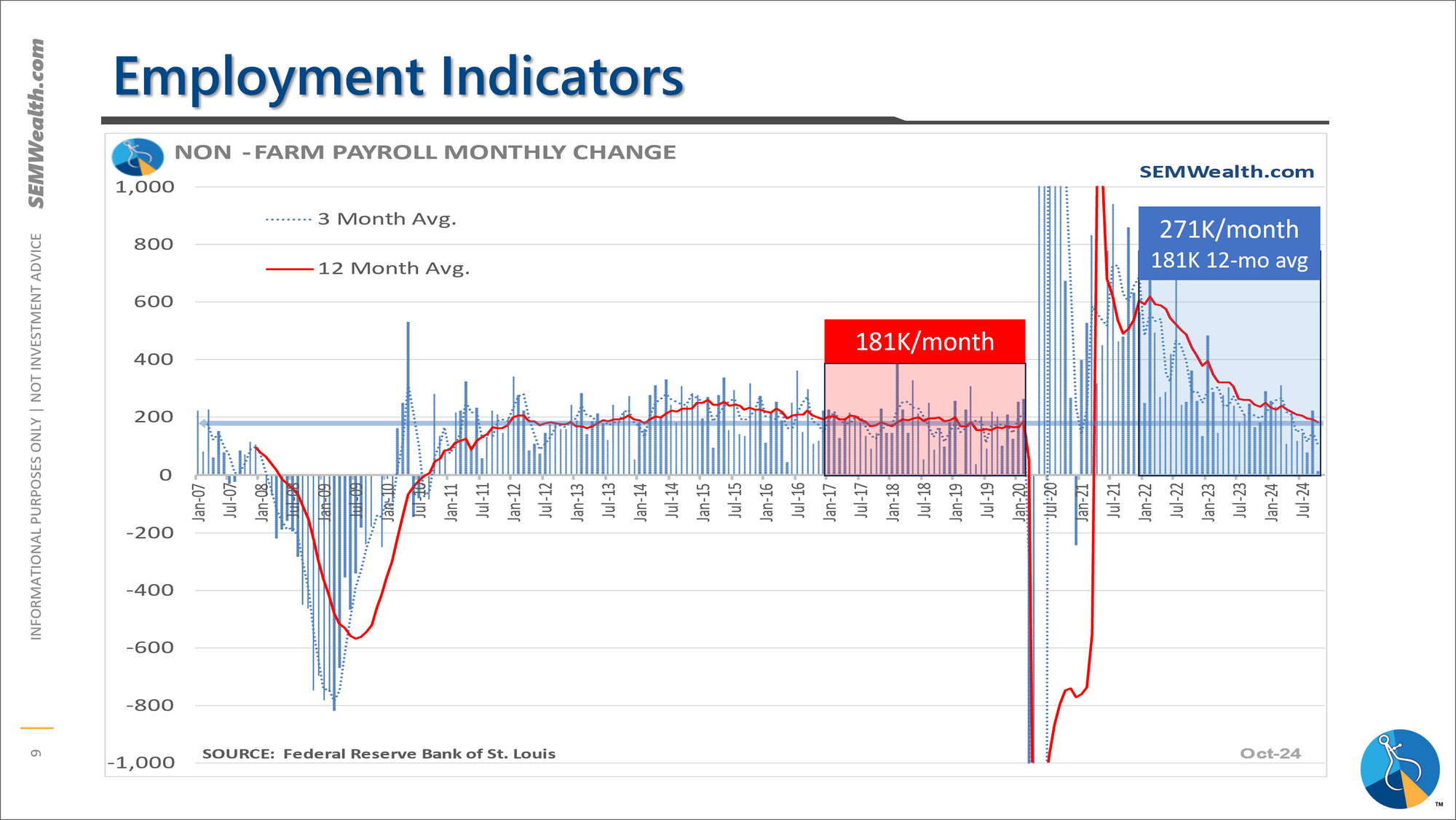

The payrolls report on Friday was certainly negative. I've never liked how they did this report as they run their survey over one-week and then estimate the rest of the month. When the official tax records are all reported it is likely they will revise the number higher. Regardless, the current 12-month average is essentially the same level of jobs we saw during the pre-COVID Trump years.

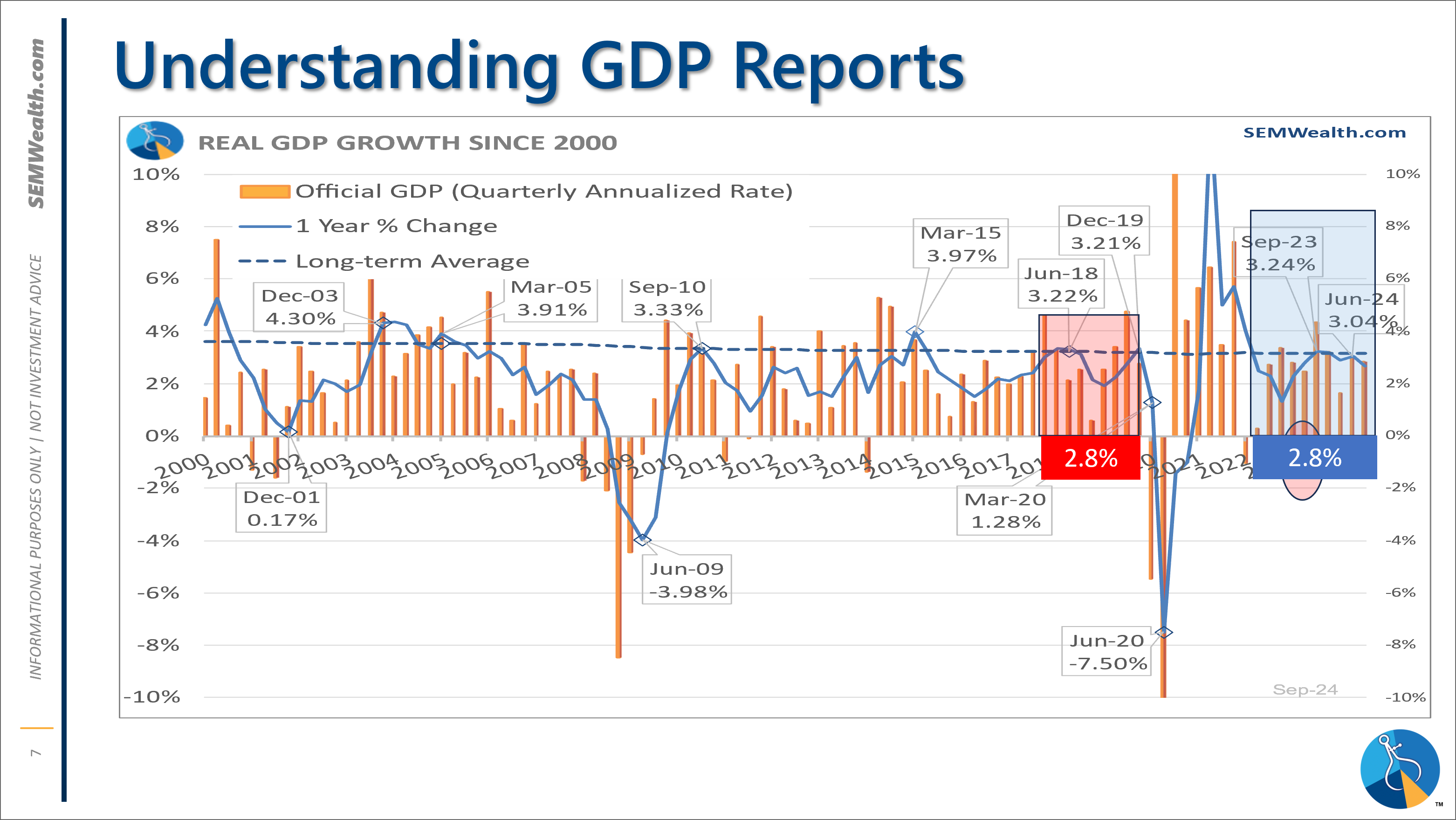

The biggest thing everyone misses is the fact we have had over two decades of Republican-only, Democrat-only, and split control. Under both Trump and Biden our economy only broke above the long-term average growth rate of 3% on two occasions each. Our economy is too complex to believe that a one-sided solution will magically create economic growth. Both pre-COVID Trump and post-COVID Biden had an average growth rate of 2.8% (below average).

