Minus a 6-8 week bump in the road during COVID, stocks have been going up nearly non-stop for 11 years. We did see a couple of "slowdown" scares in late 2015 and again in 2018, but with hindsight those were buying opportunities. Both of the slowdowns came at a time where the Federal Reserve was putting in motion policies to unwind their stimulus efforts used to fight the Great Recession. The key difference back then was inflation was stubbornly low, so the Fed was able to back off of their "unwind" to help boost the economy (and stock market).

We are again looking at a situation where the Fed is attempting to unwind their (unprecedented) stimulus. The difference this time versus the last 11 years is inflation is a major problem that is causing issues throughout the global economy. We cannot expect the Fed to simply stop pulling back stimulus because the economy slows. Everyone seems to trust the Fed to engineer a nice, easy unwind, but I've never seen that accomplished in my career. I'm not sure why now would be different.

On my advisor calls last week my advice was this:

Ignore the short-term fluctuations. We are at a time where maintaining as much of our capital as possible is our only goal. There are few places to make money without taking on significant risks. Picking what might do well in the weeks and months ahead is simply a guessing game. There are times where it is easy to invest and others where it is quite difficult. The way we've survived the last 30 years has been knowing the difference between the two. When it is difficult, we choose to sit on the sidelines as much as possible and wait for times when it is easier.

Weekly Talking Points:

- The focus returns right now is inflation, economic growth, interest rates, and what the Federal Reserve will do next. Fundamentally and logically, this should be viewed as a bad thing unless you believe economic growth will be BETTER than it was in 2021.

- Taking an even bigger step back, with Fed action puts the economy moving towards a place of standing on its own. The last time the economy didn't have Fed and Congressional stimulus was 2019. At that point the economy was heading towards a sharp slowdown in growth.

- The only thing that could drive stocks higher is more euphoria. Stocks can go up longer than we think is possible, but it shouldn't embolden you into believing they will never go down. The market is well overdue for a real bear market (35% drop in prices which lasts 18-24 months).

- Your investments should align with your financial plan, cash flow strategy, investment objectives, risk tolerance, and overall investment personality. If you made changes in the past year simply because you wanted to make more money, now is a very good time to shift back to where you were before that jump. If you are already in alignment with those items, SEM's models have already taken the steps to adjust to what could be a very difficult environment.

- The real wild card is interest rates. The free market has already raised rates on long-term bonds significantly (more than 1% in 3 months). The Federal Reserve has only adjusted short-term rates by 1/4.%. While recency bias has many people believing long-term yields are going to continue to rocket higher, if the Federal Reserve begins to take more aggressive action on short-term rates, we could see long-term rates fall. Be very careful making adjustments to your bond portfolios based on recent moves!

I'm not going to expand too much on the above this week. I'd encourage you to check out our quarterly newsletter here as it provides a brief, big picture summary of where we are at. Again, IGNORE THE SHORT-TERM FLUCTUATIONS!

In case you missed it, last week we provided a look at what our economic model is saying. (Hint: It's not saying this is a buying opportunity).

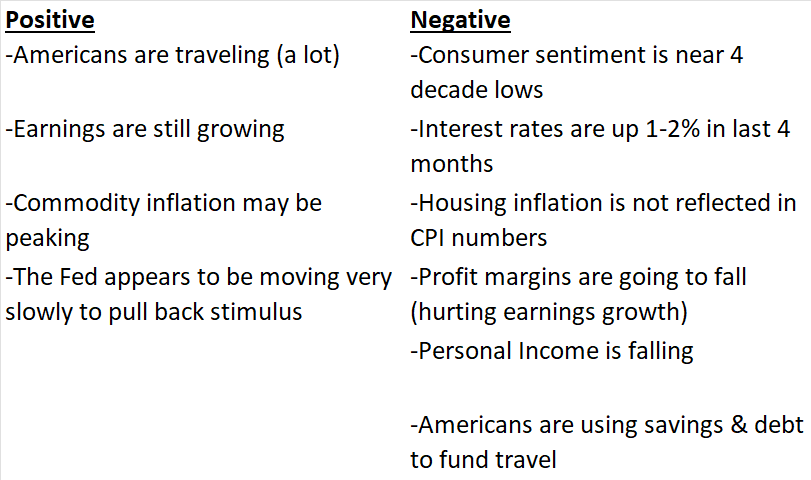

I like to make lists to get a feel of various situations and decisions. While this doesn't have any bearing on how we invest at SEM, it is something I jotted down over the weekend. I keep challenging myself to find something positive. Here is what I have. If you have anything to add, feel free to list it in the comments.

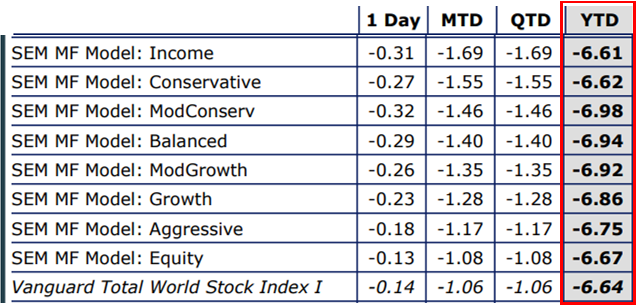

One of our advisors pointed out something interesting to me last week. We created some "mutual fund" models designed to work with small accounts. They use Vanguard mutual funds to create a very low-cost index portfolio. They are passively managed as their purpose is to be a vehicle to start accumulating money for those just starting out in investing. So far this year, it has not mattered what your stock/bond mixture has been. Bonds are not helping keep risks lower like most of us are used to.

I don't know how much this will continue, but it is something I think even for those of us who have been around for 30 years are not used to seeing very often. While we are not happy with any losses, our actively managed bond portfolios are down around 3% for the year. Again, we are at a point in the cycle where we are trying to maintain as much capital, not trying to guess what might make money. For now, basically all bond categories are in a downtrend. The difference is the magnitude of their losses. This will not persist forever. Lower risk opportunities will present themselves and when they do we plan on being ready to pounce.