It's a short week for the markets with both stock and bond markets closed on Friday ahead of Independence Day on Saturday. With so much uncertainty our brains are struggling to decide whether to focus on the positives or the negatives. It's human nature. The more uncertain the environment the more our personal biases will come into play.

I worked on our quarterly client newsletter over the weekend. It's always difficult to discuss what happened the last 3 months, highlight what to focus on in the next 3 months, and keep it to two pages. Obviously with so much happening the task is close to impossible. Here's a list of some of my thoughts I had as I wrote the newsletter.

We're dancing through a minefield

Not only are there plenty of risks both hidden and visible in the investment markets, socioeconomic issues are creating additional potential problems.

- Everything is political – it seems we need to be careful what we talk about. The risks of coronavirus, economic shutdowns, wearing a mask, and racial injustice are all topics sure to cause division for many people. The best way to combat our biases is to use data, but I've seen people questioning data and guidance from the best scientists in our country. John Hopkins, Mayo Clinic, Stanford, Texas A&M, and the CDC are all sources I saw questioned on Facebook as being "tainted". Thankfully SEM doesn't rely on any of this data for our investment decisions. We do try to provide data from sources we believe are reliable so you can make your own decisions. I like to say the correct answer is probably somewhere between the far left and far right opinions. The more unknown the situation, the more grace we should give to those who disagree with our own opinions. Apparently even in the Villages, a large retirement community in Florida, we can see an increasingly tense divide. (Language warning – these seniors are passionate about their positions!)

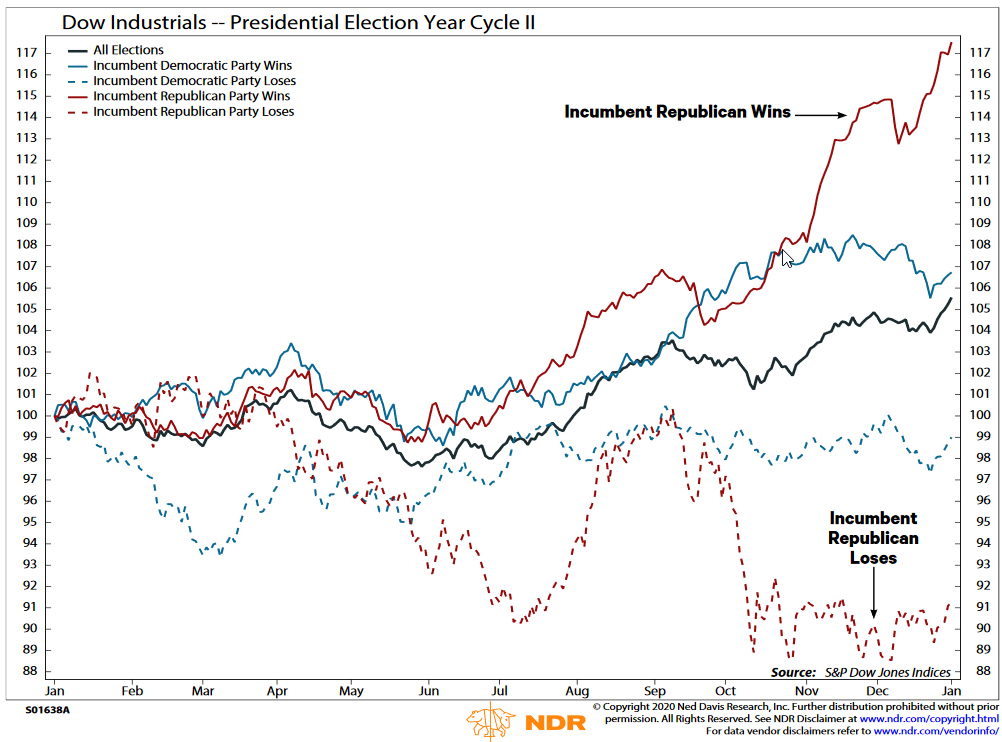

- Election will make things worse – the closer we get to the election, the more all of the above topics will be used to try to sway us to support one candidate or the other. I shared this chart last week from NDR highlighting how important the election could be for the SHORT-TERM direction of the market the rest of the year. Based on the polls we could see some big swings in the markets. In the long-run, the data is inconclusive. Remember, "don't let your political opinions influence your investment decisions."

