The Department of Labor’s Fiduciary Rule has taken effect after a two month delay. Many brokers and advisors had hoped the election of Donald Trump and his promise of “slashing” regulation would mean the DOL’s rule would never become law. The problem with that line of thinking was not understanding the way laws are written. The DOL’s Fiduciary Rule had already gone through the process of becoming a law, meaning to reverse it, a brand new law would have to be written. Whether or not the Fiduciary Rule is eventually replaced and regardless of your stance on this law, there is one thing to understand — SEM, as defined by the new rule has been serving as a fiduciary all along.

Regardless of account type (remember the new rule only impacts retirement accounts such as IRAs), SEM has been required to follow the three main points of the DOL’s rule:

-

Provide investment advice that is in the investors’ best interests.

-

Receive no more than reasonable compensation.

-

Avoid misleading statements to investors about recommended transactions.

As an SEC registered investment advisor, our focus has always been on the above since that is what was required (and also the right thing to do — see bottom of page for the SEC language). The SEC is now working on their own formal fiduciary standard for ALL account types, so whether or not the DOL’s law survives, the three standards above are likely to remain key benchmarks well into the future. An outsider would say requiring those three things is just common sense, but having been in the industry for over two decades I have seen first hand that is not the case with all advisors. Over my 18 years at SEM we’ve let a few slip through the cracks, but we have always vowed to only work with advisors that followed those standards whether they were the law or not. In other words, if you are one of the select advisors working with SEM, we believe you’ve already been implementing the DOL’s fiduciary standard for ALL account types.

Operational Changes at SEM

While we will have to implement a few procedural changes to comply with the DOL’s Fiduciary Rule. The Best Interest Contract (BIC) will be required after January 1. We are working on a more clear disclosure of the fees involved for SEM’s management services as well as ways to allow our financial advisors to charge “level” fees to their clients regardless of what investments are inside the SEM accounts. After months of work with TD Ameritrade and our current software providers in 2016 it became clear regardless of the implementation of the DOL’s Fiduciary Rule, all of the above is far easier to accomplish at Trust Company of America (TCA). With the rule going into effect, moving your clients to TCA sooner rather than later will make it easier to handle this new rule.

No Changes in Fund Selection Process

At TCA we have a nearly identical list of funds available with “no transaction fee” (NTF). However, the custodial fees charged by TCA to clients not owning NTF funds usually ends up being cheaper for the client to pay the transaction fee in order to receive the LOWEST COST share class. As an institutional investor, SEM has access to the lowest cost share classes that individuals or smaller advisors may not. Few people also realize the NTF funds actually have HIGHER costs because they are paying service fees to the custodian in order to be on the NTF platform. Whenever SEM receives a signal to buy a mutual fund, we look at all the available share classes on the platform and purchase the lowest TOTAL cost (fund expenses + any custodial fees) shares. This has always been our practice (as required by the SEC) even though it has meant the client SEES higher fees.

Going forward, my opinion is clients may be surprised by the hidden fees they have been paying on some platforms if the regulators follow through with more clear disclosures of the TOTAL fees clients are paying on these “lower cost” platforms.

Receiving “Reasonable” Compensation

Probably the biggest misunderstanding with the new rule is the definition of “reasonable” compensation. Apparently law makers working on the rule did not understand the ramifications if you put such a subjective term in the final law. Each time we have been in a prolonged bull market, clients and advisors tend to fall for the “your fees are too high” trap. When the market is going higher for a considerable period of time, any sort of risk management will cause the portfolio to under-perform a buy & hold investment. During bear markets I don’t remember any cases of a client stating our fees were “too high” given our track record of chopping off a high percentage of the downside.

While SEM’s risk management cannot guarantee portfolios will not lose value like an insurance contract, the analogy of the “value” of insurance certainly works with investment risk management. The longer you pay for your insurance without an event, the more likely you are to consider cutting your insurance coverage or dropping it altogether. However, insurance industry studies have shown demand for insurance spikes immediately after an insurable event occurs. Our experience following the last two bear markets shows the exact same thing with SEM’s active management services.

We are constantly studying what other firms are charging for their active risk-management services and studying HOW their models work. This includes looking at the TOTAL fees these managers are receiving, including the HIDDEN costs inside their portfolios. Based on the level of risk management we provide relative to the industry, it is our opinion our fees are certainly “reasonable”. I’d even argue based on what I’ve seen they could be considered cheap given the level of sophistication and daily monitoring of our clients’ accounts. I’ve seen too many monthly or quarterly “re-balance” programs charge fees that are almost the same as ours (when you include the hidden costs paid to the managers.)

One thing that is misunderstood is the amount of the fee SEM actually receives. SEM receives no more than half of the total fee charged to the client. The other half (or more in some cases) is paid to the financial advisor referring and maintaining the account. SEC laws require us to report it as SEM’s management fee. They also require us to fully disclose to the client the amount and percentage being charged. One of the nice features about the TCA platform is the ability to breakdown to the client what exactly they are paying for.

