Almost Over (Election Day Edition)

The S&P 500’s 9 day losing streak, the worst since 1980, came to an end thanks to the latest plot twist in this seemingly never-ending election season. Stock futures spiked and the markets never looked back after the FBI once again said Hillary Clinton did not break any laws (just used incredibly poor judgement for somebody that has been running for election nearly her entire adult life).

All of this should hopefully be over Tuesday night, although there are still several scenarios that could play out that would cause more uncertainty. The Dash of Insight Blog lined out the possible outcomes we could see:

-

No clear result. We might think it’s over when it’s over, but that might not be the case. (Robert Schroeder, MarketWatch) Some states might require recounts, either automatic by state law or after a challenge. A third-party candidate might win the electoral votes of one state in a close split between the major parties. That is the explicit objective of candidate Evan McMullin. Trump and /or supporters might challenge the outcome, possibly with some legal basis. Most people will remember the Bush/Gore controversy and the infamous “hanging chads.” The Supreme Court decided that dispute, splitting along partisan lines. Right now, that would be a 4-4 vote, placing emphasis on how states and lower courts decided.

-

A Trump victory. Estimates are that the market would decline by 5-7%, mostly because of increased uncertainty. Many market participants believe that Trump economic and regulatory policies would be market-friendly. (CNBC)

-

A Democratic sweep with a majority in both houses of Congress. The perception, possibly not accurate, is that this would allow a much more aggressive legislative agenda. This is probably not accurate because of the filibuster potential in the Senate. Cloture currently requires 60 (out of 100) votes. This serves to block nearly everything that does not have solid overall support. Making it more complicated is the idea of the “nuclear option” where the cloture requirement would be reduced. (Barbara Kollmeyer, MarketWatch)

-

Divided control — a Clinton Presidential victory with Republicans maintaining control of one or both houses of Congress. Markets have generally liked a deadlocked government. (Allianz)

The first two scenarios are obviously not positive, but even the third could be perceived as a negative. The 4th could bring a furious rally for the market as too many people have put on hedges or sold their positions preparing for a different outcome. Guessing the outcome is hard enough, but figuring out how the market reacts is a dangerous game that we will not play. Our trading systems have gotten more defensive the past two weeks (even our Dynamic programs) which makes sense and sticks to our core philosophy of letting the market participants and our study of market history and trends dictate our exposure, not our OPINIONS.

Tuesday, November 8

Election day is here and it should be a wild one. There used to be a code in the media to not “call” an election until polls are closed, but with early voting and non-mainstream media providing their own predictions I fully expect speculation on who is likely going to win to be occurring throughout the day. Newsweek has already made their call, choosing to ship a “Madame President” edition to retailers early as a “business decision”. They have a “President Trump” edition just in case, but did not pre-print & ship those covers.

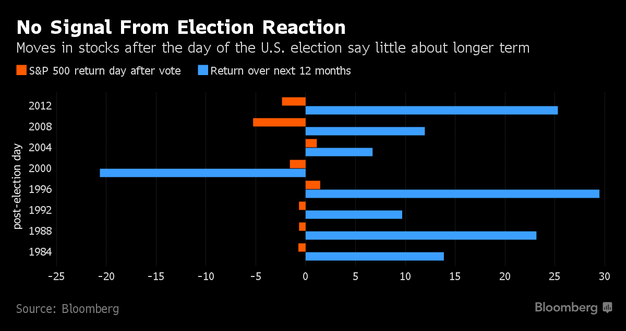

Bloomberg is telling us to not read anything into the reaction to the election as it has only had a 50/50 success rate in predicting the returns for stocks the next 12 months.