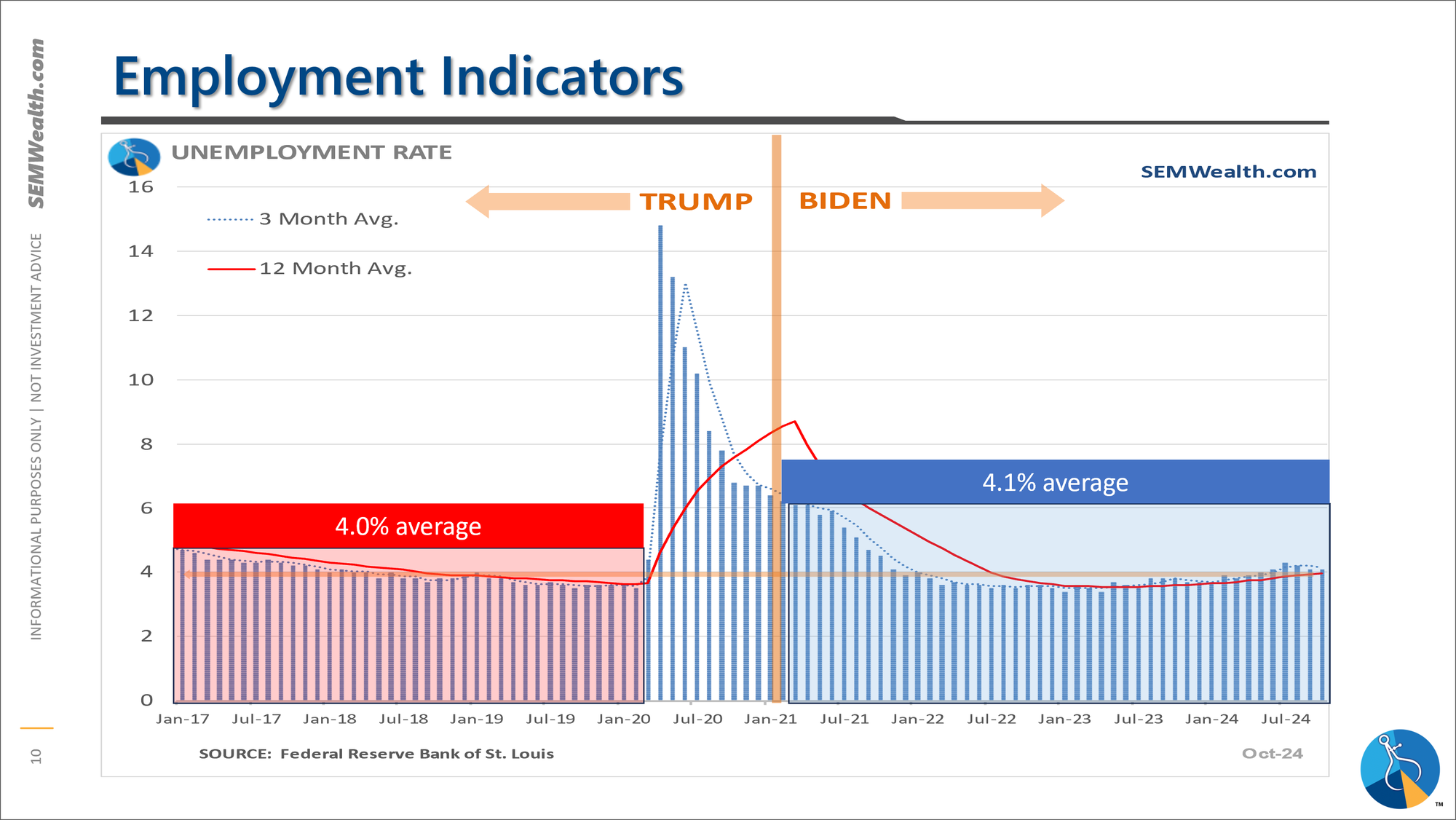

The unemployment rate has been ticking up, which could be a reason the Democrats lose. You can see up until COVID, the unemployment rate was trending lower under Trump.

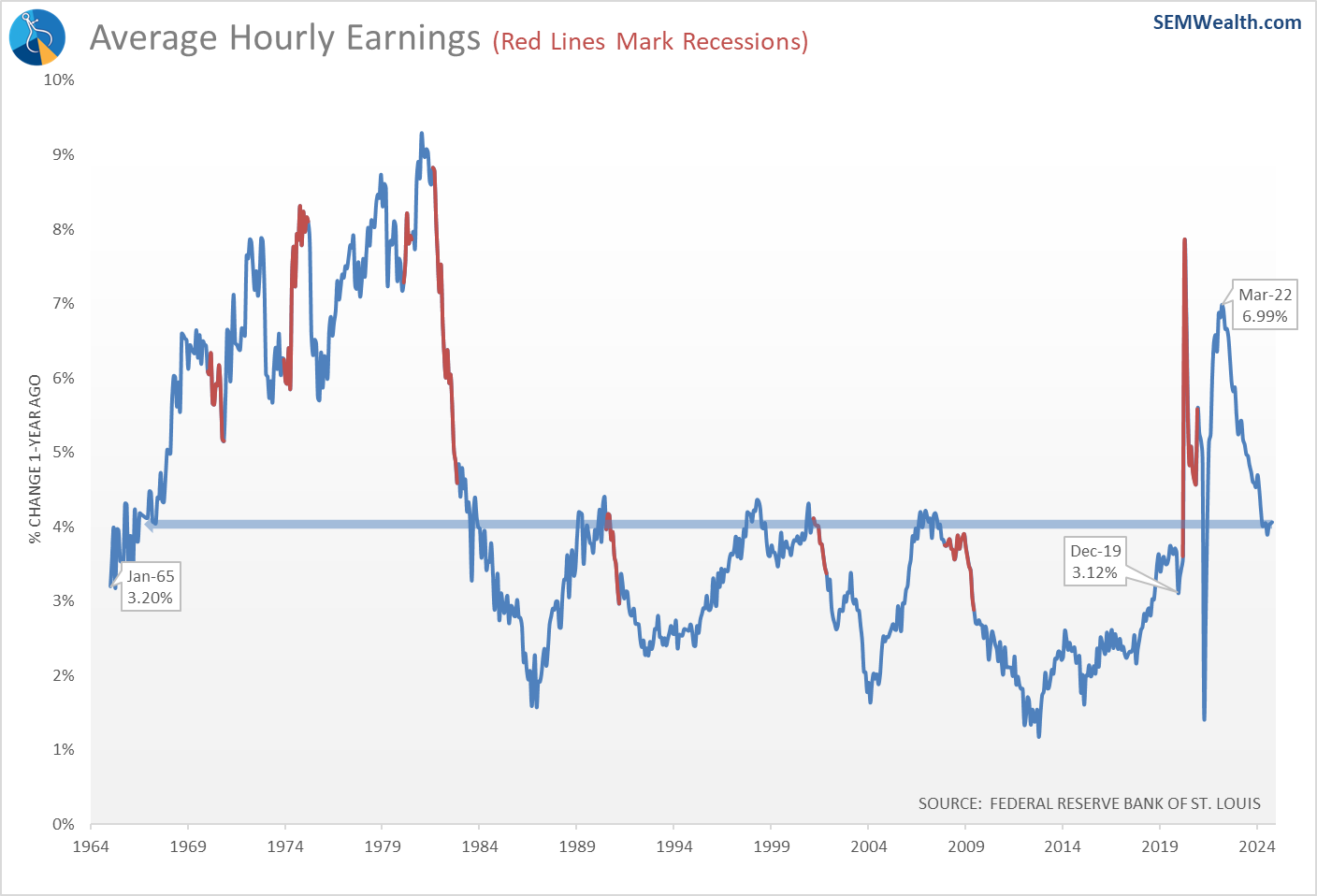

One thing not discussed too much is the huge growth in hourly earnings we witnessed during and after the pandemic. Some of this was due to forced wage increases across the country from states raising their minimum wage, but most of it was the result of the free market demanding higher wages during a labor shortage. With the mass retirement of the Babyboomer generation and not enough qualified workers to replace them wages have gone up, but at a slower rate than the rate of inflation, which further exasperates our economic divide.

