I used to manage individual stock portfolios......back in the 1990s. I described myself as a Warren Buffett/Peter Lynch style manager. Buy companies you understand with good business models selling products people want at a fair price. This was the philosophy I followed. I felt like I was a genius having portfolios heavily invested in companies like Microsoft (I was a beta-tester of Windows 95), Dell Computer (loved how easy it was to build your own computer on the internet), Cisco (we bought all of our networking equipment from them), and Nortel (we used their phone equipment which seemed pretty robust.)

I had 100 companies on my watch list where every quarter I would put the financial statements into my spreadsheets which produced some quantitative metrics which generated a "above", "average", or "below" valuation metric. I found myself justifying certain companies' high P/E, P/S, P/B and other valuation metrics as "relatively low" because their growth rates were much higher than the "developed" companies in the S&P 500. I was right for a lot of years.

I also was spooked during the mini-Asian crisis of 1997 by a quick 15% drop in many of my holdings so I added some technical indicators to get me out (and back in) to the stocks on my "buy" list. This helped a little when the real Asian crisis knocked over 20% off the NASDAQ in a couple of weeks. Both the 97 & 98 drops were "buying opportunities" (with hindsight), so when stocks dropped again in March/April 2000 this was a "buying opportunity".

Suddenly my list of 25 stocks on my "buy" list jumped to over 80. Decisions had to be made for my "focused" portfolios. The problem was I was beginning to question not only the valuation metrics but the actual financial statements (Nortel and their competitor Lucent had been found to be fudging their numbers along with many other telecom companies.) I had an existential crisis as I asked, "what is 'fair' value?" If a company can lose 20-30% of its value simply because they warned earnings growth may slow a bit (something I thought was logically given how much demand had spiked leading up to Y2K), how do we know if a company is "fairly" valued?

I had held and bought back some stocks following the April dip, but I decided I needed to "normalize" both growth rates and valuation metrics in my spreadsheet. I needed longer-term averages for both and needed to ignore the current narrative and ask "does this valuation make sense over the long-term?" Can this company truly make enough money to justify the price it is trading at?

As the market rallied into August 2000, the answer for every stock in my portfolio became "no". I closed those models and decided then the best thing to do is to stick to SEM's "top down" quantitative approach. The beauty of these models is they do not rely on financial statements or determining what a "fair" valuation metric would be for each stock (or the market overall). Each model asks:

- Is this a good time to invest? (Is the trend higher?)

- If so, where should we invest? (Which sectors of the market have the highest relative strength?)

- Which funds in those sectors are outperforming?

We stop there. We trust the experts in the strongest sectors who have the current "hot hand" to pick the individual stocks (or bonds). Because we are not long-term holders of the sectors we don't worry about whether or not the market or their holdings are overvalued.

I bring all of this up because the stock market is all the way back to where it was in March 2021.

If you'll recall this was the point where the "Reddit" stocks such as GameStop, AMC, Avis Rental Car were going ballistic because of rumors and recommendations on message boards. Logically these companies could not come anywhere near making enough money to justify their stock prices, yet they kept going higher. In February I asked, "what happens when the game stops?"

It appears the game has stopped. Now that we've given up all of the "stupid" games from the Reddit craze, the question becomes whether or not stocks are "fairly" valued. Based on the huge drops in mega-companies (eg Netflix, Target, Wal-Mart, Amazon) following "disappointing" earnings, I would guess stocks are not yet pricing in a recession. Logically we should have all expected companies to struggle with the combination of supply chain disruptions and high inflation, yet the market knocked 15-30% or more off these stocks in a day or two.

As I've said, the markets are not very logical, but I'll still try to walk you through why I believe the game has stopped.

A year ago, I discussed the four "pillars" of the rally:

- Federal Reserve Support

- Congressional Spending

- Improving Economy

- End of the pandemic

All four of those "justified" expectations for strong earnings growth and thus higher stock valuations. We are back to the same prices as 2021, yet all four pillars are either already gone or we are seeing the OPPOSITE situation. This tells me we are still in the early stages of the bear market. If your portfolio has too much risk given your financial plan, cash flow strategy, or overall risk tolerance, rallies should be looked at opportunities to sell. Unless you have a very long time horizon and are under invested in stocks, I would be very cautious "buying the dip".

In case you missed it or just need a review, I'd encourage you to check out our webinar from last week. We broke it into segments for the replay because the Q&A section included several critical questions many of our readers are asking.