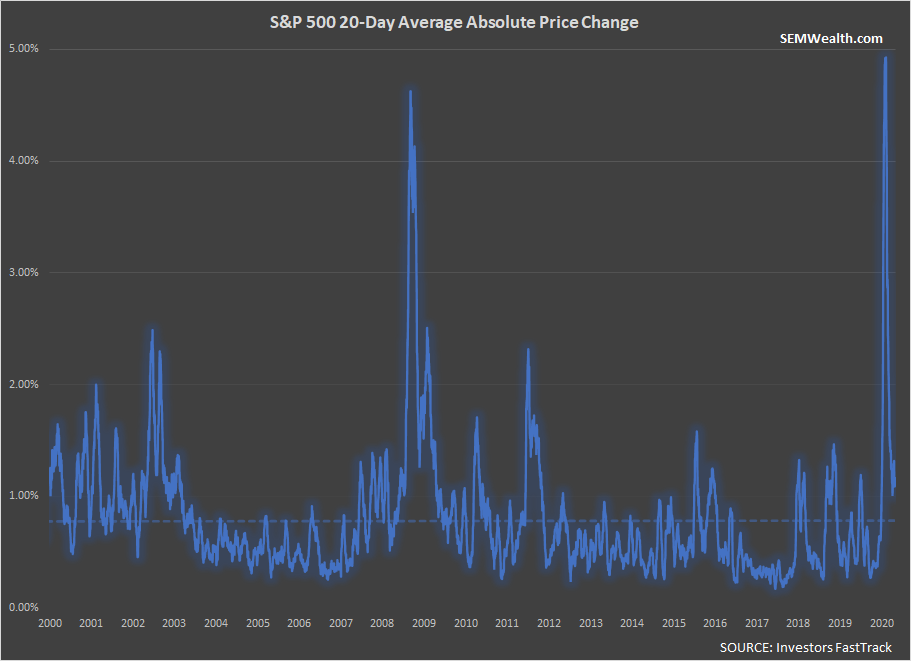

- Volatility creates additional risks - while things have calmed down a bit, we are still seeing big swings in prices on essentially no news. We might see "stocks sell off on spike in virus cases" headlines, but the spike didn't matter the day before. In the same way, "stocks rally on strong economic numbers" doesn't really tell us anything (more on the economy below). NOBODY knows how this will play out, so we will continue to see big swings in prices.

- A recession like no other – We continue to see unprecedented numbers in the economic releases. This has led many Wall Street analysts to believe we'll see a sharp comeback. They have priced stocks accordingly. From the outset I've highlighted a few things:

1.) The economy was weak to begin with (too much leverage, profit margins had peaked, and benefit of the tax cuts had disappeared).

2.) The stimulus from the Fed and Congress was welcome and needed, but is not going to prevent the companies on the edge of failure in January from failing. It will also create a drag on future growth rates.

3.) The structural damage of the recession will lead to a lower level of output. This will lead to additional stresses in the bond market, in public pensions, insurance companies, and municipalities. The market has not priced this in.

