The real risk to the rally

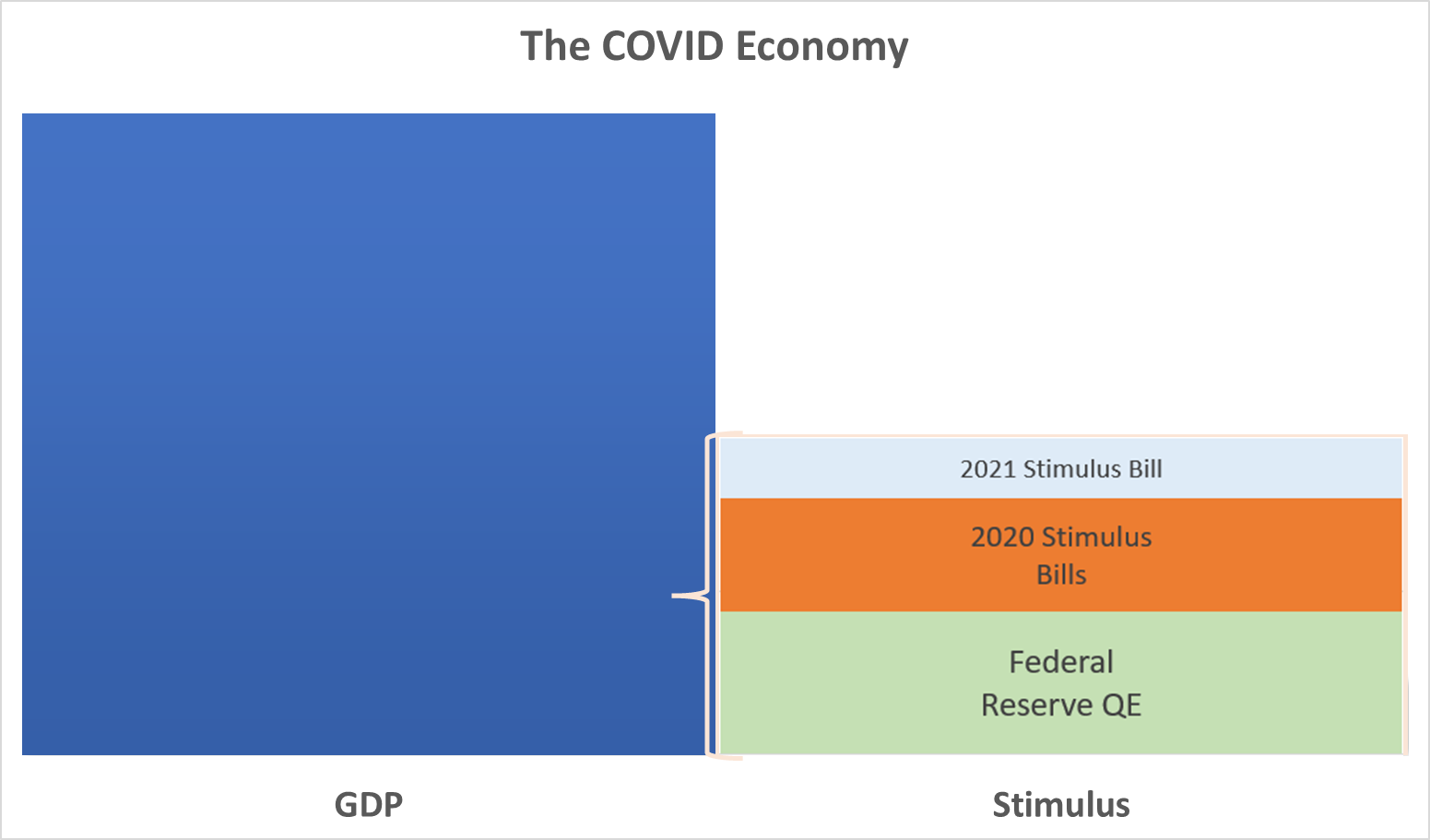

For most of the year the focus has been on the Russian invasion of Ukraine (rightly so). This may have caused some big swings in the stock market, but this focus has hidden the real risk to the nearly 2-year stock market rally. In the past few newsletters, we’ve warned about the coming shift in the economy and thus the stock market as we shift from the COVID economy to whatever it will look like in the aftermath of the unprecedented stimulus from the Federal Reserve and Congress. Combined we saw 50% of our economic output dumped into the economy. This may have helped support some areas of our country, but it also has created some unintended consequences. The most important is the seemingly runaway inflation going through our economy right now. This is going to lead to the Federal Reserve having to fight an inflation fire, which most likely means no longer having them supporting asset prices. The amount of stimulus was unprecedented, which means they have no experience how to unwind it.

