I was quoted in two articles this week. On Sunday, the New York Times published “When Gambling Seems Like a Good Investment“. The article discussed ways financial advisors deal with aggressive clients. It gave me the opportunity to highlight our behavioral approach. In this case, I discussed how we allow clients to section off small portions of their portfolios to chase more aggressive returns. While those that know me would know I typically do not advocate “gambling”, our approach allows certain clients to do this. For my direct clients I remove the entire balance of the “play money” segment from our Tolerisk projections and then show the client what would happen if they lost ALL of their play money.

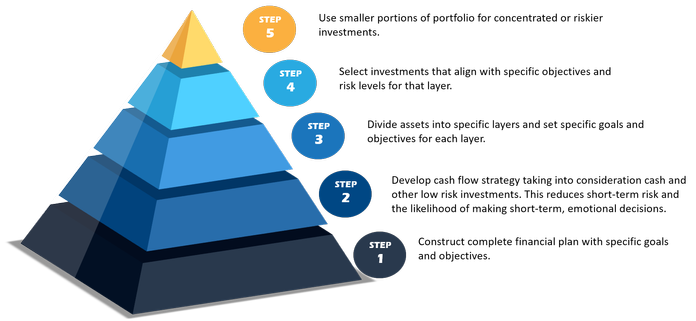

This idea is the “orange triangle” at the top of our Behavioral Portfolio Approach. It only works if the other 4 components have already been solidified. We discuss this in greater detail on the Portfolio page of our website. Our platform at E*TRADE Advisor Services is designed to work with financial advisors to implement this Behavioral Portfolio Approach in the most efficient way possible. (Click here for the details) We also made this a feature in our new marketing piece, “Your Financial Advisor & SEM” (Click here to download or order your own copies).

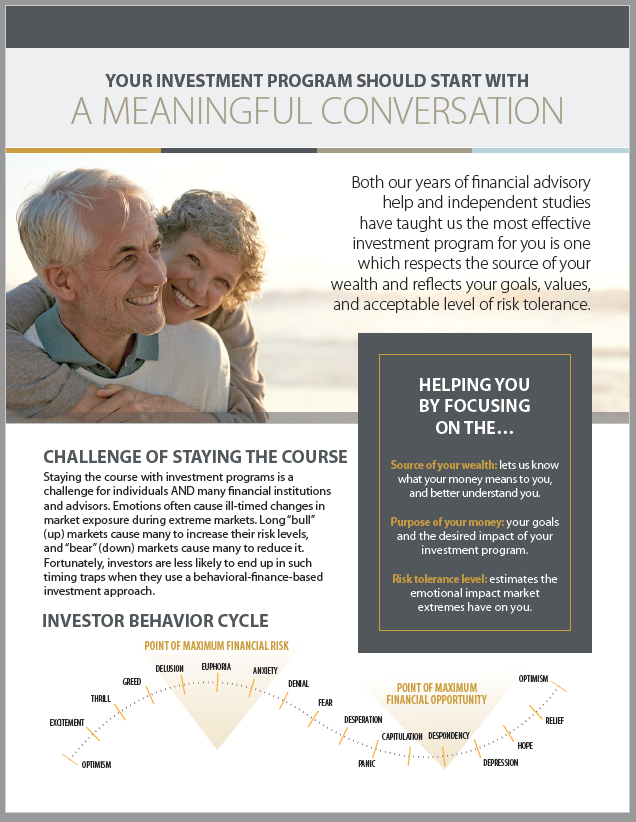

I see a lot of financial firms saying they utilize behavioral finance, but very few actually understand the key behind a true behavioral approach. Traditional finance assumes a 100% rational participant. Behavioral finance understands we cannot be 100% rational, 100% of the time. We are all humans and will have times we are not completely rational. A true behavioral approach plans for this and works to develop portfolios around each person’s specific behavioral biases. What I see most people doing is telling clients what they SHOULD do. (You should stay invested, you should have a long-term perspective, you should have a high allocation to stocks, you should ignore the noise, etc.) I agree with all of those things, but my 20+ years of experience and study of market history tells me very few people have the ability to do all of those things throughout their lives.

This brings us to the second article I appeared in, this time on Advisor Hub. The article dives deeper into how a financial advisor can adapt this approach to grow their business. If you’re a financial advisor I’d encourage you to read the whole article here.

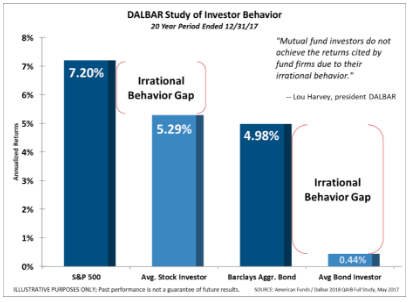

The author mentions two studies — the DALBAR Study of Investor Behavior and Vanguard’s “Putting a Value on Your Value”. With the stock market approaching the highs from 2018 (again) I thought it would be appropriate to include those two studies as our Chart of the Week.

Regardless of the 20-year period, every year when the DALBAR data is updated it shows the same thing — the average investor dramatically underperforms the market. This is the primary proof investors will not do what they SHOULD do, which is why we plan around what they likely WILL do.

The more eye-opening data point is for the fixed-income investor. These investors are the ones SEM can help the most. They tend to be conservative, which leads to a specific set of Behavioral Biases. I’d put our track record in the fixed income market up against anybody that has been around since the 1990s. (Side note, if you’re an advisor and tired of trying to select and then monitor outside managers, we have a Platinum Portfolio line-up comprised of some of the best fixed income managers in the country. Let us know if you’d like more information on these portfolios.)

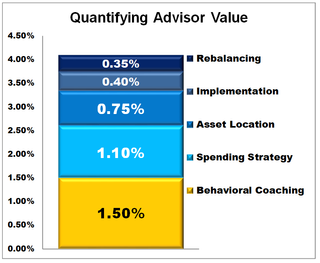

The Vanguard Study is something I think is enlightening. Even though in their marketing efforts Vanguard spends all their money telling everyone what they SHOULD be doing. Their study shows how much value Advisors have added (after paying the fees Vanguard tells you not to pay). Notice where the most value is added — Behavioral Coaching. This can mean a lot of things, but for us it means a complete Behavioral Approach to Investing. It starts with the first conversation and continues into the creation of customized portfolios, the on-going monitoring, periodic financial reviews, and constantly working with the client to ensure they are comfortable with the path they are on.

The Vanguard Study was featured in our new “Discussion Guide” which we just posted to our website. It helps guide advisors and their clients/prospects through the beginning portion of our Behavioral Approach. (Click here to download or to order copies.)

If you’re tired of constantly telling clients what they SHOULD be doing and would instead prefer to create customized solutions tailored around what your clients likely WILL be doing, we are here to help.