One of the most common behavioral biases in humans is “representativeness” bias. As Nobel Prize winning economist Dr. Daniel Kahneman described how our brains our programmed to work it is easy to see why this is the case — our brains are generally lazy and want the easiest,

Back in February during the 10 day S&P 500 correction I introduced an analogy about speeding (click here to read it.) Back then the “car in the median” was inflation. My conclusion then was it was not a cop, but enough people were racing along at

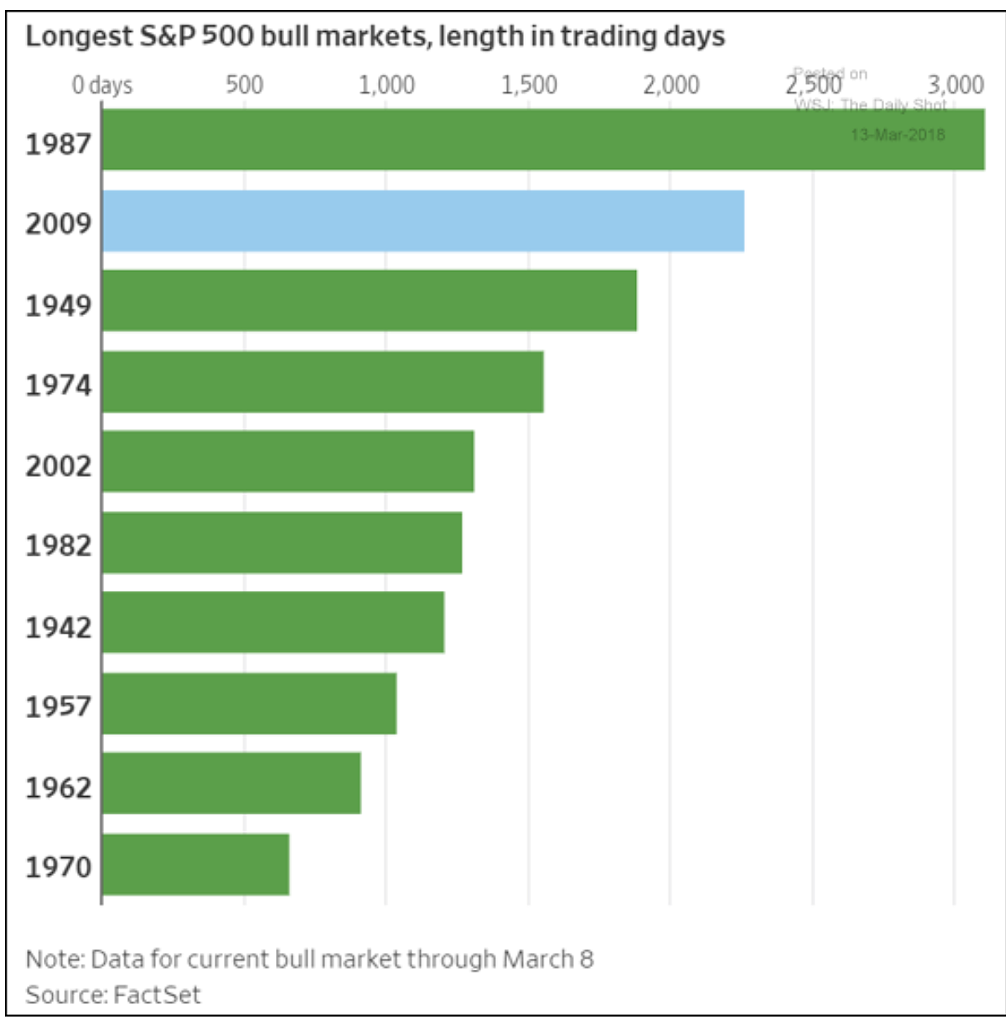

Last week we celebrated the 9 year anniversary of the start of the current bull market. I included some charts illustrating how abnormal this run has been. The Wall Street Journal last week put the current bull market in perspective with this week’s Chart of the Week.

