What’s the Score?

With football season in full force and investors once again wondering why they aren’t getting double digit returns like the S&P 500 index, I thought I would bring out my favorite investing analogy (paraphrased from Mike Mason of Mason & Associates in Newport News, Virginia.)

It’s the 4th quarter, your team has the ball, and the head coach just got knocked over on the sidelines and has gone to the locker room. The quarterback turns to you and asks, “should we run or pass?” What’s the first thing you would do? …………………….. You’d look at the scoreboard!

If you’re behind and need to catch-up, chances are you would want to pass to get down the field sooner. However, if the scoreboard looks like the one above, the wisest decision would be to run the ball. You’d keep the clock running and not take the chance of throwing an interception.

In investing, few people ever ask, “what’s the score?” Investing in the stock market with all of your money all of the time is equivalent to always throwing the ball. Sure, it is a lot more exciting and you will probably score a lot of points, but if you turn the ball over at the wrong time or in the wrong place you risk losing the game.

For most of our clients their financial scoreboard has them winning the game. They have most or all of their expenses covered by pensions or social security. The only thing that could cause them to lose the game would be by throwing an interception at the wrong time. They need to run the ball, gain some yards, and keep the other team off the field.

If you don’t know your score or you’d like a quick check-up we have a free tool available. It takes about 10-15 minutes to complete and we will send the results to your financial advisor to review your personal scoreboard along with any recommendations to tweak your investments with SEM. To get started go to:

What’s the Downside?

Most investors focus on the returns their investments have generated and pay much less attention to how much risk is involved to get those returns. During prolonged market rallies, even more conservative investors tend to shift their focus from risk management to higher returns. This can be a dangerous mistake when it comes to your retirement funds.

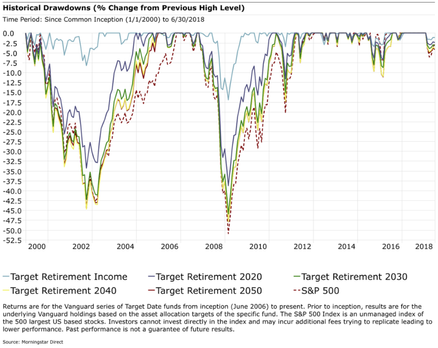

One of the more popular choices in many retirement plans is an S&P 500 index fund. The S&P 500 is comprised of 500 of the largest US based companies. Many people believe large companies are safer and therefore they are not taking too much risk by investing in an S&P 500 fund. Unfortunately, that is not the case. The S&P 500 has lost 50% of its value twice in the last 18 years. This is a risk few people are ready to experience again.

Diversifying across other asset classes outside the S&P 500 helps reduce risk, but often not enough. This is best illustrated by the “Target Date” portfolios that have become popular in recent years. Investors pick the portfolio closest to their retirement date and then the portfolio adjusts the asset allocation to match a recommended asset allocation. Most people are not aware of the downside these “diversified” portfolios may experience.

How much risk can you truly handle? This really depends. Everyone is different. Our brains are wired differently in how we perceive risk. For some an investment losing 35% or more is far too high, for others it may

be higher as they seek to capture higher returns. Matching our investments to our individual risk comfort levels makes it more likely we will stick to that investment over the long-run. Just as important as your individual risk score, however, is your ability to take risk. Again, each person’s situation is unique and depends on a wide range of factors. Matching an investment to your risk preference & situation is something your financial advisor can assist you with.

Want to know how much risk you’re taking and whether it is too much?

Go to WhatsMyScore.net to take our free financial assessment.

News & Notes:

2018 Year-End Tax Statements–what to watch for early 2019:

For taxable accounts, federal law requires your custodian to mail your IRS Form 1099 to you by January 31. Due to the increasing amount of reclassified mutual fund distributions, both of our custodians, TCA by E*TRADE & TD Ameritrade have had this extended to February 15, 2019.

SEM strongly recommends you do not make your tax appointment until after February 15.

The 2018 Consolidated 1099 mailings to you includes cost basis and sales proceeds for investments sold during 2018. This provides essential information needed to complete your Federal Tax Filing Form 1040 Schedule D and Form 8949. Please wait until you receive TCA’s and/or TD Ameritrade’s 2018 Consolidated 1099 prior to completing your taxes.

For those clients that consolidated taxable accounts from TD Ameritrade to TCA, you will receive forms from both custodians.

SEM will be posting additional information on the tax reports early next year on our website,

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money. To learn more about ENCORE Portfolios, please contact your financial advisor.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Program Reports for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.