Unprecedented actions lead to unprecedented consequences. Back in April 2007, I wrote one of our most popular articles, "The Pending Forest Fire". At the time people thought we were crazy. Everything was booming. Real estate, stocks, the job market. We were in a new era where the Federal Reserve was believed to be in complete control of the economy. Recessions and bear markets were a thing of the past.

Of course, we now know that ended up being dreadfully untrue. The "fire" erupted and nearly destroyed the economy. The Fed and Congress then took unprecedented action that eventually stopped the recession/bear market. This was after unemployment hit double digits and stocks lost over 50% of their value. The recovery afterward has once again emboldened investors, especially after the 2011 "scare" where Republicans actually seemed to care about the budget deficit, which caused a nearly 20% drop in stocks and the US to lose their AAA credit rating.

When COVID came around, the Federal Reserve and Congress did something we only have seen one other time (post 9/11) – launching a coordinated effort to "save" the economy. Over 13 months Congress passed 3 bipartisan "stimulus" bills totaling just over $5 Trillion (25% of GDP). The Federal Reserve re-wrote their crisis playbook and did what many had thought they'd never do – use their "printing press" to purchase ETFs, namely investment grade, municipal, and high yield bond ETFs. Suggestions were made they could purchase S&P 500 ETFs if necessary to "stabilize" the financial system. They ultimately have added another $5 Trillion (25% of GDP) to the economy.

If their goal was to avoid any large losses in stocks, we could say "mission accomplished." The problem is the Fed completely lost track of their primary role – keeping prices stable. This is ironically threatening another key responsibility – financial stability.

Once again everything is booming. Real estate, stocks, the job market. Recessions and bear markets are (supposedly) a thing of the past. The problem this time around is the Fed dreadfully miscalculated the impact the "stability" they created by saying they would buy any bond investment with a cusip number when combined with the money Congress was freely giving out to most Americans regardless of whether or not they were actually impacted by the COVID shutdowns.

I've said it for over a year — what did everyone expect when Congress and the Fed combined dumped 50% of GDP into the economy?