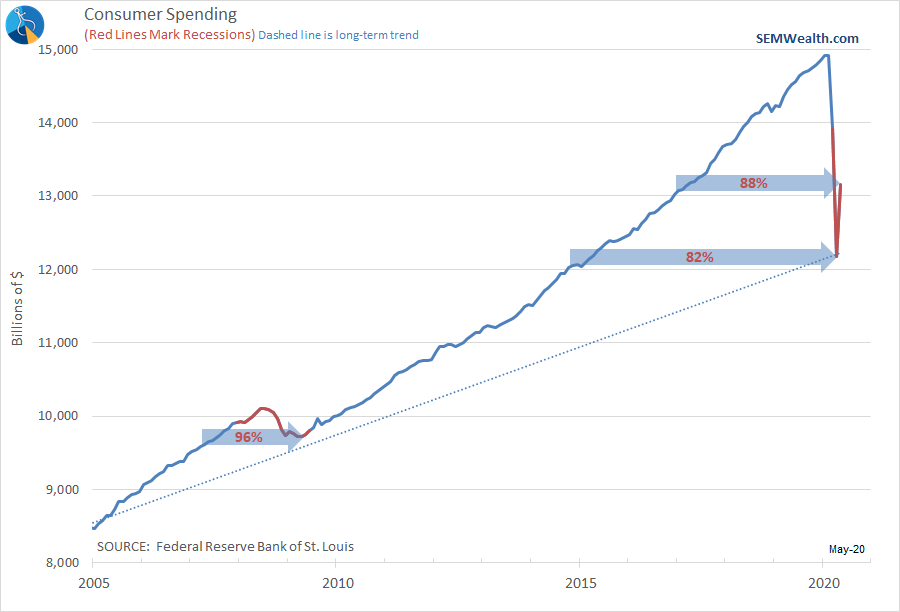

Last week we saw May consumer spending data. I added some arrows to show how the drop compares to the 2008-2009 financial crisis.

The % numbers show the activity relative to the peak. This will be a number worth watching. My educated guess is we may get back to the 95-97% range in the months ahead, but not back to 100% for several years. The market is not ready for this.

Thankfully we don't have to rely on my educated guesses (or anybody's). We'll stick to the data and trust the models that have helped us navigate all kinds of "unprecedented" environments for the last 28 years.

What a year it's been. The comment on this tweet pretty much sums it up.

Tracking the Experiments

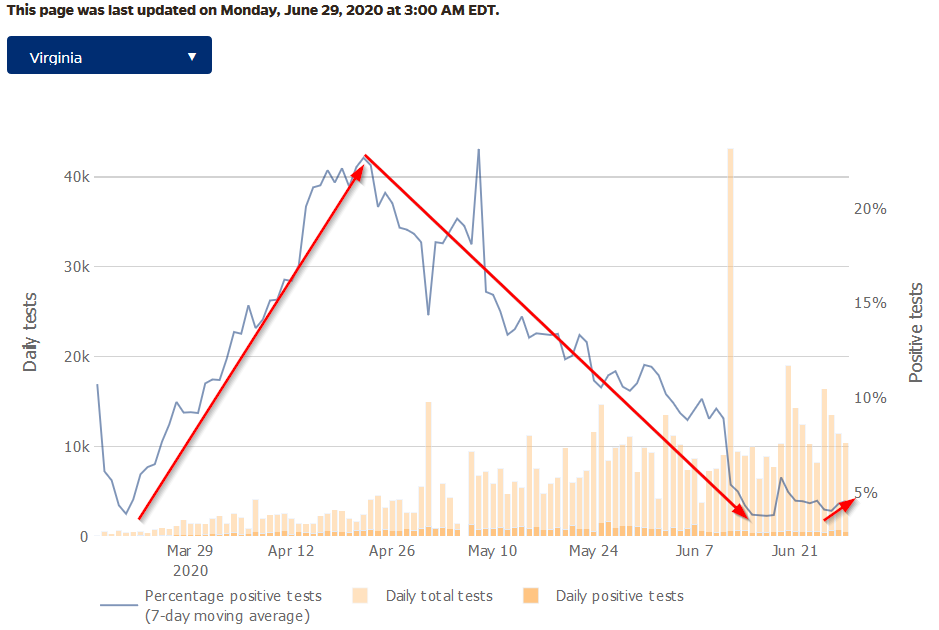

When states started to re-open at the beginning of May I said, "the good news is we're about to get 50 different (unscientific) experiments." With offices and friends and family in Arizona and Virginia, I've followed those experiments closely. In general, Virginia's governor, a Democrat and pediatric neurosurgeon has followed the guidance from scientists at what many of us felt was an overly cautious pace. Arizona's Republican governor, a businessman, allowed the economic damage and push of the citizens to lead to a partial re-opening in early May and to end the "stay-at-home" order in mid-May.

