The Federal reserve cut interest rates for the first time since 2008. Since late 2015, they have raised short-term interest rates from near 0% to 2.25%. Since June when the Fed hinted at the chances they would cut rates at their next meeting, investors have poured money into the stock market. The belief is the Fed would be able to reverse the rapid declaration in economic growth.

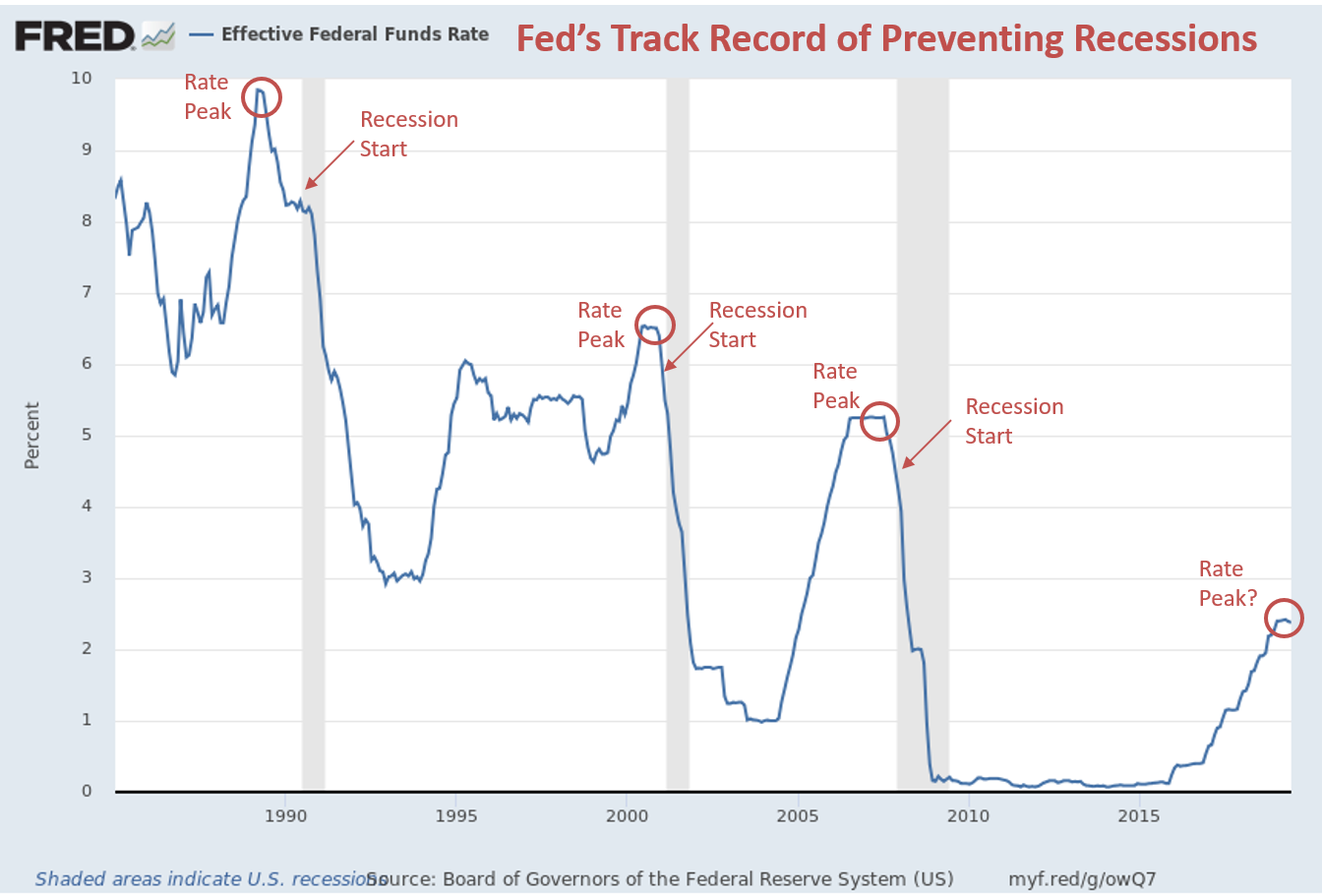

As a reminder, the Fed has a HORRIBLE track record of preventing recessions by cutting interest rates. In each of the last 3 recessions, the Fed started cutting rates BEFORE the recession started. It didn’t matter. It was too late.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

The problem is interest rate cuts and monetary policy in general take a long time to filter through the economy (typically 9-12 months). In addition interest rate cuts when we are already at/near full-employment do little to help increase personal income or the number of jobs. This late in the cycle a cut in rates also does not help improve profit margins at companies. In other words, this cut does not change anything.

We’ve covered this a lot on the blog. Here are some of the recent articles: