Last week’s Chart of the Week discussed “Conservatism” bias where we tend to fail to incorporate new information into our assessment of the current and future environments. I pointed out the tightening spread between long-term and shorter-term Treasuries as well as the jump in the TED Spread (difference between LIBOR & 3 month Treasuries). Those are subtle signs of a tightening financial market that could lead to significant problems down the road.

This week’s Chart of the Week comes courtesy of Deutsche Bank. They too are worried about the credit markets but for a different reason. According to macro strategists Quinn Brody & chief economist Torsten Slok the next crisis could come from the US government. I realize to most the prospect of a US led debt crisis is hard to imagine, but Brody & Slok highlight a brewing “perfect storm” that could spark a significant jump in Treasury yields, which could cause problems throughout the global financial system.

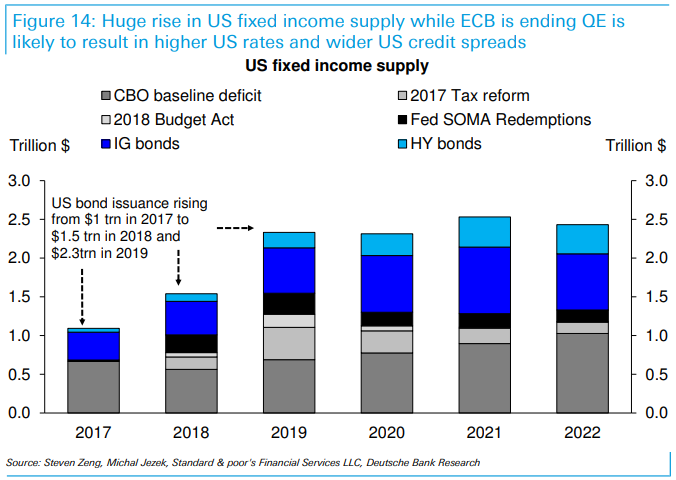

Thanks to tax cuts that are unlikely to lead to strong enough economic growth to pay for them (according to the Congressional Budget Office) along with the projected budget deficits already approved by the Republican Congress, the US will need to borrow significantly more money in each of the coming years. At the same time the Federal Reserve is already unwinding its massive balance sheet full of Treasury Bonds. In addition, the European Central Bank is in the early planning stages of unwinding their own balance sheet, which helped fuel foreign purchases of US Treasury Bonds. This will also create strains in Europe as members of the EU try to fund budgets that are a much larger percentage of GDP than the US’s ballooning deficit.

“Cliff Notes” Version: The US needs to buy significantly more money in the coming years along with the rest of the world at the same time the Central Banks who helped fund the deficits the last 10 years are looking to sell their own holdings. Lots of debt to be sold, fewer institutions will be buying.

[If you recall, it isn’t just the US government that needs to borrow a whole lot of money. S&P 500 companies also will have to more than double their annual issuance rate of debt (hitting at least $400B by 2020) just to re-finance the debt they’ve used the past 9 years to buyback stock and increase dividends. For more see “Source of the next crisis?“]

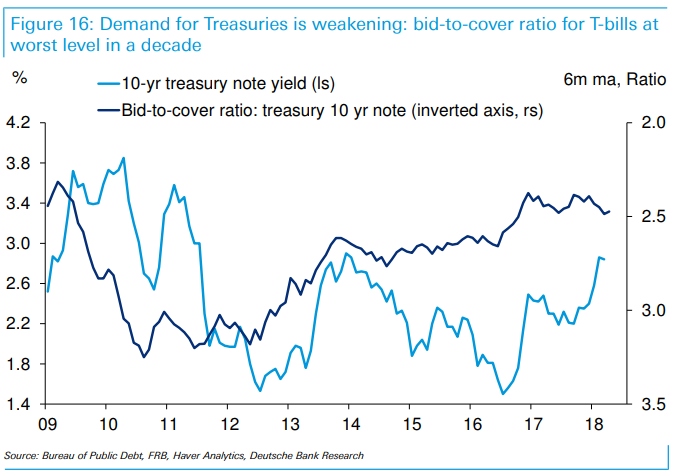

Deutsche is not sounding the alarm bells yet, but said we should all be watching the bid-to-cover ratios at Treasury auctions for signs of stress. Less demand leads to lower bid-to-cover ratios. The chart below shows the bid-to-cover ratio inverted on the right hand scale along with 10 year Treasury yields. Recently we’ve seen improvement in the 6 month ratio, but remember — the heavier borrowing starts accelerating in the coming months and will last for the next few years. A drop in bid-to-cover ratios will be the early warning sign the crisis is likely about to begin.

More importantly when looking at the chart above, note the correlation to interest rates. In 2020 it is estimated the US will be spending more on interest rates than it does on defense (making it the 3rd largest budget category behind Social Security & Medicare). Higher rates will require even more borrowing, a cycle that at some point will lead to the bond market saying “enough”, which will lead to yet another financial crisis.

In last week’s post I mentioned another bias — Representativeness Bias. Essentially our brains try to find similar periods to help us predict what will happen in the future. So many people are focused on tech stock valuations or housing prices (the signs of the last bubbles) trying to identify when the market will start to fall again. What they are missing is the fact the next bear market will not be caused by the same things that caused the last two. The market and economy has been living on massive stimulus from central banks around the world and runaway deficit spending from the governments. It is logical the very thing that caused the bull market will be the thing that causes the bubble to burst.

We may have another year before we see signs of serious strain, which gives you plenty of time to hire an experienced risk manager such as SEM to oversee what is likely to be a very difficult market.