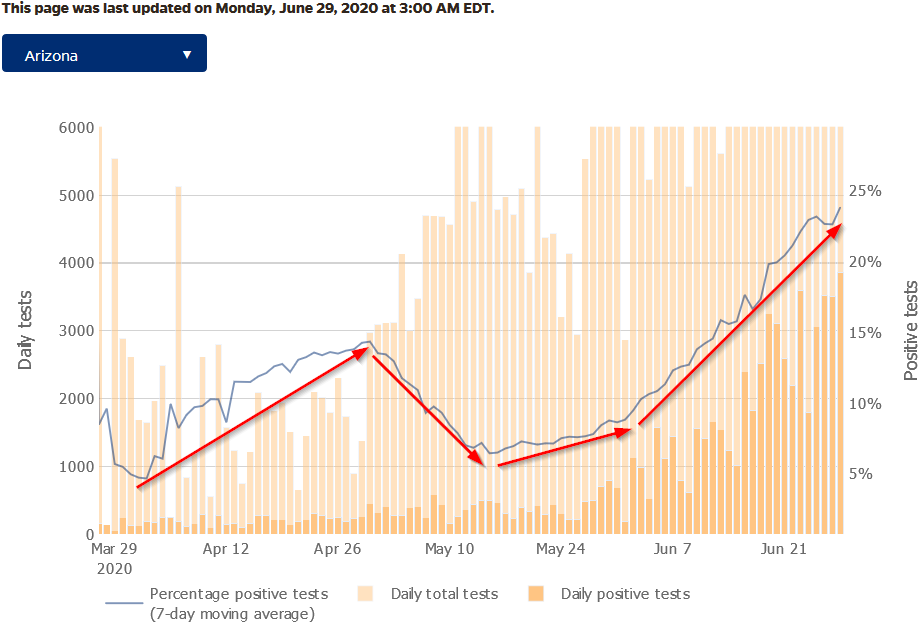

We've seen the two states go in opposite directions. The percent of positive tests, which helps normalize the number of tests illustrates how to slow the spread and how to accelerate the spread.