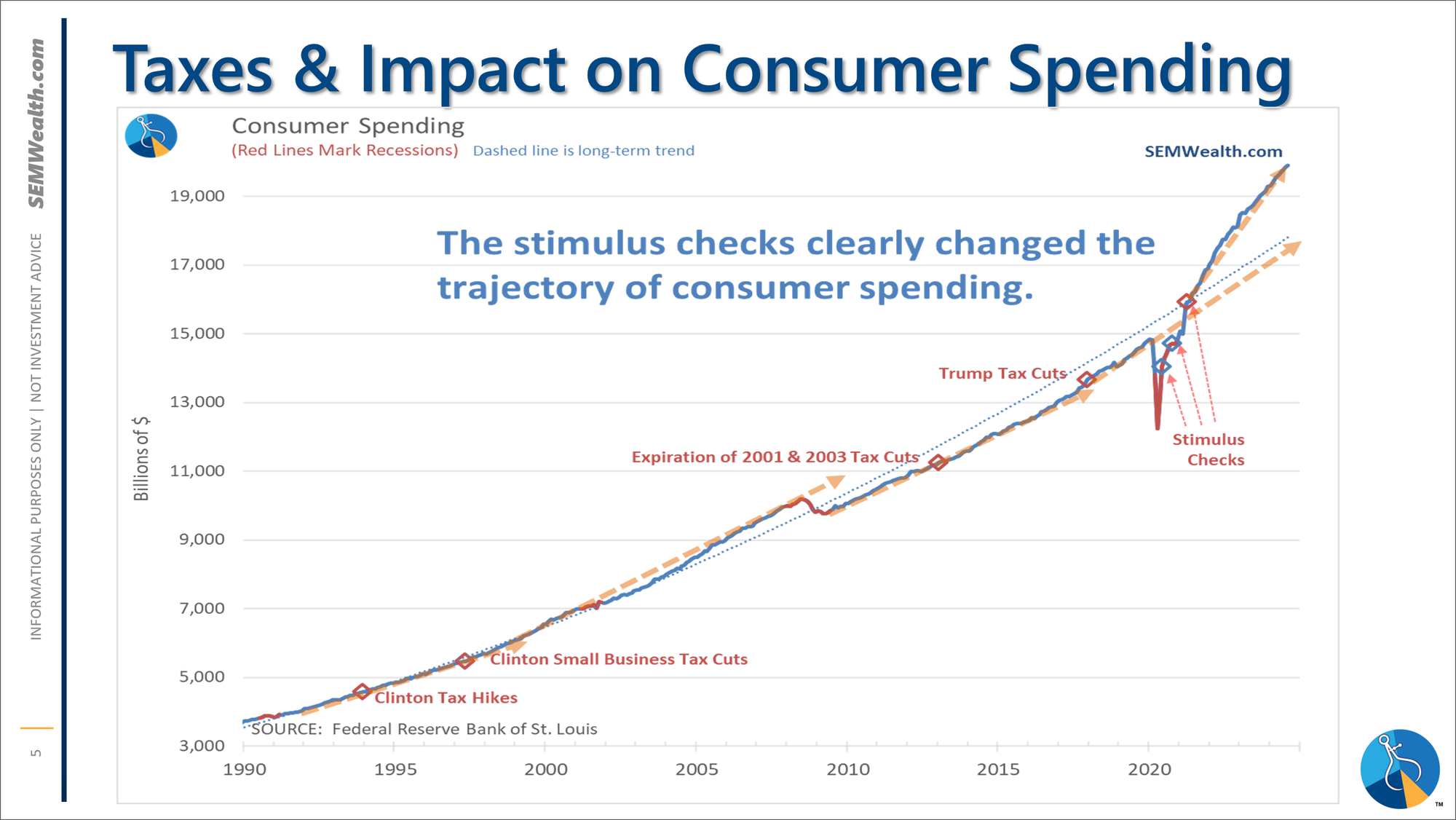

Another thing I've seen both sides completely miss is how the 3 pronged COVID stimulus checks (2 signed by Trump and 1 by Biden) completely shifted our economy. We've seen some fairly major tax cuts and hikes over the past 30 years and yet the only thing which truly shifted consumer spending (70% of our economy) was those stimulus checks.

Too many people who didn't need money (such as those on Social Security, receiving pensions, or able to work from a laptop) received money. With the service economy essentially shut down, they spent it on big ticket items and presto we had inflation.

