Long-time clients and advisors of SEM know we are not afraid to hold cash. In fact, when explaining our strategies we often quote Will Rogers, “it’s not about return ON your investment, it’s about return OF your investment.” Whether it’s your household accounts or investing accounts, having cash on hand can be a nice buffer in tough times — even if it is yielding less than 1/2%.

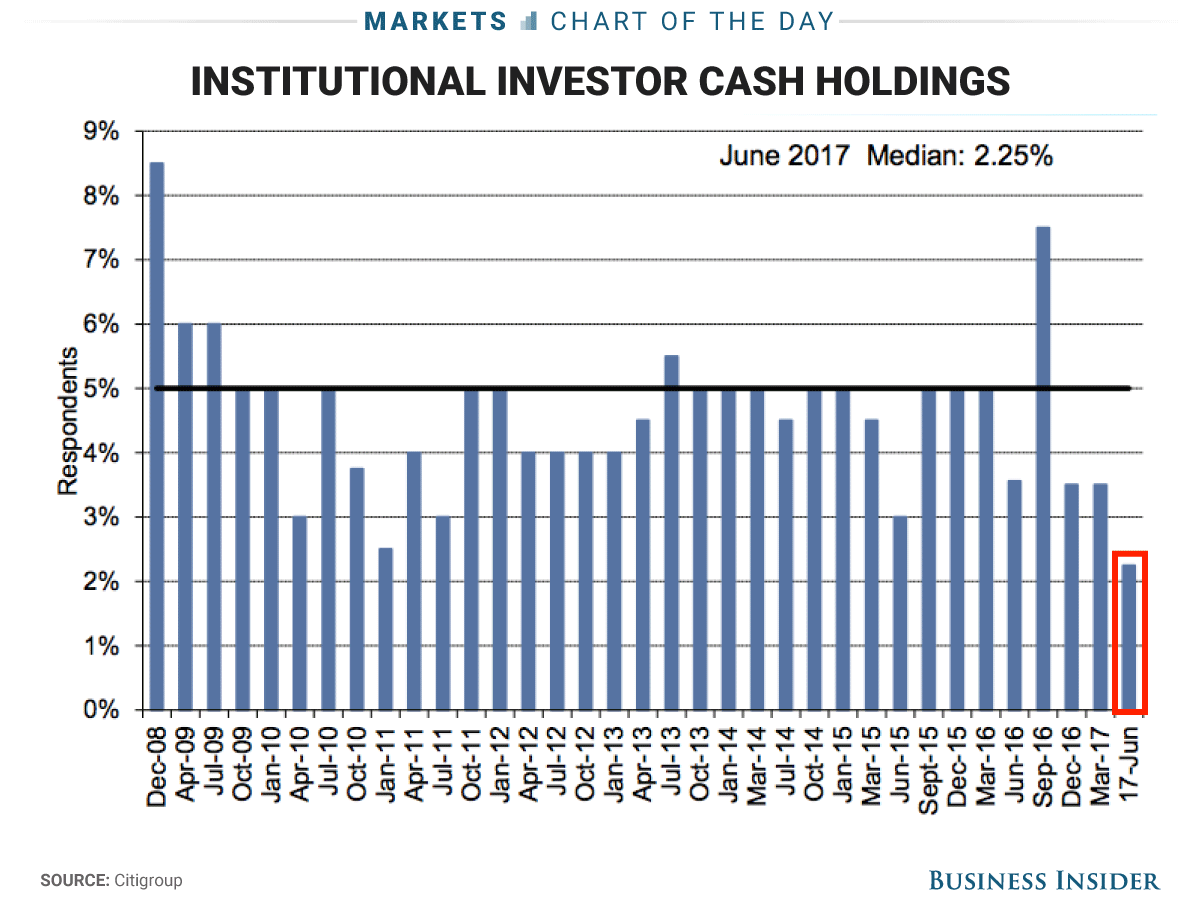

Cash holdings can also be a sign of market sentiment. If there are large amounts of cash on hand, sentiment is negative. Little cash tends to be correlated to euphoric sentiment. While these are not reliable trading signals, the amount of cash on hand can serve as a warning when looking at re-allocating current investments. This chart from Business Insider shows Institutional Investors are more confident than they’ve been since the early days of the financial crisis (before it was called the financial crisis). Even going back to early 2011 (just before the nearly 20% drop in the market) we can see low cash balances tend to show signs of an overly confident market.

SEM’s models have actually been doing the opposite lately. Most of our programs have lightened up their exposure to the markets and either moved money to shorter duration bonds or cash over the last few months. We still have significant exposure, but not as much as we had going into the year. Unfortunately, at this stage of the market cycle we see too many clients following the lead of the Institutional Investors, who tend to become emotional and chase returns in the late stages of the bull market as they lose clients. SEM’s allocations are unemotional and based on data. Who are you going to listen to?