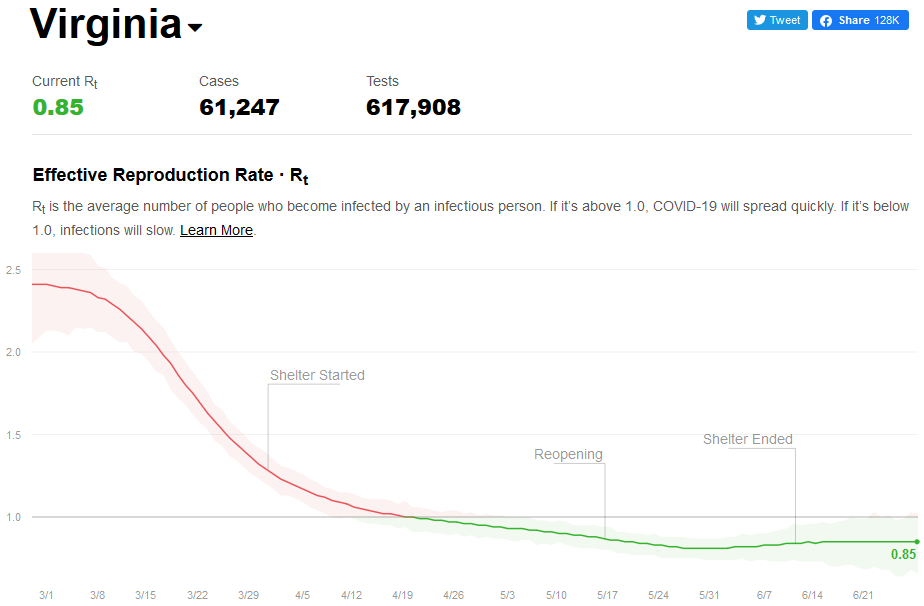

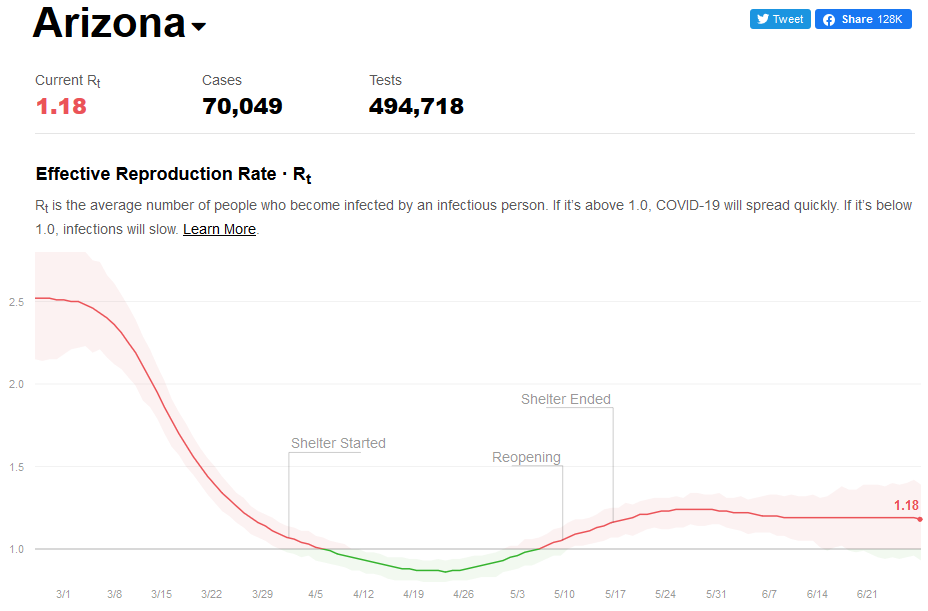

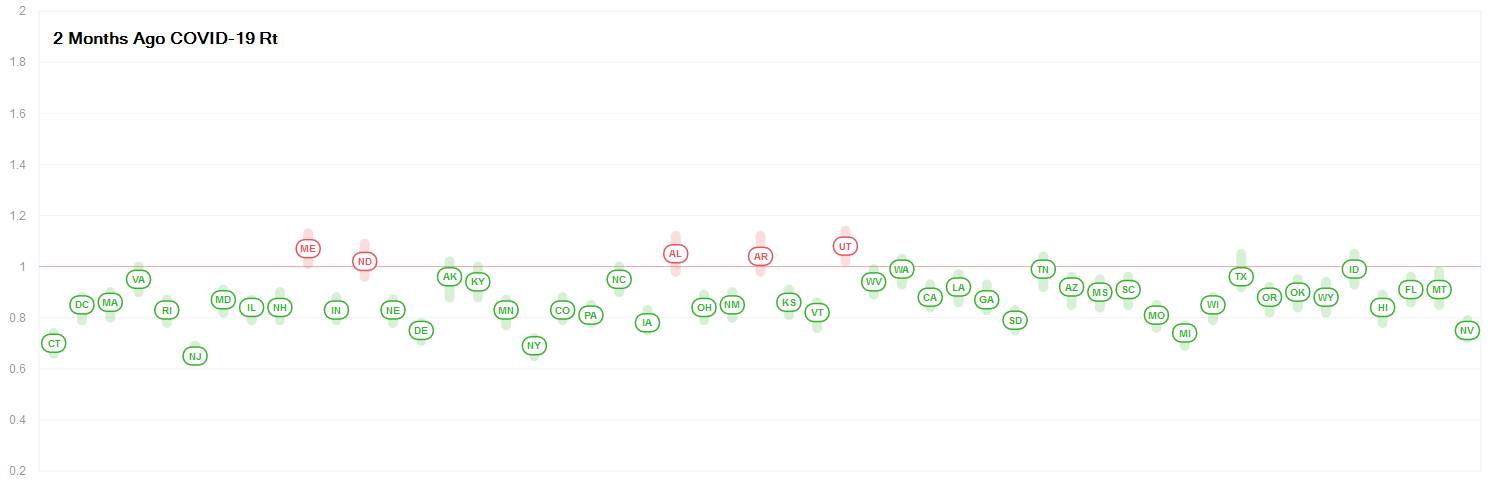

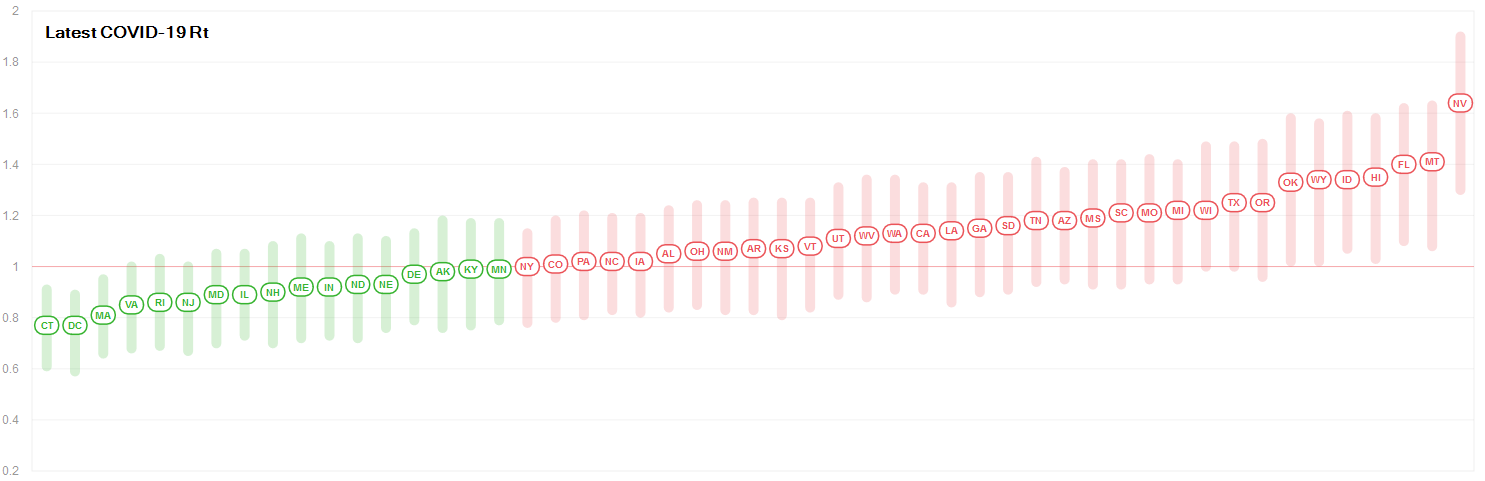

I found a new data source this morning to graphically illustrate how fast the virus is growing (RT.live) Similar to Velocity of Money, this measure shows for every virus in our system how much it spreads. Above 1 means it is still spreading, below means it is slowing down.