For the latest updates throughout the quarter go to TradersBlog.SEMWealth.com

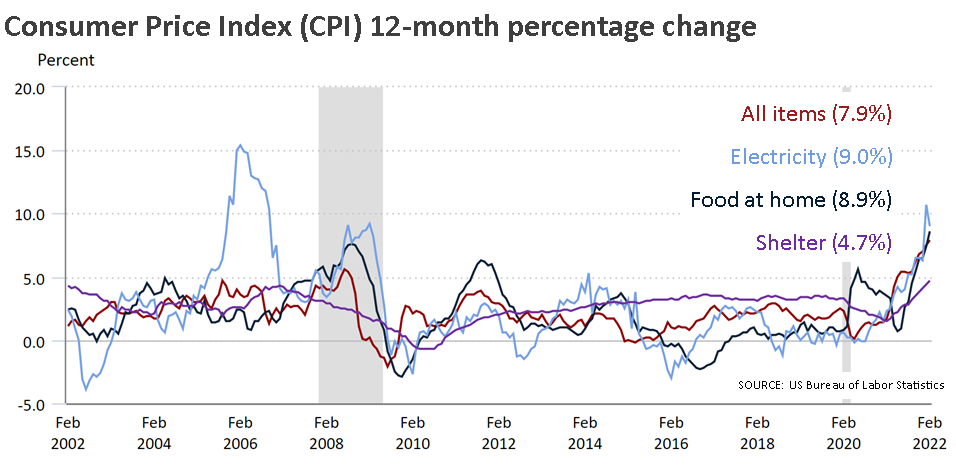

Inflation – it's more than just gasoline

Most Americans are feeling the pinch of inflation. The official numbers show inflation rates at the highest levels since the early 1980s. The big focus has been on energy prices, but in reality nearly everything is more expensive now than it was a few years ago. We understand there are plenty of opinions out there about who or what is to blame for this. We warned over a year ago about the problems of inflation, not because of a political opinion, but because of the money dumped into the economy to fight the COVID related shutdowns. When you have excess money chasing limited goods and services (due to the shutdowns), you get inflation. COVID also caused disruptions to manufacturing capacity all along the supply chain, which continues to create higher prices. There are no quick fixes or easy solutions to this problem. If inflation continues to run at these uncomfortable levels, we will likely see both an economic slowdown and significantly higher interest rates. Neither would be good for stock prices.

