The Fed cut rates, now what?

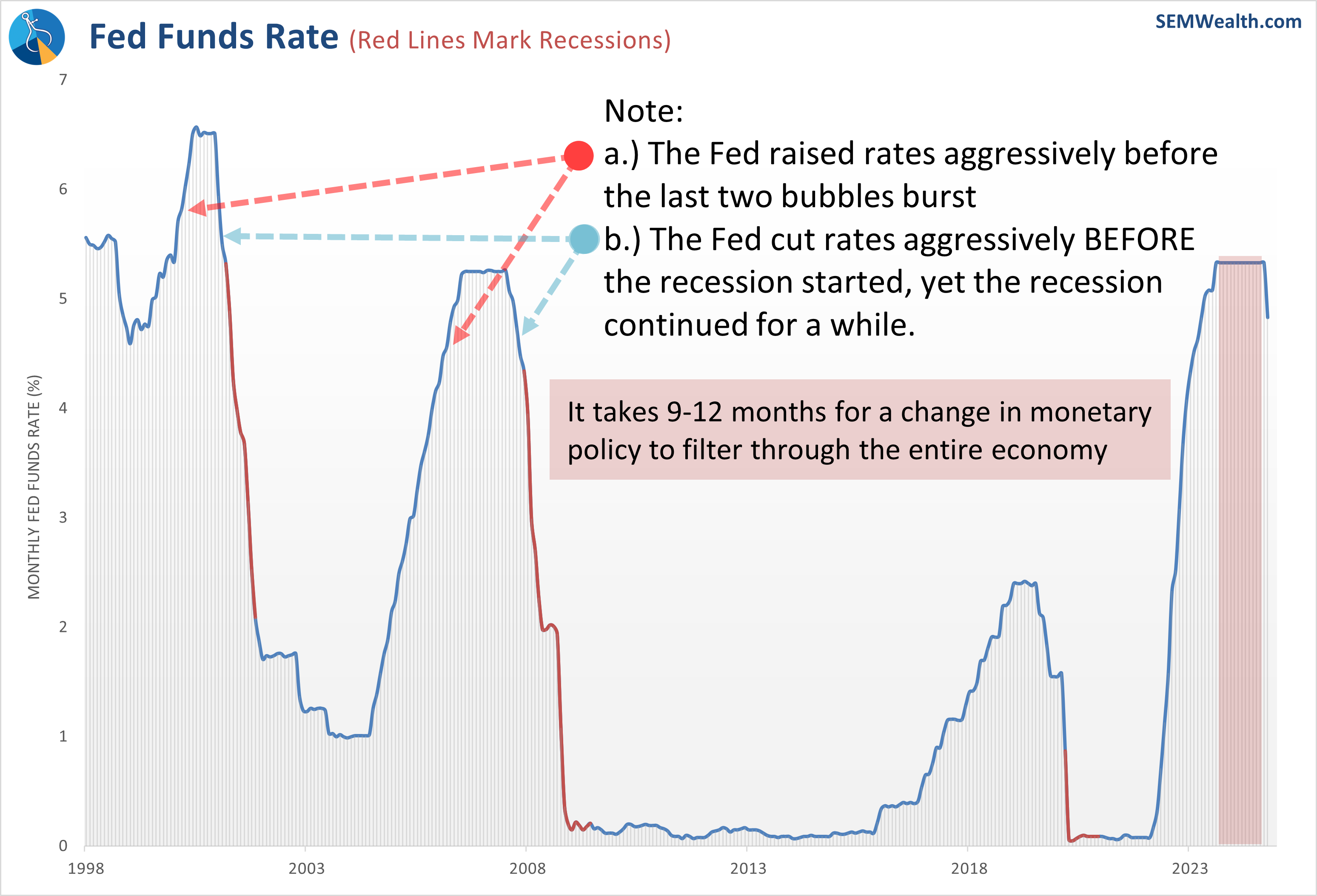

For over a year much discussion was made about when the Fed will finally cut interest rates. The thought process was a drop in rates would allow the economy to continue to grow and avoid a recession. This line of thinking means ignoring the long-term history of rate cuts. In very few instances did a rate cut signal GOOD news. The Fed often cuts rates when the economy is slowing, but because it takes 9-12 months for the impact to be felt, if the economy was already heading to recession, the initial rate cut was too little too late. It is possible the Fed is trying to get way ahead of an economic slowdown which could explain the big rate cut. Only time will tell if this was enough.