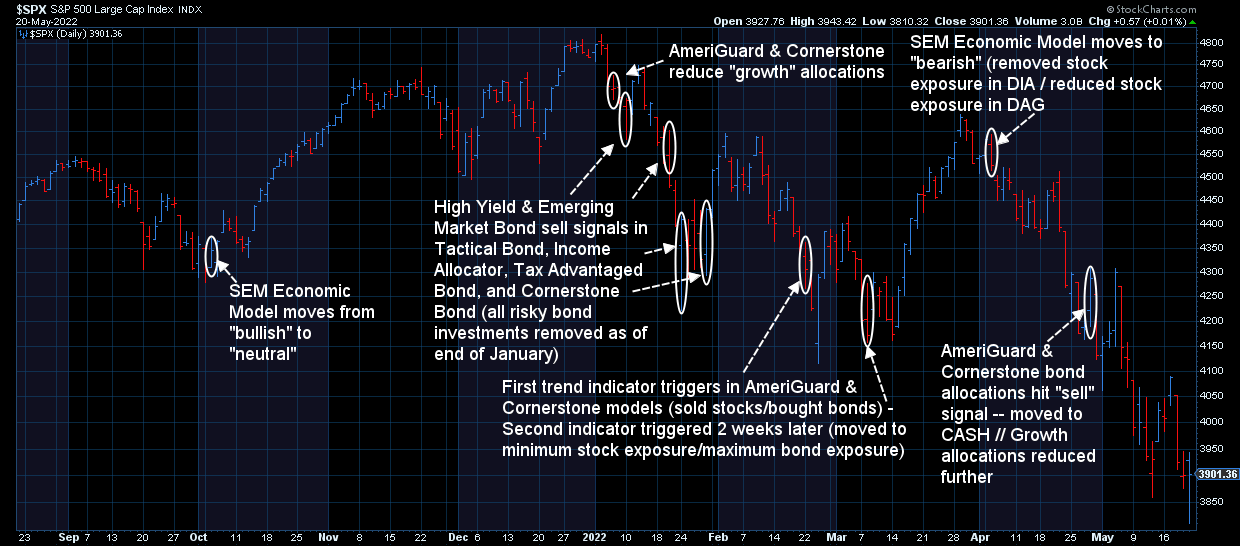

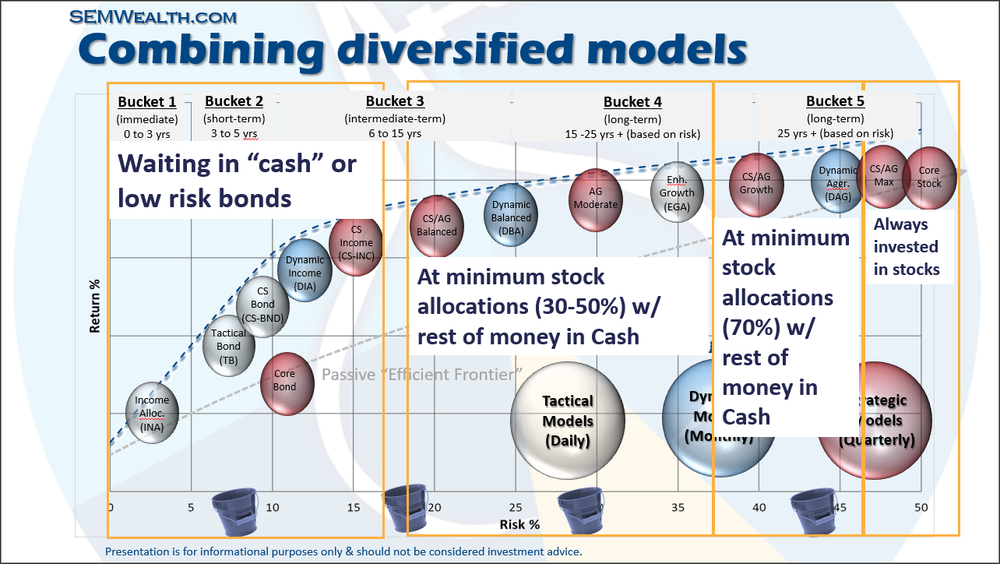

During the webinar I included a couple of graphics to illustrate both the actions SEM has already taken in the market as well as how our models are currently positioned.

If I'm right and the market is only 1/3 to 1/2 through the bear market, we have already taken the bulk of our losses in "buckets 1 & 2" (money needed in the next 5 years). We also have significantly reduced risk in bucket 3 (money needed in the next 6 to 15 years). Even our long-term bucket has reduced risk and should lose less than the market going down.