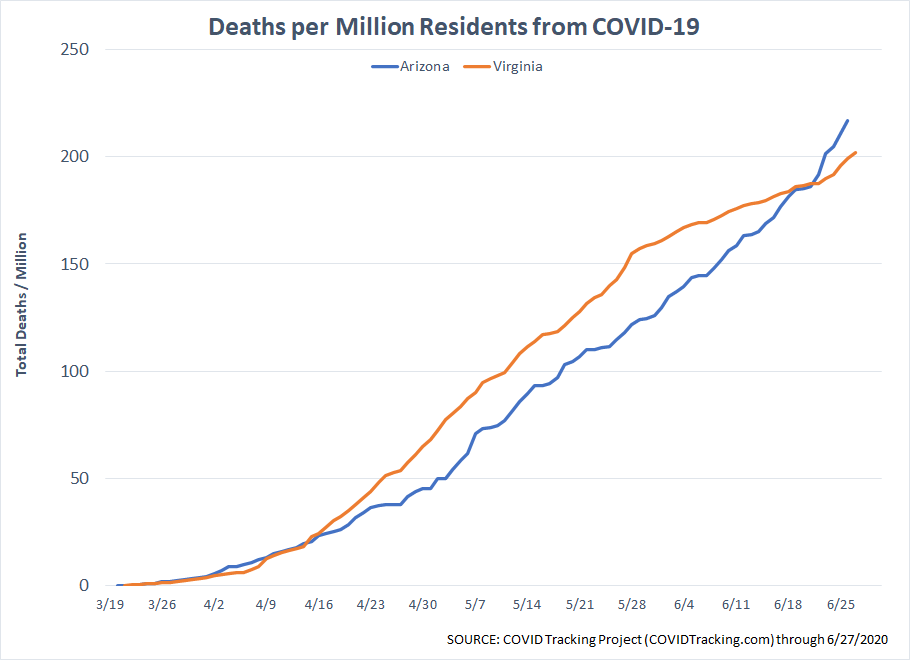

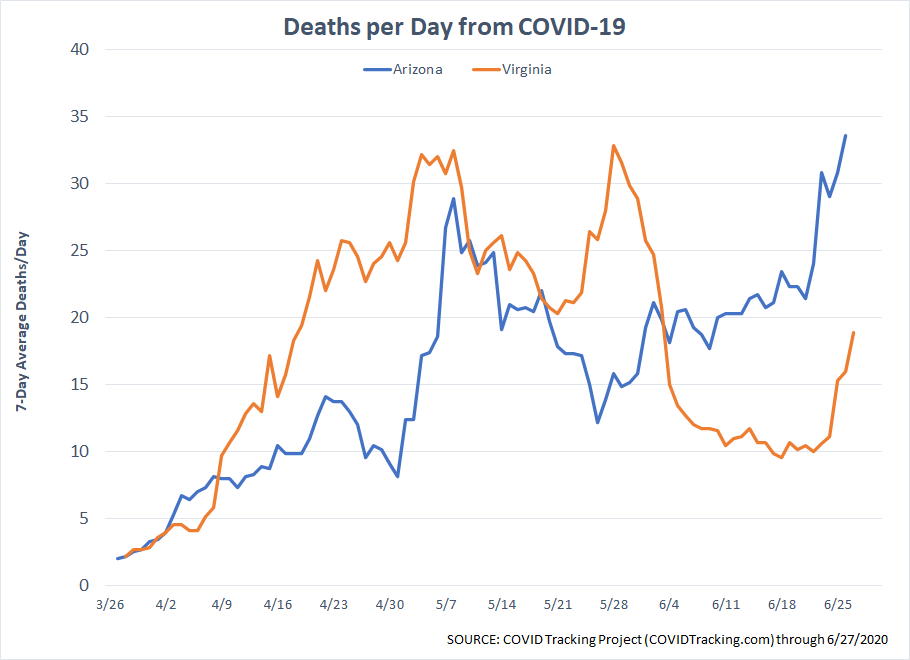

Cases turn to hospitalizations, hospitalizations turn into deaths. Yes there are issues with the data and we'll probably never know the actual number of deaths, but since the beginning we've tracked deaths more than cases because most of the time a test will be run to determine the cause of death. 62% of Virginia's deaths are from nursing home residents. This meant for the longest time Virginia had a higher death rate than Arizona. Sadly, Arizona's deaths have accelerated rapidly the last few weeks (we're 6 weeks into their re-opening).