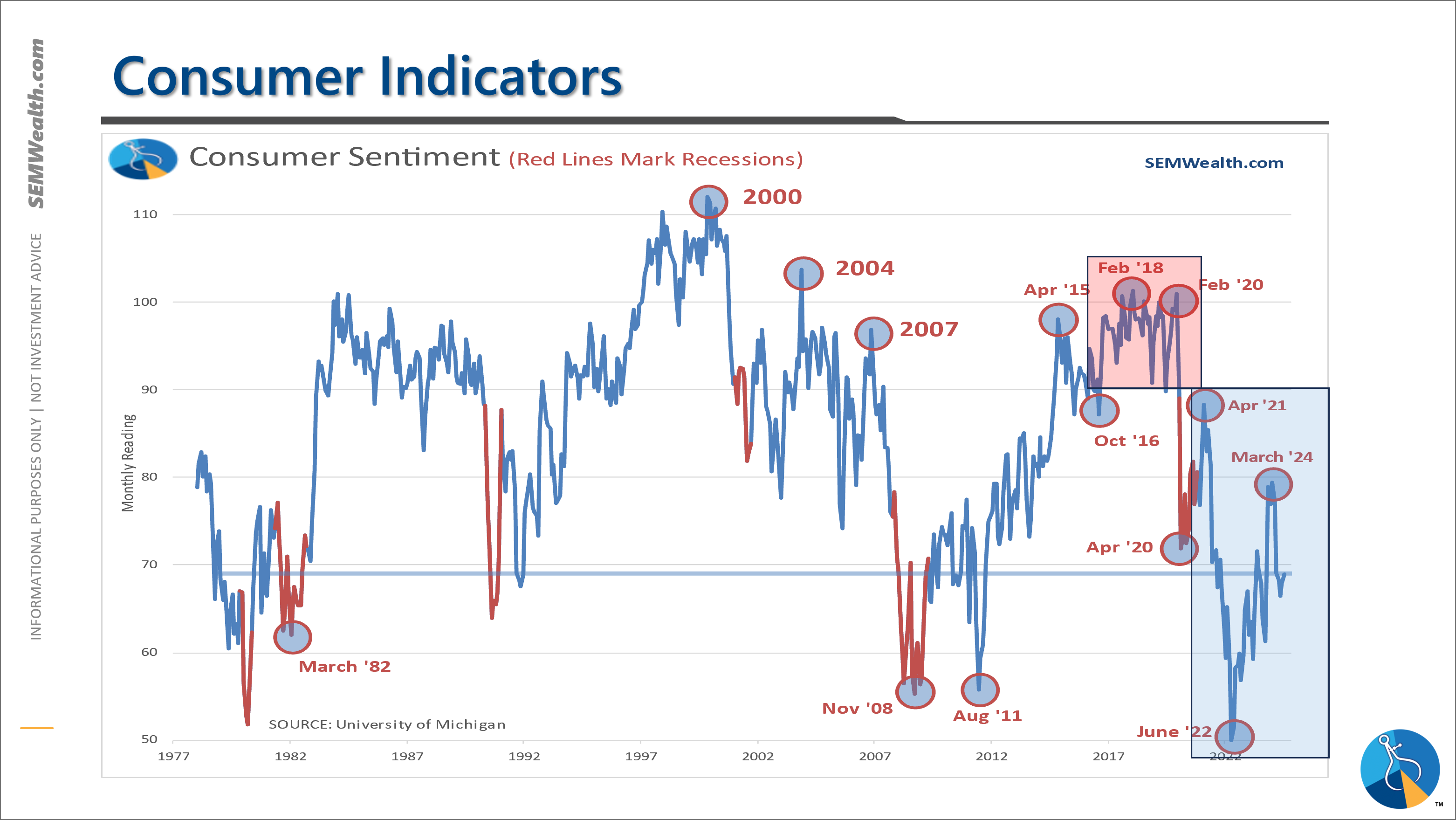

Despite this gift from the government (low taxes, massive spending) and relatively positive economic data, overall Consumers do not feel great about the economy. This is going to be a problem for whichever side "wins" the election. A close eye will show you there was initially a surge immediately after Trump won in 2016. This continued until the Trade War began in early 2018. As that calmed down in 2019 we again saw optimism climbing.

Overall, the economy is broken. Despite massive tax cuts (and increased government spending) followed by even bigger rounds of government spending neither the Trump or Biden economy could manage to climb above the long-term average just two times each. The "solution" is not going to come from the far left or the far right. They've both had their chances and they both could not make it move above the long-term growth rate. The "solutions" being proposed by both candidates will only put us deeper in debt, create an even bigger trade deficit, and spark a big increase in inflation.

Whomever wins this week, the DATA shows the economy is at risk of a recession. One wrong (short-term) move and the economy could head lower. We are due for a recession. Too many excesses were created with the COVID "solutions" which have actually done more harm than good. Those excesses need removed and the ideas thrown around by both candidates to buy votes would actually push us over the edge economically (at least over the short-term).

For now, our economic model remains "neutral". The economy has lost momentum, but isn't quite heading downward. Overall, there are more negatives than positives, so we should at least be preparing ourselves for an economic slowdown (again, no matter who wins).

Even our shorter-term readers know that I try to not take sides politically. It's not my job or position to influence our readers' political opinions. I try to take a step back and look at the big picture. Since 2010 I've been talking about the 'social cycle', a 4-phase generational cycle first written about by Neil Howe back in the late 1980s. Studying this has allowed me to not get roped into what has been a very emotional 16 years for many people (beginning with the financial crisis in 2008 which history will likely point to as the start of the 'crisis'.)

I read an interesting article in Bloomberg this weekend. It paraphrases something I've said since Donald Trump surprised everyone by knocking out a long list of 'establishment' Republicans and essentially took over the Republican party. Trump's rise to becoming the Republican party is not the problem. It is a symptom of a deep-rooted underlying problem that ALWAYS emerges at this phase of the social cycle.

We did a video series on this last year. The 'K-shaped' economy has divided our country. There is no SINGLE SOLUTION that will fix it. There is no SINGLE PARTY that will fix it. Most certainly, one SINGLE PRESIDENT cannot wave his or her magic executive order pen and change it.

Back to "Trumpism" and the Bloomberg article. This is not the first time we've seen a movement like this. Since his rise to power in 2016, Donald Trump shrewdly gained the support of the wealthy by promising all kinds of tax breaks, the end of 'wasteful' spending, and restrictive government oversight. At the same time he gained the support of the increasingly shrinking middle class by promising to 'bring jobs back to America' and punishing China, other countries, and immigrants who are "taking our jobs". Add in his unique personality and you have somebody who came to power at a time when America was already broken.

Again. Donald Trump is not the "problem" (or the "solution" based on history), but rather a symptom of our deep rooted problems that cannot be fixed with a SINGLE PARTY, SINGLE CONGRESS, or SINGLE PRESIDENT. The upper half of the "K" is upset over 'wasteful spending', 'free handouts', 'government oversite', and many other issues. The lower half of the "K" is upset that the upper half seemingly has everything while their standard of living has diminished. Trump found a way to tap into both parts of the K, which is why he has the "support" of essentially half of the voters whether they agree with his personality or not.

As we've shown above, we had essentially 3 years of pre-COVID "Trump" policies and 3 years of post-COVID "Progressive" policies. The economic data shows little difference. The problem though is both our trade deficit and especially our budget deficit has grown over that time. This is a longer-term problem that must be solved with NEW solutions that are fair to both parts of the "K".

Hopefully by next week we will have a clear winner free of credible legal challenges so we can begin deciphering what the next 2 years may look like. Regardless, we will do what we always do – focus on the data and leave our opinions and emotions out of it. For more on the current state of the markets and our model positioning, check out the next two sections below.

