Full Speed Ahead

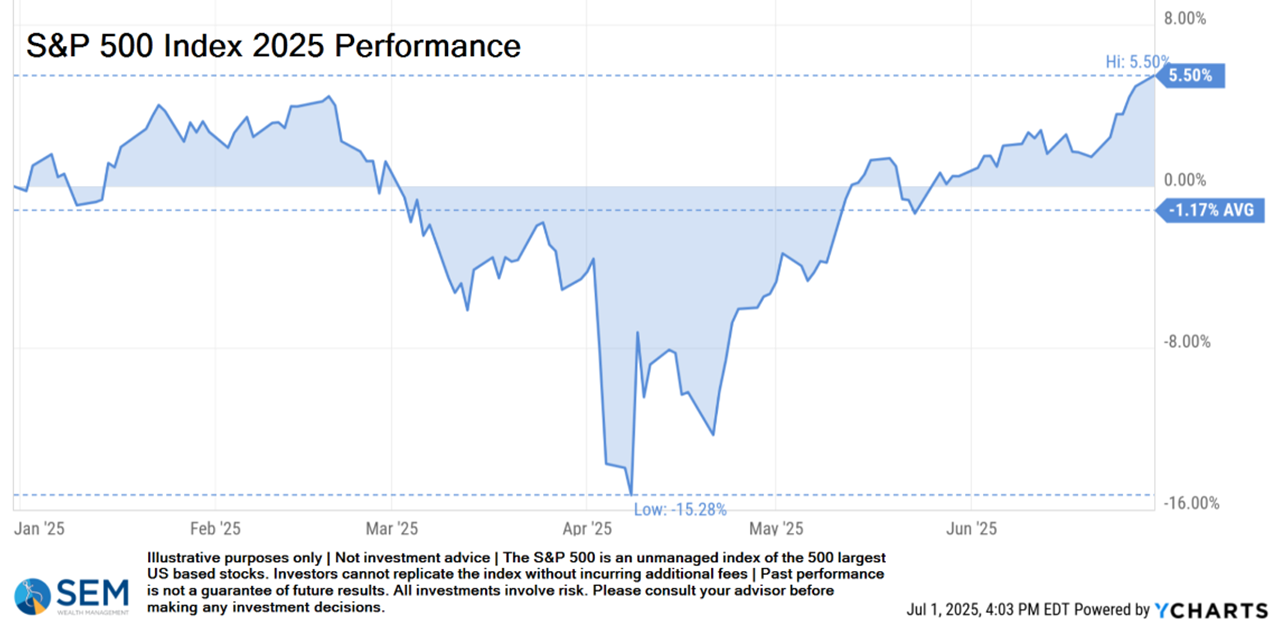

After a bruising start to the year, 2025 is turning into a lesson in market whiplash. Stocks sprinted out of the gate in January, only to skid nearly 19 % from the mid-February peak to the April 8 low—just shy of a technical bear market.

Then came the slingshot: a nine-week rally powered by cooling tariff fears, solid earnings, and the still-resilient U.S. consumer. By quarter-end the S&P 500 closed at a new all-time high, rewarding investors who stayed buckled-in for the ride.

Yet the “all clear” sign hasn’t been shown for every corner of the market:

- Health check. The equal-weight S&P 500—our proxy for the “average” stock—is still about 4 % below its record, a reminder that the megacaps are doing the heavy lifting.

- Small-caps lag. The small cap Russell 2000 ended June roughly 11 % under its November 2021 peak and is negative in 2025, even after a respectable second-quarter bounce.

Those under-the-surface gaps don’t have to spell trouble, but they deserve our attention, especially considering some of the headlines the market seems to be ignoring.

For the latest market updates, subscribe to the blog.

How fast do you need to go?

Summer road-trip season always seems to bring out the lead-foot crowd. Speed limits feel like suggestions, and every few miles someone rockets past as if shaving two minutes off their ETA is worth flirting with a ticket—or worse.

Whenever that happens I can’t help but wonder, “How fast do you really need to go? Is the extra risk worth arriving only a little bit sooner?”

The same question applies to investments. With stocks hitting fresh records, it’s tempting to “keep up with traffic” by piling into whatever is racing ahead. For some investors, that extra speed may fit the plan. For others—especially those nearing retirement or depending on steady withdrawals—the consequences of a market “speeding ticket” could be costly.

A smarter approach is to drive at a pace that matches your destination and conditions: a well-diversified mix that balances growth with steadier assets like bonds. That way, you’re more likely to reach your goals without white-knuckling every market twist and turn.