Last year we introduced a flyer to illustrate to our clients exactly what fees they are paying and what exactly it is paying for. We’ve recently added this to our website as well. (Click here for a refresher) Under the new DOL standards, we may begin including this in all of our Investment Policy Statements that are mailed when a client opens an account with SEM (another value added service not all investment managers will provide). At TCA the statement will clearly say “SEM Investment Management Fee” and “Financial Advisor Fee”. It is up to the advisor to determine whether or not their fee is “reasonable”.

Lower Fee Options Available

For those advisors that believe the 1.125% maximum fee charged for our “tactical” programs is not “reasonable”, we do offer lower cost options. First, it is important to understand SEM offers breakpoints that apply to the ENTIRE account & the ENTIRE household. If a household invests $250,000.01 with SEM, every dollar is charged the fee level corresponding to that level. We have found most advisors layer the fees where only the dollars ABOVE the break-point receive a lower fee.

Secondly, at TCA our advisors can CHOOSE the fee they charge for their financial advisor services. We’ve been told by several industry experts a “level fee” policy is the best way to avoid any potential conflicts of interest. For instance, if an advisor decides a reasonable fee for their services is 1%, they can charge the same fee regardless of what SEM investment models are implemented.

Finally, the fees charged for our “tactical” programs are higher because these models are watched EVERY DAY. It doesn’t mean we make trades every day, but we CAN. This means if the market turns quickly we can make adjustments quickly. Last year we began offering “dynamic” portfolios that charge a lower fee because they are only monitored monthly. While still providing risk management, these portfolios do not offer DAILY risk management, which justifies a lower fee.

After working with a few of our advisors, we recently rolled an even lower cost portfolio option — AmeriGuard. AmeriGuard portfolios are only monitored quarterly (with a few exceptions). This type of lower frequency management may not appeal to every client or advisor, it does have the potential to allow advisors who were previously receiving commissions on direct mutual fund business and/or had their clients invested in quarterly rebalance “strategic” asset allocations to turn their clients’ fees into something that would be considered “reasonable” under the DOL’s guidelines. Please contact me to discuss the qualifications for this new program.

Please Define “Best Interest” of the Client

Easily the thing that has me most concerned with the DOL’s Fiduciary Rule is the subjectivity of the “best interest” portion of the law. Far too often the people writing the laws do not fully understand the “root cause of the problem”. Regulators blamed “market timing” for the bursting of the tech bubble (I still don’t understand that one) and “loose lending standards” for the bursting of the housing bubble. Now they are blaming the underperformance of retirement accounts on fees & the mis-alignment of interests between advisors and investors.

There was certainly ILLEGAL trading happening during the tech bubble, and the lending standards were extremely loose, but those weren’t the issues that caused the two prior bubbles to burst. Similarly, there are some advisors that have taken advantage of investors and charged exorbitant fees, but the reason investors have not performed well inside their retirement accounts is actually the same reason the last two bubbles occurred — human emotions.

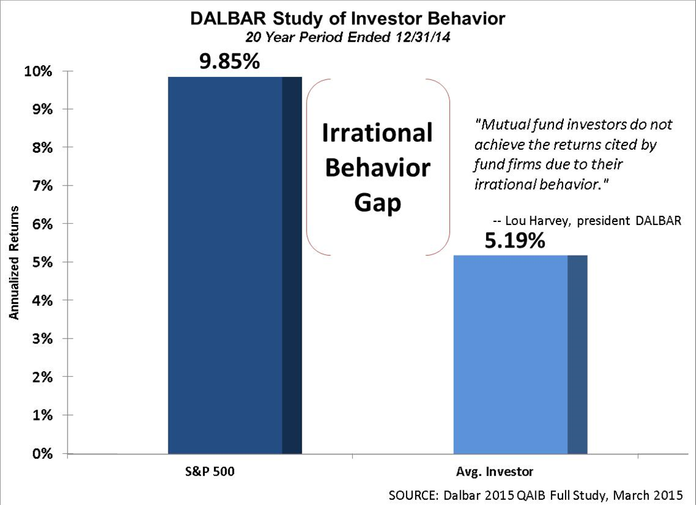

The DALBAR study is something I’ve been aware of since starting at SEM 19 years ago. Regardless of the time frame studied, the results have been the same — individual investors do not keep up with the markets because their emotions get the best of them.

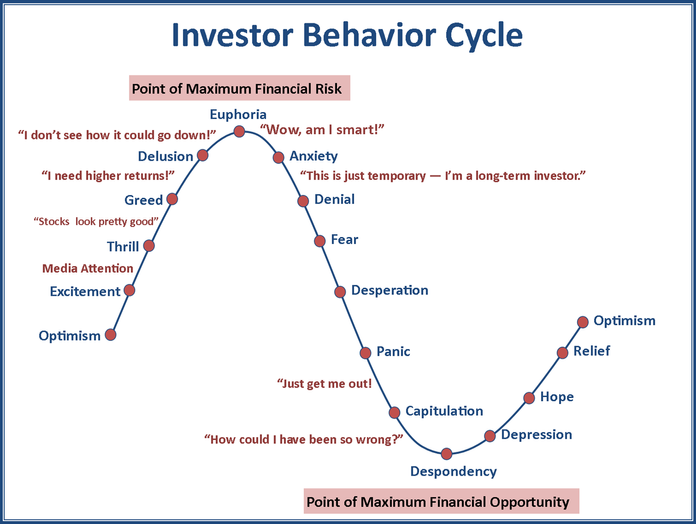

The investor behavior cycle repeats time and time again. Unfortunately for investors, we are near the top of that cycle once again.