Market Charts

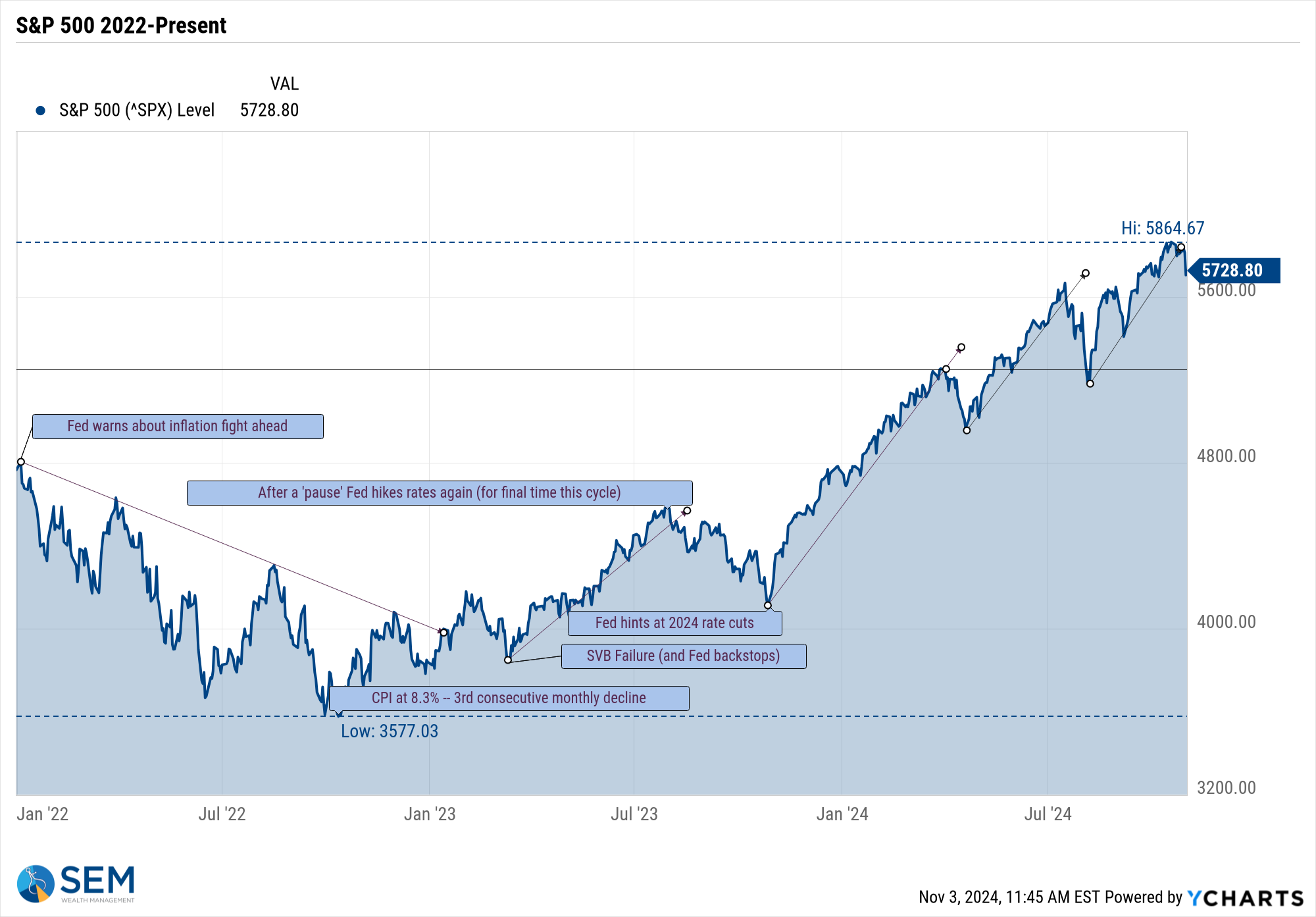

"Record highs tend to lead to more record highs.....until something significant comes along to change it." This is what I've been typing for most of the year. Stocks did not make new record highs last week and had a few big drops along the way. The question is whether or not the cause was "something significant". The issue last week was too many corporate earnings announcements including forward looking guidance which was lower than what many had been pricing in.

Remember, our economic model has been neutral saying we will have at best "average" growth (in our model that is somewhere between 2.6-3% GDP growth). The market however has been pricing in ABOVE AVERAGE earnings growth (about 10%). Long-term that cannot be possible mathematically, so one has to be wrong. Either the economy somehow starts growing at an above average rate or earnings fall to below average rates.

The resolution of this will be important with market valuations at levels we've seen just before big drops.

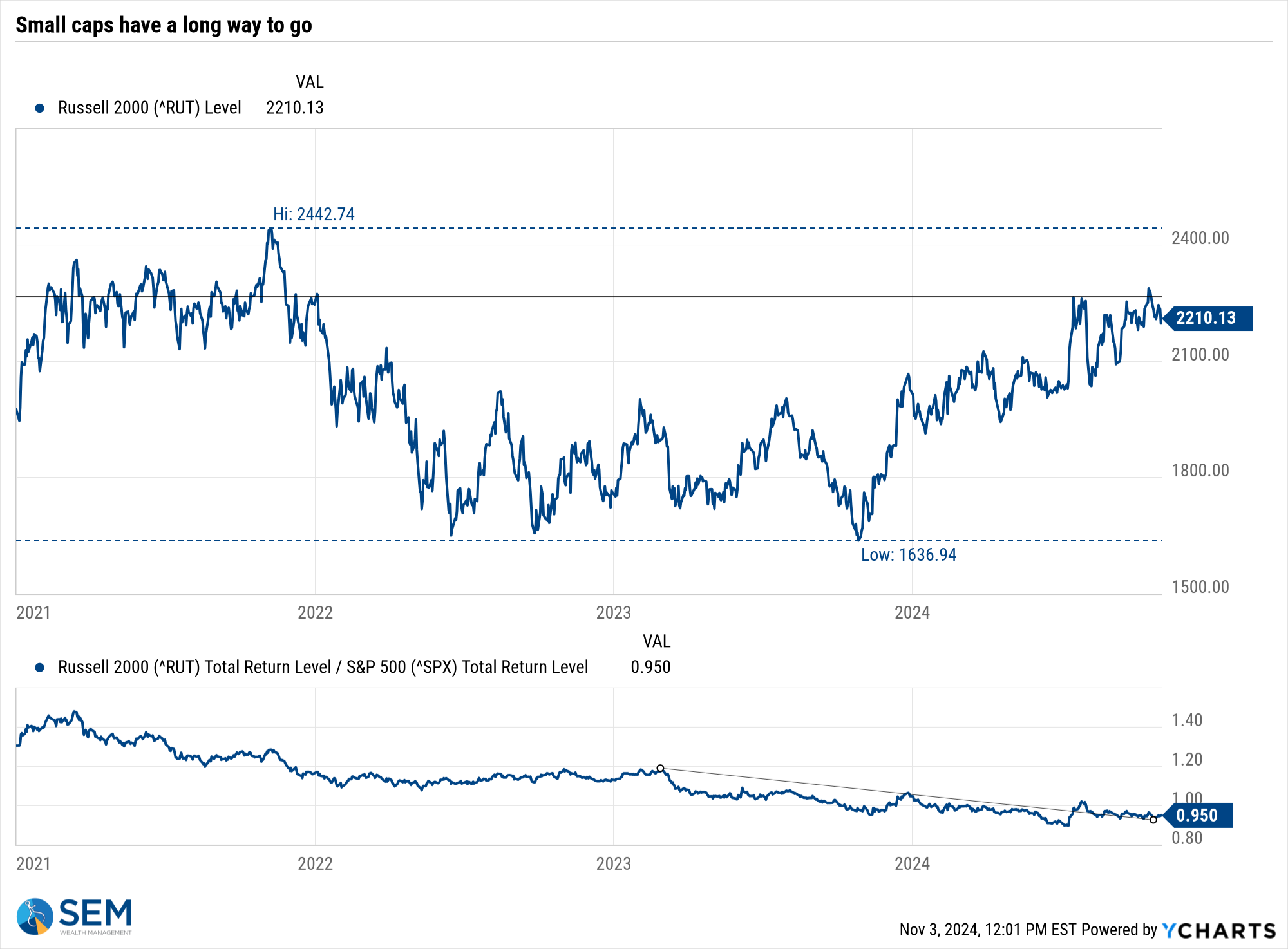

On the plus side two key indicators have not yet shown concern that economic growth is about to decelerate. The first is the small cap stock index. While never confirming the increase in stock prices this year, small caps have not given up their gains too much.