In the meantime, it is important to understand a few things:

- The Fed lowered SHORT-TERM rates, which means SAVINGS and MONEY MARKET yields also will go down.

- Credit Card and other variable rate loans SHOULD go down, but only by 1/2%.

- Mortgages are tied to LONG-TERM rates, which are set by the free market, not the Fed. The 10-year Treasury has fallen more than 1% since last fall. Any drop in interest rates will follow the direction of 10-year yields.

- The impact of rate cuts on you will depend on your personal financial situation. If you’d like to understand that better, we would recommend speaking to your financial advisor.

Can rate cuts (or the President) change the economy?

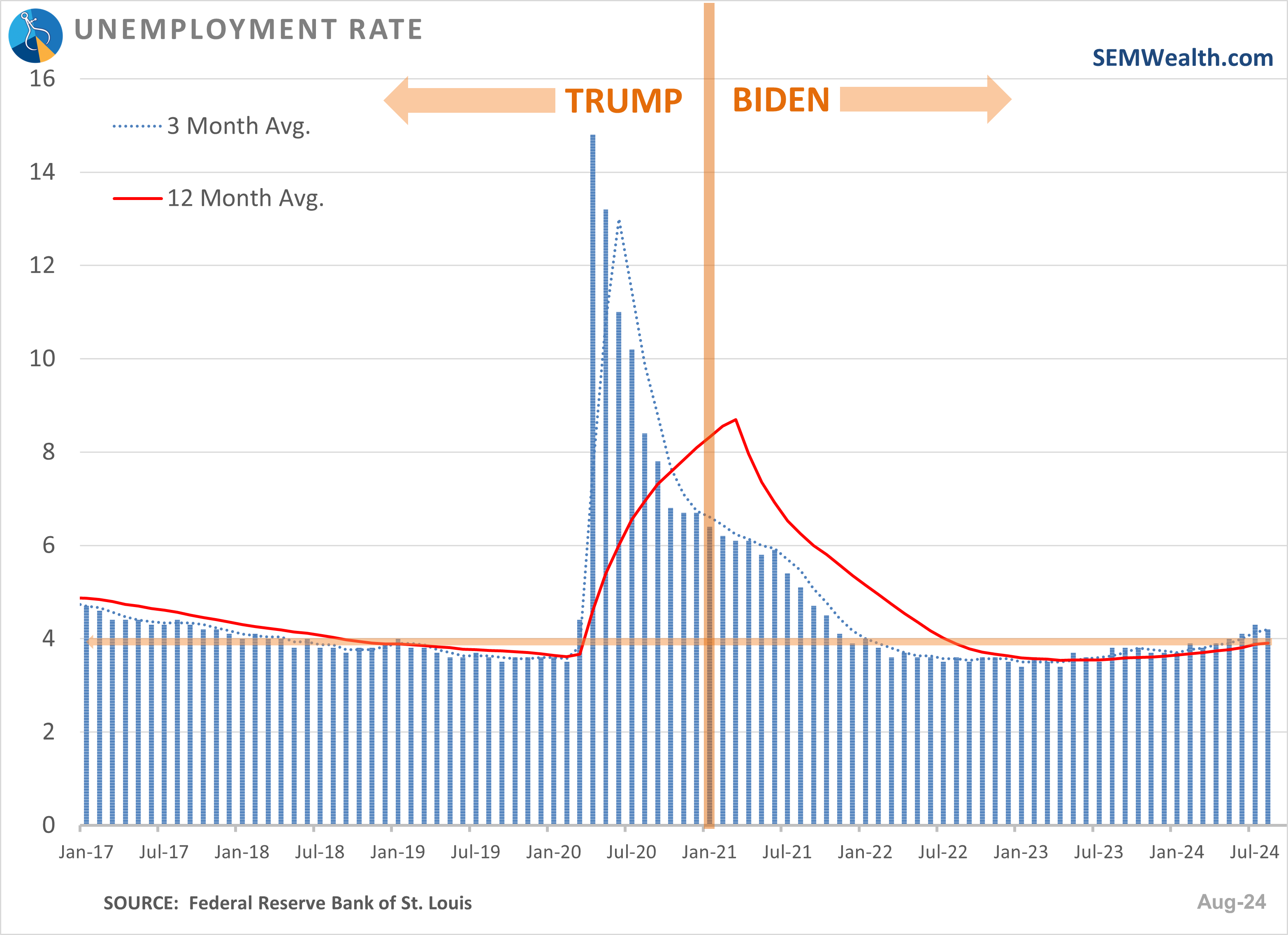

With the Fed’s 1/2% rate cut last month and most market ‘experts’ expecting another 1/2% in cuts before the end of the year, excitement is growing that the bull market is about to enter a new phase. The pivot by the Fed is surprising as two months earlier they indicated the economy and labor market was “healthy”. The stock market has thus far celebrated this rate cut, but it is far too early to tell whether or not this will reverse the recent upturn in the unemployment rate. With the election coming up (see next article) a lot of guesses are being made about which candidate would end up being “best” for the economy. Our economy has gone through a lot the last 5 or 6 years. We would caution letting any changes in interest rates (or the President) lead you to believe the economy can suddenly change for the better.

We’ve had two different presidents, from two different parties. Both parties have had control of Congress, and we’ve had a split Congress. We’ve had higher rates, lower rates, then higher rates. Despite all of this the unemployment rate is basically around the same levels as 2016.

Understanding the Impact of the Election

Here are a few things to keep in mind as we head into the election.

- Major economic policies do not change on day 1 (only regulatory guidance as allowed…..after legal challenges)

- Campaign talking points do not always become priorities once the election is won

- It is difficult to pass economic polices which both sides do not agree with

- The stock market is a ‘forward-looking mechanism’, meaning it will anticipate changes BEFORE they happen

- We will have plenty of time to adjust to any major financial changes BEFORE they become law