More importantly, if I'm wrong (remember none of our allocations are based on any of our opinions but simply data), our systems are designed to start stepping back into the markets. Because we've lost less, we don't have to guess. Bond yields, especially high yield (junk) bonds are much higher than when we sold. Stock valuations are significantly reduced (although still above average). We'll be buying back in at lower levels, which increases our chances for higher returns.

I've heard some predictions from investment managers who have said this is going to be as bad as the 2000-2002 bear market. Others have said this won't even turn into a bear market. I personally don't think it will be as bad as 2000-2002 (remember the NASDAQ lost over 80% of its value), I do think plenty of companies will lose that much. I also think not enough people are appreciating the fact during most of our investing lifetimes the Federal Reserve has been concerned about "financial stability" and hasn't even had to give a thought to inflation. They considered keeping stock prices high was part of "financial stability". Now high stock prices are a symptom of the inflation problem that they have let burn out of control. In addition, people seem to forget that not only did the Fed not see the recessions coming in 2000-2002 and 2008 until well after the fact, but they were also unable to prevent the S&P 500 from losing half of its value.

Remember, we don't have to guess. We don't have to be right. We simply have to follow the data. Each of our models ask (based on the DATA, not opinions)

- Is this a good time to invest? (Is the trend higher?)

- If so, where should we invest? (Which sectors of the market have the highest relative strength?)

- Which funds in those sectors are outperforming?

Note: Our "Momentum Stock Model" does buy individual stocks, although it has a trend indicator that puts it in cash if it is not a good time to invest. It has been in this position since mid-March and is down less than half of the S&P 500's loss going into this week.

For our talking points this week, I'm going to continue reminding everyone that there is no such thing as blanket financial advice (like you get on tv, social media, podcasts, the radio, and blogs). We cannot give you the answer because it depends on your personal situation.

Weekly Talking Points

It depends on your time horizon......

- 3-6 months: the next direction is a coin flip. We certainly could see a huge rally that recovers half of the losses so far this year. That is actually normal following a large drop in prices. Conversely, given where we were in terms of valuations and returns that were double the long-term average the past 3 years, we could continue to see prices drop. Either way, the short-term direction could be volatile.

- 6-18 months: economic fundamentals and valuations mean the market is likely going to struggle, especially when you weigh the impacts of inflation. With so much stimulus from Congress that is working its way out of the system and with unprecedented manipulation of the financial markets by the Fed, nobody knows for sure what "fair value" is for stocks and interest rates. Going into COVID our economic model was indicating a slowdown, so unless the economy got BETTER during the last two years, the best case is we will have a slowing economy, which is rarely good for stock prices.

- 18-36 months: There will be some nice rallies that will suck people into believing the worst is over. The only way this will be true is if we've gotten to the other side of the "unwind" of stimulus. A typical bear market last 18-24 months with the market dropping 35-50%. This means over the next 18-36 months we will see the "bottom". Most of the time, when we are at or near the bottom few people will WANT to buy stocks. In all past bear markets we've been met with skepticism and anger when advisors and clients see us jumping back into riskier assets. As I always say, when it feels good to buy you probably are near the top. When it feels awful, you're probably near the bottom.

- 3-7 years: This will all depend on how the STRUCTURAL issues are resolved. We entered COVID with too much debt and not enough investment. We had a massive trade imbalance. We had a demographic imbalance (too many looming retirements and not enough workers or QUALITY jobs to replace them.) During recessions we often see a restructuring of our economy. If we have leadership willing to make the difficult choices, we could see a generational low in the markets that leads to very strong economic (and market growth) for a long, long time. If we continue to use short-term solutions, we will continue to see fits and starts in both economic growth and the markets.

- 7-15 years: We could see 2-4 bull markets over this time frame. Based on market history, the market SHOULD be higher 7-15 years from now, so if your time horizon is this long the only thing you need to do with that portion of your portfolio is to make sure you are in a well-diversified portfolio that aligns with your objectives and overall risk tolerance. Remember, the industries/companies that led us into the last expansion are rarely the ones which lead during the next expansion.

- 15+ years: Based on 150 years of stock market history, stocks should be higher than they are now 15 or more years from now. Keep pouring as much money as possible into a well-diversified portfolio. Max out all available retirement plans. Avoid looking at your account values – you have a long time before you actually need the money. Stick to your plan.

I'd encourage you to read the full article for a deeper discussion.