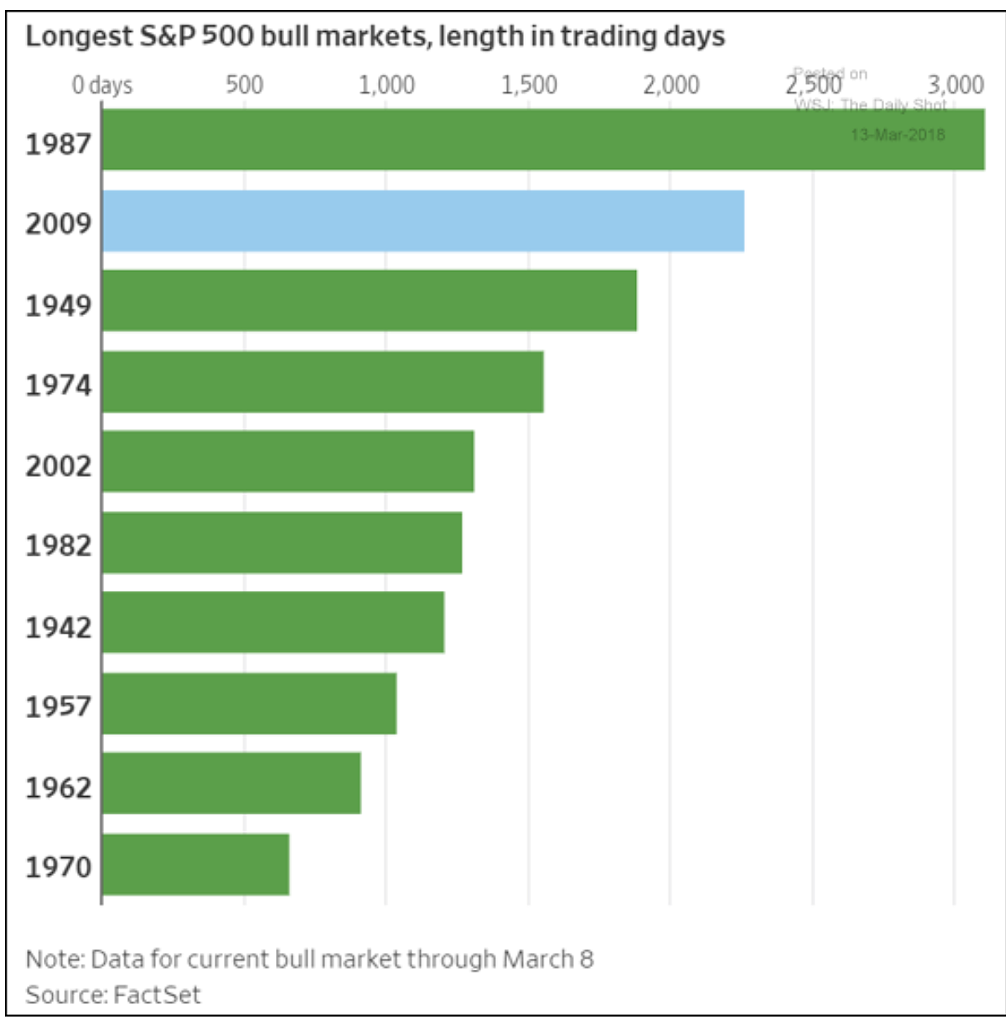

Last week we celebrated the 9 year anniversary of the start of the current bull market. I included some charts illustrating how abnormal this run has been. The Wall Street Journal last week put the current bull market in perspective with this week’s Chart of the Week.

Bull markets do not die of old age alone. I’ve heard valid arguments as to why this bull can push towards the age of the tech bubble given the momentum they expect from the tax cuts. While our economic models are not seeing any sort of an acceleration (they are still “neutral”), there also isn’t any sign of a recession, which is what all investors should be worried about. This of course can change rather quickly.

What is most important at this stage of the cycle is to right-size the overall risk in a portfolio. During the last 9 years the S&P 500 has compounded at twice the long-term average. Even when we include the tech and housing bubbles along with this bubble the S&P 500 has only grown at a 7.5% rate. While it is nice the tax cuts are putting more money in all of our pockets there has been nothing to shift the potential growth rate of our economy out of the Trump Administration. This means the market could begin the frightening “mean-reverting” even also known as a bear market at any time.

SEM can help right-size the risk in your portfolio. Whether you are a client or financial advisor we can design portfolios able to withstand whatever market environment we face over the next 9 years. If you would like a snapshot of the risk you currently have in your portfolio, just drop me a note asking for a free portfolio review.