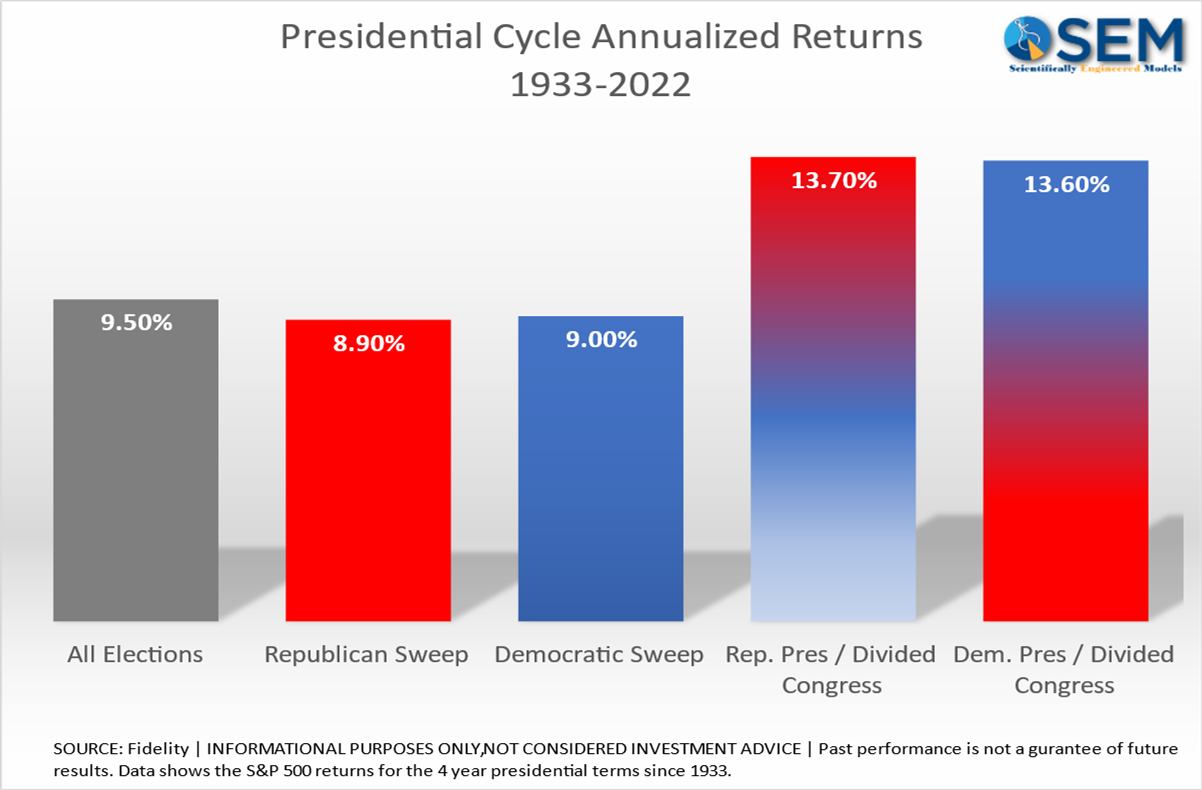

- The stock market historically prefers a SPLIT in Washington (see chart below)

- You SHOULD NOT make a change in your allocation unless your FINANCIAL SITUATION has changed. For more see “The Importance of Suitability”.

Bonus Content:

Money Talks with Dad

Even though we try our best to not make things overly complicated, sometimes we forget that not everybody is an engineer or a finance expert. Jeff’s daughter Corryn often brings him questions and says, “Dad, explain this to me like I’m a 3rd grader.” During a recent family vacation, Corryn suggested we start making videos discussing complex topics in a way ‘normal’ people can understand. So far we’ve posted 3 episodes:

- Real Life Budgeting: Filling the gap between your budgeting app and real life.

- Unexpected Expenses: How do you handle expenses you didn’t plan for?

- Political Talks with Dad: Discussing some of the economic posts we see on social media along with what we should be doing leading up to the election.

To view the first three episodes, go to our YouTube channel and make sure you ‘subscribe’ for the latest updates.

What other topics would you like to see covered in the newsletter? Let us know here.

Upcoming Webinar: Preparing your portfolio for the election results

As we move closer to the election, we are seeing more and more confident predictions about what a win from either side will mean for the economy and your investment portfolio. In this webinar we focus on what the DATA says about the true key drivers of the economy, what the impact of some of the proposed policies could be, and what historically happens following the election. We will also discuss what can be done after the election to mitigate any of the risks due to the outcome of the election.

Join us on Thursday, October 10th at Noon ET for the live webinar. Even if you can't attend live, still sign-up to have a chance to ask me a question and be notified when the replay is available. Sign-up at the link below.

The Importance of "Suitability"

Each year the Securities & Exchange Commission (SEC) Rule 3a-4 requires SEM to request certain financial information from any client accounts we manage. In previous years SEM has mailed a 1 page form for clients to complete, sign, and return. This information is important for the management of your account, and we request clients to contact their financial advisor within 90 days if there are any changes to their financial situation.

This year we are asking clients to complete the information online through our website. Your responses will be shared with your financial advisor and reviewed to ensure the investments match the financial profile. To do this clients can go to risk.semwealth.com or click on the “Take Our Risk Questionnaire” at SEMWealth.com.

If we do not receive a completed questionnaire by 12/10/2024, we will assume your information on file is current.

Creating a Customized Solution

Every investor has a unique set of circumstances that makes it difficult to find a pre-packed solution. SEM offers a wide range of investment models that are designed to be risk efficient for a broad range of investors. The key to long-term investment success is allocating your assets to the portfolio that best suits YOUR individual needs.

Step 1: Determine Your Time Horizon

Investing involves risk. Risk is essentially the volatility of returns during the time it is invested. While over the long-run an investment may have superior returns, over short periods of time the returns may be negative. The shorter the time horizon, the less risk a portfolio should have. Keep in mind different portfolios may have different time horizons based on the purpose of the funds. For investors taking income from their portfolio, separating the income portion into its own portfolio is a popular strategy.

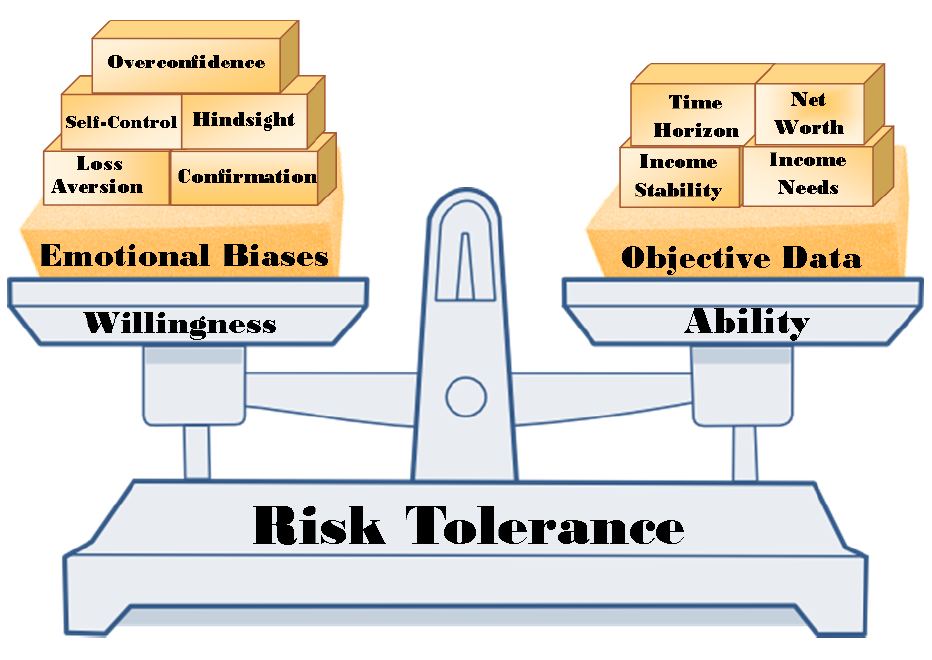

Step 2: Determine Your Risk Tolerance

Risk tolerance is generally thought of how much risk an investor is WILLING to take. This is certainly an important determinant, but it is typically driven by EMOTIONS. Often investor feelings toward risk fluctuate with the direction of the market. The more important determinant is the ABILITY to take risk. The ability to take risk is determined by data, not emotions. While time horizon is one portion of a portfolio’s ability to take on risk, other determinants are based on the individual situation.

There are numerous questionnaires, including SEM’s, available to determine the WILLINGNESS to take risk. Your advisor can look at your overall situation to help you determine your ABILITY. Like Time Horizon, portfolios can be separated into different portions based on the purpose and objectives for that money.

Step 3: Understand Your Personality

Too often our industry places clients in portfolios using a pre-determined model based on age. Our behavioral approach understands that even if you have time on your side and the ABILITY to take on risk, if you are invested in a portfolio that does not fit your overall investment personality there will be times where you are not comfortable. Typically when we are not comfortable we are more likely to make an emotional decision.

Step 4: Determine Your Customized Portfolio Blend

SEM’s Risk Questionnaire generates a blend that matches your time horizon, risk tolerance, and personality. It is designed to be a starting point with additional adjustments to be made to make the portfolio fit into the overall financial plan. You may already be in an optimized, custom blend of SEM models, but when you submit your questionnaire results SEM will send them to your advisor to review your portfolio and how it compares to your results. Upon review your advisor may work with SEM and possibly recommend a change to your investment allocations.

Understanding Your Portfolio Allocation

Creating a Customized Behavioral Portfolio

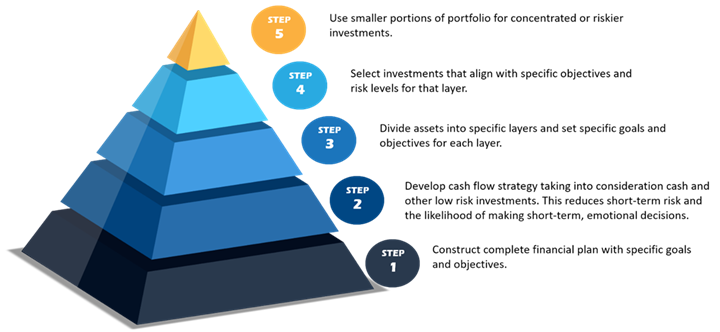

SEM works closely with our financial advisors to create a customized portfolio. We believe the strength of the portfolio starts with a solid financial plan as the foundation & then follows these steps.

