“Buy when investors are fearful, sell when they are greedy.” – Warren Buffet

Having managed money through both the tech & housing bubbles, you would think nothing could surprise me when it comes to stock market manias. Warren Buffet’s advice to sell when they are greedy could have been followed three years ago. Instead another Wall Street saying is again coming true — ‘markets stay irrational far longer than you can stay solvent.’ If you’ve ever watched or read “The Big Short” you would know that the stars of the story, the ones who saw the burst coming and staked their entire careers on betting on the downfall were nearly forced out of what turned out to be the investment of a lifetime.

No matter how you measure it (Price/Earnings, Price/Sales, Market Capitalization/GDP, Shiller P/E) the market valuation is at a level we’ve only experienced during past market bubbles (1929, 2000, 2007). Economic growth is anemic, Congress has shown no ability to implement any of the pro-growth policies President Trump promised, the White House is surrounded by investigations and accusations of wrong-doing, and American is in a state of social unrest we haven’t seen since the 1960s. To top it all off, the Federal Reserve is not only raising interest rates they are planning to begin unwinding their $3 Trillion+ balance sheet — something that has never been done in the history of central banking.

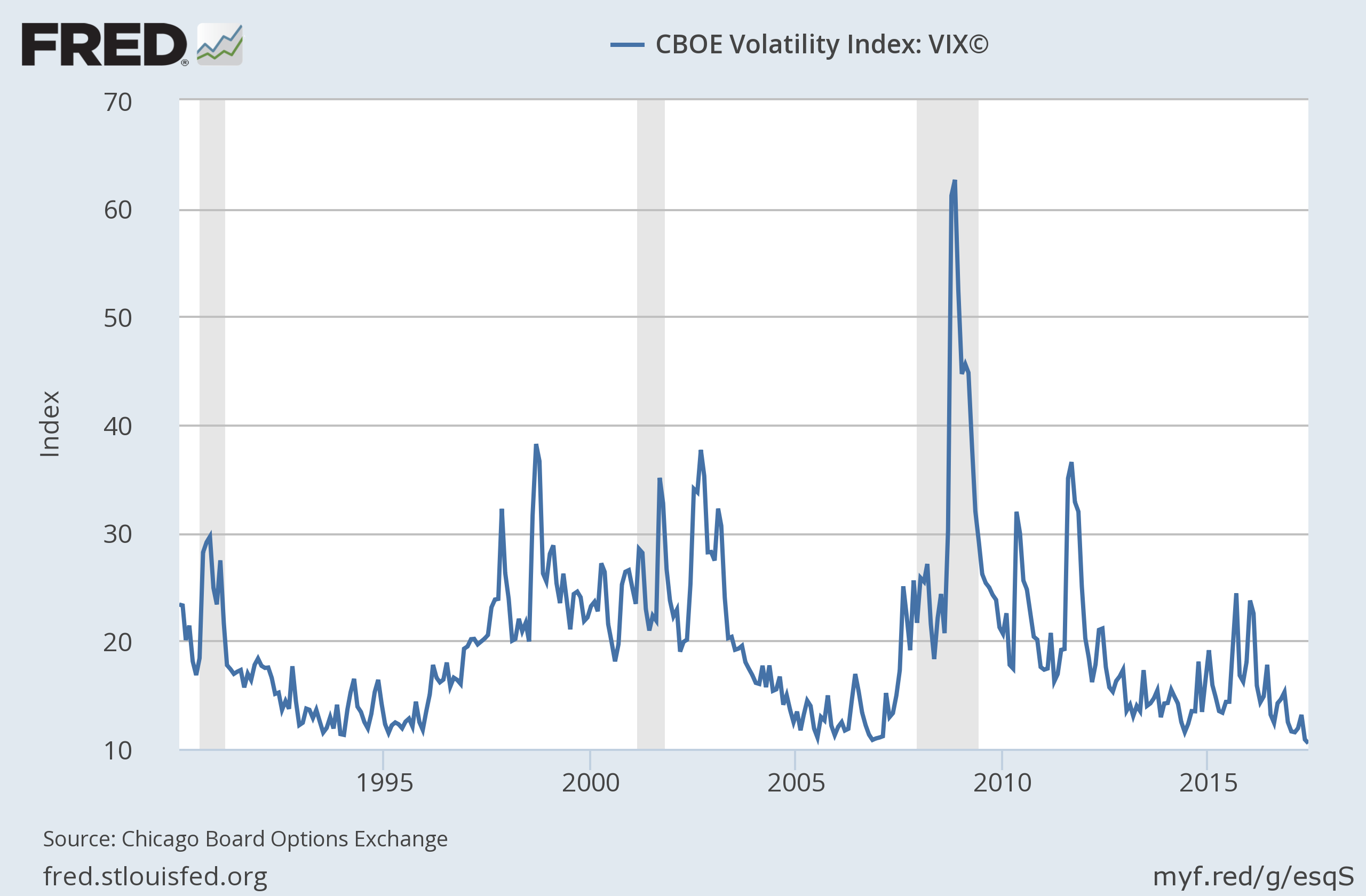

Given this you would think the market would be showing some signs of concern. Instead the exact opposite is taking place — stocks are at record highs & the Volatility Index is at a record low. For those of you unfamiliar, the Volatility Index is calculated based on the price of options in the market. The more concerned investors are about a looming correction, the higher the Volatility Index. The more complacent investors are about risk, the lower the Volatility Index.

For our part, we are remaining “solvent” by doing what we’ve always done — following the trends in the market and investing our clients’ money wherever those trends may take us. At the same time, our models are designed to look for signs of trouble based on past market corrections. Over the past several weeks we’ve seen our systems give very small warning signals, causing us to reduce our holdings just slightly. However, we are still participating quite nicely in the upside of the market, especially in our growth oriented strategies.

On the fixed income side, we’ve again seen far too many clients looking at the lower returns and moving their money into far riskier assets. The more the market goes up, the more they tell themselves they made the right decision. However, as I witnessed during the last two bubbles, when the market finally returned to “normal” those clients saw their accounts lose far more than they could afford or were comfortable with. Most ended up bailing out and not not enjoying the upside when the market finally hit bottom. That’s just the way market seem to work.

SEM has a strong line-up of investments and we can work with our clients and advisors to structure a portfolio to give them some upside participation while still providing enough risk management so they do not become another casualty of the market mania. If you find yourself frustrated with the returns in your risk managed portfolio let me know. We most likely have a solution.