Working According to Plan

It is easy to get lost in the short-term noise of the investment markets. While technology has certainly increased the amount of noise each of us sees each day, the short-term focus of the financial media has always been something which derails investors from achieving their financial goals.

In the past 9 months the wild swings in both stock and bond prices has given us a “stress test” for our trading systems, investment models, and investment allocations for our clients.

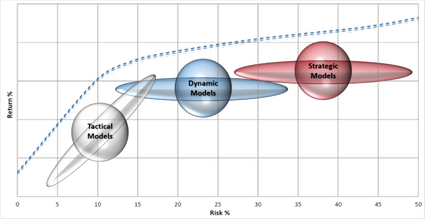

In terms of our investment models, we are happy to report all are performing as we would expect at this point in the market cycle. At SEM we have 3 distinct investment management styles. Each plays a specific role in the overall investment portfolio.

Tactical Models—Defense First!

Our tactical models, in particular Income Allocator and Tactical Bond, play a critical role for most of our clients’ investment portfolios. The reason is our clients tend to be already retired, approaching retirement, or have a lower risk comfort level, all of which decreases the amount of risk which can be taken inside the portfolio. These models are designed to help decrease the risk by actively monitoring the trends in the markets and moving to defense accordingly.

Early last October these systems moved to “defense” as the markets took a sudden downturn. They spent the rest of the quarter in the relative safety of lower risk bonds. In early January they went back on offense before moving back to defense in the middle of May as the market endured a sharp sell-off following yet another negative turn in the on-going “trade war” with China. After the Federal Reserve hinted they could cut interest rates as soon as July, the markets reversed again to the upside in June. Our tactical models went back on offense again in mid-June.

While with hindsight the back and forth trades may appear to not be necessary, we have to remember the primary goal is to chop off potentially large losses. The markets can and will go down, sometimes severely. The last nine months have illustrated how quickly our tactical models can move to defense.

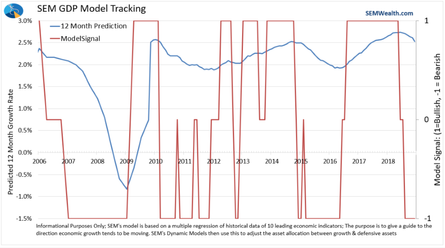

Dynamic Models—Adjusting to the Economic Outlook

Our Dynamic Models have been the star the last 9 months. These models use our economic model to measure the trend in economic growth. If the growth trend (blue line in the chart) is increasing, we want to increase our exposure to risky assets. When it flattens we want a neutral allocation, and when it begins to trend down we want to remove the risky assets in our portfolio. In our Dynamic Aggressive Growth (DAG) model the “riskiest” assets are small cap and emerging market stocks. For our Dynamic Income Allocation (DIA) the riskiest assets are dividend growth stocks and high yield bonds.

Last fall, the economic model shifted from “bullish” (rising growth) to “neutral”, and then in February fully shifted to “bearish” (declining growth rate). Eliminating the riskiest assets from the Dynamic models has paid off nicely, providing a much smoother experience for our clients in what has been a volatile year. For our Dynamic Income clients it has meant some very nice gains as Treasury Bonds (a core holding during “bearish” phases) have tacked on sizeable returns.

Having the Dynamic models inside a portfolio the last nine months has proven to be a nice diversifier for our clients. Whether we head into a recession or return to stronger growth, these models are designed to adjust the portfolio when the DATA (not the pundits on TV) indicate there are significant changes in the direction of the economy.

AmeriGuard™—long-term investing with a twist

As expected, our AmeriGuard™ portfolios can cause the most amount of angst when the stock market falls rapidly. By design these portfolios will participate more in a falling market in order to receive the benefits of long-term growth. Rather than buying and holding, AmeriGuard will tweak the allocations as the longer-term market cycle shifts. It is important to understand AmeriGuard provides a diversified portfolio with the ability to still eliminate some underperforming parts of the market. More importantly, the AmeriGuard portfolios have built-in mechanisms to reduce some of the stock market allocation if necessary. This helps with the behavioral tendency of investors wanting to “do something” during a prolonged decline.

It is important to note, AmeriGuard is not designed to keep up with the S&P 500 index as the S&P can become too focused on one industry or a handful of stocks. CNBC reported recently just 5 stocks (Microsoft, Facebook, Amazon, Disney, & Apple) accounted for 34% of the gains in the 2nd quarter. Historically a mega-cap weighted market like this has been a risky time to be invested in the S&P 500. In our opinion, the more diversified AmeriGuard approach is a more prudent approach for most investors.

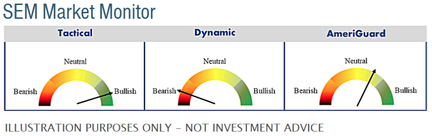

A Truly Diversified Plan

What is interesting as we close the quarter is how our 3 different investment strategies are positioned. Given all the unknowns the market and economy are facing, having this type of diversified approach should be reassuring for our clients that we are ready regardless of what happens next.

The Only Plan That Matters

Your personal financial plan is the only plan that should matter. SEM works with advisors across the country to structure a customized investment portfolio designed around your financial plan, cash flow strategy, and investment personality. Life can be unpredictable, which is why it is so important to work closely with your financial advisor to make sure your plan has the flexibility to adjust as necessary.

Find out what’s really moving the markets at SEMTradersBlog.com

We are constantly bombarded with headlines used by pundits to explain the most recent movement in the stock or bond markets. We realize this can be confusing, which is why we created SEMTradersBlog.com. There you will find unemotional assessments of what is really driving the market. During the last quarter we discussed the trade war, interest rates, and our economic outlook. We also posted several articles digging into what may cause the next financial crisis — investment grade bonds. Whenever you’re concerned or confused about what is happening in the market, we’d encourage you to turn to SEMTradersBlog.com

Want to learn more about Behavioral Finance? Check out our new resource:

SEMWealth.com/Behavioral-Finance

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money. To learn more about ENCORE Portfolios, please contact your financial advisor.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Program Reports for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.