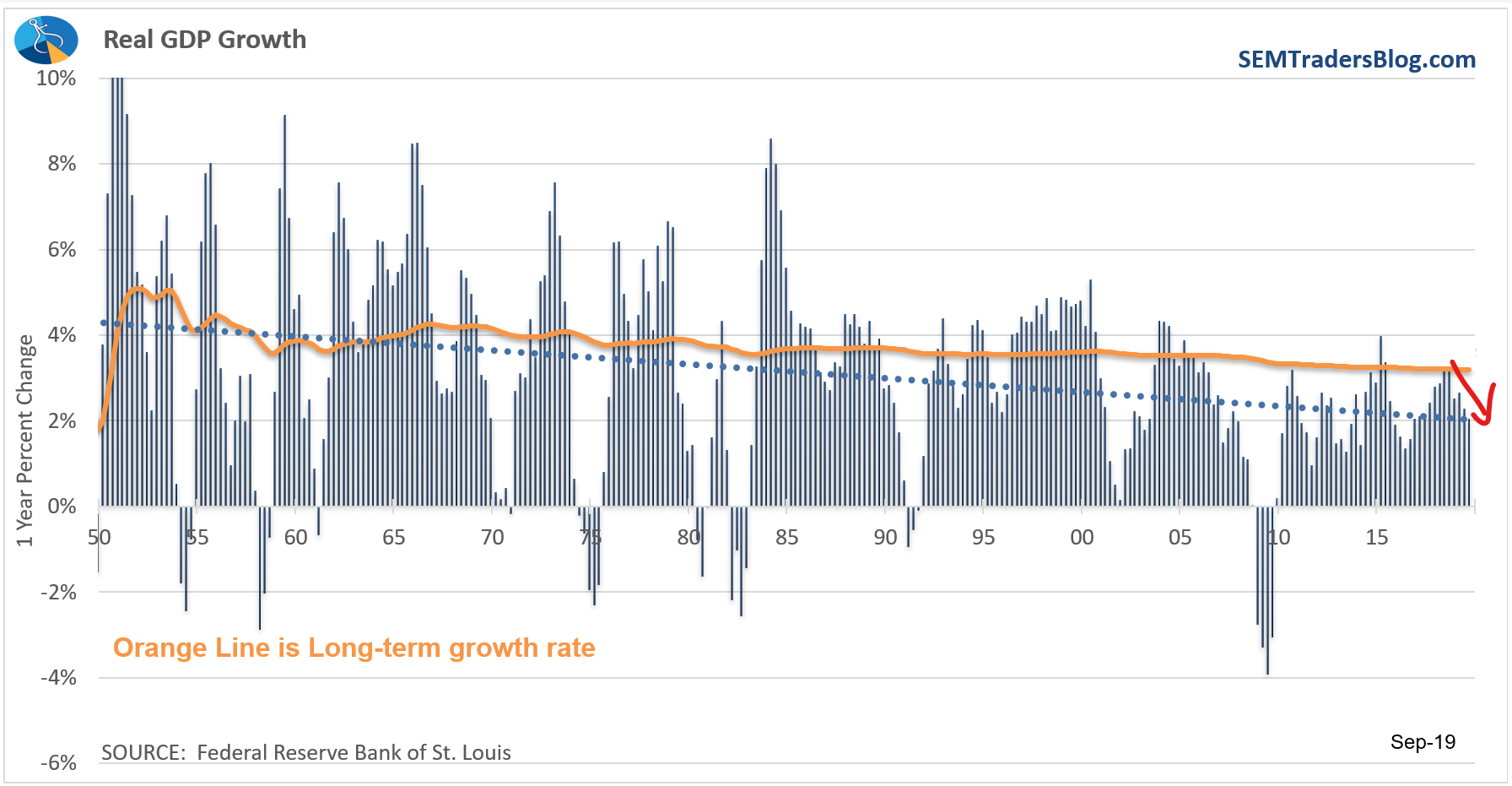

Earlier this week we learned the US Government ran a nearly $1 Trillion deficit this fiscal year. Despite promising 4%+ GDP growth to pay for the tax cuts, the temporary boost has already reversed and the trend is now clearly to the downside. As I’ve said since the time they were proposed, I prefer to keep more of my income and not give it to the government, but from an economic standpoint, the tax cuts were poorly structured and poorly timed in terms of the economic cycle.

A case can be made that the “trade war’ has been the culprit behind the slowdown. Another case could be made that the reduction in the Fed’s balance sheet at the same time they raised interest rates is the reason behind the slowdown. Either way, we are about to see if either was the case with the president appearing to back down on the rhetoric about additional tariffs and the Fed again cutting interest rates and implementing a form of mini-QE (even if they don’t call it that.)

For now we will stick with the data, which shows despite $1 Trillion in deficit spending AND 3 Fed rate cuts so far this year, the economy continues to slow. Some of the economic indicators show signs of improving, so maybe the worst is over, or maybe the slowdown will continue. This is the beauty of our quantitative approach — we don’t have to guess, we just wait for the data to indicate clearly which way we should adjust our asset allocation across our three management styles.