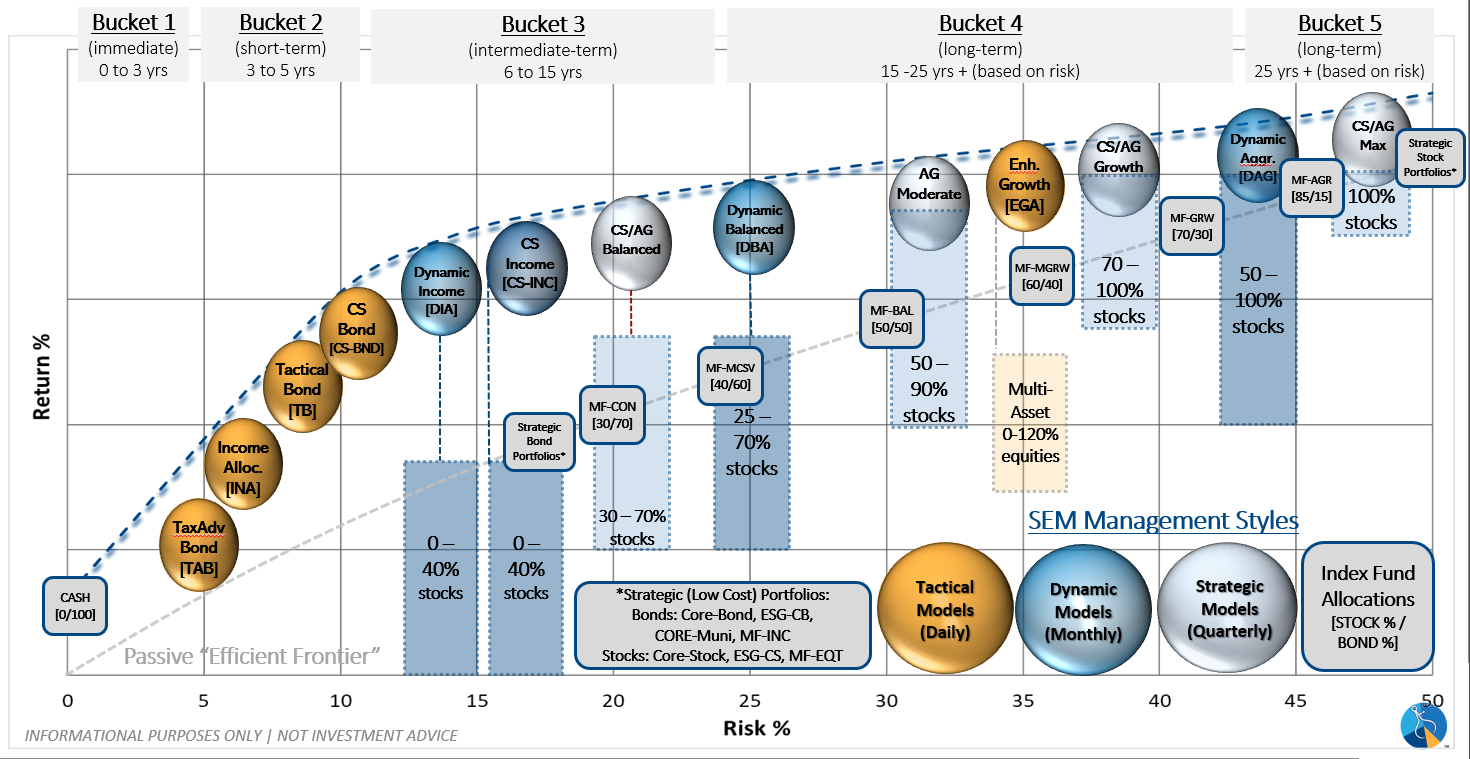

SEM's Portfolio Building Blocks

Beginning in step 3 above, SEM works with the financial advisor to select investment models that fit the financial plan, cash flow needs, and the client’s personality. We have over a dozen building blocks to choose from across three distinct investment management styles (tactical, dynamic, & strategic). Each model has its own risk/return profile which can be blended with other models to create the customized portfolio. Each plays a different role. Note in general, the higher returns you seek, the longer time horizon you need to have, and the more risk you must be willing to accept.

Download/Print version of the Newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.