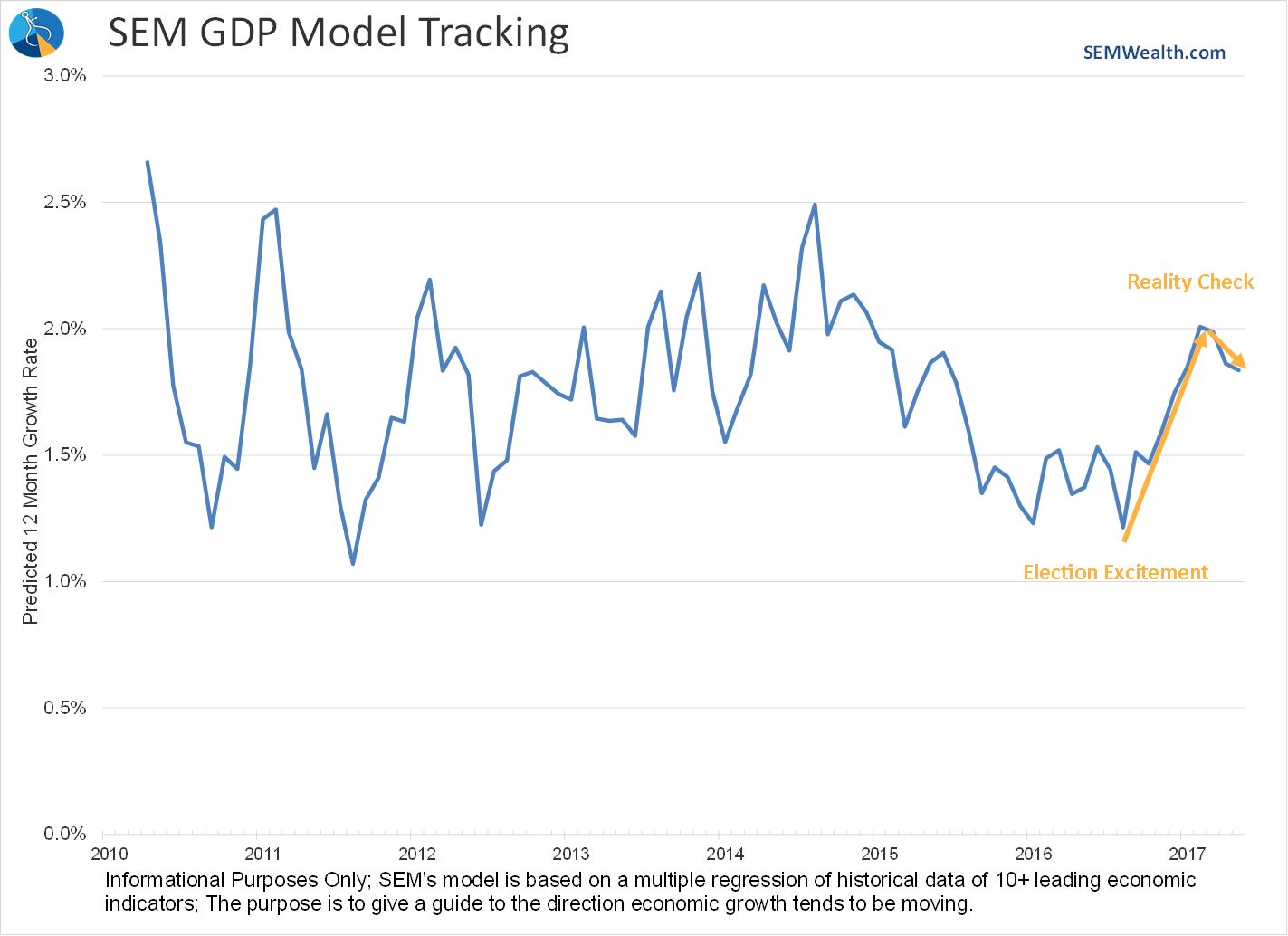

Following the election, the stock market staged a furious rally under the assumption President Trump and the Republican led Congress would implement “pro-growth” economic polices that would jump start an economy that has been unable to grow at even an average pace despite trillions of dollars being thrown at it by the Fed and the last Administration. My leading economic indicators picked up on the hope as “soft” indicators such as sentiment, manufacturing surveys, & optimism indices returned to levels we had not experienced during the entire 8 year recovery.

Unfortunately, the “soft” indicators did not turn into “hard” spending and we’ve seen the economic momentum wane in recent months. This has caused my leading economic indicator index to roll over enough to create a “bearish” growth signal in our Dynamic programs. While this signal is not anywhere close to pointing towards a recession, the lost momentum is something that should be a concern for investors.

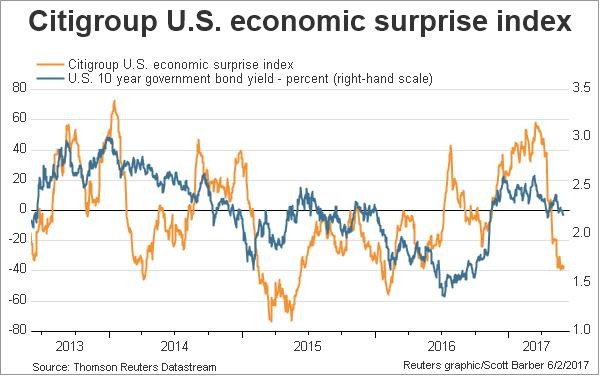

Another way to look at the disappointing data is the Citi Economic Surprise Index. This index measures where the economic data has been coming in versus the expectations of analysts.

Whichever way you look at it caution appears warranted until we see the Trump Administration gain some momentum on their growth policies.