Remember: the journey matters as much as the arrival—choose a speed that lets you enjoy both.

If you would like a personalized review of your portfolio, go to Risk.SEMWealth.com

Potential Roadblocks Ahead

The stock market has overcome some negative headlines and events the first half of 2025. Does this mean the worst is over or are there potential problems ahead? Here are 4 areas which could cause some delays the back half of the year.

Roadblock 1: The Trade War

Consensus view: The President often talks tough on tariffs but eventually prioritizes market stability—hence the term which started in the 2nd quarter—TACO (“Trump Always Chickens Out”).

Risk: The rhetoric becomes policy as our trading partners take a stand. Broad-based tariffs stick, margins compress, and global supply-chain inflation returns.

Roadblock 2: Economic Slowdown

Consensus view: The U.S. economy has already dodged two recession scares in three years—resilience is the base-case.

Risk: “Soft” survey data bleeds into “hard” spending and hiring numbers, revealing that resilience was overstated.

Note: SEM’s Economic Model went “bearish” at the beginning of June. See the details here:

Roadblock 3: US Debt & Deficit

Consensus view: Congress passes the debt ceiling extension and the expanded tax cuts without an issue. Demand for Treasuries remains robust; the bond market appears comfortable funding larger deficits.

Risk: A buyers’ strike drives the 10-year yield decisively above 5%, forcing a messy repricing across risk assets.

Note: This is more likely a “long-term” problem, but could flare up at any time.

Roadblock 4: Middle East (and other) Conflicts

Consensus View: Iran’s direct military capacity is very limited, and oil markets have largely priced in regional instability. The US involvement is expected to be a one-time attack to quickly end the Iranian threat.

Risk: A broader conflict could disrupt global energy flows—especially through the Strait of Hormuz—and lead to a sustained spike in oil prices, increased market volatility, and heightened global security concerns.

We hope the consensus view is the final outcome. One thing we have always said, “hope is not a strategy”. Sometimes headlines don’t matter…...until they do. When that happens, SEM is here, ready to deploy our time-tested risk management strategies.

Bonus Content

Money Talks with Dad: Financial Literacy for everyone

Our monthly video series continued in June with "Housing Part 3". The purpose of Money Talks is to explain complex financial topics in a way everyone can understand. Check out the latest video below and make sure you subscribe to get notified whenever new episodes post.

Should we 'dump' Treasuries?

While it wasn't something on my radar, the July 6-7 BRICS Summit has apparently caused concern on several media outlets. Over the past month we received several inquiries about the use of Treasuries in our portfolios, whether we are concerned about the BRICS countries conspiring to devalue the dollar, and asking about increasing the amount of tech exposure in their portfolio.

For those of you not following along, BRICS is the group of countries represented by Brazil, Russia, India, China, & South Africa. This is the 17th annual summit. Last year they added Egypt, Ethiopia, Iran, Saudi Arabia, the UAE, and Indonesia. Overall, mostly because of China, the total economic of output of the BRICS bloc is equivalent to the output of the "G7" countries (also known as the "developed" economies).

In addition to calling for a review of the UN Security Council, asking the G7 countries to pay for climate change, and criticizing the military conflicts in the middle east, the agenda item catching the most attention is the call for a "BRICS" payment system, which would eliminate the use of the dollar in trade between the countries. This has raised concerns on those media outlets about the "end of US dollar dominance".

Here are some of my thoughts:

1. “Dump Treasuries” vs. “Keep a Safety Net”

- Why we still own Treasuries and will in the future:

- When credit markets hiccup, short-term U.S. Treasury bills remain the one asset class that reliably holds up (they gained in both the 2000-02 and 2008 bear markets while stocks were down double-digits).

- In a recession, longer Treasuries often rise because yields fall—giving the portfolio an offset when stocks stumble.

- Today roughly 45 % of the Bloomberg U.S. Aggregate Bond Index is U.S.-government related debt—so every “core” bond fund has meaningful Treasury exposure whether managers like it or not.

- You are currently receiving around 4 3/8% in a US Government Money Market and can receive 4 1/3 to 4 7/8% in Long-term US Government Bonds. Compare this to a S&P 500 dividend yield of less than 1.25% -- close to the all-time low of 1.14% hit just before the tech bubble burst in 2000.

- How SEM uses Treasuries:

- Tactical Bond moves to T-bills whenever high-yield spreads say “danger.” (this includes Money Market accounts backed by US Treasury Bills)

- Our Dynamic models switch into Treasuries only if both our economic trend and duration signals flash bearish (this could be short, intermediate, or long-term Treasuries depending on the current environment.)

