Despite my nickname of "Mr. Sunshine" I actually am an optimist at heart. I believe America will continue to prosper and be a global economic super-power. I have faith our citizens will be able to (eventually) put aside their growing ideological differences and do what is right for America. I trust our country will be able navigate the significant under-funding of pensions, Social Security, and Medicare without resorting to class or generational warfare. I have confidence the stock market will be significantly higher than it is today when I retire in 30 years.

I get my nickname because I'm no Pollyanna. I'm also a realist. I've studied history. I've dug into other economic crisis. I've managed money in the stock market for over 25 years. I've sat with investors who were invested far too much in the stock market at the wrong time in their financial lives. Their previous advisors were Pollyannas who convinced them everything was great and over the long-term they'd make significantly more money staying invested in the market.

The problem was they either did not have the ABILITY (which should have been discovered via a financial plan) nor the WILLINGNESS (which should have been discovered via a combination of a thorough risk assessment and personally knowing the client). As the DALBAR study has shown for the last 20 years I've been receiving it, this leads to investors not getting the benefit of the long-term growth of the stock market. The majority of people end up selling after a large market decline and do not get fully invested until the end of the bull market cycle.

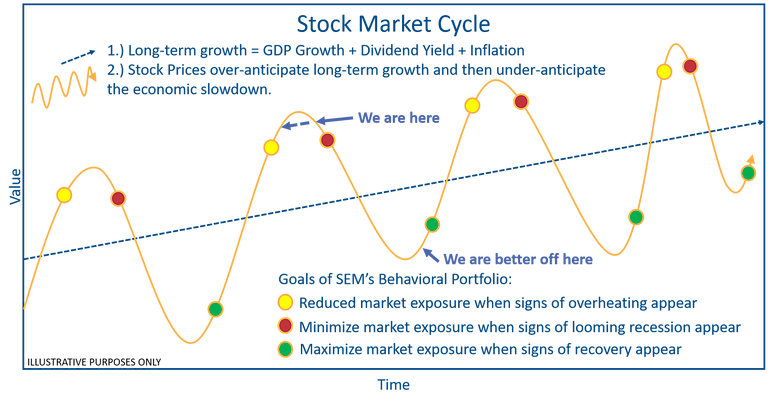

At SEM we have designed our portfolios to adapt to the ABILITY (financial plan and cash flow strategy) and WILLINGNESS (true risk tolerance and investment personality). Each customized portfolio is designed to have a mixture of strategies which help navigate the various stages of the market cycle. When we create a customized portfolio, it will show the maximum, minimum, and average equity exposure. Rather than buying and holding a passive mixture of funds, we will systematically adjust the allocations based on the current state of the cycle.

It will not be perfect, but the goal is to reduce market exposure as we get to the riskiest point in the cycle (the data is saying we are close to that point now). We will not get down to our minimum investments until the data is clear the up cycle is over and we've entered the down cycle. Likewise, the systems are designed to let the down cycle play out and not get back to maximum investments until we've received clear signals the worst is over. Again it is not perfect, but this strategy allows our clients to receive the long-term benefits of the stock market at a level of risk they should be able to stick with.

If you are a financial advisor and would like to know more about how we can help your clients, I'd love to schedule a short meeting with you. If you're an individual investor and would like to work with one of our financial advisors, please let me know and I can find one in your area. Finally, if you're a current SEM client and would like a review of your portfolio, click here to take our risk assessment.