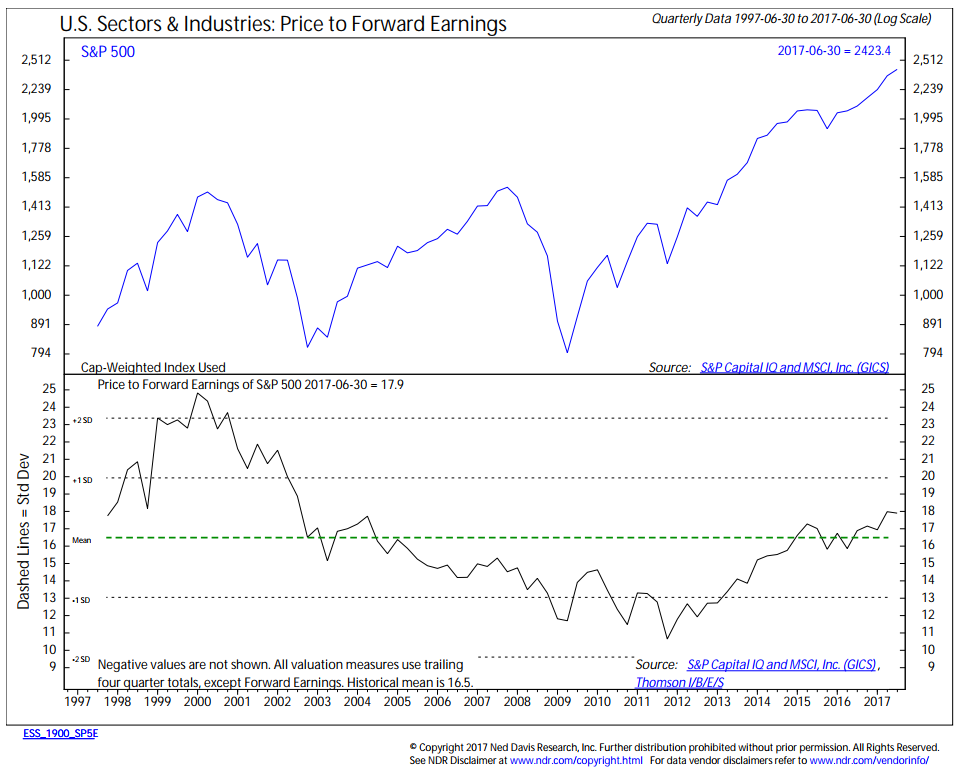

Earnings season has brought a constant stream of “better than expected” earnings reports, which has led to a seemingly endless string of new record highs for the S&P 500. The bulls have argued the new highs are justified based on the earnings the companies behind them are generating. The problem with that argument is even if you use the “forward P/E” ratio, which takes the current price divided by the EXPECTED earnings for the next 12 months, stocks still look expensive.

The argument of course will be “the P/E isn’t as high as in 1999.” To me that is like somebody in Arizona saying on a 115 degree day, “well at least it’s not 120.” Like the heat in Arizona, once valuations get to these levels it doesn’t really matter how much higher it goes. It is a dangerous situation.

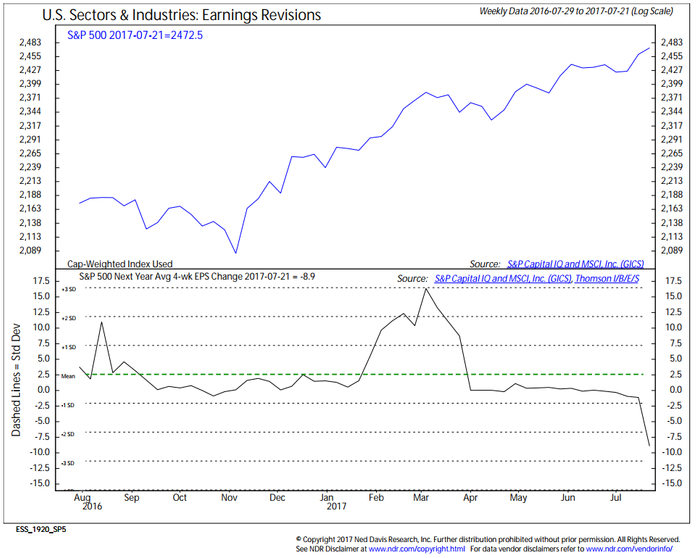

Making matters worse for the bulls is the direction of expectations. The expectations for 2018 continue to decline and are likely to continue in that direction unless the Republicans and Trump administration can get their acts together and begin putting to work all the “pro-growth” agenda items that helped them win the election.

As I’ve said for a few years, valuations being high is not a catalyst for a sell-off. We do not use any valuation metrics in our models, but we do know from studying history bear markets almost always begin with stocks at high valuations making abandoning risk management at this point in the game a potentially devestating move for your portfolio.