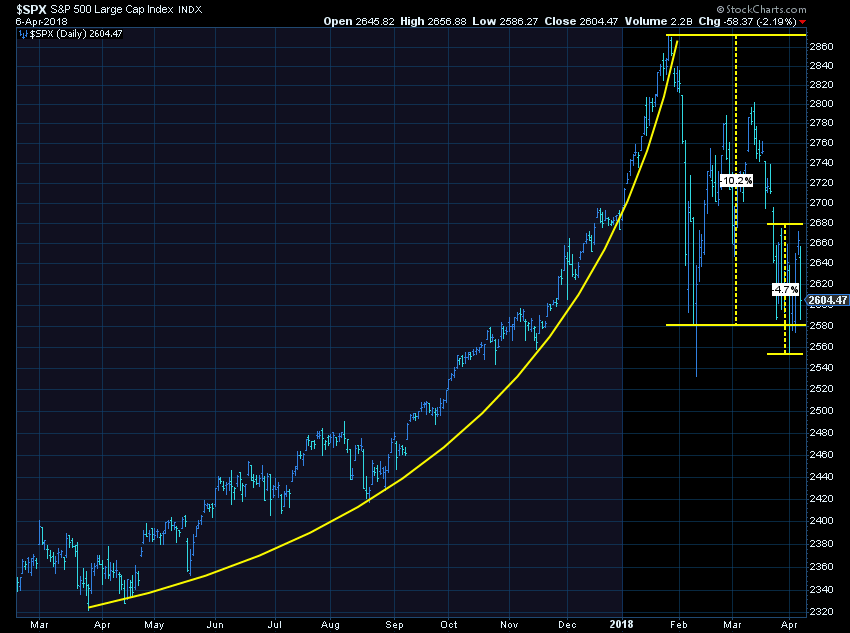

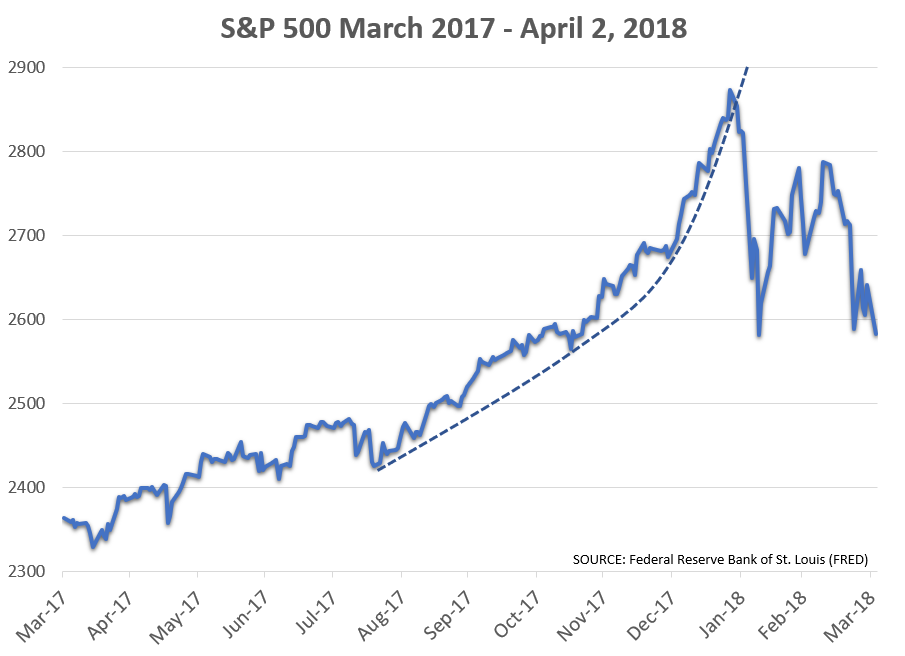

Despite the volatility of the news flow, the stock market made a parabolic move higher in 2017 and set records for the lowest level of price volatility on record. Since the beginning of February, the market has done what I expected when you have a president that tests policy ideas