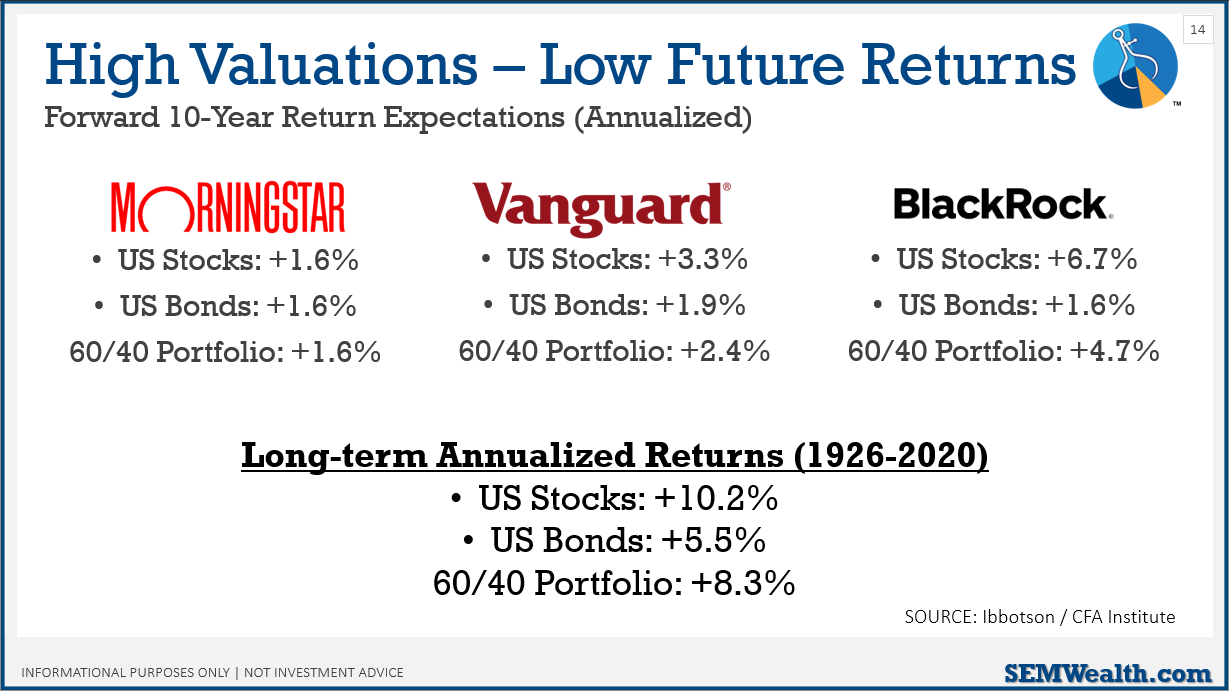

While I continue to see Wall Street firms and their perma-bulls trying to convince investors stocks are still the best place to be, investors are missing the fact all of the "stimulus" has to be paid back. Unless that stimulus leads to sustained, higher growth rates, it will be a drag on future economic growth. Over the very long-term, stocks grow based on the following formula:

GDP GROWTH + INFLATION + DIVIDENDS

The way GDP is calculated, it is impossible for stocks to grow faster than the above for the long-term. This means if stocks get too far ahead of the formula, we eventually see a reset in prices. This usually comes when it becomes very clear GDP growth (and dividends which tend to be slashed during an economic decline) is about to slow.