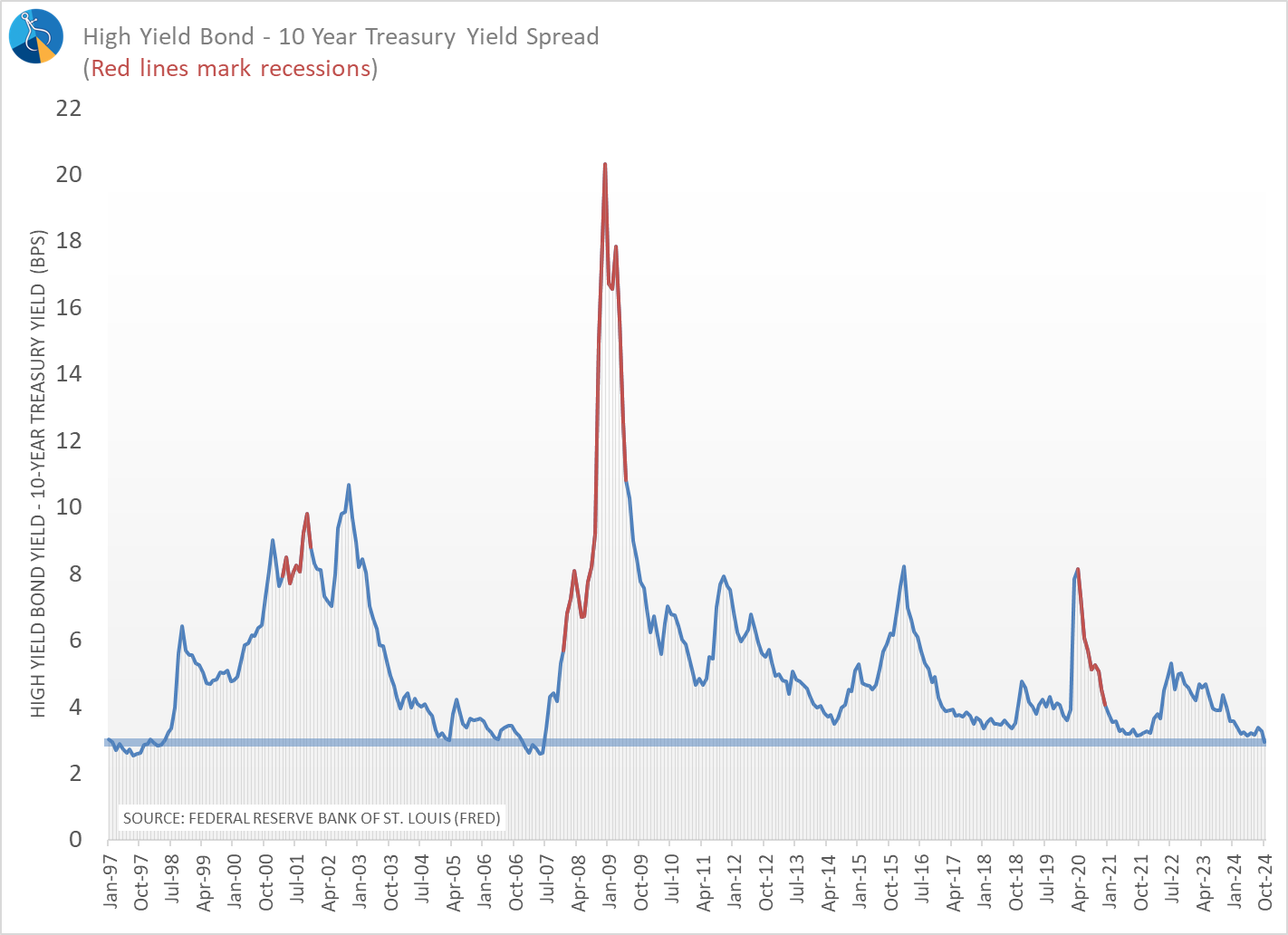

The other indicator is high yield bonds. While the price of all bonds, including high yields have fallen, the spread, which is the difference in yield between high yield corporate bonds and Treasury bonds is close to an ALL-TIME LOW. Spreads nearly always spike well before a recession.

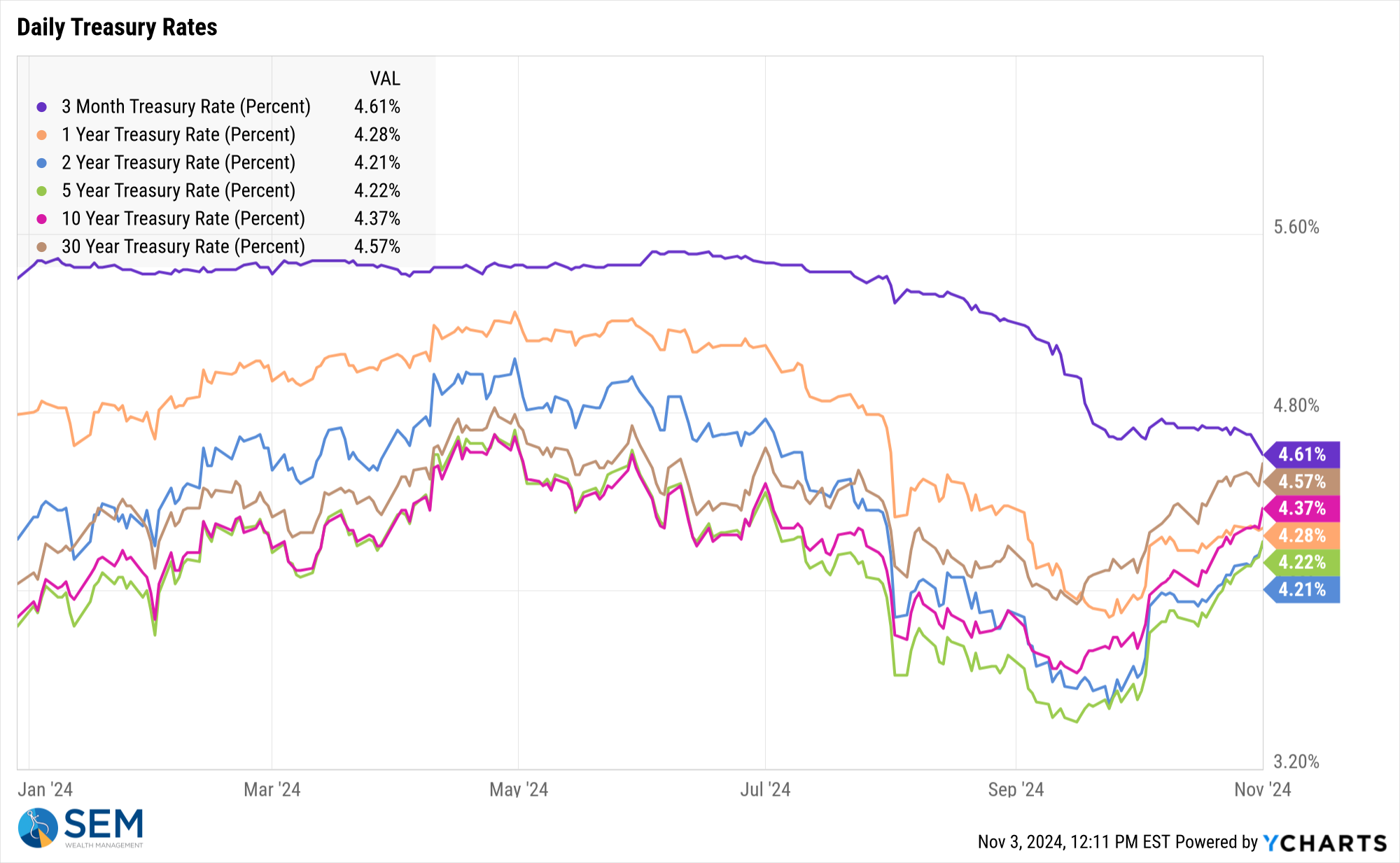

So far this tells me the market is not too concerned about an economic slowdown, but is instead concerned about INFLATION. The 10-year Treasury yield continues its march higher.

In fact, all yields have been climbing except the one controlled by the Federal Reserve. As mentioned above, the proposed "solutions" if implemented to fix our broken economy from both candidates are on paper quite inflationary and the market is adjusting to that fact. As I mentioned in our SEM University, neither candidate can simply declare they want prices lower and magically wipe out inflation. The market is smarter than the voters who believe that apparently.

Based on the outcome and any credible legal challenges things could either settle down or become quite interesting this week. Stay tuned.