Despite having 2 million fewer people than Virginia, the number of people dying from COVID in Arizona each day is now higher than it's ever been in Virginia.

That said, you'll notice the upturn in Virginia as well. We're 1 month into the end of our "stay-at-home" order, which is about the time you'd start seeing an up-turn. The state enters "Phase 3" on July 1, which is as close to a full re-opening as possible. The only exclusions will be full contact sports and events with more than 250 people. Masks are still mandatory in all public spaces.

Going back to RT.Live and looking at the whole country. Here's a good illustration. The first shows 2 months back we only had 5 states with an Rt above 1.

We now have 33.

What's the point of looking at all of this? First, it's not political. I'm an independent. Second, there is no "right" answer in how to handle this. Finally, this virus is far from solved and will continue to be a drag on our economy until it is.

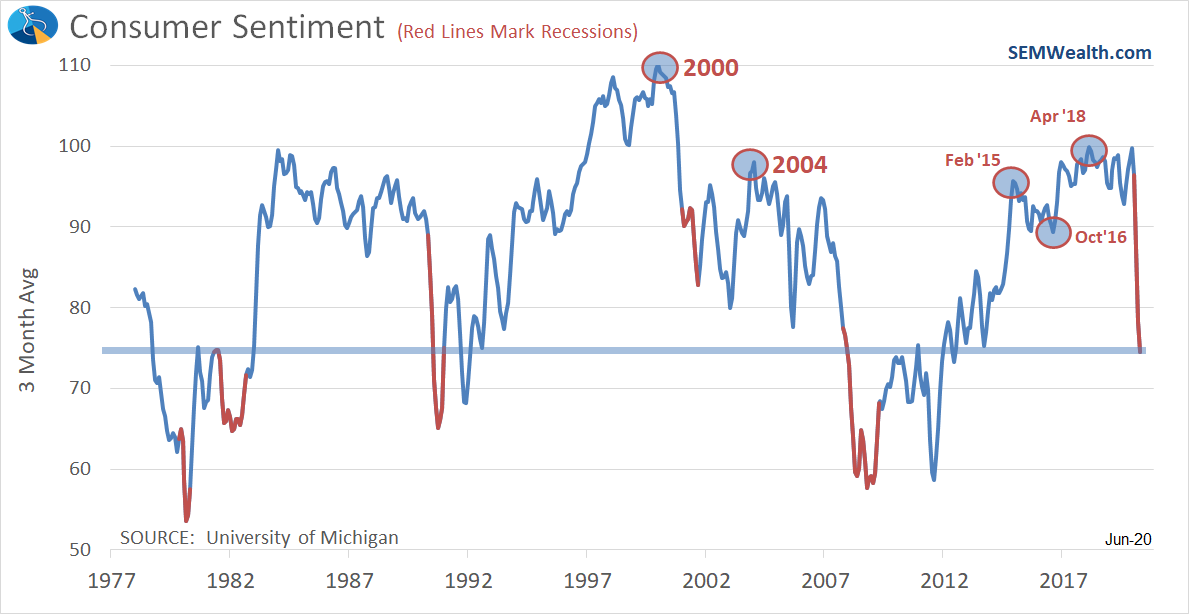

Our country relies on consumers spending money freely. If they feel confident they will spend more. The latest update on Consumer Sentiment shows sentiment is still low, but it is also well above the depths of the 2008 Financial Crisis.

I said this last week – whatever your political position, I think we all want the economy to grow. The leading scientists have conducted numerous studies which show wearing a mask helps slow the spread. If we slow the spread, less people are hospitalized, fewer people die, and governors will not restrict our movement. This gives people more confidence to go out and spend money because they both feel safer in public, but more secure in their financial positions. No politics, just data, science, and logic. Slow the spread, boost the economy. In my opinion that should be the message from the President if he truly wants to get the economy moving again before the election.