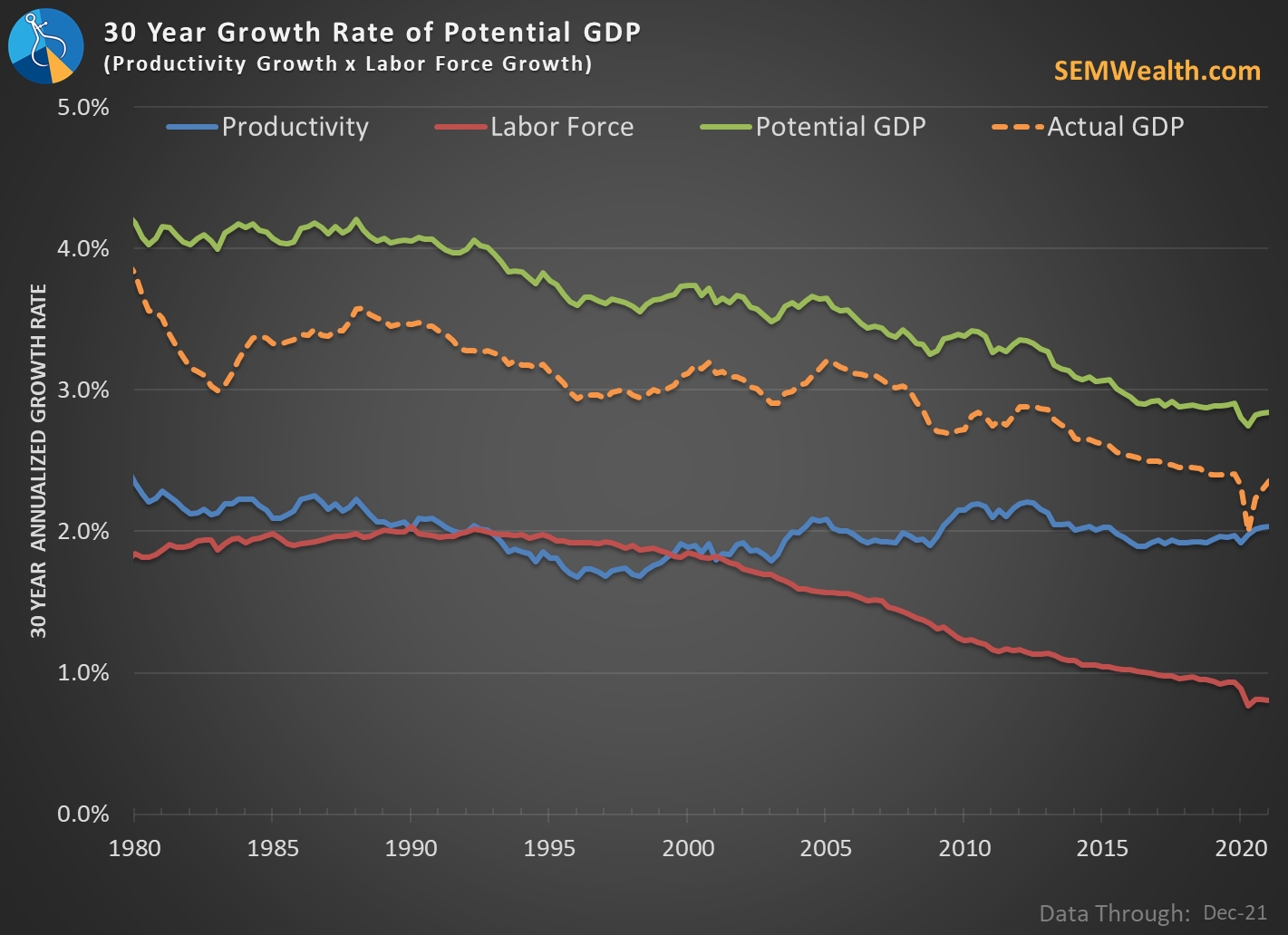

Potential GDP growth (the highest sustained rate the economy can grow) is based on a simple formula:

GROWTH IN LABOR FORCE + GROWTH IN PRODUCTIVITY

Essentially:

HOW MANY PEOPLE ARE WORKING + HOW MUCH ARE THEY PRODUCING

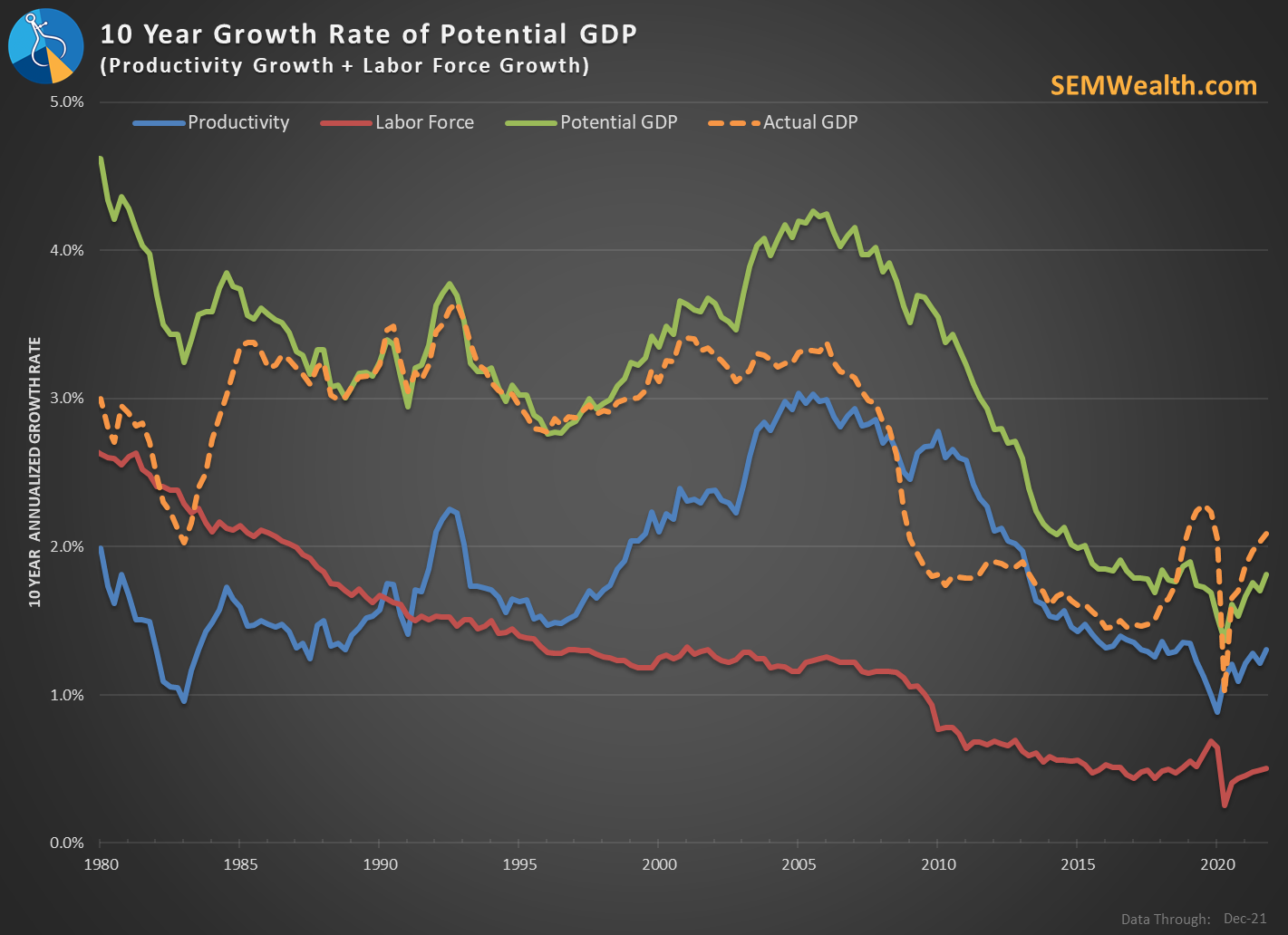

For the better part of 3 decades we've seen actual GDP growth (the orange dashed line) running consistently below potential (the solid green line).

We can also see why GDP growth has been declining from a long-term average of 4% all the way down to the current 2.3% rate — the labor force is shrinking and productivity growth has been flat.