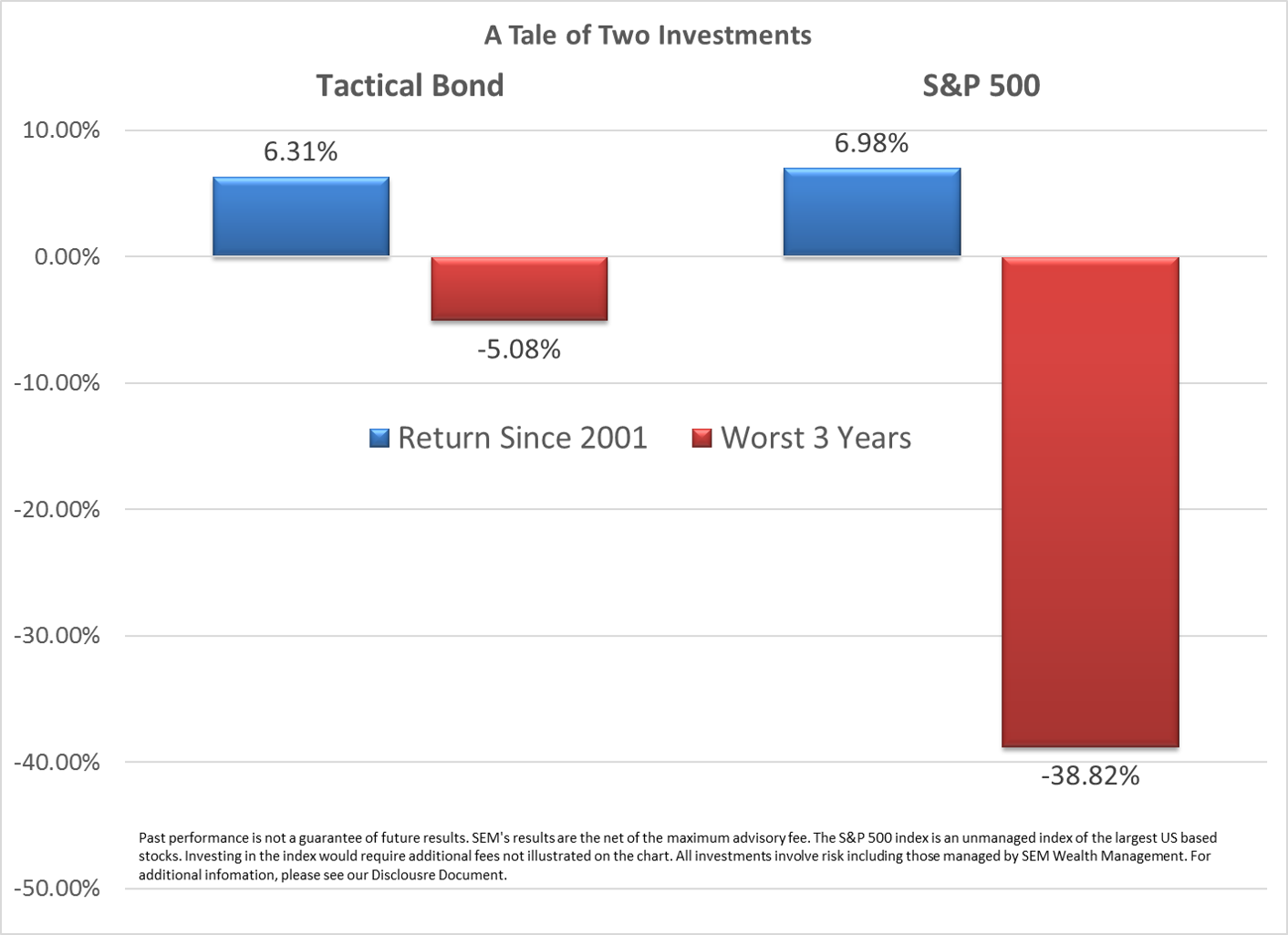

Over the past several years as the S&P 500 has marched steadily higher clients in our lowest risk strategies (Income Allocator & Tactical Bond) have grown anxious. Even though most clients invested in these two programs are there because they either had a very low ability or willingness

2017 was a record breaking year for the stock market in terms of volatility (or lack thereof). This led to money flooding into stocks to start 2018 as the expectation for more calm ahead drew money away from other lower risk asset classes. The massive influx of cash sparked a

The aftermath of a parabolic move

2017 was a record breaking year for the stock market in terms of volatility (or lack thereof). This led to money flooding into stocks to start 2018 as the expectation for more calm ahead drew money away from other lower risk asset classes. The

One of the most common behavioral biases in humans is “representativeness” bias. As Nobel Prize winning economist Dr. Daniel Kahneman described how our brains our programmed to work it is easy to see why this is the case — our brains are generally lazy and want the easiest,