SEM Model Positioning

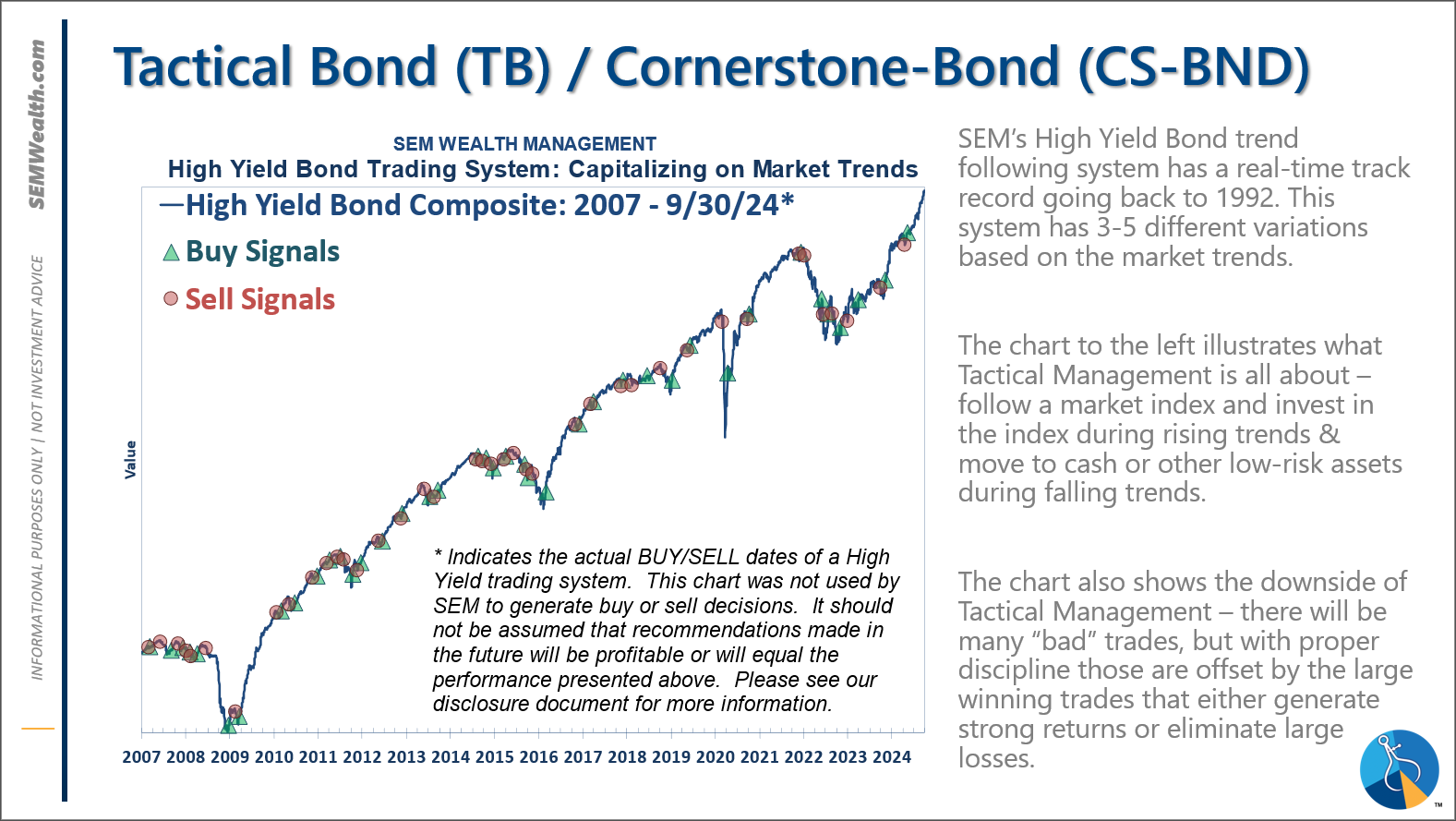

-Tactical High Yield had a partial buy signal on 5/6/24, reversing some of the sells on 4/16 & 17/2024 - the other portion of the signal remains on a sell as high yields continue to oscillate.

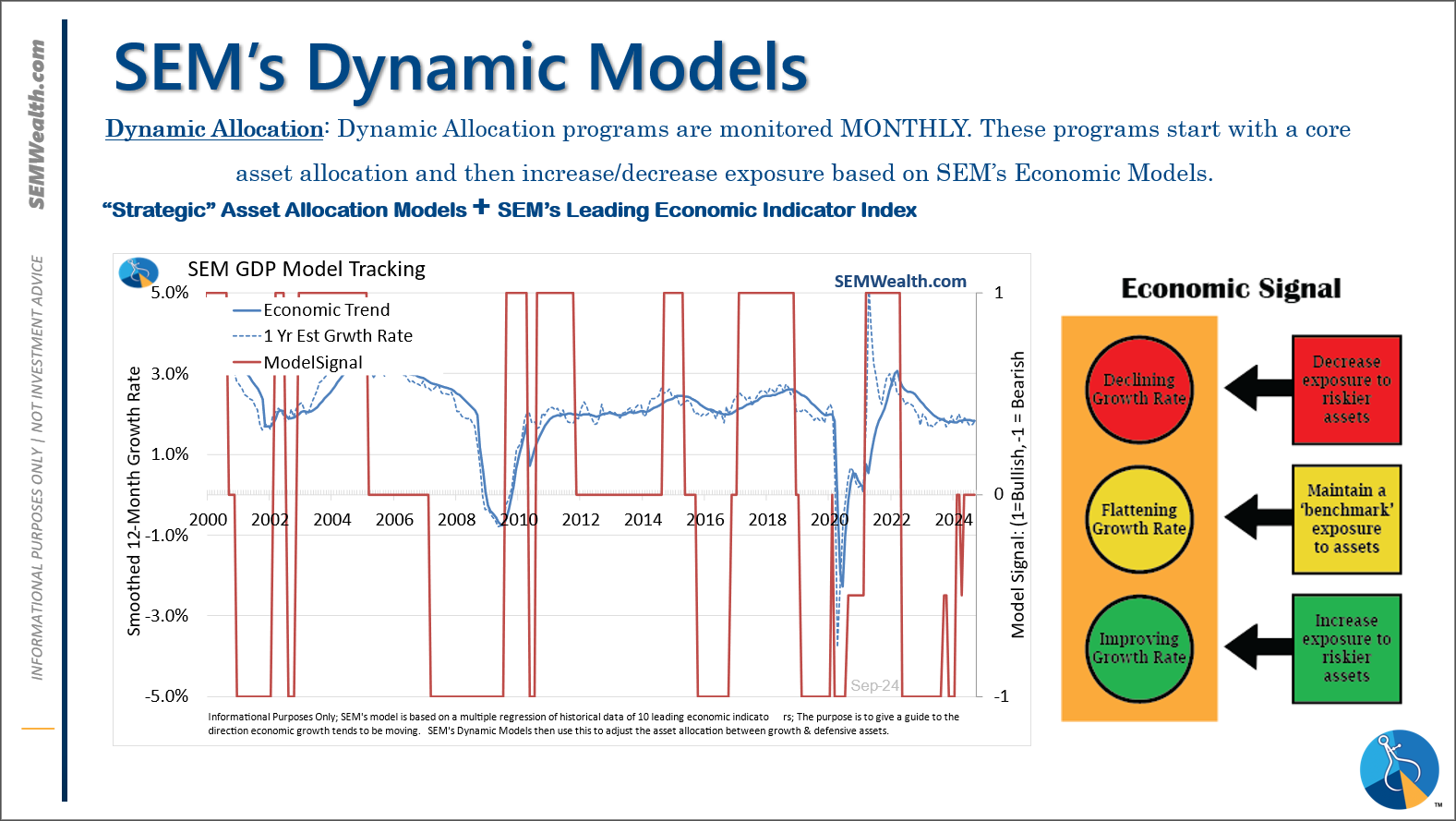

-Dynamic Models are 'neutral' as of 6/7/24, reversing the half 'bearish' signal from 5/3/2024. 7/8/24 - interest rate model flipped from partially bearish to partially bullish (lower long-term rates).