My biggest fear is the DOL’s Fiduciary Rule will force far too many clients into “low cost” investment options that offer little in the way to protect them from the inevitable emotions that ALWAYS occur inside a bear market. We’ve already seen during this bull market a massive push into passive investments. A few weeks back my Chart of the Week was titled “The Passive Investment Bubble“. I ended it with a quote from the “father” of index investing, Vanguard founder Jack Bogle:

“If everybody indexed, the only word you could use is chaos, catastrophe. There would be no trading, there would be no way to convert a stream of income into a pile of capital or a pile of capital into a stream of income. The markets would fail.”

Like too many laws, something that is designed to protect individuals may end up doing them more harm than good. I strive to always put the clients best interests first, which means becoming even more vocal in the dangers of 100% passive investing. Humans are emotional. There is nothing wrong with that, but it does mean we need to develop portfolios that help offset each individual investors’ behavioral biases.

When you are told you have to have surgery, do you seek out the lowest cost surgeon or do you want to be in the hands of the best available option? (thanks John S for that analogy). Why is it when it comes to our retirement funds, the “best interest” is the cheapest option? We each only have one shot at retirement. Do you really want to find the cheapest option or seek out the best available one?

Regardless of the outcome of the DOL Fiduciary Rule, I’m here to help find that best available option.

Already a Fiduciary

Besides the SEC required mandate on how SEM treats each client, as a CFA Charterholder, I am already required to be a “fiduciary” as defined by the DOL’s Fiduciary Rule. As one article on the CFA Institute website put it:

Putting investors first has been the anthem of CFA® charterholders since the first charter was granted in 1963. Charterholders must adhere to a strict code of ethics and standards of professional conduct, which include the obligation to conduct oneself with the duty of loyalty, prudence, and care — the underlying principles of fiduciary duty — regardless of whether one works in a fiduciary capacity.

The duties of CFA Charterholder’s are the crux of the CFA Code of Ethics (which also align to SEM’s own Code of Ethics). For Investment Analysts, the Code says:

Position: Clients’ interests should always receive the highest priority in investment research.

Rationale: Analysts have fiduciary duties toward their clients. The duty required of a fiduciary exceeds that which is acceptable in many other business relationships because the fiduciary is in a position of trust. Fiduciaries owe undivided loyalty to their clients and must place client interests before their own. Such priorities enhance investor confidence in the capital markets, and in the reputation of investment research analysts, their firms, and financial markets.

The Code also uses the term, “Prudent Investor” in several places. They define it as:

The fiduciary duty shows up first in Standard III: Duties to Clients with “Members and Candidates must determine applicable fiduciary duty and must comply with such duty to persons and interests to whom it is owed.”

The Prudent Investor Rule requires a fiduciary obligation to the client which entails loyalty, impartiality and prudence (care, skill and caution). The CFA Institute requires that clients’ interests should always receive the highest priority in investment research, above the interests of the firm and of the advisor.

Finally, in terms of “soft dollars” (money paid to Charterholders from investment firms), the CFA Institute has strict requirements on any such payments.

In the soft-dollar standards, the investment manager must fulfill their fiduciary duty through three general practices.

-Seeking to obtain best execution through best value

-Minimize transaction costs

-Use brokerage (soft dollars) only for the benefit of the client

When I was interviewing with the Wall Street firms in the mid-1990s I was completely turned off by their attitude towards clients. Not all firms are “bad apples”, but there was enough of them that they spoiled everything for the whole bunch. A fiduciary standard is not something any of us should be afraid of. I look at it as a way to weed out those “bad apples” and create opportunities for everyone that was already serving as a fiduciary.

The SEC also makes it clear all SEC registered advisors are fiduciaries:

Investment Advisers Are Fiduciaries

As an investment adviser, you are a “fiduciary” to your advisory clients. This means that you have a fundamental obligation to act in the best interests of your clients and to provide investment advice in your clients’ best interests. You owe your clients a duty of undivided loyalty and utmost good faith. You should not engage in any activity in conflict with the interest of any client, and you should take steps reasonably necessary to fulfill your obligations. You must employ reasonable care to avoid misleading clients and you must provide full and fair disclosure of all material facts to your clients and prospective clients. Generally, facts are “material” if a reasonable investor would consider them to be important. You must eliminate, or at least disclose, all conflicts of interest that might incline you — consciously or unconsciously — to render advice that is not disinterested. If you do not avoid a conflict of interest that could impact the impartiality of your advice, you must make full and frank disclosure of the conflict. You cannot use your clients’ assets for your own benefit or the benefit of other clients, at least without client consent. Departure from this fiduciary standard may constitute “fraud” upon your clients.