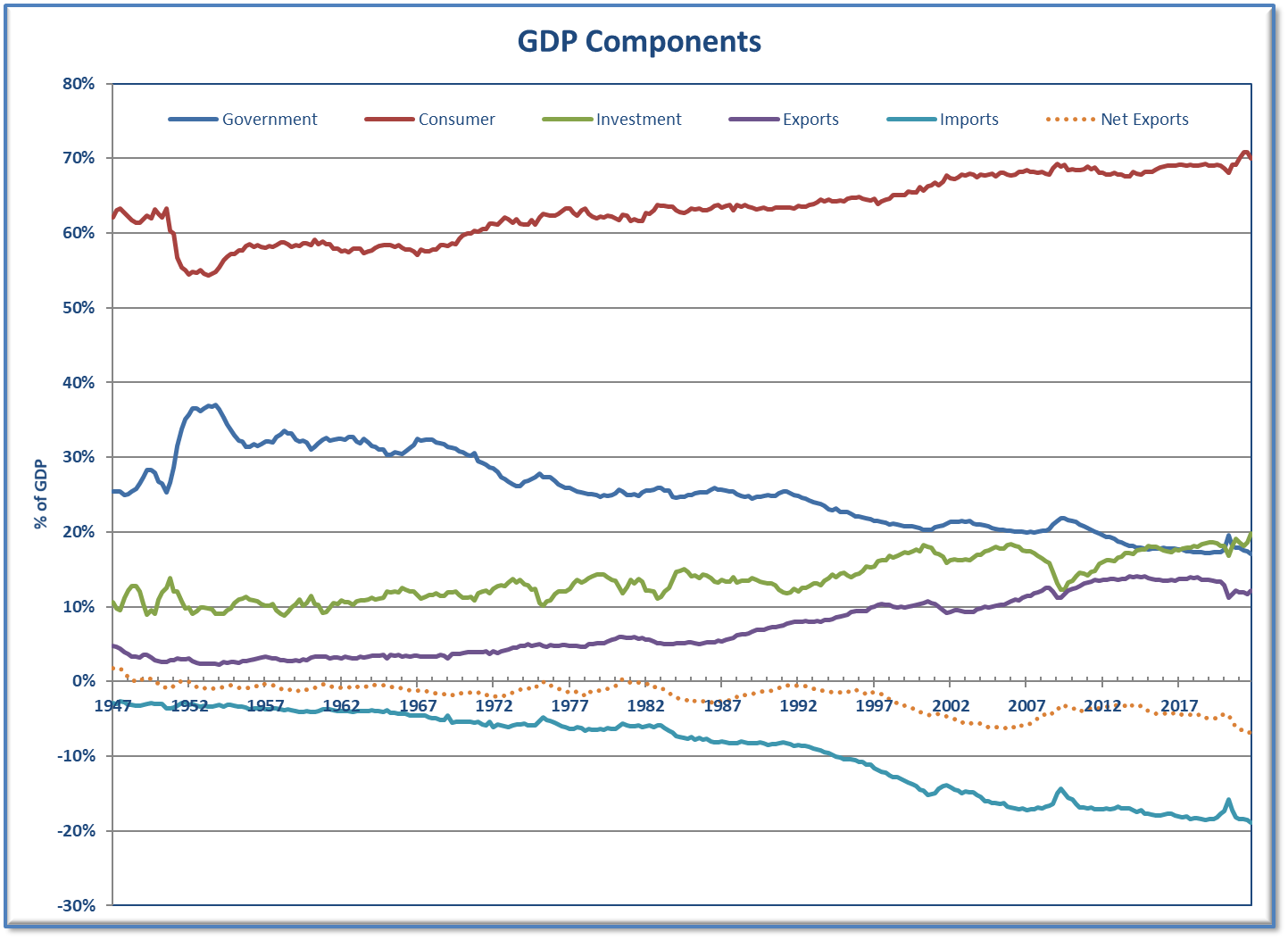

Both the gap between potential and actual GDP and the lack of improvement in productivity is directly related to our twin deficits (trade & budget). As we focused on maximizing corporate profits, we constantly found ways to offshore anything we could. When we break down GDP into the various components, we can see the drag our trade deficit has created (the dashed orange line is the difference between exports and imports – if we import more than we export, it reduces economic growth).