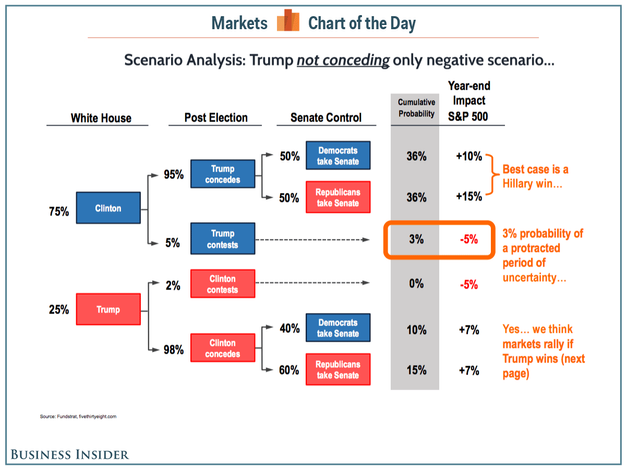

Business Insider instead turned to uber-bull Tom Lee of Trendstat who sees only one negative scenario for stocks (Trump contesting the election). This really shouldn’t surprise you as according to Lee, every drop in the market including the ones in 2008 were “buying opportunities”. (Good work if you can find it!)

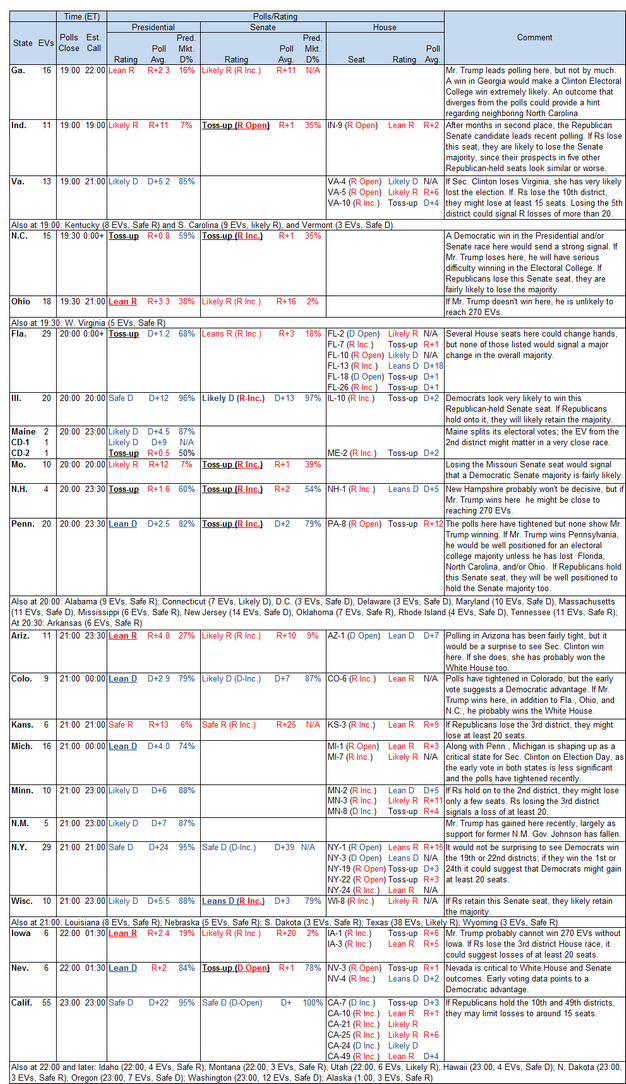

For those of you wanting the intricate details on election day, Goldman Sachs (as usual) provides the most thorough analysis. They warn that the polls and prediction markets are disagreeing in many swing states, which could lead to some incorrect “calls” throughout the day. Here is their minute by minute guide to election night.

Whatever your political leanings, this is one for the history books. Depending on how things shake out we may not know until Wednesday who the next President is. This could potentially stretch out days, weeks, or even months. Keep in mind the supposedly ‘non-partisan’ Supreme Court is split 4-4 down party lines so they may not even provide a final ruling if necessary.

Yesterday’s rally was enough for our Volatility System inside EGA to issue a sell signal, bringing it down to a “moderate” exposure level, matching our other investment programs. Over the coming days, weeks, and months a more clear picture should develop. While things are sorted out, I’m certainly glad we have our well-tested mechanical trading systems in place to remove our subjective emotions from the investment decisions.

Check back tomorrow for additional updates.

Be sure to check our our Current Allocations for the latest trade signals.