Don’t get me wrong. I love my job. One of the primary reasons I chose this field is to help people. However, every once in a while we run into somebody that is beyond help. After dealing with somebody last week who fell into that category this video

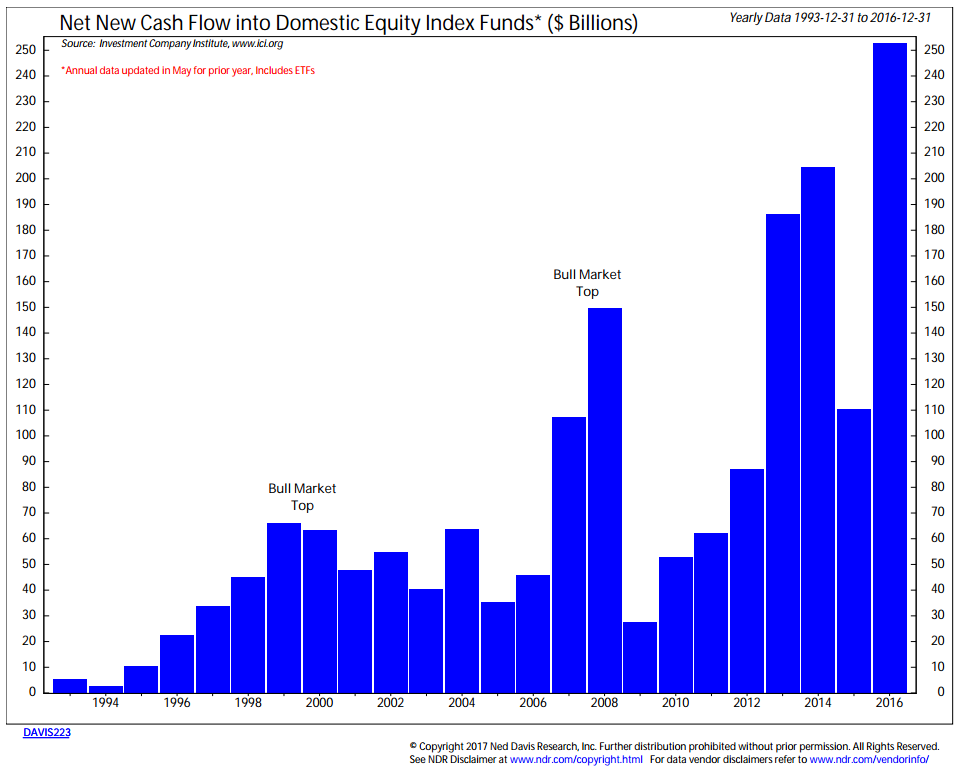

“Active investing is dead.”

“Buying a low cost index fund is the best way to ensure financial success.”

“Nobody wants to pay a fee for something they can do themselves.”

Those are just a sampling of the comments I’ve

Humans do not like change. It’s just how our brains are wired. We would rather see a negative outcome by sticking with a known than risk having a negative outcome by making a change.

Last week I discussed “conservatism” bias, which is the failure

Despite the rebound in job creation in April, the big picture has not changed. Throughout this century we’ve seen corporations taking a bigger piece of GDP at the expense of the labor force. Please do not take this statement as an endorsement of socialism. Instead it is a

Each morning this week I’ve scanned the news looking for the “story” to develop in my mind to relay to our advisors and clients. Each morning I’ve come away with nothing. This morning as I again could come up with nothing it finally hit