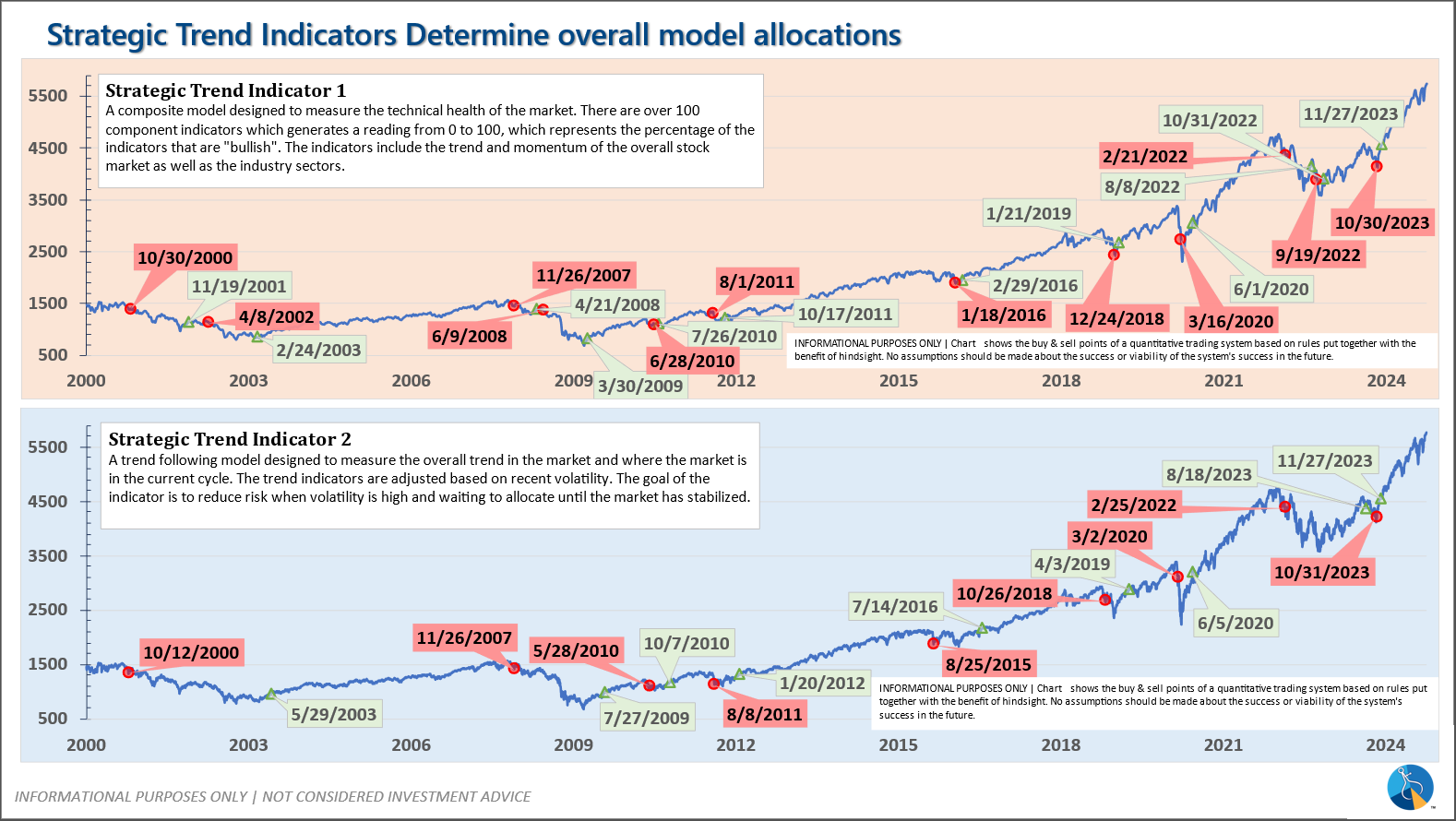

-Strategic Trend Models went on a buy 11/27/2023; 7/8/24 – small and mid-cap positions eliminated with latest Core Rotation System update – money shifted to Large Cap Value (Dividend Growth) & International Funds

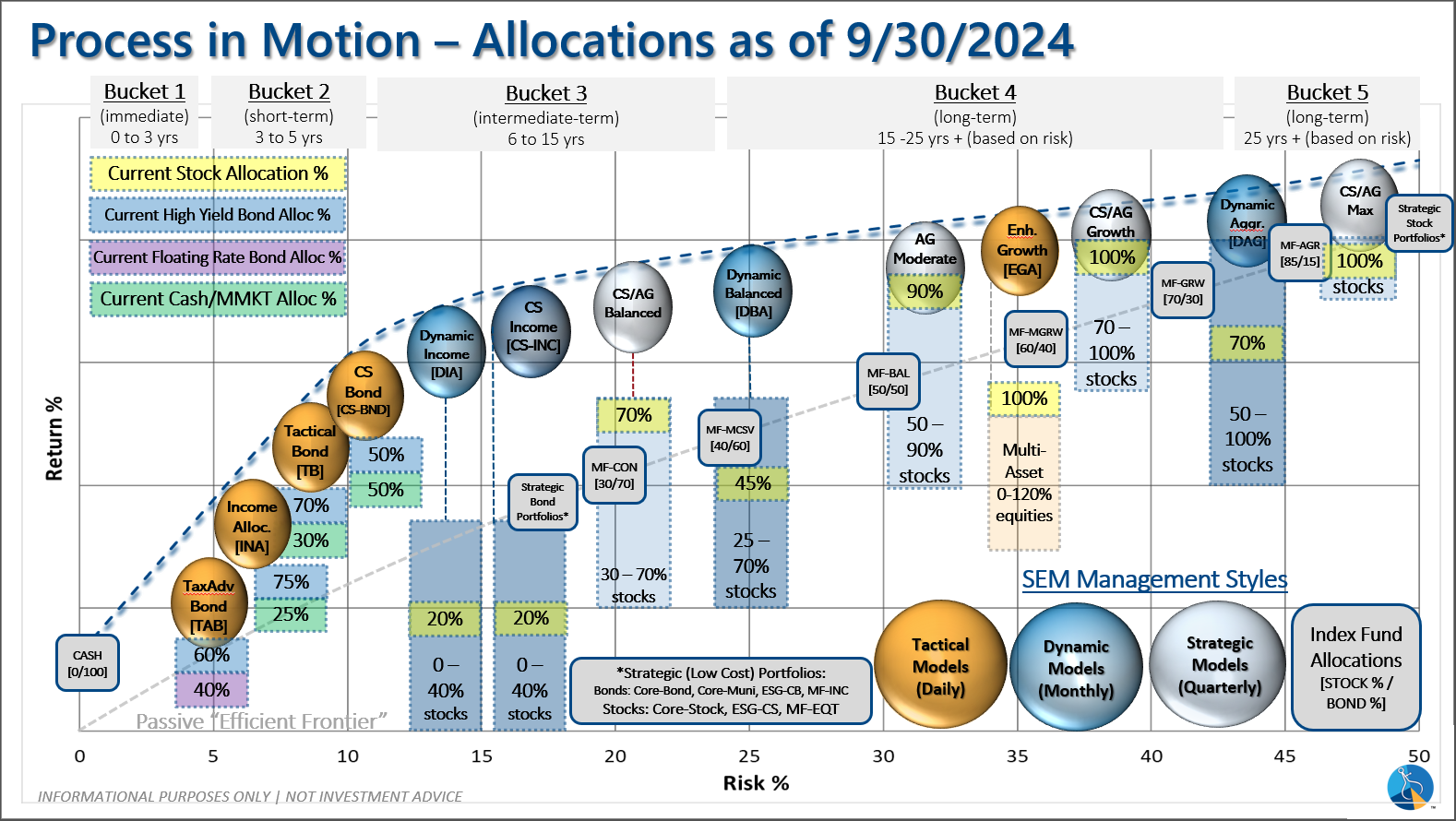

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): On 5/6/24 about half of the signals in our high yield models switched to a buy. The other half remains in money market funds. The money market funds we are currently invested in are yielding between 4.3-4.8% annually.

Dynamic (monthly): The economic model was 'neutral' since February. In early May the model moved slightly negative, but reversed back to 'neutral' in June. This means 'benchmark' positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth. The interest rate model is slightly 'bullish'.

Strategic (quarterly)*: BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change:

Questions or comments - drop us a note?

Curious if your current investment allocation aligns with your overall objectives and risk tolerance? Take our risk questionnaire