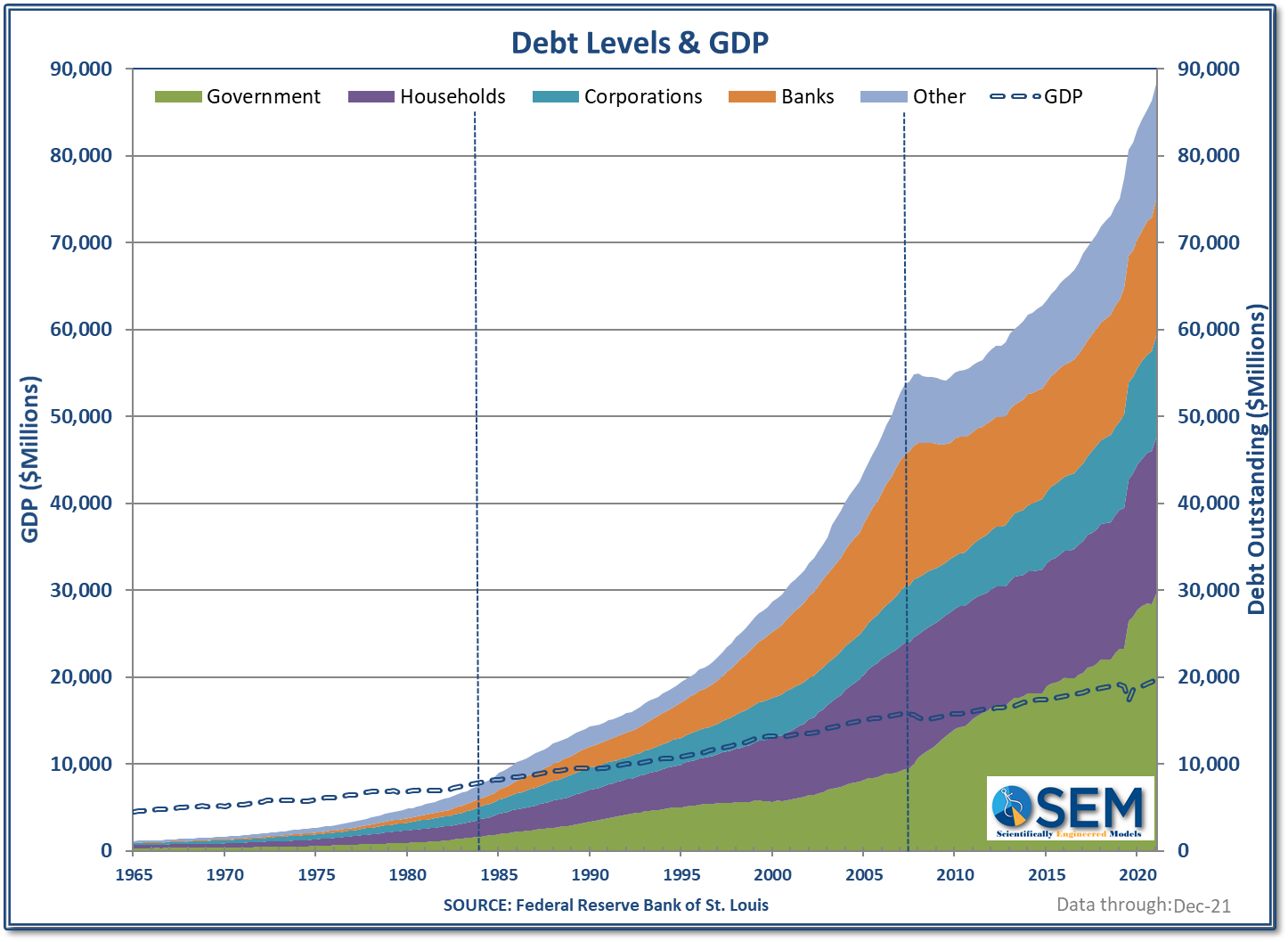

At the same time, our country has been relying on more and more debt to prop up the economy. The first vertical dashed line marks the point our overall debt exceeded economic output. The second vertical line marks the financial crisis. Most perma-bulls have argued America's "balance sheet" is far healthier than it was before the financial crisis. This chart tells a different story – debt has exploded since the financial crisis.

Debt is future spending brought forward. At least 2/3 of the debt used to "stimulate" the economy has been spent (which is why we have an inflation problem). This money didn't turn into investments which would create long-term economic growth, but instead to buy "stuff" and more recently "experiences" (vacations, weddings, etc.) That money is gone, but still needs to be paid back. This will create a major drag on economic growth.

The biggest names on Wall Street are forecasting the drag on growth over the next 10 years (they just aren't letting you know via their marketing materials and media appearances.) You have to dig deep into their "capital market" expectations to find out what they really think (and what they are likely saying privately to their largest clients.)

Circling back to the potential GDP equation, we can see the impact of the "stimulus". It artificially pushed actual GDP above "potential" GDP. This created inflationary pressure which is creating an additional drag on future economic growth.

This post wasn't fun to write. Believe it or not, I'm an optimist, but I'm also a realist. We use data to make our decisions and the data (and logic) is telling us clearly there are going to be some very difficult times ahead. This doesn't mean there won't be significant opportunities ahead as well. I'm very confident we as a country will figure this out and do whatever is necessary to get through the pending implosion due to the unprecedented policies the Fed and Congress used in their attempt to avoid any recessions.

Patience over the next several months and likely next several years will be necessary. When it feels really great to be invested in stocks, that's probably a sign the top is near. Based on conversations I had last fall, that was pretty close to the best people felt in a decade about stocks. Conversely, the best time to buy stocks will be when people look at you like you're crazy for even suggesting it. We're nowhere close to that yet. We still see things like AMC and GameStop, which have zero chance of earning enough to justify their stock prices go up 30-40% in a week.

Every bear market is different in terms of what industries and companies are decimated and which ones thrive. In the long-run, companies who offer something valuable to American consumers will do well. The economy will grow and the stock market will grow with it. The key is keeping enough capital intact during the downtimes to take advantage of cheap prices when things turn back around.

When that happens is anybody's guess. For now, based on our tactical, dynamic, and strategic models, caution is warranted.

Weekly Talking Points:

- Inflation is likely nearing a peak, but the long-term impact on growth is likely to be a drag for the next 9-12 months.

- The economy is going to be forced to stand on its own, which increases the chance of a recession in late 2022/early 2023. On average the stock market loses 35-50% just before and during a recession.

- In the short-term euphoria could drive stocks higher. This should be used as an opportunity to reduce risk for investors with a time horizon of less than 10 years and/or those who jumped into stocks in 2021 simply to "make more money".

- Your investments should align with your financial plan, cash flow strategy, investment objectives, risk tolerance, and overall investment personality. If you are already in alignment with those items, SEM's models have already taken the steps to adjust to what could be a very difficult environment.

- Even with SEM's models, the expectation should be for lower returns until the still euphoric market prices adjust to the reality of lower growth ahead. Our goal during these times is to lose as little as possible within each model's mandate, so we can pounce when it is easier. Remember, when it feels the worst will be the point of maximum opportunity. Our data-driven models are designed to invest when it feels the worst and to act well before most investors are even aware a bottom has been put in.