Whatever happens, we have a plan

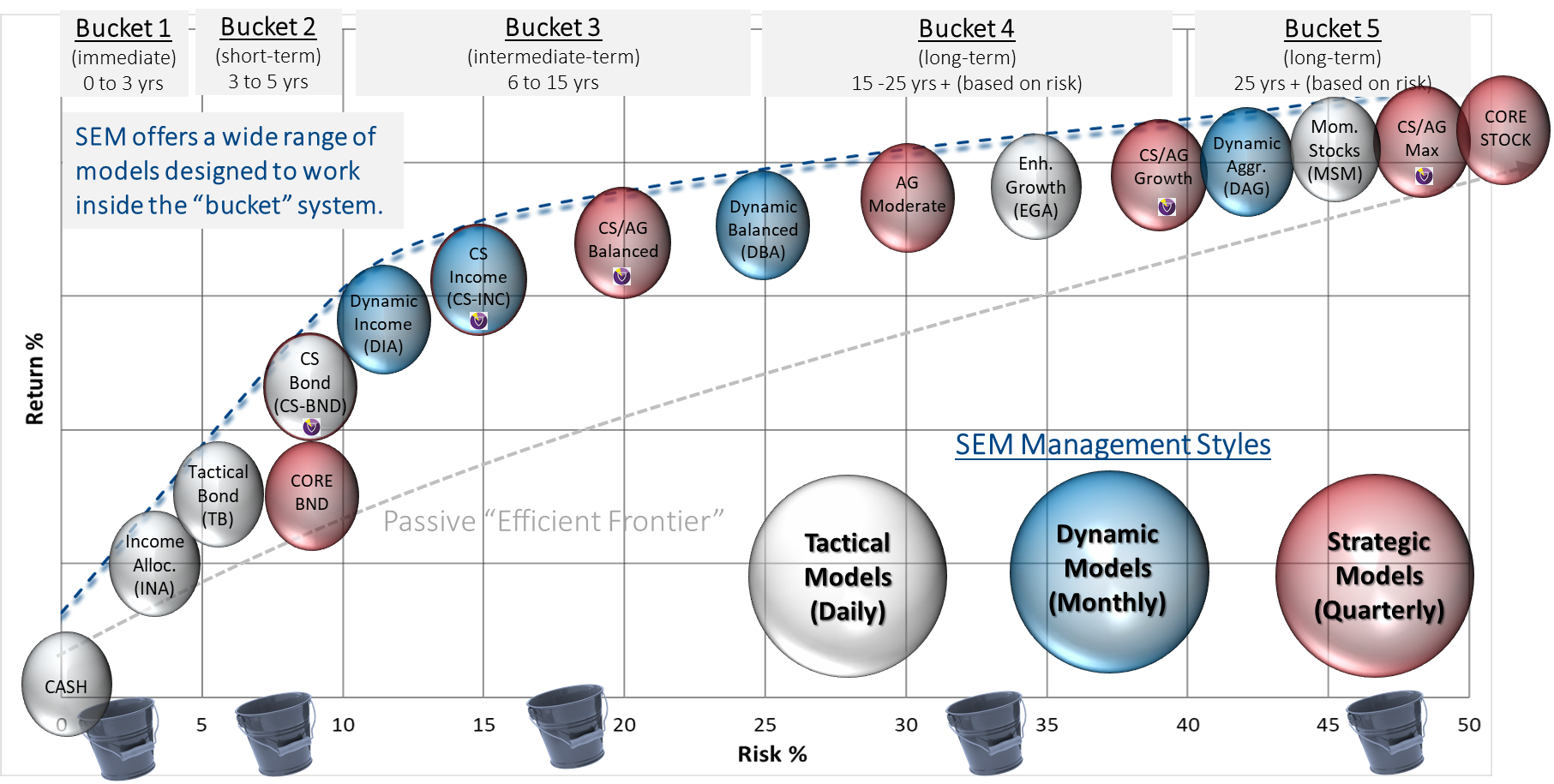

The past quarter has proven once again the value of a disciplined, quantitatively based plan in the midst of uncertainty. While it is too early to tell as we write how the conflict in Russia will end, there is always a danger of a tyrant who does not play by the developed world’s rules of doing things nobody expects. There are also things, such as a pandemic that was not predicted by anybody until it happened. For 30 years, SEM has been calmly handling all sorts of different sources of uncertainty. We thought it would be helpful to walk through the recent moves SEM took to reduce the risk in our clients’ investment accounts:

· October 1: SEM’s economic model moves from "bullish" to "neutral". Dynamic Income Allocation (DIA) (and Cornerstone-Income) sells half of dividend stock exposure. Dynamic Aggressive Growth (DAG) sells half of small cap exposure. Bonds are added in place of these positions. This model issued a bearish signal on April 1, 2022, eliminating small cap (DAG) and dividend stocks (DIA)

· January 3: AmeriGuard & Cornerstone Balanced & Growth core positions eliminate small cap growth and added Large Cap Value.

· January 10: First sell signal in High Yield Bond system, reducing exposure by 1/4 in Tactical Bond (TB).

· January 19: Second sell signal in High Yield Bonds, reducing exposure in TB, Tax Advantaged Bond (TAB), and Income Allocator (INA).

· January 24: Third and fourth (final) sell signals in High Yield Bonds, reducing exposure in TB, INA, and Cornerstone-Bond (CS-BND). This puts TB & CS-BND in fully "risk-off" positions.

· January 31: INA sells last high yield bond position, placing this model fully in "risk-off" mode.

· February 22 (two days before Russia invaded Ukraine): First trend indicator triggers in AmeriGuard & Cornerstone Balanced & Growth models, cutting stock exposure to half of the target range (Balanced now at 50% stock, Growth at 85%).

· March 7: Second trend indicator triggers in AmeriGuard & Cornerstone Balanced & Growth models, cutting exposure to minimum of the target range (Balanced now at 30%, Growth at 70%).

At the end of the quarter, several of the above systems were on the verge of moving back into the markets. This is the beauty of our mechanically based models. It doesn’t matter what our opinions are about what may happen next. We let the numbers determine the next move. Of course, our experience tells us just because the market rallies a bit it doesn’t mean the worst is over.

While each of our investment models are designed to stand on their own, the real value comes when we combine multiple models into one investment portfolio. This allows the longer-term bucket to stay invested longer and the shorter-term bucket to focus more on managing risk. The allocation to each management style and investment model is determined by the financial plan, cash flow strategy, investment objectives, risk tolerance, and investment personality of each client.

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.