In 2021 a handful of different catalysts helped the stock market have another strong year. So far in 2022, not only have all those catalysts disappeared, but new obstacles have jumped up that have taken many investors by surprise.

In this SEM University, SEM Portfolio Manager, Jeff Hybiak discussed what has happened so far in 2022 and what we should expect for the rest of the year and beyond. In addition, he detailed what SEM has done so far to sidestep some of the obstacles and how we plan to navigate what could end up a very difficult year (or two).

There were several questions asked, so the Q&A will be in a separate video. This video is just Jeff's main presentation.

What should I do? Questions

Other (General) Questions

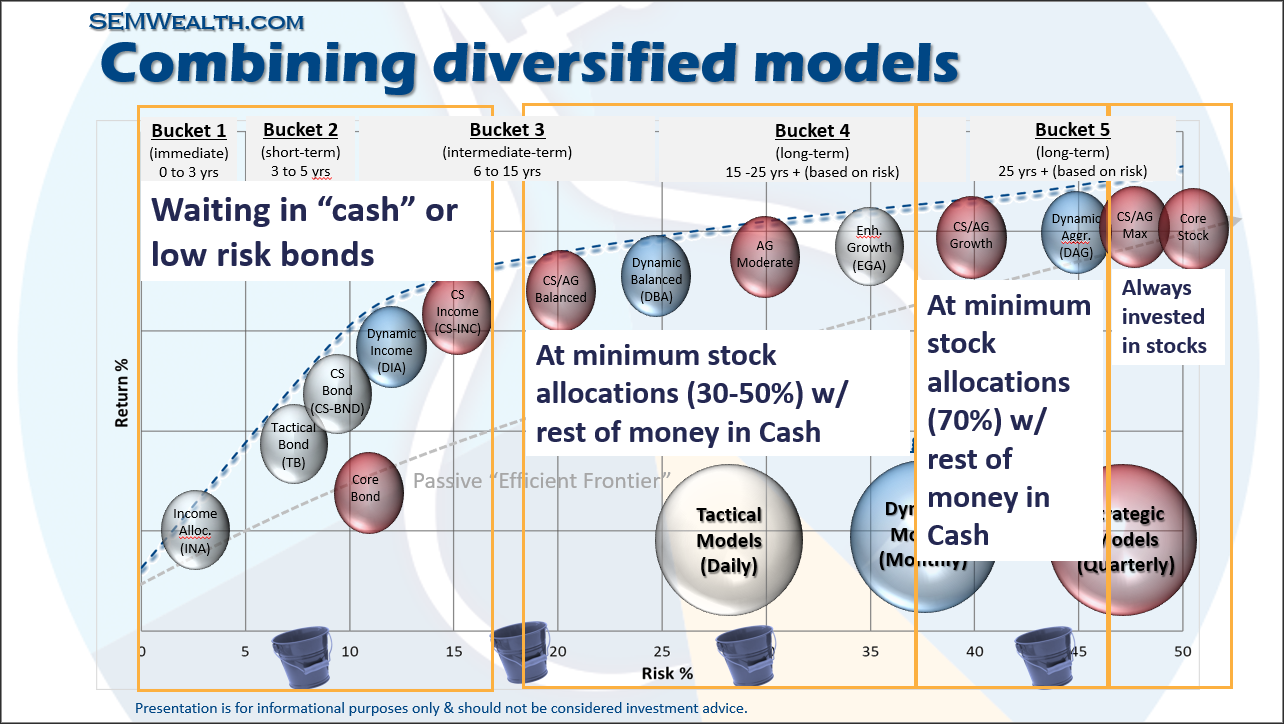

If one chart could sum everything up, it would be this one. It illustrates where each SEM model falls on the return/risk spectrum, which "bucket" it belongs in based on the time horizon, and most importantly how those "buckets" are currently positioned.

The shortest-term and lowest risk buckets are sitting in cash or lower risk investments. The middle-term buckets are at their minimum stock allocations. The longest-term bucket, as designed remains invested. You would only have money in that bucket if your time horizon was very long.