Bull

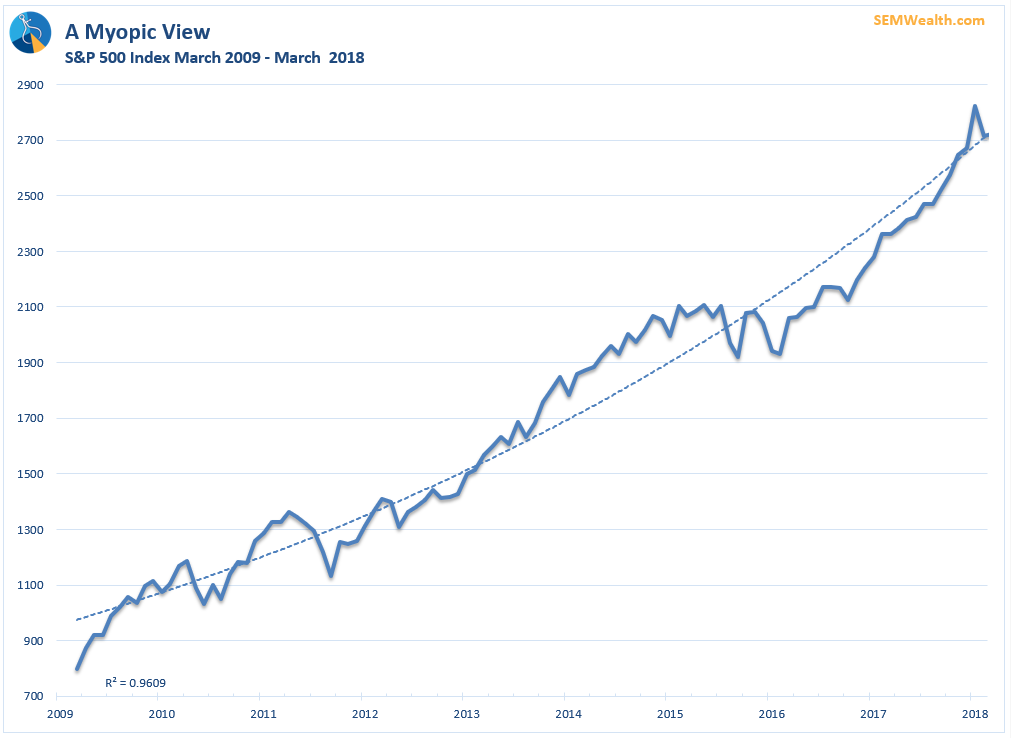

Today is the 9 year anniversary of the “bottom” of the financial crisis. The S&P 500 lost over 50% of its value during the crisis, falling to a level of 673. It has since rallied over 300% from the depths of the crisis. The only bump

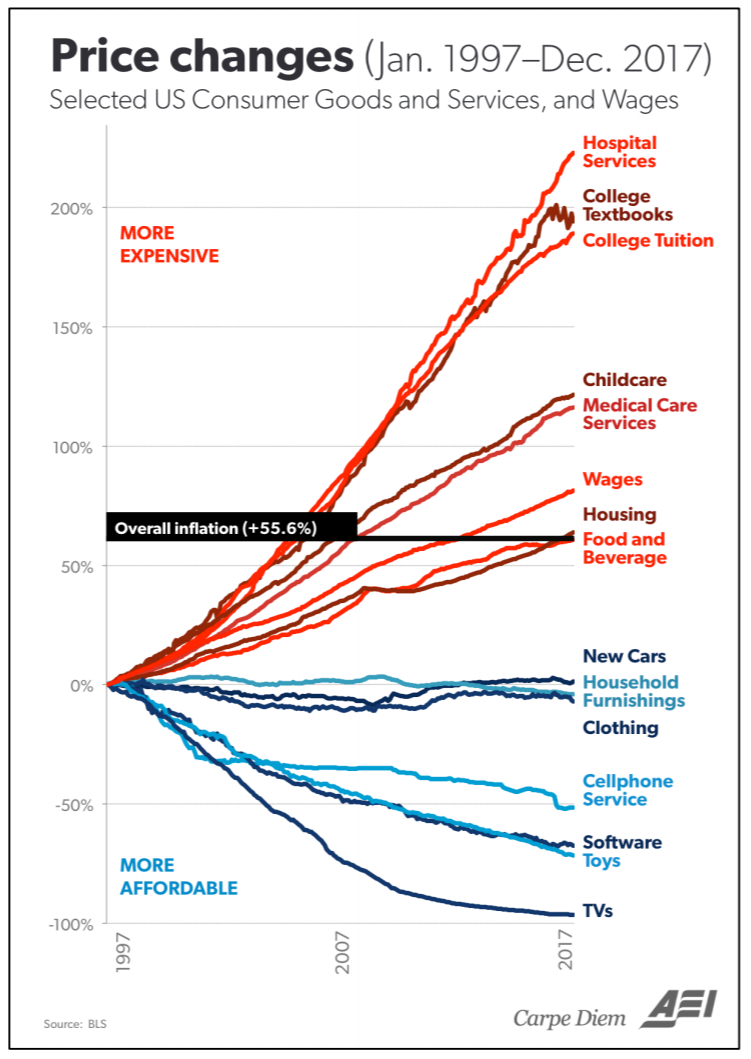

Since the beginning of February stock & bond market participants have been spooked by the prospects of inflation and the impact it could have on investment returns. Last week’s “Chart of the Week” examined the longer-term trend in inflation measurements. The conclusion was yes it is