The past few weeks I’ve been fortunate enough to sit in over a dozen client meetings with our advisors. Whether they were prospective SEM clients or longer-term clients, there has been a common theme — most do not see any risk in the market. One even commented, “it was much more overvalued in the 90’s.” This client also happened to bring along a nice, glossy proposal put together by a large name broker-dealer that was one of the Wall Street banks saved by the Fed & Congress in 2008. In it they included a comparison of today’s valuation metrics and those of the 1990s. The high cost proposal somehow forgot to include the valuations in 1929 & 2007, both of which would have shown valuations currently ABOVE those levels.

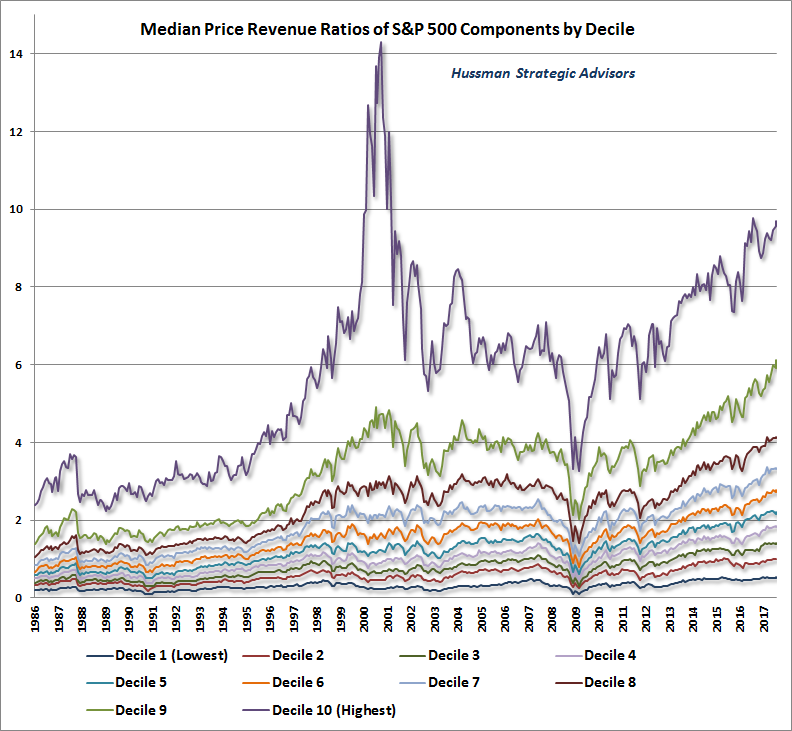

John Hussman of Hussman Strategic Advisors this week pointed out the problem with using the 1990s valuation metrics for comfort with the market. His statisticians broke the S&P 500 down by decile. This enlightening data shows us something hidden in the 1999 comparison — the 1999 market was driven to extremes by a small segment of stocks. Currently EVERY decile except the top 1 is at or ABOVE the 1999 valuation point.

For the past several months I’ve been highlighting the dangers of these valuation levels for long-term investors, and the concerns I have given the overwhelming complacency towards risk by individual and institutional investors alike. This week we saw how quickly the market could turn on relatively minor news. When you are at extreme valuations and have extreme lows in risk premiums, it does not take much to turn the market lower.

Our indicators are on high alert and have scaled back exposure over the past few months. They are close to putting even more risk management into play relatively soon if necessary. This is in stark contrast to what most of the clients have wanted to do at this point. I’ve been around long enough to know that by itself is reason to not abandon risk management at this point in the game.