- Strategic Models: AmeriGuard & Cornerstone can dial government-bond weight up or down, or even go nearly zero, depending on whether rate risk or credit risk is the bigger threat.

Bottom line: Treasuries aren’t there to shoot the lights out—they’re the airbag. If we ever reach a point where we can’t rely on U.S. government bonds, every other asset class will be in far bigger trouble (especially technology stocks which benefit from the stability of the US government and economy.)

2. I want to “Pile into Technology”

Remember, we already own A LOT of Technology

- The S&P 500 which is already held inside AmeriGuard and Dynamic Aggressive Growth is over 40 % technology + communication-services stocks (Info Tech ~33 %, Comm Services ~10 %). (This surpasses the tech weight of the 2000 bubble)

- AmeriGuard can overweight tech explicitly through growth ETFs and sector funds when our relative-strength models says so.

- Adding even more tech after a 500 %+ run since 2020 comes with major risks (and drawdowns)—as the -78 % collapse in 2000-02 reminded everyone.

Diversification = owning assets that don’t all soar and sink together. We already have plenty of tech exposure; the trick is knowing when to trim, not just when to chase.

Side Point: Both AmeriGuard and our Dynamic strategies can move to "overweight" positions in Emerging Markets (the countries which comprise the BRICS bloc), providing opportunities if they are able to better coordinate their economic agenda to become more competitive with the US-led "G7" economy.

3. BRICS, Gold, and the end of the U.S. Dollar

- Dollar dominance: The US dollar still accounts for ~58 % of global FX reserves and is projected to remain above 50 % even a decade from now. There simply isn’t another currency (or a new BRICS coin) with the legal, financial-market, and military infrastructure to replace it overnight.

- Gold’s role: Gold can hedge against confidence shocks, but it’s volatile—down >45 % from 2011–15. We treat it as a useful satellite, not a core holding.

- BRICS meeting noise: Past summits produced headlines, not hard currency plans. We’re monitoring, but a July announcement won’t rewrite global settlements on day one.

- Let's use logic: The primary reason the US Dollar (and our Treasury offerings) have been used as the world's currency and "safe haven" is even despite the more recent political divisions, we have the most stable political, financial, and economic system in the world. Would you trust an organization that includes Russia, China, and Iran to provide the same sort of stable currency?

Key Point: The US certainly has some debt and deficit problems, but as US based investors there could be major risks if you pre-emptively attempt to get out of US dollar based investments or to move more than a token amount into assets such as gold (more than 10% of your investable assets).

If you have additional concerns you'd like to discuss, please reach out to your financial advisor and we can go into more details.

4. Our 60/40 Isn’t Static—It’s Three Adaptive Engines

Our "average" client is invested in a portfolio that typically has around 60% exposure to stocks. The difference is with SEM we can scale up and down that exposure. We can also shift to an overweight or underweight position in US or international stocks.

It is important to understand how we are set-up to adapt to whatever may come up in the future, including the worst case scenario being discussed on some of the major media channels.

|

Style |

What drives changes? |

Example moves |

|

Tactical |

Credit-spread & trend signals |

Sold high-yields, bought T-Bills in Q1 2022 |

|

Dynamic |

Econ dashboard + rate-risk model |

Added intermediate Treasuries in early-2022 slowdown |

|

Strategic (AmeriGuard) |

Relative strength & valuation |

Rotated some money from U.S. growth to emerging-market equities in Q1

2025 |

Going back to the original concerns, we're not “heavy” in long bonds all the time—exposure flexes with the data, not the TV talk shows.

The takeaway: Sensational topics like the end of the dollar dominance attract viewers; portfolios succeed through disciplined process. We’ll keep steering your mix based on evidence, not morning-show sound bites.

Tech Tip: Be Vigilant

Over the past few months we've again seen an acceleration in reports of sophisticated attempts to gain access to personal financial information. With increasingly sophisticated tools, it is important to always take great care before turning over any information to an unexpected contact. Nine months ago our Director of Technology wrote about "Pig Butchering" after some advisors reported their clients falling for some scams. We'd encourage everyone to read this article again as a reminder of how easily it can be to become a victim if you aren't vigilant.

In addition to this, during the busy summer season we typically see an increase in other types of schemes. One thing we notice is when you are rushed or not at your computer, it is more easy to fall victim to a scam. Imagine a scenario where you are trying to have something done with your house (or anything that requires your signature) and you receive a Docusign email. If you're on vacation or simply really busy, it is more difficult to know if the email is legitimate. Here is an article Dustin wrote last year discussing a trend in fake Docusign emails.

Download/Print version of the Newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.